Ray Dalio Trading Strategy & Philosophy

Ray Dalio, the founder of Bridgewater Associates, is widely regarded as one of the most successful hedge fund managers of all time.

His unique approach to trading and investment management is built on a set of principles he has developed over decades.

Dalio’s trading philosophy revolves around balancing risk, seeking uncorrelated returns, and understanding the “economic machine” (i.e., how the economy truly works from a cause-and-effect standpoint).

His strategy is based in his idea of a principled approach to decision-making, which he wrote down in his book, Principles: Life & Work.

Below, we explore the core elements of Ray Dalio’s trading strategy and philosophy.

Key Takeaways – Ray Dalio Trading Strategy & Philosophy

- Understand the Economic Machine – Dalio studies debt and credit cycles, analyzing productivity, business cycles, and long-term debt trends to predict economic shifts.

- Principles-Based Decision Making – Dalio prioritizes data-driven, systematic decisions to avoid emotional biases.

- All Weather Portfolio – Using the concept of risk parity and various asset classes, Dalio’s portfolio is structured to perform well irrespective of the market environment.

- Risk Management & Diversification – Avoiding over-leverage and focusing on diversification, Dalio reduces risk while targeting more consistent, stable returns.

- AI and Computerized Decision-Making – Dalio is an influential thinker when it comes to the application and use of AI and computers in decision-making in the market (his firm is almost entirely systematic in its approach to trading).

Understanding the ‘Economic Machine’

The Concept of the Economic Machine

Dalio’s trading strategy revolves around his understanding of what he calls “the economic machine.”

Dalio sees the economy as a set of cycles and flows that move predictably over time.

He believes that the economy functions as a machine with clear, interlocking parts such as:

- productivity growth

- business cycles as central banks change lending and borrowing conditions to balance growth with inflation, and

- long-term debt cycles (that occur when interest rates hit zero and new forms of policy are needed to stimulate)

Analyzing these components and their interactions, Dalio tries to predict economic shifts ahead of others before they impact the markets.

Dalio’s approach involves breaking down complex economic systems into simpler, more understandable parts.

He studies the relationships between debt, income, spending, and credit to understand economic behavior at a fundamental level.

This perspective allows him to anticipate broad, macro-related market movements and react accordingly.

Debt and Credit Cycles

Dalio pays particular attention to debt and credit cycles, which he sees as critical drivers of economic activity.

He categorizes these cycles into:

- short-term debt cycles*, which last about five to ten years (on average) and

- long-term debt cycles, which can last for 75-100 years.

The short-term debt cycle revolves around the business cycle.

The long-term debt cycle involves more substantial shifts when interest rates hit zero. These often to paradigm shifts (e.g., quantitative easing, fiscal policy taking a larger role) or economic resets.

From understanding where the economy is within these cycles, Dalio positions his trades to benefit from the expansion and contraction phases.

For instance, he might reduce exposure to risk assets at the bottom of a short-term debt cycle (i.e., low inflation, low growth, high unemployment) to take advantage of their cheapness and increase holdings in safer assets during frothier periods (i.e., higher inflation, low unemployment) to be more cautious.

As another example, if a country is late in the long-term debt cycle, he might evaluate what this means for the currency.

If interest rates are low and more stimulation and money printing is needed to get the economy going, he might short the currency in favor of another currency that’s not as late in their long-term debt cycle.

__

* Note that “short-term and long-term debt cycle” are not terms commonly used in economics or traditional financial contexts. If you use these, most people won’t know what you’re talking about.

Principles-Based Decision Making

Radical Transparency and Truth-Seeking

One of Dalio’s most well-known beliefs is the principle of “radical transparency.”

In his hedge fund, Bridgewater Associates, Dalio insists on complete openness and honesty.

He believes an environment where everyone feels comfortable challenging each other, he can get closer to the truth.

This approach extends to his trading philosophy, where he prioritizes objective analysis over individual biases or emotions.

In trading, Dalio tries to eliminate emotions by creating a set of investment principles that guide his decisions.

According to inside sources, around 99% of their decision-making for their portfolios is done systematically and not by the CIOs (traditionally they’ve had three) pulling the levers in a discretionary way.

A former employee’s biggest lesson from Dalio’s strategy:

Dalio insists on a rigorous analysis and testing of ideas, leading to an incremental improvement over time.

The Importance of Independent Thinking

Dalio encourages independent thinking in his approach.

He believes that to outperform the market, traders have to be willing to think differently than the crowd.

However, this contrarianism is always grounded in data and analysis rather than mere opposition to popular opinion.

Dalio’s emphasis on independent thinking leads him to seek out uncorrelated opportunities.

