Exchange-Traded Funds (ETFs)

ETFs get their name, ‘exchange-traded funds,’ because, much like stocks, they are traded on exchanges. The appeal of trading ETFs lies in their flexibility, diversification, and cost-efficiency. They offer access to a wide range of assets, sectors, and markets.

This guide explains the basics of ETF trading, from how they work to finding suitable funds for your trading portfolio.

Quick Introduction

- Exchange-traded funds (ETFs) offer diversification by holding a variety of assets including stocks, commodities, or bonds, helping to reduce individual investment risk.

- They are traded on stock exchanges throughout the trading day, unlike mutual funds which only trade once a day after the market closes.

- ETFs provide easy access to specific markets, sectors, or themes, allowing you to implement targeted investment strategies with relative simplicity.

- They disclose their holdings daily, allowing you to know exactly what assets they own.

Best 4 ETF Brokers

These are the 4 best brokers for ETFs, taking into account the number of ETFs available, trading fees, market research and tools:

What Are ETFs?

An ETF tracks the performance of a specific group of assets, such as stocks, bonds, or commodities, and offers a straightforward way to trade in a wide range of these assets without having to buy them individually.

If the value of the assets in these bundles increases, so does the value of the ETF. In this way, owning a share in an ETF is essentially speculating on the strength of an economy or market, rather than one asset within the list. This makes it a very diverse trading investment.

Exchange-traded funds were initially created to provide investors with a more cost-effective and liquid alternative to traditional mutual funds.

They were first introduced in the early 1990s, with the launch of the SPDR S&P 500 ETF (SPY), designed to track the performance of the S&P 500 Index.

Unlike mutual funds, which are priced at the end of the trading day, ETFs trade on stock exchanges throughout the trading day, giving traders intraday liquidity.

Before launching, newly created ETFs must obtain approval from the relevant financial regulatory authority in the market where they intend to be listed.

For instance, in the US, the ETF sponsor submits a detailed proposal to the Securities and Exchange Commission (SEC) for review and approval.

Today, the industry has grown significantly, with thousands of ETFs available globally, attracting both individual and institutional traders.

Income Or Accumulation

ETFs will either have an income or accumulation asset class. Often, you will see the same fund has the option for the investor to choose one or the other.

The asset class determines how you will receive returns. Stocks and shares are regularly paying out dividends to their investors when, and if, they make a profit.

In an accumulation fund, this capital is reinvested for fund growth, meaning more stocks are bought. Whereas an income fund pays the dividends (either monthly, quarterly or annually) back to the fund owners.

Types Of ETFs

ETFs come in various types, each designed to cater to specific trading strategies:

- Equity: An equity ETF primarily holds a diversified portfolio of stocks.

- Index: Index ETFs track the performance of specific market indices, aiming to replicate the returns of the underlying index. Examples include tracking the S&P 500 and the Nasdaq.

- Sector: These ETFs focus on specific sectors of the economy, such as technology, healthcare, financial services, or energy. They offer targeted exposure to particular industries.

- Commodity: These ETFs track the performance of commodities like gold, silver, oil, natural gas, and agricultural products. They may hold physical commodities or use futures contracts to replicate price movements.

- Currency: Currency ETFs provide exposure to foreign currencies relative to a base currency, such as the US dollar. You can trade them for diversification and hedging.

- Bond: These ETFs invest in bonds and other fixed-income securities. They can focus on government bonds, corporate bonds, municipal bonds, or specific durations (e.g. short-term or long-term bonds).

- Factor: These ETFs follow specific investment styles or factors like value, growth, dividend yield, low volatility, or momentum.

- Inverse: Inverse ETFs aim to deliver the opposite returns of an underlying index or asset. They are used for shorting or hedging strategies and are designed for short-term trading.

- Leveraged: Leveraged ETFs use financial derivatives to amplify returns. For example, a 2x leveraged ETF seeks to provide double the daily returns of its underlying index, while a 3x leveraged ETF aims for triple the returns. These are also intended for short-term trading and carry higher risks.

- Multi-Asset: These ETFs hold a mix of asset classes, providing you with a diversified portfolio in a single fund. They can include a combination of stocks, bonds, and other assets.

- Thematic: These ETFs focus on specific investment themes or trends, such as clean energy, cybersecurity, robotics, or cannabis.

- Global And International: These ETFs provide exposure to international markets, allowing you to diversify beyond your domestic market. Examples include ETFs tracking foreign stock markets or regions.

