Apple

Apple (AAPL) is one of the most widely traded stocks globally with an average daily volume of close to 40 million shares. In this article, we’ll cover the various aspects of trading Apple stock, including determining its fundamental value through different modes of analysis, technical analysis, and the various products by which the company can be traded: its underlying shares, options, bonds, and CFDs.

The Top Online Brokers For Apple Stock Trading

Business overview

Apple’s primary business runs through its flagship iPhone product, and it also designs and manufactures the iPad, MacBook, Watch, AirPods, and HomePod. These are powered by software applications including iOS, macOS, watchOS, and tvOS operating systems.

Its Services portfolio includes the App Store, cloud services, Apple Music, Apple Pay, AppleCare, and licensing. The adoption of the Apple Watch has helped Apple strengthen its position in the wellness and personal health monitoring space.

Additional services include Apple Arcade, Apple Card, Apple News+, Apple TV app, Apple TV channels, and the Apple TV+ subscription service.

Fundamental Analysis

There are two basic ways you can do fundamental analysis:

i) Bottom-up

ii) Top-down

Going bottom-up entails looking at individual companies and projecting their revenues, cost structure, and balance sheet (assets against liabilities) to obtain a general understanding of the intrinsic value of the business.

Going top-down means looking at higher-level macroeconomic factors to determine whether certain asset classes are worth buying, and if so, what sectors within those are best (e.g., tech, cyclicals, staples, and so on), and what companies are best (to buy) or worst (to short).

Top-down is commonly applied in macro disciplines, where these types of traders will look at things like economic capacity utilization to determine where we are in the business cycle, debt to income ratios to observe debt sustainability, and the risk premiums between and among asset classes. We covered these concepts in greater details in our article on the big three economic and market equilibriums.

Some investors will use a combination of both approaches, identifying asset classes and sectors that are a good fit from a top-down perspective and finding the best companies to invest in within that framework.

Bottom-up fundamental analysis of Apple stock

Fundamentally, the value of a business is the amount of cash you can take from it over its life discounted back to the present.

Following the idea that a dollar today is worth more than a dollar tomorrow or in any future period, any cash earned in a future period is discounted back using a required return on investment (also called the discount rate) to determine its present value.

Figuring the sum of these cash flows at the discount rate is typically called discounted cash flow analysis.

Determining business valuations is more of an “art” – there is no perfect numerical answer. Everyone has a certain return requirement and the future naturally has a wide variety of possible outcomes.

And because the cash flows of equities are theoretically perpetual, small shifts in the expectation of a future income stream can have an outsized move on the price of a security. This contrasts with most forms of bonds where the total return received over a number of periods/years is known in advance and more of the analytical emphasis is placed on the risk of default.

Apple Discounted Cash Flow Example

To determine the intrinsic value of Apple as a business we need to make reasonable projections for the upcoming annual period and for periods beyond that. To keep things simple, we can simply input values like revenue growing a certain percentage year over year. The assumptions should be in line with realistic expectations.

For example, the fiscal year 2020 (FY2020), we can say that Apple will earn $280 billion in revenue.

Apple is a relatively mature, stable business and its margins don’t fluctuate too much year to year. EBITDA margins are just shy of 30 percent. Depreciation as a percentage of sales comes in close to 4 percent. Its effective tax rate is about 15 percent.

We also need to input certain variables related to its balance sheet, such as cash (an asset that adds to the value of a company), its debt and effective cost, and its shares outstanding.

We also need to know its capital expenditures and R&D expense, which is effectively what it’s spending to invest back into the business to help it grow. If we set this equal to depreciation, then this offsets the impact on cash flow.

Generally, cash flow is the sum of:

Cash flow =

+ Either [Net income] or [Net operating profit after-tax (NOPAT)]*

+ Depreciation and amortization

+/– Any net change in working capital (e.g., inventories, receivables, payables)

– Capital expenditures

*Net income is used when valuing only the equity in the business as the interest expense (debt) is subtracted out. NOPAT is used when valuing the enterprise value of the business, which includes the debt capitalization.

We also need to know our required rate of return. Stocks historically earn about 5-6 percent in excess of cash. Cash yields effectively nothing in most of the developed world or a negative return even in nominal terms, so 5-6 percent as a required return could be reasonable.

From another perspective, the Sharpe ratio of any asset class, or a measure of excess returns to excess risks, is usually 0.2-0.3. Empirically, any lower and the returns don’t compensate enough for the risk and the asset could be considered overpriced. Any higher, and it attracts competition and forward returns eventually get bid back down.

The annualized volatility of equities is usually around 15 percent for a US index. For individual stocks they are typically higher, as a diversified basket tends to be more stable than any given company whose valuations can change a lot around major data releases.

For example, Apple’s historical volatility is around 43 percent annualized.

However, if one is well-diversified to something resembling an index, the volatility of the individual security won’t be the reference point off which to base the Sharpe ratio calculation.

If stocks have about 15 percent annualized volatility, then a 0.2 to 0.3 Sharpe ratio would place the expected return somewhere at 3 to 6 percent using basic multiplication.

If using 43 percent (i.e., concentrated position in Apple), then your discount rate would need to be a lot higher (some 8.6 to 12.9 percent) to account for the extra risks.

A discount rate of 6 to 7 percent is pretty standard. We’ll run our analysis off 7 percent.