He tries to identify assets or markets that are overlooked or misunderstood.

Accordingly, he tries to create portfolios that deliver returns regardless of broader market movements.

This diversification is key to his overall strategy.

The All Weather Portfolio

Building a Resilient Portfolio

One of Dalio’s most famous contributions to investment management is the concept of the “All Weather Portfolio.”

As the name suggests, this portfolio is designed to perform well across various economic environments, from inflationary booms to stagflation to deflationary busts.

Dalio’s belief is that it’s impossible to predict precisely when different economic environments will occur, so the portfolio is structured to weather any condition.

He also wanted a framework where he could invest money for family trusts that could not have the big ups and downs, withstand time, and not rely on manager skill.

The Main Asset Classes

The All Weather Portfolio is built around four main asset classes: equities, bonds, commodities, and inflation-protected securities.

Each asset class is selected for its performance characteristics under different economic scenarios.

For instance, equities perform well in growth periods, while bonds offer stability during recessions.

Commodities tend to do well in inflationary environments (and are sometimes a cause or contributor to inflation).

Risk Parity Approach

The core principle behind the All Weather Portfolio is risk parity.

Risk parity is a strategy that allocates investments based on risk rather than capital.

Instead of allocating a fixed percentage of capital to each asset, Dalio assigns weight based on the volatility and risk profile of each asset class.

This means that lower-risk assets like bonds might take up a larger portion of the portfolio than higher-risk assets like stocks.

Dalio’s risk parity approach tries to achieve a balanced risk exposure across different assets, so that no single asset class dominates the portfolio’s performance.

This reduces the impact of market fluctuations and economic shifts, creating a more stable return profile over time.

The All Weather Portfolio is essentially what came out of Dalio’s belief in diversification and risk management.

Managing Risk and Avoiding Overleveraging

Emphasis on Diversification

Dalio’s approach to risk management centers on diversification.

He views diversification as the only “free lunch” in investing, as it allows traders/investors to reduce risk without sacrificing returns.

Dalio diversifies not only across asset classes but also within asset classes, so that his portfolio has minimal exposure to any single economic risk.

From spreading trades with different correlations across various markets, Dalio reduces the likelihood of significant losses.

This strategy also better helps his portfolio have exposure to assets that perform well in different environments, from high growth to deep recession.

Overall, it reduces vulnerability to specific market environments.

Dalio has called himself a “singles hitter” in that he’s content to avoid strikeouts (large losses) and home runs (big gains) in favor of more consistent returns.

This contrasts with other traders like Stan Druckenmiller who are all about concentration and capitalizing on what they believe is a smaller opportunity set.

Avoiding Over-Leverage

Dalio is cautious about using leverage, as he has seen firsthand the dangers of excessive borrowing or becoming too large of a participant in your markets.

His book Principles documents the cases of the fall of Bunker Hunt cornering the silver market in 1980 and Australian brewery executive Alan Bond making inadvertent currency bets through his lending practices.

In Dalio’s view, over-leveraging is one of the primary reasons traders/investors fail, as it exposes them to outsized risks during market downturns, which inevitably come at some point.

Instead of relying heavily on leverage, Dalio focuses on achieving returns through smart asset allocation and diversification.

He uses leverage in moderation and carefully, only when he believes it’s necessary for prudent portfolio “engineering” and balancing risks more equitably.

His disciplined approach to leverage reflects his broader emphasis on risk management and capital preservation.

Macro Research and Data-Driven Insights

Extensive Research and Backtesting

Dalio’s investment strategy is grounded in thorough macro research and analysis.

Bridgewater’s team conducts macroeconomic research to understand global economic trends, geopolitical shifts, and general money and credit dynamics (where is money flowing and how is it influencing markets and economies).

Dalio uses historical data to identify patterns.

This way, he can test his ideas against real-world scenarios to make sure they’re sound – i.e., different countries, different currencies, different time periods.

Backtesting

Backtesting is an integral part of this process.

Running simulations on historical data, Dalio and his team can see how different strategies would have performed under various conditions.

This approach helps Bridgewater to refine its investment models incrementally.

Constant Adaptation to Changing Markets

Markets are always evolving in various ways – new types of buyers and sellers of various types of influence with various types of motivations in various types of economic environments – and Dalio believes that traders and investors have adapt to stay ahead.

He emphasizes the importance of learning from mistakes and adjusting strategies based on new information.

Dalio views each market cycle as a learning opportunity, using insights from past experiences to inform future decisions.

Learning from history is important to him.

He talks about using historical data to understand the drivers and form templates to help understand the future.

He remains open to change, updating his models and principles as needed.

This willingness to adapt – and his belief in evolution of various forms – is a core tenet of his philosophy, as he recognizes that no strategy is perfect or permanent.

