Futures Trading

Futures trading began on exchanges in Japan during the 1700s as a way for rice farmers to hedge against moving prices. Today these derivatives are traded all over the globe and are available across a range of asset classes.

This guide to futures trading for beginners will explain what futures contracts are and how they work, describe the advantages and disadvantages of using them, and illustrate how investors can begin trading these high-risk, high-reward securities.

Quick Introduction

- Futures contracts are derivative instruments that allow speculators to profit from price changes in an underlying asset.

- Unlike options, futures commit an investor to complete a trade for a specified price and at a pre-determined time.

- While first introduced for commodities, they have since evolved to cover a wide range of assets including stocks, bonds, and forex.

- A trader who goes long will generate a profit when they sell (or close) the contract at a higher price than they paid to enter the position.

- Conversely, someone who takes a short position will make money by purchasing (or covering) the contract at a lower price than they originally received when they initially sold it.

- Futures prices often move faster than traditional markets, which can create opportunities for short-term traders.

Best Futures Brokers

We have tested hundreds of online brokers as of October 2025 and these 4 offer the best range of futures contracts with attractive trading conditions:

What Are Futures?

Futures contracts are agreements where a buyer and a seller assent to trade a pre-determined quantity of an asset for a set price on a particular date.

Traders typically have a variety of contracts to choose from with different expiration dates, and there are generally recognized expiration cycles, such as monthly or quarterly, that apply to most futures contracts.

Futures are complex financial vehicles known as derivatives. Their value is sourced (or derived) from the price of an underlying asset, although crucially an investor does not need to own said asset to trade these contracts.

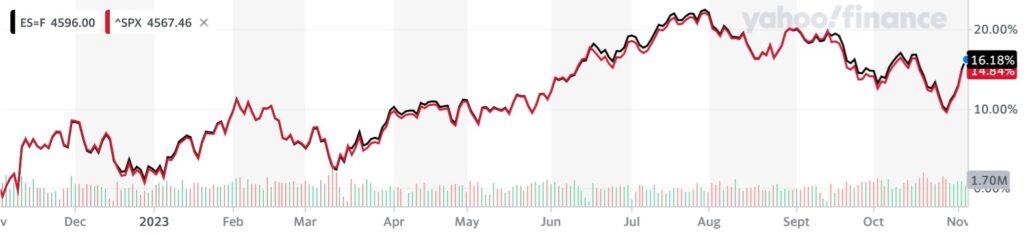

Below you can see the close correlation between the E-mini S&P 500 futures contract and the S&P 500 stock market index upon which it is based.

A Booming Market

Futures can be used to trade a wide variety of assets including commodities, equities, indices, bonds, cryptocurrencies, interest rates and foreign currencies.

Exchanges for these financial instruments were first set up around 300 years ago in Asia for the trading of soft commodities (or agricultural products). These contracts provided farmers with a price guarantee for their crops and/or livestock, and gave them enough money to last until harvest time.

It also provided them with peace of mind by allowing them to hedge against falling prices. Wholesalers, meanwhile, could protect themselves from rising costs as well as effectively manage their inventories by trading with futures.

These protections are as important now as they were centuries ago, so futures are still a critical instrument when it comes to commodities trading. But today these derivatives are also hugely popular with speculators as well as producers, manufacturers, wholesalers and other businesses, while the range of assets they can be used to trade has also ballooned.

The futures market has subsequently grown to gigantic proportions. According to the World Federation of Exchanges, a staggering 29.59 billion of these contracts changed hands in 2022.

Futures Versus Options

Futures trading has been compared to options, another form of derivative instrument that allows a trader to speculate on the price movement of an underlying asset.

However, options contracts have the upper hand in one respect. They provide individuals with the right – but importantly not the obligation – to purchase said asset within a certain timescale. This in turn lessens the risks posed to traders.

Having said that, futures trading has some significant advantages over dealing in options. These include:

- Superior liquidity, which makes it quicker and easier for traders to open and close positions.

- A higher level of available leverage means that futures trading profits can be magnified.

- Online broker charges and fees can be substantially lower on futures contracts.

- Investors don’t have to worry about time decay, which is the rate at which an options contract declines in value as the expiration date approaches.

Where Are Futures Contracts Traded?

Futures are predominantly traded on financial exchanges, although they are also sometimes traded over the counter (OTC).

The contracts that are traded on these centralized marketplaces are highly standardized and key details such as contract size, asset quality, and expiration dates follow clear pre-specified rules. Ensuring that each contract is the same makes them more easily tradable.

