Interest Rates

An interest rate represents the amount of interest that is due per period in relation to the amount borrowed, lent, or deposited. Interest rates can refer to any period of time, but it generally takes the form of an annual percentage.

For example, a 5 percent rate of interest on a bond or mortgage generally means five percent of a loan’s amount is due per year.

Interest rates can apply to sums of money with a maturity of less than one year, such as days, weeks or months, but they are typically annualized.

The Top Brokers For Forex Trading Against Interest Rates

Other Interest Rate Terms

The short-term interest rate set by the central bank is often called any of the following:

– cash rate

– deposit rate

– overnight rate

– base rate

– specialized terminology (e.g., federal funds rate for the US Federal Reserve)

APR stands for annual percentage rate and represents a finance charge expressed as an annual percentage. For example, a $100 charge on a borrowed amount of $1,000 would represent an APR of 10 percent.

APR typically uses simple interest instead of compound interest like mortgages.

An EAR refers to an effective annual rate. It is used to help consumers compare loans and other investment products with different compounding frequencies (e.g., simple daily, compounded continuously) to understand their interest-based costs or returns. It does not control for differences in fees between products. It is sometimes called the annual equivalent rate (AER).

Annual percentage yield (APY) is the interest rate earned at a bank or credit union from a certificate of deposit (CD) or savings account. These generally use compound interest.

A coupon rate refers to the amount paid on a fixed income investment per year divided by the par value of the bond. A bond with a par value of $1,000 and disburses two $20 coupons to its owners per year has a coupon rate of 4 percent (two multiplied by $20 divided by $1,000).

The current yield of an investment is the annual coupon rate divided by the current market price of a bond.

The yield to maturity (YTM) of a bond represents the annual yield of a bond if the investor holds it to maturity. The YTM represents the rate where all remaining cash flows (remaining coupons plus the repayment of the par value of the bond at maturity) equal the current market price.

The yield to call (YTC) is an annual rate of return on a bond if the security is redeemed by the issuer at the earliest allowable callable date.

It is calculated as:

YTC = (coupon interest payment + (call price – market value) / number of years until call) / (( call price + market value ) / 2 )

The yield to worst (YTW) represents the yield in a worst-case scenario – how low the yield on the bond can get (within the terms of the obligor’s agreement) without defaulting. This is most applicable to bonds with an early call provision.

Yield to worst is always a number less than the yield to maturity because of the shorter investment period.

It is the lesser value of yield to maturity or yield to call.

A discount rate is used to discount future cash flows to determine an asset’s present value (i.e., its price). This is commonly applied in fixed income and equities analysis.

Interest rates can be fixed rate or floating rate.

Floating interest rates can be indexed to a benchmark interest rate, such as the central bank rate, an internationally accepted standard (like what Libor had been), or to inflation.

Many governments, including the US and UK, provide both fixed and floating rate fixed income securities for sale to the public. In both cases, they are indexed to inflation.

Investors commonly use the inflation-linked versions of government bond issuances for:

- diversification to a fixed income or broader asset portfolio

- as an inflation hedge, or

- to help them hedge against their own unique set of liabilities, which can be fixed and/or floating rate (i.e., nominal or real) in nature.

A portfolio with a set of liabilities marked to inflation or real terms would generally look at an inflation-linked bond as its risk-free asset. This could include any portfolio that makes adjustments for cost of living, such as some pension funds.

For a portfolio with a set of liabilities linked to the prevailing nominal risk-free rate (i.e., most hedge funds that borrow at a fixed rate), the standard nominal bond would be considered the risk-free rate.

Monetary Policy’s Influence On Interest Rates

Interest rates are an important component of how monetary policy is conducted. The adjustment of short-term (and sometimes long-term) interest rates is used to help optimize variables like inflation, unemployment, investment rates, and currency stability.

Central banks will generally lower interest rates when they want to lower unemployment rates and increase investment rates and overall output in an economy.

They will typically raise interest rates when they want to cool down the rate and/or rate of change in inflation or, in some cases, to tame asset bubbles.