Dalio on AI and Computerized Decision-Making in Markets

Let’s look at some of Dalio’s thinking as it pertain to the use of AI, machine learning, and the use of computers in markets.

“The most painful lesson that was repeatedly hammered home is that you can never be sure of anything: There are always risks out there that can hurt you badly, even in the seemingly safest bets, so it’s always best to assume you’re missing something.”

This is an important lesson learned through experience: nothing is ever certain, and risks are always present.

Beginning traders are often very certain of themselves while experienced traders are more cautious due to their experience.

Even the safest, most calculated decisions carry the potential for unexpected outcomes.

This principle is particularly relevant in not just trading, but also decision-making and life planning. Individuals and organizations often operate under the illusion of control or predictability.

He stresses the importance of assuming “you’re missing something,” advocating for maintaining a mindset of humility and vigilance.

This means recognizing blind spots, accepting that no amount of preparation guarantees safety, and actively seeking out potential risks.

External variables or unseen factors disrupt expectations, so it’s important to never be too certain.

This means, in Dalio’s view, diversification in your positioning, scenario planning, and regularly updating one’s understanding of current conditions.

Dalio’s insight reminds us that overconfidence in any single assumption, no matter how seemingly reliable, is a vulnerability.

Why Assume Incompleteness

This approach encourages continual learning and proactivity.

In leadership, innovation, and strategy, flexibility and awareness of potential gaps allow for better and more nuanced decisions.

Acknowledging what you don’t know opens the door to collaboration, seeking out diverse perspectives (rather than dismissing or feeling challenged by them), and iterative problem-solving.

It also reduces the impact of surprises.

The Takeaway: Success Through Vigilance and Open-Mindedness

Dalio’s principle here is essentially a call to stay vigilant and open-minded.

In interviews, he often brings up his personal crash in August 1982, when he lost all he had worked for – 7 years – over his failure to take in others’ perspectives.

The inherent unknowns of markets and life requires a mindset that is both cautious and adaptable.

“Investment systems built on machine learning that is not accompanied by deep understanding are dangerous because when some decision rule is widely believed, it becomes widely used, which affects the price. In other words, the value of a widely known insight disappears over time.”

Here, Dalio cautions against the over-reliance on investment or trading systems built solely on machine learning, warning of their inherent limitations.

Machine learning algorithms can process vast amounts of data and identify patterns, but it’s important that they be paired with deep human understanding.

He argues for a balanced approach, combining advanced technology with the nuanced judgment of experienced, expert decision-makers.

Widely Used Rules and Their Declining Value

A key danger of machine learning in trading is its tendency to overgeneralize.

For example, it’s easy for computers to optimize on the past.

But that leaves them prone to struggling when confronted with environments it’s never dealt with before.

When a particular decision rule, identified by an algorithm, becomes widely accepted and adopted, it inevitably affects the price of assets tied to that rule.

This phenomenon creates a paradox: the more popular and widely used an insight becomes, the less valuable it is over time.

Because then it’s in the price.

Essentially, the market adapts, and the original advantage disappears.

For instance, if a machine learning system identifies a pattern predicting stock growth based on a specific indicator, widespread adoption of that strategy will drive up the price of those stocks.

Eventually, the strategy’s predictive power diminishes as the underlying markets shift in response to its popularity.

Why Deep Understanding is Essential

Dalio stresses the need for deep understanding to complement machine learning.

While algorithms excel at identifying correlations, when not done well, they lack the ability to discern causation or anticipate complex human and market behaviors.

Without a strong foundation of domain expertise, systems based purely on machine learning are vulnerable to errors and misinterpretations.

Deep understanding involves:

- recognizing the limitations of data

- questioning the assumptions underlying models, and

- anticipating the broader implications of market dynamics

This human element enables decision-makers to adapt strategies as conditions evolve, something machine learning alone can’t accomplish.

The Takeaway: Balance Technology with Insight

Dalio’s perspective serves as a reminder that technology is a tool, not a replacement for human judgment.

Machine learning, when used thoughtfully alongside expert understanding, can improve your decision-making.

Does it make sense?

Blindly following algorithms without appreciating their limitations can lead to large risks, particularly in new, dynamic, and adaptive markets/situations.

Leverage the strengths of both technology and human insight to achieve sustainable outcomes.

“We would need to make sense of the formulas the computer produces, of course, to make sure that they are not data-mined gibberish, by which I mean based on correlations that are not causal in any way.”

He talks about the need for scrutinizing the outputs of computer-generated formulas to be sure they’re not merely the result of data mining.

Data mining occurs when patterns are identified based on correlations that lack any genuine causal connection.

