Best Brokers With Low Minimum Deposit 2025

Low deposit brokers offer an excellent entry point for beginners, casual traders, or anyone looking to test the financial markets without a hefty cash commitment.

Many trading platforms have lowered their starting deposits in recent years, so you’ve got even more options. Let’s dig into our list of the top brokers with low minimum deposits.

Best Brokers With The Lowest Minimum Deposit

Based on our hands-on tests, these are the 6 best brokers with the lowest minimum deposit requirements:

Why Are These The Best Brokers For Low Deposits?

Here is a quick summary of why we decided these are the top brokers for low entry requirements:

- Interactive Brokers is the best broker with a low minimum deposit in 2025 - Interactive Brokers (IBKR) is a premier brokerage, providing access to 150 markets in 33 countries, along with a suite of comprehensive investment services. With over 40 years of experience, this Nasdaq-listed firm adheres to stringent regulations by the SEC, FCA, CIRO, and SFC, amongst others, and is one of the most trusted brokers for trading around the globe.

- NinjaTrader - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- UnitedPips - Operating since 2016 and based in Saint Lucia, UnitedPips is a non-dealing desk broker serving clients in over 137 countries. It specializes in CFD trading across around 80+ assets with high leverage up to 1:1000.

- OANDA US - OANDA is a popular brand offering exceptional execution, low deposit requirements and advanced charting and trading platform features. The top-rated brand has over 25 years of experience and is regulated by trusted agencies, including the NFA/CFTC. Around the clock support is available for short-term traders, alongside flexible contract sizes and automated trade executions.

- Moomoo - Moomoo is an SEC-regulated app-based investment platform that offers a straightforward and affordable way to invest in Chinese, Hong Kong, Singaporean, Australian and US stocks, ETFs and other assets. Margin trading is available and the brand offers a zero-deposit account as well as several bonuses.

- Capitalcore - Capitalcore is an offshore broker, based in Saint Vincent and the Grenadines and established in 2019. Traders can choose from four accounts (Classic, Silver, Gold, VIP) with lower spreads and larger bonuses as you move through the tiers. Where Capitalcore distinguishes itself is its high leverage up to 1:2000 and zero swap fees, though these don’t compensate for the weak oversight from the IFSA and paltry education and research.

Comparison Of Top Low Deposit Brokers

Find the right low starting deposit broker for you with our comparison of core features:

| Broker | Minimum Deposit | Minimum Trade | Deposit Methods |

|---|---|---|---|

| Interactive Brokers | $0 | $100 | ACH Transfer, Automated Customer Account Transfer Service, Cheque, Debit Card, TransferWise, Wire Transfer |

| NinjaTrader | $0 | 0.01 Lots | ACH Transfer, Cheque, Debit Card, Wire Transfer |

| UnitedPips | $10 | 0.01 Lots | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, PayPal, Perfect Money |

| OANDA US | $0 | 0.01 Lots | ACH Transfer, Debit Card, Mastercard, Visa, Wire Transfer |

| Moomoo | $0 | $0 | ACH Transfer, Wire Transfer |

| Capitalcore | $10 | 0.01 Lots | Bitcoin Payments, Credit Card, Debit Card, Ethereum Payments, Mastercard, PayPal, Perfect Money, Visa |

How Safe Are These Low Entry Brokers?

How reliable are the top brokers with minimal deposit requirements and how do they help safeguard your balance

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| Interactive Brokers | ✘ | ✔ | ✔ | |

| NinjaTrader | ✘ | ✘ | ✘ | |

| UnitedPips | ✘ | ✔ | ✔ | |

| OANDA US | ✔ | ✘ | ✘ | |

| Moomoo | ✘ | ✘ | ✔ | |

| Capitalcore | ✘ | ✔ | ✔ |

Brokers With A Budget-Friendly Entry Point Mobile Comparison

Are these brokers with a small starting deposit good for trading on mobile?

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| Interactive Brokers | iOS & Android | ✔ | ||

| NinjaTrader | iOS & Android | ✘ | ||

| UnitedPips | Web Access Only | ✘ | ||

| OANDA US | iOS & Android | ✘ | ||

| Moomoo | Yes (iOS & Android) | ✘ | ||

| Capitalcore | Android, Webtrader | ✘ |

Are The Top Brokers With A Budget-Friendly Entry Point Brokers Good For Beginners?

