Derivatives

Derivatives are financial securities whose value is based on that of an underlying asset. They allow traders to make money from a variety of asset classes, including stocks, currencies and commodities, without having to hold the underlying security.

This guide will explain what derivatives are and how they work, discuss the most popular forms of these trading instruments, and reveal the advantages and disadvantages of dealing with them.

Quick Introduction

- Derivatives are financial instruments that allow traders to profit from changes in asset prices without having to own said asset.

- Futures, options, and contracts for difference (CFDs) are popular derivative products among day traders.

- Derivatives trading often involves leverage, a tool which can turbocharge both profits and losses.

- Traders can go long and short with these products, meaning they have an opportunity to make money whichever direction asset prices move in.

Best Derivatives Trading Brokers

We have reviewed dozens of brokers and we recommend these 4 platforms for trading derivatives:

What Are Derivatives?

Derivatives are contracts between two counterparties that derive their value from an underlying asset (like a commodity or stock) or a financial indicator (such as interest rates).

Derivative products such as futures contracts were first introduced centuries ago as a risk management tool in agriculture and industry. They allow market participants to hedge against price fluctuations in essential goods like commodities, or to guard against adverse movements on foreign exchange markets.

Nowadays these financial instruments are also wildly popular with speculators. Individuals do not have direct exposure to any underlying asset through ownership; they simply aim to capitalize on any price changes in the base asset.

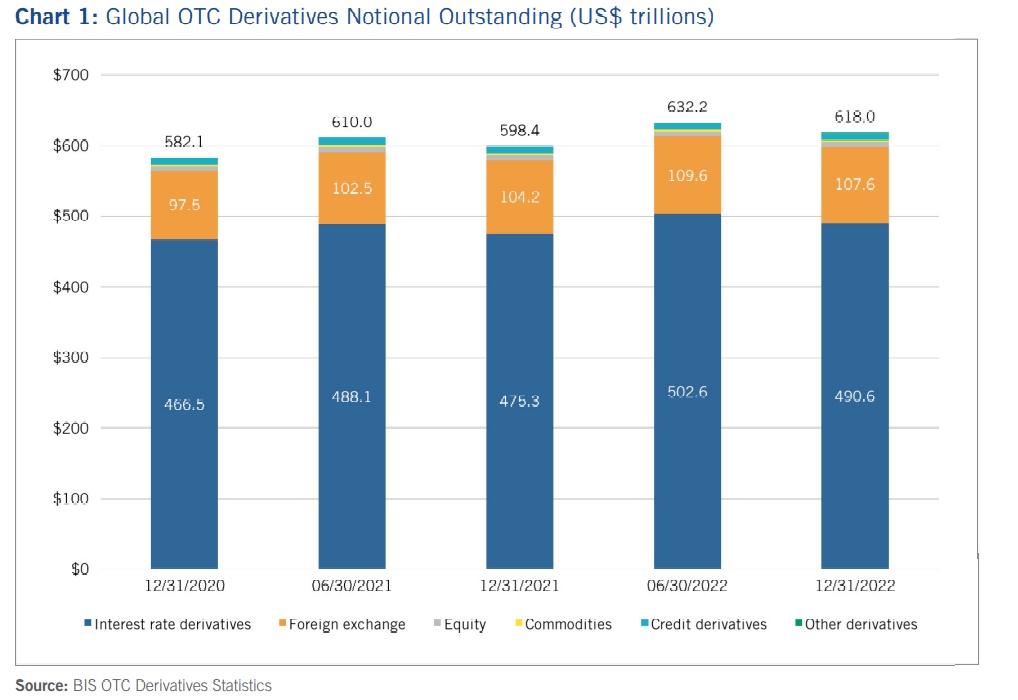

The global derivatives market is huge and growing at a steady pace. According to the Bank of International Settlements (BIS), the notional value – in other words, the total value of the underlying assets in a contract – of OTC derivative products rose to $618 trillion in 2022.

How Are Derivatives Traded?

Derivatives can be traded in two ways:

- They can be transacted through a regulated financial exchange, or

- They can change hands over the counter (OTC)

OTC trades are made directly between two parties, and carry a variety of advantages including client privacy and better customization of contracts. But a lack of transparency and counterparty risk (the danger of one party defaulting on its obligations) are two major drawbacks with this route.

