Day Trading Strategies

A successful strategy for day trading is essential when you are looking to capitalize on frequent, small price movements. An effective strategy typically uses technical analysis, utilizing charts, indicators and patterns to predict future price movements.

This tutorial will give you a thorough break down of day trading strategies for beginners, working all the way up to advanced, automated and even asset-specific strategies.

It will also outline some regional differences to be aware of, as well as pointing you in the direction of some useful resources. Ultimately though, you will need to find a day trading strategy that suits your specific trading style and requirements.

Quick Introduction

Ensure that your broker suits strategy-based trading. You will want things like these to be supported by the trading platform:

- Excellent trade execution quality – (read why execution speed is not the only thing to consider),

- Price action data ( + Level 2 if possible),

- Ability to trade direct from graphs,

- Trade automation,

- Stop losses and take profit orders,

- Platform reliability

Visit our top brokers to ensure you have the right trading partner in your broker.

Best 3 Brokers Suited To Strategy Based Trading

Based on our experts' tests, these brokers offer the best conditions, tools and environment for strategy-based trading:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

IQCent

IQCent -

4

OANDA USCFDs are not available to residents in the United States.

OANDA USCFDs are not available to residents in the United States.

Trading Strategies for Beginners

Before you get bogged down in a complex world of technical indicators and charting jargon, focus on the basics of a simple day trading strategy.

Many make the mistake of thinking you need a highly complicated strategy to succeed intraday, but sometimes the straightforward can be effective.

A strategy should first and foremost simplify decision making. Trade size, opening prices and exit strategies all become streamlined when viewed within an overall strategy.

The Basics

Incorporate the invaluable elements below into your strategy.

- Money management – Before you start, sit down and decide how much you’re willing to risk. Bear in mind most successful traders won’t put more than 2% of their capital on the line per trade (many experienced traders opt for a lot less). You have to prepare yourself for some losses if you want to be around and successful, long term.

- Time management – Ensure any time allocated to trading is used efficiently. Time is money.

- Start small – Whilst you’re finding your feet, stick to a maximum of around three assets or markets during a single day. It’s better to get really good at a few than to be average and making no money on too many.

- Education – Stay up to date on any core markets, but equally, learn to separate ‘noise’ from ‘signal’.

- Consistency – It’s harder than it looks to keep emotions at bay when you’re five coffees in and you’ve been staring at the screen for hours. You need to let maths, logic and your strategy guide you, not nerves, fear, or greed.

- Timing – The market will get volatile when it opens each day and while experienced day traders may be able to read the patterns and profit, you should bide your time. So hold back for the first 15 minutes, you’ve still got hours ahead.

- Demo Account – A must-have tool for any beginner, but also the best place to backtest or experiment with new, or refined, strategies for advanced traders. Many demo accounts are unlimited, so not time restricted.

Components Every Strategy Needs

Whether you’re after automated day trading strategies, or beginner and advanced tactics, you’ll need to take into account three essential components; volatility, liquidity and volume.

If you’re to make money on tiny price movements, choosing the right security is vital. These three elements will help you make that decision.

- Liquidity – This enables you to swiftly enter and exit trades at an attractive and stable price. Liquid commodity strategies, for example, may focus on gold, crude oil and natural gas.

- Volatility – This tells you your potential profit range. The greater the volatility, the greater profit or loss you may make. The cryptocurrency market is one such example well known for high volatility, but also high risk.

- Volume – This measurement will tell you how many times the stock/asset has been traded within a set period of time. For day traders, this is better known as ‘average daily trading volume.’ High volume tells you there’s significant interest in the asset or security. An increase in volume is frequently an indicator a price jump either up or down, is fast approaching.

5 Day Trading Strategies

The following strategy ideas rely on charting techniques. They can be tweaked and amended to suit a range of markets and assets.