The trading of futures on financial exchanges has other key benefits for investors, including:

- Deep liquidity – High trading volumes make it easier for investors to enter and exit positions.

- Price transparency – Real-time prices, volumes and other futures trading information are readily available, allowing traders to make informed decisions.

- Better protection – The use of clearing houses as intermediaries between buyers and sellers helps to reduce the chances of one party defaulting on their obligations. Exchanges are also regulated by government bodies, ensuring market integrity and providing investor protection.

- Wide product ranges – The use of established exchanges means that a large selection of different futures contracts are available for a variety of underlying assets.

What Futures Can I Trade?

Certain futures contracts can only be traded on one exchange, whilst others change hands in multiple places.

For instance, currency futures (like contracts based on the GBP/USD pairing) can be traded on the Chicago Mercantile Exchange (CME), the Intercontinental Exchange (ICE) and Eurex.

Alternatively, investors looking to trade oil futures based on the West Texas Intermediate (or WTI) oil benchmark can only transact these contracts on the New York Mercantile Exchange (NYMEX).

Particular exchanges also only allow the trading of futures to institutional and professional traders. The London Metal Exchange (LME), for instance, does not allow copper futures to be bought and sold by retail traders. These participants will instead have to choose an alternative exchange like the CME or ICE to do business.

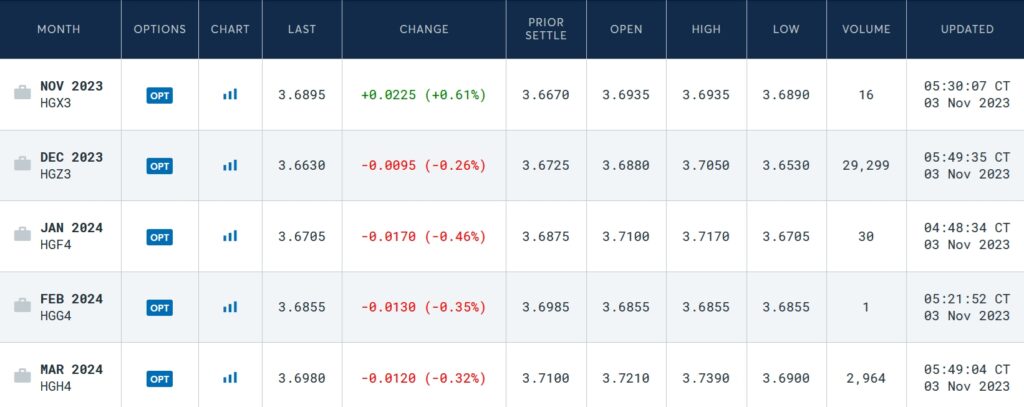

Here you can see several copper contracts traded on CME. The column on the left shows the date when each contract is due to expire, while information on prices (including price changes) and volumes can also be seen.

How Futures Trading Works

Long and Short

As with almost all derivatives, futures traders can make money when asset prices rise or fall.

Taking a long position involves purchasing a contract with the expectation that the underlying asset will rise from the spot price (this is the price for immediate settlement and delivery). If the price of the said asset has increased from the time of purchase to the date of expiry, the trader can sell the contract at a higher price and make a profit.

Going short, on the other hand, means selling a futures contract on the expectation that the underlying asset will decline from the current spot value. These bearish investors are essentially committing to sell the asset at the expiration date for its contract price.

Should the trader guess correctly and the asset value fall, they can make money by buying the contract back at a cheaper price.

Sizing Things Up

The relationship between the price of futures contracts and the value of the underlying assets are closely correlated. But the existence of lots (in other words contract sizes) makes the trading of both very different.

Let’s take aluminium futures as traded on CME as an example. Each contract represents a unit of 25 metric tonnes, meaning that if the price of the lightweight metal increased by $10 a tonne, a trader that has taken a long position would make a profit of $250 ($10 x 25 tonnes).

This graphic shows key details for the Henry Hub natural gas futures contract that’s traded on NYMEX. As well as showing the lot size per contract, other details like daily trading volumes, product code, and exchange trading hours are presented.

Cash Settlement And Rollovers

Futures contracts specify dates when the agreement expires and when physical delivery of the underlying asset is due. But in practice, the vast majority of traders have no intention of taking possession of the asset in question.

In fact, many futures contracts are designed so that physical delivery does not take place. Agreements instead are settled in cash, meaning that investors maintain their position until the final day and have the assurance of closing out their position at the expiration price.

