How Much of a Portfolio Should Be in Cryptocurrency?

How much of your portfolio should be in cryptocurrency?

In previous articles, we discussed cryptocurrency as an alternative to stocks and gold. To some extent, it could be.

The main issue with cryptocurrencies right now is their speculative nature. It means there’s a lot of volatility, often some 10x the level of stocks, depending on the timeframe and how volatility is measured.

Naturally, most don’t feel comfortable putting material amounts of wealth or savings into cryptocurrencies because of this.

And for larger investors, liquidity is an issue. Bitcoin has the highest market cap of any cryptocurrency market, but it’s not very deep in comparison to the very largest stocks in the market.

With a bond, you’re at least getting some type of more or less guaranteed income. With a stock, you’re buying earnings in a business.

Bitcoin and cryptocurrencies are something similar to gold in concept. They can potentially function as an alternative store of value, even though they’re too volatile for that right now. They are essentially a call option on the concept of a gold-like store of value asset.

In a previous article, we looked at the idea of how the price of bitcoin would change if more people took money out of the gold market and put it into bitcoin.

Then, of course, that distribution can get much wider if you think about where bitcoin’s price could go if more people start moving money out of low-yielding Treasury or developed market sovereign bonds – a much deeper market than gold – and into bitcoin.

Either way, you can make a lot or lose a lot putting your money into bitcoin and other cryptocurrencies.

Even though you can make a lot because of their volatility and increased appeal, you also have to be prepared to lose 80 percent or more. Bitcoin alone was down 82 percent in 2018 after its 2017 run.

But they’re still important to understand or possibly even integrate into a portfolio.

