Black Monday (1987) – Causes & Lessons for Today’s Portfolios

The financial world was shaken on October 19, 1987, a day that is infamously known as Black Monday.

The largest one-day percentage drop in the history of the Dow Jones Industrial Average occurred, shedding 22.6% of its value in a single day.

This day marked a significant event in financial history, drawing global attention to the vulnerabilities of the market.

Understanding the causes and lessons from Black Monday is important in managing contemporary investment portfolios.

Key Takeaways – Black Monday (1987)

- The event underscores the importance of portfolio diversification and systemic risk management, as these strategies help mitigate the impact of significant or sudden market downturns.

- The regulatory improvements post-Black Monday, such as the introduction of circuit breakers, highlight the need for adaptive and protective mechanisms in today’s financial markets to safeguard against extreme market volatility.

- Diversified portfolios did well despite the one-day crash. (We run a test of two portfolios.)

Key Statistics – Black Monday (1987)

- The Dow Jones Industrial Average (DJIA) fell by 22.6% on October 19, 1987, marking the largest one-day percentage drop in its history.

- Global markets followed suit with falls of similar magnitude: Hong Kong fell by 45.5%, Australia 41.8%, Spain 31%, United Kingdom 26.5%, and Canada 22.5%.

- By the end of October, markets in Hong Kong had fallen 45.8%, Australia 41.8%, Spain 31%, the United Kingdom 26.4%, the United States 22.7%, and Canada 22.5%.

- The SEC reported that program trades made up nearly 60% of trading volume on the New York Stock Exchange (NYSE) on Black Monday.

- Prior to the crash, the US trade deficit in September 1987 stood at $15.7 billion, significantly higher than expected.

- From the start of 1987 to October 1987, the U.S. dollar had depreciated by approximately 18% against the German Mark and the Japanese Yen.

Causes of Black Monday

Globalization of Financial Markets

Globalization played a significant role in the occurrence of Black Monday.

The 1980s saw increased interconnectedness among global financial markets.

Any significant economic event had the potential to create ripples across various markets.

On October 15, 1987, the Iranian missile attack on a US warship led to a surge in oil prices.

This event sparked fears about the state of the economy and set the stage for the market crash.

Computerized Trading

The advent of computerized trading, specifically portfolio insurance and program trading, played a role in amplifying the effects of the crash.

Portfolio insurance is a strategy that uses futures contracts to hedge against market risk.

Program trading involves the use of computer algorithms to execute trades when certain market conditions are met.

As the markets started falling, these algorithms triggered massive sell orders, accelerating the market crash.

According to a report by the Securities and Exchange Commission (SEC), program trades made up nearly 60% of trading volume on the New York Stock Exchange (NYSE) on Black Monday.

Economic Indicators

Various economic indicators also played their part in setting the stage for Black Monday.

Inflation fears had been building up due to higher-than-expected trade deficit numbers and a falling US dollar.

In September 1987, the US trade deficit stood at $15.7 billion, significantly higher than market expectations.

Moreover, the dollar had depreciated by approximately 18% against the German Mark and the Japanese Yen from the start of the year to October 1987.

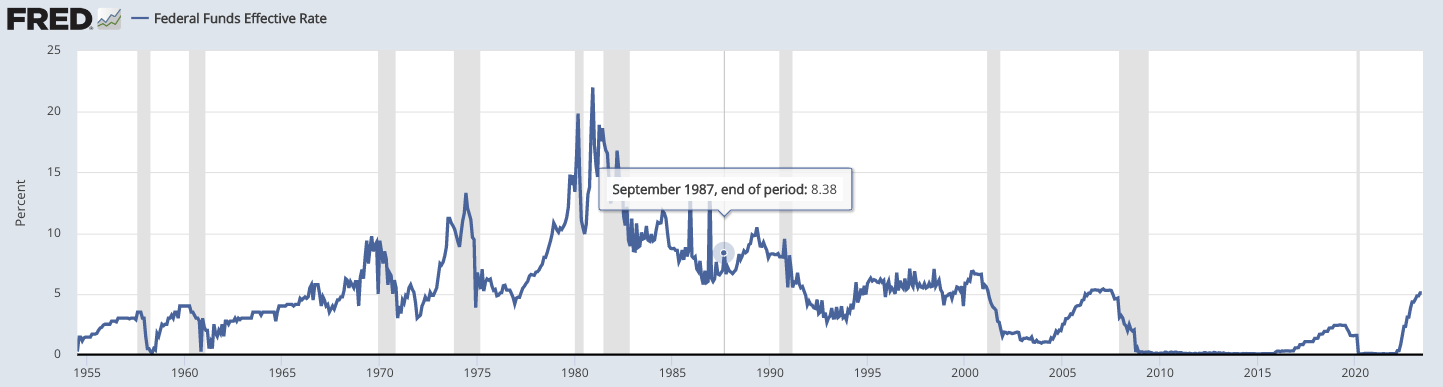

The fed funds rate was 8.25-8.50%.

