Bond Trading

Trading bonds can help to diversify investment portfolios. They can provide a stable source of income through interest payments and can act as a hedge against stock market volatility. Additionally, bonds can offer opportunities for profit when interest rates change or in response to specific economic conditions.

This guide explains how the bond trading market works for beginners, the different ways you can invest in bonds, plus their merits and risks.

Quick Introduction

- A bond is a type of debt instrument issued and sold by a government, local authority or company to raise money.

- The entity borrows the funds for a predetermined amount of time over which interest must be paid. At maturity, there is a final interest payment and return of principal.

- Pay attention to transaction costs when trading bonds, including broker commissions, bid-ask spreads, and any other fees, because bonds may have lower yields compared to other investments.

- Assess the credit risk of the issuer, interest rate risk, and liquidity risk. Different bonds carry different levels of risk, so it is essential to align your bond investments with your risk tolerance and investment goals.

- Diversify your bond portfolio to spread risk. Holding bonds with varying maturities, issuers, and credit qualities can help reduce the impact of adverse events.

Best Bond Trading Brokers

We recommend these 4 brokers for trading bonds in October 2025:

What Are Bonds?

Bonds are financial instruments issued by governments, municipalities, corporations, or other entities to raise capital. They serve as a way for these issuers to borrow money from investors.

When you invest in bonds, you essentially lend your money to the issuer in exchange for periodic interest payments (known as coupon payments) and the return of the bond’s face value (known as the principal) when it matures.

The interest rate is determined by the size of the coupon and the price of the bond at purchase. If it is held to maturity, it also represents the rate of return on the investment.

Investment bonds are categorized based on their credit quality. High-quality investment-grade bonds, such as government bonds or those issued by financially stable corporations, are considered less risky and typically offer lower interest rates.

Conversely, lower-quality or non-investment-grade bonds, often referred to as junk bonds, come with higher credit risk and offer higher interest rates to compensate you for the increased risk of default.

Most corporate and government bonds are traded on public exchanges. Some, however, are traded on over-the-counter markets, where buyers and dealers exchange securities without regulatory oversight from an exchange.

Types Of Bonds

There are various types of bonds you can trade, each with its unique characteristics and issuers. Some of the most common types of bonds include:

Fixed-Rate Bonds

Fixed-rate bonds, also known as plain vanilla bonds, pay a fixed interest rate (coupon rate) over the bond’s life. The interest rate does not change regardless of fluctuations in market interest rates.

Fixed-rate bonds provide predictability and a stable income. These bonds are widely used by various issuers, including governments, corporations, and municipalities, making them one of the most common types of bonds in the market.

Zero-Coupon Bonds

Zero-coupon bonds, also known as zeros or deep discount bonds, are bonds that do not make periodic interest payments (coupon payments) during their term. Instead, they are sold at a significant discount to their face value (par value) and provide a return by appreciating in value over time.

You receive the face value of the bond at maturity, which represents your profit.

Government Bonds

Sovereign bonds, also known as government bonds, are debt securities issued by national governments. They are considered among the safest investments because they are backed by the full faith and credit of the issuing government.

These bonds can be issued in local currency or foreign currencies and serve as a means for governments to raise funds for various purposes, including infrastructure projects, budget deficits, or debt refinancing.

Sovereign bonds are often categorized based on their maturity, such as short-term bills, intermediate-term notes, and long-term bonds. Sovereign bonds are attractive because of their low credit risk and relative stability.

Corporate Bonds

Corporate bonds are debt securities issued by corporations to raise capital for various purposes, such as expansion, acquisitions, or debt refinancing. These bonds come in varying degrees of risk depending on the creditworthiness of the issuing company.

Investment-grade corporate bonds are considered safer, typically offering lower yields, while high-yield or junk bonds carry higher credit risk and provide higher yields to compensate investors.

Corporate bonds are attractive if you are seeking a balance between risk and return. They offer the potential for regular interest income and may provide diversification in your investment portfolio.

Municipal Bonds

Municipal bonds, often referred to as ‘munis,’ are debt securities issued by state and local governments or their agencies to fund public projects and infrastructure development. These bonds play a critical role in financing essential public services, such as schools, hospitals, roads, and utilities.