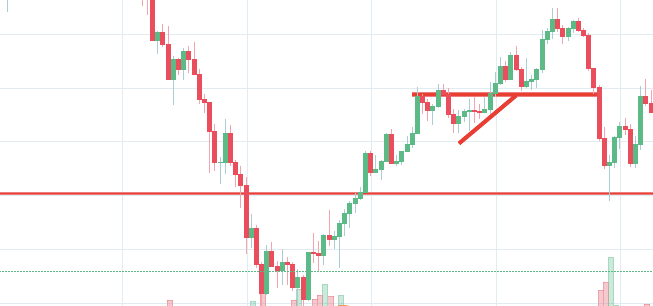

1. Breakout

Breakout strategies centre around when the price clears a specified level on your chart, with increased volume. The breakout trader enters into a long position after the asset or security breaks above resistance. Alternatively, you enter a short position once the stock breaks below support.

After an asset or security trades beyond the specified price barrier, volatility usually increases and prices will often trend in the direction of the breakout.

You need to find the right instrument to trade. When doing this bear in mind the asset’s support and resistance levels. The more frequently the price has hit these points, the more validated and important they become.

Entry Points

This part is nice and straightforward. Prices set to close and above resistance levels require a bearish position. Prices set to close and below a support level need a bullish position.

Plan your exits

Use the asset’s recent performance to establish a reasonable price target. Using chart patterns will make this process even more accurate. You can calculate the average recent price swings to create a target. If the average price swing has been 3 points over the last several price swings, this would be a sensible target. Once you’ve reached that goal you can exit the trade and enjoy the profit.

2. Scalping

One of the most popular strategies is scalping. It’s particularly popular in the forex market, and it looks to capitalise on minute price changes. The driving force is quantity. You will look to sell as soon as the trade becomes profitable. This is a fast-paced and exciting way to trade, but it can be risky. You need a high trading probability to even out the low risk vs reward ratio.

When considering scalping, it is important to check your broker permits it.

Be on the lookout for volatile instruments, attractive liquidity and be hot on timing. You can’t wait for the market, you need to close losing trades as soon as possible.

3. Momentum

Popular amongst trading strategies for beginners, this strategy revolves around acting on news sources and identifying substantial trending moves with the support of high volume. There is always at least one stock that moves around 20-30% each day, so there’s ample opportunity. You simply hold onto your position until you see signs of reversal and then get out.

Alternatively, you can fade the price drop. This way round your price target is as soon as volume starts to diminish.

This strategy is simple and effective if used correctly. However, you must ensure you’re aware of upcoming news and earnings announcements. Just a few seconds on each trade will make all the difference to your end of day profits.

4. Reversal

Although hotly debated and potentially dangerous when used by beginners, reverse trading is used all over the world. It’s also known as trend trading, pull back trending and a mean reversion strategy.

This strategy defies basic logic as you aim to trade against the trend. You need to be able to accurately identify possible pullbacks, plus predict their strength. To do this effectively you need in-depth market knowledge and experience.

The ‘daily pivot’ strategy is considered a unique case of reverse trading, as it centres on buying and selling the daily low and high pullbacks/reverse.

5. Using Pivot Points

A day trading pivot point strategy can be fantastic for identifying and acting on critical support and/or resistance levels. It is particularly useful in the forex market. In addition, it can be used by range-bound traders to identify points of entry, while trend and breakout traders can use pivot points to locate key levels that need to break for a move to count as a breakout.

Calculating Pivot Points

A pivot point is defined as a point of rotation. You use the prices of the previous day’s high and low, plus the closing price of a security to calculate the pivot point.

Note that if you calculate a pivot point using price information from a relatively short time frame, accuracy is often reduced.

So, how do you calculate a pivot point?

- Central Pivot Point (P) = (High + Low + Close) / 3

You can then calculate support and resistance levels using the pivot point. To do that you will need to use the following formulas:

- First Resistance (R1) = (2*P) – Low

- First Support (S1) = (2*P) – High

The second level of support and resistance is then calculated as follows:

- Second Resistance (R2) = P + (R1-S1)

- Second Support (S2) = P – (R1- S1)

Application

When applied to the FX market, for example, you will find the trading range for the session often takes place between the pivot point and the first support and resistance levels. This is because a high number of traders play this range.

It’s also worth noting, this is one of the systems & methods that can be applied to indexes too. For example, it can help form an effective S&P day trading strategy.