This can cause misleading conclusions and ineffective decisions.

The Danger of Correlation Without Causation

Formulas derived from vast data sets may reveal correlations that appear significant but are ultimately meaningless if no causal relationship exists.

For instance, a formula might show a strong relationship between two variables, like ice cream sales and beach attendance, but without recognizing the underlying causative factor – seasonal heat – the formula’s usefulness is severely limited.

This can lead to decisions based on illusions rather than actionable insights.

Making Sense of Formulas

Dalio insists that humans must interpret and validate computer outputs to discern whether they’re logically sound and causally relevant.

This involves understanding the context, questioning assumptions, and testing whether the relationships uncovered hold true under different conditions.

Also, are you a genuine expert who can examine the decision-making criteria and evaluate its outputs?

Relying blindly on outputs without this step risks applying flawed formulas in high-stakes scenarios, such as trading, investing, or policymaking.

The Takeaway: The Need for Judgment

Computers are better at finding patterns (generally), especially in unorganized data.

Humans are nonetheless important in assessing the validity of those patterns through a lens of causality.

Blending computational power with critical thinking, traders and organizations can avoid the issues of simply data mining and develop strategies rooted in sound logic and actionable relationships.

“Of course, given our brain’s limited capacity and processing speed, it could take us forever to achieve a rich understanding of all the variables.”

He acknowledges the inherent limitations of the human brain in processing and understanding the vast number of variables that influence complex systems.

With finite capacity and relatively slow processing speed, our brains are simply overwhelmed by the sheer complexity of interdependent factors in systems like economies, markets, or organizations.

When it comes to markets, we have a bias to simplify everything and adopt an illusion of control and certainty.

This, in turn, usually leads to poor decision-making.

Markets are enormously complex and you can’t deny reality or run from that and expect to make good decisions.

For example, an inflation gauge is over 100,000 different variables, all with different methods for how they’re calculated, how they’re weighted, and so on.

And changes in discounted inflation are just one of many variables impacting markets.

We’ve mentioned that the computer is better at raw calculation, memory, processing speed, and doing all of it less emotionally.

The human, on the other hand, can act as the designer and overseer and focus on what it’s good or better at – e.g., creativity, intuition, synthesis, strategic thinking, decision-making, vision.

The Challenge of Complexity

Achieving a “rich understanding” of all variables requires synthesizing a vast amount of information, identifying relationships, and discerning causation.

However, as systems grow more complex, the number of relevant variables increases.

In turn, this makes comprehensive understanding virtually impossible for an individual.

For example, predicting economic trends requires analyzing countless factors such as interest rates, geopolitical events, consumer behavior, and technological innovations – all of which interact dynamically.

Why Understanding Takes Time

Given these limitations, the process of fully grasping complex variables is time-intensive and iterative.

Human cognition often relies on simplifying assumptions or heuristics, which can lead to oversights or errors.

While collaboration and specialization can distribute the cognitive load, even groups of experts face challenges in coordinating insights effectively.

The Role of Technology in Extending Capacity

Dalio implies that technology, such as artificial intelligence and machine learning, can help overcome these human limitations by processing and analyzing data at scales and speeds far beyond human capabilities.

But these have to be guided by human understanding and judgment to so their outputs are meaningful and actionable.

The Takeaway: Acknowledging Our Limits

Rather than aiming for exhaustive understanding, traders, individuals, and organizations should focus on prioritizing key variables and leveraging “thinking” technologies to augment their cognitive capacity.

By accepting the limitations of the human brain and working within them, we as traders and decision-makers can allocate our efforts more effectively and build systems that accommodate complexity.

“We may be too hung up on understanding; conscious thinking is only one part of understanding.”

Dalio challenges the notion that conscious thinking is the sole path to understanding.

He suggests that human cognition encompasses more than logical, deliberate thought processes, with subconscious and emotional elements playing significant roles in how we make sense of the world.

The Limits of Conscious Thought

While conscious thinking allows for deliberate analysis and problem-solving, it is inherently slow and limited in capacity.

This is why over-reliance on purely rational approaches can lead to tunnel vision or incomplete understanding.

Conscious thought is only one layer of a much broader cognitive framework, which includes intuition, pattern recognition, and emotional insights.

Of course, emotions can be very bad in trading.

But they can also be great, too. For example, inspiration, and using helpful emotions/feelings as motivation.

The Role of Subconscious Understanding

Subconscious processes often work in the background, integrating experiences, memories, and emotions to form a deeper understanding.

For example, intuition – often described as a “gut feeling” – arises from the brain’s ability to recognize patterns without explicit reasoning.

Similarly, emotional responses can provide information about risks or opportunities that logical thinking might overlook.

