Wall Street Crash of 1929 – Causes & Lessons for Today’s Portfolios

The Wall Street Crash of 1929 remains a stark reminder of the potential consequences of unbridled economic growth, speculative investing, and the consequences of overlooking risk management.

The stock market crash not only devastated the US economy but also sent shockwaves throughout the world, contributing to the Great Depression of the 1930s.

We look into the causes, impacts, and lessons that can be drawn from this pivotal moment in history to guide investors in managing their portfolios today.

Key Takeaways – Wall Street Crash of 1929: Causes & Lessons

- The Wall Street Crash of 1929 serves as a reminder of the consequences of uncontrolled economic growth, speculative investing, and the neglect of risk management.

- The crash not only devastated the US economy but also had a global impact, contributing to the Great Depression of the 1930s.

- Lessons from this historic event emphasize the importance of diversifying investment portfolios to mitigate risk and avoid the pitfalls of market crashes.

Key Statistics – Wall Street Crash of 1929: Causes & Lessons

- Stock Market Crash: The Wall Street Crash of 1929 occurred on October 24, 1929, also known as “Black Thursday.” However, the crash continued throughout the following week. The stock market experienced significant declines in stock prices, leading to panic selling, and didn’t bottom until July 1932.

- Stock Market Losses: By the time the stock market hit its lowest point in 1932, the Dow Jones Industrial Average had declined by about 89% from its pre-crash peak in 1929.

- Unemployment: The Great Depression resulted in widespread unemployment. In the United States, the unemployment rate rose from around 3% in 1929 to a staggering peak of approximately 25% in 1933. It took many years for the economy to recover, and unemployment remained high for a significant period.

- Bank Failures: The banking system faced severe challenges during the Great Depression. From 1930 to 1933, over 9,000 banks failed in the United States, leading to the loss of people’s savings and worsening the economic situation.

- GDP Contractions: The Great Depression had a severe impact on economic output. In the United States, the Gross Domestic Product (GDP) contracted by approximately 30% from 1929 to 1933. Other countries around the world also experienced significant declines in their GDPs.

- International Trade Decline: Global trade suffered a significant setback during the Great Depression. International trade volume plummeted as countries implemented protectionist measures, such as high tariffs, in an attempt to shield their domestic industries. This worsened the economic downturn and hindered recovery efforts.

- Deflation: The Great Depression was characterized by deflation, a sustained decrease in the general price level of goods and services. Falling prices made it challenging for businesses to generate profits, and it worsened the burden of debt for individuals and institutions.

- Social Impact: The Great Depression had a profound impact on society. Many people experienced poverty, homelessness, and hunger. Shantytowns, often referred to as “Hoovervilles,” emerged as makeshift communities of unemployed individuals living in poverty.

The Great Crash: Understanding the Causes and Impacts of the Wall Street Crash of 1929

The 1929 stock market crash was the result of a combination of economic factors and rampant speculation.

The booming economy of the 1920s, coupled with easy access to credit, enabled a surge in stocks.

Margin loans of 10:1 were not uncommon, meaning investors could put down just $1 to get more than 10x that in terms of exposure. Moreover, interest rates were low, which fueled the process.

As stock prices soared, a speculative bubble formed, setting the stage for a dramatic collapse.

The crash not only wiped out billions of dollars of wealth, but it also triggered a downward spiral of deflation, unemployment, and economic stagnation that lasted for years.

What Caused the Crash? Examining the Economic Factors That Led to the Wall Street Crash of 1929

Several economic factors contributed to the Wall Street Crash of 1929.

First, a period of economic prosperity and growth in the 1920s fueled excessive optimism and risk-taking.

Second, low interest rates and easy credit facilitated rampant speculation and margin buying, inflating stock prices.

Third, a lack of regulation and oversight allowed for market manipulation and fraud.

Finally, an agricultural overproduction crisis led to falling commodity prices and rural bank failures, further exacerbating the situation.

How Human Behavior Contributed to the Wall Street Crash of 1929

The Wall Street Crash was not just a product of economic factors but also a result of human psychology.

As the market soared, investors became increasingly confident, leading to a positive feedback loop that further inflated stock prices.

