Binary Options Day Trading

Binary options trading hinges on a simple question: will an asset’s price be above or below a certain level at a specific time? Binaries are one of the simplest instruments to trade, but how exactly do they work, and what are their pros and cons? This guide to binary options day trading for beginners covers all the basics.

Quick Introduction

- Binary options are derivatives where you make a bet on the price movement of an underlying asset without taking ownership of it.

- A correct prediction will see you win a fixed payout, typically a percentage of your investment. An incorrect prediction will see you lose your stake.

- Binary options brokers offer trading on a range of underlying assets, from stocks and forex to commodities and cryptocurrencies.

- Binaries are particularly popular with short-term traders, with contract timeframes starting from just a few seconds through to minutes, hours, days and even weeks.

- A robust trading strategy and a sensible approach to risk management are essential to have a successful binary options trading experience.

Top 4 Binary Options Brokers

These are the top 4 binary options brokers according to our latest tests:

Download DayTrading.com’s Binary Options Trading For Beginners PDF.

What Are Binary Options?

Binary options are derivatives that can be traded on almost any market. They are popular because they are straightforward – you know precisely how much you could win, or lose before you make the trade. This is why they are also known as ‘all or nothing’ trades.

Binary or the similar digital options have been around for decades, though initially, only large institutions had access. However, the US SEC opened the floodgates in 2008 by allowing binaries to be traded through an exchange – Nadex.

How Do Binary Options Work?

To understand how a binary options trade works in practice, let’s look at an example:

Will Tesla’s stock price, currently valued at $200, increase or decrease in the next two hours?

You stake $200 that it will, and your broker offers a payout of 75%.

Two hours pass and Tesla’s share price is now valued at $205.

As a result, your trade finishes ‘in the money’ and the broker pays you $350 ($200 stake + $150 payout ($200 * 0.75)).

If Tesla’s stock price had fallen by the two-hour mark, your bet would have finished ‘out of the money’, and you would have lost your $200 stake.

Contract Components

It’s important to understand the key variables within a binary contract:

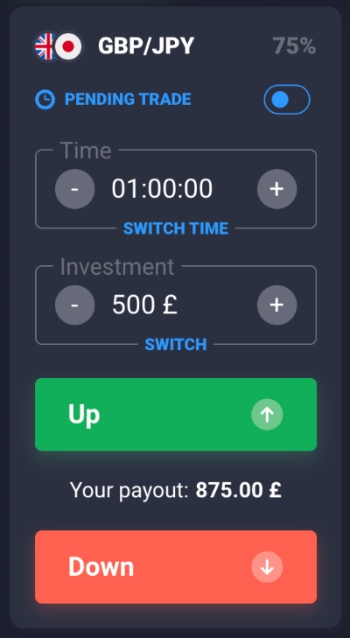

- Asset – This is the market you will be speculating on. The best binary options brokers offer opportunities on stocks and shares, major, minor and exotic currency pairs, metals like gold and silver, energies such as oil and gas, plus cryptocurrencies including Bitcoin. In the example below, GBP/JPY is the underlying asset.

- Expiry time – This is the length of time the contract will be open. The top platforms offer a range of expiries, from turbos that span a matter of seconds, to 1-minute, 2-minute, 5-minute, and 30-minute contacts, plus longer binaries of 1-hour, 4-hour, several hours, days, weeks, and even months. In the example below, the expiry time is set to 5-minutes.

- Stake – This is the amount you wish to bet on the trade. In the example below, £500 is the investment amount. Remember, if the trade moves against you, you will lose the entire amount.

- Payout – This is how much you stand to win or lose depending on the outcome. This is normally a percentage of the staked amount. In the example below, the platform is offering a 75% return on this trade, so the potential payout is £875 (£500 + £375).

- Strike price – This is the price the asset must be above or below to finish ‘in the money’ and win the pre-agreed payout. Note, instead of a strike price, some beginner-friendly binary options platforms simply ask you to decide whether the value of an asset will increase or decrease beyond the existing price, as shown in the example below via the ‘up’ and ‘down’ buttons.

Option Types

There are a number of different option types to choose from. These are the most popular:

- Up/Down (High/Low) – The most simple and prevalent binary option. Will the price be higher or lower than the current price when the expiry time comes?

