Expert Advisors (EAs)

Expert Advisors (EAs) are programable trading robots available on MetaTrader 4 and MetaTrader 5. This tutorial will explain how Expert Advisors work and how to set them up on MT4 and MT5. We also cover the pros and cons of trading forex, stocks and more with EAs.

Expert Advisor Brokers

-

1

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States. -

2

FOREX.com

FOREX.com -

3

xChief

xChief -

4

InstaTrade

InstaTrade -

5

Exness

Exness -

6

IC Markets

IC Markets

This is why we think these brokers are the best in this category in 2026:

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- FOREX.com - Founded in 1999, FOREX.com is now part of StoneX, a financial services organization serving over one million customers worldwide. Regulated in the US, UK, EU, Australia and beyond, the broker offers thousands of markets, not just forex, and provides excellent pricing on cutting-edge platforms.

- xChief - xChief is a foreign exchange and CFD broker, established in 2014. The company is based offshore and registered with the VFSC and FMA. Users can choose between a wide selection of accounts and base currencies, making ForexChief accessible to global traders. The brand also stands out for its no deposit bonus and fee rebates for high-volume traders.

- InstaTrade - InstaTrade, based in the British Virgin Islands, is an online broker specializing in fixed income structured products and active trading through CFDs. Its zero-spread accounts, excellent research notably through InstaTrade TV, and access to the popular MT4 alongside its own web-accessible InstaTrade Gear, make it an attractive option for short-term traders at every level.

- Exness - Established in 2008, Exness has maintained its position as a highly respected broker, standing out with its industry-leading range of 40+ account currencies, growing selection of CFD instruments, and intuitive web platform complete with useful extras like currency convertors and trading calculators.

- IC Markets - IC Markets is a globally recognized forex and CFD broker known for its excellent pricing, comprehensive range of trading instruments, and premium trading technology. Founded in 2007 and headquartered in Australia, the brokerage is regulated by the ASIC, CySEC and FSA, and has attracted more than 180,000 clients from over 200 countries.

OANDA US

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, AUD, JPY, CHF, HKD, SGD |

Pros

- Day traders can enjoy fast and reliable order execution

- Beginners can get started easily with $0 minimum initial deposit

- The broker offers a transparent pricing structure with no hidden charges

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

- It's a shame that customer support is not available on weekends

FOREX.com

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Futures and Options on Metals, Energies, Commodities, Indices, Bonds, Crypto |

| Regulator | NFA, CFTC |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- The in-house Web Trader continues to stand out as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- With over 20 years of experience, excellent regulatory oversight, and multiple accolades including runner-up in our 'Best Forex Broker' awards, FOREX.com boasts a global reputation as a trusted brokerage.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Demo accounts are frustratingly time-limited to 90 days, which doesn’t give you enough time to test day trading strategies effectively.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

xChief

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The low minimum deposit of $10 will appeal to beginners, as well as the beginners’ guides in the Library

- Traders can access a copy trading solution via the MetaQuotes Signals service

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

Cons

- Fees and minimums are imposed on most withdrawal methods, including a €60 minimum for SWIFT bank transfers

- The broker trails competitors when it comes to research tools and educational resources

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

InstaTrade

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | FISP, CFDs, Forex, Stocks, Indices, Commodities, Cryptos, Futures |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Minimum Deposit | $1 |

| Minimum Trade | 0.01 |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, RUB |

Pros

- InstaTrade delivers an excellent suite of charting tools for day traders with its web trader comprising 250+ indicators, 11 chart types and a user-friendly design.

- VPS hosting caters to algo trading strategies with a dedicated physical server providing rapid execution speeds as low as 9 milliseconds.

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

Cons

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade is registered in the offshore jurisdiction of the British Virgin Islands, resulting in limited regulatory safeguards for retail investors.

Exness

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs on Forex, Stocks, Indices, Commodities, Crypto |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Minimum Deposit | Varies based on the payment system |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:Unlimited |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Exness Terminal offers a streamlined experience for beginners with dynamic charts while setting up watchlists is a breeze.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Exness has expanded its range of CFDs and added a copy trading feature, but there are still no real assets such as ETFs, cryptocurrencies or bonds

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

IC Markets

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, Bonds, Futures, Crypto |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Minimum Deposit | $200 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- As a tightly regulated and widely respected broker, IC Markets prioritizes client security and transparency, helping to ensure a reliable trading experience globally.

