US Housing Bubble & Financial Crisis of 2007-08 – Causes & Lessons

The US Housing Bubble and the subsequent Financial Crisis of 2007-08 was a period characterized by a drop in housing prices and other assets, which subsequently led to a severe global economic recession that threatened to become a depression with interest rates hitting zero.

The crisis was the worst financial disaster since the Great Depression (specifically the 1929-32 period).

Key Takeaways – US Housing Bubble & Financial Crisis of 2007-08

- The US Housing Bubble and the subsequent Financial Crisis of 2007-08 caused a severe global economic recession and cost the US economy over $22 trillion.

- The housing bubble was fueled by factors such as deregulation, subprime lending, and overvaluation of properties.

- The crisis led to the collapse of major financial institutions, a credit crunch, and a severe global recession with high unemployment rates.

Key Statistics – US Housing Bubble & Financial Crisis of 2007-08

- Rapid Housing Price Growth: Between 1996 and 2006, the price of the typical American house increased by around 125% (more than doubled).

- Subprime Mortgages: In 2005, the peak of the housing market, subprime loans totaled more than $600 billion or about 20% of the US mortgage market.

- Securitization: By 2007, mortgage-backed securities (MBS), which bundled home loans into complex financial products, accounted for more than $7.5 trillion of the US mortgage debt.

- Decline in Home Prices: By February 2009, average US housing prices had fallen by over 20% from their mid-2006 peak.

- Foreclosures: There were approximately 1.3 million foreclosures in 2007, up 79% from 2006.

- Unemployment: Unemployment rose from 4.7% in November 2007 to peak at 10% in October 2009.

- Global Impact: The crisis reduced the global GDP growth by an estimated 5.1% in 2009.

- Bank Failures: 25 US banks failed in 2008. By 2013, more than 500 had failed.

- Federal Intervention: The US government committed $700 billion in Troubled Asset Relief Program (TARP) funds to bail out banks and other companies.

- Stock Market Impact: From its peak in October 2007 to its trough in March 2009, the S&P 500 index fell by approximately 50%.

- Wealth Decline: From 2007 to 2010, US household wealth declined by $16 trillion or about 24%.

The US Housing Bubble

The housing bubble in the US, a period characterized by high home prices and increased housing construction, peaked in 2006.

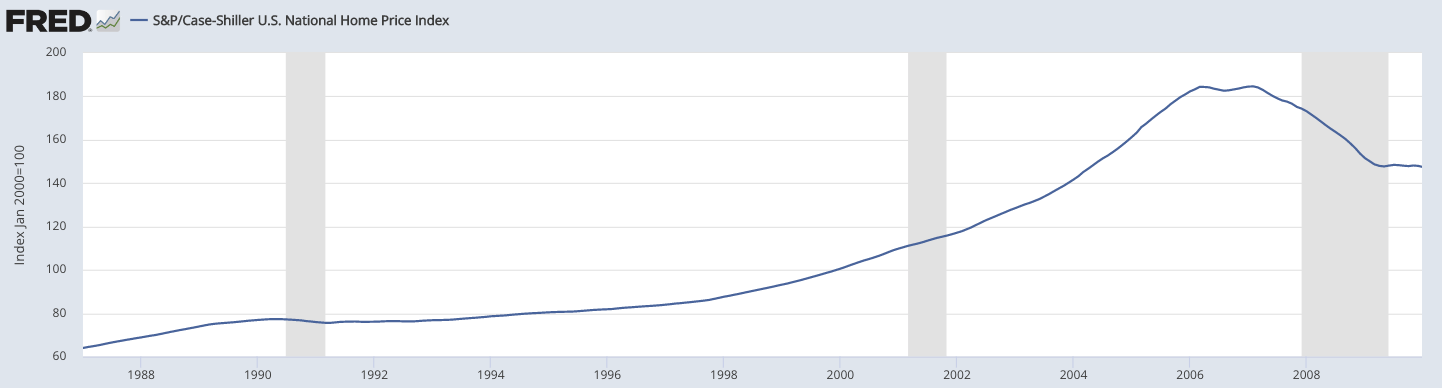

Data from the Federal Reserve shows that the Case-Shiller home price index increased by 125% between 1996 and 2006, outpacing income growth and rent increases.

Homeownership rates during this period also reached a historic high of 69.2% in 2004, compared to the average rate of 64% from 1965 to 1995, according to the US Census Bureau.

S&P/Case-Shiller U.S. National Home Price Index

Causes of the Housing Bubble

Deregulation

One of the key causes of the housing bubble was deregulation in the financial industry.

