Best Stock Brokers For Day Trading 2026

Want to buy shares or speculate on stock prices but don’t know which brokerage to use? We’ve reviewed, compared and rated the best stock brokers and platforms for day trading stocks.

Top 6 Stock Brokers for Day Trading

Our comprehensive analysis of 140 brokers, conducted as of February 2026, reveals the following day trading platforms as the top choices for stock traders:

-

1

Interactive Brokers

Interactive Brokers -

2

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

3

NinjaTrader

NinjaTrader -

4

FOREX.com

FOREX.com -

5

TradeUp

TradeUp -

6

InstaTrade

InstaTrade

Why Are These Brokers the Best for Stock Trading?

Here is a quick overview of why we think these are the best stock brokers:

- Interactive Brokers is the best stock broker for day trading in 2026 - IBKR provides access to an unparalleled array of equity products originating from 24 diverse countries. Whether seeking capital appreciation, dividends, or voting rights, you can directly invest in stocks. Alternatively, you can engage in speculative trading on price movements through CFDs, futures and more than 13,000 ETFs. IBKR also enhanced its European equity derivatives offering in 2024 by adding trading on CBOE Europe Derivatives (CEDX).

- eToro USA - You can trade 3000+ popular US stocks and ETFs at eToro US, with zero commissions and fractional shares available. The broker remains an excellent choice for beginner stock traders, thanks to its comprehensive eToro Academy and user-friendly stock market research features.

- NinjaTrader - Stocks can be traded by connecting the NinjaTrader platform to supporting brokers. The firm also provides access to a range of index futures via standard and micro contracts, including the E-Mini S&P 500 Index Futures and E-Mini Russell 2000 Index Futures.

- FOREX.com - FOREX.com provides access to a wide array of US, EU, and UK stock CFDs, featuring spreads as narrow as 1 point. This enables you to speculate on established household names and emerging IPOs, fostering ample opportunities for diversification within stock portfolios. US stocks are accessible from as low as 1.8 cents per share.

- TradeUp - In our tests across mobile, web and desktop, TradeUP delivered a strong stock-trading experience with basic market/limit/stop/stop-limit orders, 22 core indicators and 30+ drawing tools, reliable quotes/fills, and clean confirmations. Beyond mainstream U.S. equities, access extends to selected OTC names and 250+ Chinese ADRs (e.g., BABA, BIDU, NIO).

- InstaTrade - InstaTrade offers an average selection of around 200 global stocks and indices, subject to your location. A modest commission rate of 0.1% on US shares is applied, complemented by various tools designed to keep you informed on stock market developments, though its 'Stock Markets' analytics hadn't been updated for 4+ months during our latest round of testing.

Best Stock Brokers For Day Trading 2026 Comparison

Uncover the top stock broker for your needs with our comparison of features essential for active stock traders:

| Broker | Stock Fee | ESG Stocks | Spot Trading | Financial Regulator |

|---|---|---|---|---|

| Interactive Brokers | 0.003 | ✔ | ✔ | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| eToro USA | $0 | ✔ | ✘ | SEC, FINRA |

| NinjaTrader | - | ✘ | ✔ | NFA, CFTC |

| FOREX.com | 0.14 | ✘ | ✔ | NFA, CFTC |

| TradeUp | - | ✔ | ✔ | SEC, FINRA |

| InstaTrade | 8 (Apple Inc) | ✘ | ✘ | BVI FSC |

How Safe Are These Stock Brokers?

How reliable are the top stock brokers and do they have tools that help protect your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| eToro USA | ✘ | ✘ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| FOREX.com | ✘ | ✔ | ✔ | |

| TradeUp | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ |

Mobile Stock Trading Comparison

Are these brokers good for stock trading on mobile?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| eToro USA | iOS & Android | ✘ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| FOREX.com | iOS & Android | ✘ | ||

| TradeUp | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ |

Are the Top Stock Brokers Good for Beginners?

Stock trading beginners should use providers that provide trading with virtual money (demo accounts) and have other features that new traders need.

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| eToro USA | ✔ | $100 | $10 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| TradeUp | ✔ | $0.01 | $1 | ||

| InstaTrade | ✔ | $1 | 0.01 |

Compare Advanced Stock Trader Features

Are these stock trading platforms good for advanced traders?

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| eToro USA | ✘ | ✘ | ✘ | ✘ | - | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| TradeUp | - | ✘ | ✘ | ✘ | - | ✘ | ✔ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

Compare the Ratings of Top Stock Brokers

Find out how the top stock brokers score in all core areas following our hands-on tests.

