Pension Funds – How Do They Invest? [Example Portfolio]

Pension funds operate by pooling the money of many investors to allocate into a wide variety of assets, including stocks, bonds, real estate, and other investment alternatives.

Pensions are managed by professional fund managers that oversee a pool of funds specific to a certain group, such as a group of teachers in a particular school district, city, or state.

Pension funds are one of the largest types of institutional investors, with an estimated $40 trillion in assets under management globally.

Pension funds are important players in the financial markets, providing capital to businesses and helping to finance economic growth.

How do Pension Funds Invest

Pension funds typically invest in a diversified mix of assets in order to achieve their goals. Pension fund managers use a variety of investment strategies, depending on the objectives of the fund.

These investment vehicles have been historically risk-averse, given the need to reliably provide income to pension holders.

For example, the California Public Employees’ Retirement System, known as Calpers, held only bonds in its portfolio until 1967, believing that equities were too risky for such a conservative investment plan.

Given that bond yields have been low for so long and pensions have struggled to generate the types of returns they need, equities and other equity-heavy vehicles (private equity, hedge funds, real estate) have become a bigger part of their portfolios.

Moreover, as inflation became a bigger problem in recent years, there became a bigger need to have good diversification not with respect to only changes in global economic growth, but also to changes in inflation.

This can include higher allocations to assets like certain types of equities, commodities and alternative currencies, and inflation-linked bonds (ILBs).

Real returns, therefore, become a focal point under higher inflation or stagflation environments rather than nominal returns.

Asset-Liability Matching

Pension funds have a certain amount of liabilities they need to meet over time (pension distributions), which are matched by assets that throw off cash flow or need to be sold in order to meet these liabilities.

These are often called matched-funding strategies.

For example, many pension funds might need to generate 7 percent returns per year to remain viable over the long run.

Others might be 6 percent, while others might be higher. It all depends on the fund (e.g., their existing funding levels, their incoming contributions, their current and future liabilities).

So pension fund managers will devise a strategy and overall strategic asset allocation mix that can realistically achieve this mark while trying to minimize risk as much as possible.

In other words, achieve the best risk-adjusted returns possible while keeping overall risk within acceptable parameters.

For example, if:

- government bonds yield an average of 2 percent

- corporate bonds yield an average of 4 percent

- public equities yield an average of 6 percent, and

- real estate, private equity, and hedge funds yield an average of 8 percent…

…these managers will look to counterbalance enough of the high-risk assets against the lower-risk assets to achieve a healthy balance.

For instance, to achieve 7 percent, they might put 35 percent in alternatives (real estate, private equity, and hedge funds), 35 percent into public equities, and 15 percent each into corporate bonds and government bonds and use 20 percent borrowed money to reach that goal.

There are also other options that pension funds have to meet their obligations, such as requiring more contributions from those within the pension plan, more contributions from local governments, borrowing via municipal bonds, or other strategies.

Leverage within a pension plan

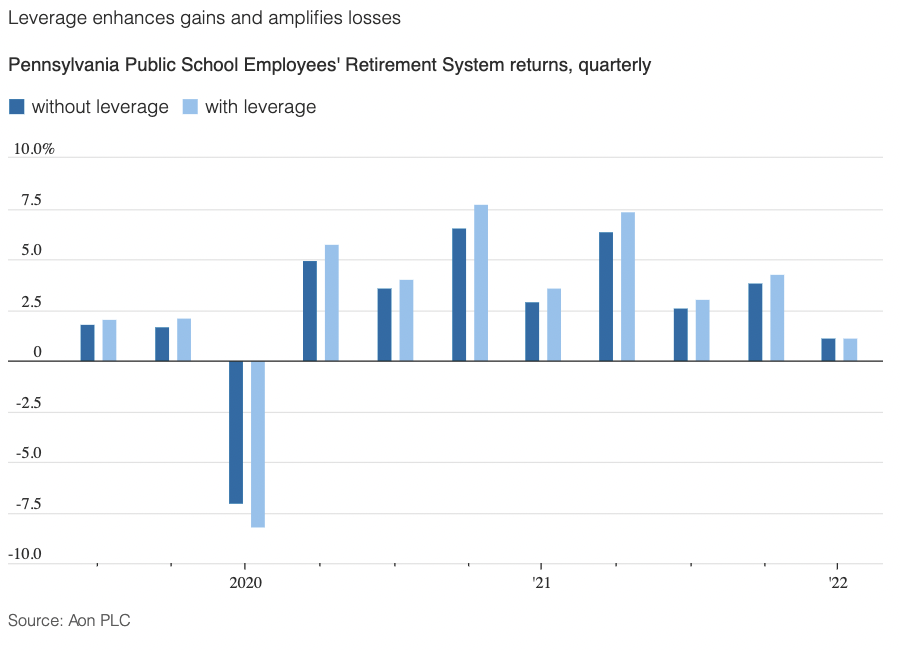

Leverage within a pension plan has always been a controversial subject.

