Weekend Trading

Day trading at the weekend is a growing area of finance. The underlying forex market trades 24 hours a day from Sunday night to Friday night and is closed on weekends. However, some brokers now offer separate weekend forex markets (synthetic prices that track major pairs), giving retail traders more opportunities to trade on Saturdays and Sundays.

In this tutorial, we detail the key markets for weekend trading, strategy choices and some benefits and risks to consider.

Quick Introduction

- Weekend trading is becoming popular as traders look for further opportunities while enjoying flexibility in terms of when they access markets.

- As well as weekend forex trading, Bitcoin trading and cryptocurrency trading is also available around the clock all days of the week, plus the weekend.

- A lesser-known alternative is binary options weekend trading. Binary options are perhaps the simplest possible short-term instruments – just decide if the price of an asset will go up or down within a chosen timeframe, e.g 60 seconds.

- Some brokerages now also offer weekend trading on indices as the growth in part-time day trading continues.

- If you are trading on the weekend, it is important to adjust your strategy accordingly, as the markets can behave differently, with lower volume and volatility risks.

Best Weekend Brokers

These are the 4 best brokers for trading over the weekend:

-

1

Interactive Brokers

Interactive Brokers -

2

NinjaTrader

NinjaTrader -

3

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation

eToro USAeToro USA LLC and eToro USA Securities Inc.; Investing involves risk, including loss of principal; Not a recommendation -

4

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Plus500USTrading in futures and options involves the risk of loss and is not suitable for everyone.

Can You Trade On The Weekends?

There is a popular misconception that you cannot trade over the weekend. Perhaps this is because understandably, many in the financial world would like Saturdays and Sundays off.

In the US, stock exchanges like the NYSE and NASDAQ have a 09:30-16:00 ET main session, plus pre-market and after-hours trading on weekdays – but no regular trading over the weekend. On the other hand, many Middle Eastern exchanges trade Sunday–Thursday (for example, Saudi Arabia and Kuwait), and some, like Tehran, trade Saturday–Wednesday.

So, the answer is yes, you definitely can start trading online at the weekend.

What Can You Trade?

Weekend trading in stocks, forex, cryptocurrencies, binary options, and futures has grown in popularity among retail investors. Below, we outline some of the top assets and trading vehicles.

Stocks

Stocks (in some locations and at some brokers) are one of the popular markets still available on Saturdays and Sundays (usually via broker-created derivatives, not the cash market itself). Some of the largest stock indexes available during the weekend are:

- DFM Index – This index is based on the Dubai stock exchange, which is one of the major exchanges in the United Arab Emirates.

- Tadawul Index – This is the only stock exchange located in Saudi Arabia and hosts some major oil companies, including Saudi Aramco.

- Kuwait Stock Exchange – This is the national stock exchange in Kuwait and includes the biggest firms, banks, insurance companies, and real estate.

- Tel Aviv 35 (TA-35) Index – Israel’s main blue-chip index, made up of the 35 largest companies by market capitalisation on the Tel Aviv Stock Exchange.

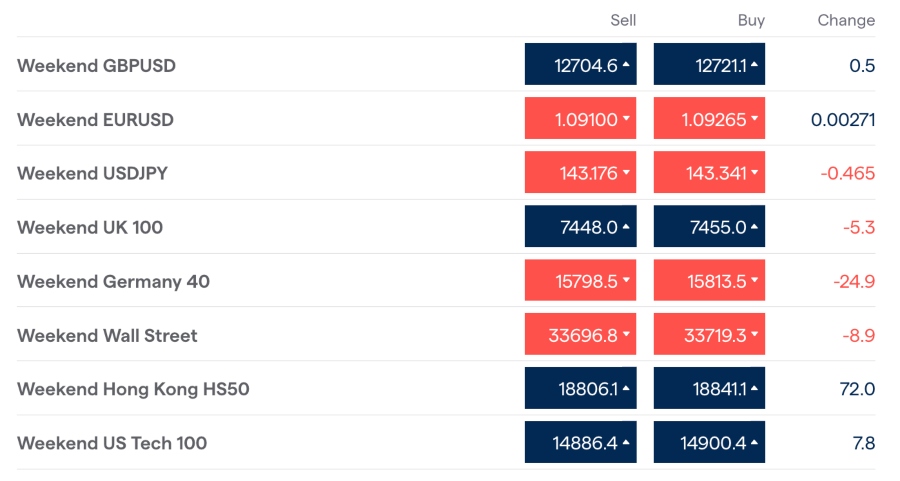

In addition to the above, some brokers are now also offering weekend trading on European and US indices, including the FTSE, DAX and even the Dow Jones. However, always ensure you read the terms of weekend trades, particularly if using stop losses.

At IG, for example, weekend indices and FX are separate markets from their weekday versions. Stops and limits attached to weekday positions won’t be triggered by weekend prices. If you open a weekend position and keep it open past the Sunday close, it will roll into the weekday market, with any attached stops and limits carried over.

These conditions may play a vital part in your strategy, so make sure you understand them. As more brokers start to offer weekend trading, the differences between how they operate will grow.

