Why Interest Rates Can’t Rise Much

The IIF recently published that the global debt stock has reached $255.3 trillion at the end of 2019. This also doesn’t take into account non-debt liabilities like pensions and healthcare (which, when capitalized, are many times larger), and are debt-like in nature because they represent future IOUs.

Namely, retirees expect that they will receive retirement benefits like social security and healthcare that they were promised, or a large amount of spending power while no longer producing anything. Workers, at the same time, will expect to get spending power that will be commensurate with what they’re producing. It is not feasible for both to be satisfied relative to their expectations.

This $255+ trillion is nearly three times global output (total goods and services sold, also known as GDP) of about $90 trillion.

If rates are raised on that debt stock by even 25bps (0.25 percent), that’s another $638bn in debt service requirements per year.

That means an extra 0.7 percent of global GDP will go toward debt servicing and away from consumption and investment. Global GDP is expected to grow 3-3.5 percent in 2020. If rates increase even 100bps, practically all of global GDP growth would go toward debt servicing, holding all else equal.

It would actually be worse because 100bps on rates would materially cut credit creation. Higher rates have a negative feed-through into the economy, which compounds the problem. With US stocks having an effective duration of about 19 (the inverse of their forward annual yield of about 5.2-5.3 percent), that means about a 20 percent drop in equities if interest rates rose 100bps. Other equity markets would be similar.

That means if you trade rates, you could probably feel reasonably comfortable on taking long bets on long-term rates in the parts of the world (even the US) where rates are positive and debt liabilities are far in excess of output. They can’t raise rates very much in any of the top three reserve-currency countries (US, Europe, Japan) without hitting asset markets because of the high levels of debt and non-debt obligations that impair the financial flexibility of each area.

I am personally flat on rates over the next six months, but long eurodollars (a US interest rate product that closely follows the fed funds market) 3-7 years out and expect the 170-200bp spreads to be pretty well closed by then.

(Long rates means expecting interest rates to decline. The price of an interest rate futures contract is typically 100 minus the rate in percentage terms. So if an interest rate is priced to be 2 percent over a particular month represented by the futures contract, its value would be 98. An increase in the value of the contract would mean a drop in the interest rate or the expectation of its future value.)

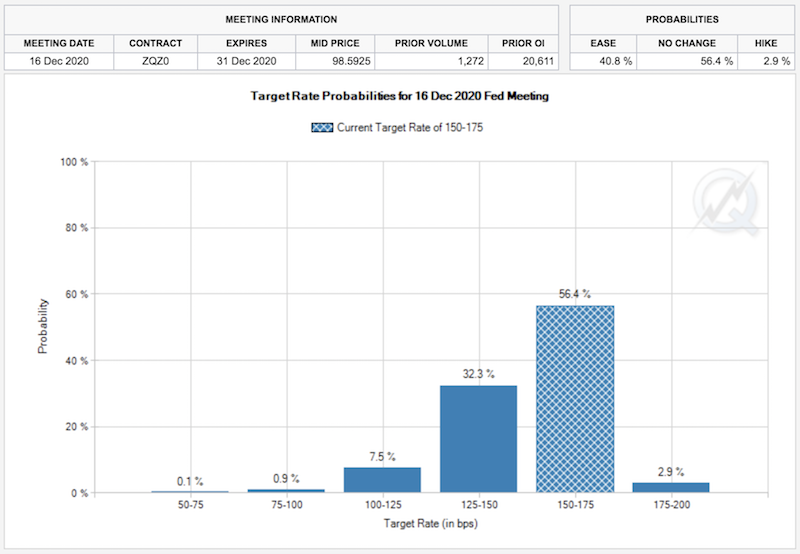

Through the end of 2020, there’s about 11bps of decline priced into the fed funds rate (about 59% chance of a hold throughout 2020; 41% chance of a cut).

(Source: CME Group)

There’s some way to go before a hike is priced in, so going 35-40bps in the other direction would be a problem for asset prices if growth expectations don’t rise in conjunction.

There’s a lot of debt so inflation isn’t going to be a problem if the Fed holds rates throughout 2020 or cuts. Hiking the cash rate would cut into the premium of equities over cash. It’s about 370bps now – i.e., only an extra 3.7 percent expected return is priced into equities over cash per year – which isn’t much extra compensation (but it’s not horrible either).

Once that gets into the low-300bps range, then the forward Sharpe on equities is getting into the sub-0.2 range, which means not a lot of return for a lot of risk. At a certain point, investors will no longer be willing to get that little return for the amount of risk they’re taking on.

Negative interest rates

Interest rates and, by extension, bond yields, can only go so negative. With bond yields negative in much of developed Europe and Japan, the expected returns of these assets are particularly bad.

Rates rising only slightly more than what’s discounted in has a negative effect on all asset prices (e.g., equities, private equity, real estate) because this discount rate is used to calculate the present value of future cash flows, which constitute the prices of these assets. When interest rates decline, the effective durations of all assets lengthen. This makes them more sensitive to changes in rates.