One notable feature of municipal bonds is that the interest income they provide is often exempt from federal income taxes and may also be exempt from state and local taxes if you reside in the issuing municipality.

High-Yield Bonds

High-yield bonds, often referred to as junk bonds, are bonds issued by corporations or entities with lower credit ratings. These bonds are considered higher risk due to the increased likelihood of default compared to investment-grade bonds. As a result, issuers offer higher coupon rates.

Zero-Coupon Bonds

These bonds, also known as ‘zeros’ or ‘deep discount bonds’, are bonds that do not make periodic interest payments (coupon payments) during their term. Instead, they are sold at a significant discount to their face value (par value) and provide a return by appreciating in value over time.

You receive the face value of the bond at maturity, which represents your profit.

Foreign Bonds

Foreign bonds are debt securities issued by foreign governments or corporations in currencies other than your domestic currency. These bonds provide opportunities to diversify your portfolios and gain exposure to international markets.

The appeal of foreign bonds lies in the potential for higher yields or favorable currency movements.

Convertible Bonds

Convertible bonds are hybrid securities that offer you the option to convert your bonds into a specified number of shares of the issuing company’s common stock. These bonds provide you with the potential for capital appreciation in addition to regular interest payments.

Convertible bonds offer a balance between fixed-income stability and the opportunity to participate in a company’s stock price growth. They allow you to benefit from rising stock prices while providing a safety net of fixed-income returns if the stock performs poorly.

Index Bonds

Index bonds, also known as bond index funds or bond ETFs (Exchange-Traded Funds), are investment vehicles that track the performance of a specific bond index, such as the Bloomberg Barclays U.S. Aggregate Bond Index.

Trading bonds like these provides exposure to a diversified portfolio of bonds that match the index’s composition and performance.

Asset-Backed Securities (ABS)

Asset-backed securities are bonds that are backed by pools of various types of financial assets, such as auto loans, credit card receivables, or mortgages. These bonds derive their value and cash flows from the underlying assets.

ABS are typically structured with different tranches, each carrying a different level of risk and return. They offer exposure to income generated from a diversified portfolio of consumer loans and other financial assets. The performance of ABS is linked to the repayment of the underlying loans by borrowers.

Green Bonds

Green bonds are a specialized type of bond designed to raise funds for projects and activities that have positive environmental or climate-related impacts.

These bonds are issued by governments, financial institutions, corporations, or other entities and are used to finance environmentally friendly projects such as renewable energy, energy efficiency, clean transportation, and sustainable agriculture.

How Bonds Pay Interest

Bonds pay interest in the form of periodic payments known as ‘coupon payments.’ Here is a detailed explanation of how this process works:

Coupon Rate

When a bond is issued, it comes with a fixed interest rate known as the ‘coupon rate.’ For example, if a bond has a face value (also called par value) of $1,000 and a coupon rate of 5%, it means the bond will pay $50 in annual interest (5% of $1,000) to the bondholder.

Payment Frequency

The frequency of coupon payments can vary. Most bonds make semiannual payments, meaning you will receive half of the annual interest every six months. In our example, you would receive two payments of $25 each every six months.

Coupon Dates

Bond issuers specify certain dates when coupon payments will be made. These dates are known as ‘coupon dates’ or ‘interest payment dates.’ You must own the bond on the ‘record date’ to receive the upcoming coupon payment.

Interest Calculation

The bond issuer calculates the interest payment based on the face value of the bond and the coupon rate. Using our example, if you own the bond on a coupon date, you will receive $25 (half of the annual interest) on each payment date.

Payment Method

You typically receive your coupon payments through various methods, depending on how the bond is held. If the bond is held in physical form, you may need to present physical coupons (detachable interest payment slips) to a bank or financial institution for payment.

However, most bonds today are held electronically through brokerage accounts or in electronic form through the issuer’s registry, and coupon payments are made electronically.

Tax Considerations

Coupon interest payments are typically subject to income tax. The tax treatment may vary depending on the type of bond and the tax laws in your jurisdiction. Some government bonds, such as U.S. Treasury bonds, may have tax advantages.

