17+ Unique Investments – Exploring Uncommon Hedge Fund Strategies

In this article, we consider various unique investments and uncommon hedge fund strategies beyond standard investments in stocks, bonds, commodities, currencies, and the like.

Trading and investing, in the end, is simply a just-make-money game that doesn’t have to stick with only conventional approaches and strategies.

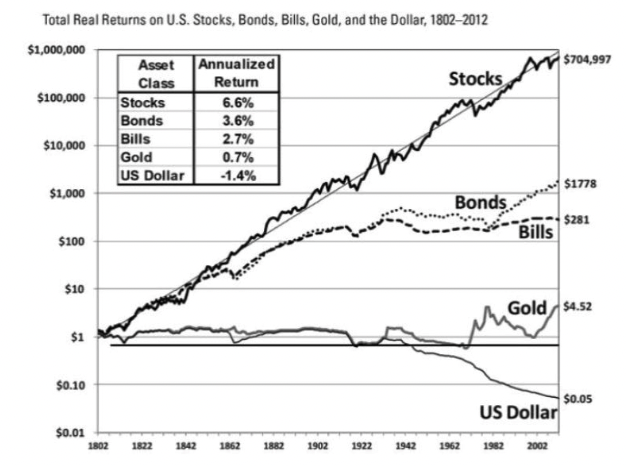

Stock and bond investments are largely combed over by everybody, so there is lots of competition and that brings down prospective returns.

You might expect stocks to yield about 6 percent over the long run and bonds to yield in the low single-digit percentages (the nominal yield is always published).

But in niche markets, there can be much more opportunity and therefore higher returns potential.

Let’s take a look.

Litigation Finance

Class action lawsuits are expensive to litigate.

Law firms will sell future claims from these lawsuits to hedge funds in order to help finance the upfront costs of them.

Hedge funds can make a lot of money if the case is successful.

Of course, some cases yield nothing and according to experts in this space, there is rarely any class action lawsuit that has win odds of greater than 90 percent.

But those who truly have an edge may be able to pick cases that yield returns in around 80 percent of the cases.

Film Financing

Movies can be boom or bust.

And some productions can be expensive, which in turn requires financing. So some hedge funds will come in to bet on the movies they think will go on to have success relative to their costs.

The basic process of film financing due diligence is looking at the revenue that’s been historically generated by the actors, directors, screenwriters, and the quality of the script.

It can also help form connections with well-heeled investors in the entertainment industry.

Music

The music industry has changed a lot over the years, going from physical sales of records and CDs to everything becoming much more digital.

Some investors will look to buy the music catalogs of successful recording artists.

We discussed investing in the music industry more in this linked article.

YouTube channels

Sometimes you hear of YouTube channels coming up for sale.

YouTube channels are often valued somewhere around 1.5x the past year’s revenue, but it can vary.

Investors may look to buy a YouTube channel to benefit from the Adsense revenue that the videos generate or any new or recurring revenue, such as from affiliate sales.

The difficulty with YouTube channels is that there is often a specific creator or face behind them. So it’s difficult for a new person to take over.

Many people subscribe to a YouTube channel for a specific personality, so a change in who does the videos is likely to lead to a lot of unsubscribes, which is a big part of the business.

It’s not like buying a blog or website where it’s easy to take over the content production.

So they are rarely sold because they tend to have so much more value for the current owner than a new would-be owner.

But a YouTube channel could be thought of as a passive revenue stream assuming it’s monetized.

At the same time, the YouTube algorithm rewards channels that produce new content regularly, which means any channel held passively could be a declining asset.

This might also account for the lower prices associated with channels.

But buying a YouTube channel for a lump sum to get the stream of revenue from it is one thing that investors could look into.

Life Settlements

Several hedge funds invest in life insurance claims.

How does this make money? In a rather macabre way, these generate higher returns when someone passes away earlier than expected.

Madoff Claims (Distressed Asset Investing)

Some funds look to buy the claims of bankrupt companies or private partnerships.

For example, the claims of victims of the Bernie Madoff investment fraud were one of the best-performing investments back in 2011-2012.

Hedge funds bought these claims for pennies on the dollar and got higher returns as more money was located for the victims and hedge funds who bought into them.

