‘Hot Assets’ – How to Avoid Falling for the ‘Current Big Thing’

In markets, there is commonly the “hot thing” going around. There are always so-called hot assets that are the thing that nobody should miss out on.

Sometimes it’s a certain stock or group of stocks:

- the Nifty Fifty in the late-60s and 1970s

- Cisco, Enron, Worldcom, among others of the dot-com bubble

- Tesla was the main hot stock in the late-2010s and early-2020s (along with Zoom, Peloton, DoorDash, and others).

All of these stocks became poster childs for “bubble stocks“.

Sometimes it’s a certain new assets, like bitcoin or cryptocurrency.

Sometimes it’s real things like houses (e.g., 2003-07 and 2020-22 in the US).

And sometimes it even becomes ordinary, “boring” investments like US Series I Bonds – a form of savings bonds issued by the US Treasury.

‘Hot Assets’ and the Environment

Many of these assets become cheap as a result of the environment we’re in.

Easy liquidity conditions and strong public promotion were responsible for the rise in many dot-com stocks, Tesla, and bitcoin (among other cryptocurrencies).

Easy lending conditions and leveraging practices led to the mid-2000s housing bubble. Money and credit handouts and a strong desire for many people to move led to the housing rush in the early-2020s.

There’s No Such Thing as a Sure Thing

Unfortunately, there’s no such thing as good returns with no risk.

No risk means no returns or bad returns.

The case of I bonds

When everybody got excited over I bonds, they came at the trade-off of being a lower-capacity asset that serves a particular need in certain circumstances.

Their drawbacks included:

- Low capacity ($10k per year per entity)

- Inflation-protection only (no increase in buying power, real return of about zero), and

- Early-redemption penalties (must hold for 1 year; loss of 3 months of interest if redeemed in years 1-5; no penalty after 5 years)

When inflation goes back to normal, lots of people are going to be cashing out of them because the interest on them will fall back to very low levels again.

And that, of course, signals a good thing in one important respect – inflation fell.

And when lots of people dump these bonds – as that’s what those chasing the “hot” thing are inclined to do – that will trigger the early-redemption penalty for many people plus the tax bills associated with the interest.

There have been times during I bonds’ history when the rate was 0.00 percent. There is no fixed rate and the variable rate is all in the calculation associated with CPI-U inflation.

When inflation falls, people will lose their interest as it was just a temporary vessel for retaining the buying power on a smaller sum of money.

They won’t like the return falling back to 0-2 percent and will want to kick it to the curb for something better.

However, if they want some level of inflation protection in their portfolio, which should have more than just I bonds, then it’s an asset that can be part of the puzzle.

If Series I bonds are, e.g., 5-10 percent of someone’s portfolio, that’s perfectly reasonable.

It’s not prudent to be heavily concentrated in them (or in any asset or asset class) because of environmental bias.

Namely, I bonds don’t have high rates in lower inflation environments.

And those who decide to concentrate their savings in these who don’t have “low inflation” assets (i.e., assets that benefit when inflation falls relative to discounted expectations) won’t benefit from that shift when inflation falls.

Having Balance and Diversification Is Critical

Balance is key. Not concentrating in the hot thing that will no longer be hot once the environment changes.

Because the environment will always change.

Will your portfolio successfully change with the environment?

Most people’s portfolios are biased to do well when growth is good and inflation is low to moderate.

When it deviates from that, they tend to do poorly.

Do you have assets that can help you do well in a higher inflation environment?

Do you have assets that can help you do well in a lower growth environment?

And in a way that can help you offset some or all of the losses in the regular assets?

There’s a tendency to want to concentrate in what ostensibly is “the sure thing” or “the best thing” (which there never is).

People tend to overemphasize asset classes that have done well in the recent past rather than thinking about balance and diversification.

Or they want to hold things that make them feel safe, like holding a lot of cash (the worst thing over the long run) or lots of safe bonds that have poor nominal and real returns.

Diversification based on assets, asset classes, countries, and currencies will raise returns relative to risk more than anything one can practically do.

The average person won’t be able to play the cycles well.

Moreover, they won’t have an informational edge on professional investors who they are competing with when they’re trying to make tactical moves in the market.

So their best bet is to diversify and not rely on any one asset or income stream.

Moreover, it’s important to focus on real (inflation-adjusted) returns and not nominal returns.

Portfolios & Aggressiveness/Conservatism

As people get older, they tend to shy away from equities.