- In/Out (Range or Boundary) – A ‘high’ and ‘low’ figure will be set. You are then making a determination as to whether the price will finish within or outside of these boundaries.

- Touch/No Touch – Levels will be set that are either higher or lower than the current price. You then enter a position as to whether the price will ‘touch’ these levels between the time of trade and expiry. Payout will come as soon as the touch takes place.

- Ladder – These are similar to up/down trades. However, instead of using the current price, the ladder will have pre-determined levels that are staggered up or down. These normally demand a substantial price move. The flip side of this is returns will frequently exceed 100%. Although it is worth noting, both sides of a trade are not always available.

Is Trading Binary Options Legal?

Despite a somewhat negative reputation, trading binary options is legal. Many companies operate fairly. Opinions have been split because there are some that operate scams.

Regulation in certain regions has also meant binaries have been withdrawn from the retail market, such as the EU. However professional traders can still use them.

In regions such as India and Australia, binaries are legal – but traders should make sure they use a reputable broker.

The reputation of binary trading has suffered a lot from dishonest marketing and fraudulent brokers. Too many unregulated platforms promise quick cash, whilst operating dodgy schemes.

Banc de Binary is a prime example of a scam brokerage. The firm did not gain the relevant licensing needed to trade in the US, meaning many aspiring binary traders were left with no financial protection. In 2016, the company agreed to pay $11 million to settle charges brought against it by the SEC.

Binary Options vs CFD Trading

With contracts for difference (CFDs), you have potentially unlimited risk. If the price of the asset moves significantly, the value of the trade can grow very large, very quickly – for better or worse.

Binary options work slightly differently. Whilst you are still investing without owning the asset in question, the gain and loss are fixed. With a binary trade, it doesn’t matter how much the price changes as long as it’s above or below the price point in question (depending on whether you predicted the price to go up or down).

Likewise, if the price sinks to zero, you’ll only lose what you put in. Essentially, with binary options you get fixed risk and know in advance exactly how much you stand to gain or lose.

Pros & Cons Of Trading Binary Options

Pros

- Simplicity – Because you are making a determination on only one factor, direction, your bet is straightforward. The price can only go up or down. You also don’t need to concern yourself with when the trade will end, the expiry time takes care of that. Whereas in other markets, you may need a system to limit your losses, such as a stop-loss.

- Fixed risk – Trade stocks, gold, and crude oil and you’ve got a vast number of factors to contend with, from slippage and margin to news events and price re-quotes. With binaries, your risk is kept to a minimum with fewer variables.

- Trade control – Because you know what you may make or lose before you enter the trade, you have greater control from the start. Trade in stocks, for example, and you have no guarantee that your trade will make the entry price.

- Profit potential – Compared to other trading, the returns in binaries are attractive. Some brokerages promise payouts of over 90% on a single trade.

- Choice – Rather than being constrained to a specific market, such as cryptocurrencies or stocks, binaries gift traders the opportunity to trade across virtually all markets.

Cons

- Reduced trading odds – Whilst you can benefit from trades that offer in excess of 80% payouts, these are often when the expiry date is some time away from the trade date. If the odds of your binary trade succeeding are very high you may have to make do with reduced payout odds.

- Limited trading tools – Whilst most brokerages offer advanced charting and analysis capabilities, trading tools for binary traders often fall short of the mark. Fortunately, there are other online sources for these graphs and tools, plus brokers are working to increase their offerings.

- Price of losing – Your odds are tilted in favor of losing trades. Approximately for every 70% profit, the corresponding loss of the same trade would result in an 85% loss. This means you need a win percentage of at least 55% to break-even.

- Position sizing – Unlike other markets, brokers often set a trading floor, with minimum accounts a trader needs to enter the market. This means losing capital can happen with ease. Whilst a stocks broker may permit you to open an account with $250, trading micro-lots, most binary brokers won’t allow $50 trades. So, even with $250 in your account, just five trades that don’t go your way could see you sink into the red.

Getting Started

Starting to trade binary options is fairly straightforward:

Step 1 – Find a broker

This is one of the most important decisions you will make. You need a top binary options broker that meets all your requirements and who will enhance your trade performance.

Importantly, there is no universal best broker, it depends on your individual needs. Some firms offer minimum trades of just $10, whilst others require hundreds or even thousands. The solution is to do your homework first.