But intuition has to be backed up by learning, training, and success in whatever it is (in our case, trading, though much of this is applicable beyond finance and markets).

Achieving Holistic Understanding

Dalio encourages embracing a more holistic view of understanding that combines conscious reasoning with insights derived from subconscious processes.

This requires balancing logic with intuition, trusting one’s instincts, and recognizing the value of emotions as part of decision-making.

For example, a seasoned trader might use quantitative analysis alongside intuition honed by years of experience to make better decisions.

Have you ever gotten a result from logical analysis that didn’t “feel right”?

And your sense ended up being correct?

This ties back to what we mentioned earlier about combining the raw computational strength of computers with our own understanding.

The Takeaway: Expanding the Definition of Understanding

So, by recognizing the limits of conscious thought and embracing the broader spectrum of human cognition, individuals can potentiallyachieve a richer and more nuanced understanding of complex situations.

This approach can allow for more flexible, adaptive, and effective decision-making.

Ray Dalio Quotes

“The more you can spread your bets, the less you have to depend on any one bet being right.”

In trading and investing, no one can predict the future perfectly, and even the most carefully selected investments carry risks.

A well-diversified portfolio doesn’t rely on any single asset or sector to succeed, increasing the likelihood of overall stability.

Diversification allows the portfolio to absorb potential losses from underperforming assets by balancing them with gains – or non-losses – from others.

Even if the other parts of the portfolio don’t gain but at least aren’t losing, you’re diluting the fall.

For example, let’s say you have 5 portfolio positions with the following allocations:

- Stocks = 20%

- Nominal Bonds = 20%

- Inflation-Linked Bonds = 20%

- Private Cash-Flowing Assets = 20%

- Commodities = 20%

And let’s say, over one quarter, stocks fall 20%, nominal bonds fall 5%, inflation-linked bonds are flat, private cash-flowing assets are flat/not marked to market, and commodities rise 10%.

To calculate the total loss/gain:

- Stocks = 20% allocation * -20% return = -4%

- Nominal Bonds = 20% allocation * -5% return = -1%

- Inflation-Linked Bonds = 20% allocation * 0% return = 0%

- Private Cash-Flowing Assets = 20% allocation * 0% return = 0%

- Commodities = 20% allocation * 10% return = +2%

Total Loss/Gain = -4% + (-1%) + 0% + 0% + 2% = -3%

So, the portfolio experienced a total loss of 3% for the quarter.

If the portfolio was 100% in stocks the portfolio would have lost 20%.

This is the benefit of having different assets and returns streams that act differently from each other.

This approach is about building a foundation for consistent, long-term growth rather than risking your capital on a limited selection of choices, which can materially raise your left-tail risk.

“The key is your return-to-risk ratio. Risk and diversification are of paramount importance, and the fact is that if you diversify well, you can reduce your risk by 70% or 80% if you take uncorrelated, good things.”

Dalio stresses that the success of a trading or investment strategy hinges on its return-to-risk ratio, where managing risk and ensuring diversification are critical.

We’ve covered this in other articles where truly diversified returns streams can reduce your risk without reducing your return.