However, portfolios that avoid equities in whatever form (i.e., ownership in different businesses) are riskier than those without them.

As we mentioned, each asset class has a different environmental bias.

So if people’s portfolios are just cash and safe bonds they’re exposing themselves to a certain environmental bias in a concentrated way.

For example, we designed two example portfolios:

“Portfolio 1” – a simple diversified one with some equities allocation and

“Portfolio 2” – one with 50 percent cash and 50 percent 10-year Treasuries

Portfolio Allocations

| Asset Class | Allocation |

|---|---|

| US Stock Market | 24.00% |

| Gold | 10.00% |

| Commodities | 5.00% |

| TIPS | 16.00% |

| Global Bonds (Unhedged) | 5.00% |

| Long-Term Tax-Exempt | 15.00% |

| 10-year Treasury | 10.00% |

| Total US Bond Market | 15.00% |

| Asset Class | Allocation |

|---|---|

| Cash | 50.00% |

| 10-year Treasury | 50.00% |

The simple diversified one has gotten 0.84 percent of return for each 1 percent unit of risk (volatility). The base portfolio got 5.18 percent return off 6.2 percent vol.

The one concentrated in cash and safe bonds has gotten only 0.62 percent of return for each 1 percent unit of risk. Base portfolio got 2.22 percent return off 3.6 percent vol.

Portfolio Returns

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Portfolio 1 | $10,000 | $21,869 | 5.18% | 6.20% | 14.92% | -9.92% | -15.90% | 0.72 | 1.05 | 0.78 |

| Portfolio 2 | $10,000 | $14,047 | 2.22% | 3.60% | 11.03% | -5.15% | -7.63% | 0.41 | 0.69 | -0.29 |

Sharpe and Sortino are just risk-adjusted measures of performance and the cash/safe bonds lag behind a lot on an absolute and risk-adjusted basis (i.e., cash/bonds seems safer but isn’t because of the lack of balance).

More statistics are provided in the Appendix to this article.

Beware of black-and-white trading and investing takes

The standard catechisms that people go “all in” on equities when they’re younger and then “get out” when they’re older are both very suboptimal black-and-white approaches that create highly unbalanced, environmentally biased portfolios with poor risk-adjusted returns that cost people money over their lifetimes.

There will always be a certain amount of risk and market wiggles that are necessary to get the returns.

If stocks fall, it probably means other stuff in the portfolio is going up (given different environment biases), so to maintain the desired allocations, you can trim the stuff going up to buy the stuff that’s falling.

When things are falling, it means you can buy earnings at a cheaper price.

For example, when a farmer sees the value of farmland falling, he doesn’t think about how much money he’s losing (unless he’s planning on selling or perhaps needs a certain value for collateral), he thinks about how much net income the land he owns is generating and perhaps if it would be a good idea to add more land to increase his earnings.

While there will be times when even a well-diversified portfolio of assets will fall, it won’t go down to the same extent as an undiversified portfolio. And it won’t stay down because a severe and extended period of poor performance won’t be acceptable to policymakers.

Why There Is No ‘Sure Thing’ – Payoffs Are Reflected in Prices

The financial markets are a game where what you know is not truly very much relative to what you don’t know and what you can’t be aware of.

You will often hear how many can’t believe the stock market or a certain asset acted in a certain way, even though the move it made wasn’t really all that much.

In the markets, what can be known is small relative to that in which cannot be known.

Making winning bets in the market (i.e., adding alpha) is difficult for the same reason winning in the sports betting markets is hard to do.

The range of unknowns is high compared to the range of knowns relative to what’s discounted into the market pricing.

Analogously, we know each year that a certain set of NBA teams have much better odds of winning the NBA title than others.

Likewise, we know the same six or so English Premier League teams are going to have a shot of winning it (with the odds skewed even within those six). Everyone else is mostly looking to finish well or avoid being relegated.

You might think it’s a smart bet to put money on Liverpool or Manchester City winning the EPL, but there are already a lot of other bettors doing the same thing.

This raises the price of the bet and reflects the high probabilities of getting the outcome this particular subset of bettors expect.

What this also means is that you can bet on an average team or one of the likely relegation candidates to win the EPL and make a lot if you’re right given it’s not a “crowded” bet (similar to analogous trades in the market).

But the probability of such a bet working out is low and this is reflected in the long odds.

By extension, we can say that everything is more or less an equally good bet – that is, the size of the reward multiplied by the odds of winning.