That means basic cash and short-term bonds would yield relatively well in nominal terms.

Stocks compete against those instruments for investment funds. So if stocks were to yield below that (which can be checked through such measures like the inverse of the P/E ratio), so they become ripe for a cheapening.

In the lead-up to Black Monday, stocks were above 20 earnings, which would suggest less than a 5% forward yield for the next year’s earnings.

This either means more earnings are needed (which can take a while) or price falls.

Overvaluation isn’t enough to trigger price declines, but it can make them more likely.

Lessons from Black Monday

The Importance of Diversification

One of the key lessons from Black Monday is the importance of portfolio diversification.

Investors who had diversified portfolios across different asset classes and geographic locations were less impacted by the crash.

Diversification is not just about owning different stocks, but about spreading investments across asset classes such as bonds, commodities, currencies, and different geographic regions.

Systemic Risk Management

Black Monday highlighted the significance of managing systemic risk.

The crash showed that no market operates in isolation, and a systemic shock can reverberate through all related markets due to their interconnectedness.

Investors and financial institutions now place significant emphasis on understanding and managing systemic risk.

Regulatory Improvements

The crash led to regulatory improvements, such as the introduction of circuit breakers to prevent a repeat of such a drastic market crash.

Circuit breakers are mechanisms designed to temporarily halt trading on an exchange during significant declines to prevent panic selling.

In the aftermath of Black Monday, the SEC introduced circuit breakers in 1988 to offer a cooling-off period during significant market volatility.

Relevance to Today’s Portfolios

Embrace Technology Wisely

While technology and algorithmic trading have evolved significantly since 1987, Black Monday serves as a reminder of their potential adverse impacts.

Investors should be aware of the risks associated with high-frequency trading and automated trading systems.

While these systems can bring efficiency and speed to trading, they can also amplify market volatility.

The flash crash of August 2010 is another episode of faulty technology. Those with “open left tails” in their portfolio (e.g., selling put options) could have been wiped out (some portfolio managers were).

Stay Alert to Global Economic Indicators

Given the interconnectedness of markets and economies, it is crucial to stay abreast of basic economic indicators.

Awareness of macroeconomic indicators such as inflation rates, trade deficits, and currency exchange rates can help in anticipating potential market shifts (e.g., if inflation is above target, central banks are likely to tighten monetary policy).

Understand Risk and Uncertainty

What we don’t know is always more than what we know.

Investors/traders should recognize that while they can manage and prepare for risk, they should also be ready for unknowns that could potentially lead to significant market shifts.

What Role Did Portfolio Insurance Have on the 1987 Crash?

Portfolio insurance was a financial innovation in the 1980s and was widely used leading up to the crash in 1987.

It was a type of program trading designed to use futures contracts to hedge against equity risk.

When the market started to decline, these portfolio insurance strategies would automatically initiate large sell orders in an attempt to limit the losses.

Selling begat more selling.

While portfolio insurance was designed to protect investors from market downturns, it ended up playing a significant role in exacerbating the crash on Black Monday.

A general summary of how:

- Automatic Selling: The selling mechanisms of portfolio insurance kicked in when the market started to fall, adding more selling pressure to an already declining market. This further drove prices down and created a feedback loop.

- Market Illiquidity: The sheer size of sell orders from portfolio insurance strategies overwhelmed the market, leading to severe illiquidity. This mismatch between sellers and buyers widened the bid-ask spread and contributed to the extreme price drops.

- “Panic”: The large selling pressure and rapid declines in the market sparked panic among other investors. This led to more selling, contributing to the snowball effect that ultimately resulted in the crash.

After Black Monday, portfolio insurance was widely criticized for its role in the crash.

The event led to changes in the regulation of program trading and highlighted the potential risks of financial strategies that rely on automatic, mechanistic selling in response to market downturns.

How Did a Backtest of the 1987 Crash Perform?

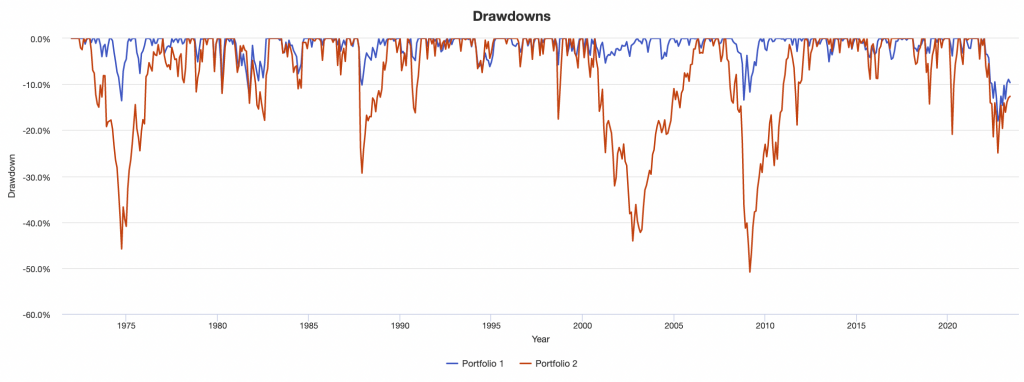

Naturally, a portfolio that wasn’t only concentrated in stocks did better than one that was.