Beginners should use low deposit brokers that support trading with virtual money and provide support to help new traders get going.

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| Interactive Brokers | ✔ | $0 | $100 | ||

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| UnitedPips | ✔ | $10 | 0.01 Lots | ||

| OANDA US | ✔ | $0 | 0.01 Lots | ||

| Moomoo | ✔ | $0 | $0 | ||

| Capitalcore | ✔ | $10 | 0.01 Lots |

Compare Advanced Trader Features

Are these low deposit trading platforms good for advanced traders?

| Broker | Automated Trading | VPS | AI | Pro Account | Leverage | Low Latency | Extended Hours |

|---|---|---|---|---|---|---|---|

| Interactive Brokers | Capitalise.ai & TWS API | ✘ | ✔ | ✘ | 1:50 | ✔ | ✔ |

| NinjaTrader | NinjaScript or via Automated Trading Interface | ✘ | ✘ | ✘ | 1:50 | ✔ | ✘ |

| UnitedPips | - | ✘ | ✘ | ✘ | 1:1000 | ✘ | ✘ |

| OANDA US | Expert Advisors (EAs) on MetaTrader | ✘ | ✔ | ✘ | 1:50 | ✔ | ✘ |

| Moomoo | - | ✘ | ✘ | ✘ | 1:2 | ✘ | ✔ |

| Capitalcore | - | ✔ | ✘ | ✘ | 1:2000 | ✘ | ✘ |

Compare The Ratings Of The Top Brokers With A Low Funding Threshold

Uncover how the top low-entry brokers stack up in key areas following our in-depth evaluations.

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| Interactive Brokers | |||||||||

| NinjaTrader | |||||||||

| UnitedPips | |||||||||

| OANDA US | |||||||||

| Moomoo | |||||||||

| Capitalcore |

How Popular Are These Low Starting Deposit Brokers?

Many traders looking to make a small initial investment prefer popular brokers (with large client bases):

| Broker | Popularity |

|---|---|

| Moomoo | |

| Interactive Brokers | |

| NinjaTrader | |

| UnitedPips |

Why Start Trading With Interactive Brokers’s Small Deposit Requirement?

"Interactive Brokers is one of the best brokers for advanced day traders, providing powerful charting platforms, real-time data, and customizable layouts, notably through the new IBKR Desktop application. Its superb pricing and advanced order options also make it highly attractive for day traders, while its diverse range of equities is still among the best in the industry."

Christian Harris, Reviewer

Interactive Brokers Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Stocks, Options, Futures, Forex, Funds, Bonds, ETFs, Mutual Funds, CFDs, Cryptocurrencies |

| Regulator | FCA, SEC, FINRA, CFTC, CBI, CIRO, SFC, MAS, MNB, FINMA, AFM |

| Platforms | Trader Workstation (TWS), IBKR Desktop, GlobalTrader, Mobile, Client Portal, AlgoTrader, OmniTrader, TradingView, eSignal, TradingCentral, ProRealTime, Quantower |

| Minimum Deposit | $0 |

| Minimum Trade | $100 |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, INR, JPY, SEK, NOK, DKK, CHF, AED, HUF |

Pros

- With low commissions, tight spreads and a transparent fee structure, IBKR delivers a cost-effective environment for short-term traders.

- IBKR is one of the most respected and trusted brokerages and is regulated by top-tier authorities, so you can have confidence in the integrity and security of your trading account.

- The TWS platform has clearly been built for intermediate and advanced traders and comes with over 100 order types and a reliable real-time market data feed that rarely goes offline.

Cons

- Support can be slow and frustrating based on tests, so you might find it challenging to reach customer service representatives promptly or encounter delays in resolving issues.

- TWS’s learning curve is steep, and beginners may find it challenging to navigate the platform and understand all the features. Plus500's web platform is much better suited to new traders.

- IBKR provides a wide range of research tools, but their distribution across trading platforms and the web-based 'Account Management' page lacks consistency, leading to a confusing user experience.

Why Start Trading With NinjaTrader’s Small Deposit Requirement?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Stocks, Options, Commodities, Futures, Crypto |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- NinjaTrader is a widely respected and award-winning futures broker and is heavily authorized by the NFA and CFTC

- You can get thousands of add-ons and applications from developers in 150+ countries

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

Cons

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

- There is a withdrawal fee on some funding methods

Why Start Trading With UnitedPips’s Small Deposit Requirement?

