Best Day Trading Software

Day trading software provides tools that help investors analyze markets and make trades. The best day trading software can help identify potentially profitable trading opportunities and automate order execution in line with chosen strategies.

In this guide, we explain how trading softwares work and compare the tools offered by the top forex, stock, commodity and crypto brokers. We also explore software demo accounts, computer equipment, and regional differences.

Best Trading Software 2026

We have tested the trading software at hundreds of brokers as of February 2026, and these are the best options:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone. -

5

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

6

FOREX.com

FOREX.com

Here is a short overview of each broker's pros and cons

- Interactive Brokers - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- eToro USA - eToro is a social investing platform that offers short-term and long-term trading on stocks, ETFs, options and crypto. The broker is well-known for its user-friendly community-centred platform and competitive fees. With FINRA and SIPC oversight and millions of users across the world, eToro is still one of the most respected brands in the industry. eToro securities trading is offered by eToro USA Securities, Inc.

- Plus500US - Plus500US is a well-established broker that entered the US market in 2021. Authorized by the CFTC and NFA, it provides futures trading on forex, indices, commodities, cryptocurrencies, and interest rates. With a 10-minute sign-up, a manageable $100 minimum deposit, and a straightforward web platform, Plus500 continues to strengthen its offering for traders in the US.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

Interactive Brokers

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

NinjaTrader

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- You can get thousands of add-ons and applications from developers in 150+ countries

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- Non forex and futures trading requires signing up with partner brokers

- There is a withdrawal fee on some funding methods

- The premium platform tools come with an extra charge

eToro USA

"eToro remains a top pick for traders looking for leading social investing and copy trading services. With a low deposit, zero commissions and an intuitive platform, the broker will meet the needs of newer day traders."

Jemma Grist, Reviewer

eToro USA Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, ETFs, Crypto |

| Regulator | SEC, FINRA |

| Platforms | eToro Trading Platform & CopyTrader |

| Minimum Deposit | $100 |

| Minimum Trade | $10 |

| Account Currencies | USD |

Pros

- The broker's Academy offers comprehensive learning materials for beginners to advanced-level investors

- Investors can access Smart Portfolios for a more hands-off approach, covering a range of sectors and markets such as renewable energy and artificial intelligence

- A free demo account means new users and prospective day traders can try the broker risk-free

Cons

- There's no MetaTrader 4 platform integration for traders who are accustomed to using third-party charting tools

- There's a narrower range of day trading instruments available compared to competitors, with only stocks, ETFs and cryptos

- Average fees may cut into the profit margins of day traders

Plus500US

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Cryptocurrencies, Metals, Agriculture, Forex, Interest rates, Energy, Equity Index future contracts |

| Regulator | CFTC, NFA |

| Platforms | WebTrader, App |

| Minimum Deposit | $100 |

| Minimum Trade | Variable |

| Leverage | Variable |

| Account Currencies | USD |

Pros

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

- Plus500 added prediction markets to its 'Plus500 Futures' platform in February 2026, with event-based trades covering 10 categories, from financials to politics, including short-term opportunities with intraday contracts that expire after just 15 minutes.

- The Futures Academy is an excellent resource for new traders with engaging videos and easy-to-follow articles, while the unlimited demo account is great for testing strategies

Cons

- The proprietary platform is user-friendly but lacks advanced technical analysis tools found in third-party solutions like MetaTrader 4

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- OANDA is a reliable, trustworthy and secure brand with authorization from tier-one regulators including the CFTC

- The broker's API facilitates access to 25 years of deep historical data and rates from 200+ currencies

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- The range of day trading markets is limited to forex and cryptos only

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

Cons

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

How Trading Software Works

Online trading software can be broken down into four categories:

- Data – Before you start investing, you need to know the price of the stocks, futures, or currencies you want to trade. For stocks and futures, those prices will usually come from exchanges. Forex, however, doesn’t have a central exchange.

- Charting – Experienced traders will usually chart prices in graphing software like Sierra Chart. Many vendors will also offer data feeds. These charting packages usually offer basic technical analysis indicators. Opt for a more advanced package, and you can benefit from extra indicators and the ability to back-test strategies.

- Trade execution – With your data to hand and after analyzing it on a chart, at some point, you will want to open a position. For that, you will need some sort of trade execution software, such as an electronic trading platform. A lot of options today will also allow you to develop your own trading strategies with an application programming interface (API). They may also offer automated trading capabilities specifically for day trading.

- Broker vs. independent vendor – Many online brokers offer software directly linked to their in-house systems. You can also use third-party applications like Quantower through independent software vendors with platforms that support integration. The benefit of third-party solutions is that they often have more advanced features and enable you to trade at several different brokers through a single interface.

Operating System – Mac or Windows?

When choosing your software, you need something that works seamlessly with your desktop or laptop. Any crashes or technical issues could cost you profits.