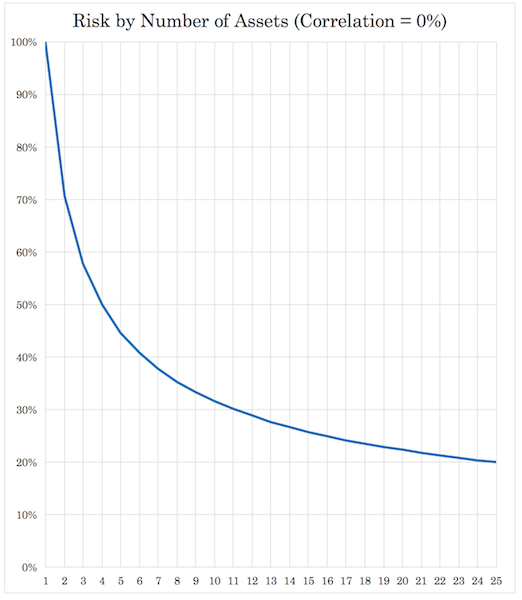

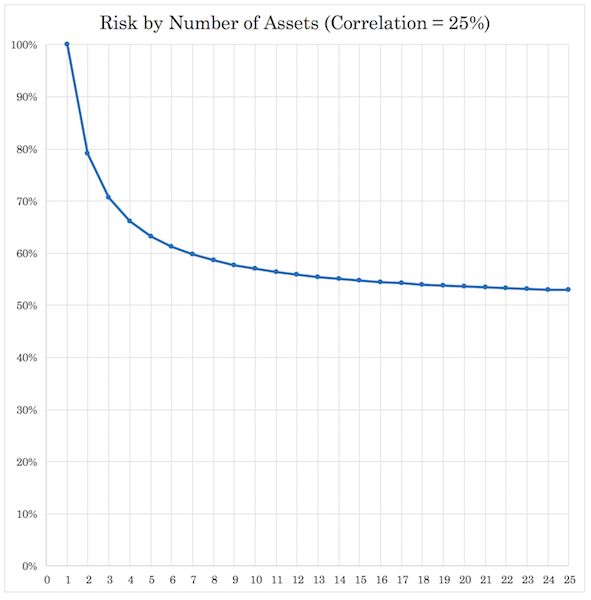

At a 0% correlation between returns streams:

At 25% correlation it starts to lag:

Focusing on this ratio, traders can aim for maximum returns while controlling the level of risk taken.

Diversification is at the heart of this approach: when a portfolio includes a range of high-quality, uncorrelated assets, it becomes less vulnerable to downturns, as the performance of one asset doesn’t directly impact another.

Doing this in practice, of course, is not easy.

Dalio asserts that well-diversified portfolios can reduce risk by as much as 70-80% when they consist of uncorrelated investments.

This means that the more variety an investor or trader includes within a portfolio, the more stable it becomes, as different assets react differently to market forces.

“Human managers process information spontaneously using poorly thought-out criteria and are unproductively affected by their emotional bias. These all lead to suboptimal decisions. Imagine what it would be like to have a machine that processes high-quality data using high-quality decision-making principles/criteria.”

Dalio critiques traditional human decision-making in this quote by highlighting the limitations that come from spontaneous and emotionally-driven choices.

He observes that people often use inconsistent or poorly thought-out criteria to process information, which can cloud their judgment and lead to suboptimal results.

This is absolutely true in trading as well.

Emotions like fear, greed, and bias are often powerful influences, causing people to make decisions that deviate from rational analysis.

For instance, in financial management, emotional reactions to market fluctuations can result in impulsive trades rather than decisions grounded in objective data.

Dalio implies (and is backed by his other writing) that human decision-making can be inconsistent and unreliable due to these spontaneous and sometimes subconscious influences.

Dalio contrasts this with the potential benefits of machine-based decision-making.

He stresses the value of a machine capable of processing vast amounts of high-quality data without the limitations of emotional bias or inconsistent criteria.

Such a machine would apply well-defined principles and criteria (as programmed directives) and produce more consistent and potentially more optimal decisions.

In fields like finance, management, and operations, such a machine could have a significant edge, if done right, because it would be able to process data quickly, analyze patterns, and make data-driven decisions without emotional interference.

The human, on the other hand, has limited awareness and processing speed.

For Dalio, high-quality decision-making comes from applying well-developed principles consistently.

He suggests that building a system – or “machine” – that combines vast data processing with established principles could elevate decision-making to a level that humans can’t achieve.

By and large, Dalio advocates for a hybrid approach – i.e., leveraging the reliability of machines alongside human insight and experience as a way to create a balanced decision-making process.

“The greatest tragedy of mankind is that people hold onto their opinions and don’t allow themselves to be open-minded.”

Dalio touches on a key limitation in human nature: the tendency to cling to opinions.

We all have our heads full of lots of opinions, and we all have a lot that simply aren’t correct or useful.

He views this as a significant tragedy, as people’s unwillingness to reconsider their perspectives or engage openly with differing views stifles growth and collaboration.

Dalio advocates for open-mindedness, a trait he sees as essential for learning and improvement.

When people hold rigidly to their own opinions, they prevent themselves from understanding other perspectives or seeing potential flaws in their own thinking.

This resistance to change and self-examination not only limits individual growth but can also lead to conflicts and misunderstandings, both in personal relationships and in society.

People can even become enemies simply because their brains process information differently.

Dalio’s point here is that true progress requires open-mindedness – the ability to question, adapt, and refine one’s beliefs.

For him, growth comes from challenging assumptions, welcoming constructive criticism, and seeking to understand diverse viewpoints.

His emphasis on open-mindedness aligns with his broader philosophy on decision-making: that openness to new information and perspectives leads to better can also lead to incremental improvement in his own processes.

“Whenever I make an investment decision, I observe myself making it and think about the criteria I used. I ask myself how I would handle another one of those situations and write down my principles for doing so. Then I turn them into algorithms. I am now doing the same for management and I have gotten in the habit of doing it for all my decisions.”

Here, Dalio describes his approach to refining his decision-making process by carefully observing and analyzing his own actions.

Each time he makes a trade or decision, Dalio reflects on the criteria he used, asking himself how he could handle similar situations in the future.

