Best Forex Brokers In 2025

We’ve tested hundreds of platforms to bring you our selection of the best forex brokers. Explore the forex trading platforms that excel for their:

- Excellent selection of currency pairs

- Great pricing on short-term trades

- Intuitive Forex charting platforms

- High levels of regulation and trust

- Fast and reliable order executions

Top 6 Brokers For Day Trading Forex In 2025

We've evaluated 227 forex providers as of October 2025 and these are our 6 best brokers for day trading forex:

What Makes These Brokers The Best For Day Trading Forex?

Here’s a snapshot of why these forex brokers beat out the competition in our latest tests:

- Interactive Brokers is the best broker for day trading forex in 2025 - IBKR presents an extensive range of over 100 major, minor, and exotic forex pairs, surpassing the offerings of nearly all leading alternatives, though not CMC Markets. Forex trading occurs over multiple platforms and boasts institutional-grade spreads starting from 0.1 pips and 20 complex order types, including brackets, scale, and one-cancels-all (OCA) orders.

- NinjaTrader - NinjaTraders supports the trading of popular currencies including the EUR/USD. The software also offers advanced features to streamline the trading experience, including complex order types like market if touched (MIT) and one cancels other (OCO).

- Plus500US - Plus500 US offers futures trading on a small selection of 13 currencies, including popular pairs like the EUR/USD and GBP/USD. Day trading margins are competitive, starting from $40, while the educational resources do an excellent job of breaking down the basics of forex futures for new traders.

- FOREX.com - FOREX.com continues to uphold its stature as a premier FX broker, offering 80 currency pairs and boasting some of the most competitive fees in the industry. With EUR/USD spreads dipping as low as 0.0 and $7 commission per $100k, it stands out.

- OANDA US - OANDA offers a diverse selection of 68 currency pairs, more than many alternatives. The broker’s in-house platform offers superb day trading capabilities via powerful TradingView charts, including 65+ technical indicators and 11 customizable chart types.

- Videforex - Videforex offers trading on a growing range of over 40 currency pairs through leveraged CFDs with spreads from 0.1 pips. Alternatively, traders can use binaries to speculate on upward/downward price movements with payouts up to 98%. Integrated technical analysis, economic calendars, and market news, all available within the platform, help support FX trading decisions. Videforex added fresh exotics in 2025 like THB and MXN for diverse trading opportunities.

Top Forex Trading Platforms Comparison

Find the right provider for you with our comparison of the elements most important to active FX traders:

| Broker | Number of Currency Pairs | EUR/USD Spread | Currency Indices | Forex App Rating | Minimum Deposit | Regulators |

|---|---|---|---|---|---|---|

| Interactive Brokers | 100+ | 0.08-0.20 bps x trade value | - | / 5 | $0 | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| NinjaTrader | 50+ | 1.3 | - | / 5 | $0 | NFA, CFTC |

| Plus500US | 13 | 0.75 | - | / 5 | $100 | CFTC, NFA |

| FOREX.com | 84 | 1.2 | - | / 5 | $100 | NFA, CFTC |

| OANDA US | 65+ | 1.6 | - | / 5 | $0 | NFA, CFTC |

| Videforex | 40+ | 0.1 | - | / 5 | $250 | - |

How Safe Are These Forex Trading Providers?

Find out how our top brokers for trading forex protect your capital:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| Plus500US | ✘ | ✘ | ✔ | |

| FOREX.com | ✘ | ✔ | ✘ | |

| OANDA US | ✔ | ✘ | ✘ | |

| Videforex | ✔ | ✔ | ✘ |

Are The Top Forex Brokers Good For Beginners?

New traders should pick a broker that allows forex trading with virtual money, alongside other features geared towards beginners:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| Plus500US | ✔ | $100 | 0.0 Lots | ||

| FOREX.com | ✔ | $100 | 0.01 Lots | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| Videforex | ✔ | $250 | $0.01 |

Are The Top Forex Brokers Good for Advanced Traders?

