Dot-Com Bubble – Causes and Lessons for Today’s Portfolios

The Dot-Com Bubble, which took place from 1995 to 2001, is often used as a textbook example of a speculative bubble.

A speculative bubble occurs when the price of an asset, in this case tech stocks, significantly surpasses their intrinsic value.

The era was marked by a rapid rise in equity markets fueled by investments in internet-based companies during the bull market of the late 1990s.

At the height of the bubble, in March 2000, the NASDAQ index, which includes many technology companies, reached a peak of 5,048.62, a more than 400% rise from 1995.

However, from March to October 2002, the bubble “burst,” and the NASDAQ had fallen by 78% from its peak.

This dramatic fall led to significant financial losses for investors and traders (day trading online was in its early stages) and caused many dot-com companies to go out of business when their business model didn’t work and they couldn’t raise capital.

Key Takeaways – Dot-Com Bubble

- The Dot-Com Bubble was a speculative market bubble in the late 1990s fueled by over-optimism and speculation around internet-based companies.

- It resulted in a rapid rise and subsequent collapse in the value of tech stocks.

- Lessons from the Dot-Com Bubble include the importance of sustainable business models, diversification in portfolios, avoiding market timing, and maintaining emotional discipline in trading/investing.

- Investors can apply these lessons by thoroughly researching and analyzing companies, diversifying their portfolios, focusing on sustainable business models or indexing, sitting out speculative fevers, and making decisions based on sound analysis rather than what sounds good or is promoted well.

Key Statistics – Dot-Com Bubble

- The NASDAQ Composite index, which includes many technology companies, peaked at 5,048.62 in March 2000, representing over a 400% increase from 1995.

- By October 2002, the NASDAQ Composite had fallen 78% from its peak, marking the end of the Dot-Com Bubble.

- In a 2000 report by the Bank for International Settlements, it was found that over half of the dot-com companies in 1999 were not making a profit.

- Venture capital investment into tech startups dramatically increased from $11.4 billion in 1995 to a staggering $105 billion in 2000, according to a report by PricewaterhouseCoopers.

- Many investors, due to a lack of portfolio diversification, faced significant financial losses when the bubble burst.

- A large number of companies were heavily overvalued despite lacking sustainable business models or clear paths to profitability.

- The bubble highlighted the inherent risk of market timing, with many investors buying at the peak and suffering losses when the bubble burst.

Causes of the Dot-Com Bubble

Over-optimism and Speculation

One of the major factors that led to the Dot-Com Bubble was the over-optimism and speculation around the potential of the internet.

Many investors, buoyed by the promise of the new digital age, began investing heavily in any company with a “.com” in its name, even if it had no profits or, in some cases, no revenue.

According to a 2000 report by the Bank for International Settlements, more than half of the dot-com companies in 1999 were not making a profit.

Easy Access to Venture Capital

Another factor that contributed to the bubble was the easy access to venture capital.

Venture capitalists, hoping to capitalize on the internet boom, poured billions into startups with little more than vague business plans and no clear path to profitability.

Internet traffic became a metric that suggested potential success.

According to a report by PricewaterhouseCoopers, venture capitalists invested $105 billion in tech start-ups in 2000, up from just $11.4 billion in 1995.

Irrational Exuberance

The term “Irrational Exuberance” was coined by former Federal Reserve Board Chairman Alan Greenspan, and encapsulates the euphoria and irrationality that characterized the period. The term is still widely used today.

Investors were buying up dot-com stocks at high prices, believing they would continue to rise and ignoring the warning signs of a bubble.

This resulted in a huge mismatch between the prices of these stocks and the underlying value of the companies.

Lessons for Today’s Portfolios

Something Revolutionary Can Still Be a Bad Investment

Even revolutionary ideas or technologies can make for poor investments if their valuations aren’t commensurate with their financial performance.

This can occur if a company can’t successfully monetize its product, if the market isn’t ready, can’t control its costs and make the business viable, or if the company is overvalued based on hype and speculation.

So, despite the potential disruptive impact, the company’s business viability and valuation matter significantly in investment decisions.

Diversification

The Dot-Com Bubble serves as a reminder of the importance of diversification.

During the bubble, many traders/investors had portfolios that were heavily weighted toward tech stocks.