Filling in the discounted cash flow (DCF) model

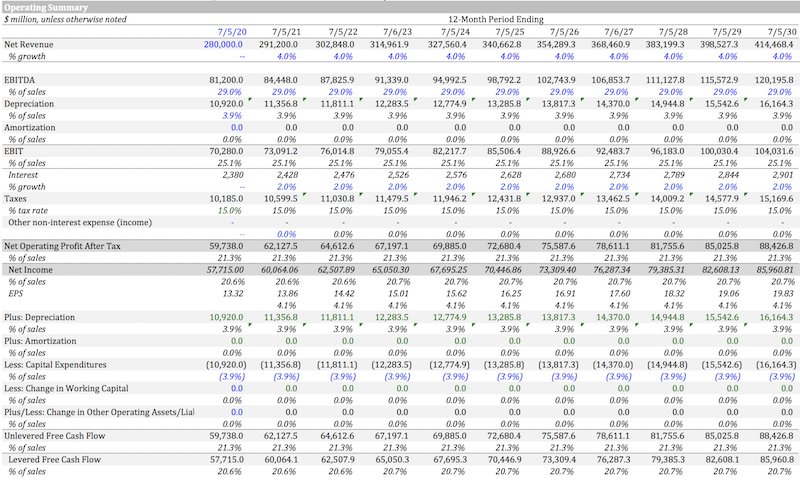

Here we can look at our DCF model line by line.

We tend to discount out ten years.

We set our desired return on equity to 7 percent. Most companies also have debt, as does Apple. Debt is cheaper than equity because in the event of a potential liquidation bankruptcy bondholders are senior to stockholders. In other words, they get paid first in such an event. Common stockholders get paid last.

Apple’s effective cost of debt is around 2 percent, which lowers the overall cost of capital of the company. On a weighted average basis, given equity is about 93 percent of Apple’s capital structure and debt is 7 percent, its overall cost of capital is about 6.65 percent. This is the discount rate we evaluate the entire company on.

We can also adjust the valuation to a range figure by taking the valuation around that 6.65 percent figure, at plus/minus 50bps. In other words, we can find the valuation of the company over a discount rate range running from 6.15 to 7.15 percent.

Later on, to get the value of the equity, we subtract out the debt and add “excess” cash (cash not needed to pay near-term liabilities) to get to the equity value of the company. Dividing by the fully diluted share count gets the value per share.

Projection period

Over the projection period, we go at the half-year intervals since this is being written about halfway through the calendar year.

We also have two projections – unlevered free cash flow (UFCF) and levered free cash flow (LFCF).

Throughout this article we are using unlevered free cash flow, which is simply the valuation of the entire company. To get at the equity, we have to subtract out the debt at the end as noted above. Levered free cash flow calculates the equity value directly.

In the free cash flow calculation, we are taking each of the yearly projections and discounting the cash flow back to the present by our 6.65 percent discount rate (and +/- 50bps above and below it).

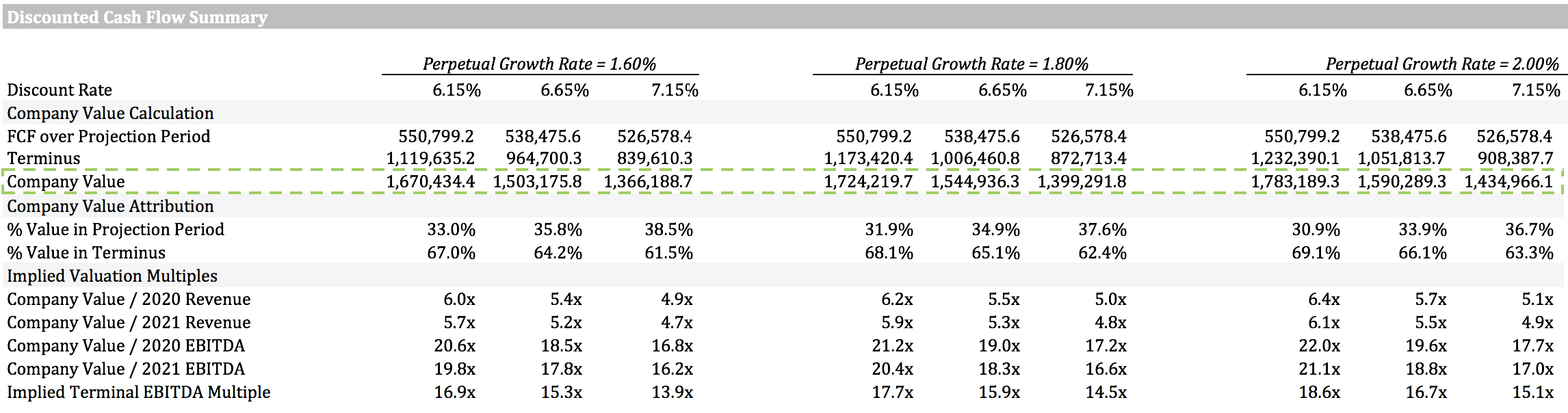

Then we sum those up to find that the estimated total discounted cash flow out of Apple over the next ten years is about $538 billion. Using our range, it goes from about $526 billion to $551 billion.

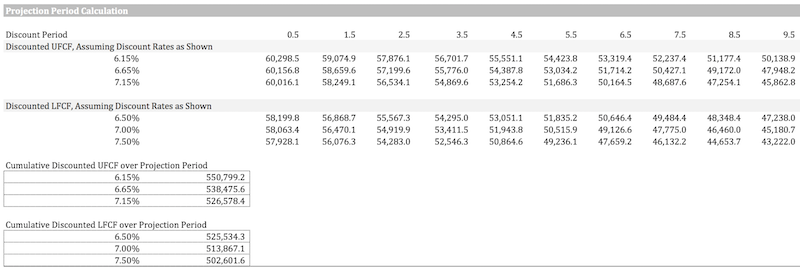

Terminal Value Calculation

To get to our terminal value – i.e., the total value of the company not included in our 10-year projection period – we need to do that calculation.

