Leverage Trading for Beginners

Leverage trading allows you to enhance your position size, which increases both profit, and loss, potential. In this guide, we cover the definition of leverage trading with examples for beginners. Find out if trading with leverage is worth the risk.

Quick Introduction

- Leverage trading, also known as trading on margin, enables you to increase your buying power in return for a cash deposit.

- The broker essentially lends you money, magnifying potential returns (and losses).

- After a leveraged position is closed, the borrowed capital is returned to the broker and you keep any profits.

- Leverage is often written as a ratio, for example 1:20. Alternatively, it can be written as a multiple (20x), or a percentage (5%).

- With leverage of 1:20, a $100 outlay would give you $2,000 in buying power ($100 x 20).

- The level of leverage available varies depending on local regulatory restrictions, the volatility of the asset, the broker you trade with, and your status as a retail or professional trader.

Best Leverage Trading Brokers

These are the 4 best brokers for leveraged trading and their available leverage:

Alternatively, see our list of brokers with the highest leverage.

What Is Leverage Trading?

Leverage in trading refers to the practice of borrowing funds to amplify the size of a trading position beyond your own capital. It allows you to control larger positions with a relatively small amount of your own money, potentially magnifying both profits and losses.

While leverage can enhance potential gains, it also increases the risk of substantial losses, making it a double-edged sword that requires careful risk management and an understanding of the potential consequences.

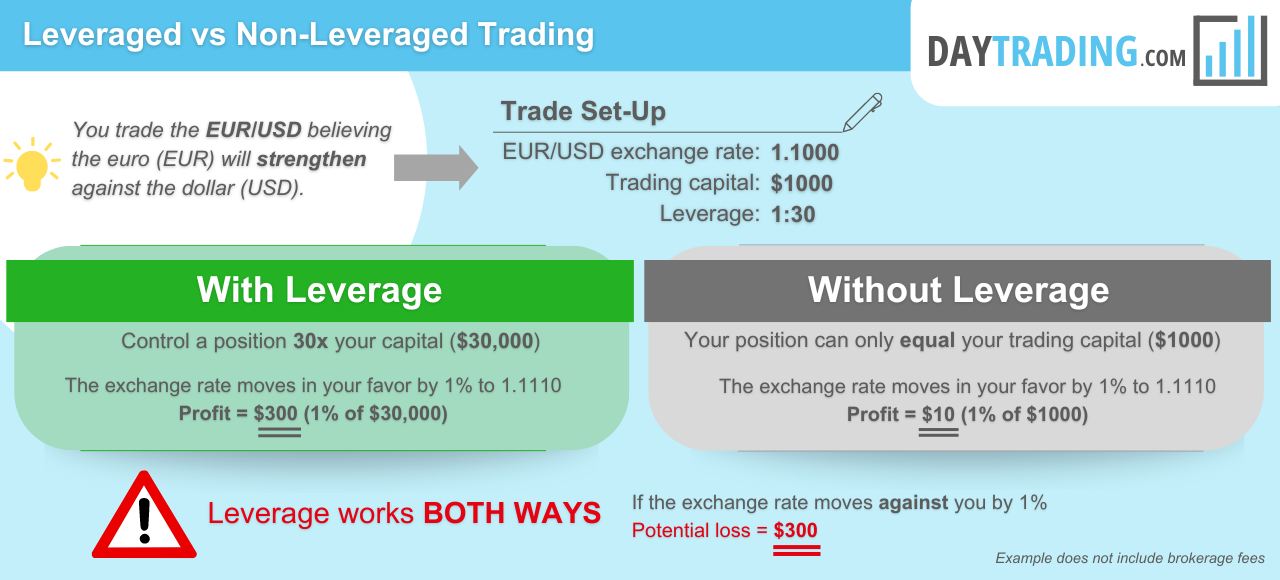

Example

To show you how it works, let’s consider a real-world example of how you might use 1:30 leverage in the context of forex trading:

Leverage Calculator

Use the calculator at XM to see what a trade might cost to open and to help calculate the effect of leverage on risk/reward.

What Markets Can You Trade With Leverage?

Leverage trading can be used in all popular financial assets, including forex, stocks, cryptocurrency, commodities, and exchange-traded funds (ETFs).

However, it’s important to note that the level of leverage available can vary significantly between different markets and brokers. For example, forex leverage trading is permitted with most authorities up to 1:30. On the other hand, cryptocurrencies are incredibly volatile and so are subject to much lower limits, usually around 1:2 or 1:3. Leverage trading on stocks is usually permitted up to around 1:5.

Some of the most popular markets where leverage is commonly used include:

- Forex: Foreign exchange trading involves the exchange of one currency for another. It is one of the most popular markets for leveraged trading, and you can use leverage to control larger positions in currency pairs.