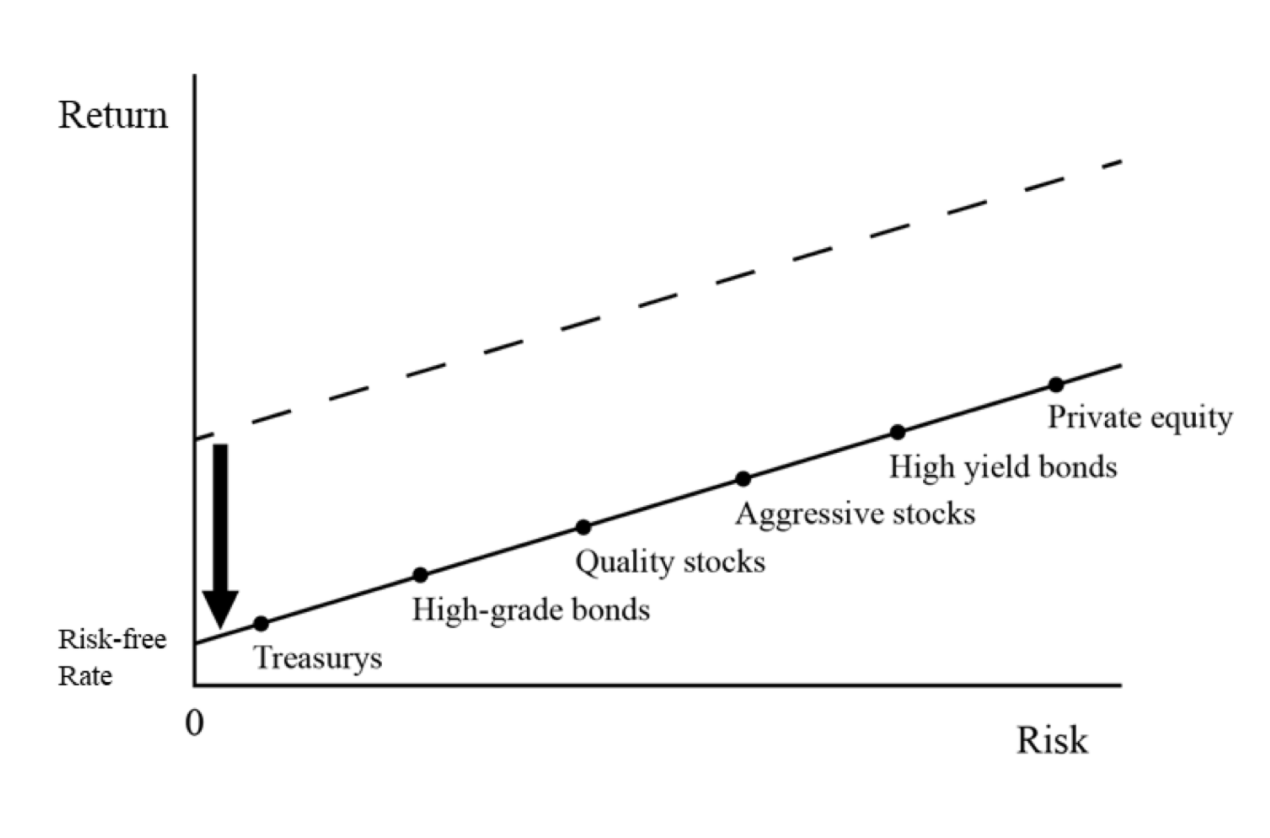

Cryptocurrencies and their rise are largely a function of the environment we’re in. When cash and bonds yield so poorly, the money moves into other stores of value.

A lot of the activity is speculative flows. But some increasingly view cryptocurrencies as a potential store of value with cash and bonds effectively destroying wealth with negative real yields.

Bitcoin and cryptocurrencies don’t yield anything on their own. They aren’t sources of yield on their own, much like gold, other precious metals (e.g., silver), commodities, collectibles, and other forms of real assets.

But when the yields decline on financial assets, that’s less important. Alternative stores of value become increasingly attractive in relation.

The main constraint holding back many people is (again) the volatility.

For institutional investors, the concern is not only the volatility, but also the liquidity and the lack of clarity on the regulatory picture.

Will cryptocurrency become harder to own if people are using it to conduct illegal activity or move their money outside the country?

If you’re trying to build a portfolio that has a somewhat modest risk profile, adding a lot of cryptocurrency is difficult.

Traditionally, when portfolios add in commodities as a type of inflation protection, the allocation allotted to them is often just 5 to 10 percent of a portfolio because of the volatility.

Bitcoin is about 3x as volatile as oil and about 10x as volatile as stocks and gold.

So having even just a small piece of your portfolio in bitcoin and other cryptocurrencies is a lot of risk.

How much cryptocurrency to own in a portfolio

One way to answer the question is to look at the risk decomposition if cryptocurrency is added to a portfolio.

Risk decomposition means how much of the portfolio’s risk can be attributed to any single asset or asset class within it.

This is a much easier question to answer. For example, many people, if open to the idea of owning cryptocurrency, might accept having 5 percent of their portfolio’s risk attributed to it.

But how much cryptocurrency is this in practice? Given its volatility, is it even one percent of the portfolio’s allocation?

Below, we’ll construct different kinds of portfolios and give example portfolio allocations that include cryptocurrency and we’ll look at how much of the risk decomposition it takes up.

As bitcoin is easily the market leader in the space and the one cryptocurrency that’s coming along as a type of reserve asset (even if only very marginally), we’ll be using bitcoin as the proxy.

90 percent stocks, 10 percent bitcoin

Let’s say you prefer having a pure stock portfolio, but would like to allocate 10 percent into bitcoin.

What’s the risk decomposition of that 90/10 stocks/bitcoin portfolio?

The answer might surprise you – the bulk of the portfolio’s risk would be in bitcoin.