"UnitedPips is ideal for traders seeking leveraged trading opportunities, the security of fixed spreads, and the flexibility to deposit, withdraw, and trade cryptocurrencies - all in one sleek TradingView-powered platform."

Christian Harris, Reviewer

UnitedPips Quick Facts

| Bonus Offer | 40% Deposit Bonus |

|---|---|

| Demo Account | Yes |

| Instruments | CFDs, Forex, Precious Metals, Crypto |

| Regulator | IFSA |

| Platforms | UniTrader |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD |

Pros

- Although being handed off mid-chat due to shift changes during testing was frustrating, customer support is generally good with quick, helpful responses, and 24/7 support via phone and email for regional teams is a definite advantage.

- UnitedPips’ platform performs well, with an intuitive design that will appeal to beginners, while the TradingView integration delivers powerful charting tools without overwhelming users, making it straightforward to execute trades efficiently.

- UnitedPips offers impressive leverage up to 1:1000 with zero swap fees or commissions, which can enhance potential returns for day traders and swing traders looking to control prominent positions with less capital.

Cons

- UnitedPips lacks comprehensive research, while the educational content for beginner traders is woeful. Compared to brokers like eToro, which offers tutorials, webinars, and advanced courses, UnitedPips offers minimal resources to help new traders understand key concepts.

- UnitedPips' selection of tradable instruments is still minimal, comprising a bare minimum selection of forex, metals and crypto. There are no equities, indices or ETFs, which may be a drawback for experienced traders looking for diverse opportunities.

- Unlike brokers such as IG, UnitedPips is an offshore broker not regulated by any 'green tier' financial authorities, raising concerns for traders seeking assurance and protection under well-established regulatory frameworks.

Why Start Trading With OANDA US’s Small Deposit Requirement?

"OANDA remains an excellent broker for US day traders seeking a user-friendly platform with premium analysis tools and a straightforward joining process. OANDA is also heavily regulated with a very high trust score."

Jemma Grist, Reviewer

OANDA US Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Forex, Crypto with Paxos (Cryptocurrencies are offered through Paxos. Paxos is a separate legal entity from OANDA) |

| Regulator | NFA, CFTC |

| Platforms | OANDA Trade, MT4, TradingView, AutoChartist |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD, EUR, GBP, CAD, AUD, JPY, CHF, HKD, SGD |

Pros

- Beginners can get started easily with $0 minimum initial deposit

- Day traders can enjoy fast and reliable order execution

- Seasoned day traders can access industry-leading tools, including an MT4 premium upgrade and advanced charting provided by MotiveWave

Cons

- It's a shame that customer support is not available on weekends

- There's only a small range of payment methods available, with no e-wallets supported

- The range of day trading markets is limited to forex and cryptos only

Why Start Trading With Moomoo’s Small Deposit Requirement?

"Moomoo remains an excellent choice for new and intermediate stock traders who want to build a diverse investment portfolio. What really stands out is the broker's user-friendly app and the low trading fees."

Jemma Grist, Reviewer

Moomoo Quick Facts

| Bonus Offer | Get up to 15 free stocks worth up to $2000 |

|---|---|

| Demo Account | Yes |

| Instruments | Stocks, Options, ETFs, ADRs, OTCs |

| Regulator | SEC, FINRA, MAS, ASIC, SFC |

| Platforms | Desktop Platform, Mobile App |

| Minimum Deposit | $0 |

| Minimum Trade | $0 |

| Leverage | 1:2 |

| Account Currencies | USD, HKD, SGD |

Pros

- The broker offers access to extended pre-market trading hours

- There is no minimum deposit requirement making the broker accessible for beginners

- Moomoo is a Member of FINRA and the Securities Investor Protection Corporation (SIPC), adding another level of security for prospective clients

Cons

- It's a shame that there is no 2 factor authentication (2FA), despite the other security features on offer

- There is no phone or live chat support - common options at most other brokers

- There is no negative balance protection, which is a common safety feature at top-tier-regulated brokers

Why Start Trading With Capitalcore’s Small Deposit Requirement?