On one hand, pension plans tend to be underfunded and require return targets that are difficult to reach with traditional allocations. This could favor mild levering of the portfolio to achieve those goals.

Others argue that applying leverage to such critically important vehicles is too dangerous.

US pensions plans have traditionally been averse to leverage. Some of the largest have only recently started adding leverage.

The Pennsylvania Public School Employees’ Retirement System (PSERS) adopted leverage well ahead of other funds back in 2012.

The Teacher Retirement System of Texas, the US’s fifth-largest public pension fund, began leveraging its investment portfolio in 2019.

Calpers started leveraging its portfolio in July 2022.

Canadian pensions and leverage

Canadian pension funds have been more open to leverage for longer.

In Canada, retirement plans borrow amounts equivalent to 15 to 20 percent of their assets, on average.

But their pension funds also tend to be better funded, have higher employee contributions, and lower target returns.

Even so, when the $420 billion Caisse de dépôt et placement du Québec underperformed pension peers during the 2008 financial crisis, its chief executive partially placed part of the blame on leverage.

How is leveraging done?

Typical pension fund leveraging strategies include:

- cash borrowing (i.e., within the portfolio itself)

- issuance of municipal bonds (proceeds from the bonds deposited within the pension fund)

- using futures (i.e., owning an asset with lower collateral requirements)

- using options and other derivatives to limit downside while having potentially leveraged upside

- repurchase agreements

Leverage can help achieve healthier balance in a portfolio than what could otherwise be done.

For example, a lack of leverage may force pensions to be more concentrated in riskier assets.

And stocks, real estate, private equity, and hedge funds are already leveraged themselves (e.g., companies have debt).

If smaller amounts of borrowed funds can help reduce reliance on riskier assets, and shift the mix to a better balance and help diversify the portfolio, it can be both return-enhancing and risk-reducing.

So, instead of leverage being thought of in a black-and-white way (“no leverage is good, any leverage is bad”) a portfolio that is modestly leveraged and well-diversified can be better than one that is not leveraged and concentrated.

Below is a glimpse of the Pennsylvania Public School Employees’ Retirement System return with and without leverage based on an analysis done by Aon Plc:

Pension Funds and Alternative Investments

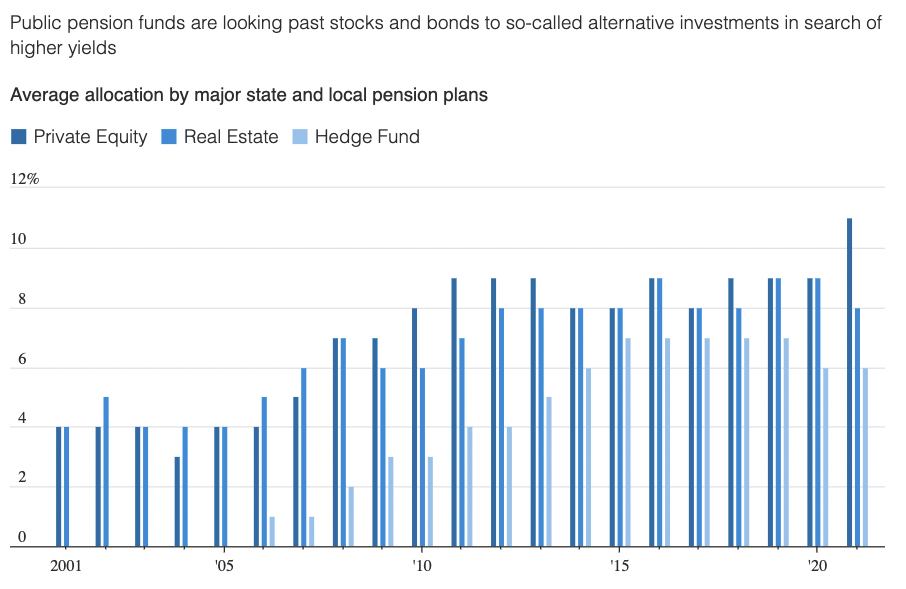

Pension funds often allocate money to real estate, private equity, and hedge funds.

