Asian Financial Crisis (1990s) – Causes & Lessons for Today’s Portfolios

In the late 1990s, the Asian Financial Crisis swept through several East Asian nations, causing an economic downturn that was felt globally.

The crisis began in Thailand in 1997 with the collapse of the Thai baht, following the decision by the government to unpeg the currency from the US dollar.

It then rapidly spread to neighboring countries, triggering a chain of financial disasters that culminated in a regional economic crisis.

It affected currencies, stock markets, and other asset classes, causing economic disruption, social unrest, and political upheaval.

Key Takeaways – Asian Financial Crisis (1990s)

- Excessive foreign debt, currency devaluation, and financial liberalization without strong regulation were the main causes of the Asian Financial Crisis in the late 1990s.

- The crisis resulted in severe economic contraction, falling stock markets, and widespread social and political turmoil across Asian countries.

- Lessons for today’s portfolios include the importance of diversification, risk management, and contingency planning, as well as the need to invest in countries with strong regulatory frameworks and governance (or be commensurately compensated for the excess risk).

Key Statistics – Asian Financial Crisis (1990s)

- The crisis began in 1997 with the collapse of the Thai baht, leading to a rapid devaluation of the currency by 50% from July 1997 to January 1998.

- The GDP growth rate for the region fell from an average of 8% in 1996 to -7.7% in 1998, according to the International Monetary Fund.

- Indonesia experienced the most significant economic contraction, with a decline of 13.1% in 1998.

- The MSCI Asia ex Japan Index, a stock market index of Asia-Pacific shares excluding Japan, declined by 59% in 1997.

- The total capital inflow into East Asian economies increased from $20 billion in 1985 to $110 billion in 1995, according to the World Bank.

- The International Monetary Fund provided rescue packages totaling about $120 billion to the worst-hit economies.

Causes of the Asian Financial Crisis

Excessive Foreign Debt

One of the primary causes of the Asian Financial Crisis was the excessive borrowing of foreign debt by Asian countries.

During the early 1990s, there was a massive influx of foreign capital into Asian economies (investors/traders seeking new, higher-returning markets).

According to the World Bank, the total capital inflow into East Asian economies increased from $20 billion in 1985 to $110 billion in 1995.

This capital influx led to rapid economic growth, but it also increased the vulnerability of these economies to external shocks.

Currency Devaluation

The crisis was triggered by the decision of the Thai government to unpeg the Thai baht from the US dollar.

This decision led to a rapid devaluation of the currency.

From July 1997 to January 1998, the value of the Thai baht against the US dollar fell by 50%.

Why did the Thai government unpeg the Thai baht from the US dollar?

The Thai government made the decision to unpeg the Thai baht from the US dollar as part of their efforts to liberalize their financial system and promote economic growth.

Prior to the crisis, the Thai baht had been pegged to a fixed exchange rate with the US dollar, which provided stability but also limited the government’s ability to respond to economic pressures. (We write about these trade-offs more in this article.)

By unpegging the Thai baht, the government aimed to enhance their monetary policy autonomy and allow the currency to float freely based on market forces.

They believed that a flexible exchange rate would make the Thai baht more competitive and help boost exports, thereby stimulating economic growth.

However, the decision to unpeg the currency without adequate safeguards and regulation in place exposed vulnerabilities in the Thai economy and triggered a speculative attack on the baht, leading to its rapid devaluation and ultimately contributing to the wider Asian Financial Crisis.

Financial Liberalization without Strong Regulation

Another contributing factor to the crisis was the financial liberalization pursued by several Asian countries without sufficient financial regulation and oversight.

In their pursuit of economic growth, these countries liberalized their financial systems, allowing for easier access to foreign capital.

However, this liberalization was not accompanied by robust regulatory frameworks to oversee the financial sector, resulting in financial instability and vulnerability to crisis.

Impact of the Asian Financial Crisis

Economic Contraction

The crisis resulted in severe economic contraction across Asia.

According to the International Monetary Fund, the GDP growth rate for the region fell from an average of 8% in 1996 to -7.7% in 1998.

Indonesia, the hardest hit, experienced an economic contraction of 13.1% in 1998.

Impact on Stock Markets

Stock markets across the region plummeted.

The MSCI Asia ex Japan Index, a stock market index of Asia-Pacific shares excluding Japan, declined by 59% in 1997.