"The major selling points of Capitalcore are its high leverage options up to 1:2000 and zero commission or swap fees. However, its weak regulatory oversight from the IFSA and non-existent education place it far behind the top brokers."

Christian Harris, Reviewer

Capitalcore Quick Facts

| Bonus Offer | 40% Deposit Bonus up to $2,500 |

|---|---|

| Demo Account | Yes |

| Instruments | Forex, Metals, Stocks, Cryptos, Futures Indices, Binary Options |

| Regulator | IFSA |

| Platforms | WebTrader, Pro |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD |

Pros

- Capitalcore has added binary options trading on 30+ currency pairs, metals and crypto with one-click trading and payouts up to 95%.

- The Capitalcore platform provides comprehensive charting tools and a wide range of 150+ technical indicators, ideal for detailed market analysis.

- While a relative newcomer to binary options space, its transparent, accessible service earned it runner up in DayTrading.com's 2025 'Best Binary Broker' award.

Cons

- Capitalcore’s threadbare education and research seriously trail category leaders like IG, making it less suitable for aspiring traders.

- Capitalcore is not regulated by major financial authorities and has an unproven reputation, raising concerns about the safety of client funds.

- The web platform was inconsistent during testing, with occasional technical glitches that meant the trading platform wouldn’t load.

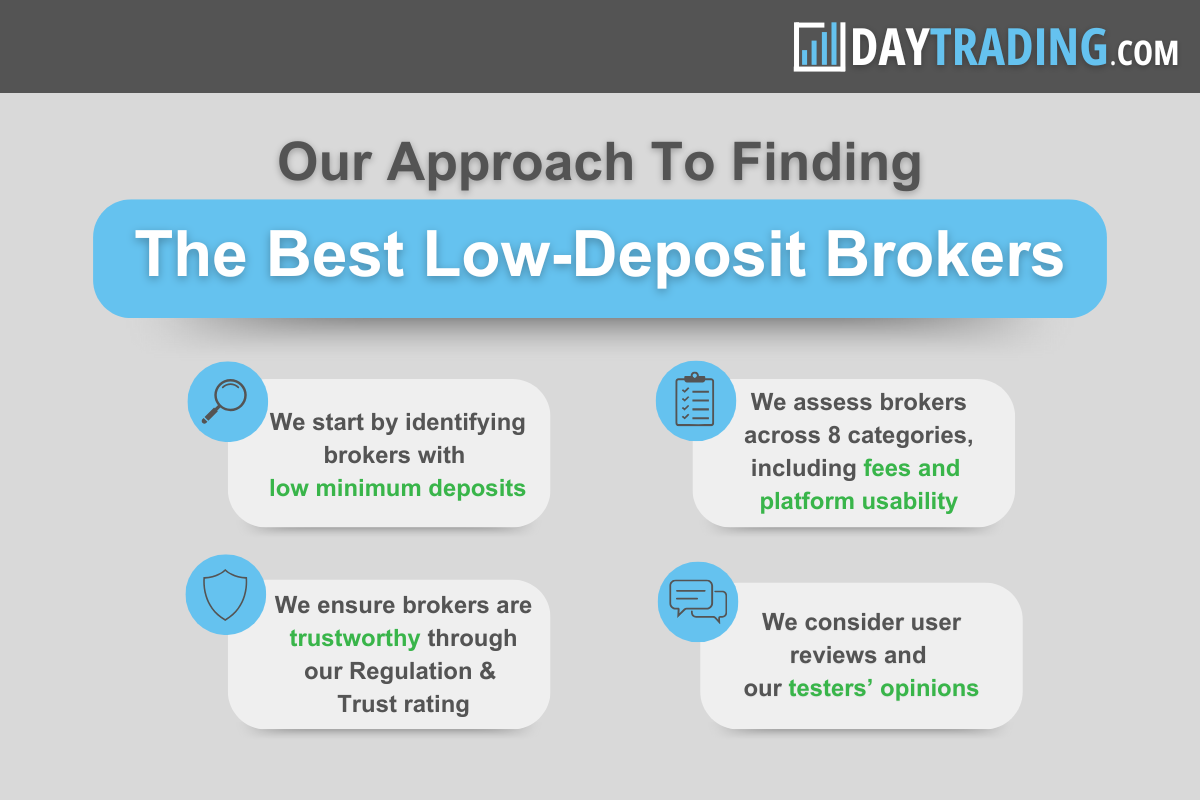

Methodology

To rank the best low deposit brokers, we:

- Recorded the minimum deposit for 227 brokers as of October 2025;

- Overlayed our overall ratings following exhaustive tests and analysis conducted by our experts;

- Listed the very best brokers that combine low starting deposits with a terrific all-round trading environment.