In some form or another, central bank interest rate policy is run with the goal of maintaining inflation within a certain range or up to a certain level. This helps keep economic activities healthy without excessive price pressures and without deflation.

When central banks have just one mandate, it is typically based on inflation policy. This is true with respect to the European Central Bank (ECB).

Others, like the US Federal Reserve, have a statutory dual mandate or stable prices within the context of maximum employment (plus a third informal mandate of financial stability).

How Are Interest Rates Influenced?

Interest rates are influenced by many factors, including (but not limited to) the following:

– central bank policy

– fiscal policy

– the supply and demand for loan funds in the market

– competing investments

– the duration of the investment (primarily a function of the term to maturity)

– the borrower’s likelihood of default

– general creditworthiness of entities issued loans

– collateral amounts

– the currency in which the loan is denominated

– features of the contract, such as whether bonds are callable or not

– reserve requirements in the banking system

Generally nominal interest rates are positive. A dollar today is worth more than a dollar tomorrow.

The entity lending money is deferring consumption to the future to consume more later. As a result, interest rates are typically positive and yield curves are upward sloping to reflect the demand for higher interest rates for longer lending agreements.

Inflation expectations

Inflation expectations also feed into interest rates. If someone expects inflation to go up by two percent per year, then that will add onto the risk premium required for making the loan.

Inflation reduces the purchasing power of money over time. Since most economies exhibit some level of inflation, the borrower must compensate the lender for this diminished purchasing power.

We can always see what forward inflation expectations are by looking at the yields on inflation-linked bonds versus their fixed rate counterparts.

The difference between the two is known as the breakeven inflation rate.

10-year Breakeven Inflation Rate (US)

(Source: Federal Reserve Bank of St. Louis)

30-year Breakeven Inflation Rate (US)

Competing Investments

All investments compete with each other for available capital.

Investors can choose among cash, bonds, equities, real estate, private investments, commodities, different currencies, and so forth.

When choosing one source of returns, the investor is essentially forgoing the returns of all other investments.

The interest rate demanded on an investment will need to be commensurate with its risk.

An investor will demand a higher rate on bonds than cash and a higher rate on stocks relative to bonds (unless they’re a form of bonds that are particularly risky).

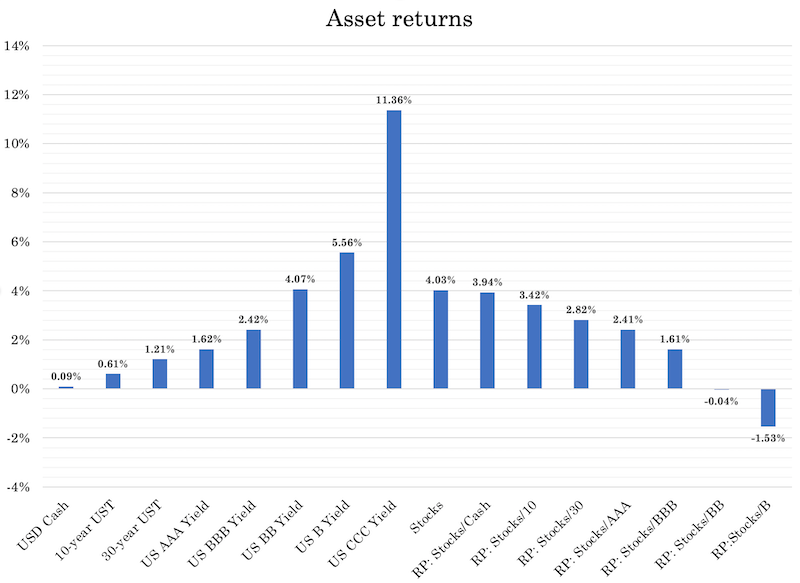

For example, we can see a steadily increasing forward return for bonds relative to cash, riskier credit and equities relative to safer credit, and so on.

Interest Rates Based On Risk

Interest rates include the probability that an entity may default. This may be due to bankruptcy, non-payment, injury or death, or any reason that could lead to a default on the loan.