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| eToro USA | |||||||||

| NinjaTrader | |||||||||

| FOREX.com | |||||||||

| TradeUp | |||||||||

| InstaTrade |

Compare Stock Trading Fees

The cost of trading stocks with a brokerage may have a large impact over time:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| Interactive Brokers | ✘ | $0 | |

| eToro USA | ✔ | $10 | |

| NinjaTrader | ✘ | $25 | |

| FOREX.com | ✘ | $15 | |

| TradeUp | ✘ | $0 | |

| InstaTrade | ✘ | - |

How Popular Are These Stock Brokers?

Some traders prefer the most popular stock brokers (those with the most signed up clients).

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Interactive Brokers | |

| eToro USA | |

| NinjaTrader | |

| FOREX.com |

Why Trade Stocks With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Stock Exchanges

Interactive Brokers offers trading on 18 stock exchanges:

- Abu Dhabi Securities Exchange

- Borsa Italiana

- CAC 40 Index France

- Chicago Mercantile Exchange

- Euronext

- IBEX 35

- Japan Exchange Group

- Korean Stock Exchange

- London Metal Exchange

- London Stock Exchange

- Nairobi Securities Exchange

- Nasdaq

- Nasdaq Nordic & Baltics

- New York Stock Exchange

- Russell 2000

- Shenzhen Stock Exchange

- Tadawul

- Toronto Stock Exchange

Pros

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Why Trade Stocks With eToro USA?

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

eToro USA offers trading on 3 stock exchanges:

- Dow Jones

- New York Stock Exchange

- S&P 500

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- The low minimum deposit and straightforward account opening process means beginners can get started quickly

- The online broker offers an intuitive social investment network with straightforward copy trading on cryptos

Cons

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- Average fees may cut into the profit margins of day traders

Why Trade Stocks With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Automation | Yes |

| Account Currencies | USD |

Stock Exchanges

NinjaTrader offers trading on 2 stock exchanges:

- Chicago Mercantile Exchange

- New York Stock Exchange

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

- You can get thousands of add-ons and applications from developers in 150+ countries

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Why Trade Stocks With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Automation | Yes |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Stock Exchanges

FOREX.com offers trading on 14 stock exchanges:

- Australian Securities Exchange (ASX)

- Borsa Italiana

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hang Seng

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Pros

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

Why Trade Stocks With TradeUp?

"TradeUp is best suited to budget-conscious day traders looking to trade U.S. and global markets with zero commissions on a user-friendly mobile app. Its more than 250 Chinese American Depositary Receipts (ADRs), including Alibaba Group (BABA), also make it suitable for trading Chinese equities."

Christian Harris, Reviewer

TradeUp Quick Facts

| Fractional Shares | Yes |

|---|---|

| Demo Account | Yes |

| Regulator | SEC, FINRA |

| Platforms | Desktop, Web, Mobile |

| Minimum Deposit | $0.01 |

| Automation | No |

| Account Currencies | USD, EUR, GBP |

Stock Exchanges

TradeUp offers trading on 4 stock exchanges:

- Hong Kong Stock Exchange

- Nasdaq

- New York Stock Exchange

- S&P 500

Pros

- TradeUp’s platforms work smoothly across multiple devices based on our tests, including mobile apps for iOS and Android, a desktop app for Windows and Mac, and a web-based platform. This allows active traders to switch between devices without losing continuity, whether you’re at home or on the go.

- TradeUp offers commission-free trading on US stocks and ETFs, and support for fractional shares lets you buy portions of a share for as little as $5.This makes it a cost-effective choice for active day traders who want to minimize trading expenses.

- TradeUp runs an integrated and intuitive financial calendar that helps you track earnings, dividends, and IPOs relevant to your watchlist, enabling you to stay ahead of market-moving events.

Cons

- The platform's technical indicators have limited customization options from our use. On both mobile and web versions, you can't layer multiple indicators on the same chart simultaneously, which restricts more sophisticated chart analysis.

- TradeUp does not support popular third-party platforms like TradingView or cTrader, so traders who rely on those for advanced charting, automation, or community features won't find that flexibility.

- TradeUp's educational resources aren't kept updated, and were over 6 months old in our latest tests. While there are articles and tutorials aimed at newcomers, the content is somewhat limited and does not cover more advanced trading strategies or deeper topics.