Consider this simple three-asset portfolio:

Portfolio 1

- 35% Stocks

- 50% 10-Year Treasury Bonds

- 15% Gold

Against:

Portfolio 2

- 100% Stocks

We can see a notable drawdown in 1987 for the stocks portfolio (red line) versus a minor one for the diversified example (blue line).

We look at how it did specifically during the Black Monday period in terms of numbers:

Historical Market Stress Periods

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 |

|---|---|---|---|---|

| Oil Crisis | Oct 1973 | Mar 1974 | -2.65% | -12.61% |

| Black Monday Period | Sep 1987 | Nov 1987 | -10.13% | -29.34% |

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% | -3.72% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% | -17.57% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% | -44.11% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% | -50.89% |

Overall, by the end of November 1987, the market recovered all of its losses, as steep as they were.

FAQs – Black Monday (1987)

What happened on Black Monday, 1987?

On October 19, 1987, global stock markets crashed in a dramatic fashion. This day is known as Black Monday.

On this day, the Dow Jones Industrial Average (DJIA) in the United States fell by 22.6%, its largest one-day percentage decline in history.

Other major markets around the world also experienced significant losses, both before and after the DJIA’s crash.

What were the main causes of the Black Monday stock market crash?

The causes of Black Monday are numerous and complex.

Some of the key contributing factors were:

- Overvaluation: Many experts argue that stocks were significantly overvalued leading up to Black Monday. The five years prior had seen a strong bull market, which led to complacency and exuberance among investors.

- Program Trading and Computer Algorithms: Program trading, where computers automatically execute large trades when certain market conditions are met, contributed to the speed and severity of the crash.

- Illiquidity: Illiquidity in the markets amplified the selling pressure. As prices dropped, more and more investors tried to sell their stocks, but there were not enough buyers.

- Rising Interest Rates: The US had been increasing interest rates in the preceding months, which often has a negative effect on stock prices as cash and new bonds have higher yields to compete with riskier assets.

Could a similar crash like Black Monday happen again?

While it is impossible to predict with certainty, it’s plausible that a similar crash could occur again.

Financial markets are complex systems influenced by a wide array of factors, including economic indicators, corporate earnings, geopolitical events, and investor sentiment.

Despite measures put in place to prevent similar occurrences, like trading curbs and circuit breakers, the possibility of a significant market crash cannot be entirely ruled out.

Such measures can only temporarily restrain price falls if equilibrium values are lower.

How can traders/investors prepare their portfolios for a potential market crash?

Investors can take several steps to protect their portfolios from a potential market crash:

- Diversification: Spreading investments across various asset classes (stocks, bonds, commodities, real estate, etc.) and sectors can reduce the risk associated with a crash in any one area.

- Asset Allocation: Tailoring the mix of assets in a portfolio based on one’s risk tolerance, investment horizon, and financial goals can help in managing the potential downside.

- Emergency Fund: Having an emergency fund in liquid, low-risk assets can provide financial stability and prevent the need to sell investments at depressed prices during a downturn.

- Regular Portfolio Review: Regularly reviewing and rebalancing a portfolio can ensure that it stays aligned with one’s financial goals and risk tolerance.

- Investing in Quality: Quality companies with strong fundamentals are likely to withstand market crashes better and recover faster.

What were the lessons learned from Black Monday?

Several lessons emerged from Black Monday:

- Importance of Circuit Breakers: To prevent a similar crash, stock exchanges implemented “circuit breakers” that halt trading if the market falls by a certain percentage in a single day. These can help when markets fall for weird, programmatic reasons.

- Risks of Programmatic Trading: The role of program trading in exacerbating the crash led to increased scrutiny and regulation of computerized trading.

- Psychology of Trading and Investing: Black Monday underscored the role of herd mentality in trading and investing. It served as a reminder that market downturns can be opportunities to buy quality stocks at reduced prices. The market recovered afterward.

- Significance of Risk Management: The event highlighted the importance of risk management in investment strategies, including diversification and prudent asset allocation.

Conclusion

The causes of Black Monday and the lessons learned provide insights for managing today’s investment portfolios.

Awareness of global economic conditions, understanding the potential impact of tech advancements on market volatility, and understanding systemic risk are important.

The events of Black Monday underscore the importance of avoiding concentrated asset class exposures and readiness for the unknowns involved in markets.

Related Content on Historical Financial Bubbles and Disasters

- Tulip Mania

- South Sea Bubble & Mississippi Company

- Panic of 1837

- UK Railway Mania

- Erie War

- 1873-1896 Depression

- Panic of 1907

- Wall Street Crash of 1929

- 1973 Oil Crisis

- 1979 Energy Crisis

- 1980s S&L Crisis