Silver Brokers 2025

While lacking the prestige of gold, frequent price volatility means that silver can be a superior asset for short-term traders. In this silver trading guide, we explain what moves the price of the metal and the different ways you can trade it.

Quick Introduction

- Silver is a malleable metal that plays a major role as both a tradable asset and an industrial commodity.

- Individuals can trade silver using instruments like futures, options, CFDs and ETFs.

- Macroeconomic news, the movement of the US dollar, and gold prices influence the price of silver.

- The gold-silver ratio is a useful tool that can help traders decide if the precious metal is undervalued.

Best Brokers For Trading Silver

Our hands-on tests show that these are the 4 top silver brokers in 2025:

Understanding The Silver Market

When it comes to precious metals trading, gold is a more popular market:

- Large institutions buy gold as a currency hedge when interest rates and yields on other assets decrease.

- Central banks prioritize buying the yellow metal as a reserve asset to diversify their currency exposure.

- Gold is also more popular with retail traders than its cheaper ‘sister’ metal.

Yet it would be a mistake to describe the silver market as insignificant. Silver is one of the world’s top 10 commodities by trading volume: on the day this guide was written, a whopping 79,972 silver futures contracts changed hands on The Commodity Exchange (COMEX) in the US.

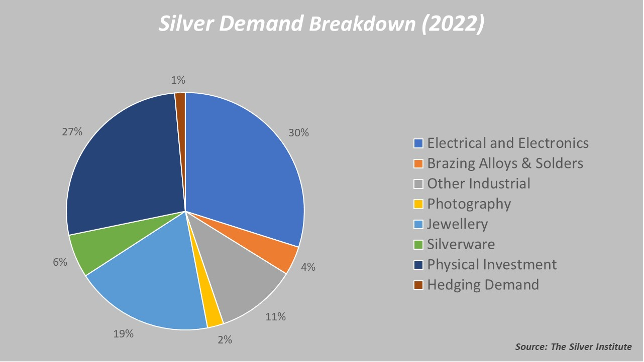

And, while gold is used primarily as an investment asset, silver serves as both a key industrial commodity as well as a store of value.

It is also widely used in the manufacture of jewellery, and cumulative demand for the metal has soared in recent years.

According to The Silver Institute, global silver demand struck a record high of 1.24 billion ounces in 2022, up 18% year on year. Off-take rose across most categories, with physical silver investment rising 22% from the prior year (to 332.9 million ounces).

Pros and Cons Of Trading Silver

Pros

- Volatility – Silver prices can be much choppier than gold, providing superior opportunities for short-term traders to make money from market fluctuations.

- Easy to trade – The silver market is highly liquid, making it easy for day traders to enter and exit positions. Traders also have a wide range of ways they can play the market, from buying physical metal to trading futures contracts, CFDs and company stocks.

- Diversification – Silver’s role as a hedge against inflation helps spread risk and can protect traders’ portfolios from sharp slumps when prices rise.

- Cheapness – The grey metal is much cheaper than other precious commodities like gold and platinum group metals (PGMs). This makes trading it available to a wider range of individuals.

- Dual purpose – Silver’s role as an industrial and investment metal means prices can rise during economic upturns and downturns.

Cons

- Price unpredictability – Silver’s role as an investment and industrial commodity means that prices can move in surprising directions following macroeconomic news. Failure to understand the complex suite of factors that affect values can result in poor decision-making.

- Leverage risks – Many of the securities used to trade silver allow investors to use large amounts of borrowed funds. Whilst this can potentially rev up profits, it may also lead to monster losses.

- Holding costs – Owning silver bars comes with the added cost of vaulting and insuring the precious metal. Short-term traders can avoid this by speculating on silver prices using derivatives.

What Drives Silver Prices?

Like all commodities, prices are subject to the laws of supply and demand and are highly sensitive to macroeconomic and geopolitical conditions.

Signs of excess or deficient mine production also influence silver values.

The malleable metal is extremely versatile and thus has a broad assortment of applications:

- Its conductivity makes it a key component in the manufacture of electronics and solar panels.

- High reflectivity means it is a core material in mirrors and photographic film.

- Its role as a catalyst for various chemical reactions means it is widely used in the chemical industry.

- Silver is a cherished material in jewellery production thanks to its aesthetic qualities (one-fifth of demand).

This all means that silver prices are extremely sensitive to broader economic conditions. As such, news on the following can impact demand and silver trading prices: Global growth, consumer spending, manufacturing output and employment levels.