This wiped out billions of dollars in wealth, affecting both institutional and individual investors.

Lessons for Today’s Portfolios

Importance of Diversification

One of the key lessons for today’s portfolios from the Asian Financial Crisis is the importance of diversification.

During the crisis, investors who had their portfolios heavily concentrated in Asian markets suffered substantial losses.

Diversification, both geographically and across asset classes, can help mitigate such risks and provide a buffer against such crises.

Risk Management and Contingency Planning

The Asian Financial Crisis underscored the importance of risk management and contingency planning in investment strategies.

Investors need to understand the risks associated with different investments, especially in volatile and emerging markets.

They should also have contingency plans in place for potential market downturns.

Need for Strong Regulation

The crisis highlighted the critical role of strong financial regulation in maintaining stability and preventing crises.

For traders/investors, it underscored the importance of investing in countries with robust regulatory frameworks and strong governance.

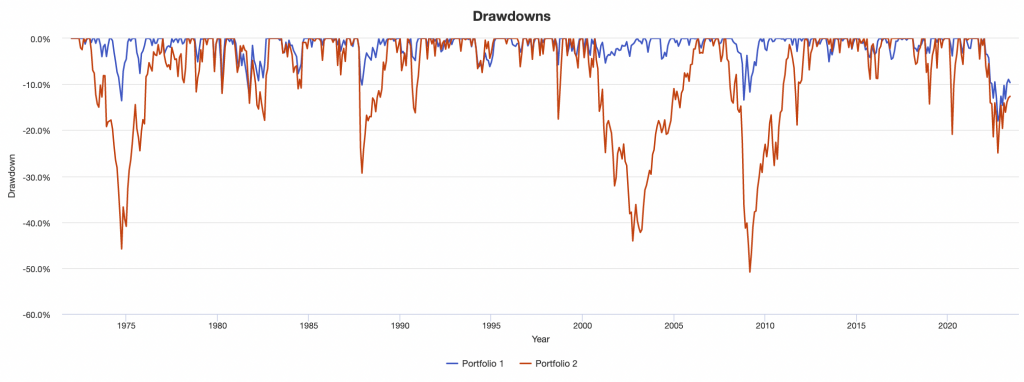

How Did Portfolios Do Through the Asian Crisis?

Like in other scenarios, a portfolio that wasn’t heavily concentrated in anything did better than one that was.

Consider this simple three-asset portfolio:

Portfolio 1

- 35% Stocks

- 50% 10-Year Treasury Bonds

- 15% Gold

Versus:

Portfolio 2

- 100% Stocks

We can see that in 1998 there was a nearly 20% drawdown for stocks (red line) during the Russian default and LTCM crisis.

LTCM had exposure to Russian bonds, so these crises intermixed. With LTCM’s leverage, it threatened the US financial system due to the sheer exposure.

However, for the diversified portfolio (blue line), neither the Asian crisis nor the Russian default/LTCM crisis hit them too significantly.

We look at how it did specifically during the Asian Crisis specifically:

Historical Market Stress Periods

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 |

|---|---|---|---|---|

| Oil Crisis | Oct 1973 | Mar 1974 | -2.65% | -12.61% |

| Black Monday Period | Sep 1987 | Nov 1987 | -10.13% | -29.34% |

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% | -3.72% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% | -17.57% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% | -44.11% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% | -50.89% |

It was about a six-month recovery period, even though the market losses weren’t that much.

For those who had emerging market exposure it would have been different.