When the Federal Reserve believed that the fed funds rate was “far from neutral” at the beginning of Q4 2018 and kept up that narrative until the end of the year, that repricing of the future interest rate path pushed down US equities by 20 percent. In bygone eras, unexpectedly shifting monetary policy seemingly on a whim was a surprise, but not lethal to risk assets (see Paul Volcker’s “Saturday night massacre” in October 1979 to finally break inflation). Today, such conduct would be unfathomable and central bank communication to the market is tightly prepared and deliberate to avoid roiling markets.

There is a general awareness that relying on negative interest rates won’t work long-term. Negative rates make cash a little bit less attractive, but not by much. In particular, it won’t push investors into the type of assets that help finance spending and materially improve the real economy.

Negative interest rates can become counterproductive if savers are forced to save more (instead of spending more) because they’re not getting paid enough on the savings that they do have.

It can have negative contribution to productivity if the availability of cheap capital allows “zombie companies” to continue and perpetuate. Zombies are largely defined as companies that don’t have the operating income to meet their interest payments and don’t have a clear path to getting there. In other words, the business models are shaky if not outright untenable. If capital is free or close to it, rolling over debt becomes easy without having to pay back the principal, and there isn’t much of a hurdle rate to productive investment.

There’s also the wealth inequality issue. People who have owned financial assets benefit from these policies while those who don’t get left behind. This feeds populism and bleeds into social and political movements.

Negative interest rates can’t be relied on interminably to support the economy.

Market addiction to liquidity

In the final days of 2018, the Fed raised interest rates for the final time and commented that it planned on raising them 2-3 times, in 25-bp increments, in 2019. That went along with balance sheet run-off, which would make cash scarcer in the private sector by running down bank reserves.

Once the market dislocation became intolerable – the aforementioned 20 percent decline in US equities, or the textbook threshold for what’s called a “bear market” – they walked back on their forward guidance. Interest rates in the US were cut three times this year. The balance sheet is going back up. This is not QE, as the fed funds rate is not at zero and the Fed is buying short-duration Treasury bills to calm short-term rates and not buying duration to lower rates further out on the curve. Moreover, the Fed is not pushing more money into the private sector beyond keeping reserves steady.

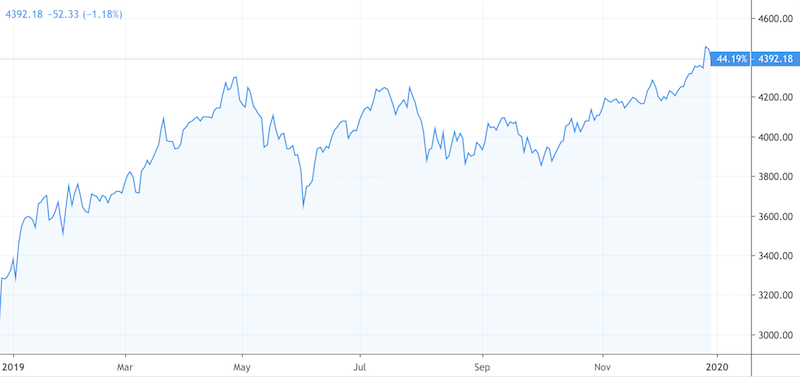

This created a V-shaped recovery in stocks.

The markets are basically dependent on continuous low interest rates and liquidity injections because of the size of the debt stock. Raising rates just a little bit has no issue in slowing down the economy because of the effect on pushing more capital into debt servicing and away from consumption and investment.

On the liquidity issue – are ETFs structurally sound?

Exchange traded funds (ETFs) are sometimes questioned as a potential systemic issue, particularly as the range of funds and inflows have increased in recent years.

An ETF is simply a basket of securities that people invest in where there’s promised liquidity. In other words, an ETF is an implicit guarantee of a cash-out for the underlying securities at sensible bid/ask prices. Some traders, mostly high-frequency traders, have businesses built around arbitraging out pricing differentials between ETFs and the basket of underlying securities held within the structure.

In liquid markets, ETFs make sense. When dealing with developed market large cap equities, ETFs are pretty sound structures to capture this type of exposure.

But in markets that are less liquid, like corporate credit (both investment grade and high yield) and some parts of emerging markets (both equity and credit), this type of promised liquidity may not be reliable. In a normal environment, they are fine. When the market becomes less liquid – in an environment when many investors want to liquidate their investment because they need cash – the ETF structure is likely to be more tenuous.

The short answer is that most ETFs provide reasonable diversified, liquid exposure when times are good, though the dispersion in robustness will be greater when market liquidity falters, particularly for inherently illiquid markets.

The liquidity picture set up 2019 for a solid year

Liquidity is the primary reason why 2019 was an all-around good year for returns among almost all asset classes.