Reinvestment

You can choose to reinvest your coupon payments in additional bonds or other investments to potentially enhance your returns. This is especially common when interest rates are low.

Maturity

The bond continues to make coupon payments until it reaches its maturity date. At maturity, you will receive the final coupon payment along with the return of the bond’s face value.

Pros and Cons of Trading Bonds

- Income Generation: Bonds typically provide regular interest payments, offering a predictable source of income for investors.

- Diversification: Trading bonds can diversify a portfolio by providing stability and acting as a hedge against stock market volatility.

- Safety: High-quality bonds, such as government bonds, are considered safer investments compared to stocks, as they have a lower risk of capital loss.

- Capital Preservation: Bonds can help preserve capital, especially if held until maturity, as they return the face value at that time.

- Risk Management: Trading bonds can be used to manage interest rate risk or to speculate on interest rate movements, providing tools for risk management.

- Lower Potential Returns: Bonds generally offer lower returns compared to stocks over the long term, limiting potential wealth growth.

- Lack of Liquidity: Some bonds may have limited liquidity, making it challenging to buy or sell them quickly at desired prices.

- Inflation Risk: Fixed-income bonds may not keep pace with inflation, eroding the real purchasing power of their returns over time.

- Credit Risk: Trading bonds from issuers with lower credit ratings (e.g., corporate bonds) carry a higher risk of default, which can result in loss of principal.

- Interest Rate Risk: Bond prices can fluctuate significantly due to changes in interest rates, potentially leading to capital losses for bondholders.

Credit Risk and Interest Rate Risk

There are two main risks of bond trading: credit risk and interest rate risk.

Credit risk is derived from the potential that a bond issuer will not have the financial means to make principal and interest payments. Issuers, whether they be governments, corporate entities, or municipalities, are generally rated on their credit quality by assessing their cash flow metrics (and their stability) against their debt load.

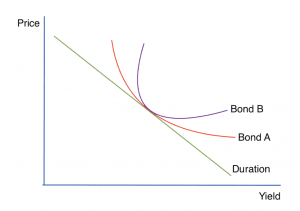

Interest rate risk boils down to two subcomponents: duration and convexity:

- Duration is the amount of time it takes to reach breakeven on a fixed-income investment. The longer a bond’s duration, the greater its interest rate risk. Yields are inversely related to fixed-income bond prices. So as yields rise, prices decrease.

- Convexity is a measure of how duration changes with respect to changes in interest rates. This is a better measure of interest rate risk.

Duration, as a risk management tool, operates under the assumption that changes in interest rates and bond yields are linear. In reality, the relationship is non-linear and best illustrated by convexity. The more curved the relationship between price and interest rate changes, the more inaccurate duration becomes as a risk measure.

Mathematically, duration is the first derivative of a bond’s price relative to interest rates. Convexity is the second derivative with respect to how a bond’s price changes relative to interest rates, or the first derivative with respect to how a bond’s duration changes relative to interest rates.

In the diagram below, duration shows the inverse relationship between price and yield. Bond B is more convex than Bond A. This means that option B is more volatile than option A, given a smaller change in interest rates will impact its price to a greater extent.

What Makes A Bond Have Higher Convexity?

All of the following are associated with higher convexity:

- Lower coupon payment

- Longer time to maturity

- Lower credit rating/higher credit risk

If you are looking to make higher returns or have a clearer opinion on the future direction of interest rates, bonds with higher convexity and/or duration may be appropriate.

If you are looking to achieve stable cash flow over the long-run, bonds with lower convexity and duration may be the better option.

How To Trade Bonds

You can start trading bonds in 5 straightforwards steps:

Select A Bond

Bonds come in various types, including government bonds, municipal bonds, corporate bonds, and more.

You can choose bonds that match your risk tolerance, investment goals, and time horizon.

Purchase A Bond

Once the desired bonds are selected, you can purchase them through a broker, financial institution, or on the open market.

The bond’s purchase price is typically either at par value (face value), a premium (above face value), or a discount (below face value).

Receive Interest Payments

Bonds typically pay periodic interest, known as coupon payments. The frequency and amount of these payments vary depending on the bond’s terms.

You receive these interest payments as income throughout the bond’s life.