Breaking down his decisions into a set of principles, he can capture his insights and turn them into algorithms. As such, these principles can be applied consistently in similar scenarios.

This approach is central to Dalio’s broader management philosophy: creating a systematic, principles-based framework for decision-making.

Dalio suggests that writing down these principles and transforming them into algorithms removes the influence of impulsive or emotional reactions and creates a repeatable, objective process.

From standardizing his approach, he can improve the quality of his decisions over time.

That way, he can incrementally learn from each experience rather than relying solely on intuition or memory.

Dalio extends this method beyond investment decisions to management and other areas of life.

His goal is to establish a reliable, principles-based system that continually refines itself when managing complex situations and achieving long-term success.

“Timing the market is a fool’s game.”

Timing the market – trying to predict when prices will rise or fall to buy low and sell high – isn’t easy.

Many traders are tempted to time the market to maximize returns, but this strategy is more often than not a losing game.

Market prices are influenced by countless, often unpredictable factors, from economic trends to geopolitical events.

Even seasoned traders find it nearly impossible to consistently predict these movements accurately because there are so many variables affecting prices and so much variance to so many of them.

Trying to time the market often results in emotional decisions, like panic selling during downturns or buying during peaks, which can reduce long-term returns.

Instead, a more reliable strategy is to focus on strategic allocation – consistent, long-term investment and allow time and compound growth to work in your favor.

“The best way to manage risk is to diversify your portfolio.”

Diversification is one of the most fundamental principles in risk management for not only trading and investing but all businesses.

Spreading trades/investments across a variety of assets – like stocks, bonds, real estate, or commodities – allows you to reduce exposure to the risks associated with any single asset or market.

Different assets perform differently under various market environments; when one is down, another might be up – or at least performing differently – balancing out potential losses.

Diversification doesn’t guarantee profits or eliminate losses, but it can make a portfolio more resilient to market fluctuations.

Holding a range of positions, traders can achieve a more stable return over time.

It’s especially helpful during economic downturns, as a diversified portfolio is likely to withstand losses better than one concentrated in a single asset type.

The ultimate goal is to balance risk and reward by blending various assets in a way that aligns with your risk tolerance and financial goals.

“Investing is about managing risk, not avoiding it.”

Risk is unavoidable.

And not to get overly Tony Robbins-ish, but the biggest risk is taking no risk.

The goal isn’t to eliminate it entirely, but to manage it effectively.

Avoiding risk altogether would mean avoiding the trades/investments that can offer the high returns.

Instead, smart trading is about understanding and controlling risk to achieve financial goals without taking on undue uncertainty.

Managing risk involves assessing each trade, position, or investment’s potential returns against its associated risks and balancing them according to one’s objectives and tolerance.

Risk management can involve strategies like diversification, hedging, or adjusting portfolio allocations based on market analysis.

It also includes setting clear goals and expectations, like defining a long-term investment horizon that allows for temporary market volatility.

“All investments compete and it’s not easy to tell whether one investment is better than the other. Because if people could do that life would be easy and everybody would make a ton of money, and this is a competitive game that’s very difficult to compete in.”

In the markets, every investment opportunity competes for capital, but determining which trades or investments are “better” is far from straightforward.

If it were easy to discern one good investment, trade, or asset from another, trading and investing would be simple, and everyone could effortlessly make large profits.

However, the reality is that trading is a competitive and complex game. Assets in different classes each have unique risks, rewards, and behaviors in response to economic changes.

Trading decisions are difficult because each opportunity has many variables that can affect its performance, and no single investment consistently outperforms others across all timeframes and market environments.

This is why Dalio believes there is no single answer, and it has to be a diversified answer.

What may be a good investment today might not be tomorrow, depending on factors like growth and inflation shifts, interest rates, changes in risk premiums, or regulatory changes.

Traders must weigh these factors carefully, understanding that each investment competes for their limited capital.

Diversifying across various investments and maintaining a long-term perspective can help navigate this.

Instead of trying to pick clear “winners,” you don’t need to do that if that’s not your thing.

The goal should be to build a balanced portfolio capable of weathering different market environments.

“But when I mean financial engineering, I don’t mean go into an optimizer and throw things around and see what spits out. I mean understanding the parts and how to put those parts together.”

He emphasizes that true financial engineering requires a deep understanding of the elements within a portfolio and the thoughtful integration of these elements – i.e., rather than relying on naive optimizations off recent historical data that lacks the deep understanding.

Financial engineering involves more than just using software to generate asset allocations.

It’s about dissecting each component of an investment strategy to understand the fundamental drivers of the pricing, correlations (also on a fundamental level, not based on historical averages), and how they contribute to the overall portfolio.