Derivatives are available for a wide range of underlying assets, including stocks, indices, commodities, forex, cryptocurrencies, bonds, interest rates and credit instruments like credit default swaps (CDSs).

Pros & Cons Of Trading Derivatives

Pros

- Leverage – Derivative traders can control larger positions with the use of leverage. They therefore have a chance to generate greater profits than if they used just their own funds.

- Choice – Derivatives can be used to speculate on the price movements of a wide range of assets. This also allows investors to create a diversified portfolio which in turn reduces risk.

- No ownership challenges – Derivative traders can speculate on an asset’s price movements without having to own it, meaning problems like delivery and storage can be avoided.

- Flexibility – Non-ownership means that traders can profit during rising and falling markets. If they believe an asset will fall in value they can choose to take a short position.

- Liquidity – Some derivative products (like futures and options) can be more liquid than the underlying markets upon which they derive their value. This can make it easier for traders to enter and exit positions.

Cons

- Higher risk – The wide-scale availability of leverage makes derivatives trading much more dangerous. Just as profits can be magnified, losses can spiral out of control quickly if markets move in an unfavorable direction.

- Complexity – Derivatives are sophisticated financial vehicles. This means investors need to have a sound knowledge of how they work, in addition to understanding what moves the underlying markets upon which they source their value.

- Counterparty risks – Some derivative products like CFDs are traded over the counter rather than on regulated financial exchanges. This creates the risk that one party may fail to meet its obligations.

What Are The Different Types Of Derivatives?

Contracts For Difference (CFDs)

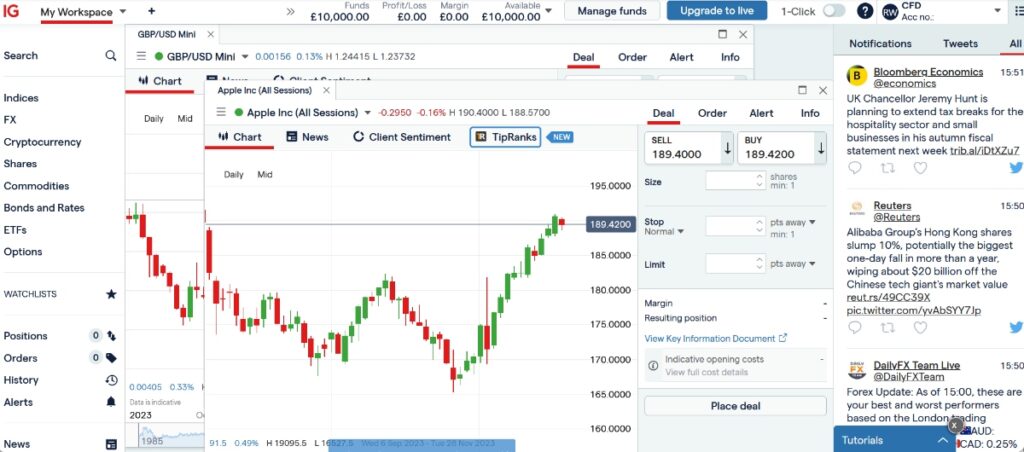

Contracts for difference (CFDs) are agreements between two parties to pay the difference between the opening and closing price of an asset.

A trader opens a CFD position by entering into a contract with a broker and, unlike most other derivatives, these instruments do not have a fixed expiration date. This gives traders much greater flexibility.

CFDs typically offer higher levels of leverage than other derivative products, which makes them especially popular with individuals whose trading strategies revolve around using borrowed funds.

CMC Markets, for instance, allows leverage of up to 1:500 for holders of its professional CFD account.

Higher leverage can also mean you book mammoth losses if markets move in the wrong direction. For this reason, CFDs are banned in the US and Hong Kong, while regulations governing them are tight in parts of Europe.

A CFD In Action

Let’s say that a CFD trader believes that shares in Steve’s Soda Emporium (which are trading at $100 apiece) will rise in value. They decide to go long and buy 100 contracts, a move that creates a total position value of $10,000 (100 CFDs multiplied by $100).