Silver prices are also highly sensitive to the strength of the US dollar. When the currency rises in value it becomes more expensive to purchase the metal, and vice versa.

Like most commodities, silver is priced using the dollar on global markets.

The Gold-Silver Ratio

Just like gold, silver is a safe-haven asset that investors flock to when market confidence sinks. It is used as a store of value during times of inflation, and as a wealth preserver during times of economic stress or uncertainty. For this reason, silver prices often closely track those of gold.

The gold-silver ratio is a historical metric used to appraise the relative value of these precious metals and is calculated by dividing the price of gold per ounce by the price of silver per ounce.

The gold-silver ratio has averaged around 15 to 1, meaning it would take 15 ounces of silver to buy one ounce of gold. Changes in the ratio can affect silver prices by influencing trader behaviour.

A high ratio, for example, can suggest that the grey metal is undervalued in comparison to gold, prompting a rush of buying interest and a surge in prices.

Different Ways To Trade Silver

Physical Silver

As with gold, or many of the other precious metals, physical silver is popular with investors seeking to benefit from appreciating prices.

Silver bars are the most cost-effective way for investors to purchase the metal in large quantities. This is because coins often feature intricate and detailed designs that require extra costs to manufacture.

Many mints and retailers also offer to store silver on behalf of their customers. This, along with taking out insurance to cover against loss and damage, means that investors in actual metal often endure additional expenses.

We recommend these firms if you want to invest in physical silver:

Best Silver Vaults

Spot Contracts

A spot contract involves buying or selling a specified amount of the dual-role metal at the current market price for immediate settlement.

Spot silver agreements are traded by a wide range of individuals and institutions. Mining companies, manufacturers and jewellers, for instance, will buy these contracts to hedge against adverse price movements.

Traders meanwhile can trade them to diversify their portfolios and speculate on price movements.

Future Contracts

Silver is – like most commodities – mostly traded through the exchange of futures contracts.

These financial instruments state that a pre-agreed amount must be bought and sold for a set price and within a specified timescale. The prices of these contracts are based on spot silver values.

Futures are derivative vehicles, which means that they derive their value from the price of an underlying asset.

They are especially effective for commodities trading, as they allow traders to speculate on market movements without having to worry about taking physical delivery.

Silver futures are primarily traded on several major commodity exchanges:

- COMEX in the US

- Multi Commodity Exchange (MCX) in India

- Shanghai Futures Exchange (SHFE) in China

Options Contracts

Options are another common way for individuals to trade silver. As the name implies, they provide owners with the choice as to whether to buy or sell a quantity of the underlying asset later on and at a pre-set price (known as the strike price).

This gives traders much more flexibility, although this advantage over futures contracts attracts a higher price.

As with other types of derivatives, traders can choose to take either a long or a short position with silver options.

In other words, they have a chance to make money when the price of the precious commodity rises or falls in value.

Here you can see a series of quotes on silver futures on COMEX. On the left are prices for call options, which give the contract owner the right to buy the metal. Prices for put options, which allow holders to sell silver on the expiration date, can be seen on the right.

Another reason why futures and options are so popular is because they allow individuals to use substantial levels of leverage, which is effectively a loan from a broker.

By using borrowed funds, you can open a much larger position than if you used just your own funds, which in turn provides the opportunity to make even greater profits.

Contracts for Difference (CFDs)

