Best CFD Brokers In 2026

Discover our list of the best CFD brokers with great CFD trading platforms. Every CFD provider we recommend has been tested by our research team, earning a high overall rating and the trust of our experts.

Top 6 CFD Brokers

In February 2026 we have reviewed 140 brokers and our hands-on tests show that these are the 6 best CFD brokers:

Why Are These Brokers the Best for CFD Trading?

Here is a short summary of why we think these are the best CFD brokers:

- Interactive Brokers is the best CFD broker in 2026 - Over 8,000 CFDs are offered on a vast array of instruments, encompassing stocks, indices, forex, and commodities. Moreover, the TWS platform lends itself to seasoned day traders, offering a comprehensive selection of over 100 order types and algorithms, alongside premium market data sourced from reputable sources such as Reuters and Dow Jones.

- xChief - You can trade a competitive range of CFDs encompassing crypto, indices, energies and metals, with very high leverage up to 1:1000. ECN pricing is available, with spreads from 0.0 pips and low commissions from $2.50. A Cent account is also available for those on a smaller budget.

- InstaTrade - InstaTrade offers the flexibility to trade CFDs across various markets, from stocks and indices to forex and commodities. Where it excels is its dynamic leverage up to 1:1000, amplifying potential returns and losses with negative balance protection preventing accounts from falling below zero.

- Focus Markets - Focus Markets has clearly been built for crypto traders, offering an impressive 90+ derivatives, including major tokens like Bitcoin, Ethereum and Ripple. With high leverage, a commission-free trading account and fast execution on MT5, it delivers a reliable environment for active crypto traders.

- Exness - Exness provides CFDs on forex, stocks, indices, commodities, and cryptos with leverage up to 1:2000, tailored for advanced day traders and featuring over 100 technical indicators in its proprietary terminal.

- IC Markets - You gain access to over 2,250 CFDs, available for trading 24/5 across popular markets such as forex, commodities, indices, stocks, and bonds. Utilizing deep liquidity and advanced bridge technology, IC Markets ensures optimal conditions for scalpers, hedgers, and algo traders alike.

Compare the Best CFD Brokers on Key Attributes

Find the best CFD broker for you based on our comparison of key features important to CFD traders:

| Broker | Minimum Deposit | Leverage | Platforms | Regulators |

|---|---|---|---|---|

| Interactive Brokers | $0 | 1:50 | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| xChief | $10 | 1:1000 | MT4, MT5 | ASIC |

| InstaTrade | $1 | 1:1000 | InstaTrade Gear, MT4 | BVI FSC |

| Focus Markets | $100 | 1:500 | MT5 | ASIC, SVGFSA |

| Exness | Varies based on the payment system | 1:Unlimited | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| IC Markets | $200 | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower | ASIC, CySEC, CMA, FSA |

How Safe Are These CFD Brokers?

How dependable are the top CFD brokers and do they have features that help safeguard your funds?

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| xChief | ✘ | ✘ | ✔ | |

| InstaTrade | ✘ | ✔ | ✔ | |

| Focus Markets | ✘ | ✔ | ✔ | |

| Exness | ✘ | ✔ | ✔ | |

| IC Markets | ✘ | ✔ | ✔ |

Compare Mobile CFD Trading

Are these brokers good for mobile CFD Trading?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| xChief | iOS & Android | ✘ | ||

| InstaTrade | iOS & Android | ✘ | ||

| Focus Markets | iOS & Android | ✘ | ||

| Exness | iOS & Android | ✘ | ||

| IC Markets | iOS & Android | ✘ |

Are the Top CFD Brokers Good for Beginners?

CFD trading beginners should use brokers that allow trading with virtual money (a demo account) and have other features that new traders need:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| InstaTrade | ✔ | $1 | 0.01 | ||

| Focus Markets | ✔ | $100 | 0.01 Lots | ||

| Exness | ✔ | Varies based on the payment system | 0.01 Lots | ||

| IC Markets | ✔ | $200 | 0.01 Lots |

Are the Top CFD Brokers Good for Advanced Traders?