- Stocks: While stock trading is typically done on a cash basis, some brokers offer leverage for trading stocks through products like margin accounts or contracts for difference (CFDs). These instruments allow you to control a larger position in stocks than your initial capital would permit.

- Commodities: Commodities like oil, gold, and silver can be traded with leverage. You can use instruments like commodity futures contracts or CFDs to gain leveraged exposure to these markets.

- Indices: Stock market indices, such as the S&P 500 or Nasdaq, can be traded with leverage through index futures or CFDs. This allows you to speculate on the overall performance of a market index.

- Cryptocurrencies: Some cryptocurrency brokers offer leverage for trading digital assets like Bitcoin and Ethereum. You can use leverage to magnify potential gains (or losses) when trading cryptocurrencies.

- Bonds: Leverage can also be applied to bond trading through instruments like bond futures. You can speculate on interest rate movements and bond price changes with leverage.

- Options And Futures: Options and futures contracts inherently involve leverage. These derivatives allow you to control a larger position in the underlying asset by paying a fraction of its value as a premium or margin.

Pros of Trading With Leverage

- Amplified Profits: Leverage magnifies potential gains, allowing you to earn more with less capital

- Capital Efficiency: Leverage enables you to control larger positions, making capital usage more efficient

- Access To Bigger Markets: Leverage provides access to larger, more diverse markets

- Hedging: Leverage can be used for risk management through hedging strategies

- Increased Liquidity: Leverage enhances liquidity, facilitating quick entry and exit from positions

Cons of Trading With Leverage

- High Risk Of Losses: Leverage magnifies losses as much as profits, potentially leading to significant capital erosion

- Margin Calls: You may face margin calls, requiring additional funds to cover losses, which can lead to forced liquidation

- Psychological Stress: High leverage can induce emotional stress and impulsive trading decisions

- Interest Costs: Borrowed funds for leverage may incur interest, affecting overall profitability

- Limited Margin For Error: Small adverse price movements can lead to substantial losses, leaving little room for error in trading decisions

Regulations

Leverage levels in trading can vary significantly from one country to another due to differences in regulatory frameworks. Unregulated brokers offer even higher leverage than regulated brokers (up to 1:1000 in some cases), but it’s important to note that trading with excessively high leverage is riskier and may not be in your best interests.

Here are some real-world examples of different regulated leverage levels in various regions around the world:

- United States: Leverage levels for retail forex trading are heavily regulated by the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). The maximum allowable leverage for retail forex trading is restricted to 1:50 for major currency pairs and 1:20 for minor and exotic pairs.

- European Union: Regulated by the European Securities and Markets Authority (ESMA), leverage for major currency pairs is capped at 1:30, while leverage for other CFDs, including indices and commodities, has varying limits depending on their volatility.

- United Kingdom: The Financial Conduct Authority (FCA) also regulates leverage levels for retail traders. The FCA implements similar restrictions to the EU, with a maximum leverage of 1:30 for major forex pairs and lower leverage for other instruments.

- Australia: To protect retail traders, the Australian Securities & Investments Commission (ASIC) has imposed leverage restrictions on forex trading. The maximum leverage allowed for major currency pairs is 1:30, while for minor currency pairs it is 1:20. Exotic currency pairs and non-currency CFDs have even lower leverage limits.

Regulations can change as authorities often review and adjust leverage limits to enhance investor protection and mitigate risk. You should always check the latest regulations in your respective region and be aware of the specific leverage limits in place when conducting trading activities.

How To Manage Risk When Trading With Leverage

Managing risk when trading with leverage is essential to protect your capital and minimize the potential for significant losses. Here are some best practices for risk management when using leverage in trading:

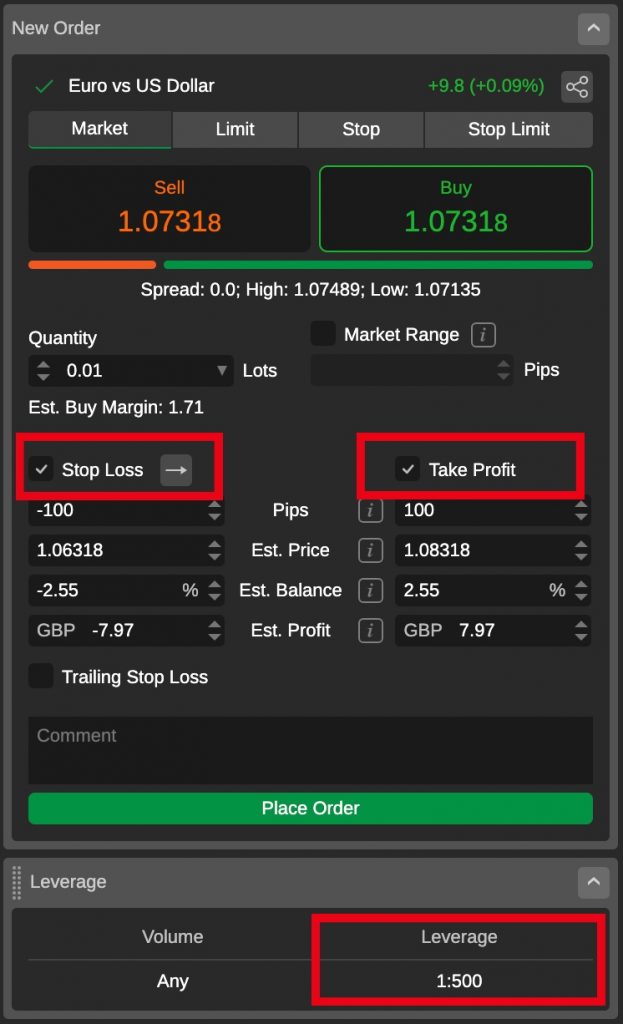

Set Stop-Loss Orders

Always use stop-loss orders to define the maximum amount of loss you are willing to tolerate on a trade. This order automatically closes your position if the market moves against you, helping to limit potential losses.

Diversify Your Portfolio

Avoid putting all your capital into a single trade or asset. Diversifying your portfolio across different instruments or asset classes can spread risk and reduce the impact of a single losing trade.

Use Proper Position Sizing

Determine the appropriate position size based on your risk tolerance and the size of your trading account. Avoid over-leveraging by ensuring that your position size is within your risk management guidelines.

Set Risk-Reward Ratios

Before entering a trade, establish a clear risk-reward ratio. This means that you should have a target for potential profit that is larger than your stop-loss level. For example, if your stop-loss is 2% of your account, aim for a potential profit of at least 4% or more.

Limit Leverage

Be conservative with the amount of leverage you use. Just because high leverage is available doesn’t mean you have to use it all. Consider using lower leverage levels to reduce risk.

Continuous Education

Keep learning and improving your trading skills. The more you understand the markets, technical and fundamental analysis, and trading strategies, the better equipped you’ll be to make informed decisions.

Emotional Control

Maintain emotional discipline and avoid making impulsive decisions based on fear or greed. Stick to your trading plan and risk management rules.

Stay Informed

Be aware of economic events, news releases, and market developments that can impact your trades. Stay informed to adapt to changing market conditions.

Regularly Review And Adjust

Periodically review and adjust your risk management strategies as your trading account grows or your risk tolerance changes. Reevaluate your trading plan to ensure it aligns with your financial goals.

Risk Capital

Only trade with money you can afford to lose. Avoid using funds that are necessary for essential living expenses or long-term financial goals.

Bottom Line

Understanding leverage is paramount before employing it in a real trading account due to its significant impact on risk and potential returns. First and foremost, you need to grasp that leverage is a double-edged sword. While it allows you to control larger positions and potentially amplify profits, it equally amplifies the risk of substantial losses. This means that a seemingly small market movement against a leveraged position can result in a significant capital loss.

Without a comprehensive grasp of its implications and a robust risk management plan, you risk jeopardizing your long-term success in the markets. You must establish clear stop-loss levels, position sizing rules, and risk tolerance limits. Failing to do so can result in overexposure and potentially wipe out your account.

Trading with leverage is not inherently bad and can be a powerful tool when used wisely. However, it requires a diligent and disciplined approach to risk management to safeguard your capital and navigate the markets effectively.

FAQ

How Does Leverage Trading Work?

Leveraged trading (or trading on margin) means funds are borrowed from a broker to increase position sizes beyond what your available balance would usually allow. The amount of leverage is usually expressed as a ratio i.e. 1:30. After closing the position, you will repay the broker back the debt, taking the profit on the larger position size.

What Is Leveraged Vs Margin Trading?

Trading on margin is the same as leveraged trading. The term margin refers to the deposit value and the remainder of the position is placed with borrowed funds. This strategy allows you to leverage the capital you have to place a position that is larger than it would usually allow.

Is Leverage Trading Gambling?

No, leverage trading is not gambling. It is classed as a financial product and is therefore regulated by the relevant authorities, such as the CFTC, NFA, FCA, ESMA or ASIC. However, trading using leverage does carry risk which could lead to losses.

Is Leverage Trading Taxable?

Profits earned from leverage trading may be taxable, just like you would pay tax on money earned from an employer. If you are an investor, your earnings may be subject to capital gains tax, whereas if you are a short term trader, such as a day trader, your earnings will likely be taxed as business income.

Note that some websites charge interest on the borrowed funds. We would advise that you consult a tax professional to ensure you are meeting legal obligations within your country.

Article Sources

- Leveraged Trading: A professional approach to trading FX, stocks on margin, CFDs, spread bets and futures for all traders, Robert Carver

- Leverage Trading In Cryptocurrency, M. J. Kelley II

- FCA Change To Leverage Trading Rules On CFDs

- ESMA Leverage Trading Rules (page 8)

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com