There are two different ways to do a terminal value calculation:

a) Perpetuity growth model

b) Exit multiple model

Perpetuity Growth Model

The perpetuity growth model takes the free cash flow from the final year of the projection period and multiplies it by 1 plus the growth rate (i.e., of the economy) and then divides by the difference between the discount rate and growth rate:

FCF * (1 + g) / (k – g)

FCF = free cash flow of final period

g = growth rate (i.e., of economy)

k = discount rate

In this case, we could assume that the long-term growth rate of the economy is about 1.8 percent, and the discount rate is 6.65 percent.

The terminal year free cash flow was about $88 billion (NOPAT, or net operating profit after tax). Plugging all that in:

$88bn * (1 + 0.018) / (0.0665 – 0.018) = $1,856bn

That’s around $1,856 billion, or $1.856 trillion. But it’s not in present value terms.

To turn it into present value terms, we need to take that figure and divide it by 1 plus the discount rate to the power of the terminal year discount period (which was 9.5 years).

$1,856bn / (1 + 0.0665)^9.5 = $1,006bn

That comes to $1,006bn, or $1.06 trillion.

Exit Multiple Model

The exit multiple model takes the final year’s FCF and multiplies it by an appropriate valuation model.

For example, many companies’ valuations are expressed as a multiple of EBITDA (earnings before interest, taxes, depreciation, and amortization).

In this case, we could take our free cash flow from our final projection year, $88 billion, and multiply it by a representative EBITDA multiple. This could be the median trading multiple for publicly traded industry peers (i.e., companies that are close to what Apple does as possible for congruency).

Whatever that multiple is, the FCF figure would be multiplied it, with that number divided by 1 plus the discount rate to the power of the terminal year discount period (9.5 years).

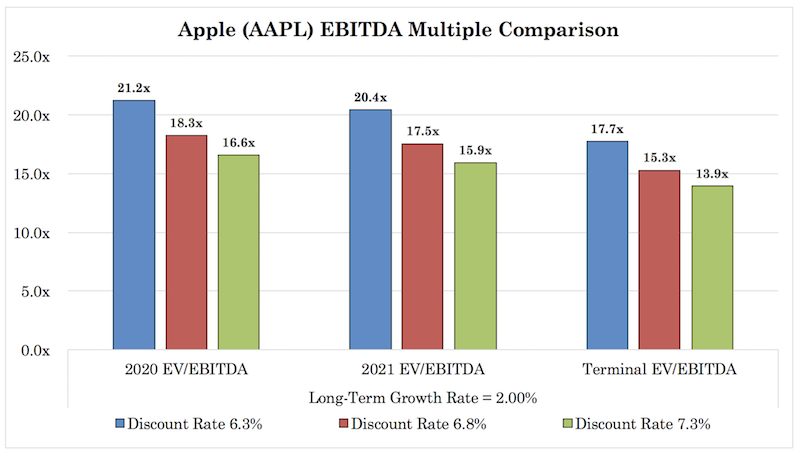

We can also infer from the perpetuity growth model what this terminal EBITDA multiple would be. Based on these projections it would come to around 16x.

($88bn * 16) / (1 + 0.0665)^9.5 = approximately $1 trillion

Perpetuity growth vs. Exit multiple

The perpetuity growth model is sensitive to the inputs. Small deviations in the discount rate and perpetual growth rate can swing the terminal value wildly.

The exit multiple model must be considered in the context that valuation multiples change over time because of interest rates, the economic cycle, and the overall margins, growth, and/or profitability of the industry and individual businesses within it.

The perpetuity growth model is used more heavily by academics while the exit multiple is used more in the business world.

Total Valuation

Sensitized across our entire valuation range, based on the discount rate and perpetual growth assumption, we get a value running from $1.37 trillion to $1.78 trillion for the entire value of the business.

If we subtract out the debt to give the equity value we get $1.32 trillion to $1.72 trillion.

To find the appropriate per-share price, we take the enterprise value, subtract the debt, and add the amount of cash, then take that figure and divide by the number of shares outstanding.

This range goes from $298 to $395 per share.

As this is being written, Apple stock is $364 per share, so it’s roughly fairly valued by this measure.

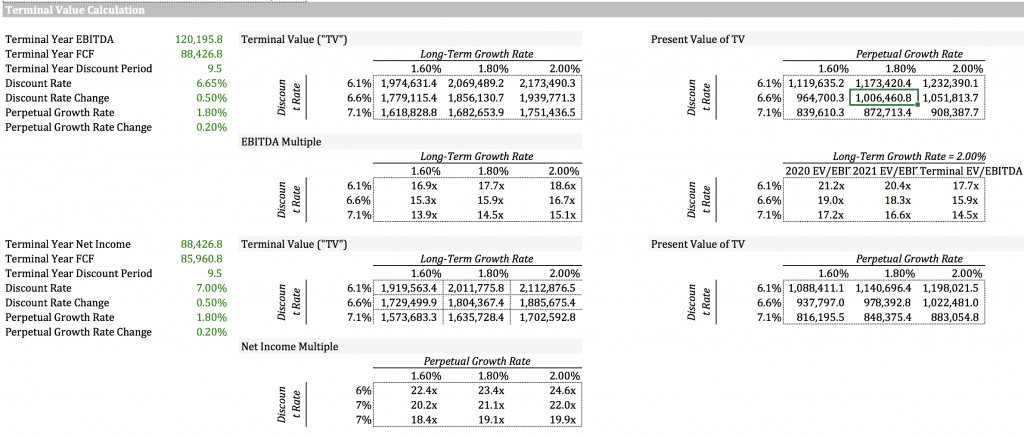

‘Football field’ graph

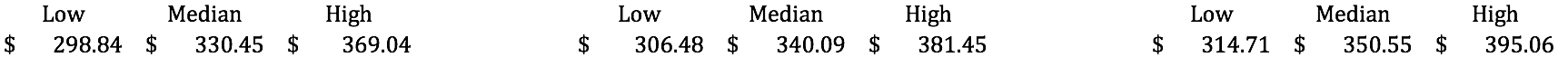

In some presentations, investors may show their valuation range through what’s commonly called a “football field” graph because of its resemblance to the yard markings on a field.