Cons

- There are fees for certain withdrawal methods, including a $20 wire charge, which can eat into profits, especially for frequent withdrawals.

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Interest isn't paid on unused cash, an increasingly popular feature found at alternatives like Interactive Brokers.

How Expert Advisors Work

Expert Advisors are trading algorithms, also known as bots, that can be deployed on the MT4 and MT5 platforms. EAs are built in the IDE (Integrated Development Environment) and can be used to trade forex, indices and commodities, amongst others. They are essentially designed to execute positions and strategies based on pre-determined criteria.

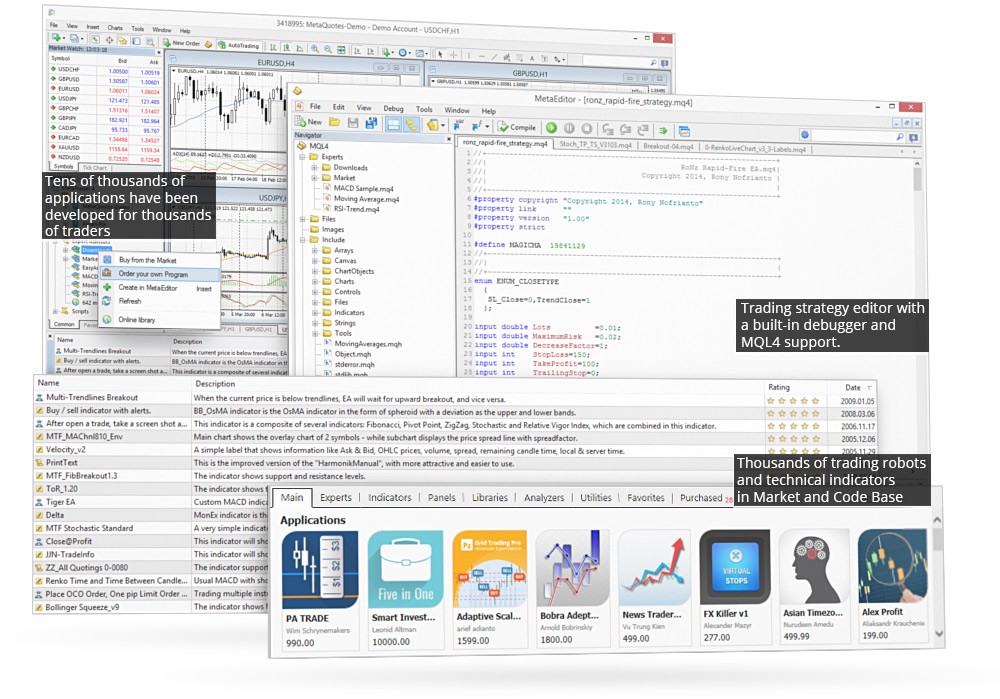

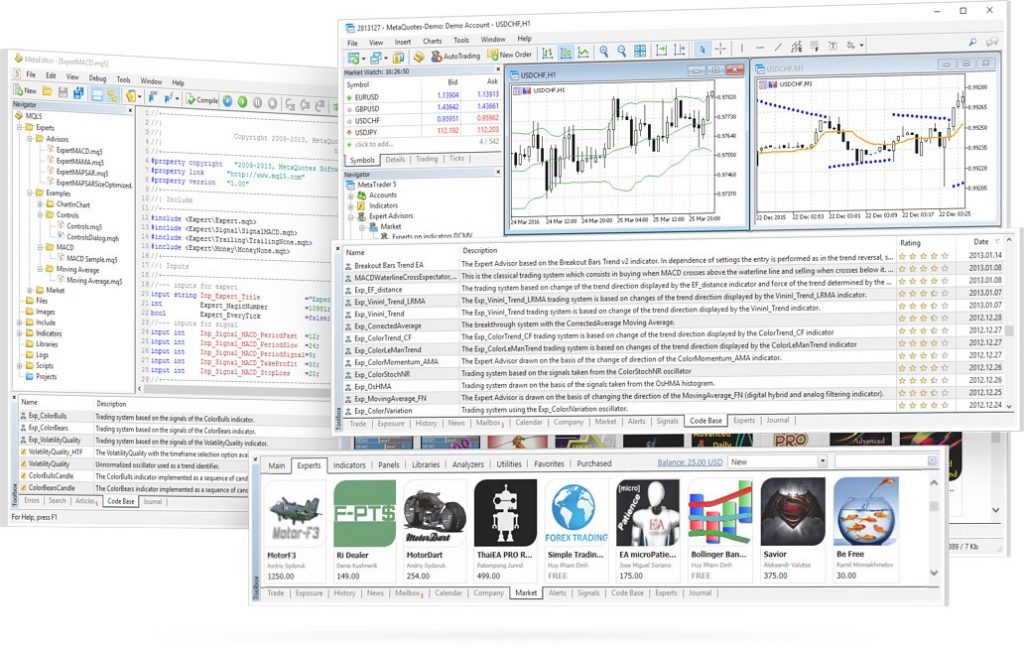

The built-in MetaEditor facilitates the development and testing of automated trading strategies on both MetaTrader platforms. And importantly, 950+ bots are available for free from Code Base while 1,700+ paid-for Expert Advisors can be purchased from the MetaTrader Market. Alternatively, EA developers can sell individual robots via the Freelance service. Paid for bots range from $10 up to several thousand US Dollars.

Parameters

Fundamentally, Expert Advisors follow a long list of yes/no rules that they consider when either alerting you to a potential trading opportunity or automatically executing positions themselves.

For those interested in the fully automated route, EAs can be left to open and close positions around the clock, seven days a week. Of course, regular monitoring and refinement are advised as profits aren’t guaranteed.

Pros

Versatile

One of the key selling points of Expert Advisors is that they can be used to develop a range of complex trading strategies, based on an unlimited set of criteria. They can be applied to scalping strategies, intraday trading systems, and swing trading setups. Importantly, they can also be tested against historical market data to gauge results.

Emotion