Even if you put 10 percent of your allocation into bitcoin and the rest in the S&P 500, 63 percent of your risk allocation would be in bitcoin just because of how volatile it is.

| Portfolio | Name | Risk |

|---|---|---|

| 90% Stocks | SPDR S&P 500 ETF Trust | 36.57% |

| 10% Bitcoin | Grayscale Bitcoin Trust (BTC) | 63.43% |

95 percent stocks, 5 percent bitcoin

If you backed off a bit and put 5 percent of your portfolio into bitcoin and the rest into stocks, one-third of your risk would be in bitcoin.

| Portfolio | Name | Risk |

|---|---|---|

| 95% Stocks | SPDR S&P 500 ETF Trust | 67.18% |

| 5% Bitcoin | Grayscale Bitcoin Trust (BTC) | 32.82% |

99 percent stocks, 1 percent bitcoin

At 99 percent, it’s better but still high. If you lowered it to one percent bitcoin and the rest stocks, you’d have only about 3 percent of the risk in bitcoin.

| Portfolio | Name | Risk |

|---|---|---|

| 99% Stocks | SPDR S&P 500 ETF Trust | 96.88% |

| 1% Bitcoin | Grayscale Bitcoin Trust (BTC) | 3.12% |

50 percent stocks, 50 percent bitcoin

And just for fun, what would be the risk decomposition if you put half in each?

About 98 percent of your risk(!) would be in bitcoin with a 50/50 allocation.

| Portfolio | Name | Risk |

|---|---|---|

| 50% Stocks | SPDR S&P 500 ETF Trust | 2.05% |

| 50% Bitcoin | Grayscale Bitcoin Trust (BTC) | 97.95% |

This is why in previous articles we discussed portfolio allocations as not based on capital or nominal currency amounts – e.g., putting half of your dollars in stocks and half of your dollar in bonds so that it’s ostensibly balanced – but rather done with regard to balancing your risk.

Even a 50/50 stock/bond portfolio has about 80 percent of its risk in stocks because stocks are more volatile than bonds.

The traditional 60/40 stock/bond portfolio – which seems somewhat balanced and is a popular portfolio allocation among not only individual investors but also institutions like pension funds – has about 90 percent of its risk in stocks.

So if you choose to split half each to stocks and cryptocurrencies, your portfolio’s movement and overall risk will be very dominated by cryptocurrency. Stocks are quite risky and volatile on their own, but cryptocurrency would put that into overdrive. A half stocks and half crypto portfolio would be around 5x the risk of the stock market.

Cryptocurrency mixed in with both stocks and bonds

80 percent stocks, 10 percent bonds, 10 percent bitcoin

Let’s say you like having some bonds in your portfolio to help with diversification and having a source of liquidity to buy stocks when they fall (for example).

And say you match the bond portion with bitcoin. So you go from a 90 percent stocks, 10 percent bonds portfolio, to adding 10 percent bitcoin by allocating out of stocks.

Because bitcoin is about 10x as volatile as stocks and your stock portfolio is only 8x as large as bitcoin, bitcoin actually dominates the risk profile. It’s nearly 70 percent of the risk decomposition. Since bonds are at only 10 percent and much less volatile than either, its risk of those will barely be felt.

| Portfolio | Name | Risk |

|---|---|---|

| 80% Stocks | SPDR S&P 500 ETF Trust | 30.94% |

| 10% Bonds | iShares 20+ Year Treasury Bond ETF | 0.11% |

| 10% Bitcoin | Grayscale Bitcoin Trust (BTC) | 68.95% |

60 percent stocks, 30 percent bonds, 10 percent bitcoin

Let’s say you wanted to do a spin-off of the 60/40 concept where you take the 40 percent bond portion and convert a quarter of it to bitcoin, leaving you with 30 percent of the allocation in bonds and 10 percent in bitcoin.

| Portfolio | Name | Risk |

|---|---|---|

| 60% Stocks | SPDR S&P 500 ETF Trust | 18.94% |

| 30% Bonds | iShares 20+ Year Treasury Bond ETF | 3.05% |

| 10% Bitcoin | Grayscale Bitcoin Trust (BTC) | 78.01% |

It actually makes the bitcoin portion dominate the portfolio even more even though it seemingly appears more balanced than the 80/10/10 approach above.