Experienced CFD traders should look for sophisticated tools to enhance the trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai, TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| xChief | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| InstaTrade | Experts Advisors (EAs) on MetaTrader | ✔ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| Focus Markets | Expert Advisors (EAs) on MetaTrader | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

| Exness | Expert Advisors (EAs) on MetaTrader | ✔ | ✘ | ✔ | 1:Unlimited | ✔ | ✘ |

| IC Markets | Expert Advisors (EAs) on MetaTrader, cBots on cTrader, Myfxbook AutoTrade | ✔ | ✘ | ✘ | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) | ✔ | ✘ |

Compare the Ratings of Top CFD Brokers

See how the top CFD brokers compare in all key areas according to our hands-on tests:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| xChief | |||||||||

| InstaTrade | |||||||||

| Focus Markets | |||||||||

| Exness | |||||||||

| IC Markets |

Compare CFD Trading Fees

The cost of trading with a CFD broker will make a big difference over time. Here's how the top CFD providers stack up on costs:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee | CFD FTSE Spread | CFD GBP/USD Spread | CFD Oil Spread | CFD Stocks Spread |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | ✘ | $0 | 0.005% (£1 Min) | 0.08-0.20 bps x trade value | 0.25-0.85 | 0.003 | |

| xChief | ✘ | - | 70 | 0.9 | 12 | 50 | |

| InstaTrade | ✘ | - | 660 | 0.2 | 0.0 | 8 (Apple Inc) | |

| Focus Markets | ✘ | $0 | 1.2 | 0.0 | 0.03 | Variable | |

| Exness | ✘ | $0 | 15.2 | 0.0 | 0.0 | 0.5 (Apple Inc.) | |

| IC Markets | ✘ | $0 | 1.0 | 0.23 | 0.03 | 0.02 |

How Popular Are These CFD Brokers?

Many traders prefer the most popular CFD brokers, i.e those with the most signed up clients:

| Broker | Popularity |

|---|---|

| InstaTrade | |

| Interactive Brokers | |

| Exness | |

| xChief | |

| IC Markets |

Why Trade CFDs with Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| FTSE Spread | 0.005% (£1 Min) |

|---|---|

| GBPUSD Spread | 0.08-0.20 bps x trade value |

| Stocks Spread | 0.003 |

| Leverage | 1:50 |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- Interactive Brokers has been named Best US Broker for 2025 by DayTrading.com, recognizing its long-standing commitment to US traders, ultra-low margin rates, and global market access at minimal cost.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

Why Trade CFDs with xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| FTSE Spread | 70 |

|---|---|

| GBPUSD Spread | 0.9 |

| Stocks Spread | 50 |

| Leverage | 1:1000 |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- The broker offers several account types to suit different traders, including a Cent account for beginners and pro-level hedging/netting accounts

- xChief delivers a high-quality day trading environment via the MT4 and MT5 platforms, with market-leading charts, indicators and tools

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- The broker trails competitors when it comes to research tools and educational resources

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

Why Trade CFDs with InstaTrade?

"Although InstaTrade offers active trading on a comprehensive platform, it stands out with its fairly unique Fixed Income Structured Product (FISP), providing passive investment opportunities with up to 50% returns in 6 months if conditions are met. "

Christian Harris, Reviewer

InstaTrade Quick Facts

| FTSE Spread | 660 |

|---|---|

| GBPUSD Spread | 0.2 |

| Stocks Spread | 8 (Apple Inc) |

| Leverage | 1:1000 |

| Regulator | BVI FSC |

| Platforms | InstaTrade Gear, MT4 |

| Account Currencies | USD, EUR, RUB |

Pros

- Despite an average investment offering of around 300 assets, InstaTrade offers a particularly strong suite of currency pairs, catering to advanced traders seeking opportunities in volatile exotics.

- InstaTrade TV, consisting of video interviews and valuable market insights spanning equities, cryptos and more, helps identify opportunities and inform short-term trades.

- InstaTrade claims to "guarantee" returns through the structured element of its passive trading solution (FISP), with applications approved within 24 hours.

Cons

- Marketing of the FISP, especially phrasing around the “guarantee of profitability” and the “elimination of risks of trading on financial markets” raises concerns.

- InstaTrade’s growing educational tools provide valuable information for aspiring traders, but still trail category leaders like eToro with no structured course based on experience level.

- Profits are only guaranteed in the FISP if investors do not reach the 50% profit level and attract other users with a total sum of $4 for each dollar in compensation.

Why Trade CFDs with Focus Markets?

"Focus Markets is perfect for experienced traders familiar with MetaTrader 5, offering flexible crypto transactions (USDT and BTC) and access to over 90 cryptocurrencies for seamless speculation, deposits, and withdrawals."