- Dividend: Dividend ETFs invest in stocks or funds with a history of paying dividends. They are popular among income-focused investors.

Where To Find The Best ETFs

Most ETFs and index funds are invested through fund owners. Examples of the most popular are Fidelity, ARKK, AJ Bell and Charles Swab.

Plus, since ETFs are traded on exchanges, they are accessible through retail brokers, including the likes of Pepperstone, IG and Webull.

However, there are literally thousands of funds on the market, so finding funds with the highest returns will take a bit of research.

Luckily, many of the best providers offer tools to help you find the correct ETF to invest in for you. We have listed some of the top resources below:

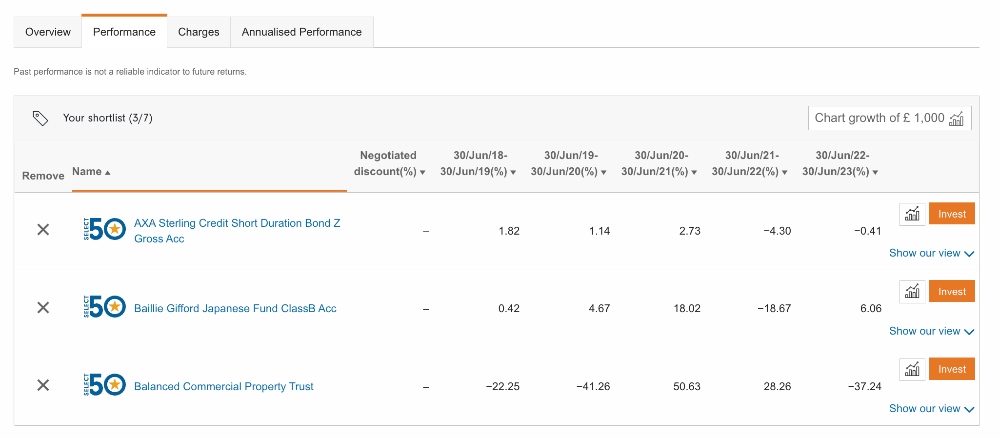

Wealth 50 List, Hargreaves Lansdown

This HL fund list is a great starting point for those looking to whittle down the list to something more manageable.

The HL researchers look at four key criteria: the fund manager and their previous performance, their process of stock selection and the team’s culture.

Fidelity Select ETF List

Fidelity analysts have compiled a list of the most cost-effective and well constructed ETFs they provide. They only include products that directly hold the securities highlighted, meaning there are no derivative ETFs in this list.

iShares Compare Funds Tool

This page allows you to select your top 4 iShares funds and compare them side by side. Factors such as the benchmark index, investment objective and expense/charge ratio are displayed alongside each other for easy comparison.

Forbes Advisor Best ESG Funds

For those looking to find funds that have a positive impact on environmental and social factors, Forbes compiles a monthly list of the top ETFs to watch in this sector.

ESG trading funds are increasingly popular as investors look for ways to use their savings for good, such as investment in green energy or micro-capital firms. Each ETL has a description of why they have picked it. These are based on previous performance and fee ratios. However, due to their ‘people over profit’ philosophy, ESG ETLs are not known for their high dividends vs traditional funds.

ETF News Outlets

Companies, such as the news outlet Stream, offer free analysis and commentary on the top ETFs. This is a great way to keep your finger on the pulse.

Important: steer away from lists that only consider best performing trading ETFs over the short term. Past performance is not an indication of future gain, and this is an oversimplification of what to look for. It might be that this fund is invested in risky stocks that have returned strong profits this year, but will not be replicated in the coming quarters.

Much more important is the fund manager’s past performance, their strategy for the future and your confidence in this.

10 Best ETFs

The popularity of ETFs can vary depending on market conditions, trends, and individual trading strategies. However, some funds have consistently attracted a significant amount of trading volume due to their liquidity, diversity, and relevance to various market themes.

These are some of the most popular ETFs to trade:

- SPDR S&P 500 ETF Trust (SPY): This tracks the performance of the S&P 500 Index, which represents the 500 largest publicly traded companies in the United States. It is one of the most widely traded ETFs and provides exposure to the US stock market.

- Invesco QQQ Trust (QQQ): QQQ tracks the Nasdaq-100 Index, which consists of 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It is popular among traders interested in technology and growth stocks.