When the bubble burst, these traders/investors suffered significant losses.

To avoid this, it’s important to have a diversified portfolio that spans different asset classes and sectors.

Sustainable Business Models

Another key lesson from the Dot-Com Bubble is the importance of sustainable business models.

During the bubble, many companies were overvalued despite having no clear path to profitability. Some still had little to no revenue.

So, it’s important to study the business models of the companies they’re investing in.

Market Timing

The Dot-Com Bubble also highlights the dangers of trying to time the market.

Many investors bought stocks at the peak of the bubble, only to see their value plummet when the bubble burst.

Time in the market – rather than market timing – is what usually yields the best results.

Emotional Discipline

Lastly, the bubble underscores the importance of emotional discipline in investing.

Many investors got caught up in the euphoria of the dot-com era and made irrational decisions they later regreted.

It’s hard to sit on the sidelines when everyone else is making money almost every day.

But in any game of probability, there’s such a thing as “good outcome but bad decision” just as there’s “bad outcome but good decision”

Investors/traders need to keep their emotions in check and make decisions based on thorough research and analysis, not hype and speculation.

How Did Portfolios Do Through the Dot-Com Bubble?

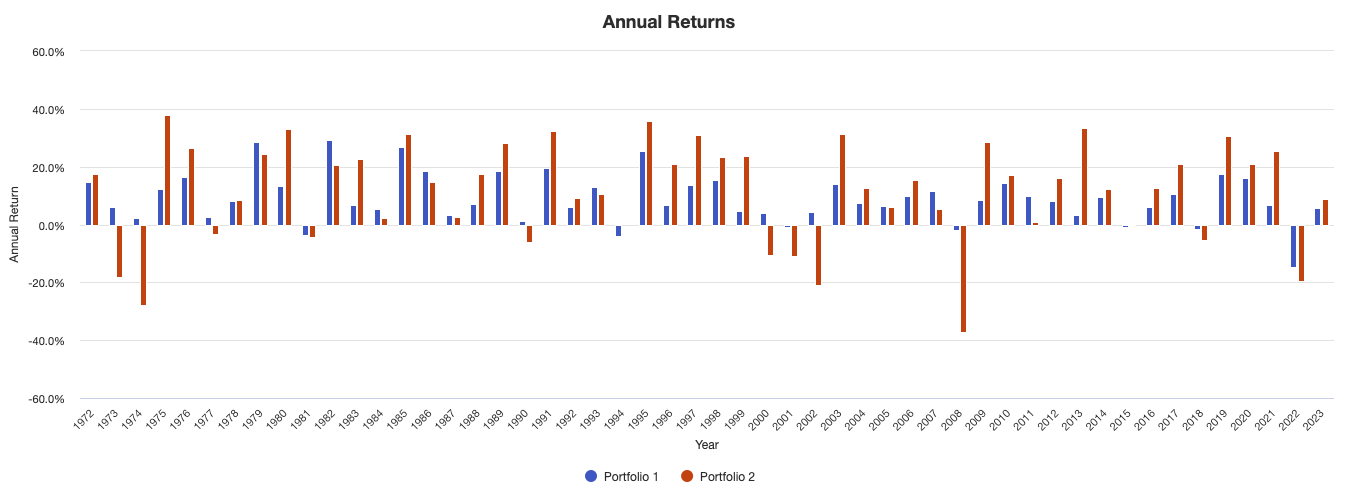

Like in other articles on historical market bubbles and crashes, we looked through two basic portfolios – one that’s diversified and one that’s not.

Consider this simple three-asset portfolio:

Portfolio 1

- 35% Stocks

- 50% 10-Year Treasury Bonds

- 15% Gold

Versus:

Portfolio 2

- 100% Stocks

We can see that from 2000-02 there was a 44% drawdown for a diversified basket of stocks (red line). (Tech concentration would have resulted in a 78% drawdown.)

However, the diversified portfolio didn’t see drawdowns of this nature at all.

We look at how it did specifically during the Dot-Com Bubble specifically:

Historical Market Stress Periods

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 |

|---|---|---|---|---|

| Oil Crisis | Oct 1973 | Mar 1974 | -2.65% | -12.61% |

| Black Monday Period | Sep 1987 | Nov 1987 | -10.13% | -29.34% |

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% | -3.72% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% | -17.57% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% | -44.11% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% | -50.89% |

The max drawdown for the diversified portfolio was 5% vs. 44% for the stocks portfolio.

