Best Trading Signal Providers In 2026

Available from a range of brokers and third-party providers, trading signals are an increasingly popular tool, providing a prompt to buy or sell a particular asset.

Explore the best signal providers following our hands-on tests. We also explain how to choose signals and how you can incorporate them into your trading strategy to improve your understanding.

Best Brokers For Trading Signals 2026

These 6 brokers with signals achieved the highest overall ratings following our latest in-depth reviews. They offer a large pool of signals with clear performance metrics, making them stand-out options:

Why Are These The Best Providers For Trading Signals?

Here’s a concise summary of why we believe these brokers are best for trading signals:

- NinjaTrader is the best signal provider in 2026 - NinjaTrader is a US-headquartered and regulated brokerage that specializes in futures trading. There are three pricing plans to suit different needs and budgets, as well as ultra-low margins on popular contracts. The brand's award-winning charting software and trading platform also offers a high-degree of customization and superb technical analysis features.

- xChief - During testing, xChief's MetaQuotes Signals access stood out, letting traders automatically copy top performers or offer their own signals. PAMM accounts allow following experienced traders, while MQL4/5 support enables custom indicators and EAs. The platform’s signals are flexible, practical, and suited for both automated and hands-on strategies.

- Optimus Futures - Optimus Futures delivers strong signal and alert capabilities, with 50+ built-in indicators, volume and TPO analysis, plus TradingView alert integration and SignalStack for automated trade execution.

- RoboForex - In our tests, RoboForex impressed with its mix of in-house and third-party signals, especially via CopyFX. Execution was quick, and the trade ideas weren’t just recycled patterns - they adapted well to market shifts. We found the diversity of strategies particularly valuable for traders wanting flexible, hands-on signal options.

- XM - When we tried XM’s trading signals, the appeal was their clarity and consistency across multiple timeframes. Delivered through MT4/MT5, the signals felt practical rather than generic, with solid risk levels attached. We noticed stronger reliability on major FX pairs, making them genuinely useful for active traders needing structure.

- AvaTrade - During our tests, Vantage’s signal tools stood out for their integration with MT4/MT5, offering clear, real-time trade ideas that actually aligned with market conditions. The signals were actionable, reliable, and a strong aid for short-term strategy execution.

How Safe Are These Trading Signal Providers?

Discover the reliability of the top real-time trading signal providers and how they safeguard your funds:

| Broker | Trust Rating | Guaranteed Stop Loss | Negative Balance Protection | Segregated Accounts |

|---|---|---|---|---|

| NinjaTrader | ✘ | ✘ | ✘ | |

| xChief | ✘ | ✘ | ✔ | |

| Optimus Futures | ✘ | ✘ | ✔ | |

| RoboForex | ✘ | ✔ | ✔ | |

| XM | ✘ | ✔ | ✔ | |

| AvaTrade | ✘ | ✔ | ✔ |

Compare Mobile Trading Signals

See how these brokers measure up for mobile trading signals:

| Broker | Mobile Apps | iOS Rating | Android Rating | Smart Watch App |

|---|---|---|---|---|

| NinjaTrader | iOS & Android | ✘ | ||

| xChief | iOS & Android | ✘ | ||

| Optimus Futures | iOS & Android | ✘ | ||

| RoboForex | iOS & Android, R StocksTrader | ✘ | ||

| XM | iOS, Android & Windows | ✘ | ||

| AvaTrade | iOS & Android | ✘ |

Are The Top Automated Trade Signal Providers Good For Beginners?

Beginners should use trading signals alongside other key tools for new traders:

| Broker | Demo Account | Minimum Deposit | Minimum Trade | Education Rating | Support Rating |

|---|---|---|---|---|---|

| NinjaTrader | ✔ | $0 | 0.01 Lots | ||

| xChief | ✔ | $10 | 0.01 Lots | ||

| Optimus Futures | ✔ | $500 | $50 | ||

| RoboForex | ✔ | $10 | 0.01 Lots | ||

| XM | ✔ | $5 | 0.01 Lots | ||

| AvaTrade | ✔ | $100 | 0.01 Lots |

Compare The Ratings Of Top Signal Trading Brokers

Discover how the leading brokers for trading signals rate across key areas after our in-depth evaluations:

| Broker | Trust | Platforms | Assets | Mobile | Fees | Accounts | Research | Education | Support |

|---|---|---|---|---|---|---|---|---|---|

| NinjaTrader | |||||||||

| xChief | |||||||||

| Optimus Futures | |||||||||

| RoboForex | |||||||||

| XM | |||||||||

| AvaTrade |

Compare Trading Fees

Trading costs, including mark-ups on signals, can add up fast - here is how the top providers compare:

| Broker | Cost Rating | Fixed Spreads | Inactivity Fee |

|---|---|---|---|

| NinjaTrader | ✘ | $25 | |

| xChief | ✘ | - | |

| Optimus Futures | ✘ | $0 | |

| RoboForex | ✘ | $0 | |

| XM | ✘ | $5 | |

| AvaTrade | ✔ | $50 |

How Popular Are These Brokers With Trading Signals?