Why Trade Stocks With InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Fractional Shares | No |

|---|---|

| Demo Account | Yes |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Automation | Yes |

| Account Currencies | USD, EUR, RUB |

Stock Exchanges

InstaTrade offers trading on 12 stock exchanges:

- Australian Securities Exchange (ASX)

- CAC 40 Index France

- DAX GER 40 Index

- Dow Jones

- Euronext

- FTSE UK Index

- Hong Kong Stock Exchange

- IBEX 35

- Japan Exchange Group

- Nasdaq

- S&P 500

- SIX Swiss Exchange

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- InstaTrade sports one of the most cluttered websites and client cabinets in the industry, potentially overwhelming new traders, especially compared to XTB’s intuitive trading journey and resources.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

How Did DayTrading.com Choose The Best Brokers For Day Trading Stocks?

We exhaustively evaluated each stock broker, assigning them an overall rating that served as the basis for our platform rankings. This rating is a culmination of:

- Quantitative metrics: We scrutinized over 200 data points across 8 core categories, carefully documented by our experts.

- Qualitative insights: Our extensive testing process yielded valuable observations that further informed our evaluation.

Below are the key considerations that shaped our stock broker ratings. We recommend you take these factors into account when choosing an online stock broker.

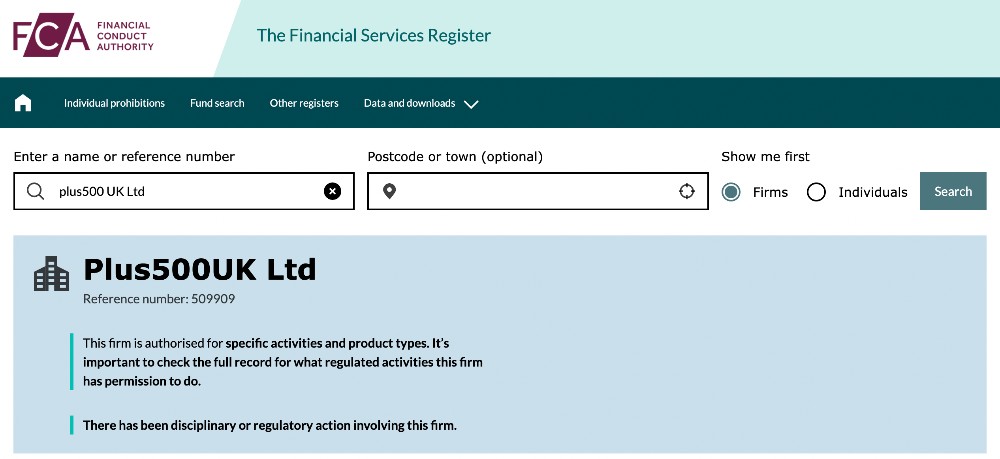

Regulation and Trust

We prioritized online stock brokers that are authorized by trusted financial regulators like the US Securities & Exchange Commission (SEC), UK Financial Conduct Authority (FCA), and Australian Securities & Investments Commission (ASIC).

That’s because top-tier regulators ensure stock brokerages provide measures that can help protect your capital from business failure. The UK’s Financial Services Compensation Scheme (FSCS), for example, protects investments up to £85,000.

Leading regulators also enforce restrictions on leveraged stock trading for retail investors, typically set at 1:5. Leveraged trading is particularly common among short-term traders and it’s regulated to curb potential losses, offering protection in case the stock markets move against you.

- Plus500 maintains its position as one of the most heavily regulated stock brokers (via CFDs) we’ve tested with real money, earning our trust with 7 licenses and a listing on the London Stock Exchange.