The Gramm-Leach-Bliley Act of 1999 removed barriers between investment banks and commercial banks, leading to a proliferation of complex and risky financial products like mortgage-backed securities.

Subprime Lending

Subprime lending was another major cause of the bubble.

Subprime loans, which are loans made to borrowers with low credit scores, rose from 8% of all mortgages in 2003 to 20% in 2006, according to the Federal Reserve.

These loans carried high-interest rates and were often adjustable-rate mortgages (ARMs), meaning that the interest rate could increase significantly after an initial period.

Overvaluation

Finally, the overvaluation of properties contributed to the housing bubble.

The price-to-rent ratio, a measure of the profitability of owning a house, was 32% above its historical average by the end of 2005 according to the OECD.

The Financial Crisis of 2007-08

When the housing bubble burst, it triggered a financial crisis. Home prices started to decline in 2006, with the Case-Shiller home price index falling by 20% by the end of 2008.

This led to a wave of foreclosures, with more than 3.1 million foreclosure filings reported in 2008, an 81% increase from 2007, according to RealtyTrac.

The crisis spread to the wider financial sector because many financial institutions held mortgage-backed securities that were tied to American real estate.

According to the Financial Crisis Inquiry Report, nearly half of the more than $2 trillion in mortgage-backed securities purchased by financial institutions in 2006 were made up of subprime and other risky loans.

As the value of these securities plummeted, many financial institutions faced significant losses and some, such as Lehman Brothers, even filed for bankruptcy in September 2008. Bear Stearns had to be acquired earlier in the year.

This led to a credit crunch, where banks became unwilling to lend to each other, leading to a freeze in global credit markets.

The Economic Consequences

The financial crisis led to a severe global recession, with world GDP growth falling from 4% in 2007 to -0.1% in 2009 according to the World Bank.

In the US, the unemployment rate jumped from 5% in December 2007 to a peak of 10% in October 2009, according to the Bureau of Labor Statistics.

Lessons for Today’s Traders

Here are some lessons that traders and investors can take from that time:

Diversification

As the saying goes, don’t put all your eggs in one basket.

This principle became especially relevant during the crisis as those who had their investments concentrated in real estate or financial sector stocks were hit hard.

Understanding Investments

Before trading or investing in a product, it’s important to understand it fully.

The crisis was partially caused by the sale and purchase of complex derivatives that many otherwise sophisticated traders and investors didn’t fully understand.

Risk Management

The crisis highlighted the importance of having effective risk management strategies in place.

This might involve diversifying, using options, or setting stop losses.

Be Skeptical of Hype

Just because everyone else is investing in something doesn’t mean it’s a good idea.

Many people got caught up in the housing hype, and when the bubble burst, they were left holding assets worth less than they paid for them.

Market Cycles

All markets go through cycles of boom and bust.

Being aware of these cycles can help inform investment decisions and prevent panic when a downturn does happen.

Regulatory Environment

Changes in government policy and regulation can have significant effects on investment sectors.

The deregulation of certain parts of the financial industry played a role in the crisis.

Debt Levels

High levels of debt can make an investment or an entire market more vulnerable to downturns.

Many homeowners and financial institutions were over-leveraged during the bubble, which contributed to the severity of the crisis.

Long-Term Perspective

Investing and even trading should be seen as a long-term process.

Holding onto quality investments for the long-term can still result in gains.

As the old cliche goes, time in the market is a better strategy than market timing.

Impact of Financial Institutions

Large financial institutions can both positively and negatively affect the market.

During the crisis, the behaviors of several large banks significantly contributed to market instability.

Their overleveraging meant small changes in the equity position can lead to insolvency.

So when their exposures to the housing bubble dropped in value, some went under or required external support.

Quality Matters

In a downturn, quality assets generally perform better than lower-quality ones.

This was particularly seen in the difference in performance between prime and subprime mortgages during the crisis.

How Did Portfolios Do Through the Financial Crisis?