Many traders favor signal brokers with the highest number of registered clients:

| Broker | Popularity |

|---|---|

| XM | |

| NinjaTrader | |

| xChief | |

| RoboForex | |

| AvaTrade |

Why Use Trading Signals From NinjaTrader?

"NinjaTrader continues to meet the demands of active futures traders looking for low fees and premium analysis tools. The platform hosts top-rate charting features including hundreds of indicators and 10+ chart types."

Tobias Robinson, Reviewer

NinjaTrader Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures, Forex, Stocks, Options, Commodities, Futures, Crypto (non-futures depend on provider) |

| Regulator | NFA, CFTC |

| Platforms | NinjaTrader Desktop, Web & Mobile, eSignal |

| Minimum Deposit | $0 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:50 |

| Account Currencies | USD |

Pros

- Traders can get free platform access and trade simulation capabilities in the unlimited demo

- NinjaTrader continues to deliver comprehensive charting software for active day traders with bespoke technical indicators and widgets

- Low fees are offered, with $50 day trading margins & commissions from $.09 per micro contract

Cons

- There is a withdrawal fee on some funding methods

- Non forex and futures trading requires signing up with partner brokers

- The premium platform tools come with an extra charge

Why Use Trading Signals From xChief?

"xChief continues to prove popular with investors looking to trade highly leveraged CFDs on the popular MetaTrader platforms. The broker's rebate scheme and investment accounts will particularly appeal to seasoned traders. However, the lack of top-tier regulatory oversight is a major drawback."

William Berg, Reviewer

xChief Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Metals, Commodities, Stocks, Indices |

| Regulator | ASIC |

| Platforms | MT4, MT5 |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY, CHF |

Pros

- Traders can access a copy trading solution via the MetaQuotes Signals service

- xChief offers STP/ECN execution with low spreads from 0.0 pips and low commission rates starting from $2.50 per side

- The broker offers a turnover rebate scheme geared towards active investors, as well as trading credits and several other occasional bonuses

Cons

- The Classic+ and Cent accounts provide access to fewer instruments than the other account types, at 50+ and 35+, respectively

- xChief is an offshore broker with weak regulatory oversight from the VFSC, so traders will receive limited safeguards

- The total range of 150+ assets is much lower than most competitors who typically offer hundreds

Why Use Trading Signals From Optimus Futures?

"Optimus Futures is best for active futures day traders who want low per-contract costs and the flexibility to build a custom trading setup across platforms like Optimus Flow, TradingView, and Sierra Chart. Its fast order-routing, low day trading margins, depth-of-market and footprint analysis tools, plus the ability to select your own clearing firm, make it especially suited to high-volume traders focused on U.S. and global futures markets."

Christian Harris, Reviewer

Optimus Futures Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | Futures on Indices, Metals, Energies, Softs, Bonds, Cryptos, Options on Futures, Event Contracts |

| Regulator | NFA, CFTC |

| Platforms | Optimus Flow, Optimus Web, MT5, TradingView |

| Minimum Deposit | $500 |

| Minimum Trade | $50 |

| Account Currencies | USD |

Pros

- Futures commission rates are competitive, and there’s transparent access to trading on major exchanges, while the firm's fee calculator makes it a breeze to estimate trading costs before placing orders, helping to avoid surprises.

- The brokerage provides the flexibility to choose your clearing firm, including Iron Beam, Phillip Capital, and StoneX, allowing for direct control over where your funds are held and the associated transaction costs - helpful for customizing the futures trading setup.

- Optimus Futures has expanded its suite of software, with a variety of futures trading platforms, including its own Optimus Flow, CQG, MetaTrader 5, and TradingView, making it easy to find the right fit for charting, order management, and execution.