The futures exchange will calculate the difference between the price at which the trader entered the contract and the final cash settlement price. If a person takes a long position, and the settlement price is greater than the entry price, they will receive a cash payment. Similarly, investors who initially went short and sold a futures contract will receive a payout if the settlement price is lower than their entry price.

In the event that the market moves in an adverse direction, the trader will have to pay the difference between the contract’s initial purchase price and the final settlement price. This will be deducted from their trading account.

You can also go down the rollover route if you decide not to take delivery of the underlying asset. This involves closing out a futures contract before it expires and simultaneously opening a new contract with a later expiration date.

Rolling over allows you to continue as normal with your speculative or hedging strategies.

Trading On Margin

One massive benefit of futures trading is that high levels of leverage are available. In fact, the use of borrowed cash is extremely common in the buying and selling of these contracts.

Investors need to put down an initial deposit, known as margin, if they wish to use leverage. This is essentially collateral that is deposited to cover potential losses, and is usually a percentage of the total value of the position that a trader wishes to control.

The use of loaned money from a brokerage means that traders require less capital to get started. It also allows them to make more money by controlling a larger position than they would be able to if they used only their own funds.

However, investors need to be careful with using leverage, and especially those who are new to futures trading.

Utilizing borrowed funds is a double-edged sword: while the rewards can be high, risks are also much greater and vast losses can be racked up quickly.

A broker may ask you to deposit extra funds, known as a margin call, if losses mean the maintenance margin falls below the minimum required level.

Leverage In Action

Let me show you an example of how leverage works. Let’s say that Trader A believes that the WTI oil price benchmark will rise in value, and they wish to take advantage of this by trading futures contracts.

They opt to buy a WTI futures contract with a three-month expiration date on NYMEX. With a current oil price of $70 per barrel, and the contract representing 1,000 barrels of oil, the total value of the contract is $70,000.

Trader A also chooses a broker that offers leverage of 1:10, meaning that they must deposit an initial margin of $7,000 to carry out the trade.

Now let’s assume that the WTI price reaches $80 per barrel at the expiration date, an improvement of $10 from the entry price. The trader would have made a profit of $10,000 from that futures contract (the profit of $10 per barrel multiplied by the 1,000 barrels controlled by said contract).

Meanwhile, the return on their initial investment (in other words the margin) would stand at an impressive 143% (the $10,000 profit divided by that $7,000 initial deposit).

How To Start Futures Trading

Mastering The Fundamentals

Futures contracts are more complex than many other financial instruments. And as I’ve also explained, the widescale availability of leverage adds extra risk. For these reasons, new investors need to put in a lot of time and effort to find out how these securities work before they start trading.

But learning about futures themselves is just one part of the education process. To successfully trade these derivatives, one also needs to have a sound knowledge of what moves the prices of the underlying assets.

For instance, someone trading silver futures will need to understand how prices of the grey metal react to industrial production data, inflation readings, interest rate changes, supply-side news and US dollar movements, to name just a few influential factors.

Helpfully, there is wealth of information out there to help novice traders get in the swing of things and devise a trading strategy.

Specialist investing websites, webinars, and online trading communities are all great resources, for example. Financial magazines, news sites, and stock market web pages, are valuable resources for new and experienced investors alike.

Talking Technical

Having a strong awareness of technical analysis is also important for trading futures. This is essential for spotting trading opportunities as well as managing risk.

Charts can help investors forecast price movements, gauge market volatility, identify trends, and establish support and resistance levels, to name just a few of their many benefits.

Technical analysis is an excellent tool for all market participants. However, is it generally considered to be a more critical tool for day traders than for longer-term investors.

This is because these traders (like scalpers) are focused on exploiting small price movements within extremely tight timescales. Technical analysis allows them to identify short-term trends, patterns, and price fluctuations which in turn can help them make profitable trading decisions.

Opening A Trading Account

Having completed these steps, the next stage is to select a brokerage with which to do business with. Fortunately there are plenty of companies out there that permit the trading of futures contracts, so investors have a good chance of finding a firm that can meet their needs.

Some of the key things to consider when deciding which brokerage to use include:

- Dealing costs – High commissions and fees, along with wide spreads, can seriously impact the profits futures traders make over time.

- Trading platform – Platforms that are easy to use, have fast execution times, and boast a variety of tools and functions can boost futures trading performance.

- Asset classes – Not all brokerages may offer the financial assets that an investor wishes to trade with futures contracts.

- Leverage and margin – Certain companies will allow investors to borrow more funds than others, while some also have stricter rules on margin maintenance.