Hold Or Trade

After purchasing bonds, you have the option to hold them until maturity or trade them in the secondary bond market.

Bond prices can fluctuate based on changes in interest rates, credit conditions, and other market factors.

If you sell a bond before maturity, you may receive more or less than the face value, depending on prevailing market rates.

Settle At Maturity

When a bond reaches its maturity date, the issuer repays the bond’s face value to you. At this point, the bond investment is considered complete, and you receive the final coupon payment.

Bottom Line on Trading Bonds

Bonds have a rich history and make for an appealing financial product for many aspiring investors. This bond trading tutorial has covered the different types available, plus their respective pros and cons.

Use our rankings of the best brokers for trading bonds to get started.

FAQ

Are Treasury Bonds The Same As Savings Bonds?

No. Treasury bonds are long-term government debt securities with fixed interest rates, typically with maturities of 10 to 30 years, purchased for income and capital preservation. Savings bonds, on the other hand, are savings products and often used for shorter-term savings goals or gifts.

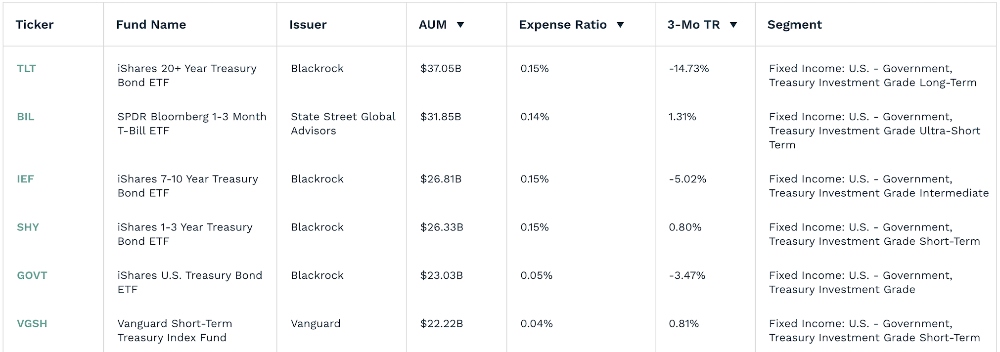

What Are Treasury ETFs?

Treasury ETFs are investment funds that track the performance of a portfolio of U.S. Treasury securities, providing a convenient way to gain exposure to the treasury bond market. These ETFs trade on stock exchanges, allowing you to buy and sell shares throughout the trading day, offering liquidity and flexibility.

Treasury ETFs come in various types, such as those focusing on short-term, long-term, or inflation-protected treasury bonds, catering to different investment objectives.

Which Bonds Are Best?

Choosing the right bonds for your portfolio depends on your investment goals and risk tolerance. If you seek safety and stability, trading government bonds are suitable due to their low credit risk. For income and some risk, consider investment-grade corporate or municipal bonds.

High-yield bonds offer higher potential returns but come with higher credit risk, while specialized bonds like green bonds align with ESG (Environmental, Social and Governance) goals.

Diversification across bond types can help balance risk and return.

Can You Day Trade Bonds?

While it is technically possible to day trade bonds, it is not as common or straightforward as day trading stocks or other more liquid securities.

Day trading involves buying and selling assets within the same trading day to profit from short-term price movements, but the bond market is generally less liquid than the stock market, making it more challenging to execute quick trades.

Some bonds, especially those issued by governments or major corporations, may have sufficient liquidity for day trading, but others may not.

The bond market has different trading hours from the stock market, and it typically has shorter trading hours and less active trading during the day. This can limit the opportunities for day trading bonds.

Bonds tend to have lower price volatility compared to stocks, which means that potential profits from day trading bonds may be more limited. Additionally, bond prices are influenced by interest rate changes, which can be less predictable than stock price movements.

Recommended Reading

Article Sources

- The Bond Market: Trading and Risk Management, Christina I. Ray, 1993

- A Simple Approach to Bond Trading: The Introductory Guide to Bond Investments and Their Portfolio Management, Stefano Calicchio, 2020

- Bond Markets: Structures and Yield Calculations, Patrick J. Ryan, 2020

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com