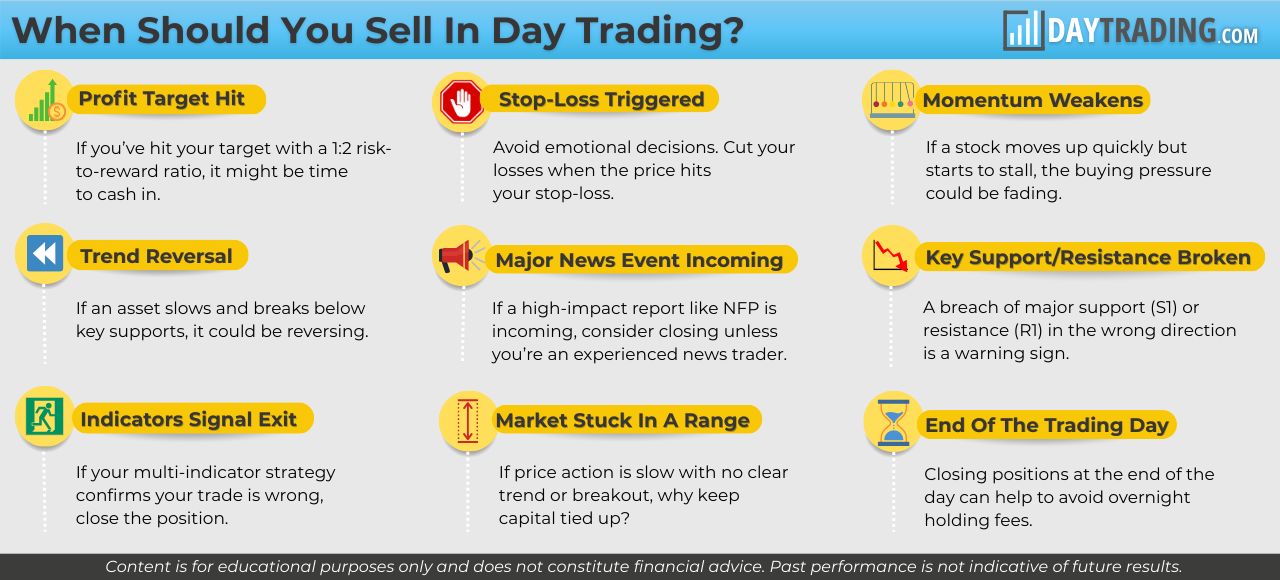

When Should You Sell In Day Trading?

A question we hear a lot is when should you sell, or close a day trade?

This is important because timing your exit is just as crucial as picking the right entry.

Here’s what to consider:

- Profit Target Reached. Example: You risk 40.50 per share and aim for $1.00 gain. Once you’re up $1, sell.

- Stop-Loss Triggered. Example: You enter at $100 and set a SL at $96. If it drops, you’re securely out at $96.

- Momentum Weakens. Example: The stock jumps from $10 to $12 but stalls – don’t wait for a reversal, think about exiting before it dips.

- Trend Reversal: Example: You bought at $20, but it drops below the 9 EMA and starts making lower lows. It could be time to get out.

- Major News Incoming. Example: You’re long EUR/USD, and NFP is about to drop. Instead of risking extreme volatility, you close out and re-enter later.

- Key Support/Resistance Broken. Example: You go long at $25, expecting a bounce off support, but price crashes through S1 instead. Don’t wait – think about a quick exit.

- Indicators Signal Exit. Example: You go long based on RSI and MACD, but both shift bearish. Trust the data and exit before losses stack up.

- Market Stuck In A Range. Example: You expect a breakout, but hours pass, and it keeps bouncing between small S & R levels. No movement = no opportunity.

- End of the Trading Day. Example: You bought early at $50, and by 3:50 PM it’s at $52 – it might be time to sell before market close.

Limit Your Losses

This is particularly important if you’re using margin. Requirements for which are usually high for day traders.

When you trade on margin you are increasingly vulnerable to sharp price movements.