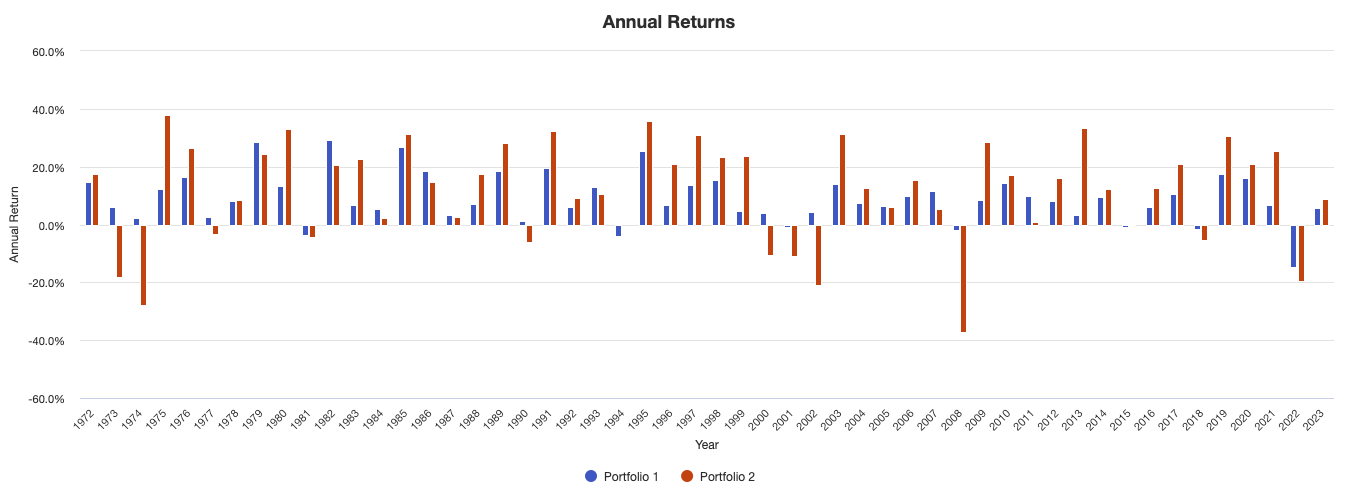

In our other studies of historical market bubbles and crashes (linked below), we looked through two basic portfolios – one that’s well-diversified and one that’s not (full exposure to the stock market).

Consider this simple three-asset portfolio:

Portfolio 1

- 35% Stocks

- 50% 10-Year Treasury Bonds

- 15% Gold

Versus:

Portfolio 2

- 100% Stocks

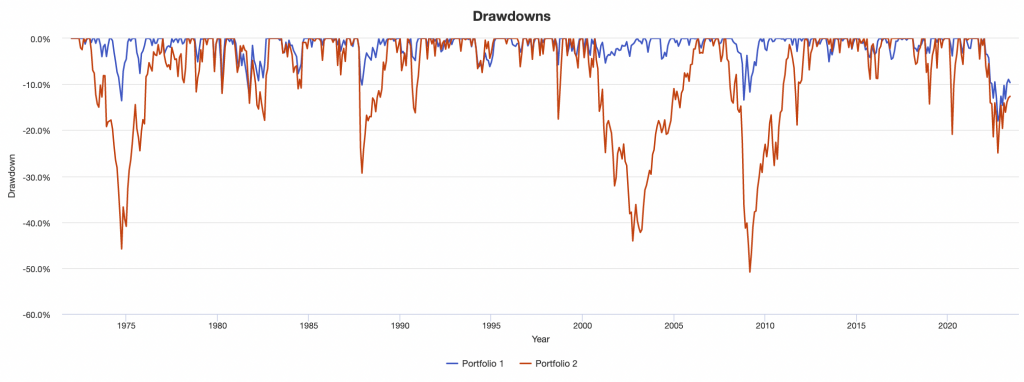

We can see that from 2007-09 there was about a 50% drawdown for a diversified basket of stocks (red line).

However, the diversified portfolio had a much more modest drawdown of 13-14%.

We look at how it did specifically during the 2007-09 financial crisis:

Historical Market Stress Periods

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 |

|---|---|---|---|---|

| Oil Crisis | Oct 1973 | Mar 1974 | -2.65% | -12.61% |

| Black Monday Period | Sep 1987 | Nov 1987 | -10.13% | -29.34% |

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% | -3.72% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% | -17.57% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% | -44.11% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% | -50.89% |

The max drawdown for the diversified portfolio was 13.4% vs. 50.9% for the stocks portfolio.

For a trader who bought at the top of the mania in March 2000, the fall was eventually 78% by October 2002.

We can see that the diversified portfolio lost just a small amount in 2008 while the stocks portfolio lost 37% that year.

FAQs – US Housing Bubble & Financial Crisis of 2007-08

What was the US Housing Bubble and Financial Crisis of 2007-08?

The US Housing Bubble was a period of excessive speculation in the housing market that peaked around 2006 and led to a sharp fall in home prices.