Seasoned traders should look for powerful tools to elevate the forex trading experience:

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai & TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| Plus500US | - | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| FOREX.com | Expert Advisors (EAs) on MetaTrader | ✔ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Videforex | ✔ | ✘ | ✘ | ✘ | 1:500 | ✘ | ✘ |

Compare the Ratings of Our Top Forex Trading Platforms

See how our top forex trading brokers rate in key areas after our in-depth tests of their FX trading capabilities:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| Plus500US | |||||||||

| FOREX.com | |||||||||

| OANDA US | |||||||||

| Videforex |

Compare Forex Trading Fees

The cost of frequently trading currencies adds up over time, so here's how our leading forex brokerages measure up on pricing:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee | GBP/USD Spread | EUR/USD Spread | GBP/EUR Spread |

|---|---|---|---|---|---|---|

| Interactive Brokers | ✘ | $0 | 0.08-0.20 bps x trade value | 0.08-0.20 bps x trade value | 0.08-0.20 bps x trade value | |

| NinjaTrader | ✘ | $25 | 1.6 | 1.3 | 1.6 | |

| Plus500US | ✘ | $0 | - | 0.75 | - | |

| FOREX.com | ✘ | $15 | 1.3 | 1.2 | 1.4 | |

| OANDA US | ✘ | $0 | 3.4 | 1.6 | 1.7 | |

| Videforex | ✘ | $10 | 0.1 | 0.1 | 0.1 |

How Popular Are These Forex Trading Brokers?

Lots of traders prefer the most popular forex brokers (those with the most clients):

| Broker | Popularity |

|---|---|

| Interactive Brokers | |

| NinjaTrader | |

| FOREX.com | |

| Videforex |

Why Day Trade Forex With Interactive Brokers?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| GBPUSD Spread | 0.08-0.20 bps x trade value |

|---|---|

| EURUSD Spread | 0.08-0.20 bps x trade value |

| EURGBP Spread | 0.08-0.20 bps x trade value |

| Total Assets | 100+ |

| Leverage | 1:50 |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- While primarily geared towards experienced traders, IBKR has made moves to broaden its appeal in recent years, reducing its minimum deposit from $10,000 to $0.

- There's a vast library of free or paid third-party research subscriptions catering to all types of traders, plus you can enjoy commission reimbursements from IBKR if you subscribe to Toggle AI.

- Interactive Brokers has launched ForecastTrader, a unique, zero-commission product where users can trade yes/no Forecast Contracts on political, economic, and climate events, with fixed $1 payouts per contract, 24/6 market access, and 3.83% APY on held positions.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- You can only have one active session per account, so you can’t have your desktop program and mobile app running simultaneously, making for a sometimes frustrating trading experience.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

Why Day Trade Forex With NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| GBPUSD Spread | 1.6 |

|---|---|

| EURUSD Spread | 1.3 |

| EURGBP Spread | 1.6 |

| Total Assets | 50+ |

| Leverage | 1:50 |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Account Currencies | USD |

Pros

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

Why Day Trade Forex With Plus500US?

"Plus500US stands out as an excellent choice for beginners, offering a very user-friendly platform, low day trading margins, and access to the Futures Academy to enhance trading skills. Its powerful tools and reliable service helped it scoop second place in DayTrading.com's annual 'Best US Broker' award."

Michael MacKenzie, Reviewer

Plus500US Quick Facts

| Bonus Offer | Welcome Deposit Bonus up to $200 |

|---|---|

| EURUSD Spread | 0.75 |

| Total Assets | 13 |

| Leverage | 1:50 |

| Platforms | WebTrader, App |

| Account Currencies | USD |

Pros

- The trading app provides a terrific user experience with a modern design, a clean layout and mobile-optimized charts

- Plus500 is a publicly traded company with a good reputation, over 24 million traders, and a sponsor of the Chicago Bulls.

- Plus500US excels for its low fees with very competitive day trading margins and no inactivity fees, live data fees, routing fees, or platform fees

Cons

- Plus500US does not offer social trading capabilities, a feature available at alternatives like eToro US which could strengthen its offering for aspiring traders

- Although support response times were fast during tests, there is no telephone assistance

- Despite competitive pricing, Plus500US lacks a discount program for high-volume day traders, a scheme found at brokers like Interactive Brokers

Why Day Trade Forex With FOREX.com?