For a trader who bought at the top of the mania in March 2000, the fall was eventually 78% by October 2002.

The stock market was down for three consecutive years for the all-stocks portfolio (2000, 2001, and 2002).

On the other hand, the diversified portfolio had modest gains in 2000 and 2002 and was roughly breakeven in 2001.

FAQs – Dot-Com Bubble

What was the Dot-Com Bubble?

The Dot-Com Bubble, also known as the Internet Bubble or Tech Bubble, was a speculative market bubble centered around the rise of internet-based companies that occurred in the late 1990s and burst in the early 2000s.

It was characterized by the rapid increase and then collapse in the value of tech and internet-based companies, often regardless of their profitability or business model.

What were the primary causes of the Dot-Com Bubble?

The Dot-Com Bubble was primarily caused by speculation and a widespread belief that internet-based businesses would revolutionize the economy.

This led to a flood of investment, often in startups with unproven business models.

Other contributing factors include the availability of venture capital funding, the growth of online trading, which made it easier for individuals to trade or invest in stocks, and a lack of regulatory oversight.

How did the Dot-Com Bubble affect the stock market?

The Dot-Com Bubble had a significant impact on the stock market, particularly the NASDAQ, where many tech and internet-based companies were listed.

During the height of the bubble, the NASDAQ rose dramatically.

However, when the bubble burst, the index fell from a peak of over 5,000 in March 2000 to just over 1,000 by October 2002 – a drop of approximately 78%.

How did the Dot-Com Bubble affect the economy?

The Dot-Com Bubble had a mixed effect on the economy.

During the boom, it led to job creation, particularly in the tech sector, and stimulated economic growth.

However, when the bubble burst, it triggered a recession in the US and other parts of the world.

This led to job losses, particularly in the tech sector, and a slowdown in economic growth.

What were some of the most notable companies that collapsed during the Dot-Com Bubble?

Several high-profile companies collapsed during the Dot-Com Bubble. Some of these include Pets.com, Webvan, and eToys.com.

These companies raised significant amounts of capital and had high-profile initial public offerings (IPOs), but they were unable to turn a profit and eventually went bankrupt.

What lessons can today’s investors learn from the Dot-Com Bubble?

The Dot-Com Bubble offers several important lessons for today’s investors.

First, it highlights the dangers of speculation and investing in companies with unproven business models.

Second, it underscores the importance of diversification as a way to mitigate risk.

Third, it illustrates the potential for markets to become disconnected from fundamental economic realities.

How can investors apply these lessons to their current portfolios?

Investors can apply these lessons by being cautious about investing in hype-driven sectors or companies with unproven business models.

They should also aim for a diversified portfolio, which can help to mitigate the risk of a single sector or company’s failure.

Finally, investors should keep an eye on the broader economic fundamentals and be wary of markets that appear to be significantly overvalued.

How can the Dot-Com Bubble inform regulatory policies?

The Dot-Com Bubble underscores the need for strong regulatory oversight of financial markets.

This can help to prevent excessive speculation and protect investors.

Regulators may also need to consider the unique challenges posed by new technologies and business models, and adapt their policies accordingly.

Are there parallels between the Dot-Com Bubble and the AI craze of the 2020s?

While there are some similarities between the Dot-Com Bubble and certain aspects of the AI craze – such as the rise of technology companies and high levels of speculation – there are also important differences.

The financial landscape has evolved considerably since the early 2000s, with changes in regulations, investment practices, and the broader economy.

Therefore, while historical events like the Dot-Com Bubble can provide valuable lessons, they don’t necessarily predict future market behavior.

Related Content on Historical Financial Bubbles and Disasters

- Tulip Mania

- South Sea Bubble & Mississippi Company

- Panic of 1837

- UK Railway Mania

- Erie War

- 1873-1896 Depression

- Panic of 1907

- Wall Street Crash of 1929

- 1973 Oil Crisis

- 1979 Energy Crisis

- 1980s S&L Crisis

- Black Monday (1987)

- Asian Financial Crisis