Stocks-Bonds Correlation

The relationship between stocks and bonds is commonly referenced when it comes to portfolio diversification.

Historically, the interaction between these two asset classes has fluctuated, influenced by the market environment, monetary policy, economic cycles, and sentiment.

Stocks and bonds can be diversifying, but aren’t inherently diversifying.

We look into the concept of stocks-bonds correlation, its historical context, and its implications for investors.

Key Takeaways – Stocks-Bonds Correlation

- Correlation Fluctuates

- The stocks-bonds correlation isn’t stable.

- Inflation shocks often lead to positive correlation, reducing diversification.

- Growth surprises generally create negative correlation.

- Economic Drivers

- Inflation and growth surprises – i.e., shifts in expectations – are the primary drivers of stock-bond dynamics, not their absolute levels.

- Traders will need to focus on unexpected shifts if they wish to trade this dynamic.

- Inflationary Risks

- In inflation-driven environments, traditional diversification falters.

- Alternatives like gold, commodities, and inflation-linked bonds can offer better hedging.

- Policy Shifts Matter

- Coordinated fiscal and monetary policies increase inflation risks, which can complicate traditional diversification strategies.

- Dynamic Strategies

- Traders can monitor relative yield differences and adjust portfolios to account for changing correlation dynamics.

Understanding the Basics of Correlation

What is Correlation?

In finance, correlation measures the degree to which two assets move in relation to each other.

It’s expressed as a value between -1 and +1:

- Positive correlation (+1) = Both assets move in the same direction.

- Negative correlation (-1) = Assets move in opposite directions.

- Zero correlation (0) = No consistent relationship between the movements of the two assets.

The Historical Context of Stocks-Bonds Correlation

Low Yield Environment: Positive Correlation

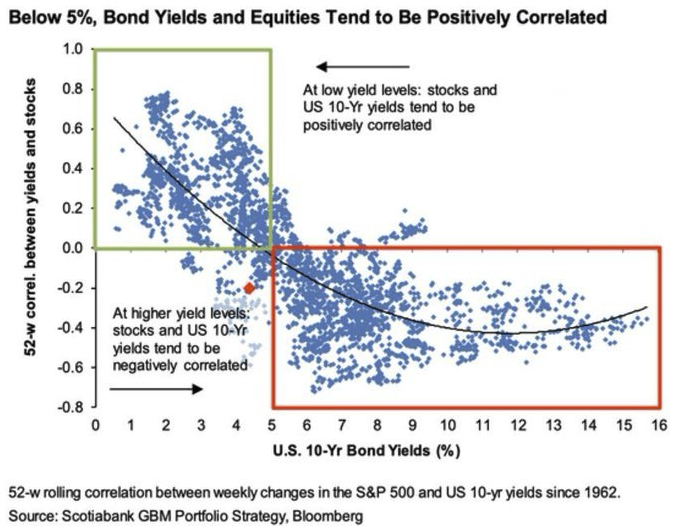

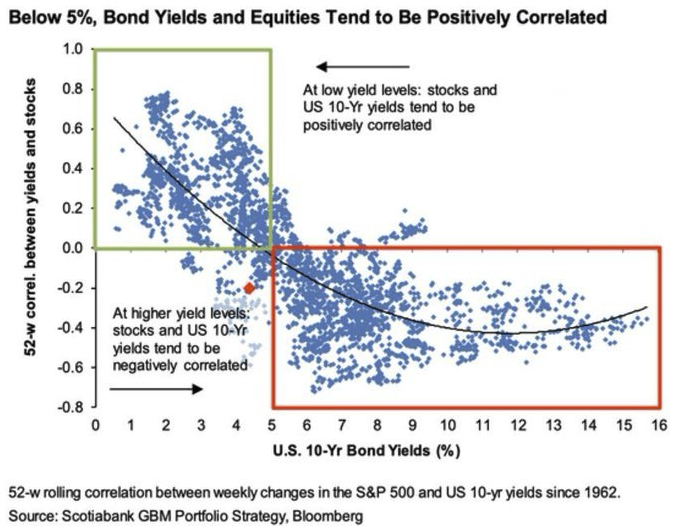

Historically, stocks and bonds tend to show a positive correlation during periods of low bond yields (below 5%, as shown in the chart).