US stock market indices were up 30 percent, though much of it was simply digging out of the Q4 2018 hole. Lower rates also pushed up fixed income of all durations. Commodities improved on improved global growth outlook from more accommodative central banks. Gold improved heavily off lower real rates. Risk-free assets, like US Treasuries, including cash, saw positive returns.

On top of that, volatility was below average for most of the year.

This is what liquidity injections help accomplish and why the actions of central banks are so important.

Going forward

Nonetheless, these types of returns cannot continue indefinitely. Since the March 2009 bottom, US equities markets have returned 16 percent annualized. Yet the inescapable reality is that financial assets collectively cannot outperform the growth of the economy over the long-run. There are only goods and services. Financial assets are simply claims on them.

If long-term US growth is about 1.7 to 1.8 percent (which is reasonably high compared to below 1 percent for Japan and just above 1 percent for developed Europe), and inflation averages about 2 percent or a bit less, this means financial assets have about a 3.5 to 4.0 percent return base going forward. Financial engineering, such as the path of interest rates and corporate merger and divestiture activity, can help juice equities returns somewhere above that to a bit over 5 percent, but returns will be nothing like the past – the 16 percent annualized since the 2009 bottom or the 11 percent annualized over the past half-century.

Going forward, investors are likely to be rewarded for quality – namely, companies with stronger balance sheets (have little capacity to run into debt issues) are likely to outperform over the next several years.

Putting money into segments of the high yield market and emerging market corporates are more at risk. When markets decline, with the riskier, less traded markets, they are fewer market participants available to make the market (i.e., provide reasonable bid/ask spreads).

For example, sovereign debt from Argentina and Turkey often attract in less experienced investors because of the higher yield (though increasingly more sophisticated investors who simply have nowhere else to go to get the returns they need). These markets tend to be fine when everything is good in the world, and do poorly when a) the countries run into problems, which are recurring, or b) there’s a dislocation globally, people need cash, and lower quality securities are the first to be let go from a portfolio and are willing to get out at any price.

The important of cash

Cash provides a buffer to avoid not only running too close to margin requirements such that normal market fluctuations could force you to sell, but also provide the opportunity to pick up securities when prices fall. It provides flexibility.

As global stock markets go up, more experienced traders and investors are selling the lower quality securities in their portfolios, which helps raise cash. When opportunities come along – e.g., Q4 2018 – this provides the ability to pick up securities at reasonable prices. The “FANGMAN” stocks (FB, AMZN, NFLX, GOOG, MSFT, AAPL, NVDA) are up 44.2 percent since the December 2018 dislocation.

Securities like FB, AMZN, GOOG, MSFT, and AAPL in particular are quality companies to pick up in sell-offs because of their clean balance sheets and massive cash generation in growing markets.

Markets have a tendency to overshoot both ways

The biggest mistake traders to make is that they believe that what happened in the past is likely to continue in the future. Even for algorithmic traders, their systems are heavily optimized based on what’s worked in the very recent past rather than focusing on the cause-effect relationships.

Investments that have done well in the past are typically assumed that they will continue to be good. But usually, high past returns are indicative that something has become a more expensive investment, not a better one. Likewise, recent poor returns simply mean that something has become a better investment, not a worse one.

The tendency of traders to buy after prices have increased, for no other reason that the price has gone up, causes prices to overshoot. When prices rise, traders often become greedy and fearless. Likewise, when prices fall and traders become cautious and fearful, and often need to raise cash, they tend to sell.

There is generally a lag between the price extreme and the recognition of an overshoot. Accordingly, there is the tendency to overshoot in one direction followed by a move in the other.

When Argentinian bonds traded down to below 30 cents on the dollar in September 2019, the market overshot on the way down. “Tourist” investors were spooked on the move down and sold out any price available even though the selling price didn’t accurately reflect the probability of default and likely residual return if said debt was defaulted on.

Conclusion

Because of the high stock of global debt, we know that interest rates can’t rise much without rising debt servicing in a dangerous way and triggering a fall in more-sensitive-than-normal asset prices through the net present value effect.

The rebound from the Q4’18 drop saw US equities rise nearly 30 percent in 2019. Bonds of all varieties produced positive returns. Cash saw a positive return. As did gold, oil, and commodities as a whole. Central bank liquidity greatly assists in this process.

However, traders will need to recognize that with financial assets at their current prices, forward returns will naturally be low. The US economy is not likely to grow by much more than 3.5-4.0 percent in nominal terms (1.5-2.0 in real terms) going forward. Financial assets are simply claims on goods and services and cannot indefinitely outperform the growth in their production.

Debt cycles cause wide variations in the distribution of returns of long-duration assets. So, when a supportive credit environment allows above-trend growth, the typically high returns of equities in this phase of the cycle are assumed to continue (people have a bias to extrapolate what they’ve gotten used to). But the type of returns experienced in this phase are not sustainable. The most common mistake investors make is that investments that have done well in the recent past are better investments rather than more expensive investments.