This will show the lower, middle or median, and upper valuations of the range across various criteria. In this case, Apple stock is valued across the discount rate range – 6.65 percent +/- 50bps, and across the perpetual growth rate range of 1.80 percent +/- 20bps.

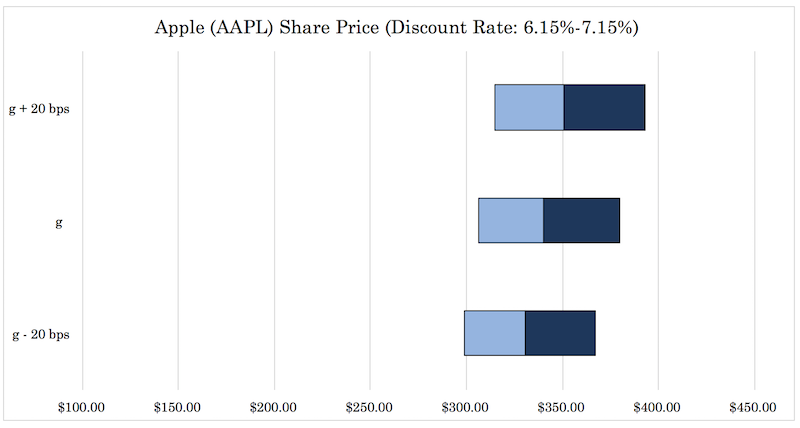

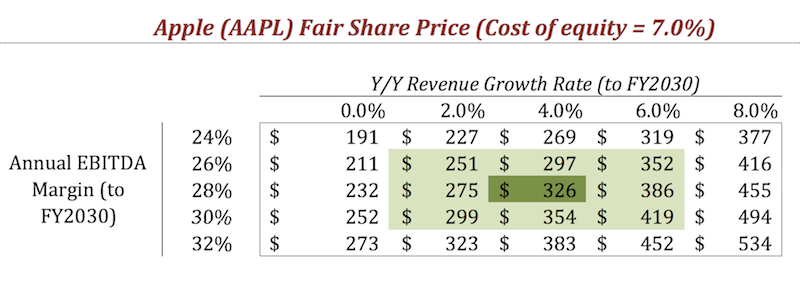

Revenue and margin sensitization

We can also present the valuation through a graph that sensitizes the valuation to two different variables, like revenue growth and margins while holding things like the discount rate/expected rate of return constant.

This has the benefit of seeing a range of outcomes based on two important variables – i.e., what is revenue going to be growing at and how much of it turns into earnings or cash flow.

In this case, we use revenue growth and EBITDA margins. Our base case is around 4 percent year over year revenue growth in the 10-year projection period and EBITDA margins of just under 30 percent. Our discount rate/cost of equity is kept at 7 percent.

The numbers that are non-color coded give us a broad range. The light green numbers give us a tighter range that are closer to our base case of expectations, while the number in the middle gives a type of overall median projection.

We run the range from 0 to 8 percent year over year revenue growth and EBITDA margins running from 24 to 32 percent.

This gives us a broad range of $191 to $534 per share, a tighter range of $251 to $419 per share, and a general median of around $326 per share.

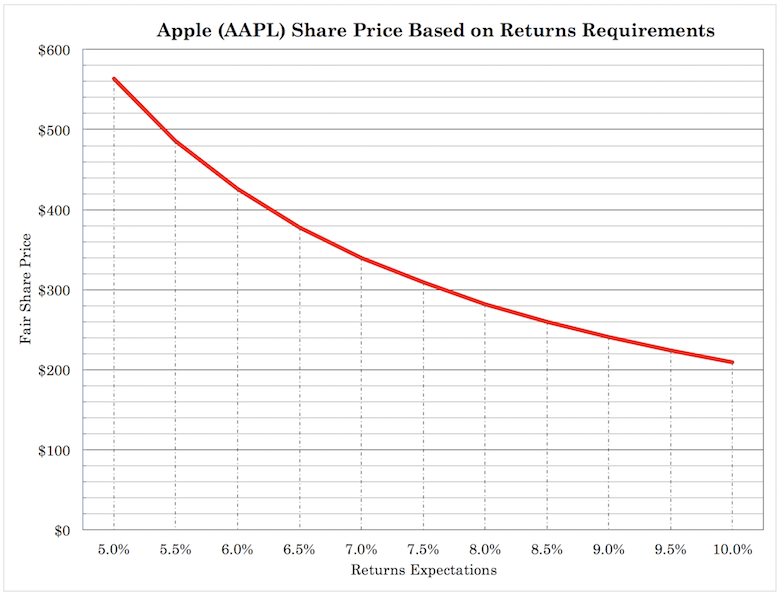

Sensitized to expected return

A discount rate is an expected return on investment.

If you only need 5 percent return per year you’re going to be willing to pay more upfront than someone wanting 10 percent return per year. The higher the price the lower the forward returns, generally speaking.

In this case, we find that someone only needing 5 percent return per year could be willing to pay up to a fundamental value of around $560 per share (about a 50 percent premium from current prices as this is being written).

On the other hand, someone wanting 10 percent return per year could have to wait until a price of just over $200 per share.

Capital Structure

The capital structure of a company refers to how its funded – i.e., the composition between debt and equity funding.

Debt and equity each have their pros and cons as a funding source.