Christian Harris, Reviewer

Focus Markets Quick Facts

| FTSE Spread | 1.2 |

|---|---|

| GBPUSD Spread | 0.0 |

| Stocks Spread | Variable |

| Leverage | 1:500 |

| Regulator | ASIC, SVGFSA |

| Platforms | MT5 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, SGD |

Pros

- Focus Markets is regulated by ASIC – one of the most respected regulatory bodies in the financial industry with robust safeguards like negative balance protection, ensuring you can’t lose more than your balance in volatile markets.

- While its meagre four commodities won’t meet the needs of some serious traders interested in softs and metals, Focus Markets offers a huge suite of 90+ cryptos, providing short-term opportunities on high-reward, high-risk assets.

- Focus Markets excelled in the deposit and withdrawal category during testing, offering more base currencies than most competitors, including USD, CAD and EUR - and a range of traditional and popular crypto payment options, including BTC and USDT.

Cons

- Focus Markets’ 24/5 support lacks direct phone help and unresponsive live chat, while email replies took a full business day during our latest tests. This slow support is a major drawback for active traders who need quick resolutions.

- Focus Markets still has a long way to go to compete with the best brokers - with virtually zero research tools and education, plus limited value-add features like VPS hosting, copy trading and swap-free accounts.

- Regulatory protection is a location lottery at Focus Markets – Australian traders benefit from strong ASIC oversight, but those using the SVGFSA-registered entity face limited recourse options in disputes.

Why Trade CFDs with Exness?

"After slashing its spreads, improving its execution speeds and support trading on over 100 currency pairs with more than 40 account currencies to choose from, Exness is a fantastic option for active forex traders looking to minimize trading costs."

Christian Harris, Reviewer

Exness Quick Facts

| FTSE Spread | 15.2 |

|---|---|

| GBPUSD Spread | 0.0 |

| Stocks Spread | 0.5 (Apple Inc.) |

| Leverage | 1:Unlimited |

| Regulator | FCA, FSCA, CMA, FSA, CBCS, BVIFSC, FSC, JSC |

| Platforms | Exness Trade App, Exness Terminal, MT4, MT5, TradingCentral |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, INR, JPY, ZAR, MYR, IDR, CHF, HKD, SGD, AED, SAR, HUF, BRL, NGN, THB, VND, UAH, KWD, QAR, KRW, MXN, KES, CNY |

Pros

- Fast and dependable 24/7 multilingual customer support via telephone, email and live chat based on hands-on tests.

- Highly competitive spreads, reduced for USOIL and BTCUSD in 2024, are available from 0 pips with low commissions from $2 per side.

- Improved execution speeds, now averaging under 25ms, offer optimal conditions for short-term traders.

Cons

- Apart from a mediocre blog, educational resources are woeful, especially compared to category leaders like IG which provide a more complete trading journey for newer traders.

- Retail trading services are unavailable in certain jurisdictions, such as the US, UK and EU, limiting accessibility compared to top-tier brokers like Interactive Brokers.

- MetaTrader 4 and 5 are supported, but TradingView and cTrader still aren’t despite rising demand from active traders and integration at alternatives like Pepperstone.

Why Trade CFDs with IC Markets?

"IC Markets offers superior pricing, exceptionally fast execution and seamless deposits. The introduction of advanced charting platforms, notably TradingView, and the Raw Trader Plus account, ensures it remains a top choice for intermediate to advanced day traders."

Christian Harris, Reviewer

IC Markets Quick Facts

| FTSE Spread | 1.0 |

|---|---|

| GBPUSD Spread | 0.23 |

| Stocks Spread | 0.02 |

| Leverage | 1:30 (ASIC & CySEC), 1:500 (FSA), 1:1000 (Global) |

| Regulator | ASIC, CySEC, CMA, FSA |

| Platforms | MT4, MT5, cTrader, TradingView, TradingCentral, DupliTrade, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, NZD, JPY, CHF, HKD, SGD |

Pros

- IC Markets offers fast and dependable 24/5 support based on firsthand experience, particularly when it comes to accounts and funding issues.

- You have access to over 2,250 CFDs across various markets, including forex, commodities, indices, stocks, bonds, and cryptocurrencies, allowing for diversified trading strategies.

- IC Markets offers among the tightest spreads in the industry, with 0.0-pip spreads on major currency pairs, making it especially cost-effective for day traders.