Cryptocurrencies

Due to its 24/7 operation, the cryptocurrency market is also available to trade on weekends. In fact, digital assets such as crypto CFDs have fast become one of the most popular markets to trade on Saturdays and Sundays.

For example, eToro facilitates both weekday and weekend crypto trading through a single platform. IC Markets also offers weekend trading on cryptocurrency CFDs with no commissions and leverage up to 1:200.

Some regulators, including the UK’s Financial Conduct Authority (FCA), have placed permanent restrictions on retail CFDs, including leverage caps between 1:30 and 1:2.

Binary Options

Binaries are particularly popular with weekend traders, allowing users to bet on whether the price of an underlying security, such as crypto, will rise or fall over a given timeframe. A correct bet will result in a fixed payout, while an incorrect prediction leads to the loss of your original stake.

Binary options, like CFDs, can also be traded on a range of underlying assets. Some binary options brokers, such as Pocket Option, offer OTC contracts on weekends across multiple asset classes (currencies, commodities, stocks, indices and cryptocurrencies). Availability varies by broker, so always check which instruments actually trade on Saturdays and Sundays.

In the EU, ESMA has banned the sale of most binary options (and CFDs) to retail clients due to investor protection concerns. Weekend binary options trading is typically only available via offshore or professional-client accounts.

Why Trade On The Weekend?

There are several reasons why you might want to start trading at the weekend:

- Strategy friendly – Whilst some strategies will turn handsome profits in a high volume week, others will perform better on the weekends. The Asian markets that are open, for example, behave differently from many Western markets. This plays into the hands of certain traders with strategies better suited for the different market conditions.

- More trading = more profit – Whilst this is not always the case, in general, the more time you spend trading, the greater opportunity you have to turn profits. However, it’s important to remember that very frequent intraday trading can trigger additional regulatory requirements, such as FINRA’s pattern day trader rules.

- Flexibility – For some, trading in the week simply isn’t an option. The weekend is ideal for those with busy schedules and intra-week commitments. You have the freedom to choose the hours that suit you.

- Focus – If your week is hectic, the weekend may come with fewer distractions. This could translate into greater concentration and enhanced trading decisions.

- Hedging – Weekend trading can be used to hedge against risk if an open weekday position takes a negative turn. For example, if you predict an economic announcement on Saturday that could impact an existing position, you could open an opposing weekend trade in the same asset to offset a proportion of the losses.

Restrictions On Weekend Trading

Despite the numerous benefits weekend day trading offers, there remain several limitations. The most problematic of which include:

- Limited instruments – There are fewer assets available on the weekends. If you like to trade using the news and with instruments you have a good understanding of, you may face problems. For example, Nokia, Ford Motors, and Twitter are all traded on the New York Stock Exchange and out of bounds at the weekend. However, those trading on price movements using technical analysis may still be able to turn profits.

- Low volume – On weekdays, forex trades around the clock as sessions roll from London to New York to Asia. At the weekend, the underlying FX, gold and oil markets are closed, but some brokers quote separate weekend markets with much lower liquidity and wider spreads, which can lead to flat price action at times.

- Time zones – This limitation is rather self-explanatory. Your body clock may not look favorably on trading over the weekend. Stock exchanges in the Middle East, for example, operate at less friendly hours if you’re based in the UK or the US. If you don’t want to get up in the middle of the night, you might want to think twice.

- Brokers’ hours – Many brokerage firms take the view that there aren’t enough customers to warrant opening their doors over the weekends. This means you will need to check your broker’s trading times. Pocket Option, Nadex, FXCM, and IG all offer weekend trading platforms.

- Dangers of volatility – Whilst volatility also promises traders plenty of opportunities to turn profits, trading OTC leveraged products also comes with risks. Because normal market participants aren’t active, there are often vast differences between bid and ask prices for stocks. This leads to some traders getting hoodwinked.

Do Weekends Affect Trading Strategies?

Yes, they do. As a result of the big market players spending their profits on the weekend, the markets on Saturday and Sunday can behave in peculiar ways. You will find increased volatility and varying volume.

This all means you need to amend your strategy in line with the new market conditions. Alternatively, you may want a unique weekend trading strategy.

Below, several strategies have been outlined that have been carefully designed for weekend trading.

Weekend trading has also been boosted by those ‘always on’ assets – cryptocurrencies. Brokers have seen that the appetite to trade is growing and add markets all the time, for example, the DOW IG Weekend and other indices.

Closing Gaps – Gap Trading Strategy

The market conditions are ideal for this weekend gap trading forex and options strategy. Gaps are simply pricing jumps. At some point, something shifted the market, leading to a price jump to a higher or lower level, whilst excluding the prices in between.

Firstly, what causes the gaps? Any number of things can be the cause, from new movements to accelerated movements. The one thing they do require, though, is substantial volume. Because the weekend sees the big players out of the game, you will struggle to find these gaps. Instead, you will find closing gaps.

Closing gaps can be created by just a few traders. For whatever reason, a few people invest in the same direction. The market then spikes, and everyone else is left scratching their head. So, what do they do? They think it must be a mistake and trade in the opposite direction, looking to profit from the error.