This is a form of distressed asset investing.

Fraud Activism (Short Selling)

Some hedge funds specialize in digging into the weeds of a company and spotting accounting irregularities, which can come in various forms (e.g., suspiciously high accounts receivable, expense misclassification, capitalizing costs that should be expensed, and so on).

They might also take their research public to let other investors stress-test their thinking and figure things out for themselves.

Funds or individuals with high social followings have in-built credibility and may move markets by themselves.

They may give an indication on social media that they’ll soon be sharing their research soon to generate interest, then let their followers know at the specified time.

Art and collectibles

Many funds specialize in art and collectibles investing.

Many focus on artists that are known globally, such as Picasso, Van Gogh, da Vinci, Rembrandt, Pollock, etc.

These are museum-quality artists who will have their pieces displayed 100+ years from now and have strong secondary markets.

Many high-net-worth individuals also prize art to display in their homes.

Art and collectibles also come with insurance costs. Typically, it costs 1-2 percent of the value to insure.

So for every $1 million in fine art and collectibles, one might expect around $10k to $20k per year in annual insurance costs.

Pottery

Pottery investors are similar to art funds where they focus on buying investment-grade pottery and ceramics.

Many pieces come from China.

And some believe that investing in old to very old (some pieces literally hundreds or more than 1,000 years old), investment-grade Chinese pottery could correlate well to the level of overall Chinese wealth, as there may be a greater want to own a piece of their country’s history.

Many investors and traders outside of China are not keen on dealing with China’s rule of law issues with traditional equity and bond securities. So Chinese pottery could be a potential proxy of getting exposure to the market instead.

Stringed Instruments

Stringed instruments have been a popular hedge fund investment for years.

There are a few firms that manage funds that focus on stringed instruments.

The instruments in these portfolios are usually violins, cellos, and guitars.

And they’re usually high-end, well-known brands such as Stradivarius, Amati, and Guarneri.

These instruments can be expensive, with some costing millions of dollars.

But they’re also portable and have low storage costs relative to other investments like art, wine, or other forms of liquor.

One issue with investing in stringed instruments is that it can be difficult to value them.

This is because there aren’t a lot of sales data points and the market is relatively illiquid.

Wine

Wine tends to get more valuable as it ages, similar to how a stock price will increase over time.

This is due to the fact that there are many more wine drinkers than there are collectors.

And as the world’s population continues to grow, and the number of countries with an affluent middle class grows, the market for wine should continue to expand.

However, it can be difficult to store wine properly.

Not all wines age well, are valuable, or appreciate even in nominal terms, so it is important to really know what you’re doing before making any investment decisions, like with all assets.

Certain brands tend to appreciate better over time and there are now wine exchanges to help facilitate transactions.

Moreover, many investors can buy wine wholesale and sell bottles at the standard individual unit cost, not unlike other forms of retails.

Cigars

Cigars are similar to wine in that they can get better with age.

However, cigars have the added benefit of being much easier to store than wine.

Cigars also do not need to be kept in a controlled environment to the same extent as wine does.

Cigars can be stored in a humidor, which is a box that controls the humidity and temperature of the cigars.

Cigars have been around for centuries and are likely to continue to be popular in the future.

Limited edition cigars from Habanos can be a good investment if they are kept in great condition for a long enough period of time.

Single Malt Scotch

Like wine, single malt scotch tends to increase in value over time.

Moreover, decades ago, distilleries didn’t predict the growth in Asian demand (mostly because China’s growth is higher than anticipated) and didn’t produce enough leading to more demand relative to supply.

As markets like China and India grow, so does the demand for the limited amount of aged, high-quality scotch, potentially creating more upward pressure on prices.

Weather Derivatives

Remember when Hurricane Sandy caused all sorts of damage in New York City?

Well, some hedge funds were able to profit from that by investing in weather derivatives.

These are basically contracts that pay out based on changes in the weather.

So, if a hurricane hits, the hedge fund could make money.

What’s better is that the weather is not related to credit cycles like traditional assets like stocks, bonds, commodities, and changes in exchange rates.

Catastrophe Bonds (CAT bonds)

CAT bonds are similar to weather derivatives in that they pay out when there is a natural disaster.