The broker they select provides them with leverage of 10% (or expressed as 1:10 in ratio terms). This means that they have to lay down a margin of $1,000 to open the trade.

After putting down their deposit the trader hits the ‘buy’ button and sits back to monitor the market. After a few days, Steve’s Soda Emporium’s share price moves to $110, meaning that the trader is in a profitable position. At this point, they decide to close the position and book some profit.

So how much has the trader made? First, we need to calculate the profit per CFD which, in this case, comes out at $10 (the $110 selling price minus the $100 purchase price). Then we need to multiply this value by the number of contracts the trader purchased (100).

On this occasion, the trader has made a profit of $1,000 with this trade. Their return on investment (ROI) – which is calculated as the profit divided by the initial margin – would have come out at 100%.

The above example effectively illustrates the power of leverage as a trading tool. Let’s say the CFD trader chose not to borrow funds from their broker, and used the $1,000 they put down as margin to just purchase 10 contracts instead. They’d have made a profit of $100 and recorded a lower ROI of 10%.

Futures Contracts

Futures are standardized financial agreements that require a buyer and seller to exchange a specified asset within a selected timeframe and for an agreed price. They are primarily traded on financial exchanges, although they can also be dealt OTC.

Traders may only be able to trade particular futures contracts on particular financial exchanges. For instance, rubber futures only change hands in Asia, the bulk of which are transacted on bourses in Japan, Singapore or China.

Due to their high standardization, these contracts can easily be traded on exchanges because they are interchangeable. Liquidity is therefore high, and traders can enter and exit positions swiftly and straightforwardly.

Some of the key features specified on a futures contract include:

- A description of the underlying asset

- The contract size, which is often described in lots

- The contract expiration or delivery date

- The minimum price fluctuation or tick size, which represents the smallest unit by which the price of the contract can change

Forward Contracts

Forwards are similar to futures in that they specify a certain quantity of an asset to be transacted within a specified timescale at a pre-defined price. However, these are only traded on an OTC basis.

The beauty of forwards is that they are highly customizable. The terms and conditions that bind buyers and sellers can be incredibly specific on issues concerning quantities, price, and delivery dates. This makes them unsuitable for exchange-based trading where contracts follow that standard formula.

On the downside, the non-standard nature of forward contracts means that they lack the daily marked-to-market mechanism associated with futures contracts.

Unlike futures, forwards are only settled on the agreed-upon settlement date, potentially exposing participants to risks associated with the absence of regular market value adjustments.

For this reason, retail traders are not major players in the forwards market. Institutional investors including hedge funds and investment banks are the predominant traders of forwards contracts, along with companies who are looking to mitigate business risks.

Options

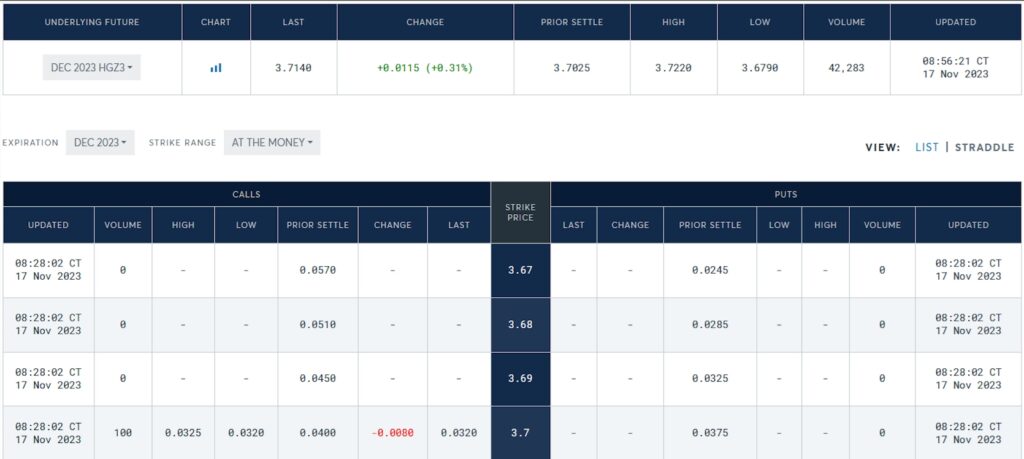

Like futures and forward contracts, options give traders the right to buy or sell an asset at a pre-agreed price and within a specified timeframe. But importantly they do not include an obligation for the contract holder to exercise the trade, thus providing the individual with greater flexibility.