In such environments:

- Economic Growth Signals – Low/falling bond yields often reflect loose monetary policy and stable inflation, creating favorable conditions for equity markets.

- Risk-On Sentiment – Investors/traders may perceive both stocks and bonds as attractive investments, leading to concurrent price increases in both asset classes.

High Yield Environment: Negative Correlation

As bond yields rise above 5%, the correlation between stocks and bonds typically turns negative:

- Inflation and Tight Monetary Policy – Higher yields usually signal tighter monetary policy aimed at curbing inflation. This environment often pressures equities.

- Competition for Capital – Higher bond yields make fixed-income investments more attractive, pulling funds away from riskier assets like stocks.

- For example, if traders can get 6% yields in safer bonds and stocks are trading at a forward P/E of 20x (i.e., the inverse of that – 5% – is the current yield), then bonds compete well with stocks.

- Accordingly, this can lead to a greater level of price action dictated by flows between the two.

Unstable Stock-Bond Correlation

The relationship between stocks and bonds is often assumed to provide reliable diversification, but this correlation is, of course, unstable.

Inflationary shocks, in particular, disrupt this dynamic.

Historical trends reveal that the correlation between these asset classes fluctuates significantly depending on the economic environment.

In periods dominated by growth-driven dynamics – i.e., growth volatility is the dominant driver of returns and not inflation – stocks and bonds often show negative correlation.

Conversely, during inflation-driven periods, this relationship can flip to a positive correlation, reducing their diversification value.

The volatility in the stock-bond correlation shows the need for a nuanced understanding of the relationship.

Economic surprises – whether tied to inflation or growth – are the key factors influencing this relationship, rather than the absolute levels of growth or inflation themselves.

As in the way markets work, it’s not how things are but how they transpire relative to discounted expectations.

Economic Drivers of Correlation

The stock-bond correlation is primarily shaped by unexpected shifts in economic growth or inflation.

For example, during the 1990s and early 2000s, growth surprises had a dominant role in markets.

This environment created a sustained period of negative correlation between stocks and bonds, as equity markets thrived on optimism, while bonds provided a hedge against downturns.

As such, this tended to create a new generation of traders and investors relying on a relationship that isn’t actually reliable.

In contrast, periods characterized by inflationary pressures, such as the post-World War II era, this created a positive stock-bond correlation.

In these inflation-driven times, both stocks and bonds often struggled simultaneously and undermined their traditional roles as counterbalancing assets.

This pattern of alternating drivers shows the importance of understanding the macroeconomic forces at play when constructing a portfolio.

Shift to a More Unified Fiscal and Monetary Policy Environment

The fiscal and monetary policy environment has shifted in recent years, moving toward coordinated fiscal and monetary interventions.

This increases the probability of inflation becoming a more dominant driver than growth in shaping stock-bond dynamics.

Under these conditions, low bond yields and tighter liquidity create additional challenges for diversification.

The traditional framework of relying on bonds to offset equity risk becomes less effective, forcing traders and investors to rethink their strategies and what kind of allocation approaches are best.

Inflation Hedge Strategies

To mitigate the risks associated with inflation-driven correlations, investors can integrate inflation-sensitive assets into their portfolios.

These include:

- Gold – A traditional store of value that tends to perform well during periods of currency devaluation.

- Commodities – Assets like oil and agricultural products, which often appreciate when inflation rises. They can create a bit of a chicken-and-egg dynamic where they’re often the source of inflation.

- Inflation-Linked Bonds – Government-issued securities that adjust for inflation – at least one form of it (i.e., CPI) – which provides a more stable income stream in such environments.

These strategies can help cushion portfolios against the dual pressures of falling stock and bond prices during inflationary shocks.

Innovative Portfolio Construction

The future of portfolio management may more so lie in developing assets and strategies that reduce environmental biases.

Namely, less reliance on specific macroeconomic factors like growth or inflation.

Focusing on creating instruments or portfolios that deliver more consistent returns across varying economic conditions, traders and investors can achieve better resilience and risk-adjusted returns in their portfolios.

For example, we discussed such an approach with stocks in this article.