These allocations have gone up over time.

(Source: Boston College Center for Retirement Research, WSJ)

At the beginning of the century, pension funds would allocate an average of about 8 percent to these investments. In the 2020s, they are allocating about 25 percent to real estate, private equity, and hedge funds.

The pension funds that are allocating the larger portions to these investments tend to be the largest and most well-funded pension funds.

The largest pension fund in the United States, the California Public Employees’ Retirement System (Calpers) pension plan for state workers, had close to $500 billion under management.

It allocated about 18 percent of its assets to real estate, private equity, and hedge funds.

The second largest pension fund, the New York State Common Retirement Fund (CRF), which covers state workers outside of New York City, had almost $250 billion in assets and allocated about 28 percent to these investments.

The pension funds that are allocating smaller portions to alternative investments tend to be the smaller pension funds or those that have fewer funding worries and don’t need to take more risk going into illiquid alternatives.

Pension funds that invest in real estate, private equity, and hedge funds are subject to lock-up periods that can span as long as 10 years.

Pension Funds Buying Real Estate

Pension funds may buy cash-producing real estate or invest in private equity, hedge funds, or alternative investment managers than invest in real estate.

The pension funds may also buy real estate investment trusts (REITs) that trade on major exchanges.

Pension funds have become an important source of capital for real estate investing and development.

In the early 2020s, pension funds were estimated to own close to $1 trillion in commercial real estate, with about two-thirds held through REITs and other public investments and one-third held through private equity or hedge fund managers.

The largest pension fund investors in real estate include:

- Calpers

- CRF

- Florida State Board of Administration

- Texas Teacher Retirement System

- Ohio Public Employees Retirement System

Those five hold an estimated $60 billion total in real estate.

Pension funds have been active investors in real estate, both directly and indirectly, for many years.

However, pension fund investment in real estate has increased in recent years as pension funds seek to diversify their portfolios and find investments that will generate higher returns than traditional investments such as stocks and fixed income.

Pension funds are attracted to real estate for a number of reasons, including the potential for high returns, the income generated by cash-producing properties, and the potential hedging benefits of real estate against inflation.

Hedge Funds, Private Equity, and Venture Capital Investments by Pension Funds

Hedge funds

Pension funds also invest in hedge funds.

Hedge funds pursue a variety of strategies and can provide the advantage of providing positive returns with no correlation to their other investments.

Hedge funds counting pension funds among their clients first became popular around 2006 and has since grown to around 6 percent of the average pension fund’s investment allocation.

Pension funds are estimated to have more than $1 trillion invested in hedge funds globally.

Private equity

Pension funds are also active investors in private equity.

Private equity firms raise money from pension funds and other investors to buy companies or invest in companies that are not publicly traded.

Pension fund investment in private equity has grown in recent years as pension funds seek to generate higher returns than they can earn in the stock and bond markets.

Pension funds are estimated to have more than $1 trillion invested in private equity, and more to private equity than hedge funds.

Venture capital

Pension funds are also active investors in venture capital, which is a type of private equity that invests in early-stage companies.

Venture capital firms raise money from pension funds and other investors to invest in start-up companies with high growth potential.

Pension fund investment in venture capital has grown in recent years as pension funds seek to generate higher returns than they can earn in the stock and bond markets.

Pension funds are estimated to have more than $50 billion invested in venture capital globally.

Naturally, pension fund investment in venture capital is lower than that of real estate, hedge funds, and private equity given that venture capital is involved in very early-stage companies.

It can provide a bit of growth in pension portfolios, but its returns can be very volatile and therefore less safe.

Example Pension Fund Portfolio

An example pension fund portfolio might include the following assets within the following allocation ranges:

- Public equities – 25 to 50 percent

- Non-investment-grade corporate bonds – 5 percent

- Investment-grade corporate bonds – 15 to 25 percent

- Government bonds (nominal) – 10 to 20 percent

- Government bonds (inflation-linked) – 10 to 20 percent

- Private equity – 5 to 15 percent

- Real estate – 5 to 10 percent

- Hedge funds – 5 to 10 percent

- Venture capital – 0 to 2 percent

- Commodities* – 0 to 10 percent

- Cash – 10 percent to minus-25 percent (leveraged)

*Commodity exposure can be captured in other parts of the portfolio such as in equity and credit investing and not necessarily through direct commodity investments. Pension funds tend to have a strong preference for cash flowing investments.