Dalio is critical of a surface-level approach where people might “throw things around” in optimization software without genuinely understanding the underlying assets.

This approach risks missing the nuanced interactions between assets.

For Dalio, a successful investment strategy requires investors to be methodical in how they assemble these parts – e.g., the base allocation, leveraging, derivative overlays.

This means thoughtfully combining assets that serve specific roles – like growth, stability, or inflation protection – in a way that improves the portfolio’s resilience and performance.

“The controlling of risk with diversification, the right balancing, and perhaps some leverage, is something that produces the best results.”

Dalio views risk control as the cornerstone of everything, achieved through careful diversification, balancing, and, in some cases, moderate leverage.

Diversifying reduces the likelihood of large losses due to any single asset’s poor performance, creating a more resilient portfolio.

Balancing involves strategically allocating capital among different asset classes (and different countries and currencies) to optimize returns while maintaining a desired risk level.

This approach reduces the impact of broader market fluctuations on overall portfolio performance.

Dalio also suggests that, when used prudently, leverage can improve returns by allowing traders to better create balance and use capital more efficiently without overexposing their portfolios to risk.

In other words, leverage isn’t a black-and-white thing (“any leverage is bad, no leverage is good”), but rather a well-diversified portfolio that’s carefully calibrated to specific risk levels using leverage/leverage-like techniques is safer than a highly concentrated, unleveraged portfolio.

Nonetheless, leveraging should be approached with caution and only when the portfolio is well-diversified and balanced, as it can magnify both gains and losses.

The combination of these strategies, he believes, creates the best chance of achieving stable, long-term results.

Overall, Dalio’s philosophy is one where diversification, balance, and judicious use of leverage work in concert to optimize performance without compromising stability.

“The greatest mistake of the individual investor is to think that a market that did well is a good market rather than a more expensive one.”

He warns against the common misconception that a strong-performing market is inherently “good” or a safer place to invest.

When a market has recently performed well, prices are likely to be higher, often making investments within that market more expensive and potentially overvalued.

This mindset can lead traders and investors to buy at inflated prices due to FOMO or because of recency bias, increasing the risk of losses if the market corrects or declines.

Traders frequently chase trends, assuming that past performance guarantees future results.

However, this approach overlooks the underlying valuations and economic factors that might make these investments riskier at these higher prices.

Dalio’s idea is that a market’s past performance doesn’t make it an inherently better opportunity.

Instead, it may mean that prices have risen to levels where the expected return is now lower, and the risk of a downturn is higher.

For Dalio, prudent investing requires looking beyond recent performance to assess whether a market is offering genuine value.

This involves evaluating whether an asset’s price reflects its intrinsic worth rather than simply being swayed by recent trends.

“Gold is a currency. It is still, by all evidence, a premier currency. No fiat currency, including the dollar, can match it… Gold should be a part of everyone’s portfolio to some degree because it diversifies the portfolio and it is a storehold of wealth.”

Dalio views gold as a unique asset that provides stability and value in a portfolio.

He argues that gold functions as a “premier currency,” distinct from fiat currencies like the dollar, euro, or yen.

Unlike fiat currencies, which can be printed and are subject to losses due to inflation (if nominal interest rates paid on it are inadequate) and policy changes, gold has intrinsic value and a long history as a store of wealth.

Dalio believes that including gold in a portfolio helps to diversify it, protecting against currency depreciation and other economic unknowns.

Gold serves as a hedge, especially during times of financial instability or when fiat currencies lose value. Gold is priced relative to a reference currency, essentially making it a type of inverse money/currency.

Its consistent demand and limited supply have helped it maintain value over centuries.

For Dalio, adding gold to a portfolio is a way to increase its resilience, providing a layer of protection when other assets may be underperforming.

It’s like an alternative form of cash and can be structured as an overlay.

This diversification strategy aligns with his broader approach to risk management, emphasizing the importance of including assets that are uncorrelated with traditional markets and capable of preserving value over time.

Conclusion

Ray Dalio’s trading strategy is a blend of disciplined global macro analysis, principles-based decision-making, and a deep understanding of economic cycles.

His approach emphasizes balance, using diversification and risk parity to manage risk effectively.

Through the All Weather Portfolio, Dalio believes in the importance of preparing for any economic scenario, building a portfolio that can endure shifts and shocks.

Dalio’s philosophy extends beyond trading.

Many outside the hedge fund and finance industries have looked toward his management principles and also his life advice, reflecting his worldview rooted on “radical transparency,” independent thinking, and continuous improvement.

His commitment to understanding the “economic machine” has made him one of the most influential figures in finance, with a strategy that remains relevant and instructive for traders/investors globally.