- Customer support – Getting a technical or account problem sorted quickly and easily is critical, and especially for investors using futures day trading or scalping strategies.

- Demo accounts – Trading simulators are a great idea for new futures traders to perfect their craft before putting any money on the line.

- Regulation – Ensuring that the futures brokerage is regulated by a reputable financial authority will help protect a trader’s investments and ensure that their activities are above board.

Use our list of recommended futures brokers, reviewed by our expert team, to get started.

Pros and Cons Of Trading

Pros

- Excellent choice – Futures contracts cover a wide selection of underlying assets, allowing traders to build a diversified portfolio if they choose.

- Deep liquidity – Most futures trading is done on financial exchanges where dealing volumes are high. This allows individuals to carry out their business rapidly and straightforwardly.

- Transparency – The role of regulated exchanges means that futures trading is also highly transparent, so key information (like prices and trading volumes) is easy to obtain.

- Lots of leverage – These financial instruments allow traders to use large quantities of borrowed funds, which in turn can amplify returns if markets move favourably.

- More than one way to profit – Futures allow traders to take long or short positions, meaning they can make money whether markets appreciate or decline.

- Low trading costs – Modest charges and fees from brokers allow the potential for greater profits (this is especially important for individuals who trade more frequently).

Cons

- Leverage risks – Futures traders who use funds from their broker can accumulate large losses when things go wrong. Even small changes in the value of the underlying assets can have a devastating impact.

- Frequent volatility – Market movements for some underlying assets can be extremely erratic, which in turn leads to choppiness in the price of related futures contracts.

- Obligation to settle – Unlike options contracts, futures traders must settle by the specified date and at the stated price even if they change their mind.

- Timing issues – Futures have rigid expiration dates, so investors must time their entries and exits carefully.

Terminology

Below are two terms you may frequently come across and will need to understand:

First Notice Day

A futures trading first notice day (FND) comes the day after an investor who has purchased a futures contract may be obliged to take physical delivery of the contract’s underlying commodity. The FND will vary depending on the contract and exchange rules.

Last Trading Day

The last trading day of oil futures, for example, is the final day that a futures contract may trade or be closed out prior to the delivery of the underlying asset or cash settlement. Usually, most futures result in a cash settlement, instead of a delivery of the physical commodity. This is because the majority of the market is hedging or speculating.

You will need to take into account unpredictable price fluctuations on the last trading day of crude oil futures, or natural gas futures, for example.

But before you start trading futures, you need to get to grips with your chosen asset, as the quantity of different futures varies.

Bottom Line

Futures contracts are highly versatile financial instruments. Traders can use them to speculate on a broad spectrum of assets including stocks, forex and commodities. What’s more, participants can choose from contracts with a variety of expiration dates, from one month into the future to years in advance.

Most futures trading is done on regulated financial exchanges. This helps to minimize risk and can make it easier for traders to do business. However, dealing in these derivatives can still be dangerous owing to the availability of leverage.

Borrowed funds allow investors to control much larger positions than if they used just their own funds. But while the use of loaned money can supercharge returns, it can also leave market participants nursing painful losses. Therefore futures traders need to tread extremely carefully if they use their broker’s money to do business.

FAQ

What Is A Futures Contract?

Futures contracts are financial instruments whose prices are linked to the value of an underlying asset. They require the buyer to purchase a set quantity of a commodity, stock or other security on a selected date and at a specified price.

What Markets Can I Trade With Futures?

While futures trading was introduced as a way to hedge against fluctuating commodity prices, these derivatives can now be used to speculate on many asset classes including equities, indices, currencies and bonds.

What Affects Futures Prices?

Contract values rise and fall in line with the prices of the underlying security. They can be impacted by the macroeconomic and geopolitical landscape, supply- and demand-related news, industry-specific developments and so on.

Is Leverage Widely Used By Futures Traders?

Futures are especially popular because of the high levels of leverage that traders often use. This can create large profits but also leave investors nursing painful losses, so new investors should use either small amounts of borrowed funds or no leverage at all.

How Do I Calculate Profit And Loss When Trading Futures?

The money that an individual makes (or loses) on a futures contract is determined by the difference between the entry and exit prices.

Recommended Reading

Article Sources

- The Complete Guide to Futures Trading, Refco Private Client Group, 2005

- Trading Futures For Dummies, Joe Duarte, 2011

- Trading Commodities and Financial Futures, George Kleinman, 2013

- Copper Futures, CME Group

- Natural Gas Futures, CME Group

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com