Step 2 – Choose A Market

You can trade binaries in pretty much everything, including stocks, forex, indices, and commodities. You can bet on anything from the price of natural gas, to the stock price of Google.

Opt for an asset you have a good understanding of, that offers promising returns.

Step 3 – Decide On An Expiry Time

As a short-term trader, you’ll probably be more interested in 30 seconds, 1 minute and end-of-day expiry times. You need to balance binary options trading volume with price movement.

Whilst the more trades you make means greater profit potential, it’s better to make fewer and more accurate trades. Also, find a time that compliments your trading style.

Step 4 – Decide On Size

In the binary options game, size does matter. The greater your investment the greater the possible profit.

On the flip side, remember the entirety of your investment is on the line. You need an effective money management system that will enable you to make sufficient trades whilst still protecting you from blowing all your capital.

Step 5 – Choose An Option

You will have any number of the options outlined above to choose from. Think carefully about how confident you are in your determination.

Consider factors that will jeopardise your investment, and select an option that gives you the best chance of succeeding. Don’t automatically select a ladder trade because you want huge returns, consider which options are the safer bets.

Once you’ve made that decision, check and confirm your trade. Then you can sit back and wait for the trade payout.

Demo Video

Below is a video explaining how to trade binary options on the platform of a leading provider:

Strategies

There are two reasons you must have a binary options trading strategy:

- A strategy prevents emotions from interfering in trade decisions. Fear, greed, and ambition can all lead to errors. A strategy allows you to focus on the maths and data.

- A strategy allows you to repeat profitable trade decisions. Once you’ve found out how and why that trade worked, you can replicate it to try and create consistent profits.

There are two crucial elements to your trading method, creating a signal, and deciding how much to trade. The second is essentially money management.

Step 1 – Creating A Signal

The signal will tell you in which direction the price is going to go, allowing you to make a prediction ahead of time. The two main ways to create signals are to use technical analysis and the news.

Charts, Patterns & Indicators

If you can identify patterns in your charts, you may be able to predict future price movements. They rest on the idea that ‘history repeats itself’. You can start trading binary options using Heiken-ashi, other candlesticks, and line charts.

You can then build indicators into your strategy, telling you when to make a trade, and which binary option you should go for.

One of the great things about trading binaries is you can use any number of your normal indicators, patterns, and tools to help predict future movements. So, you can start trading with/using:

- Support and resistance levels

- Price action

- Stochastic oscillators

- MACD indicators

- Trends

- Babypips

- Mirrors

- Options close to expiry

News

You can trade binary options without technical indicators and rely on the news. The benefit of the news is that it’s relatively straightforward to understand and use. You’ll need to look for company announcements, such as the release of financial reports.

Alternatively, look for more global news that could impact an entire market, such as a move away from fossil fuels. Small announcements can send prices rocketing or plummeting.

If you can stay in the know you can trade your binary options before the rest of the market catches on. To do that you’ll need to be tuned into a range of news sources.

You can browse online and have the TV or radio on in the background. Some of the most useful news sources in terms of trading information are:

- Yahoo Finance

- CNBC

- Business Insider

- Bloomberg

- Financial Times

Step 2 – How Much You Should Trade

If you’re just starting off, it’s often best to keep things simple. Trading the same amount on each trade until you find your feet is sensible.

Below are 3 binary options trading strategies for both beginners and experienced traders.

Martingale Strategy

Binary options using the martingale trading strategy aim to recover losses as quickly as possible. To do this you’d trade larger amounts of money in the trades following a loss. So, you’d set an amount that you trade each time, say $250. However, if you lose on that $250, you’d bet $500 on the next trade. If the trade wins, you’ll already be back in the black, rather than being stuck around the break-even mark.

The problem with this strategy is that if you go on a losing streak you can lose a serious amount of capital in a short space of time. So, only use this strategy if you’ve got a relatively accurate means of making trade decisions. If you’re still in the trial and error stage, consider a different approach.

Percentage Strategy

A percentage-based system is popular amongst both binary options traders and other traders. The idea is you specify a percentage you’re willing to risk. Between 1-2% is common. So, if you’ve got $10,000 in your account, and your risk value was 2%, you could trade $200 on a single trade.