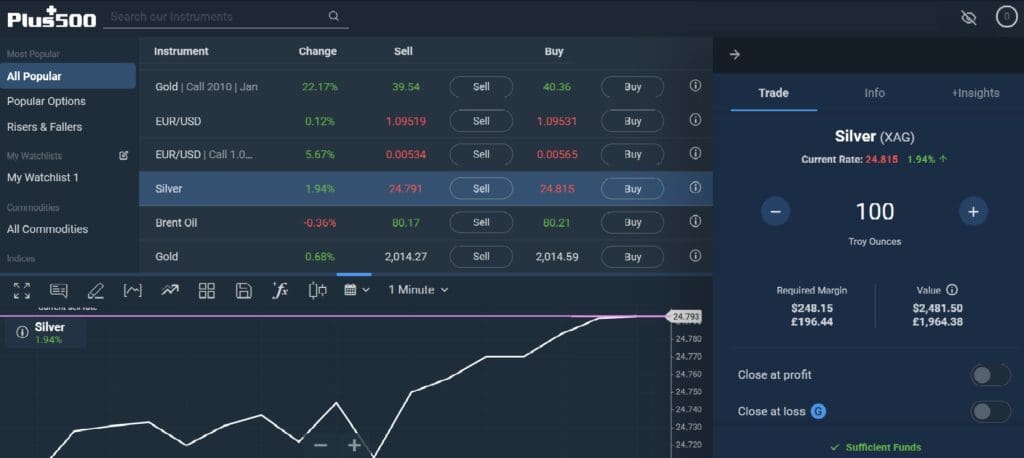

Derivatives known as contracts for difference (CFDs) are especially popular with short-term traders and day traders wishing to use leverage.

Gearing for these financial instruments is especially high, though the maximum leverage available varies according to the broker and the regulatory environment in the specific jurisdiction.

Here you can see an example of a CFD silver trade at Plus500. This broker allowed leverage of 1:10 (or 10%) for this particular trade, meaning that a trader would have to put down an initial deposit (or margin) of just $248.15 to control a position worth a total value of $2,481.50.

Using leverage can be a powerful weapon when you’ve invested correctly on how the silver market will move. However, when prices move in the ‘wrong’ direction traders can end up with thumping losses.

Even small price fluctuations can have a massive impact on the account balance, and traders may have to deposit extra funds to cover losses.

Silver Stocks

Traders can profit from rising metal prices by buying shares in silver-producing stocks.

Alternatively, they can make money when the metal value falls by taking a short position in one or more of these commodities companies.

Silver is rarely found in a pure metallic form. Instead, it is usually extracted alongside other elements including copper, lead, zinc and gold.

As a result, successful trading in silver shares also usually requires these other base and precious metals to rise in price.

The share prices of silver miners often track the value of the underlying metal. You can see this from the graph below which shows the market movement of FTSE 100-listed Fresnillo, the world’s biggest silver miner. When prices rise, shareholders usually see the value of their holdings increase, and vice versa.

Yet as you can also see above, trading a silver stock doesn’t always pay off, even when prices of the commodity increase. This is because share prices are dependent on operational factors as well as movements in the silver market.

The graph above shows a near-20% decline in Fresnillo’s share price as soaring costs put a squeeze on profits.

Trading mining stocks has one big advantage over those other financial instruments I mentioned: equity investing can provide income as well as capital gains.

Not all silver producers pay dividends, but a large number do.

Exchange-Traded Funds (ETFs)

Also traded on stock markets, exchange-traded funds (ETFs) are financial instruments that are designed to track the precious metal price.

If a trader thinks the metal will become more valuable they can buy an ETF like the iShares Silver Trust. When silver prices set by the London Bullion Market Association (LBMA) appreciate, the value of the fund follows suit.

ETFs are highly liquid, cheap to trade, and allow individuals to diversify by getting exposure to a basket of different assets.

ETFs also allow individuals to execute a variety of different trading strategies. For example, someone who thinks silver metal values will fall can go short with the ProShares UltraShort Silver ETF.

Meanwhile, investors who want to get exposure to a selection of silver miners can buy the Global X Silver Miners ETF. At the time of writing, this fund held shares in 32 different silver producers.***

How To Start Trading Silver

- Learn about the silver market – BullionVault and Kitco are a couple of good sources of precious metals news and market information. Organizations like trade body The Silver Institute and metals refiner Johnson Matthey also provide valuable information on silver supply and demand.

- Choose a broker – The key things to consider are the fees and commissions for silver trading and the quality of the platform. Traders should also choose a firm regulated by a trusted body. Importantly, the best brokers offer educational materials and analysis of silver markets to help traders identify opportunities.

- Place a trade – Once you have opened an account, log in to your broker’s platform to make a trade. Day traders may opt for a vehicle like CFDs to profit from short-term changes in silver prices using leveraged funds. Also make use of risk management tools like stop-loss orders to cap your potential losses.

Bottom Line

Online traders have a wide selection of financial instruments they can use to profit from silver. Many of these make use of leverage, too, a tool that can significantly amplify short-term trading profits.

As with any asset class, traders should do plenty of homework before they begin trading silver. And particularly those who adopt the high-risk strategy of using borrowed funds.

* Total trading volumes on 22 November, 2023

** Prices stated as of 24 November, 2023

*** Holdings current as of 24 November, 2023

Article Sources

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com