- ProShares UltraPro QQQ (TQQQ): TQQQ is a leveraged ETF that aims to provide three times the daily returns of the Nasdaq-100 Index. It is popular among traders seeking amplified exposure to the tech-heavy Nasdaq.

- ProShares UltraPro Short QQQ (SQQQ): A leveraged inverse ETF providing three times the inverse daily returns of the Nasdaq-100 Index, used to profit from declining prices in the Nasdaq.

- iShares Russell 2000 ETF (IWM): IWM tracks the Russell 2000 Index, which represents small-cap US stocks. You can use this to gain exposure to smaller companies and potentially higher volatility.

- ProShares Ultra VIX Short-Term Futures ETF (UVXY): Designed to provide leveraged exposure to short-term VIX futures contracts, allowing you to speculate on market volatility.

- Direxion Daily Semiconductor Bull 3x Shares (SOXL): A leveraged exchange-traded fund aiming to provide three times the daily returns of the PHLX Semiconductor Sector Index, used to gain amplified exposure to semiconductor stocks.

- SPDR Financial Select Sector ETF (XLF): XLF follows the Financial Select Sector Index, making it a relevant choice when focussing on financial sector stocks.

- SPDR Gold Trust (GLD): GLD provides exposure to the price of gold bullion. It is a popular way to gain exposure to the precious metal.

- iShares 20+ Year Treasury Bond ETF (TLT): TLT tracks long-term US Treasury bonds. It is often used as a trading instrument to express views on interest rates and bond market trends.

All 10 of these popular ETFs are available at eToro and IG.

ETFs vs Individual Stocks

Whether ETFs are good or bad for your trading portfolio depends upon many factors. These are the main pros and cons:

- Diversification: ETFs provide instant diversification by holding a basket of assets, reducing the risk associated with individual stocks. This diversification helps spread risk and may lead to more stable returns.

- Liquidity: ETFs are highly liquid and can be bought or sold throughout the trading day at market prices. In contrast, individual stocks may have less liquidity, making it harder to execute large trades without affecting the stock’s price.

- Flexibility: ETFs cover various asset classes, sectors, and themes, giving you the flexibility to choose from a wide range of investment options. This allows for tailoring portfolios to specific investment strategies and goals.

- Cost-Efficiency: ETFs typically have lower expense ratios than actively managed mutual funds, and their trading costs are often lower than trading individual stocks due to reduced brokerage fees.

- Tax Efficiency: ETFs are structured in a way that can result in tax advantages, such as potentially lower capital gains taxes compared to trading individual stocks. This tax efficiency can help you keep more of your returns.

- Limited Individual Stock Selection: ETFs provide exposure to a group of stocks, which means you have limited control over the specific stocks within the fund. If you want to invest in a particular company, you can’t do so directly through an ETF.

- Tracking Error: ETFs may not perfectly replicate the performance of their underlying index due to tracking errors. Factors like expenses and trading costs can cause deviations from the index’s returns.

- Intraday Price Volatility: While intraday trading is an advantage, it can also lead to more frequent price volatility, which may result in unexpected fluctuations when buying or selling ETF shares.

- Lack Of Voting Rights: When you own individual stocks, you often have voting rights in the company’s decisions. With ETFs, you typically don’t have such rights because you’re a shareholder of the ETF provider, not the underlying companies in the fund.

- Complexity: Leveraged and inverse ETFs, which aim to amplify returns or provide inverse exposure, can be complex and risky. They are designed for short-term trading and can lead to magnified losses if not used correctly, making them less suitable for inexperienced investors.

- Too Narrow: In some cases, ETFs do not cover a wide enough range of constituents. By limiting themselves to large-cap stocks, they effectively deny investors access to growth opportunities created by small-cap companies.

- Leverage Increases Risk: Diverse funds may contain leveraged financial derivatives. Leverage trading can boost investment returns, though the same goes for losses. Risk-averse investors should avoid leveraged funds, or at least carefully weigh them.

How To Start Trading ETFs

Starting to trade ETFs involves several key steps:

1. Educate Yourself

Begin by learning about exchange-traded funds, their structure, and how they work. Understand the different types, including equity, fixed income, commodity, and sector-specific funds.

Pay attention to expense ratios, tracking indices, historical performance, and asset composition. Familiarize yourself with the risks and benefits.

2. Set Clear Goals

Determine your investment objectives and risk tolerance. Are you trading for short-term gains or long-term growth?

Clarifying your goals will help you choose the right ETFs for your strategy.

