Is Cash A Good Investment?

Cash provides safety, liquidity, and optionality. Having some part of your portfolio in cash is important for a buffer room and overall protection. Traders who always expend all of their cash to stay “fully invested” will inevitably face frequent margin calls.

Bonds are a promise to deliver currency over time. Because of their duration, they usually (but not always) yield more than cash.

We covered the role of cash and bonds in more detail in separate articles, such as in the discussion of how to build a balanced portfolio, so we won’t delve too much further into it here.

Rather, cash and bonds will spoken of in the current context.

A 10-year bond gives you only an extra 60bps (0.6 percent) of yield per year. Namely, relative to something like a 3-month bill, which is a common proxy for cash.

(Source: Treasury.gov)

But 10-year bonds also fluctuate in price more because of their duration. A one percentage point upward move in interest rates moves the price of the bond by about 10 percent (i.e., around its effective duration). In other words, it takes very little movement in its price to wipe out far more than the entirety of its total annual yield.

The world’s shortage of dollars

The Federal Reserve is the US central bank and can create money and credit to help replace losses and prevent a deterioration of balance sheets. But this money heavily goes to US entities who are under its purview, and doesn’t do much to solve the problems faced by the larger dollar-related losses outside of the US.

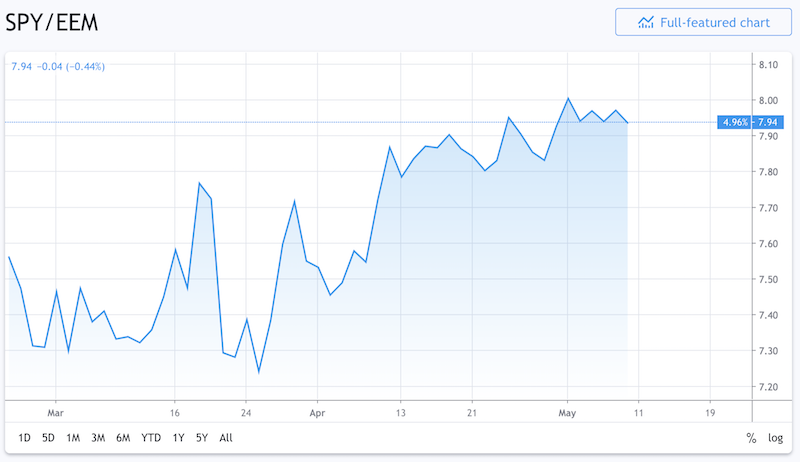

Since the top of the US stock market before the crash on February 19, 2020, emerging market equities have underperformed US equities by about 5 percent, measured by taking the value of SPY (an S&P 500 ETF) and dividing by EEM (an emerging markets ETF).

(Source: Trading View)

Because the US dollar is the world’s currency in the sense that 55 to 60 percent of the world’s borrowing, saving, and transactions occur in it, the world is desperate for dollars to replace income and meet obligations, and this shortage is supporting the value of the USD.

Having control over the creation of the world’s currency means having control over the world’s most important asset. This is especially true when there’s not enough of them. Many entities globally – individuals, corporations, and governments – need dollars, causing a short squeeze.

Eventually, this upward pressure on the US dollar will abate for either one of two reasons:

i) enough money will be created to satisfy needs through a combination of domestic printing and international access (e.g., swap lines), or

ii) defaults and restructurings will occur such that the need for money decreases.*

*Debt is a “short money” position. Debt eventually has to be “covered” by paying money out to whom it’s owed. If debt is wiped out or restructured, then the need to satisfy those liabilities with cash disappears or is reconfigured to a new arrangement.

When this occurs, the US dollar will weaken.

Moreover, it will also weaken because those holding USD-denominated debt are not going to want to continue to hold it given the interest rates on it – in both nominal and real terms – are unacceptably low. On top of that, when there’s a lot of money being created, this undermines its value.

Because of the debt load among all parts of the economy – sovereign, corporate, individual – central banks will need to keep interest rates low. There will be negative real returns and negative returns relative to other asset classes that do well when markets “reflate” (e.g., corporate credit, stocks).

Because stock markets in the US plummeted about 35 percent in a few weeks, that made cash look attractive by comparison because its value doesn’t move around much.

Nonetheless, what actions did central banks take to counteract this asset and economic decline?

They had to lower the interest rates on cash with virtually no further chance on rate hikes in developed markets for a very long time. Global rates on short-term debt are now less than one percent.

Moreover, central banks bought a lot of government debt and “printed” an unprecedented amount of money to buy other credit assets, which helps push up their prices. It lowers the cost of capital for businesses to help keep them viable.

This is similar to the period running from 1930 to just after the end of World War II.