Debt is cheaper than equity because its senior in the capital structure. The trade-off is that paying debt is an obligation. Debtholders are obligated to receive a certain amount of cash at regular intervals, otherwise the company will be in default. The upside with funding a company with more debt is you don’t have to worry about diluting your ownership stake.

Equity is more expensive, but paying out dividends to shareholders is not an inherent obligation. Equity represents the shareholders of a business. They are paid out the value of a business after all expenses and other obligations are paid. Issuing equity is safer, as you can’t “default” on it. At the same time, issuing equity dilutes a stockholder’s ownership stake.

Traders will often look at a company’s capital structure to determine how risky a business is. Generally, the higher the debt level in a business, the riskier the equity. All the debtholders need to have their claims made due on before equity holders receive anything.

Higher leverage increases default risk. An over-leveraged business whose cash flow is likely not sufficient to service the debt will typically see their stock decline by a lot.

At the same time, a company doesn’t want to be too far under-leveraged. Capitalization that’s too concentrated in equity will raise its overall cost of capital and decrease the value of the business, as the return on invested capital won’t be as high.

Namely, debt tends to lower the cost of capital for a business up to a point. But after a certain degree of debt is added, the company can become over-leveraged in the sense that it will have difficulty meeting its debt service obligations. In turn, this will hurt its credit rating and see its cost of capital increase.

Credit ratings are largely based on cash flow to debt ratios (often termed a “credit metric”). Lower cash flow to debt ratios reduce creditworthiness and increase credit costs, as investors want to be compensated more for investing in riskier businesses.

We can make assumptions about what credit metrics correspond to what credit ratings and thus debt costs.

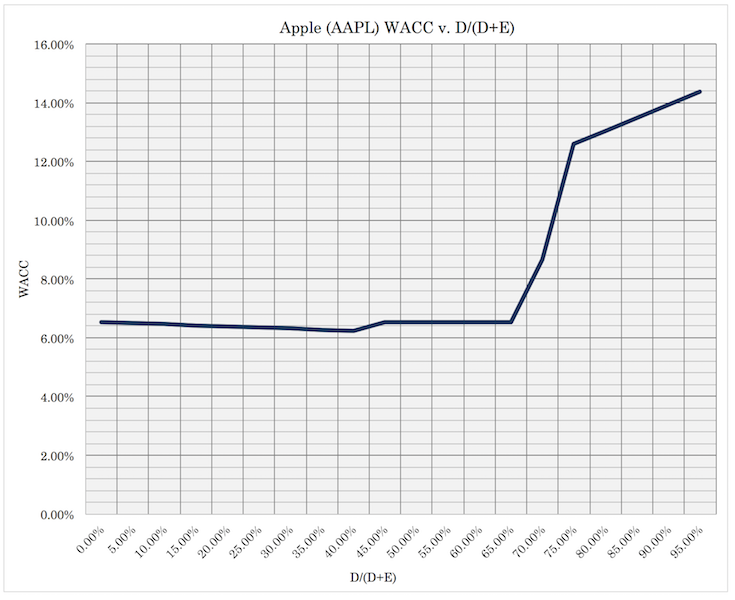

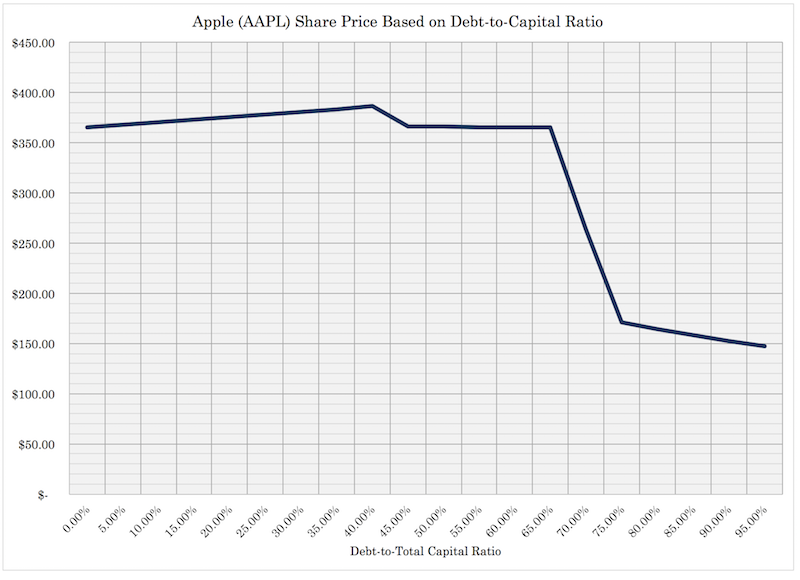

If we plot out this relationship based on what percentage of the capitalization is comprised of debt, we can see that it’s like an inverted U-shape with a huge upswing in the cost of capital beyond a certain percentage as a business becomes materially overleveraged.

Below we plot out the case of Apple (note: WACC = weighted average cost of capital; D = debt; E = equity)