Cons

- The breadth and depth of tutorials, webinars and educational resources still need work, trailing alternatives like CMC Markets and reducing its suitability for beginners.

- Despite four industry-leading third-party platforms, there is no proprietary software or trading app built with new traders in mind.

- While IC Markets offers a selection of metals and cryptos for trading via CFDs, the range is not as extensive as brokers like eToro, limiting opportunities for traders interested in these asset classes.

How To Choose A Top CFD Broker

Contracts for difference (CFDs) are a high-risk product available from hundreds of online brokers, however not all firms can be trusted and trading conditions vary. That’s why we, and you, should look at several factors to find the right CFD provider for your needs:

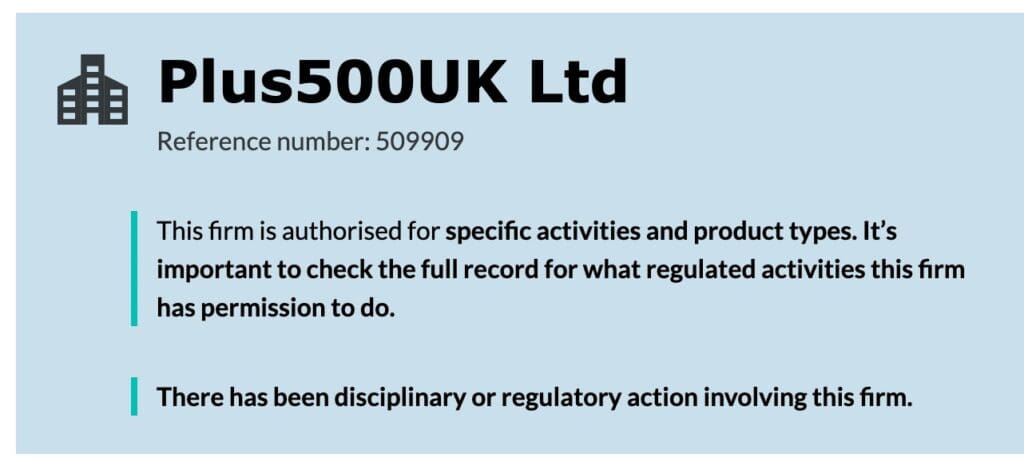

Trust

The most important consideration is choosing a trusted CFD broker.

You risk losing money in scams or from business failure if you sign up with an unreliable broker. This was demonstrated in 2023 when a seemingly credible CFD broker, EverFX, was found to be operating a scam where account managers encouraged traders to move capital to high-risk, unregulated entities, leaving clients with little to no regulatory protection.

The best sign that a CFD broker can be trusted is oversight from a top-rate regulator like the UK Financial Conduct Authority (FCA), Australian Securities & Investments Commission (ASIC), or Cyprus Securities & Exchange Commission (CySEC).

That’s why we review each CFD broker’s licensing details to ensure they have the regulatory authorizations they advertise.

We also test each broker carefully to check for unethical practices and only recommend providers that earn the confidence of our in-house experts, who have reviewed hundreds of brokers over many years.

- Plus500 maintains a very high trust score of 4.9/5 thanks to its oversight from the likes of the FCA, ASIC and CySEC, listing on the London Stock Exchange, 15+ years of industry experience, transparent trading conditions, and excellent reputation.