This is because stocks were reduced, which gives them less of a fraction of the risk decomposition. Bonds were moved up, but are less volatile than stocks, so the impact is still barely felt.

That leaves bitcoin as a larger overall share of the risk.

As we’ve discussed in other articles, to get the fixed income portfolio to balance out the stock allocation, it’s easier to leverage the bond portfolio to match the volatility of the stock portfolio. This can be done with things like futures. Or even potentially with options.

33 percent stocks, 57 percent bonds, 10 percent bitcoin

To get stocks and bonds to balance each other out in a standard stocks and bonds portfolio, you might go with something like 35/65 in terms of the dollar allocation.

So what if we balance out the allocation in a similar type of way but add in bitcoin at 10 percent?

| Portfolio | Name | Risk |

|---|---|---|

| 33% Stocks | SPDR S&P 500 ETF Trust | 5.33% |

| 57% Bonds | iShares 20+ Year Treasury Bond ETF | 13.24% |

| 10% Bitcoin | Grayscale Bitcoin Trust (BTC) | 81.42% |

Bitcoin dominates a little bit more. Stocks were lowered and bonds were raised in the allocation. This reduces the overall volatility of the portfolio. But bitcoin is kept the same, so it dominates more of the risk of the overall portfolio.

60 percent stocks, 10 percent bonds, 10 commodities, 10 percent gold, 10 percent bitcoin

Now, to get toward better balancing the portfolio, let’s add commodities and gold to the mix.

In this case we have 60 percent stocks, 10 percent bonds, 10 commodities, 10 percent gold, and 10 percent bitcoin.

Commodities are more volatile than gold, and gold is more volatile than bonds, so those risk decomposition weights are around 3, 2, and half a percent, respectively.

Collectively, that 30 percent allocation toward those three makes up less than 6 percent of the overall risk of the portfolio.

Stocks come to a bit over 20 percent.

Bitcoin, with a mere 10 percent, makes up about 73 percent of the risk allocation.

| Portfolio | Name | Risk |

|---|---|---|

| 60% Stocks | SPDR S&P 500 ETF Trust | 21.01% |

| 10% Bonds | iShares 20+ Year Treasury Bond ETF | 0.43% |

| 10% Commodities | AQR Risk-Balanced Commodities Strategy I | 3.24% |

| 10% Gold | SPDR Gold Shares | 1.99% |

| 10% Bitcoin | Grayscale Bitcoin Trust (BTC) | 73.33% |

Overall, you’d expect this portfolio to be about twice as volatile as the average portfolio comprised of stocks only and about 3x-4x more volatile than a standard 60/40 portfolio.

30 percent stocks, 30 percent bonds, 10 commodities, 10 percent gold, 20 percent bitcoin

Now let’s say we took those same assets and allocated 30/30/10/10/20.

Bitcoin is now at 20 percent, stocks lower, bonds are raised, and commodities and gold stay put.

As you might expect, bitcoin’s risk went up. It’s now about 93 percent of the total risk allocation despite being only 20 percent of the portfolio.

| Portfolio | Name | Risk |

|---|---|---|

| 30% Stocks | SPDR S&P 500 ETF Trust | 2.81% |

| 30% Bonds | iShares 20+ Year Treasury Bond ETF | 2.05% |

| 10% Commodities | AQR Risk-Balanced Commodities Strategy I | 1.09% |

| 10% Gold | SPDR Gold Shares | 1.11% |

| 20% Bitcoin | Grayscale Bitcoin Trust (BTC) | 92.94% |

But how about if we lower it to a more reasonable two percent?