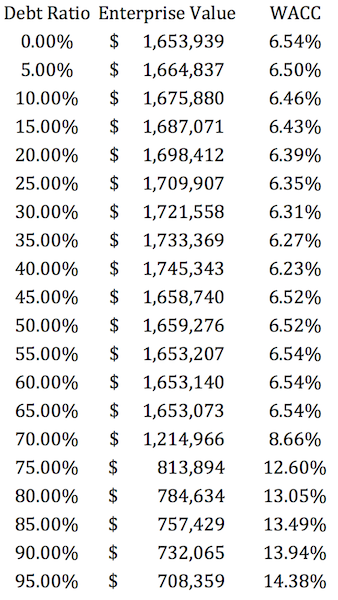

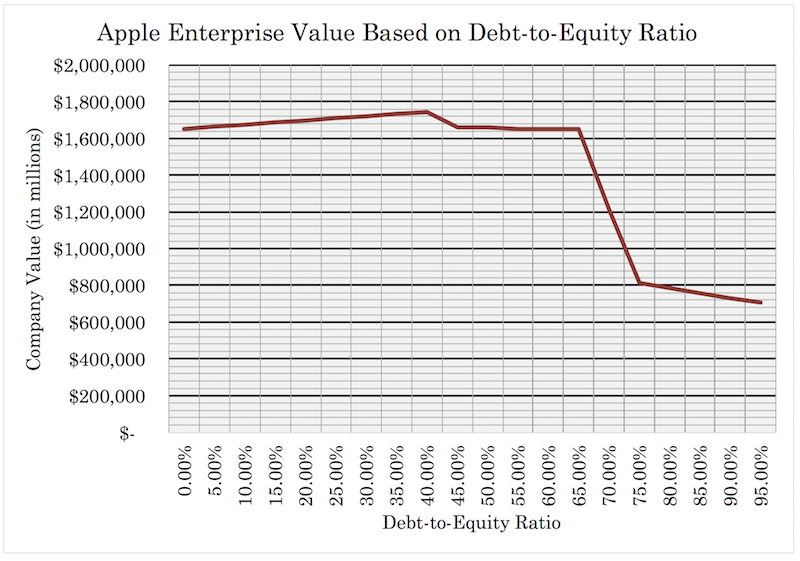

We can simulate out the effect for the debt ratio and WACC have on enterprise value (through the same discounted cash flow approach discussed earlier).

As can be observed, the enterprise value of the company goes up to a point with more debt capitalization due to its cheapness relative to equity. But it declines after a point because debt is an obligation and therefore there comes a point where the cons to taking on more debt outweigh the pros.

Graphically:

Then we can also translate this into the share price:

Apple’s capital structure is approximately 93 percent equity and 7 percent debt. It has very little leverage.

It could add more debt to more cheaply capitalize the business, but based on the shape of its capital structure curve, it wouldn’t add much benefit to the company’s stock price.

Apple regularly buys back its own shares to benefit stockholders. This would also have the effect of getting a slightly more optimal debt to equity balance in its capital structure.

Capital structure composition and its influence on the value of a company is an important consideration for management teams.

Activist investors might also target capital structure improvements in a company they hold a stake in. For example, they might ask an under-leveraged company to issue debt to buyback equity. This would not only improve the share price, but also get the capital structure composition to a more optimal point, and therefore also benefit the valuation from the financial engineering tailwind.

In some cases, a company may want to issue dividends to shareholders. Dividends state, in a de facto sense, that a certain amount of earnings is guaranteed. Companies that slash their dividends typically see their stock pounded.

Issuing dividends can also help diversify the shareholder base by getting more investors seeking the safety of dividends, even if the dividend is a nominal amount. (Apple’s dividend yield is a bit under 1 percent).

In other cases, a company may prefer buybacks instead. This can help get an under-leveraged capital structure to a more optimal point on the curve. As mentioned, this may not only increase the share price but also help in a financial engineering sense. Apple primarily prefers buybacks over dividends currently.

Top-down fundamental analysis

Investors that use top-down fundamental analysis will look at the broader economy first before looking into individual companies.

For example:

1) How is the economy performing relative to its potential (i.e., output gap)?

2) What is debt servicing relative to income?

3) What is the return on cash, the return on bonds, the return on stocks, and the relative risk premiums between them?

We’ve covered the overarching macro environment in other articles with cash and bond rates at zero or close to zero throughout the developed world. This is pushing more money and credit into the stock market and driving up their prices.

Tech, in particular, does well in a “reflation” because its duration is very long. In other words, most of the anticipated cash flows of these companies comes far out in the future. Apple currently trades at around 30x forward-twelve-months (FTM) earnings.

Combining the two approaches

Some traders will use a combination of both top-down and bottom-up fundamental approaches.

For example, some traders want a certain structure to the portfolio that helps them improve return for each unit of risk. Within each asset class, they may also want to better balance their risk and allocate a certain amount to tech, consumer products, and so on. Then they’ll go within each sector to identify the best companies and buy and sell at the appropriate price points.

For instance, in the previous section, we noted that one version of Apple’s fair value went from $298 to $395 per share. A fundamental trader might interpret that to buy the stock at $298 and sell at $395.

They might also weight their position more heavily at the lower end of the range and less so at the higher end of the range following the standard ‘buy low and sell high’ procedure. In other words, they will trade the range and add or sell incrementally.

Technical Analysis

Technical analysis is a wide-ranging subject that involves the transformations of volume and price data to generate potential interpretations of future price movement.

Many traders also combine fundamental analysis with technical analysis. Fundamental analysis helps generate an understanding of where an instrument should reasonably trade.

To keep things simply, if a trader believes Apple stock is cheap at $200 but expensive at $400 they could look for price signals that help them get long in the lower portion of that range and sell or short-sell as price goes higher.

Some might use moving average crossovers as buy and sell signals. Such events, usually involving 2-3 moving averages, are meant to be taken as a change in trend when they all crossover from a previous trend and align with the new one. The longest moving average will crossover last to “confirm” the new trend.

For example:

Stocks can also be influenced, in a pure technical sense, by their underlying options markets.

Some stocks (like Tesla) don’t have large short interest as a percentage of the float but do have large put open interest. Put open interest acts as a resting stop due to the way certain participants operate their hedging arrangements between the cash equities and options.

For example, if a market maker is underwriting put options, it will often hedge that exposure (because of the limited upside, large downside) by delta hedging the position. One delta hedges a short put option position by short-selling 100 share per options contract.

Short-selling a security can have an influence on pushing a stock down. Likewise, covering a short can have the influence of causing a stock price to go up.