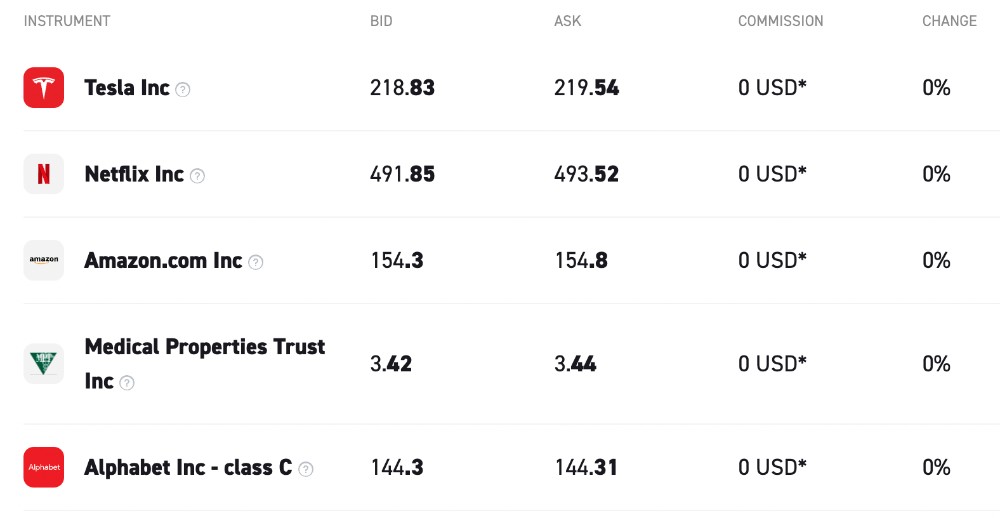

Stock Trading Fees

We chose brokers that offer low stock trading and non-trading fees, taking into account commissions on popular shares, margin fees, plus any deposit/withdrawal and inactivity charges.

Picking a brokerage account with low trading fees is especially important if you are day trading stocks, as a large volume of transaction fees can cut into profit margins.

- XTB continues to stand out for its low stock trading fees after introducing zero commissions on shares and charging a competitive 0.5% conversion fee. It’s also one of a limited number of stock brokers we’ve tested to offer high interest on uninvested cash (up to 4.9%).

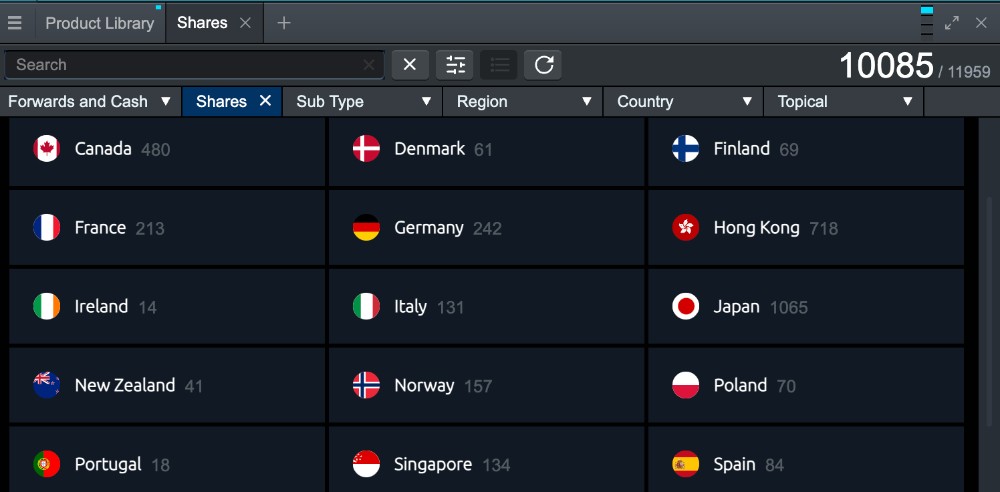

Stock Market Access

We favored brokers with access to a wide range of stock exchanges, providing short-term trading opportunities across a selection of markets and industries.

Importantly, stock market trading is centralized, meaning that shares in most large companies are sold through national exchanges, such as the New York Stock Exchange (NYSE), National Association of Securities Dealers Automated Quotations (NASDAQ), and London Stock Exchange (LSE).

Companies will not be listed on all exchanges, therefore, you should look for a broker with a global reach, especially if you want to build a diverse portfolio.

Also, some brokers specialize in buying and selling company shares directly, while others only allow you to speculate on stocks as the underlying assets using products like CFDs. These derivatives can be an excellent option for day traders looking for leveraged vehicles to profit from shorter-term price movements.

- Year after year, we’ve been impressed with CMC Markets, which offers an almost unrivalled suite of 10,000+ shares including major stocks in technology, banking, finance, plus consumer and retail sectors.