The main difference is that CAT bonds are issued by insurance companies to help them cover claims from policyholders.

So, if there is a hurricane or other disaster, and the insurance company has to pay out a lot of claims, the CAT bond will help cover those costs.

Investors in CAT bonds basically get paid for taking on that risk.

CAT bonds can be very profitable, but they are also very risky.

You could potentially lose all your investment if there is a major disaster.

But, if you’re willing to take on that risk, CAT bonds could be a great way to profit from natural disasters.

Water Rights

Water rights in the Western US and Australia are two markets where you can buy shares of water from river systems.

These water rights are separate from the land rights and can be traded freely.

These investments produce a yield, which is the water you can sell into the market each year, and can increase in value, such as the value of the water right itself.

Water rights have been an investment where interest in heating up as the world’s population continues to grow and water becomes an increasingly scarce resource.

It also dovetails with the increased investment focus on climate matters and ESG.

The Western US is especially vulnerable to drought and the levels of Lake Powell (the largest freshwater reservoir in the US created by the Hoover Dam) have almost consistently fallen since the beginning of the century, so water rights in that region could become even more valuable in the future.

Ship Counting

Commodity funds will often have sources at major ports throughout the world that will count the number of ships that are leaving and entering, what commodity they are carrying, where they are coming or going, and whatever info they can get to better understand the supply and demand of these markets.

This data is then used to make investment decisions.

For example, if there are more ships carrying iron ore leaving China than expected, that could be an indication that Chinese steel production is about to increase, which would then lead to increased demand for iron ore and other steel-making commodities.

This is just one example of how ship counting can be used to make investment decisions.

Winning Lottery Tickets

Those who win lotteries are typically given the choice to take a lump sum payment or receive payments over 20, 25, or 30 years, in the form of an annuity.

Most choose the lump sum, as they get the money upfront.

However, taking the present value using a reasonable discount rate (e.g., the expected return of the S&P 500), taking the annuity is usually the better choice just from a financial value point of view.

A lottery annuity is essentially the same thing as a state-issued bond of the same duration and these municipal bonds are already developed markets.

Some hedge funds will pay the winner a higher lump sum in exchange for them taking the option to take the annuity and then sell the bond back into the market, taking the arbitrage between the two.

Gaming

If you have an edge in any game, this can be a source of profits.

Poker is a game where skill can give players an advantage.

Blackjack was also viable for those who had effective card counting systems, until casinos introduced bigger decks (6- or 8-deck tables) that made counting more difficult.

Or even introduced automatic shuffle to take away the edge entirely.

Any skill-based game that has a positive expected value and is uncorrelated to one’s other investments can be valuable.

In most cases, gambling is a very bad idea for purposes of trying to make money, given the house edge.

Even those who are successful (such as good sports bettors) risk getting booted from a casino if they are too “sharp”/successful. Moreover, many betting markets are not that deep.

And the markets that are deeper where high rollers don’t have to think as much about moving a line tend to be more competitive and efficient.

Informational edges

Informational edges wherever they come from.

For example, an investor in digital assets like blogs and websites could identify a set of keywords that have high search volume and little competition or new emerging topics that could be useful to create content on.

In turn, they can monetize that content with ads, affiliate revenue, sponsored placements, cost-per-click deals, or use it to support existing content and so on.

Or, for instance, in some countries, economic data is reported weekly or monthly whereas in others it’s reported quarterly. The more frequent data can be used as a leading indicator of what’s going to happen in the markets that report quarterly.

An Amazon warehouse worker could have a better grip on the state of consumer spending just based on order volume than many sophisticated investors might, as they observe order flow on a continual basis.

Trading and investing is all about a way to gain an edge regardless of the strategy being used.

Conclusion – Unique Investments and Uncommon Hedge Fund Strategies

These are just a few examples of unique investments that hedge funds pursue.

While some might be considered risky, others can actually be quite stable, safe, and provide good returns.

It all depends on the trader, investor, manager, and their investment strategy.

The most important thing is to master something instead of getting caught up in what the next shiny object might be. There is competition in everything to some degree.

So if you’re looking for something different from the ordinary, then these unique investments and uncommon hedge fund strategies might be worth considering.