Cons

- Live chat support is handled entirely by a bot, so despite several attempts in our tests, it wasn't possible to get access to a human agent, which can be frustrating when urgent or complex questions arise.

- There are limited payment options and no toll-free numbers for international support, while withdrawals cost $20 to $60, potentially making frequent withdrawals costly for active traders.

- There's no true 'all-in-one' account management dashboard - key functions like risk settings, software downloads, and subscriptions are split across different sections or platforms, so it required extra digging to set everything up during testing.

Why Use Trading Signals From RoboForex?

"RoboForex is great if you want a vast range of 12,000+ day trading markets with ECN accounts, powerful charting and loyalty promotions. It also stands out for stock traders with its user-friendly R StocksTrader platform, featuring 3,000+ shares, fees from $0.01 and sophisticated watchlists."

Christian Harris, Reviewer

RoboForex Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Futures |

| Regulator | IFSC |

| Platforms | R StocksTrader, MT4, MT5, TradingView |

| Minimum Deposit | $10 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:2000 |

| Account Currencies | USD, EUR |

Pros

- The broker offers two commission-free withdrawals each month in the Free Funds Withdrawal program, helping day traders to minimize transaction costs.

- RoboForex is known for its tight spreads starting from 0 pips and low minimum deposits from $10, making it accessible to those on a budget. The ability to trade with micro lots further lowers the barrier to entry for new traders.

- The R Stocks Trader platform rivals leading solutions like MT4, with netting and hedging capabilities, comprehensive backtesting, Level II pricing, and a flexible workspace.

Cons

- RoboForex provides a variety of account types, which, while offering flexibility, can be overwhelming for newer traders trying to choose the most suitable option for their trading style. Alternatives, notably eToro, provide a smoother entry into online trading with one retail account.

- While RoboForex offers competitive spreads, some of its account types come with high trading commissions up to $20 per lot, trailing the cheapest brokers, such as IC Markets.

- Despite 15+ years in the industry and registering with the Financial Commission, RoboForex is authorized by one ‘Red-Tier’ regulator – the IFSC in Belize, lowering the level of regulatory protections for traders.

Why Use Trading Signals From XM?

"With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years."

Christian Harris, Reviewer

XM Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Commodities, Indices, Thematic Indices, Precious Metals, Energies |

| Regulator | CySEC, DFSA, SCA, FSCA, FSA, FSC Belize, FSC Mauritius, CMA |

| Platforms | MT4, MT5, TradingCentral |

| Minimum Deposit | $5 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:1000 |

| Account Currencies | USD, EUR, GBP, JPY |

Pros

- XM has rolled out platform upgrades with integrated TradingView charts and an XM AI assistant, delivering faster execution, smarter analysis, and a sleeker, more intuitive trading experience.

- XM’s growing roster of 1,000+ instruments provides diverse short-term trading opportunities, with unique turbo stocks, fractional shares, and more recently thematic indices.

- XM secured a category 5 license from the Securities and Commodities Authority (SCA) of the United Arab Emirates in late 2025, strengthening its regulatory credentials and making it a strong option for traders in the Middle East.

Cons

- XM relies solely on the MetaTrader platforms for desktop trading, so there’s no in-house downloadable or web-accessible solution for a more beginner-friendly user experience with unique features.

- While the XM app stands out for its usability and exclusive copy trading products, the selection of technical analysis tools needs to be improved to meet the needs of advanced traders.

- XM is falling behind the curve by not offering cTrader and TradingView which are increasingly being favored over MetaTrader for their smoother user experience and superior charting packages.

Why Use Trading Signals From AvaTrade?

"AvaTrade offers active traders everything they need: an intuitive WebTrader, powerful AvaProtect risk management, a smooth 5-minute sign-up process, and dependable support you can rely on in fast-moving markets."

Jemma Grist, Reviewer

AvaTrade Quick Facts

| Demo Account | Yes |

|---|---|

| Instruments | CFDs, Forex, Stocks, Indices, Commodities, ETFs, Bonds, Crypto, Spread Betting, Futures |

| Regulator | ASIC, CySEC, FSCA, ISA, CBI, JFSA, FSRA, BVI, ADGM, CIRO, AFM |

| Platforms | WebTrader, AvaTradeGO, AvaOptions, AvaFutures, MT4, MT5, AlgoTrader, TradingView, TradingCentral, DupliTrade |

| Minimum Deposit | $100 |

| Minimum Trade | 0.01 Lots |

| Leverage | 1:30 (Retail) 1:400 (Pro) |

| Account Currencies | USD, EUR, GBP, CAD, AUD |

Pros

- AvaTrade launched AvaFutures to offer low-margin access to global markets, then expanded in 2025 as one of the first brokers to add CME’s Micro Grain Futures, and then later in the year went further by integrating with TradingView.