Short-term interest rates hit zero, long-term interest rates were also held low through “yield curve control” and the backstopping of various forms of collateral.

There was the creation of money by the Fed and buying of financial assets, all the standard forms of monetary policy. What types of financial assets they buy depends on what policymakers want to save. What are the costs and benefits to letting various entities fail?

2008

In the 2008 financial crisis, policymakers believed it was reasonable to let Lehman Brothers and Bear Stearns fail (i.e., zero out shareholders and most of the claims available to creditors), but other entities were saved.

Why cash is the worst investment over time

While the volatility of cash is low, there is a negative return to it in various ways:

i) negative real return and often negative nominal return (even now in the United States on some debt maturities)

ii) negative returns in relation to various forms of goods and services

iii) negative returns in the long-run relative to other financial assets (“risk premiums”)

These negative returns add up to a lot over time. Losing two percent returns per year (i.e., a typical risk premium of bonds over cash) over thirty years means losing out on 81 percent aggregate returns.

Losing out on 4-5 percent per year (as in a typical spread of equities over cash) over thirty years can mean losing out on investment returns of 3.2x to 4.3x.

Cash, which is now money that doesn’t bear interest throughout the developed world, is important to have in some quantity.

But it’s a long-term underperformer to other asset types – especially assets that retain their value or increase their value during periods of reflation.

Final Thoughts

Increasingly, bondholders will question whether the bonds they hold, which receive negative real and nominal interest rates, are quality stores of wealth.

On top of this, ample amounts of money are being created to help service existing debt problems and to assist in replacing lost incomes. This deprecates its value long-term. (In the short-run, currency demand in excess of supply helps support the currencies in which this is relevant.)

Emerging market dollar bonds offer higher yields but are risky alternatives. First, they are borrowing in a foreign currency, yet make their income in domestic currency. Given their currency is less in demand to reserve currencies, emerging market currencies typically decline in downturns, much like other risk assets.

Some countries, like Ecuador, are on the US dollar, which they turned to as a result of a previous crisis ending in 2000. But don’t have the capacity to print more of it for their own needs, which falls exclusively within the control of the Federal Reserve.

Other countries, like the major oil exporters, such as Saudi Arabia, Oman, Qatar, and the UAE, use the US dollar as a conventional peg to encourage global confidence in their currency values.

When countries have limited demand for their domestic currency because they aren’t used much (or at all) as global reserves, they have limited ability to provide assistance to their economies.

This limitation drove down bond and currency demand (i.e., prices) and drove up yields.

(Source: Ice Data Indices, LLC; St. Louis Fed)

Commodity exporters have been hit hard by the drop in oil prices. Commodity importers might see some relief from lower energy prices, but their own economic issues with the virus has more than offset any savings in that regard.

India, in particular, a major importer of oil, is suffering. Its total public support spending has come to just 0.7 percent of GDP, which is well shy of the 10-20 percent figure that’s been common in developed countries. Its financial sector was already troubled heading into the downturn.

Roughly 25 percent of all emerging market government debt is at risk of moving into distressed grade territory.

Most emerging markets have been ill prepared financially to handle the storm with much less capacity to stimulate their economies relative to developed markets, and their debt is cheap for a reason.

Will the debt ever be paid off?

In the US and developed world, it will never be paid off.

There are three main ways governments can pay their debt:

i) cut spending

ii) raise taxes

iii) create money

Because of the limitations to cutting spending and raising taxes (adversely affects people so those governments will get voted out after a point), they inevitably go with the third.

The government debt and long-term obligations related to pension and healthcare (which are many multiples of the headline debt figure) will never be paid off through productivity outcomes that result in a tax-take above government spending, which would then theoretically go on to pay down debt and more than service long-term obligations.

Printing money comes with its own problems, but is the least painful alternative. In fact, many politicians and economists are calling for more of it, mainly because the consequences are simply far-off or not well known.

Will all this spending be inflationary?

In the financial economy, it certainly can be. When liquidity is provided into the financial sector, it gets into assets. The price of a financial asset is money and credit spent on it divided by the quantity. The key driver of liquidity in the financial markets is central banks, so it’s particularly important to pay attention to them.

In the real economy, the inflationary elements of money creation are offset through the deflationary effects of the holes blown in income and balance sheets (i.e., lower spending).

It’s a money creation exercise where more will fall on the government to buy it (or monetize it directly) rather than the private sector who will question the value of the debt assets (i.e., currency delivered over time) when receiving negative real and nominal rates of return.

People will increasingly have to decide whether negative-returning assets (i.e., the cash and bonds in reserve currency countries) are good stores of wealth.

Accordingly, they will have to determine what their options are in terms of alternative investment assets (e.g., gold, stocks, real estate and other real assets).