The entity doing the lending will charge a certain amount to compensate for this risk of default, based on the probability of default and the expected loss given default.

For example, if credit analysts determine, based on the information available to them, that there’s a 10 percent likelihood that the borrower will default over the course of the loan and the expected loss given default is 30 percent of the total loan value, then they might charge an extra three percent interest (0.10 * 0.30) on the loan plus a small premium to create an expected profitable outcome for making the loan.

This extra risk premium helps ensure the lender that it is compensated for the range of loans that are expected to default within the portfolio.

Macroeconomic Considerations

At the sovereign level, interest rates are a function by nominal growth rates (real growth plus inflation).

Nominal interest rates need to be somewhat below nominal growth rates or the debt will compound faster than the economy can grow.

For developed countries, there is practically no credit risk, as the obligor (i.e., the government) can always pay what they need to pay in nominal terms. They have control of their money creation process.

In developing countries, sovereign risk plays a more important role, so a credit risk premium is often embedded in the yields of their debt to a degree.

As emerging markets do not have reserve currencies (i.e., limited international use of their currency and savings within it), they are limited in the extent to which they can print money to satisfy their debt obligations.

Given emerging markets also have structurally higher inflation rates and usually higher real growth rates (because they have so much catching up to do), they tend to have higher interest rates than developed markets, especially when adding in a credit risk premium.

Taxes

Interest income is often subject to income taxes. The lender may increase the interest rates it demands on its loans to compensate for this influence.

Politics

Incumbent politicians benefit from a stronger economy. A boost in economic activity can be generated through lower interest rates. It can also stimulate asset markets and create a wealth effect.

This can benefit public perception of their performance and potentially increase their re-election chances.

However, the pop in economic activity may be offset through higher future inflation. Incumbent politicians nonetheless think on a timeframe relevant to their terms in office. This means political influence can lead to short-term decision-making that may not be in the best interests of the long term.

For this reason, central bank independence is a common hallmark of government and monetary policy “best practice” in most countries to keep the institution as free as possible of partisan or self-serving political influence.

Real interest rates vs. Nominal interest rates

Nominal interest rates include the real interest rate plus inflation. The real interest rate, to the lender, is the amount of expected real spending power they are likely to receive in return.

When real interest rates on financial assets become low, this incentivizes investors to seek out alternative stores of wealth.

This is why gold tends to be strongly influenced by real interest rates. Its price often rises when real interest rates decline and its price declining when real interest rates rise.

A Fuller Discussion On Interest Rates And Monetary Policy

Monetary policymakers have control over the main tools that drive money and credit creation in an economy. Interest rates are the traditional lever to help achieve their objectives.

However, there are often cases where that interest rate lever no longer works as well and non-traditional monetary policies are put into place.

Zero interest rate policy (ZIRP)

When nominal growth rates fall enough, central banks may need to lower nominal interest rates down to zero. This was the case in the US during the Great Depression, as well as 2008 due to the financial crisis.

A zero interest rate policy (ZIRP) is a policy rate that is very low (i.e., near zero or zero) interest rate set by the central bank.

When interest rates are lowered traditionally, it stimulates demand for credit.

But when the central bank hits its lower bound, it becomes difficult to stimulate further credit creation in the private sector.

Once interest rates hit zero, that dynamic is no longer there. Interest rates can go slightly negative, but at a certain point the return relative to the risk for lenders doesn’t make sense. People will still want to save and borrowers and lenders will still be cautious with each other.

Negative interest rate policy (NIRP)

It is not atypical for real interest rates to go negative. This occurs when inflation exceeds nominal interest rates.

It is nonetheless uncommon for nominal interest rates to go negative on short-term or long-term rates.

But several jurisdictions, facing low growth and inflation, have, including the ECB, Bank of Japan, Swiss National Bank, and the Riksbank (Sweden).

Long-term interest rates

Longer term interest rates can be lowered through the purchase of financial assets, commonly called quantitative easing or, colloquially, “printing money”.

This is the secondary form of monetary policy.