Pension Funds and Portfolio Rebalancing

Pension funds try to keep their allocations relatively steady.

That means when asset prices decline they will typically allocate more to them (buy).

When asset prices rise, they will typically allocate less to them (sell).

This also means as a trader or investor trying to understand the markets you participate in, if pension funds are a large part of them you can begin to understand what kind of price action you might expect within them.

Pension funds tend to be a bigger part of markets such as dividend-paying stocks.

So you’ll tend to less momentum moves in them compared to less mature companies, which tend to have more retail traders and speculators in them.

Pension Funds – FAQs

What are pension funds?

Pension funds are investment vehicles that pool the money of many investors to invest in a variety of assets, including stocks, bonds, and real estate.

How do pension funds work? Where do pension funds invest their money?

Pension funds are often managed by pension fund managers who make decisions about where to invest the money in the pension fund.

What do pension funds invest in?

Pension funds can invest in a variety of assets, including stocks, bonds, and real estate.

Pension funds often seek to diversify their portfolios by investing in a variety of asset classes to spread their risk out and not be too dependent on any one source of return.

How much do pension funds invest in real estate?

In the early 2020s, pension funds were estimated to own close to $1 trillion in commercial real estate, with about two-thirds of pension funds globally investing in real estate.

How much do pension funds invest in hedge funds?

As of 2020, pension funds are estimated to have more than $1 trillion invested in hedge funds.

How much do pension funds invest in private equity?

Pension funds are estimated to have more than $1 trillion invested in private equity and have a higher allocation in private equity than both real estate and hedge funds.

How much do pension funds invest in venture capital?

Pension fund investment in venture capital has grown in recent years, with pension funds estimated to have more than $50 billion invested in venture capital globally.

It is still a significantly smaller allocation than real estate, private equity, and hedge funds given the boom and bust nature of investing in early-stage companies.

What can you learn from a pension fund’s capital allocation style?

You can learn how to have balance, diversification, and how to use various building blocks to construct the type of returns you want in a portfolio.

How important are pension funds to the economy?

Pension funds are important to the economy as they provide retirement income for retirees and help to fund businesses and other investments.

Pension funds also play a role in stabilizing the financial markets as they are long-term investors with a large amount of capital.

What is the difference between a pension fund and an endowment fund?

An endowment fund is a type of investment vehicle that pools the money of many investors to invest in a variety of assets, including stocks, bonds, and real estate.

A pension fund is an investment vehicle that is created by an employer to provide retirement benefits for employees.

What is the difference between a pension fund and a 401(k)?

A pension fund is created by an employer to provide retirement benefits for employees.

A 401(k) is a type of retirement savings account that is offered by many employers in the United States.

What are some common pension fund investing mistakes?

1. Not diversifying a fund’s investments well enough

2. Investing too heavily in one asset class

3. Failing to rebalance the portfolio

4. Paying too many fees

5. Taking on too much risk

Do pension funds invest in cryptocurrencies?

Not directly, but they may invest in the equity and credit of firms who participate in those markets in some way.

Do pension funds buy ETFs?

Yes, pension funds may buy ETFs as part of their investment strategy.

They provide a cheap way to provide broad diversification and many of these ETFs are large and liquid (e.g., SPY, QQQ).

What is the difference between a pension fund and a mutual fund?

A pension fund is an investment vehicle that is created by an employer to provide retirement benefits for employees.

A mutual fund is an investment vehicle that pools the money of many investors to invest in a variety of assets, including stocks, bonds, commodities, and real estate and are open to a wider range of investors.

What is the difference between a pension fund and a hedge fund?

A hedge fund is an investment vehicle that pools the money of many investors to invest in a variety of assets, including stocks, bonds, real estate, commodities, crypto, and so on.

They also use leverage, swaps, derivatives, and short selling to pursue their strategies.

What is the difference between a pension fund and a private equity fund?

A pension fund is a more diversified investment vehicle that generally looks for more stable returns and less risk.

A private equity fund is an investment vehicle that pools the money of many investors to invest in buyouts of more mature companies, often with leverage (leveraged buyouts).

Private equity firms will buy both public and private companies and look to make them more efficient and stronger, then sell them to other companies or take them public to realize their gains.

Pension Fund Investing – Summary

Pension funds are long-term investors that play an important role in the economy, providing income to retirees.

They are typically diversified and invest in a variety of asset classes, including stocks, bonds, and real estate.

Pension funds may also invest in alternative investments, such as hedge funds, private equity, and venture capital.