If there are a certain level of options contracts expiring that are not rolled over into new positions, that will change market makers’ hedging arrangements (i.e., done in concert with the cash equities market) and influence the stock. If put open interest is set to decline, that will be bullish for the stock as short positions are unwound, holding all else equal.

Of course, these movements reflect pure technical movements that involve nothing related to the fundamentals of a business.

The dangers of extrapolating the past

Some traders like to use price levels, trendlines, and various other indicators as part of their analysis. But it’s important to not get overly hung up on a certain level or trend or anything related to something that is based on what happened in the past.

The idea that buying and selling activity is broadly conditioned on where price crested or reached a trough in the past (and is somehow obvious and easily exploitable) is a naïve assumption.

Trading strategies that are formed along the thinking of, “whenever X has gotten to price Y historically, it hasn’t gone below or it usually doesn’t go below, so therefore it’s a good buy” or “if X gets to price Y but breaks below then it goes from a buy to a sell” are naïve and dangerous.

These days, with cheap and abundant computing power and various forms of back-testing software, it is easy for traders to identify what approaches would have worked in the past and what has done poorly.

But using these approaches naively will fail to identify the cause and effect relationships behind the performance. The danger is in using the past to design over-fitted strategies based on historical performance.

In a closed system where the past is likely to be a very good guide to the future (e.g., a game of chess) this approach can work well. However, in trading, such over-fitting and reliance on past data is generally not appropriate.

If the future is different from the past, and the past is what the system is based on, it will inevitably lead to frustrating (or even fatal) results.

Apple trading products

Apple Stock (AAPL)

You can trade Apple in different ways.

Naturally the most common way is through the stock. It’s the most liquid market available for trading it. The bid/ask spread is usually within $0.01-0.02 during market hours.

Many brokers offer zero commissions trading on all stock trades.

Options

The options market is another way to trade a market short or long (or really anything in between).

The buyer of an option contract pays a premium that gives the trader the option to buy (in the case of a call option) or sell (in the case of a put option) a fixed quantity of stock (100 shares per contract) at a certain price (the strike price) at a certain expiry.

Example

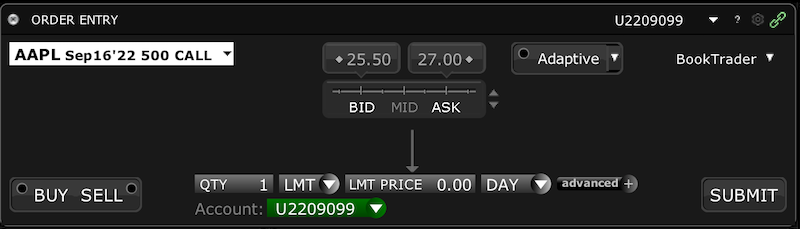

The September 2022 options chain offers a variety of strike prices on call and put options.

The September 2022 500 call currently trades at a spread of $25.50 to $27.00 per share.

That means the cost of one call option contract would be $2,550 to $2,700. This means sellers are asking for $2,700 per contract while buyers are looking for $2,550. To execute the trade, buyers have to execute at the ask (sometimes called the offer) while sellers have to execute at the bid, or somewhere agreed to in between.

Buying a call option at a price of $27 per contract means that one’s losses are limited to the premium. If Apple stock is below $500 by the expiration date, one only loses the $27 per share premium. If Apple were to land in-the-money (ITM), the profit would be the difference between the price at maturity and the strike minus the premium.

For example, if Apple is $550 at expiry, that’s a $50 per-share profit with the $500 strike price. Subtract out the $27 per-share premium, and that leaves a $23 per-share profit.

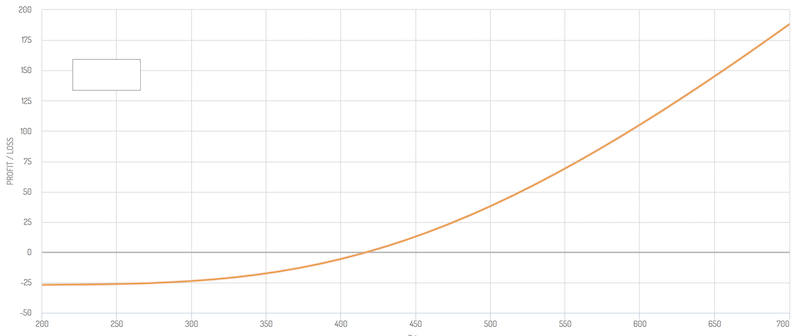

The chart below shows the fixed downside and hypothetically unlimited upside of trading options for the buyer. (For the seller, it’s the opposite, as they collect the premium but bear the risk.)

Those looking to trade volatility can also engage in more advanced strategies like straddles and strangles.