"FOREX.com remains a best-in-class brokerage for active forex traders of all experience levels, with over 80 currency pairs, tight spreads from 0.0 pips and low commissions. The powerful charting platforms collectively offer over 100 technical indicators, as well as extensive research tools."

Christian Harris, Reviewer

FOREX.com Quick Facts

| Bonus Offer | VIP status with up to 10k+ in rebates - T&Cs apply. |

|---|---|

| GBPUSD Spread | 1.3 |

| EURUSD Spread | 1.2 |

| EURGBP Spread | 1.4 |

| Total Assets | 84 |

| Leverage | 1:50 |

| Platforms | WebTrader, Mobile, MT4, MT5, TradingView |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, PLN |

Pros

- FOREX.com offers industry-leading forex pricing starting from 0.0 pips, alongside competitive cashback rebates of up to 15% for serious day traders.

- There’s a wealth of educational resources including tutorials, webinars, and a stacked YouTube channel to help you get educated in the financial markets.

- The in-house Web Trader continues to shine as one of the best-designed platforms for aspiring day traders with a slick design and over 80 technical indicators for market analysis.

Cons

- There’s no negative balance protection for US clients, so you may find yourself owing more money than your initial deposit into your account.

- Funding options are limited compared to leading alternatives like IC Markets and don’t include many popular e-wallets, notably UnionPay and POLi.

- FOREX.com's MT4 platform offers approximately 600 instruments, significantly fewer than the over 5,500 available on its non-MetaTrader platforms.

Why Day Trade Forex With OANDA US?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| GBPUSD Spread | 3.4 |

|---|---|

| EURUSD Spread | 1.6 |

| EURGBP Spread | 1.7 |

| Total Assets | 65+ |

| Leverage | 1:50 |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

- The broker offers a transparent pricing structure with no hidden charges

- There's a strong selection of 68 currency pairs for dedicated short-term forex traders

Cons

- There's only a small range of payment methods available, with no e-wallets supported

- It's a shame that customer support is not available on weekends

- The range of day trading markets is limited to forex and cryptos only

Why Day Trade Forex With Videforex?

"Videforex will serve traders looking for a no-frills, easy-to-use platform to speculate on the direction of popular financial markets through binaries. With a sign-up process that takes a matter of minutes and a web-accessible platform, getting started is a breeze. "

William Berg, Reviewer

Videforex Quick Facts

| Bonus Offer | 20% to 200% Deposit Bonus |

|---|---|

| GBPUSD Spread | 0.1 |

| EURUSD Spread | 0.1 |

| EURGBP Spread | 0.1 |

| Total Assets | 40+ |

| Leverage | 1:500 |

| Platforms | TradingView |

| Account Currencies | USD, EUR, GBP, AUD, RUB |

Pros

- Videforex regularly runs trading contests, offering practice opportunities and cash prizes to beginners and experienced traders, with position sizes from just ¢0.01.

- Videforex is one of the few brokers with 24/7 multilingual video support, providing comprehensive assistance for active traders.

- With the addition of over 60 new assets, Videforex now gives traders access to in-demand crypto (TON, ARB, PEPE, SHIB), top-performing tech stocks (Tesla, Meta, Nvidia, Amazon), and a more diverse FX portfolio (THB, ZAR, and MXN).

Cons

- The absence of any educational tools is a serious drawback for newer traders who can find blogs, videos and live trading sessions at category leaders.

- The client terminal needs improvements based on our latest tests, sporting sometimes slow and unresponsive widgets which could dampen the experience for day traders.

- Videforex lacks authorization from a trusted regulator, meaning traders may receive little to zero safeguards like segregated client accounts.