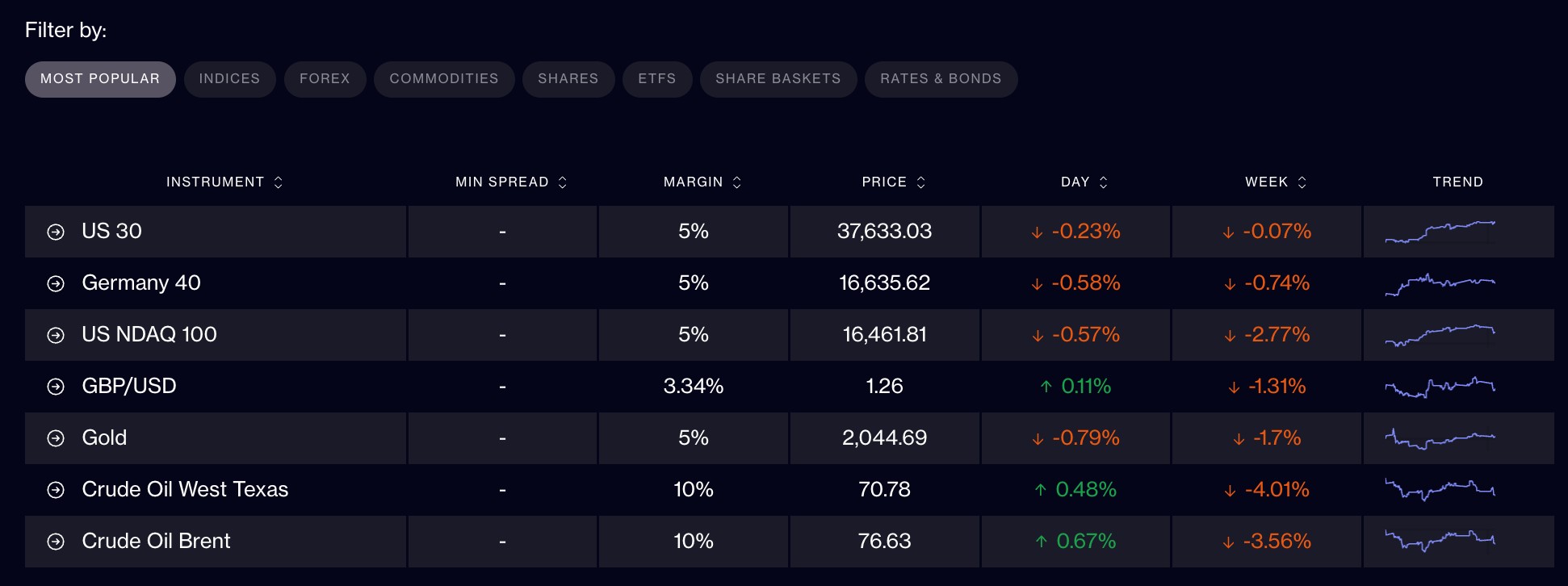

Markets

Selecting a CFD broker that offers access to the financial markets you want to speculate on is key.

CFDs are a versatile trading vehicle that can be used to trade a wide range of asset classes, including stocks, forex, commodities and cryptocurrencies, and we look for brokers that provide enough variety for traders to build a diverse portfolio.

- CMC Markets continues to excel for its above-average selection of 12,000+ CFDs, including 300+ currency pairs – more than every other CFD provider we have tested to date.

