How to Build the Boglehead 3-Fund Portfolio

The 3-fund portfolio – often called the Boglehead 3-fund portfolio after Vanguard’s late founder John C. Bogle – is a simple, low-cost portfolio that consists of just three index funds.

The Boglehead 3-fund portfolio has become one of the most popular investment portfolios among DIY investors because it is easy to understand and implementation is straightforward.

For this reason, it’s also sometimes called a lazy portfolio or lazy 3-fund portfolio because it’s simple and easy to execute.

The Boglehead 3-fund portfolio consists of a:

- US stock market index fund

- international stock market index fund, and

- bond market index fund

The specific funds you choose will depend on the broker or investment platform you’re using (e.g., Vanguard, Fidelity, etc.), but there are many options available that will fit the bill.

The funds often come in the form of an ETF, which are cheapest, or in the form of a mutual fund.

Allocations in the 3-fund portfolio

Once you’ve chosen your three index funds, all you need to do is decide how much money you want to allocate to each one.

A common split is 60/30/10, with 60 percent in stocks, 30 percent in bonds, and 10 percent in cash (e.g., savings account, money market account).

But you can adjust this to suit your own risk tolerance and investment goals.

For example, if you’re retired, looking for income and are more concerned about capital preservation, you might want to allocate a larger percentage to bonds.

Or, if you have a longer time horizon and are willing to take on more risk, you could invest a higher percentage in stocks.

The Boglehead 3-fund portfolio is a simple way to build a diversified investment portfolio with just three index funds.

It’s suitable for both beginner investors and experienced DIY investors alike. So if you’re looking for an easy way to invest without having to choose individual stocks or manage your own portfolio, this could be the right option for you.

There is a lot of value in having a simple portfolio, even for financial professionals.

Vanguard ETFs for the 3-fund portfolio

The three Vanguard ETFs that could work for the 3-fund portfolio include:

- Vanguard S&P 500 ETF (VOO)

- Vanguard Total International Stock ETF (VXUS)

- Vanguard Total Bond Market ETF (BND)

Fidelity ETFs for the 3-fund portfolio

The three Fidelity ETFs that could work for the 3-fund portfolio include:

- Fidelity ZERO Large Cap Index Fund (FNILX)

- Fidelity ZERO Extended Market Index Fund (FZIPX)

- Fidelity Government Income Fund (FGOVX)

3-fund portfolios from other providers

Other providers also offer index funds that could work for a 3-fund portfolio. Some examples include:

- Schwab US Broad Market ETF (SCHB)

- iShares Core S&P 500 ETF (IVV)

- SPDR S&P 500 ETF (SPY)

How has the 3-fund portfolio performed over time?