Another significant advantage is that Expert Advisors take the emotion out of trading. Algorithms are not affected by recent trades that have gone sour. Instead, they make decisions based entirely on logic and pre-agreed parameters.

Time

EAs can save time. Instead of manually monitoring the forex or stock market and entering and closing positions all day, an Expert Advisor can do it for you. This frees up more time to explore new markets and develop fresh strategies.

Price

Finally, EAs can be cost-effective. Users can download free bots from Code Base or pay for more advanced algorithms from the MetaTrader Market. You can also pay for bespoke bots to be built using the MetaQuotes Freelance service.

Of course, as with most things, good EAs are likely to come with a hefty price tag and even those do not guarantee consistent returns.

Cons

24/7 Trading

To run a forex EA around the clock, you will need to set up a Virtual Private Server (VPS), which often comes at a cost. And even then, it’s best to keep regular checks on progress to avoid risking substantial losses.

Profits

Unfortunately, there are scams and misrepresented EAs on MT4 and MT5. Often promising high returns with limited evidence to support claims and no track record of profits, these are to be avoided.

Beginners should carefully review bots before downloading a free solution or paying for an EA. The Code Base and Market both publish important metrics about the Expert Advisors available, including a rating, setup guidance, risk parameters, and suitable markets.

News

Expert Advisors are entirely data-driven so they don’t always respond to news events as you would expect. They aren’t able to predict all market reactions and trends so they cannot be left entirely to their own devices.

Getting Started

How To Enable Expert Advisors In MT4

Open up the MetaTrader 4 terminal and select the ‘Options’ menu under ‘Tools’. A window will then appear with the Expert Advisor section. You can then click to ‘Allow automated trading’. The platform should then enable the use of EAs.