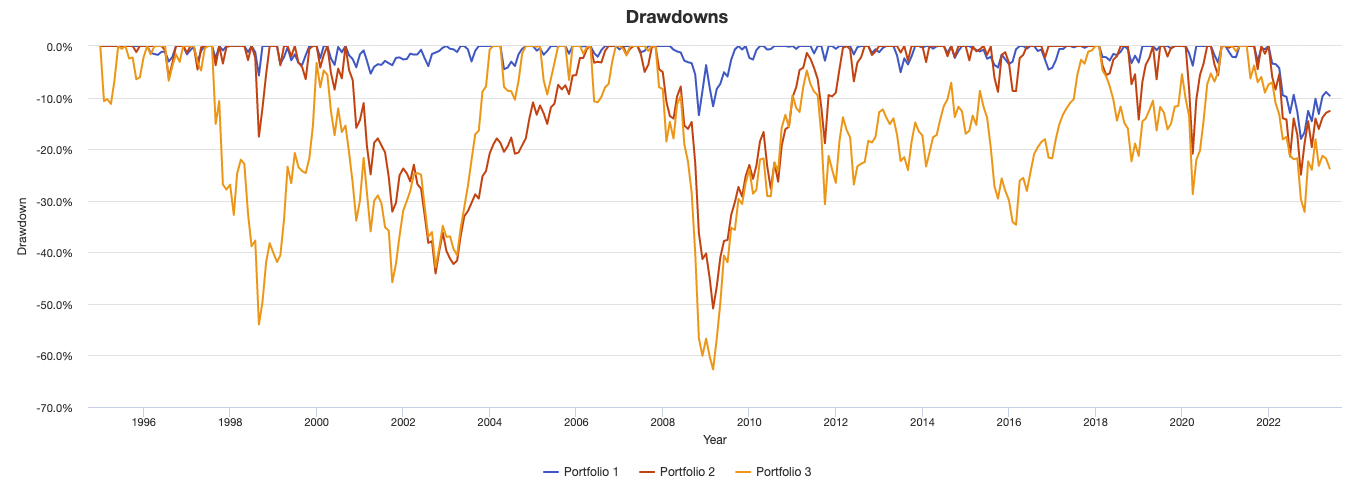

When can see this when we add in a pure emerging markets portfolio:

Portfolio 3

- 100% Emerging Market Equities

We can see the much steeper drawdowns (yellow line):

The drawdown during this time was 33%, compared to modest losses for the diversified and US stocks portfolio:

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 | Portfolio 3 |

|---|---|---|---|---|---|

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% | -3.72% | -32.75% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% | -17.57% | -26.12% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% | -44.11% | -43.10% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% | -50.89% | -62.70% |

If we look at the drawdowns chart for Portfolio 3, the recovery period was 6-7 years:

Drawdowns for Portfolio 3

| Rank | Start | End | Length | Recovery By | Recovery Time | Underwater Period | Drawdown |

|---|---|---|---|---|---|---|---|

| 1 | Nov 2007 | Feb 2009 | 1 year 4 months | Dec 2017 | 8 years 10 months | 10 years 2 months | -62.70% |

| 2 | Aug 1997 | Aug 1998 | 1 year 1 month | Jan 2004 | 5 years 5 months | 6 years 6 months | -53.99% |

| 3 | Jul 2021 | Oct 2022 | 1 year 4 months | -32.16% | |||

| 4 | Feb 2018 | Mar 2020 | 2 years 2 months | Nov 2020 | 8 months | 2 years 10 months | -28.72% |

| 5 | Jan 1995 | Mar 1995 | 3 months | May 1995 | 2 months | 5 months | -11.22% |

| 6 | May 2006 | Jun 2006 | 2 months | Nov 2006 | 5 months | 7 months | -10.92% |

| 7 | Apr 2004 | Jul 2004 | 4 months | Oct 2004 | 3 months | 7 months | -10.41% |

| 8 | Mar 2005 | Apr 2005 | 2 months | Jul 2005 | 3 months | 5 months | -9.40% |

| 9 | Jul 1996 | Jul 1996 | 1 month | Nov 1996 | 4 months | 5 months | -6.73% |

| 10 | Oct 2005 | Oct 2005 | 1 month | Nov 2005 | 1 month | 2 months | -6.57% |

| Worst 10 drawdowns included above | |||||||

This shows how concentrated portfolios tend to have longer underwater periods.

FAQs – Asian Financial Crisis (1990s)

What was the Asian Financial Crisis of the 1990s?

The Asian Financial Crisis, also known as the “Asian Contagion,” was a series of currency devaluations and other economic events that began in July 1997 with the collapse of the Thai baht.

It subsequently spread to many Asian countries, leading to widespread financial and social issues.

The crisis exposed longstanding weaknesses in the countries’ financial systems, where fast-paced growth had been fueled by high levels of debt and a speculative bubble in real estate and stock markets.

What were the main causes of the Asian Financial Crisis?