Yes, this means the potential for greater profit, but it also means the possibility of significant losses. Fortunately, you can employ stop-losses.

The stop-loss controls your risk for you.

In a short position, you can place a stop-loss above a recent high, for long positions you can place it below a recent low. You can also make it dependant on volatility.

For example, a stock price moves by £0.05 a minute, so you place a stop-loss £0.15 away from your entry order, allowing it to swing (hopefully in the expected direction).

One popular strategy is to set up two stop-losses. Firstly, you place a physical stop-loss order at a specific price level. This will be the most capital you can afford to lose. Secondly, you create a mental stop-loss. Place this at the point your entry criteria are breached. So if the trade makes an unanticipated turn, you’ll make a swift exit.

Forex Trading Strategies

Forex strategies are risky by nature as you need to accumulate your profits in a short space of time. You can apply any of the strategies above to the forex market, or you can see our forex guide for detailed strategy examples.

Cryptocurrency Trading Strategies

The exciting and unpredictable cryptocurrency market offers plenty of opportunities for the switched on day trader.

You don’t need to understand the complex technical makeup of bitcoin or ethereum, nor do you need to hold a long-term view on their viability. Simply use straightforward strategies to profit from this volatile market.

To find cryptocurrency specific strategies, visit our cryptocurrency guide.

General news regarding cryptocurrencies or even blockchain technology can transform the entire market, so stay alert. Many coins, and even stablecoins, are inter-linked – which can cause massive contagion if there is a panic – even if it only starts in one obscure coin.

Stock Trading Strategies

Day trading strategies for stocks rely on many of the same principles outlined throughout this page, and you can use many of the strategies outlined above. Below though is a specific strategy you can apply to the stock market.

Moving Average Crossover

You will need three moving average lines:

- One set at 20 periods – This is your fast moving average

- One set at 60 periods – This is your slow moving average

- One set at 100 periods – This is your trend indicator

This is one of the moving averages strategies that generates a buy signal when the fast moving average crosses up and over the slow moving average. A sell signal is generated simply when the fast moving average crosses below the slow moving average.

So, You’ll open a position when the moving average line crosses in one direction and you’ll close the position when it crosses back the opposite way.

How can you establish there’s definitely a trend? You know the trend is on if the price bar stays above or below the 100-period line.

For more information on stocks strategies, see our stocks and shares guide.

Spread Betting Strategies

Spread betting allows you to speculate on a huge number of global markets without ever actually owning the asset. Plus, strategies are relatively straightforward.

If you would like to see some of the best day trading strategies revealed, see our spread betting guide.

Note that spreadbetting is generally restricted to traders based in the United Kingdom only.

CFD Strategies

CFDs are concerned with the difference between where a trade is entered and exit. Recent years have seen their popularity surge. This is because you can profit when the underlying asset moves in relation to the position taken, without ever having to own the underlying asset.

For CFD specific day trading tips and strategies, see our CFD guide.

Regional Differences

Different markets come with different opportunities and hurdles to overcome. Day trading strategies for the Indian market may not be as effective when you apply them in Australia. For example, some countries may be distrusting of the news, so the market may not react in the same way as you’d expect them to back home.

Regulations are another factor to consider. Indian strategies may be tailor-made to fit within specific rules, such as high minimum equity balances in margin accounts. So, get online and check obscure regulations won’t impact your strategy before you put your hard earned money on the line.

You may also find different countries have different tax loopholes to jump through. If you’re based in the West but want to apply your normal day trading strategies in the Philippines, you need to do your homework first.

What type of tax will you have to pay? Will you have to pay it abroad and/or domestically? Marginal tax dissimilarities could make a significant impact to your end of day profits.

Risk Management

Stop-loss

Strategies that work take risk into account. If you don’t manage risk, you’ll lose more than you can afford and be out of the game before you know it. This is why you should always utilise a stop-loss.

The price may look like it’s moving in the direction you hoped, but it could reverse at any time. A stop-loss will control that risk. You’ll exit the trade and only incur a minimal loss if the asset or security doesn’t come through.

Savvy traders don’t usually risk more than 1% of their account balance on a single trade. So if you have £27,500 in your account, you can risk up to £275 per trade.