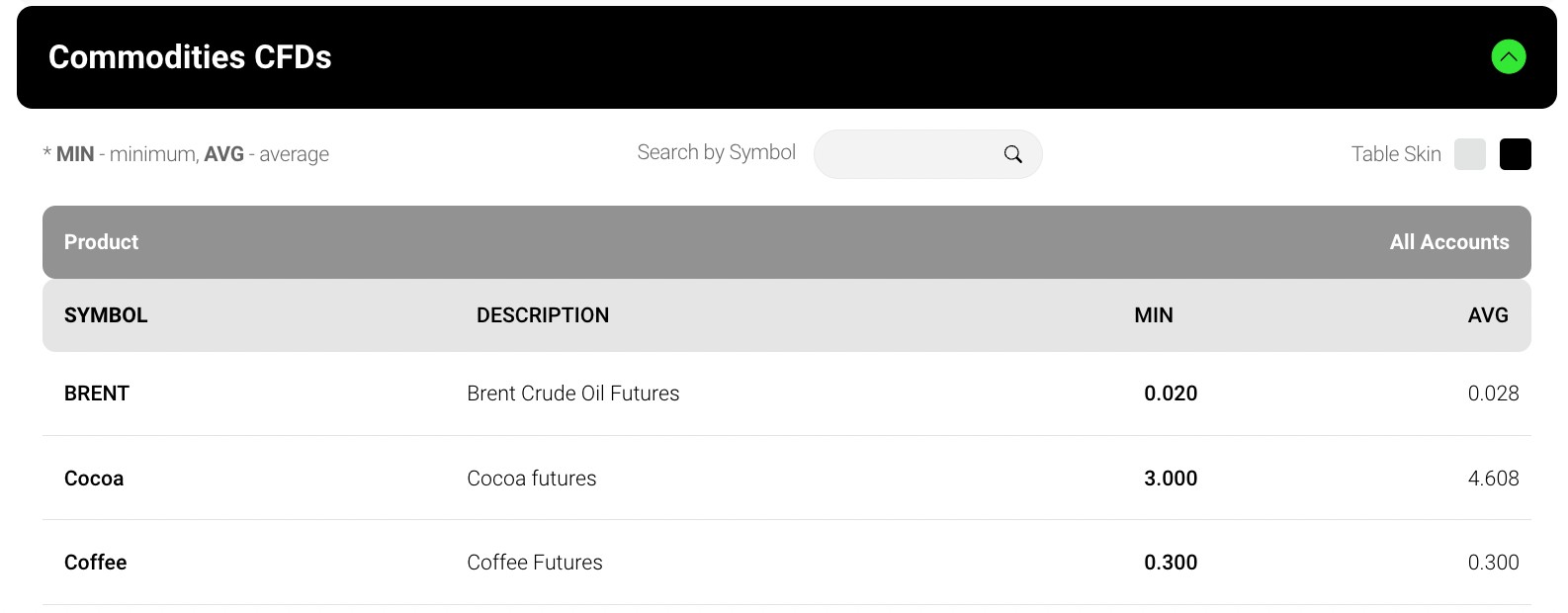

Fees

Picking a CFD broker with competitive fees is an important consideration, especially for active day traders for whom frequent costs can cut into profits.

Most CFD platforms make money through spreads. This is the difference between the quoted buy and sell prices, and real market prices. It’s essentially a markup for the broker’s services.

Fees also come in the form of commissions which take a percentage of each trade. The good news is that to stay competitive, many of the best CFD brokers are waiving commission fees.

CFD brokers also make money through financing. When you trade using margin or leverage, you essentially borrow funds from the brokerage to increase your position size. Most firms factor in a fee for these financing services.

We monitor the trading fees of our top CFD brokers each year to ensure they maintain their edge by continuing to offer tight spreads with low or no commission fees.

We also weigh the trading and non-trading fees (deposit/withdrawal charges and inactivity penalties) against the total package available, including market access and trading tools, on the basis that value for money is more important than simply having the lowest fees.

- IC Markets consistently ranks as one of our cheapest CFD brokers. The Standard account is great for beginners with commission-free CFDs and spreads from 0.8 pips, while the Raw account will serve intermediate and advanced traders with spreads from 0.0, a low commission of $3.50, plus rebates for high-volume traders.

Leverage

Given the risk of high losses with derivatives like CFDs, choosing a broker with transparent leverage and margin requirements is key.

Leverage allows you to greatly increase the potential profitability of trades with a relatively small amount of capital. Leverage is often written as a ratio, for example 1:10. Here, a $100 outlay would give you $1,000 in buying power ($100 x 10).

Importantly, the amount of leverage available can vary greatly among CFD providers. If your broker is regulated by a top-tier body like the FCA, ASIC or CySEC, then it is likely to be restricted to a maximum of 1:30 for forex and lower amounts for more volatile instruments like crypto.

These regulators also require CFD brokers to provide negative balance protection, ensuring you cannot lose more than your account balance.

Still, many traders choose to sign up with offshore CFD brokers who can offer higher amounts of leverage, sometimes reaching 1:3000.

I do not recommend beginners trade CFDs with high leverage given the risk of substantial losses. And if you do, make use of risk management tools in your broker’s platform like stop-loss orders. These can limit potential losses.

- FXCC is a good example of a reliable CFD broker that offers leverage up to 1:500 for traders who sign up with its global entity.