- The WebTrader excelled in our hands-on tests, sporting a user-friendly interface for beginners, complete with robust charting tools like 6 chart layouts and 60+ technical indicators.

- Years on, AvaTrade remains one of the few brokers offering a bespoke risk management tool, AvaProtect, that insures losses up to $1M for a fee and is easy to activate on the platform.

Cons

- While signing up is a breeze, AvaTrade lacks an ECN account like Pepperstone or IC Markets, which provides the raw spreads and ultra-fast execution many day traders are looking for.

- AvaTrade’s WebTrader has improved, but work is still needed in terms of customizability – frustratingly widgets like market watch and watchlists can’t be hidden, moved, or resized.

- Although the deposit process itself is smooth, AvaTrade still doesn’t facilitate crypto payments, a feature increasingly offered by brokers like TopFX, which caters to crypto-focused traders.

Alternatively, for traders who want signals that can be used with any broker, these 3 independent providers really impressed our experts out of the 10+ firms we’ve put through their paces:

Best Independent Signal Providers

How To Choose A Signal Provider

Choosing a signal provider can be challenging, especially with the level of misinformation out there. That’s why we, and you, should consider the following factors when selecting a provider:

Safety

Prioritize the safety and reliability of signal providers as you would when choosing an online broker.

We’ve found that not all signal providers have the same expertise, and many firms lack regulation from trusted bodies like the UK Financial Conduct Authority (FCA) or Australian Securities & Investments Commission (ASIC), making it challenging to identify trustworthy companies.

The rationale behind the limited regulation of signal providers stems from their lack of access to customer portfolios. Often operating anonymously, these services do not establish a conventional customer/provider relationship, exempting them from being classified as financial services providers similar to brokerages.

Still, the absence of regulatory oversight increases the risk of falling victim to scams, with instances of commission scammers targeting investors being reported.

For example, several thousand young traders subscribed to a WhatsApp group for regular messages with updates on assets and trading opportunities, many of whom lost considerable sums.

- FXTM is a trusted broker that provides access to Signal Centre, which stands out as a regulated signalling platform under the UK’s FCA.

Performance

Evaluate signal providers based on their historical performance.

The top providers publish reports highlighting signals’ success over a period. Consider elements such as how many signals were published, which assets the provider has distributed the maximum number of accurate prompts, and how profitable these ideas have been.

Importantly, we recommend reviewing historical performance over a longer period, for example a year, as unexpected price volatility may blur an outlook.

Be careful, though, as some providers may doctor their results to try and entice new customers. See if reviews match up to the claims made by the firm to be safe.

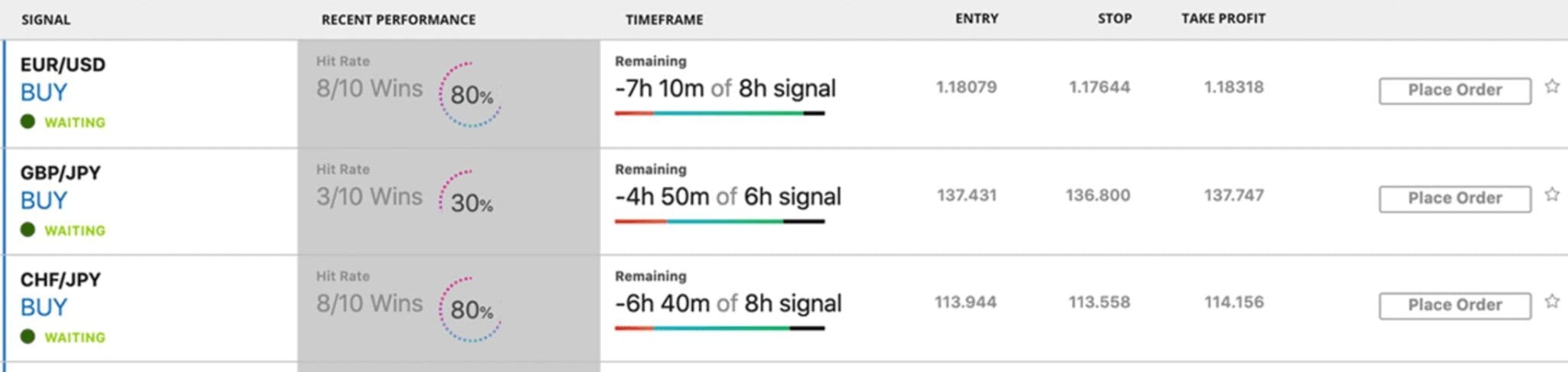

- FOREX.com excels with its user-friendly dashboard that shows the performance of signals with a hit rate out of 10.