There are no easy good or bad bets in the markets.

In the financial markets, good companies and bad companies are well known in the markets. But their stock prices reflect payoffs of what is already known.

Investors will expect more compensation (i.e., higher future returns, reflected in a higher risk premium) for an unprofitable, highly indebted company versus one that has low debt and stable cash flow.

On top of that, if you do bet, this process will change the expected payoffs.

‘Hot Assets’ – FAQs

What is a “hot asset”?

A “hot asset” is one that’s typically done well in the recent past (because of the economic or financial environment and/or because of good promotion), is offering an enticing yield, and is receiving strong monetary inflows.

What is “hot money”?

Hot money is money that quickly moves in and out of assets to take advantage of short-term price changes.

Hot money typically seeks higher returns than what’s available in cash or low-risk investments, and it’s more likely to be invested in riskier assets such as stocks, commodities, and emerging markets.

What are the dangers of investing in a hot asset?

The biggest danger is that the hot asset may not continue to perform well, especially if the reason for its recent success is reversed.

For example, an asset may have done well because interest rates fell, but if rates rise again, the asset’s price could drop sharply.

Another danger is that hot assets tend to attract a lot of investor attention, which can drive up prices and create “bubbles”.

If the asset’s price eventually falls, investors could lose a lot of money.

How can I avoid investing in a hot asset?

The best way to avoid investing in a hot asset is to diversify your portfolio across a number of different asset classes, including both growth-oriented and income-producing investments and ones that can succeed in different environments.

This will help ensure that you’re not over-exposed to any one particular asset.

It’s also important to keep an eye on market valuations and look for assets when they’re trading at fair prices.

Just because an asset has done well in the past doesn’t mean it will continue to do so in the future.

An asset that recently went up is likely a more expensive asset.

What are some examples of hot assets?

Some examples of recent hot assets have included US I Series Bonds, which became attractive as a way to preserve smaller amounts of money from inflation, and shares of electric vehicle maker Tesla.

Interest in them soared in 2022.

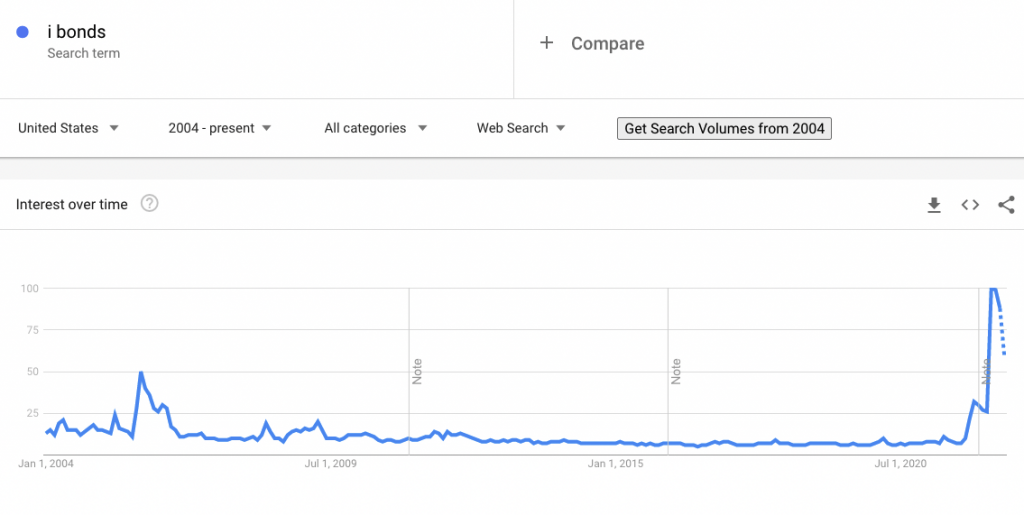

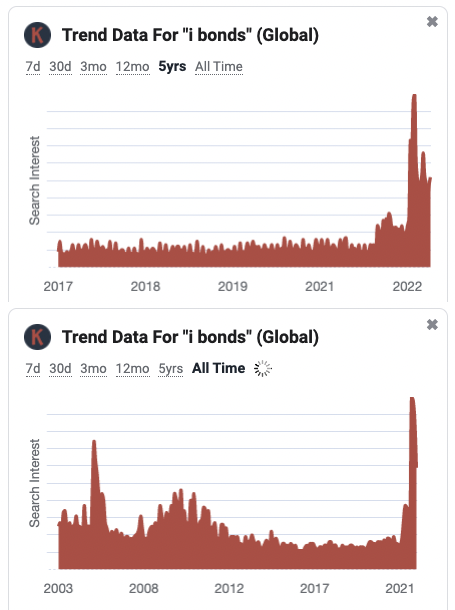

Interest in Series I Bonds According to Google Trends

Google Searched for “I Bonds” Over Time

Tesla is another example.