Once the bubble began to burst, investors rushed to sell their holdings, especially as leveraged positions went underwater (not difficult with the leverage at the time), causing prices to plummet further.

This herd mentality exacerbated the crash and contributed to its severity.

But Not Just Psychology

The 1929 crisis was analogous to 2008 that was brought on by too much debt coming due relative to income, savings, and new lending.

Even if traders/investors all woke up one morning with no recall of the current problems, they would still be in them.

Other business people, politicians, and policymakers cannot simply restore confidence and persuade them to get into riskier investments (e.g., stocks, high-yield credit) back from safer ones (cash and government bonds).

It is driven by the supply and demand of – and the relationships between – money, credit, and goods and services.

As mentioned, psychology can play a role, particularly as various players see their liquidity positions turn down.

However, debtors’ obligations to deliver money to their creditors would be too large relative to the amount of money they are bringing in through revenue, savings, new lending and capital issuance, and cost-cutting to help generate more cash flow.

The government would face the same set of choices and the same set of trade-offs, which would have the same set of consequences, and so forth.

Tracing the Timeline of the 1929 Stock Market Crash and its Aftermath

The Wall Street Crash unfolded over several days in late October 1929, beginning with the infamous “Black Thursday” on October 24th.

Panic selling ensued, with an 89% peak-to-trough fall by July 1932.

The crash marked the beginning of the Great Depression, a period of economic stagnation that lasted well into the 1930s.

The Depression saw unemployment rates soar, businesses fail, and international trade decline dramatically.

It became a period of great internal and external conflict, with hot wars developing by the end of the decade.

Lessons in Asset Allocation: Diversifying Your Portfolio to Avoid the Pitfalls of a Market Crash

One key lesson from the Wall Street Crash of 1929 is the importance of diversification in investment portfolios.

By holding a mix of asset classes, investors can reduce the overall risk of their portfolios and limit their exposure to market downturns.

Proper diversification can not only help investors weather the storm of market volatility but can also potentially lead to higher returns over the long run.

Diversification is a strategy of allocating investments among various financial instruments and asset classes such as stocks, bonds, commodities, and different currencies.

By diversifying their investments, investors can mitigate the risk of significant losses due to the poor performance of a single investment or asset class.

For example, if an investor has all their savings invested in a single stock and the company goes bankrupt, the investor could lose all their money.

However, if the investor had diversified their portfolio across several stocks, bonds, and other assets, the loss from one stock would be mitigated and potentially offset by the gains from other investments.

Moreover, diversification can lead to higher returns over the long run by reducing the impact of market volatility on investment portfolios.

Different asset classes have different levels of risk and return, and their performance can be influenced by different economic factors.

Therefore, by holding a mix of asset classes, investors can potentially earn higher returns while also reducing their exposure to market downturns.