Cost

While the most affordable trading signals might be appealing, you must recognize that cost often correlates with quality.

We’ve observed that free signals, while not always the case, frequently originate from untrustworthy sources with hidden agendas.

Many signal providers opt for a monthly subscription fee rather than a one-time (lifetime) usage charge. These fees can range from $10 per month to exceeding $500. Some brokers, however, may cover these costs for retail traders.

We recommend checking the forecasted (or historical) performance of a provider and apply it to your account capital to see how much you will be able to afford and whether a more expensive service will be worth it.

- IG is a broker I personally use and it offers complimentary trading signals on forex, index and commodity markets to registered clients. There is no extra cost to act on signals.

Markets

Choose signals based on your preferred market, trading session, or even diversify across multiple markets to align with your trading strategies and risk preferences.

Signals can offer insights into potential trading opportunities in individual stocks, forex, cryptocurrencies like Bitcoin and Ethereum, commodities such as gold and oil, and derivatives like CFDs.

- City Index offers a top-rate solution called SMART Signals, which scans 36 global markets across hundreds of thousands of data points to find daily trading opportunities.

Alerts

Select a provider that distributes trading signals through a convenient contact method, such as SMS.

If you are happy receiving signals through whatever means, then this may not be a massive issue. However, some traders may not want to provide their email address or mobile number to a signals provider, instead preferring another contact method.

If you are looking for maximum ease of use or automated execution, filter through trading signals providers by requiring that they integrate with your trading platform. This can be done directly or through an API offered by the firm, though this may require a little extra work on your end to set it up.

5 Tips For Choosing Signals

Once you have chosen a broker with trading signals or an independent platform, consider our 5 top tips when choosing individual signals:

- Look for signals with a proven history of account growth, as this could greatly impact the success of your trades.

- Gain a comprehensive understanding of the methodology behind the signals to ensure they align with your trading goals and risk tolerance.

- Evaluate how the signals manage risk by considering the risk-reward ratio, stop-loss mechanisms, and overall risk management strategies embedded within the signals to safeguard your capital.

- Determine if the signals provide real-time analysis, as signals that offer current and relevant information will be more valuable for making informed decisions.

- Assess whether the signals can be customized to suit your trading preferences and if they’re compatible with your chosen trading platform.

What Are Trading Signals?

Trading signals are indications or alerts generated by either human analysts or automated systems (using algorithms or AI) that suggest potential entry or exit points for trading financial assets.

Signals provide quick insights into potential market opportunities, allowing you to act promptly on identified signals without spending extensive hours studying charts and market data.

Signals are usually based on technical analysis, fundamental analysis, or a combination of both, aiming to guide you in making informed decisions.

They can be derived from various sources, such as price patterns, moving averages, volume trends, market sentiment, economic indicators, or specific mathematical algorithms.

Trading signals aim to identify opportunities where the probability of a successful trade is deemed higher based on historical patterns or current market conditions.

These signals typically specify:

- Asset & Timeframe: The asset (stocks, forex, cryptocurrencies, etc.) and timeframe (daily, hourly, etc.) the signal applies to.

- Entry Points: Suggested levels or conditions at which to enter a trade (buy or sell).

- Exit Points: Indications of when to close a trade to secure profits or limit potential losses (take-profit or stop-loss levels).

How Do Trading Signals Work?

Here’s a breakdown of how trading signals typically function:

- Data Collection & Analysis: Signal providers gather and analyze market data from various sources. This includes price movements, volume trends, chart patterns, moving averages, support and resistance levels, and possibly news or fundamental indicators related to specific assets or markets.

- Signal Generation: Based on the analysis, predefined criteria, or algorithms, the system generates signals. These criteria could involve specific technical indicators crossing certain thresholds, trend confirmations, or patterns emerging on charts (e.g., head and shoulders patterns, moving average crossovers).

- Delivery: Signals are then distributed to signal subscribers through various means. This could be via email, SMS, mobile apps, or within trading platforms. Some signal providers offer real-time updates, while others might offer periodic updates based on market conditions or preset time intervals.