Several intertwined factors led to the Asian Financial Crisis:

- Speculative Bubble: In the years leading up to the crisis, there was a significant inflow of foreign capital into Asian economies. This led to real estate and stock market bubbles.

- Financial Liberalization: Asian economies opened up their capital markets without sufficient regulatory oversight. This exposed them to volatile international market forces and speculative attacks.

- Fixed Exchange Rates: Countries like Thailand, Indonesia, and South Korea had their currencies pegged to the US dollar. When speculators began doubting these pegs’ stability, they started to massively sell the domestic currencies, putting pressure on the fixed exchange rates.

- High Levels of Private Debt: Many companies in these countries were heavily leveraged, often due to speculative real estate investments. When the bubble burst, they were unable to meet their financial obligations.

How did the crisis affect the economies of the affected Asian countries?

The crisis had severe and far-reaching effects on the economies of the affected countries.

They experienced a sharp contraction in their economies, accompanied by a rapid decline in their currencies’ value.

As a result, their stock markets crashed, and foreign investors pulled out their investments.

Many companies and banks went bankrupt due to heavy indebtedness, and the unemployment rates surged.

The crisis also resulted in political upheaval in some countries, including Indonesia and South Korea.

How did the Asian Financial Crisis end?

The crisis began to subside when the International Monetary Fund (IMF) stepped in late 1997 with a series of rescue packages for the worst-hit economies, totaling about $120 billion.

These packages came with strict conditions, including deep cuts in government spending and reforms in the financial sector.

Although the IMF’s involvement was initially met with criticism, it eventually helped to stabilize the currencies and restore investor confidence.

By 1999, most economies started to recover, although the social and political effects lasted much longer.

What lessons did investors and policy makers learn from the Asian Financial Crisis?

The crisis underscored the need for strong financial regulation and oversight, particularly in economies that are opening their capital markets.

It also highlighted the risks of rapid credit expansion and asset bubbles, and the importance of maintaining sound fiscal and monetary policies.

For traders/investors, the crisis underlined the importance of diversification, risk management, and understanding the macroeconomic fundamentals of the markets in which they invest.

How can the lessons from the Asian Financial Crisis be applied to today’s portfolios?

There are several ways that the lessons from the Asian Financial Crisis can inform investment strategies today:

- Diversification: Investors should ensure their portfolios are diversified across different asset classes and geographic regions to spread risk.

- Risk Management: Investors should continually monitor and manage the risks in their portfolios, including the risk of currency fluctuations, political instability, and changes in macroeconomic policies.

- Understanding Macroeconomic Fundamentals: Investors should take the time to understand the macroeconomic conditions of the markets in which they invest, including the stability of their financial systems and their vulnerability to external shocks.

- Long-Term Perspective: Short-term market volatility can be distressing, but investors should remember that markets tend to recover over the long term. It’s important to remain patient and stick to your investment plan.

- Avoiding Speculative Bubbles: It’s important to avoid getting caught up in speculative bubbles that can lead to significant losses when they burst. Be cautious of investments that seem too good to be true or that are based on overly optimistic projections. Most bets in the market, from an expected value standpoint, are a lot closer than most think.

What are the parallels between the Asian Financial Crisis and the financial crises of the 21st century?

There are some parallels between the Asian Financial Crisis and other financial crises, such as the Global Financial Crisis of 2008.

These include the rapid expansion of credit, the creation of asset bubbles, inadequate regulation and oversight of the financial sector, and the sudden withdrawal of foreign capital.

However, each crisis also has its unique characteristics and factors, underscoring the complexity of financial crises and the difficulty in predicting them.

Conclusion

The Asian Financial Crisis of the 1990s was a watershed event in global economics that had profound implications for financial management and investment strategies.

The crisis demonstrated the dangers of excessive foreign debt, the risks of rapid financial liberalization without strong regulation, and the impact of currency devaluation.

For today’s investors, the lessons from the crisis about the importance of diversification, risk management, and strong regulation remain highly relevant.

Related Content on Historical Financial Bubbles and Disasters

- Tulip Mania

- South Sea Bubble & Mississippi Company

- Panic of 1837

- UK Railway Mania

- Erie War

- 1873-1896 Depression

- Panic of 1907

- Wall Street Crash of 1929

- 1973 Oil Crisis

- 1979 Energy Crisis

- 1980s S&L Crisis

- Black Monday (1987)