Fortunately, retail investors are no longer constrained to Windows computers. Recent years have seen a surge in the popularity of day trading software for Mac devices, in particular. MetaTrader 4 and MetaTrader 5, for example, are the world’s most popular trading platforms. The Mac-compatible terminals are user-friendly and provide an easy-to-navigate interface, ideal for beginners and veterans. Signals, copy trading, plus Expert Advisors (EAs) are also available.

But regardless of whether you are looking for the best trading software for Mac or Windows, check reviews to ensure the technical tools, data feeds, portfolio trackers, back-testing capabilities, and any other features you require won’t run into compatibility hurdles.

In addition, make sure the initial download is free. Reputable brokers shouldn’t charge you for installation.

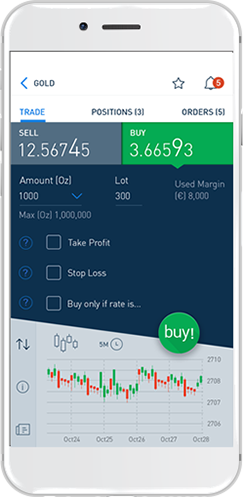

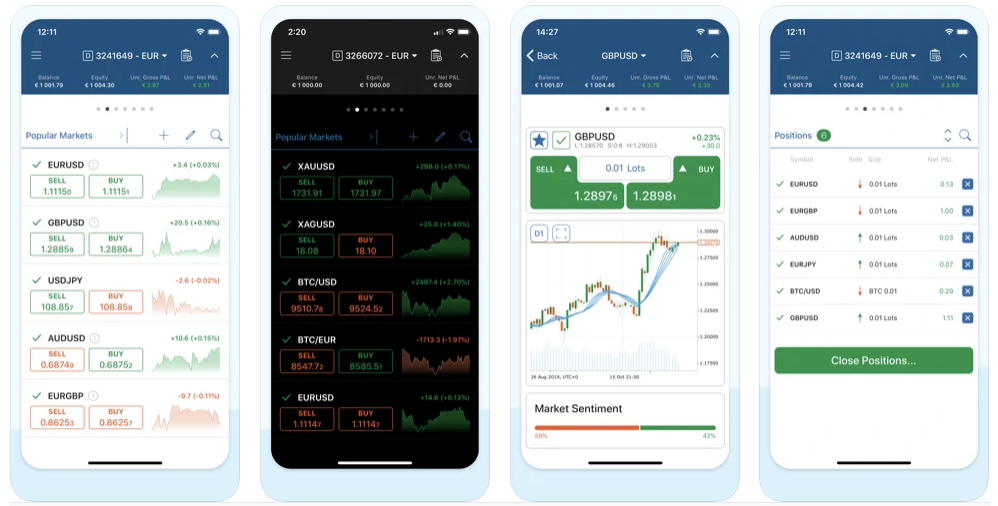

Mobile Trading Software

You can also get useful mobile trading software, normally in the form of day trading apps on iOS or Android devices. These aren’t typically designed to replace desktop applications as they lack in the capabilities area, and of course the much smaller screen doesn’t allow for any kind of advanced trading analysis. Instead, they are best used to supplement your normal, desktop-based system.

Make sure when choosing your software that the mobile app is free.

A good application will provide succinct market updates, trends, and the usual stock price tickers. If it overloads you with information that pushes you towards impulsive decisions, for example by gamifying the trading experience to make it fun or tempting in other ways, stay clear.

Comparing Trading Software

Online brokers will often offer standard software, but if you want additional features essential for your strategies, you may have to pay significantly more. So, conduct a thorough comparison before investing with your hard-earned capital.

The key points to consider include:

Cost & Need

- Does it meet your needs? – There is no one-size-fits-all trading software. Different programs will suit different investors. Are you following a simple stock strategy such as moving average tracking? Alternatively, do you want to employ a more complicated multi-conditional strategy? Will you need a direct forex feed or real-time signals? Get a free software download trial and practice on it first to make sure it caters to your needs.

- Cost – How much does the trading software cost? It is all too easy to opt for the cheapest application. But while this may save money in the short term, you may be sacrificing essential features your strategy requires. For example, Bookmap came in expensive during our tests, especially for advanced indicators, but the costs justify its numerous benefits in our view. Adding these options later may also cost you more than investing in comprehensive software to start with. Also, check to see if the program is available as part of the standard brokerage account, or does it come at an additional cost?

Technology

- Execution speed – Time is money, and nowhere is that truer than in the day trading world. Ensure your software will allow you to enter and exit positions swiftly. Check reviews for any execution red flags. A few seconds could be the difference between finishing in the red or black at the end of the day. For more information on execution speeds, see our guide.