3. Choose A Broker

Open an account with a reputable broker that offers access to a wide range of exchange-traded funds. Consider key factors like trading fees, research tools, and educational resources.

4. Practice With A Demo Account

Many brokerages offer paper trading through demo accounts that allow you to practice trading without using real money. This is an excellent way to gain experience and test your ETF trading strategies.

5. Execute Your First Trade

Once you are comfortable, begin with a small amount of capital that you can afford to risk. Use limit or stop orders to manage the price at which you buy or sell. Double-check your order details before confirming.

6. Risk Management

Implement risk management strategies, such as setting stop-loss orders, to protect your capital. Avoid making impulsive decisions based on emotions.

7. Review And Adjust

Periodically review your portfolio and ETF trading strategy. Adjust your holdings and goals as needed based on your experiences and changing market conditions.

8. Stay Disciplined

ETF trading requires discipline. Stick to your trading plan and avoid making emotional decisions. Remember that losses are a part of trading, and not every trade will be profitable.

Bottom Line

Since their inception in 1993, ETFs have seen massive growth. They offer an investment opportunity both for passive traders and active day traders. They can be tax-efficient and diverse, making them attractive to a variety of investors, regardless of their trading objectives.

Use our list of the top ETF trading brokers to get started.

FAQ

How Do ETFs Work?

Exchange-traded funds (ETFs) are baskets of securities, bundled together into one package. These investment funds are listed on a stock exchange, such as the London Stock Exchange (LSE), giving them their namesake – ‘exchange traded’.

A process known as Creation and Redemption governs ETF trading shares. The entity needed to “create” ETF shares is an Authorized Participant.

To create shares, the Authorized Participant buys stocks from the index tracked by the fund. It then puts them into the ETF, by exchanging them for shares representing equal value.

The AP sells these shares to investors.

The redemption process (i.e. selling the ETF stake) effectively reverses the above-detailed steps.

What Do ETFs Include?

ETFs can contain a multitude of instruments. In fact, almost any tradable asset can be contained in an ETF. This includes stocks and shares, bonds, commodities and cryptocurrency tokens like Bitcoin.

Are ETFs Suitable For Beginner Traders?

Exchange-traded funds can be suitable for beginner traders due to their simplicity, diversification benefits, and ease of trading on stock exchanges. They provide an accessible way to start investing in various asset classes and sectors.

Where Can I Trade ETFs?

ETFs are investment funds that are traded on a stock exchange. Therefore, you can buy exchange-traded funds with many brokers that offer stock trading. Alternatively, we have ranked the best ETF brokers.

Can ETFs Be Traded Using Leverage?

Yes. Leveraged ETFs aim to provide amplified returns by using financial derivatives and other strategies. They are designed for short-term trading and can be used to gain two or three times the daily returns (or inverse returns) of an underlying index.

However, due to their leveraged nature, they carry higher risks and are not suitable for long-term investors or those with a low risk tolerance.

Are ETFs A Safe Investment Vs Individual Stocks?

ETFs are generally diverse portfolios of investments. In theory, this makes them safer than individual stocks which rely on the fortunes of one company and its CEO.

However, the answer to this depends on the ETF’s components. Some funds contain leveraged derivatives that are exposed to increased risk.

Mutual Funds Vs ETFs: What’s The Difference?

Mutual funds and exchange-traded funds are both investment funds that can be professionally managed. However, ETFs can be bought or sold throughout the trading day at market prices, providing greater liquidity and flexibility.

Mutual funds, in contrast, are bought and sold once daily at the end-of-day NAV (Net Asset Value) price.

What Are ESG ETFs?

ESG stands for environmental, social and governance. ESG ETFs are funds that are focused on investing in companies and other assets that promote the wellbeing of the environment and the communities connected to them.

Recommended Reading

Article Sources

- FT Guide to Exchange Traded Funds and Index Funds: How to Use Tracker Funds in Your Investment Portfolio, David Stevenson

- The ETF Book: All You Need to Know About Exchange-Traded Funds, Richard Ferri

- Exchange-Traded Funds: Investment Practices and Tactical Approaches, A. Seddik Meziani

- Wealth 50 List, Hargreaves Lansdown

- Fidelity Select ETF List

- iShares Compare Funds Tool

The writing and editorial team at DayTrading.com use credible sources to support their work. These include government agencies, white papers, research institutes, and engagement with industry professionals. Content is written free from bias and is fact-checked where appropriate. Learn more about why you can trust DayTrading.com