Using Expert Advisors On MT4

To add Expert Advisors to your forex MT4 account, open MT4 and locate ‘File’. Next, click ‘Open data folder’ and choose ‘MQL4’. You should then be able to choose between ‘Expert Advisors’ and ‘Indicators’, depending on the type of input you want. You can then copy over the desired file or bot. Once complete, restart the MT4 terminal and the EA should be available in the ‘Navigator’ window.

If the Expert Advisor is available in Code Base, then the process of adding it is far simpler. Just find the desired EA or indicator and hit the ‘Free download’ or ‘Buy Expert Advisor’ buttons. Once downloaded, you can activate the EA by dragging it onto your chart and setting your variables.

How To Enable Expert Advisors In MT5

Open the MetaTrader 5 terminal and select the ‘Platform option’. Next, navigate to the ‘Expert Advisors’ tab in the pop-up menu and make sure the ‘Automated trading’ box is ticked. Once ticked, EAs can be used on your desktop or mobile MT5 application.

Using Expert Advisors On MT5

Similar to MT4, open the terminal and select ‘File’. Next, click on the ‘Open data folder’ and choose ‘MQL5’. You can then select either ‘Expert Advisors’ or ‘Indicators’. From there, you can copy over the file. Now you simply need to refresh the application and the new EA should be available in the window. Once visible, you can drag and drop the bot onto your chart to adjust any parameters.

Testing EAs

The good news is that most Expert Advisors on Code Base and the MetaTrader Market have user reviews. Many of the premium bots and indicators for sale also come with a free demo solution so that you can backtest algorithms against historical market data. Robots are usually scaled back in terms of features with the simulator, but they still give you a good indication of future performance.

Helpfully, Code Base and the Market both list the best performing Expert Advisors in 2026 and split out bots by different markets and strategies, such as forex or gold and day trading or longer-term investing.

Creating Your Own Expert Advisors

Established traders may want to build their own bot for personal use or sell their algorithm. For this, users will need to develop bots in the respective platform programming language. For MetaTrader 4, this is MQL4 while for MetaTrader 5, this is MQL5.

EAs are developed in the intuitive IDE (Integrated Development Environment) alongside MetaEditor. These are important tools that help you build, test and refine MT4 and MT5 robots to operate on forex, stock or commodity markets. Fortunately, there is a host of useful tutorials and guides online, as well as MQL4 and MQL5 forums. Other useful tips and recommendations on building your own trading bot can be found at IG and Pepperstone.

Once you have built your Expert Advisor, you can put it to work on your account, offer it as a free download on Code Base, or sell it on the MetaTrader Market.

Bottom Line

Expert Advisors are algorithms that automatically monitor the markets and execute trades based on pre-defined criteria. EAs can be used for trading popular financial markets, including forex, on both MetaTrader 4 and MetaTrader 5. A collection and database of useful tutorials and bot builder programmes are available online, especially on the MetaTrader website.

To download an EA today, head to Code Base or the MetaTrader Market.

FAQs

Are Expert Advisors Safe?

There is no guarantee of profits when trading with EAs. Whilst some of the best bots do generate decent returns, these can be pricey and often out of reach for beginners. Always check reviews of free bots before hitting download and be wary of installing Expert Advisors from third-party websites, as they could contain malicious code or be operating a scam.

Do Forex Expert Advisors Really Work?

Some FX Expert Advisors produce regular returns trading major, minor and exotic currency pairs. Of course, they will only operate effectively if trade parameters have been set up correctly. Check user reviews before downloading any free forex EAs and also backtest bots against historical data before risking funds.

Are Expert Advisors Profitable?

Some EAs have cracked creating impressive returns while others produce consistent losses. How successful a bot is ultimately depends on how well it has been developed and refined. The best performing EAs can be found on the MetaTrader Market but may come with a hefty price tag, sometimes costing thousands of dollars.

What Platforms Can You Use Expert Advisors On?

Expert Advisors are primarily available on the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. With that said, automated trading systems and services can also be found on other popular terminals, including cTrader.

Are Expert Advisors Allowed In Trading Competitions?

This is entirely dependent on the company running the competition. Some companies restrict their use. As a result, it’s best to check terms and conditions before signing up. Importantly, it is worth noting that retail Expert Advisors are legal in most major trading jurisdictions.