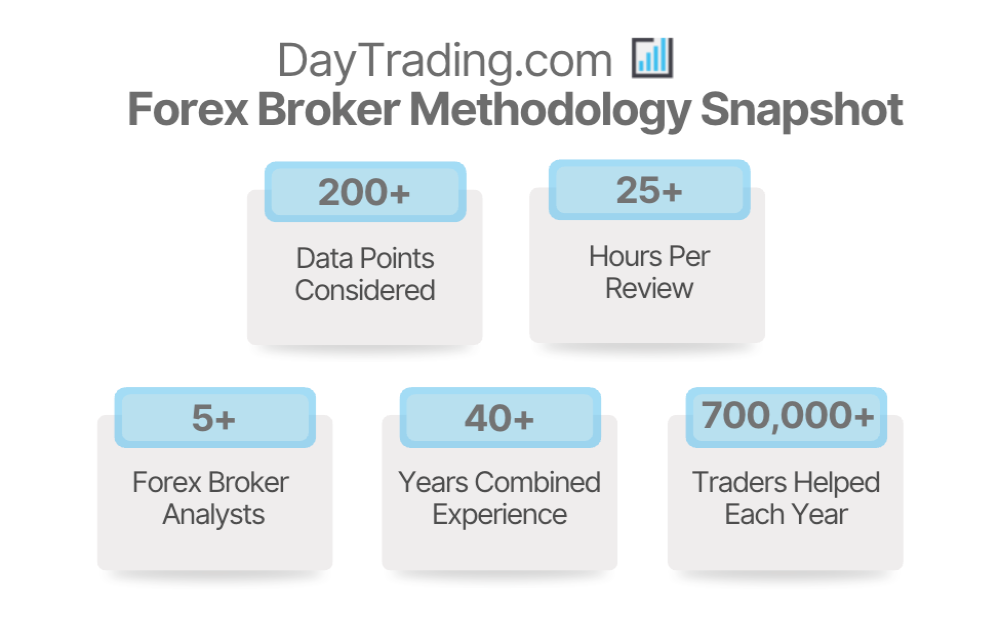

How We Chose The Best Forex Brokers

To find the best brokers for day trading forex we identified those that deliver in critical areas, unpacked below.