If you have a greater risk tolerance and consistent results you may want to increase that risk margin to 5%. The benefit of this system is that you should never lose more than you can afford. This makes it an ideal approach to take if you’re new to trading on binary options.

Straddle Strategy

This example is best employed during periods of high volatility and just before the break of important news announcements. This technique can be utilized by traders of all experience levels. It gives you the capability to avoid the call and put option selection, and instead allows putting both on a specified instrument.

You aim to utilize put when the value of the instrument has risen, yet you think that it’s going to decrease soon. Once the descent has begun, place a call option on it, anticipating it to bounce back swiftly. You can also do it in the reverse direction. Place a call on the asset’s prices low and put on the rising asset value.

This increases the chance of at least one of the trade options producing a profitable result. If you’re in a volatile market, this system could you see turn profits. This works well as a binary options trading 60 seconds strategy, and will also cover expiry times of up to one day.

Bots & Algorithmic Trading

Once you have honed a strategy that turns you consistent profits, you may want to consider using an automated system to apply it. These robots usually rely on signals and algorithms that can be pre-programmed.

The bots then do all the leg work, trading options on your behalf. The plus side is they can make far more trades than you can do manually, increasing your potential profit margin. They can also trade across different assets and markets.

It’s worth investigating your broker’s offering when it comes to auto trading and checking for robot reviews. Many allow you to build a program with relative ease. You can use your own entry points that rely on Bollinger bands, RSI/MFI patterns, and moving averages.

However, even when you’ve got your system up and running, you can’t go into trading binary options on autopilot, you need to stay tuned in. If any mistakes take place, you need to be there to remedy the problem. Technical crashes and unpredictable market changes can all cause issues, so stay vigilant.

Timing

Many binary option strategies fail to sufficiently consider time variables. Certain strategies will perform better with specific time options.

You may want to look specifically for a 5-minute binary options strategy. Alternatively, trading 15-minute binary options may better suit your needs. So, whichever strategy above you opt for, ensure you take time into account.

Education

Binary options trading 101 – immerse yourself in educational resources. As Benjamin Franklin asserted, ‘an investment in knowledge pays the best interest’. The top traders never stop learning. The markets change, and you need to change along with them.

To do that, utilize some of the resources detailed below.

- Books & eBooks – There is a whole host of books and ebooks out there that can impart invaluable information on day trading binary options. You can benefit from the knowledge of experts with decades of experience. The good thing about a book is that it allows you to learn at a pace that suits you. One book that has made learning easy is ‘Trading Binary For Dummies’, by Joe Duarte.

- Video tutorials & seminars – Engaging and easy to follow. There are numerous online video tutorials out there that can walk you through making a trade. With seminars, you’ll also be able to have questions answered, and the binary options trading basics explained, plus some brokers offer weekly seminars to keep you up to date with market developments.

- Courses – There are also binary options courses available without an investment. Alternatively, paid services are available. Udemy, for example, hosts a whole catalog of courses with clear lesson plans and objectives.

- PDFs & instruction guides – These will give you a clear breakdown of steps that you can follow and apply. The best part is you can find plenty online that are totally free and easy to download, whether you’re using Android, Windows, or iOS. The trading binary options ‘Abe Cofnas’ pdf is particularly popular.

- Forums & chat rooms – This is the perfect place to brainstorm ideas with gurus. You can benefit from recommendations and learn in real-time whilst investing in your binary options. You can also swap live chart screen grabs to get a feel for other methods and tactics.

- Newsletters & blogs – These are brilliant for keeping up to date with upcoming developments that may affect your markets. Plus, you could hear about binary options competitions (yes, they really do exist).

Tips

Journal

A trading journal with a detailed record of each trade, date, and price will help you hone your strategy and potentially increase future profits.

Whether you keep it an Excel document or use tailor-made software, it could help you avoid future dangers. As an added bonus, it can make filing tax returns easier at the end of the year.