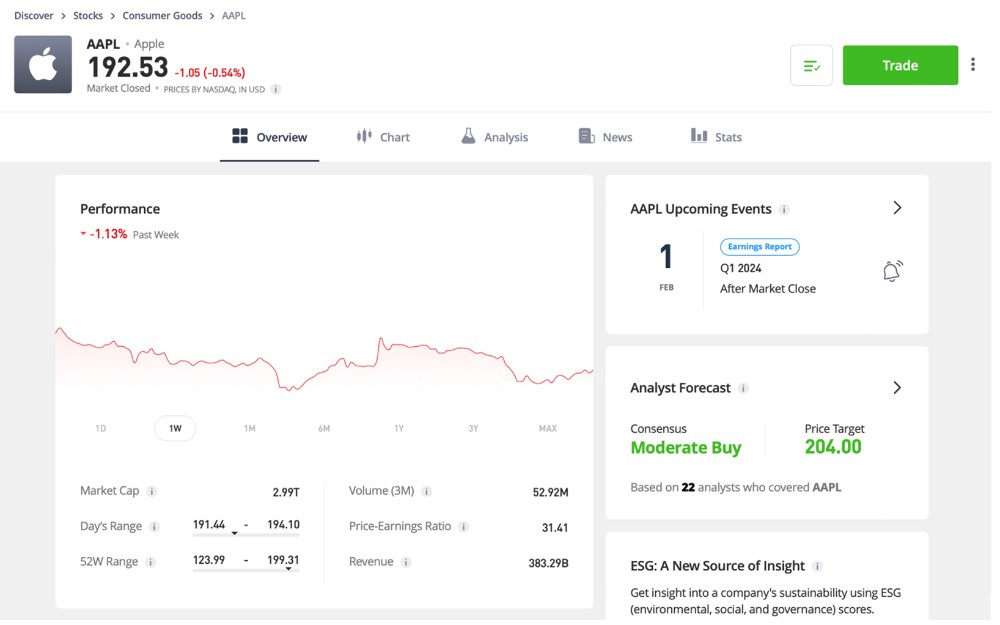

Stock Trading Platforms and Apps

We selected brokers with excellent stock trading platforms and apps that have clearly been designed with ease of use in mind for beginner traders, alongside helpful stock screeners and sophisticated analysis tools for advanced investors.

That’s because a user-friendly platform ensures smooth navigation, timely execution of trades, and provides valuable tools and insights to inform stock trading decisions.

- eToro’s stock trading platform and app stood out during testing for its simple interface that will appeal to new traders. It also provides intuitive charting and in-built indicators that will serve day traders, as well as integrated research and news feeds, trading calendars and expert commentary.

What Is A Stock Broker?

An online stock broker allows you to purchase company stocks and shares, or trade related derivatives like CFDs, via a website, desktop platform or mobile app, using just the internet.

These brokers will have connections to the stock market and will purchase the stock on your behalf. Trades can be executed at the click of a button, in real-time via their online platforms.

How Do Stock Brokers Make Money?

Stock brokers make money through several avenues. Often you will pay a commission, which is a flat fee per transaction. That said, we’re increasingly seeing online stock brokers, such as XTB, move to commission-free models.

In these instances, stock brokers may make money through a markup on the spread, which is the difference between the price a buyer is willing to pay (bid) and the price a seller is willing to accept (ask) for a particular stock, representing the transaction cost and liquidity in the market.

Some stock brokers are also market makers meaning they create liquidity by taking the other side of your trade. Sometimes, brokers can make money this way if a stock trader makes a loss.

How Do I Start Trading Stocks?

The first step is to open an account with a stock brokerage.

You will find a wide assortment of online stock brokers and trading platforms available online, but choosing the best one for you depends on the stocks you want to trade, your trading strategy and your personal preferences.

You will then need to deposit the minimum amount, which typically ranges from $0 to $500. We’ve learned that depositing more upfront can often provide access to better quality stock trading tools and market research.

After that, you can log into the stock trading platform or app to find opportunities and place trades.

If you are new to stock trading, I recommend starting with a demo account. They simulate real-life market conditions, but any orders placed are with ‘paper money’. This means you can explore a platform and practice day trading stocks before risking real money.

FAQ

Are Online Stock Brokers Safe?

The best way to stay safe is to choose a trustworthy stock broker. The most reliable sign of a trustworthy stock broker is authorization from one or more respected regulators, such as the SEC in the US, the ASIC in Australia, the FCA in the UK, or the CySEC in Europe.

We regularly verify the licenses of our recommended stock brokers on the respective regulator’s database to ensure they are authorized by the financial bodies they claim to be.

Our team is also comprised of industry experts who keep abreast of major security incidents and unfair trading practices – marking such stock brokerages down where appropriate. This was the case with Robinhood when its trading practices were found to be harmful to retail investors.