It was popularized when the US recovered from the 2008 financial crisis, though it was also used during the Great Depression (albeit later in the deleveraging process).

Modern QE in the US officially began in March 2009 (earlier in Japan, later in Europe). This represented the bottom in stocks and beginning of the decade-plus bull market run that ended in February 2020.

The interest rate driven policy (i.e., the adjustment of short-term interest rates) primarily affects the creditor and lender relationship.

However, asset buying-driven monetary policy most heavily impacts investors and savers.

QE primarily involves the purchase of debt assets, mostly bonds issued at the sovereign level and other government-backed securities. As a crisis worsens, however, a central bank will continue to backstop progressively lower-quality collateral.

When a central bank purchases a financial asset, it puts cash into the private sector.

Where does it get the money from to do this and how does the central bank do it?

It creates the cash – because it has money creation authority – and uses it to buy a bond or other financial asset.

The central bank places the bond on its balance sheet and the cash goes to the market participant who sold the bond in exchange for it.

In the case of the investor, they typically want to buy something of a characteristic that was most like what they already owned.

What the investor does with the cash makes a big difference in how effective the program is.

Does it stay within the financial system and mostly boost financial assets prices?

How much of it directly gets spent in the real economy and how much of it is indirect (e.g., by boosting creditworthiness, improving companies’ financial situations to help create jobs, and so on)?

Generally, once longer-term rates get down close to zero, then QE is also out of room and they must turn to a different form of policy that doesn’t involve interest rates.

Some call it “MMT”, tertiary monetary policy, or a different term, but once short-term and long-term rates are right around zero, then the next step is to coordinate fiscal and monetary policy to get money and credit to where it needs to go in the economy.

This can be costly in terms of what a huge extra wave of money creation can do to a currency (i.e., devaluation).

So, aggressive fiscal policy with monetary authorities providing the money to accomplish these objectives must be done with appropriate caution.

Countries with reserve currencies can push these policies further than those that don’t.

Emerging markets are not able to pursue these policies to the same extent as developed market countries without experiencing balance of payments and inflation issues as a result of the weakening of the currency.

Beyond interest rate driven monetary policy

When interest rates are exhausted at the zero lower bound – or effective lower-bound perhaps somewhere below zero – and asset buying is no longer effective because the interest rates on those bonds are zero as well, then central bankers have a new problem.

Despite policymakers’ knowledge and comfort with these policies, they have diminishing effects when their rates can’t be pushed down much further. As a result, they contribute less to increased spending and output in the economy.

Private sector credit creation begins to lag and the economy enters into a period of low growth and general stagnation.

Moreover, because risk and liquidity premiums have become so compressed due to the effects from previous policy actions, the forward returns on all assets are low. This includes not just cash and bonds, but it flows through into stocks, real estate, and private equity as well.

Investors – when they become concerned about the risks of these assets relative to their levels of forward absolute returns – are not as willing to bid up their prices further.

Because of this newly limited ability to stimulate both the economy and asset prices, central bankers must turn to tertiary forms of monetary policy.

Often this comes due to a big credit crunch in some form that forces them to try multiple approaches at the same time rather than a slow realization.

Risks

Overusing debt monetizations can cause inflation without bringing back growth to a point where stimulus measures can eventually be scaled back in an appropriate way.

Currency devaluations are also a zero-sum game. One currency’s gain is another’s loss.

Generally during weak economic conditions, nobody wants a stronger currency. It can harm manufacturers by making their goods more expensive on the international market and doesn’t help ease borrowers debt problems.

Foreign debtors who don’t hedge their liabilities get squeezed.

An increase in a currency you have your liabilities denominated in relative to another you earn your income in is essentially the same dynamic as a large increase in interest rates.

A stronger currency is essentially a tightening of monetary policy. Any countries that choose to engage in devaluation will probably see that its main trade partners want to match these devaluations tit for tat, potentially creating a “currency war”.

Typically, but not always, gold increases because of lower short-term and long-term interest rates. The need to print money causes the value of money to go down, making gold go up in relative terms.