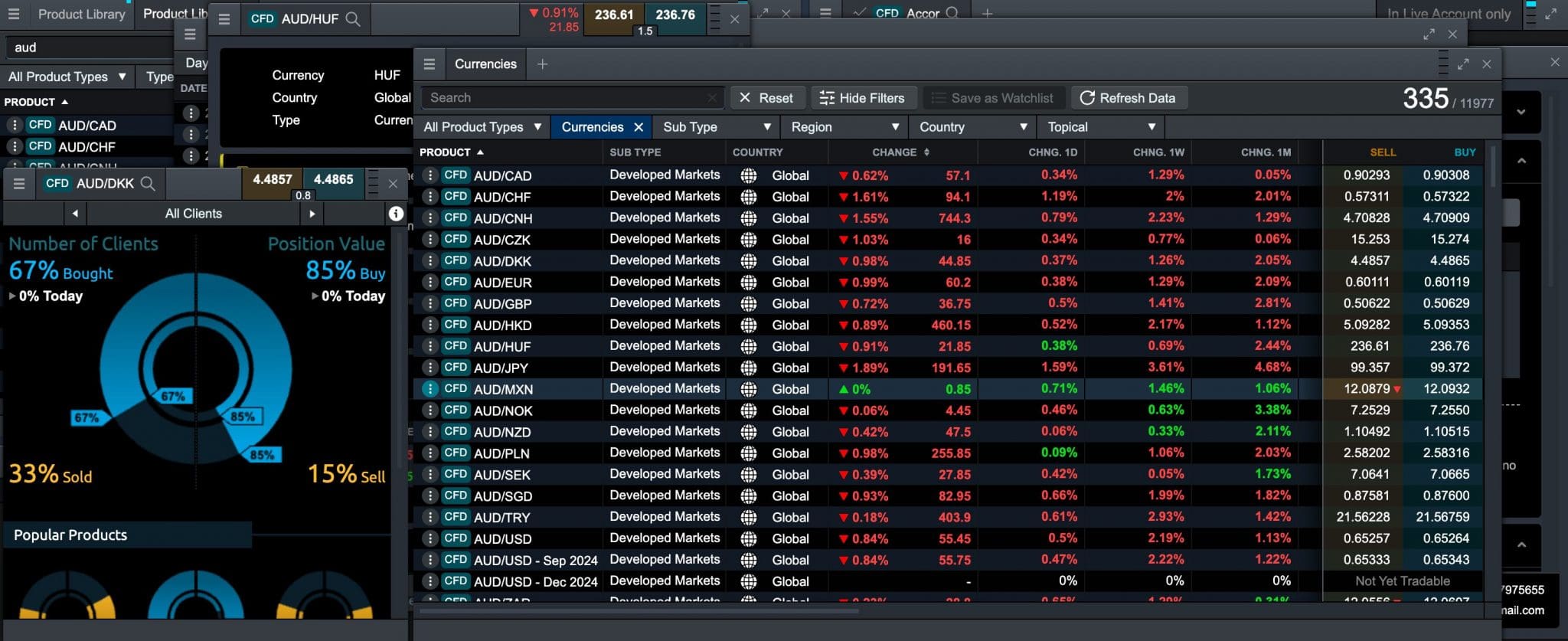

Currency Pairs

We chose forex platforms with a wide range of currency pairs, providing diverse trading opportunities while enabling investors to spread risk and use various short-term strategies.

Most of our top forex brokers offer upwards of 50 currency pairs, while CMC Markets leads the pack with an industry leading 330+ currency pairs, featuring a particularly extensive suite of exotics plus forex indices.

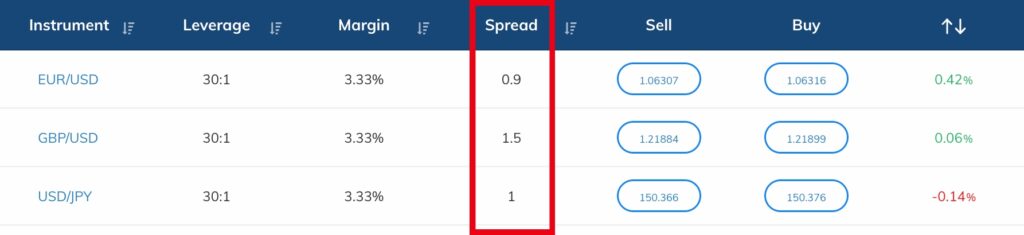

Pricing

We chose low-cost forex trading platforms that will help maximize returns, as even small differences in fees can add up over many day trades.

We evaluated both the minimum spreads on key currency pairs, notably the EUR/USD, GBP/USD and EUR/GBP, but also average spreads.

We did this by recording spreads during the most actively traded sessions – the US/London overlap and the Sydney/Tokyo overlap. We then compared these with industry averages.

Following that, we factored in any commissions and non-trading fees, from deposit and withdrawal charges to inactivity penalties. This allowed us to paint a complete picture of the costs you can expect when day trading currencies.

Our top forex brokers deliver excellent pricing, most with spreads of <1 pip on the EUR/USD, plus no or low deposit/withdrawal charges and inactivity fees.

That said, IC Markets shines as the lowest-cost forex broker overall with industry-low spreads year after year.

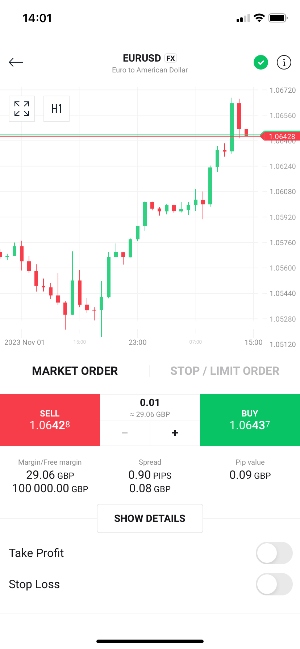

Charting Platforms

We chose forex brokers with terrific platforms, with a focus on intuitive interfaces and advanced charting tools given that many day traders use technical analysis to identify opportunities in the foreign exchange market.