Position size

A good strategy will also enable you to select the perfect position size. Position size is the number of shares taken on a single trade. Take the difference between your entry and stop-loss prices. For example, if your entry point is £12 and your stop-loss is £11.80, then your risk is £0.20 per share.

Now to figure out how many trades you can take on a single trade, divide £275 by £0.20. You can take a position size of up to 1,375 shares. That is the maximum position you could take to stick to your 1% risk limit.

Also, check there is sufficient volume in the stock/asset to absorb the position size you use. In addition, keep in mind that if you take a position size too big for the market, you could encounter slippage on your entry and stop-loss.

Learning Methods

Videos

Everyone learns in different ways. For example, some will find day trading strategies videos most useful. This is why a number of brokers now offer numerous types of day trading strategies in easy-to-follow training videos. Head to their learning and resources section to see what’s on offer.

Blogs

If you’re looking for the best day trading strategies that work, sometimes online blogs are the place to go. Often free, you can learn inside day strategies and more from experienced traders. On top of that, blogs are often a great source of inspiration.

Forums

Some people will learn best from forums. This is because you can comment and ask questions. Plus, you often find day trading methods so easy, anyone can use.

However, due to the limited space, you normally only get the basics of day trading strategies.

So, if you are looking for more in-depth techniques, you may want to consider an alternative learning tool.

Also be aware that many people on forums have their own agenda. “Pump and dump” schemes will often take place on forums.

Likewise, you may be late to the party. A strategy may have worked once, but now the market has caught up – past performance is no guarantee of future performance.

PDFs

If you want a detailed list of the best day trading strategies, PDFs are often a fantastic place to go. Their first benefit is that they are easy to follow. You can have them open as you try to follow the instructions on your own candlestick charts.

Another benefit is how easy they are to find. For example, you can find a day trading strategies using price action patterns PDF download with a quick google. They can also be very specific. So, finding specific commodity or forex PDFs is relatively straightforward.

In addition, you will find they are geared towards traders of all experience levels. Hence you can find for beginners PDFs and advanced PDFs. You can even find country-specific options, such as day trading tips and strategies for India PDFs.

Books

Having said that, a PDF simply won’t go into the level of detail that many books will. The books below offer detailed examples of intraday strategies. Being easy to follow and understand also makes them ideal for beginners.

- The Simple Strategy – A Powerful Day Trading Strategy For Trading Futures, Stocks, ETFs and Forex, Mark Hodge

- How to Day Trade: A Detailed Guide to Day Trading Strategies, Risk Management, and Trader Psychology, Ross Cameron

- Intra-Day Trading Strategies: Proven Steps to Trading Profits, Jeff Cooper

- The Complete Guide to Day Trading: A Practical Manual from a Professional Day Trading Coach, Markus Heitkoetter

- Stock Trading Wizard: Advanced Short-Term Trading Strategies, Tony Oz

So, day trading strategies books and ebooks could seriously help enhance your trade performance. If you would like more top reads, see our books page.

Online Courses

Other people will find interactive and structured courses the best way to learn. Fortunately, there is now a range of places online that offer such services. You can find courses on day trading strategies for commodities, where you could be walked through a crude oil strategy. Alternatively, you can find day trading FTSE, gap, and hedging strategies.

Trading For A Living

If you’re looking to pack up the day job and start day trading for a living, then you’ve got a challenging but exciting journey ahead of you. You’ll need to wrap your head around advanced strategies, as well as effective risk and money management strategies. Discipline and a firm grasp on your emotions are essential.

For more information, visit our ‘trading for a living‘ page.

Final Word

Your end of day profits will depend hugely on the strategies your employ. So, it’s worth keeping in mind that it’s often the straightforward strategy that proves successful, regardless of whether you’re interested in gold or the NSE.

Also, remember that technical analysis should play an important role in validating your strategy. In addition, even if you opt for early entry or end of day trading strategies, controlling your risk is essential if you want to still have cash in the bank at the end of the week. Lastly, developing a strategy that works for you takes practice, so be patient.