- Accessibility – Is it a web-based software offering? If so, you will need just an internet connection to get online, plus you should have zero installation, update, and maintenance costs. This is the best option for beginners. However, if you want to employ complex algorithms, you may need computer-based installable software. This is usually a more expensive route to go down. Note, the top copy-trading software is normally available via web-based terminals.

- Features – Active traders often rely on short-term price movements to turn a profit. What does your strategy need to monitor these price fluctuations? Will you need charts, particular data feeds, news sources, and specific market access? If so, check whether these will be included as standard.

- Analytics – Does your strategy depend on technical indicators and pattern recognition technology? Will the program recognize arbitrage opportunities, for example? Comprehensive analysis software will provide you with all the features you need in one user-friendly bundle. Jigsaw Trading, for instance, provides superb insights for order flow analysis.

Forex Trading Software

Which is the best software for forex trading available in today’s market? Finding the right solution isn’t always a straightforward decision, with hundreds of options to choose from.

The first question should be: ‘what information, resources, and tools do you need to enhance your forex trading strategy?’

Below are some of the most popular types of currency trading software available:

- Forex Trading Platforms – These enable you to manage and execute forex trades.

- Forex Signals providers – These provide recommended price levels for which to enter and exit positions.

- Technical analysis software – These offer historical and live charts with exchange rates, plus a wide range of technical indicators.

- Automated forex trading software – Once you have pre-programmed your rules and strategy, these programs will automatically execute positions on your behalf.

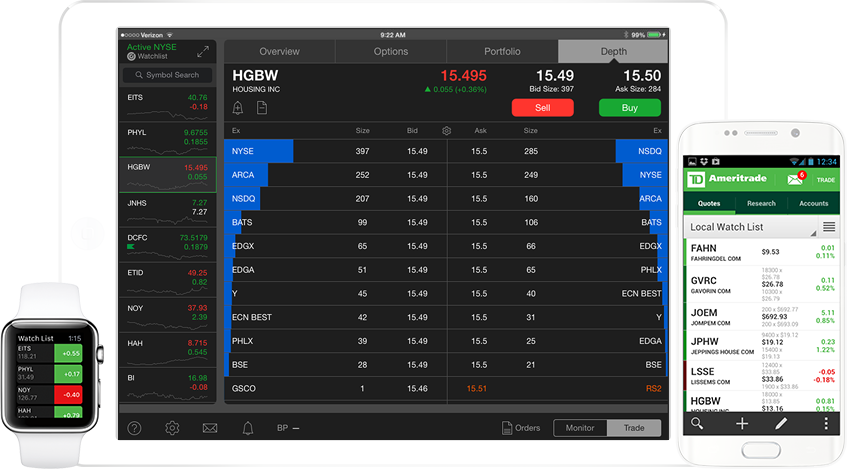

Stock Trading Software

With today’s volatile market trends, picking the right stock trading software is important. It is often said that there are very few stocks worth investing in each day. This means identifying opportunities before share prices make big moves will be what separates the profitable traders from the rest.

Before purchasing stock trading software, always check application reviews first. In addition, look for the following capabilities:

- Market scanning – These programs scan the market for opportunities and draw your attention to potential stocks via push notifications and alerts

- Charting software – These help you decipher market conditions and trends, so look for an application that offers user-friendly and intuitive charts, plus customizability options. eSignal is a particularly popular solution.

- Portfolio tracking – These track previous trades and results, helping you identify mistakes and refine strategies.

- Backtesting – These back-test your trading systems against historical data, giving you an idea of how successful your strategy may be before you risk real capital.

Other Instruments & Markets

On top of the ones above, you can also get your hands on the following:

- Commodity trading software – There is a rich supply of international applications for the commodities markets. Plus, you can find some of the best free online trading and charting software around.

- Bitcoin day trading software – As the market is still expanding, there are new options popping up every month. You can also find some of the best trading simulator software that is normally free. eToro is a particularly good choice for crypto investors.

- Emini trading software – E-mini options continue to grow so you can choose between generic systems or specialist Emini software. Good scalping options are also available, with plenty of reviews on forums.

- Penny stocks software – There is healthy competition here. In particular, there are plenty of easy-to-use buy and sell signal software for penny stocks.

- Software for NSE – You can find free programs for Indian markets, or you can choose from the ever-growing list of paid options.

- Software for cryptocurrency – These include robots, prediction software, or you can find plenty of manual solutions. You can also now get your hands on useful virtual money management software to keep your online wallet heavy.

Trading Journal Software

Day trading journals allow you to keep online log books with a detailed account of all your previous positions. This allows for analysis of your trades and your own trading behavior, with the aim to improve over time.

They usually record the instrument, date, price, entry, and exit points. This could also allow you to fill in your tax returns with ease and see if trading performance is improving.

Importantly, it can help you identify mistakes, enabling you to invest smarter in the future. This makes it some of the most important intraday trading software available.