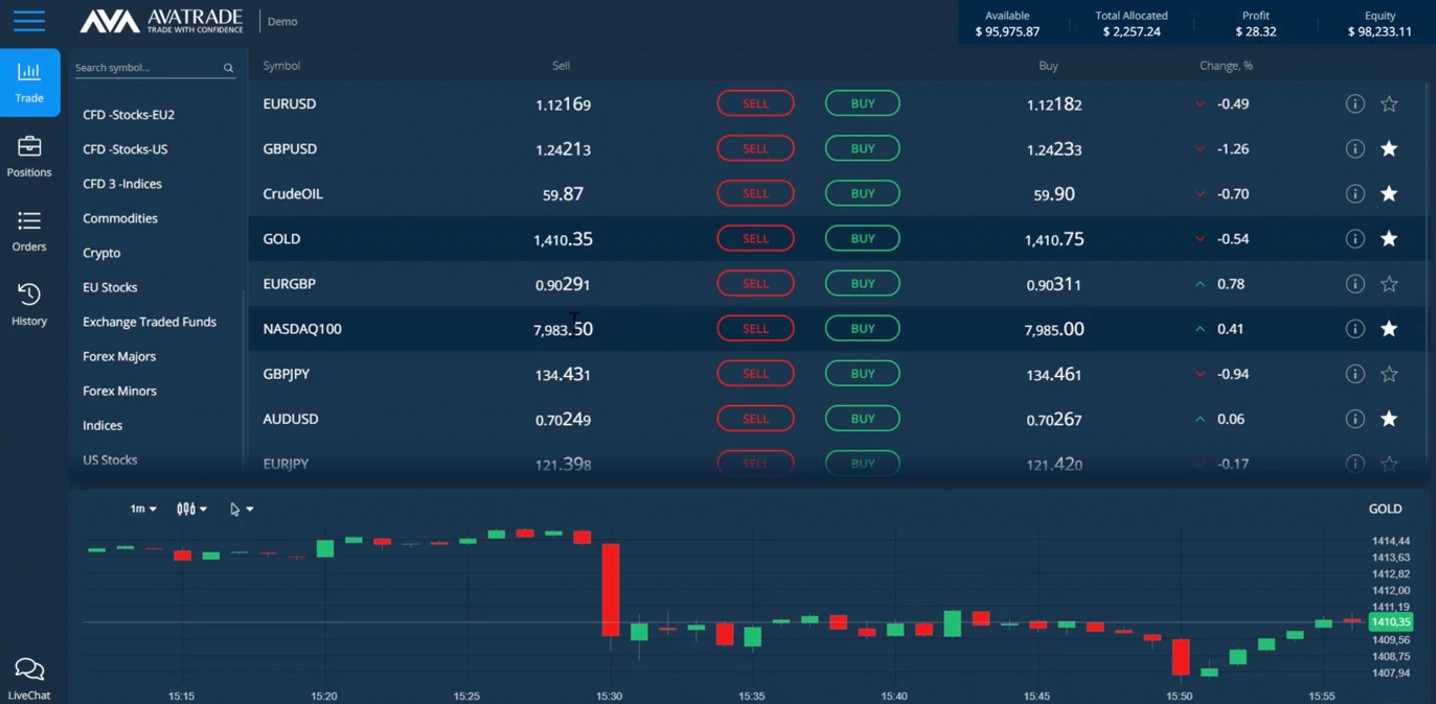

Platforms and Apps

Choosing a broker with a user-friendly CFD trading platform and the features you need to analyze the markets is essential.

Based on our extensive experience, the top CFD providers offer popular third-party software like MetaTrader 4, which is great for advanced traders interested in technical analysis and algo trading, alongside user-friendly proprietary platforms and mobile apps that deliver an intuitive user experience for beginners.

- AvaTrade stands out for its excellent platform line-up, from MT4 and MT5 to the in-house WebTrader that performed well during testing with an intelligent design, smooth user experience and a strong charting package comprising 60+ indicators, 14 drawing tools and 10 timeframes.

Value-Add Features

With many CFD brokers offering competitive packages today, considering the additional features available can be a great way to find a firm that best caters to your experience level and strategy.

We’ve seen that the best CFD providers offer a variety of extra tools to give traders the best chance at success. This can include engaging educational materials and social investing platforms to support new traders, market research tools like Trading Central to help you discover opportunities and virtual private server (VPS) hosting to give advanced day traders the fastest execution speeds with low latency.

- Pepperstone excels for its large suite of extra tools that elevate the CFD trading experience, from daily market news, code-free automation tools like Capitalise.ai, and top-rate education with guides to CFDs for beginners.

Bottom Line

The best CFD platforms provide a secure environment where you can speculate on global financial markets with user-friendly tools and low fees. Choose from our list of top CFD brokers to find the right platform for your needs.

Find out more about how we test CFD brokers.

FAQ

What Is A CFD Broker?

A CFD broker is a financial intermediary that enables you to speculate on price movements in various financial markets without owning the underlying assets.

They facilitate the trading process through an online platform. You sign up for an account, deposit funds, trade CFD products and then withdraw any profits.

Are All CFD Brokers Regulated?

CFDs are legal financial instruments that are tightly regulated in many jurisdictions. That said, brokers are banned from offering CFDs in some countries, including the United States.

For Specific Countries

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com