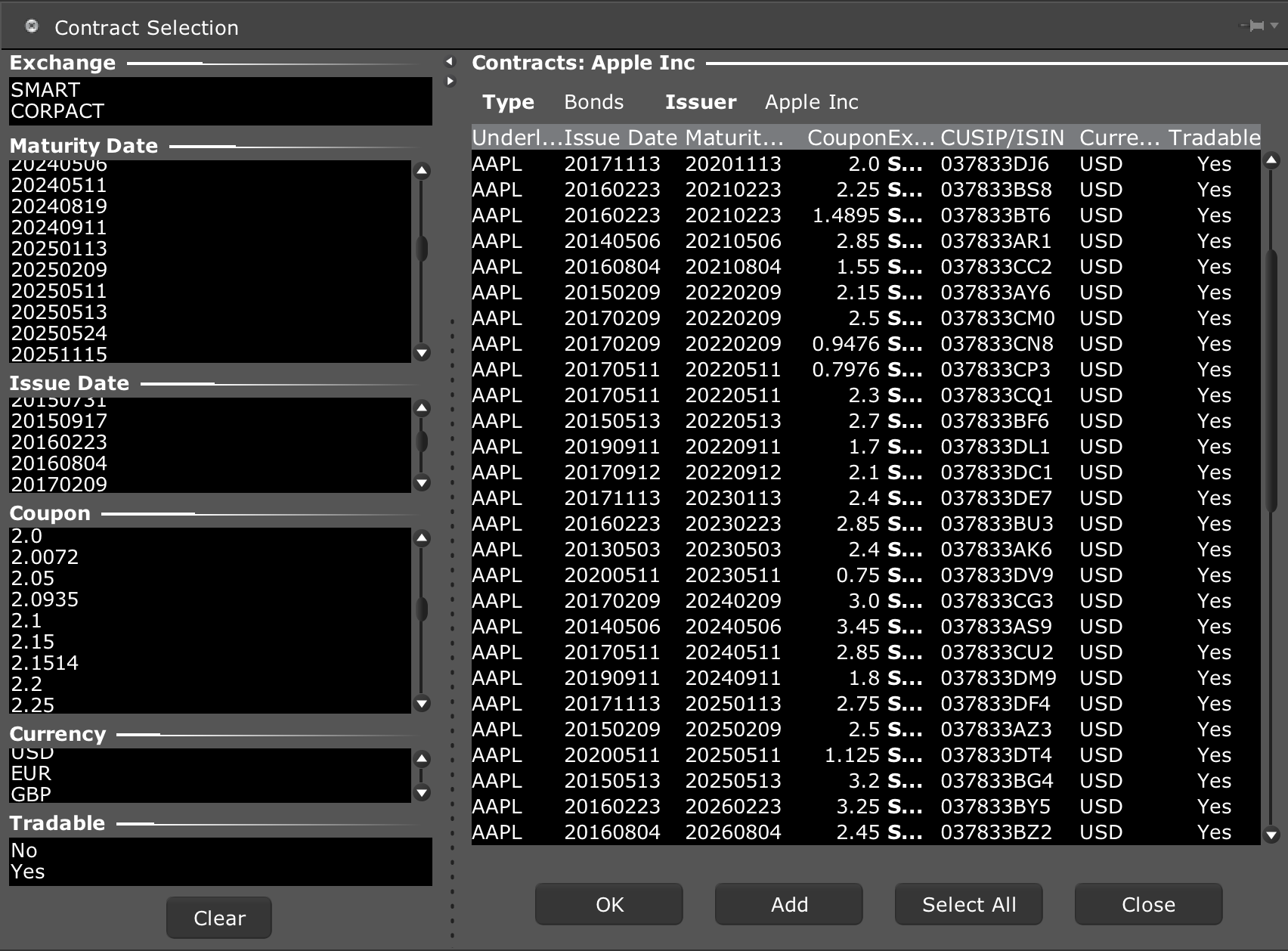

Bonds

Corporate bonds are typically the least liquid of the main markets for trading securities. Many bond issuances don’t even necessarily see any trade volume daily.

Corporate bonds are generally used by investors with longer time horizons and are less of a pure trading instrument.

Many brokers offer access to the full catalogue of Apple bond offerings.

(Source: Interactive Brokers)

Apple’s credit rating is currently Aa1 by Moody’s and AA+ by S&P. It is among the most creditworthy companies in the US.

CFD (Contract for differences)

Contract for differences allow European traders and investors to trade the price movement of a security without owning the underlying. The transaction is solely executed through the broker and client and does not use any intermediary exchange. (CFDs are not available to US traders.)

The advantages include no day trading rules, such as capital requirements or trading limitations. There are also no shorting limitations (e.g., hard to borrow or shorting fees) given no need to locate the underlying security for borrow.

They also allow for more leverage given the comparatively lighter regulatory standards, with anywhere from 2x to 30x leverage.

CFD Example

Let’s say Apple stock is trading at $375. The trader wants to buy 100 shares and has a standard 50% margin account. This trade would acquire $37,500 worth of Apple stock. With half bought on margin, the capital requirement would be $18,750. Commission costs and any spread fees might be applicable.

By contrast, for an Apple CFD trade, the broker might require a 10% margin, or $3,750 for 100 shares at $375 per share.

When entering into a CFD contract, the trader pays the spread. And because CFDs are less liquid markets, the spread is typically wider.

For instance, if the price of the underlying is $375 and the trader want to buy the stock, the ask price might be $375.10. The trader would have to pay that $0.10 per share price. On 100 shares, that would come to $10.

The stock would then need to gain those 10 cents to hit breakeven on the trade.

If the stock were to increase to $400 per share (bid price – i.e., the price where it could be exited). That would represent a $25 per share gain. On 100 shares, that’s $2,500.

On a standard stock trade where the underlying is owned, that would come to a return of 13.3 percent ($2,500 / $18,750).

For a CFD trade, the return on investment would come to 66.7 percent ($2,500 / $3,750).

Naturally, the extra return on investment is owed to the higher leverage, which can cut both ways.

Conclusion

In this article, we covered the basics of trading Apple.

We covered the types of fundamental analysis (bottom-up and top-down). We looked at the ways of going about determining a company’s value, and methods of ascertaining valuation within a range in the context of discounted cash flow (DCF) analysis.

We also covered the basics of technical analysis, integrating it with one’s fundamental point of view, and some potential pitfalls to avoid.

Some traders might be exclusively bottom-up, looking at a company’s revenues, expenses, and balance sheet to determine where a security should be trading at. Some might be more top-down, looking at the broader economy and hone in on sectors and/or individual companies that fit into that perspective. Others might integrate both approaches and work both top-to-bottom and bottom-to-top.

Apple can be traded through the underlying stock (i.e., cash equities), through its options market, bonds, and CFDs for European traders.