- Upwards gap – Traders will sell their assets. The markets will then fall, and the gap will close.

- Downwards gap – Traders will buy assets. The market will then rise, and the gap will close.

If you see gaps in low-volume markets, like on the weekends, there is a good chance they will close.

Application

Because you know the gap will close, you have all the information needed to turn a profit. You know:

- The price target – The market is going to move up until the price reaches the level of the first candlestick that makes up the gap. With downwards gaps, it should rise to the low of your previous candlestick. With upwards gaps, it should fall to the high of your initial candlestick.

- The expiry – You know the market should reach the target price within the next period. So, you can trade a high/low option. In addition, you could trade a one-touch option, which could give you a greater payout. Make sure you invest in an option with a price target inside the gap and expiry shorter than one period.

This strategy is straightforward and can be applied to forex and commodities. All you need is your weekend trading charts, and you can get to work. You can even pursue weekend gap trading with Expert Advisors (EA).

Bollinger Bands

This is an interesting approach to add to your weekend arsenal. Bollinger Bands highlight a price channel that the market shouldn’t leave. You will find that on the weekends, this price channel can be fairly accurate. This makes it the ideal foundation for your weekend strategy.

The bands are composed of three lines:

- Upper line – The moving average plus twice the standard deviation. This works as a resistance.

- Lower line – The moving average minus twice the standard deviation. This works as a support.

- Middle line – A 20-period moving average. This can be either support or resistance, depending on whether the market is trading above or below it.

On the whole, you will find the market will turn around when it approaches your Bollinger Band.

Weekend Use

These bands often yield the best results at the weekend. This is because in the week, news events and big traders can start new movements, so the trading range varies more. When the standard variation shifts, so do the upper and lower Bollinger Bands. Strong movements will stretch the bands and carry the boundaries on the trends. This can render predictions useless.

However, the reduced volume on the weekend makes the market more stable. It is unlikely that a substantial number of traders will jump on a movement and disrupt the status quo.

Application

You need to follow just three steps to implement your new weekend trading strategy:

- Build your chart – Decide on an instrument and then set up your price chart with your Bollinger Bands.

- Be patient – Now you can sit back and wait for the market to approach your bands. You need to stay patient until the market gets within one of the three Bollinger Band lines.

- Make your prediction – Now it’s time to enter your position that the market will turn. For example, you could use a high/low option that predicts the market will not breach the Bollinger band.

Because it is straightforward to apply, it’s ideal for both experienced traders and beginners.

Alternatives

If you don’t want to spend your weekend trading Bitcoin or on the stock market, there are other ways you can be productive. The weekend is an opportunity to analyze past performance and prepare for the week ahead.

Below are several worthwhile endeavors to explore on the weekends.

Education

As Paul Tudor Jones aptly highlighted, “The secret to being successful from a trading perspective is to have an indefatigable and an undying and unquenchable thirst for information and knowledge.”

Whilst practice makes perfect, you need to absorb as much information as possible. So, consider spending the weekends pursuing the following:

- Courses – There are numerous online courses that will help you get to grips with intricate strategies, taught by veteran traders. The top brokers also offer excellent education, including courses and tutorials. For our recommendations, see the education page.

- Books – You will find a whole host of books and ebooks that provide invaluable advice and guidance. If you’re looking for some of the most highly regarded, see our books page.

- Podcasts – If you’re busy on the weekend, or on a long drive to the in-laws, why not put a podcast on? You’ll find asset-specific audio casts written and recorded by experts. Just one useful tip could make the difference between a financially flailing strategy and a profitable one. See our podcasts page.

Manual Back-Testing

A popular way to predict how the markets will behave in the future is by looking to the past. You can use those lazy Sunday hours to simulate market environments of the past to test potential strategies.

Whilst it must be said that past performance is no guarantee of future performance, it can be a good indicator. Not to mention, you can work through any issues so your plan is ready to go when you head online at 09:30 am on Monday morning.

Evaluation

When the markets are open, you can often get caught in a whirlwind of emotions and trading activity. The weekends are fantastic for giving you an opportunity to take a step back. You can take a look back and highlight any mistakes.

This will help you implement a more effective trading plan next week. Perhaps you may need to adjust your risk management strategy. Perhaps it is time to try a different breakout strategy this week. So, if you’re not interested in weekend share trading, sit down and identify areas for improvement.

Planning

The weekend also gives you the opportunity to investigate any upcoming events that may impact your market. The DailyFX Economic Calendar, for example, allows you to identify important economic dates, like policy reform. You can then tweak your action plan to take into account upcoming events that are going to influence market conditions.

Final Word

For the switched-on day trader, the weekend is just another opportunity to yield profits. Whilst some of the big traders are out of town, you can find volatility in markets across the globe to capitalize on. Whilst many brokers and exchanges close, there is always some alight with activity.

If you do want to trade over the weekend, remember to amend your strategy in line with the different market conditions. Alternatively, consider one of the weekend-specific strategies above.

If you want a break from the bustle of actual trading, you can still prepare for the week ahead. You can utilize any of the educational resources listed above, or you can start back-testing and strategizing for Monday.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com