Copy Trading

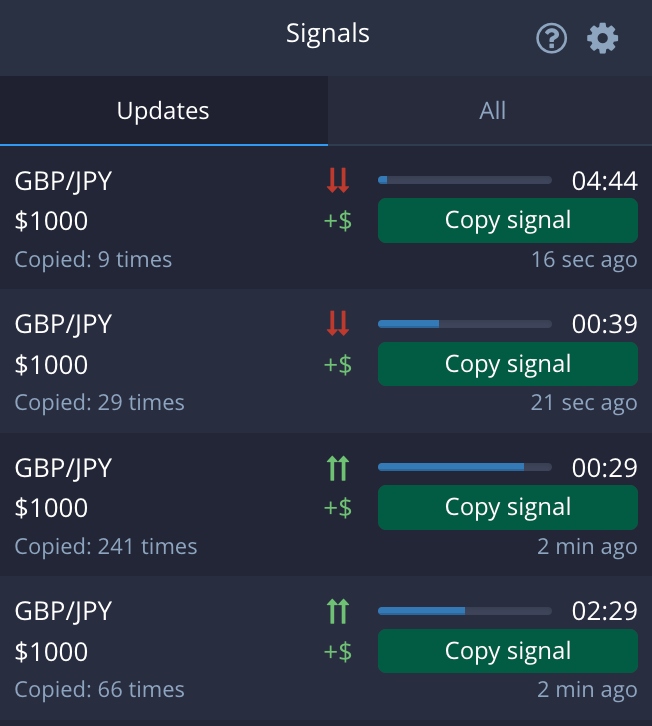

Copy trading tools may be useful for beginners, with brands such as ZuluTrade establishing a name for themselves in the auto-trading market. Pocket Option, IQCent, and RaceOption all offer their own binary options copy trading tools.

Copy trading platforms essentially let you copy professional investors, who may be executing a 1, 2, 3, or 5-minute binary options trading strategy. They can be an effective way to learn from experts.

The top platforms offer performance stats and metrics so novice investors can find the right master trader for their goals and risk tolerance.

Taxes

Some countries consider binary options as a form of gambling, such as the UK. This comes with notable benefits. The HMRC will not charge you any taxes on profits made through binary options. However, in the future, binaries may fall under the umbrella of financial derivatives and incur tax obligations.

Having said that, if day trading binaries are your only form of income and you consider yourself a full-time trader, then you may be liable to pay income tax. Whilst you are probably still exempt, it is worth seeking clarification.

Outside the UK, tax regulations differ hugely. So, before you start trading, seek advice to ascertain whether you’ll be exempt from tax. If not, will you pay income tax, capital gains tax, business tax, and/or any other form of tax?

Can Trading Binary Options Make You Rich?

In theory, yes, it can, like any type of trading, but in reality, it takes a lot of skill and luck.

There is no question of binary options potential profitably, but to get there, you’ll need the right broker, an effective strategy, and solid trading education, for example by reading the resources we offer here. Starting small, and making sure you can be profitable at all, is a good first step and test of your abilities.

Make sure not to trust any broker or person that guarantees quick profits if only you deposit more money. There is no such thing as guaranteed profits in any financial market. There are many examples of scam brokers that exploit people who mistakenly think there is such a thing as “easy money”, make sure you’re not their next victim.

FAQ

Are Binary Options Safe For Beginners?

As with all forms of online trading, you may lose money with binary options, especially if you are a beginner who doesn’t yet have a proven strategy. As such, never risk more than you can afford to lose.

How Long Does It Take To Get Good At Binary Options Trading?

There is no set time limit to master the fundamentals of binaries. For beginners, it’s all about research, practice, and patience. Spend time trading binaries in a demo profile until you feel comfortable risking real funds.

Is Trading Binary Options A Good Idea?

As binary options trading involves answering a straightforward yes/no question, some believe it is a simple trading product for beginners. And as traders never own the underlying asset, such as gold or bitcoin, binaries can be an attractive opportunity for new investors.

However, it’s important to have a robust strategy and take a sensible approach to risk management to prevent excessive losses.

Are Binary Options Banned In Europe?

Binary options have been withdrawn for retail traders by the European regulator, ESMA. Brokers not regulated in Europe may still offer binaries to EU clients.

It is also possible for EU traders to nominate themselves as professional traders. This waives their rights to regulatory protection, and means binaries are free to be used again.

Some synthetic markets can also be traded by EU traders, and while the product works exactly as a binary options, they are referred to slightly differently.

Additional Reading

If you want to learn much more about binary options, head over to our favorite site on the subject – BinaryOptions.net – the oldest and most respected online resource on binary options trading.