39 percent stocks, 39 percent bonds, 10 commodities, 10 percent gold, 2 percent bitcoin

At two percent, bitcoin looks more reasonable at about 23 percent of the risk. It’s still a lot, but it’s comparable to long-duration bonds – weighted at nearly 20x higher than bitcoin – and about one-third less than stocks.

| Portfolio | Name | Risk |

|---|---|---|

| 39% Stocks | SPDR S&P 500 ETF Trust | 35.97% |

| 30% Bonds | iShares 20+ Year Treasury Bond ETF | 22.60% |

| 10% Commodities | AQR Risk-Balanced Commodities Strategy I | 9.03% |

| 10% Gold | SPDR Gold Shares | 8.97% |

| 2% Bitcoin | Grayscale Bitcoin Trust (BTC) | 23.42% |

This overall portfolio would be about 30 percent less volatile than the stock market.

What if I want cryptocurrency in my portfolio but don’t want more than a 10 percent overall risk exposure?

This could be a reasonable overall goal.

Many people wouldn’t mind having exposure to cryptocurrency as a type of cash alternative in their portfolio as long as they can be sure it’s not going to materially impact them.

That, of course, depends on what else you have in the portfolio.

If you have an equities portfolio, 10 percent risk decomposition for bitcoin would come to about a two percent allocation – i.e., 98 percent in stocks, 2 percent in bitcoin.

If you had something closer to a 60/40 stocks/bonds portfolio, a mere one percent allocation to bitcoin would give you nearly that full 10 percent because you’re weighting the riskier asset less (stocks) and the less risky asset more (bonds).

Likewise, if you had stocks, bonds, commodities, and gold and split them 40/40/10/10, just a one percent allocation in bitcoin would get you up to a 10 percent risk exposure.

So, by and large, it doesn’t take much of a sliver of a portfolio for bitcoin to make up a disproportionate amount of the risk.

Just a 1-2 percent allocation will generally get you up to a 10 percent or higher risk allocation.

If you owned stocks and allocated just 5 percent to bitcoin and 95 percent to stocks, you’d have a portfolio that’s about double the volatility of the stock market with a third of the risk in bitcoin.

If you were to do another experiment where you wanted to allocate 50 percent of your money to stocks and split the money between bonds and bitcoin to the point where the total overall portfolio would equal the risk of the stock market, what would the split between bonds and bitcoin be?

It would be around 46 percent bonds and 4 percent bitcoin (to go along with the 50 percent in stocks). And bitcoin would take up about 48 percent of the risk in the portfolio.

These figures are not static

Cryptocurrency is a relatively new asset class. It is still quite speculative.

Most people are in it to bet on its price movement rather than hold it as a type of alternative cash or reserve asset in the way most who own gold would view the precious yellow metal.

As the regulatory picture starts to come into clearer focus and if bitcoin (as the market leader) starts to see somewhat greater institutional adoption, its volatility should wane.

This would mean traders and investors can allocate to it in a greater amount without seeing the same level of price risk.

Final Thoughts

How much risk to allocate to any given asset or asset class is a personal preference.

This article aims to help conceptualize how much cryptocurrency (using bitcoin as a proxy) would impact a portfolio in terms of risk decomposition.

As we covered in articles on how to construct portfolios, allocations should not necessarily be made based on nominal dollar amounts (e.g., 60 percent to stocks, 40 percent to bonds) but rather on how to balance risks in a portfolio.

Cryptocurrency is volatile to the point where it doesn’t take a big allocation to it to materially influence the overall portfolio’s movement. Just a 1-2 percent allocation is usually enough for bitcoin to have 10 percent overall risk exposure.

Having any more than that carries material risk. That’s a constraint on its uptake.

Before the big players in the market (large institutions) dive into it in any material way:

- Liquidity will need to be increased

- The regulatory picture will need to become clearer

- Its use as a medium of exchange or store of value will need to show progress

Once there’s some level of maturation in those respects, the volatility of the asset class should come down as it diversifies its ownership base.

But for now, few big institutional investors (who would most want to use it as a currency hedge) own cryptocurrency.

And central banks know there’s a very long way to go before they’re going to hold them as foreign exchange reserves. Central banks view cryptocurrencies as competition, as all governments want to have control of all the money and credit within their borders to ensure policy effectiveness.

Increasingly, they will roll out their own digital currencies.