Compare Day Trading Software

Make sure that when you compare programs, you check reviews first. Even those that proclaim to be one of the ‘top 10-day trading software’ can have some serious drawbacks for you individually. Also bear in mind that the easiest application won’t necessarily be the best over time, as your skill level improves. It could be a good start however, to get going, and you can always move to a different platform later.

Consider the popular and well-regarded options below:

- ZuluTrade – Automate trades and offers copy signals or traders to follow (particularly popular in the US)

- NinjaTrader – An advanced platform that also allows developers to build their own indicators

- MetaTrader – Market-leading multi-functional trading platform. Integrated with many top brokers

- AlgoTrader – This is ideal if you are looking for customizable, open-source software to implement automated strategies

- eSignal – Advanced charts and graphs to support short-term and long-term trading strategies. Extensive customization capabilities, plus custom indicators available

- eToro – Leading social trading network. Copy profitable traders – or become a ‘leader’ and earn when other traders follow you

- TradingView – A leading charting package with a wealth of technical analysis tools and the ability to build and back-test strategies. The software can monitor price charts over 30-day changes, plus automate investments and copy trades

- Trading Station 2 – A cloud-based trading platform developed exclusively for the forex broker FXCM

- TradeLocker – a newer software solution built with day traders in mind, featuring powerful TradingView charting and a terrific user interface

- JSE software – Considered one of the best futures day trading software available

- Etrade software – Nifty trading software that is fast, reliable, and used by investors of all levels

- MCX day trading analysis software – One of Tim Sykes’s highly recommended systems

- Consors software – This German application offers some of the best trading simulation software for free

Trading Software To Help With Strategies

Choosing the right trading software is an important decision. It is also important that any solution integrates with your trading strategies. If you are investing in forex using a simple price action strategy, for example, you may have everything you need with your broker’s standard software platform.

However, tools such as TradingView can help you build and back-test more advanced strategies, including using your own code if desired. Complex trading systems may also require software with a wide range of indicators and technical tools at a few clicks’ notice to help make fast and accurate decisions.

Importantly, for advanced traders, strategy needs are likely to be greater, and may require optional advanced features that are often expensive.

Demo Accounts

If you want to test a specific software before committing to it, the best way to do so is through a demo account. A paper trading solution is essentially a practice account where you trade for free with virtual funds using the real program and its features. It is a great way to trial software, strategies, and develop your own skills. We list the best day trading demo accounts here.

Regional Considerations

Tailored for Specific Markets

The best trading software for traders in Australia and Canada may fall short in Indian and South African markets. This is because the software in India may be be designed to analyze and take into account intricate Indian market dynamics. Spider Software, for example, provides technical analysis software specifically for Indian markets.

If you want to trade stocks in the West, you may find an application from far afield won’t give you access to all the data feeds and news resources you need to trade successfully.

There is also the question of cost. You can get plenty of free charting software for Indian markets. Still, the same powerful and comprehensive software in the UK, Europe, and the US, often comes with a price tag.

So, make sure your software comparison takes into account location and price.

Tax Considerations

The same principle applies to day trading tax software. Your accounting software needs to be able to accurately calculate how much tax is payable to your country’s specific body, the IRS or HMRC, for example.

Apart from wasting your time, any tax errors will fall on your lap, as will any fines.

Final Word On Location

If you’re British, do your homework and find out what the best application specifically for the UK is. If you are Canadian, check you won’t encounter any tax problems when you invest in accounting software from South Africa, for example.

Final Word

It is worth bearing in mind that your choice of broker can restrict the tools available.

Free day trading software may seem like a no-brainer to start with. However, if it comes with the sacrifice of technical tools that could enhance investment decisions, then it may cost you in the long run.

Also remember that the best trading software for forex may not be helpful for stocks, so do your research and consider all the tips in our guide above. And most importantly, you wouldn’t buy a car without test driving it first, and your trading software and application doesn’t need to be any different.

FAQs

Does Trading Software Work?

Yes, in fact you may use it without even realizing. All brokers offer some type of trading analytical software to display price charts, technical indicators, or even for keeping a journal.

How Day Trading Software Work?

There are many types of programs, with most of the popular solutions helping to facilitate informed trades. TradingView, for example, is useful for backtesting and planning strategies because it offers historical data and analytical tools.

Is Online Trading Training Software Useful?

Trading learning software, such as mock accounts, provide a cost-free space for novices to test their strategies and learn how to invest. See our list of top practice accounts here.

What Is The Best Day Trading Software?

Popular trading programs include eToro and Interactive Brokers. Importantly, you should choose a provider that suits your investing style and is user-friendly.

What Is The Best Free Trading Software?

There are many options, but one of the most popular forex and CFD software packages is free. MetaTrader is used by many brokers and is known for its reliability. Another free option is TradingView, they have charts spanning many assets, including cryptos, commodities, stocks, and indices.