Gold is essentially a contra-currency or a reference point for the value of money and, as mentioned above, tends to go up in relative terms (i.e., a certain amount of money per ounce) when the value of money decreases.

Gold doesn’t bear an interest rate like most financial assets, but it begins to look more attractive in relative terms when the real returns on other assets goes down.

Tertiary monetary policies operate by working around the interest rate and bond markets as transmission mechanisms. They are effectively constraining forces to credit creation.

When interest rates and asset buying programs are tapped out when rates on short- and long-term assets approach zero, they cease to be effective relative to what they once were.

Tertiary monetary policy forms outside interest rates

Tertiary monetary policy means that spending has to be separated from borrowing.

This inevitably means that there will be greater coordination between fiscal and monetary policy.

In these cases, the central bank isn’t solely transmitting its policy through the banking system and fixed income market. Rather, it is doing so by directly assisting spending, consumption, and other credit and liquidity programs that are traditionally solely within the purview of fiscal policy (through loans or directly providing the money).

This can take many different forms:

a) helicopter money (the central bank adopts the power to engage in fiscal policy, providing money directly in the hands of spenders and ties it to spending incentives)

b) debt monetization (the central bank funds fiscal deficits directly, effectively retiring the debt from the money they create)

c) capping the cost of capital through yield curve control (similar to what the Fed did around the time of WWII and Australia and Japan are doing now)

d) a partial or full nationalization of the commercial banks

Yield curve control, or cost of capital pegging, is similar in effect to interest rate adjustments and asset buying. Commercial bank nationalization is sometimes seen but it is not essential. Moreover, they are already subject to regulation.

Depending on the type of policy and the laws governing what they can do, the central bank can put money directly in the hands of spenders.

Moreover, policymakers will ideally incentivize them to spend it.

One way to do it is through electronic deposits and having the money expire after a certain period of time if it’s not spent. Another is to means test these payments and offer higher payments to lower earners than higher earners given the propensity of the former to spend more of what they receive. Higher earners are more inclined to save or invest it.

Accordingly, a notable weakness of secondary monetary policy (asset buying/QE), is that those who largely benefit from the program (those who own assets) have less incentive to spend the extra wealth they generate in relation to poorer people.

When asset buying is no longer very effective at stimulating the real economy (or even the financial economy when the spreads close), it will come to a point where the wealth gap is quite large while the economy remains weak.

This can come with other undesirable effects, such as higher levels of social tensions.

As a result, targeting spending programs toward those who have less wealth will tend to be more productive in terms of getting more spending the real economy.

The relative degree of coordination between fiscal and monetary policymakers runs along a spectrum.

Helicopter money, or direct cash handouts in some form, that involves sending cash to citizens directly does not necessarily require coordination with fiscal policymakers depending on the laws in the relevant jurisdiction.

On the other end of the spectrum, providing stimulus via direct government spending or by altering incentives to get people to spend more will require a more coordinated approach between the fiscal and monetary arms of the government.

There are also more targeted measures beyond interest rate policy.

Macroprudential policies, which are within the wheelhouse of central banks and their regulatory authorities, can also influence incentives and help take care of emerging problems within specific sectors (i.e., asset bubbles).

While a fuller explanation of these policies is beyond the scope of this article, the best policies tend to provide the money and credit directly to the entities who need it and give them incentives to spend it. This helps to get the spending and income flywheel going again.

Conclusion

An interest rate represents the amount of interest charged on top of the principal of a loan by a lender to a borrower for the use of a loan or other asset.

Generally, a lower risk loan will have a lower interest rate than a higher risk loan, and vice versa.

Interest rates can be impacted by many variables including duration of a loan, monetary and fiscal policy, the supply and demand for loan funds, collateral amounts, special loan features, currency of the principal amount lent, macroeconomic conditions, the availability of competing assets, among other influences.

Interest rates play an especially important role in monetary policy, including the way the primary (adjustment of short-term interest rates) and secondary (asset purchases) forms of monetary policy are conducted.