The bubble was fuelled by various factors, including low interest rates, subprime lending (loans to individuals with poor credit histories), and lax regulatory oversight.

The bursting of this bubble in 2007 precipitated the Financial Crisis of 2008, which saw the failure of several major financial institutions and led to a significant economic downturn, often referred to as the Great Recession.

It was the most severe financial crisis since the Great Depression.

It also occurred for reasons similar to 1929. There was too much debt coming due relative to income, savings, and new lending available.

Assets were sold to raise cash and a bad market ensued.

What were the main causes of the US Housing Bubble?

Several interlinked factors contributed to the creation of the US Housing Bubble:

- Low interest rates: The Federal Reserve significantly lowered interest rates following the dot-com bubble burst and the September 11 attacks, making borrowing cheaper and encouraging investment in the housing market.

- Loose lending practices: Mortgage lenders, encouraged by the demand for mortgage-backed securities, began offering loans to subprime borrowers—people who wouldn’t typically qualify for a standard mortgage loan due to poor credit history.

- Securitization of mortgages: Financial institutions bundled individual mortgages into mortgage-backed securities (MBS) and collateralized debt obligations (CDOs), which were then sold to investors. This process increased the liquidity of the mortgage market, incentivizing further lending.

- Inadequate regulation: The regulatory environment did not adequately control the risks associated with these practices. There was a lack of transparency in the financial products being sold, and regulatory agencies struggled to keep up with the innovations in the market.

- Speculative behavior: With rising home prices, both homeowners and investors increasingly viewed real estate as a safe and lucrative investment, fueling demand and driving prices up further.

What were the immediate impacts of the Financial Crisis of 2007-08?

The immediate impacts of the financial crisis were widespread and severe:

- Banking failures: Several major financial institutions collapsed or were bought out, including Lehman Brothers, Bear Stearns, and Merrill Lynch. This created volatility in the global financial markets.

- Credit crunch: Due to the crisis, banks and lenders became wary of lending, leading to a sharp contraction in the availability of credit. This had a knock-on effect on businesses and consumers, leading to bankruptcies and lower consumer spending.

- Global Recession: The crisis precipitated a severe global economic downturn, known as the Great Recession. Unemployment rates soared, many businesses went under, and international trade slowed significantly.

What were the long-term consequences of the Financial Crisis of 2007-08?

The long-term consequences of the crisis were equally significant:

- Regulatory reforms: In response to the crisis, a host of new financial regulations were enacted to prevent a similar occurrence in the future. In the US, this included the Dodd-Frank Wall Street Reform and Consumer Protection Act.

- Slow economic recovery: The recovery from the recession was slow and uneven, with impacts felt for many years after the crisis. This included sustained high unemployment rates, slow wage growth, and increased government debt due to bailout efforts.

- Shifts in economic thinking: The crisis led to a reevaluation of many mainstream economic theories, particularly those regarding the efficiency of markets and the role of government intervention.

What lessons were learned from the US Housing Bubble and the Financial Crisis of 2007-08?

Several key lessons were learned from the crisis:

- Importance of financial regulation: The crisis highlighted the critical role that effective regulation plays in maintaining the stability of financial systems.

- Dangers of financial innovation without understanding: Many of the financial products involved in the crisis, such as complex derivatives, were poorly understood by both the institutions selling them and the traders/investors buying them.

- Risk of speculation: The crisis underlined the dangers of speculative bubbles, where the price of an asset rises well above its intrinsic value based on future expectations.

- Interconnectedness of global economies: The crisis demonstrated how deeply interconnected the global economy has become, with the financial troubles in the US quickly spreading to affect the entire world.

- Significance of responsible lending: The crisis underscored the importance of responsible lending practices and the need for thorough credit checks before granting loans.

Conclusion

The US Housing Bubble and the Financial Crisis of 2007-08 had significant impacts on the global economy and markets.

While the crisis led to important reforms and highlighted key lessons, it remains a stark reminder of the dangers of excessive risk-taking, inadequate regulation, and the need for more balanced portfolios.

Related Content on Historical Financial Bubbles and Disasters

- Tulip Mania

- South Sea Bubble & Mississippi Company

- Panic of 1837

- UK Railway Mania

- Erie War

- 1873-1896 Depression

- Panic of 1907

- Wall Street Crash of 1929

- 1973 Oil Crisis

- 1979 Energy Crisis

- 1980s S&L Crisis

- Black Monday (1987)

- Asian Financial Crisis

- Dot-Com Bubble