- Interpretation: When receiving these signals you should evaluate them alongside your own strategies, risk tolerance, and market understanding. You should assess the credibility and relevance of the signals before deciding whether to act upon them.

- Execution Of Trades: Based on the received signals and your own assessment, you can execute trades or not. Signals often specify entry points (buy/sell), exit points (take-profit, stop-loss), and sometimes even recommended position sizes.

- Continuous Monitoring & Adjustment: You should monitor the market and adjust your positions based on how the market evolves. This includes managing trades by adjusting stop-loss levels, taking profits, or exiting positions if market conditions change.

It’s important to note that while trading signals can be valuable tools, they’re not foolproof. Market conditions can change quickly, leading to unexpected results.

Treat signals as a supplementary tool rather than an absolute directive.

Bottom Line

Utilizing trading signals can offer a beneficial avenue for capitalizing on gains, but it’s crucial to acknowledge that profits aren’t guaranteed.

These signals amalgamate technical, fundamental, and quantitative analyses to predict and forecast market or asset movements. Yet, these forecasts don’t always materialize, necessitating robust risk management systems. Furthermore, numerous scammers target inexperienced traders with misleading signals.

Nevertheless, following our guidelines above can help you get started with trusted signals providers and minimize associated risks.

FAQ

Are Trading Signals Legal?

Yes, trading signals are generally legal. They are essentially market analyses or recommendations provided by individuals, analysts, or automated systems, which are legal means of conveying information and strategies to assist you in making informed decisions.

However, the legality might vary based on the region and compliance with financial regulations governing investment advice and services.

How Do I Get The Most Out Of Trading Signals?

Generally, you can filter the signals that you receive with a large number of variables. For example, you could specify the assets for which you are notified of opportunities.

You can also limit the timeframes over which the signals should require a position to be open. Shorter-term day traders and scalpers may request one or five-minute signals, while others may prefer hourly or eight-hour chart notifications.

Who Gives The Best Trading Signals?

Determining the ‘best’ trading signals provider is subjective and can vary based on your individual preferences, accuracy, and compatibility with trading strategies.

Some well-regarded sources include professional analysts, reputable financial institutions, and established trading signal platforms with a track record of accuracy and reliability.

Researching and trialling various sources will help you to identify the most profitable signals for your specific trading styles and goals.

Why Do Providers Give Free Signals?

Signal providers often offer free signals to attract followers, build credibility, or as a marketing strategy to promote premium services or products.

It’s a way for signal providers to showcase their expertise, gain a larger audience, and potentially convert free users into paying subscribers for more advanced or exclusive signal offerings.

Are Trading Signals Scams?

In our experience, the majority of trading signals are either junk or scams. However, a few good ones try to help people understand trading better.

Trading signals aren’t inherently bad and often come from technical analysis, market data, or ‘expert’ opinions. The goal is to help you make smarter trading decisions.

However, the problem lies with a lot of signal providers (mainly forex) who make unrealistic promises. They might guarantee huge profits or claim an unrealistically high success rate. These tactics are often used to lure unsuspecting traders into expensive subscriptions.

To protect yourself, always do your due diligence. Research the signal provider, verify their track record, and be wary of claims that seem too good to be true.

What Are The Benefits Of Using Trading Signals?

You can use signals to enhance decision-making and save time through pre-analyzed market insights, complementing existing trading strategies.

You can access expert analyses, remove emotional biases, and use signals as a learning opportunity to improve strategies and gain insights into market dynamics and technical analysis.

What Are The Risks Of Using Trading Signals?

Using trading signals carries risks, including potential errors or inefficiencies, and reliance on historical data may not adapt well to sudden market shifts or unexpected events.

Additionally, subscription costs, overdependence without understanding underlying analysis, and lack of customization to individual preferences or trading styles can further pose challenges.

Should I Act On A Trading Signal?

When you retrieve a trading signal, it is up to you whether you follow through with the suggestion.

Some traders might assess the perceived risk (usually included in the notification) as too high or have carried out their own fundamental or technical analysis that leads them to believe the signal may not be successful.

If you have unwavering faith in the signals that are sent to you and use a program that integrates with your platform, you can automate your response. This will mean that there is less delay between the opportunity being recognized and the position being opened, likely improving the extent of any profits that are made.

However, if you implement this, you will not be able to reject signals on a case-by-case basis.

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com