A wide variety of options are available, though the most widely used are known as call options and put options. These are known as vanilla options because of their relative simplicity compared with non-vanilla (or exotic) options.

Traders will place a call option if they expect an asset to rise in value, and buy a put option if they believe the security to fall in price.

More complicated non-vanilla contracts contain bespoke rules concerning issues like when they are triggered, how they are settled, and the size of the payoff.

As with futures contracts, the vast majority of options trades take place on regulated financial exchanges.

Swaps

The swap is another frequently used form of derivative product. But as with forward contracts, they are also highly customizable. As a consequence, they are rarely used by retail investors and are only traded OTC.

Swap contracts are agreements in which two parties exchange financial instruments for a set period. Most involve cash flows that are based on a notional principal amount: this is a hypothetical amount that is used to calculate the cash flows exchanged between parties, but does not represent the actual amount of money that is traded.

The most frequently used swap contracts are interest rate swaps and currency swaps. Businesses and investors use interest rate swaps to manage their exposure to interest rate movements, while currency swaps can help them manage currency risk when they have cash flows or liabilities in multiple currencies.

For example, a company operating in the United States but with operations and expenses in the eurozone may use a currency swap contract to exchange dollars for euros (or vice versa).

How To Start Trading Derivatives

Dealing in derivatives is far more complex than simply trading the underlying assets themselves. So before a trader gets started they need to spend time getting to know the ins and outs of how these instruments work.

This is on top of acquiring detailed knowledge on what moves the prices of the securities on which these financial vehicles derive their value.

The good news is that rich information is available at the click of a button. The modern investor can enjoy a wealth of specialist investing websites, training courses, financial blogs, trading podcasts and the like online. These can be found quickly and often at low cost (or even free).

Many brokerages also offer educational tools to help new investors get off the ground. Tutorials, videos, research reports and discussion boards are frequently available that can help both new and experienced investors make better decisions.

The financial services industry is highly competitive, and the modern investor has a lot of choice when it comes to selecting a broker. So new traders should ask a lot of questions and only go with a company that they are completely happy with. Some of the key things to consider include:

- How large are the broker’s trading costs?

- What asset classes do they trade, and what levels of leverage are on offer through derivatives?

- How user-friendly is the trading platform, and what tools (such as charts and algorithmic trading are available)?

- Do they allow derivative trading ‘on the go’ via a mobile app?

- And most importantly, is the broker regulated by a trusted financial authority?

Bottom Line

Derivative products allow traders to speculate on market movements and to hedge risk. They take many forms and allow individuals to profit from a wide variety of asset classes, which makes them ideal for those who are pursuing flexible trading strategies.

Traders can also get access to significant amounts of leverage with these financial instruments. While this can result in much larger returns, it also means that investors can rack up gigantic losses if markets move unfavourably. This is why new investors in particular need to be especially careful when using derivatives.

FAQ

What Are Derivatives?

Derivatives are financial vehicles that derive their price from the value of an underlying asset.

What Are The Most Popular Derivatives?

Futures, options and CFDs are all traded in huge volumes every day by speculators seeking to profit from market movements. Critically these securities do not require ownership of any base assets.

When Can I Trade Derivatives?

Derivative instruments can be traded OTC and on financial exchanges across the globe. This provides traders with enormous flexibility when it comes to drawing up their working day.

Can I Use Leverage With Derivatives?

Leverage is commonly used to trade derivatives, and is one of the key reasons why these instruments are attractive to traders.

Recommended Reading

Article Sources

- CME: Copper Derivative Options

- ISDA: Trends In Derivative Trading Volumes 2022

- Managing Derivatives Contracts, Khader Shaik, 2014

- Derivatives, Theory and Practice of Trading, Valuation, and Risk Management, Jiří Witzany, 2020

- Financial Derivatives, Rob Quail, Robert W. Kolb, James A. Overdahl, 2003

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com