It soared in value as EVs became a hot investment trend and the stock was heavily promoted as not just a smaller auto manufacturing company (a breakeven industry where the key is to make money in after-sales cash flow), but promoted itself as an innovative tech company that would be at the forefront of various technology initiatives.

With the combination of low interest rates and lots of promises, Tesla was valued at more than $1 trillion at its peak.

But rising interest rates and questions over whether Tesla would actually produce the things it said it would or whether they were empty promises caused the stock to fall.

Other hot assets may include cryptocurrency, housing, physical art, NFTs, and other collectibles.

How do I diversify a portfolio?

The best way to diversify is to invest in a mix of asset classes that have different characteristics and respond differently to various economic conditions.

For example, you might include stocks, bonds, cash, real estate, and commodities in your portfolio.

Within each asset class, you can further diversify by investing in different types of securities.

For example, with stocks you could own shares of large companies, small companies, international companies, different sectors/sources of cash flow, different countries, different currencies, etc.

You can also mix up growth-oriented investments with ones that provide income or focus on the preservation of capital.

And finally, don’t forget to rebalance your portfolio periodically to keep it aligned with your goals.

What asset class should I invest in?

There is no one-size-fits-all answer to this question. Diversification tends to be the best way to increase your return relative to your risk, but it depends on your individual goals and risk tolerance.

Some people may be fine with a portfolio that is all in stocks, real estate, or something else, while others may prefer a more balanced approach that includes bonds, cash, and other investments.

The best way to find the right mix for you is to talk to a financial advisor or another professional who can help assess your specific situation and make recommendations.

Conclusion

Hot assets can be alluring, but they come with dangers that investors should be aware of before putting their money into them.

These dangers include the potential for sharp price declines if market conditions change, as well as the possibility that the underlying asset may not be as valuable as it appears.

The best way to avoid these dangers is to diversify your portfolio across a number of different asset classes, including both growth-oriented and income-producing investments and ones that can succeed in different environments.

This will help ensure that you’re not over-exposed to any one particular asset.

Appendix

Below are summary statistics for the two portfolios used in this article:

| Arithmetic Mean (monthly) | 0.44% | 0.19% |

|---|---|---|

| Arithmetic Mean (annualized) | 5.38% | 2.28% |

| Geometric Mean (monthly) | 0.42% | 0.18% |

| Geometric Mean (annualized) | 5.18% | 2.22% |

| Standard Deviation (monthly) | 1.79% | 1.04% |

| Standard Deviation (annualized) | 6.20% | 3.60% |

| Downside Deviation (monthly) | 1.19% | 0.59% |

| Maximum Drawdown | -15.90% | -7.63% |

| Stock Market Correlation | 0.78 | -0.29 |

| Beta(*) | 0.30 | -0.07 |

| Alpha (annualized) | 2.41% | 2.88% |

| R2 | 60.17% | 8.51% |

| Sharpe Ratio | 0.72 | 0.41 |

| Sortino Ratio | 1.05 | 0.69 |

| Treynor Ratio (%) | 14.89 | -22.26 |

| Calmar Ratio | 0.45 | -0.03 |

| Active Return | -3.34% | -6.31% |

| Tracking Error | 11.95% | 17.49% |

| Information Ratio | -0.28 | -0.36 |

| Skewness | -1.19 | 0.54 |

| Excess Kurtosis | 5.15 | 2.25 |

| Historical Value-at-Risk (5%) | -2.32% | -1.35% |

| Analytical Value-at-Risk (5%) | -2.51% | -1.52% |

| Conditional Value-at-Risk (5%) | -4.11% | -1.99% |

| Upside Capture Ratio (%) | 31.57 | -0.50 |

| Downside Capture Ratio (%) | 23.32 | -14.63 |

| Safe Withdrawal Rate | 8.69% | 7.36% |

| Perpetual Withdrawal Rate | 2.62% | 0.00% |

| Positive Periods | 115 out of 186 (61.83%) | 102 out of 186 (54.84%) |

| Gain/Loss Ratio | 1.20 | 1.36 |