Example

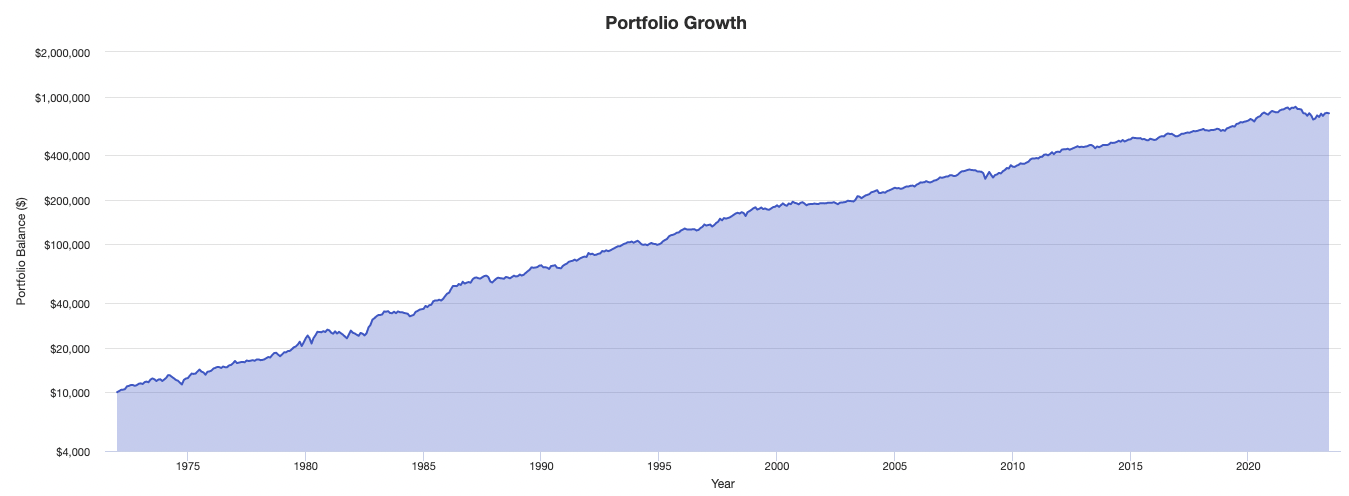

For example, let’s say a portfolio is made up of just three assets in the following proportions:

- 35% stocks

- 50% 10-year Treasury bonds (can be a mix of nominal and inflation-linked)

- 15% gold

Here are the drawdown periods of notable market events:

Historical Market Stress Periods

| Stress Period | Start | End | 35/50/15 |

|---|---|---|---|

| Oil Crisis | Oct 1973 | Mar 1974 | -2.65% |

| Black Monday Period | Sep 1987 | Nov 1987 | -10.13% |

| Asian Crisis | Jul 1997 | Jan 1998 | -2.41% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -5.72% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -5.36% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -13.40% |

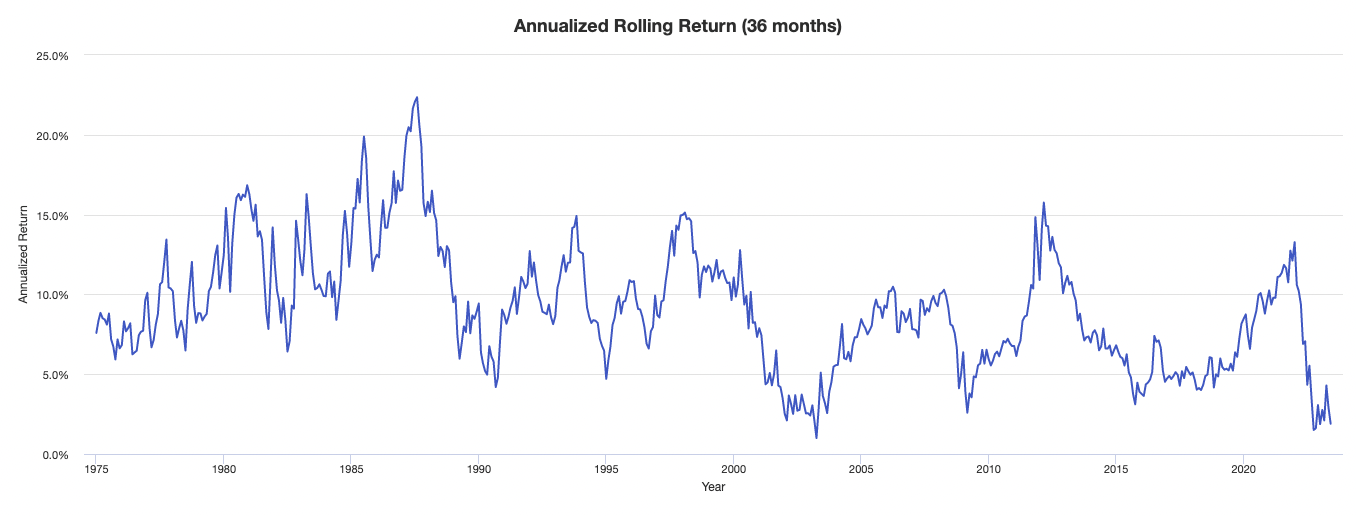

Over a 36-month rolling period, there were no negative periods (i.e., the portfolio was always higher than where it was three years ago).

All the various crises aren’t overly noticeable when taking a multi-year perspective.