Some Insights Based on Numbers

- 1940s-1990s – Positive stock-bond correlation largely prevailed due to persistent inflation surprises. This dynamic began to stabilize in the 1980s as inflation trends shifted.

- 1990s-2010s – Growth surprises took center stage. This led to a prolonged period of negative stock-bond correlation, enhancing diversification opportunities.

Factors That Drive the Relationship

So, to sum up the key factors driving the stock-bond correlation:

1) Inflation Expectations

Rising inflation erodes the real returns of bonds, causing bond prices to fall and yields to rise.

Inflation also raises costs for companies, potentially weighing on stock performance.

Stocks are a nominal asset and sometimes they can offset the price increases and the rate increases that are built into their pricing.

So, rising inflation tends to be bad for both bonds and neutral to bad for stocks.

2) Growth Expectations

Rising growth tends to be good for stocks but not great for bonds because of their fixed-rate returns.

(Corporate credit tends to do well because it’s largely in the same bucket as stocks.)

3) Central Bank Policy

When central banks lower interest rates, bond yields fall, and equities often benefit from increased liquidity.

Conversely, rate hikes can dampen stock market growth while boosting bond yields (i.e., lower prices).

4) Economic Cycles

During economic expansions, both stocks and bonds can perform well, creating positive correlation.

In recessions, investors seek safety in bonds, creating a negative correlation with stocks.

Diversification and Portfolio Management Implications

Risk Reduction

A negative correlation between stocks and bonds enhances diversification, reducing overall portfolio risk.

This is particularly valuable during market downturns when equities are under pressure.

Asset Allocation

In low-yield environments, a balanced portfolio may include a higher allocation to equities.

In high-yield environments, increasing exposure to bonds may provide better risk-adjusted returns.

Dynamic Strategies

Investors should periodically reassess the correlation dynamics to adjust their asset allocation accordingly.

Case Studies and Real-World Applications

The 2008 Financial Crisis

During the 2008 financial crisis, the correlation between stocks and bonds turned sharply negative:

- Deflationary crisis – 2008 was like 1929, where there was too much debt disproportionately concentrated, leading to a deflationary crisis. This tends to be good for the safest bonds.

- Flight to Safety – As equities fell, investors sought refuge in government bonds, driving yields down.

- Policy Response – Central banks slashed interest rates, boosting bond prices and stabilizing markets.

The Post-COVID Market

In the aftermath of the COVID-19 pandemic, the stocks-bonds correlation shifted:

- Stimulus Measures – Massive fiscal and monetary stimulus pushed both stock prices and bond prices higher. This created a positive correlation.

- Inflation Fears – Rising inflation and rate hikes began to re-establish a more positive correlation.

Ultimately, it largely comes down to: are inflation surprises (favors positive correlation) or growth surprises (negative correlation) the dominant influence?

Insights from the Chart: Visualizing the Correlation

Let’s look at this chart again.

The chart shows a relationship between US 10-year bond yields and the 52-week rolling correlation of stock and bond movements.

Green Zone (Low Yields)

Positive correlation is prominent when yields are below 5%.

Red Zone (High Yields)

Correlation turns negative as yields exceed 5%.

This reflects the impact of inflationary pressures and tighter monetary policy.

Curve Dynamics

The curve shows the non-linear nature of the correlation, emphasizing the transition points where the relationship changes.

Data also thins out at the highest levels.

Are Bonds Still Effective Diversifiers in Modern Portfolios?

Challenges in a Low-Yield Era

Historically low bond yields have raised questions about their role as a hedge against equity risk.

Bonds still provide stability and income.

Traders also need to factor in the credit risk.

The Case for Bond Alternatives

In some environments, assets like gold or commodities may serve as better diversifiers.

Traders may also consider inflation-linked bonds or high-yield bonds for different types of returns.

Private assets might also get higher traction.

But it’s not a good assumption to presume that private assets are good diversifiers or have less risk just because there’s less price data on them.

How to Use Correlation Data: Practical Steps for Traders & Investors

Monitor Yield Levels

Pay close attention to the direction of bond yields, as they influence the stocks-bonds correlation.

Look at rolling correlations to understand changing market dynamics.

Adjust Allocations

During periods of positive correlation, consider diversifying into uncorrelated asset classes.

During negative correlation phases, leverage bonds to reduce portfolio volatility.