With a rising trend in mobile forex trading, as reported by Astute Analytica, the ability to trade on the move is also crucial.

However, after using countless forex apps, we’ve found that not all mobile solutions match their desktop counterparts. Charts may not be mobile-optimized or you can’t work horizontally, resulting in a subpar user experience.

Forex brokerages are increasingly developing their own software, but the two most popular third-party platforms, supported by the vast majority of online brokers, are still:

- MetaTrader 4 (MT4): This is the gold standard for forex traders, with advanced charting, sophisticated technical analysis tools, multiple order types, and extensive customization, though we don’t like the clunky, outdated design.

- MetaTrader 5 (MT5): This is the latest iteration of MetaTrader 4. It has more powerful features, including more order types, analysis tools and faster processing. This is our pick for automated forex trading.

Our best forex day trading brokers all deliver in the tooling department, with most offering the MetaTrader suite, as well as further proprietary and third-party platforms in some instances, with FOREX.com leading the way with its terrific web platform that we loved using during testing.

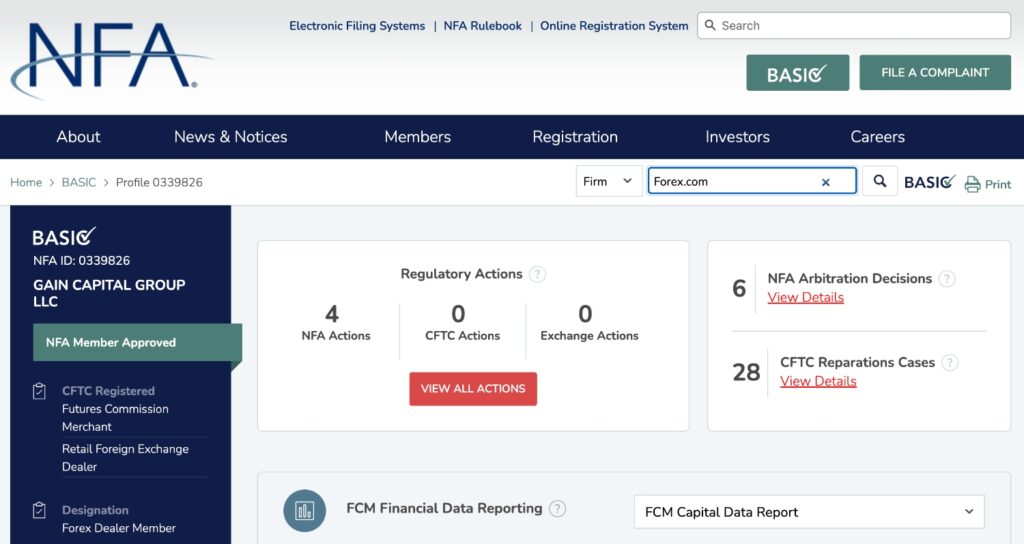

Regulation and Trust

We chose brokers authorized by trustworthy regulators to help protect forex traders from scams.

This is especially important given that the US Commodity Futures Trading Commission (CFTC) has warned it has “witnessed a sharp rise in forex trading scams in recent years”.

Picking a well-regulated broker also ensures important measures are in place to protect your account, including negative balance protection so you can’t lose more than your balance, limits on leverage to curtail excessive losses, and restrictions on forex bonuses to discourage over-trading.

You can check whether a forex broker is regulated by following these steps:

- Run the firm’s license number (normally visible at the bottom of their website) through the regulator’s online register.

- Confirm the brokerage is allowed to accept traders in your country, either through a local regulator or through an alternative, reputable body.

Most of our top forex day trading platforms are authorized by multiple ‘green-tier’ bodies in DayTrading.com’s Regulation & Trust Rating and have earned high trust scores, reflecting their regulatory credentials, industry reputation, and our traders’ direct experiences during the exhaustive review process.

That said, IG comes out on top with its long row of regulatory licenses and secure forex trading environment, featuring bespoke risk management tools you can’t find elsewhere.