What To Look For In A Low Deposit Broker

Not all low-deposit brokers are created equal. Here are five key things to prioritize:

- Low Deposit And Affordable Accounts: Look for brokers offering micro or cent accounts where you can trade with smaller amounts. Vantage scooped our best cent account broker and requires just $50.

- Competitive Trading Conditions: Ensure the broker offers tight spreads, low commissions, and reasonable swap rates to keep costs manageable (you can avoid overnight fees by day trading). Fusion Markets is the cheapest low-cost broker we’ve tested.

- Regulatory Compliance: Choose brokers regulated by trusted ‘green tier’ bodies in DayTrading.com’s Regulation & Trust Rating like the SEC (US), FCA (UK), ASIC (Australia), and CySEC (Cyprus). IG is the safest low deposit broker based on our tests.

- User-Friendly Platforms: Platforms like MetaTrader 5 or even simple proprietary apps are great for beginners. XTB’s xStation is our favorite low-deposit trading platform for novice traders.

- Leverage Options: Low-deposit brokers often offer high leverage. While leverage can amplify gains, it also increases risk, so choose wisely. GoFX offers the highest leverage we’ve seen at up to 1:3000 and requires just a $1 starting investment.

Drawing on my years of real money trading, below are my top tips for getting the most out of a low deposit broker.

- Start Small And Scale Up: Treat your initial deposit as a learning tool. Once confident, add more funds.

- Use A Demo Account: Test strategies and get comfortable with the platform before committing real money.

- Avoid Overtrading: Stick to a trading plan; don’t let emotions drive your decisions.

- Trade During Liquid Hours: Trade when markets are most active for tighter spreads and better execution.

- Choose A Broker With No Hidden Fees: Verify that the broker doesn’t charge excessive deposits, withdrawals, or inactivity fees.

What Is A Low Deposit Broker?

Low-deposit brokers are trading platforms that allow you to open an account with minimal initial investment.

We generally consider a deposit of $50 or less ‘low’, but sometimes we find trading platforms requiring just $1, or even $0.

Minimum deposits have really come down in recent years as brokers aim to make themselves more accessible to retail traders.

For example, FXCM slashed its starting deposit from $300 to $50 in 2019, Fusion Markets cut theirs from $100 to $0 in 2021, while Axi reduced theirs from $200 to $0 in 2023.

Pros

- Accessibility: Anyone can start, regardless of their situation, making it easier for new traders to participate.

- Risk Management: Small deposits minimize potential losses, making them ideal for cautious traders.

- Flexible Learning: Low deposit accounts allow you to trade in real market conditions while building skills.

- Test Strategies: They allow experimentation of strategies like day trading without risking large amounts.

- Ideal For Beginners: Perfect for learning the basics of trading without a significant upfront commitment.

Cons

- Over-Leveraging: Low deposits often tempt traders to use high leverage, which can magnify losses.

- Limited Features: Some brokers restrict advanced tools or assets for low-deposit accounts.

- Emotions: Small balances can lead to overtrading to grow accounts quickly, often resulting in losses.

- Scams: Some brokers may lower capital requirements to reel traders in.

- Hidden fees: Platforms may reduce cash requirements and then charge extra for other services, such as inactivity, conversions if your account currency differs from the traded asset, and for using advanced tools.

FAQ

Which Is The Best Low Deposit Trading Account?

The best low deposit trading account will depend on your individual needs. However, our pick of the best brokers with low minimum deposits is a great place to start, with options for active traders at every level.

Why Do Brokers Require A Minimum Deposit?

Online brokers require an initial payment to cover the costs of creating an account and to ensure traders have enough capital to open positions in their chosen market.

Minimum deposits can vary from several thousands of dollars, particularly if you open a premium or VIP account, to just $1 for entry-level solutions.

Can I Day Trade With $1?

Yes, some regulated forex and CFD trading platforms offer minimum deposits as low as $1. See our list of leading low deposit brokers for suggestions and reviews.