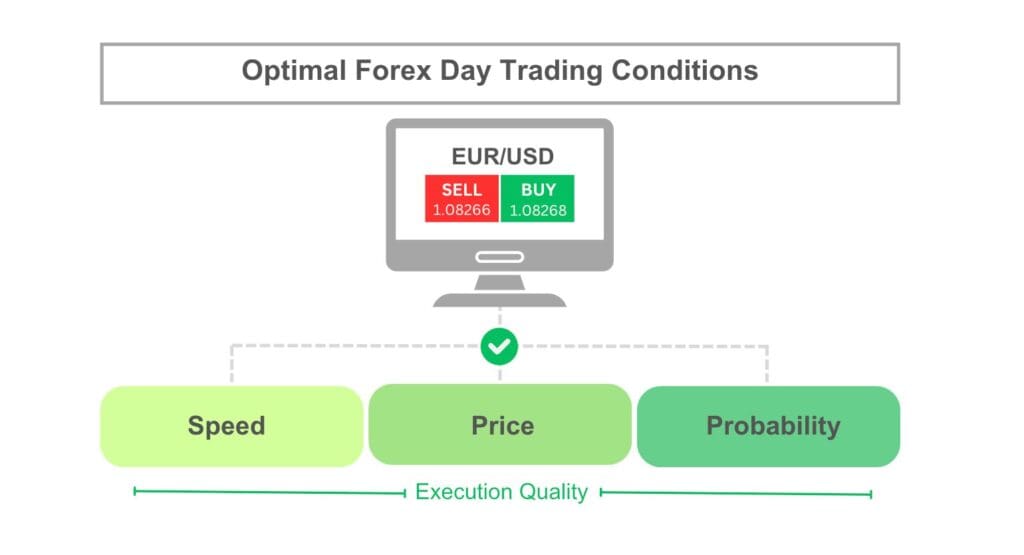

Order Execution

We chose forex trading platforms with fast and reliable order execution, preferably <100 milliseconds with no requotes, given the nature of short-term trading and the dynamics of the foreign exchange market.

The forex market is highly volatile, more so than say stocks, with rapid fluctuations that day traders need to capitalize on to generate profits.

Forex brokers with fast execution help ensure trades are carried out as close to the desired entry and exit points as possible while minimizing slippage.

Additionally, since day traders typically use leverage to amplify their buying power, even small fluctuations in currency values can trigger substantial returns or losses, with reliable execution helping to maximize returns and keeping a handle on the risks.

Most of our best forex brokers meet our benchmarks for order quality, with Pepperstone excelling for its ultra-fast speeds of 30ms.

FAQ

What Is Day Trading Forex?

Day trading forex involves speculating on the fluctuations in exchange rates between currencies, such as the EUR/USD or GBP/USD.

Day traders can make a profit by correctly predicting whether the value of one currency will rise or fall relative to another within the same trading day.

How Do I Start Forex Day Trading?

To start day trading forex you will need to open an account with an online broker. You will also need starting capital to fund your account and execute day trades.

Our analysis shows that many of the best forex day trading platforms accept new clients with a minimum deposit up to $250. However, some brokers stand out with no minimum investment, catering to budget traders – the highest-rated is Pepperstone.

Importantly, you will also need a strategy to help you decide which currency pairs to speculate on and when to exit and enter the market. A sensible approach to risk management is also required to ensure you do not lose more than you can afford.

What Is The Most Used Forex Trading Platform?

MetaTrader 4 (MT4) is the most popular forex trading platform.

The third-party trading solution, designed for trading currencies, is offered by the majority of online brokers as a desktop client, web trader and mobile app, having been downloaded from the App Store and Google Play more than 10 million times.

Recommended Reading

For Specific Countries

Article Sources

- Forex Trading Platform Market - Industry Dynamics, Market Size, And Opportunity Forecast to 2031 - Astute Analytica

- Forex Fraud Warning - US Commodity Futures Trading Commission (CFTC)

- The Retail Spot Foreign Exchange Market Structure and Participants - John Forman

- The Basics of Forex Trading - Carley Garner

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com