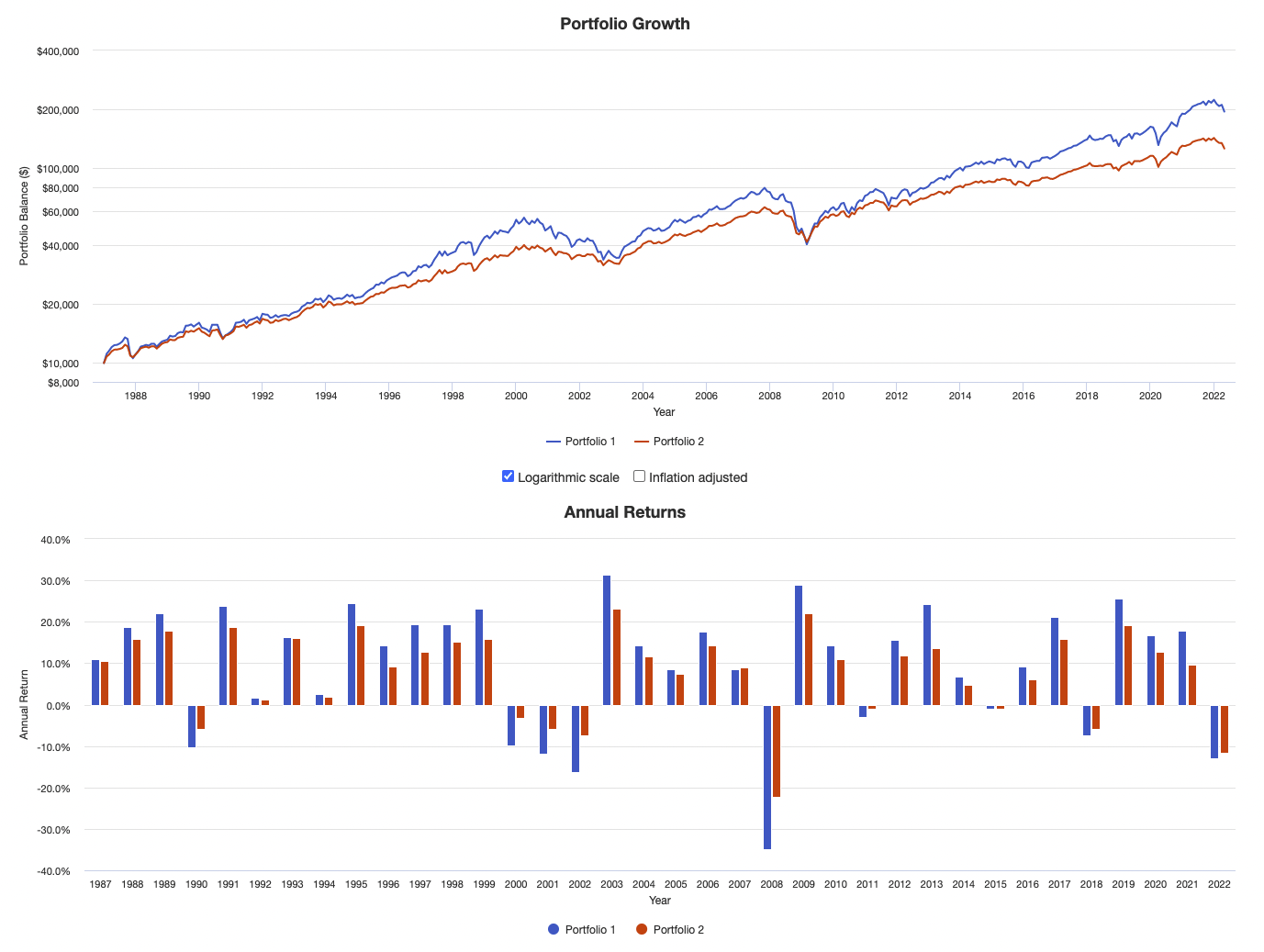

Given there’s no official allocation associated with the 3-fund portfolio, there’s no easy way to say how it’s performed.

What we can do is take different example allocations and look at their performance over time.

Let’s look at two example portfolios.

Portfolio Allocations

| Asset Class | Allocation |

|---|---|

| US Stock Market | 60.00% |

| Global ex-US Stock Market | 30.00% |

| Total US Bond Market | 10.00% |

| Asset Class | Allocation |

|---|---|

| US Stock Market | 30.00% |

| Global ex-US Stock Market | 30.00% |

| Total US Bond Market | 40.00% |

Portfolio Returns

Portfolio 2, which has more bonds, has lower returns but has better risk-adjusted returns, as evidenced through lower Sharpe and Sortino ratios, as well as lower drawdowns and less volatility.

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Portfolio 1 | $10,000 | $194,489 | 8.76% | 13.56% | 31.31% | -34.95% | -48.64% | 0.47 | 0.67 | 0.97 |

| Portfolio 2 | $10,000 | $125,829 | 7.43% | 9.32% | 23.10% | -22.32% | -33.59% | 0.50 | 0.73 | 0.92 |

Portfolio Growth and Annual Returns

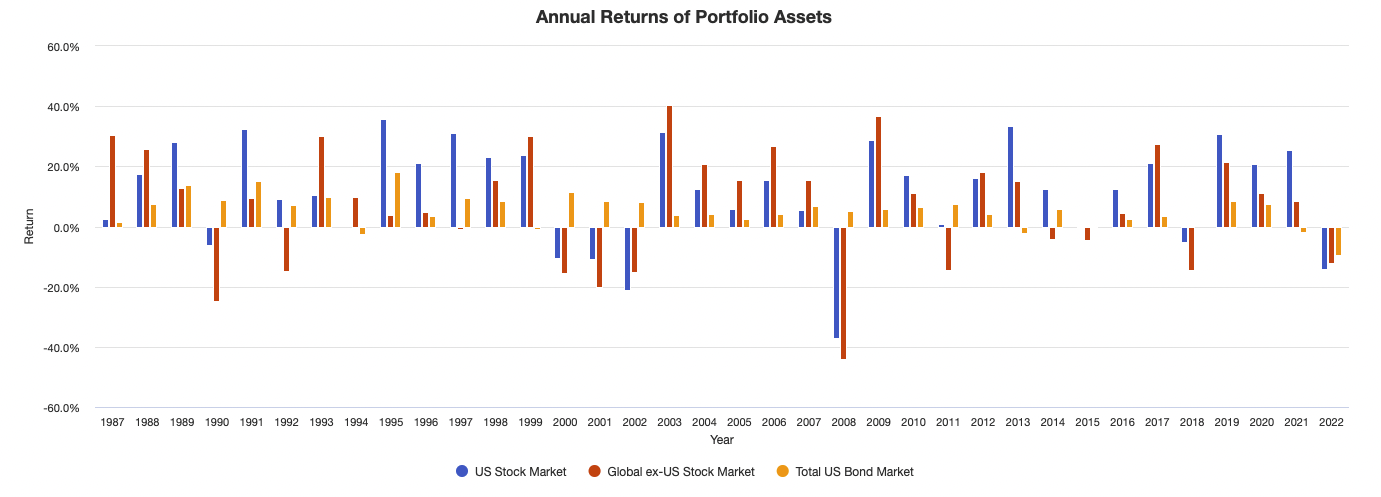

Annual returns of the three fund categories:

Drawdowns

The chart below illustrates Portfolio 2’s shallower drawdowns, especially during the dot-com crash from 2000-02 and the 2008 financial crisis:

Drawdowns for Historical Market Stress Periods

| Stress Period | Start | End | Portfolio 1 | Portfolio 2 |

|---|---|---|---|---|

| Black Monday Period | Sep 1987 | Nov 1987 | -21.75% | -13.66% |

| Asian Crisis | Jul 1997 | Jan 1998 | -4.84% | -4.11% |

| Russian Debt Default | Jul 1998 | Oct 1998 | -14.32% | -8.63% |

| Dotcom Crash | Mar 2000 | Oct 2002 | -39.13% | -21.15% |

| Subprime Crisis | Nov 2007 | Mar 2009 | -48.64% | -33.59% |

Portfolio return and risk metrics

| Arithmetic Mean (monthly) | 0.78% | 0.64% |

|---|---|---|

| Arithmetic Mean (annualized) | 9.77% | 7.90% |

| Geometric Mean (monthly) | 0.70% | 0.60% |

| Geometric Mean (annualized) | 8.76% | 7.43% |

| Standard Deviation (monthly) | 3.91% | 2.69% |

| Standard Deviation (annualized) | 13.56% | 9.32% |

| Downside Deviation (monthly) | 2.66% | 1.76% |

| Maximum Drawdown | -48.64% | -33.59% |

| Stock Market Correlation | 0.97 | 0.92 |

| Beta(*) | 0.85 | 0.56 |

| Alpha (annualized) | -0.18% | 1.41% |

| R2 | 93.51% | 83.99% |

| Sharpe Ratio | 0.47 | 0.50 |

| Sortino Ratio | 0.67 | 0.73 |

| Treynor Ratio (%) | 7.55 | 8.47 |

| Calmar Ratio | 0.47 | 0.44 |

| Active Return | -1.70% | -3.03% |

| Tracking Error | 4.13% | 7.79% |

| Information Ratio | -0.41 | -0.39 |

| Skewness | -0.80 | -0.70 |

| Excess Kurtosis | 2.32 | 1.92 |

| Historical Value-at-Risk (5%) | -6.63% | -4.03% |

| Analytical Value-at-Risk (5%) | -5.66% | -3.79% |

| Conditional Value-at-Risk (5%) | -9.18% | -6.06% |

| Upside Capture Ratio (%) | 82.53 | 55.84 |

| Downside Capture Ratio (%) | 85.22 | 52.90 |

| Safe Withdrawal Rate | 7.33% | 6.45% |

| Perpetual Withdrawal Rate | 5.57% | 4.39% |

| Positive Periods | 277 out of 424 (65.33%) | 275 out of 424 (64.86%) |

| Gain/Loss Ratio | 0.89 | 1.00 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | ||

Boglehead 3-fund portfolio FAQs

What is the Boglehead 3-fund portfolio?

The Boglehead 3-fund portfolio is a simple, low-cost portfolio that consists of just three index funds.

It’s suitable for both beginner investors and experienced DIY investors alike.

Does the Boglehead 3-fund portfolio outperform the stock market?

On a risk-adjusted basis, it will tend to do so given the bond portion provides diversification.

The international stock portfolio also helps diversify the US stocks portion on the equity side.

What are some Boglehead 3-fund portfolio ETFs?

There are many different Boglehead 3-fund portfolio ETFs available from different providers.

Some examples include Vanguard S&P 500 ETF (VOO), Vanguard Total International Stock ETF (VXUS), and Vanguard Total Bond Market ETF (BND).

Can I lose money in the Boglehead 3-fund portfolio?

As with any investment, there’s always a risk you could lose money.

However, over the long term, the Boglehead 3-fund portfolio has outperformed the stock market on a risk-adjusted basis.

How do I choose the right Boglehead 3-fund portfolio for me?

The best way to choose the right Boglehead 3-fund portfolio for you is to consider your investment goals and risk tolerance.

For example, if you are retired and more focused on generating income, you might want to allocate a larger percentage to bonds.

Or, if you have a longer time horizon and are willing to take on more risk, you could invest a higher percentage in stocks.

What is the Boglehead 3-fund portfolio asset allocation?

There is no official Boglehead 3-fund portfolio asset allocation, as it’s all a matter of discretion.

The basic concept of the 3-fund portfolio is to allocate to the basic framework of domestic stocks, international stocks, and bonds.

However, a common split is 60 percent stocks, 30 percent bonds, and 10 percent cash or shorter-term bonds.

In other words, being analogous to a 60/40 portfolio.

Is the 3-fund portfolio good for diversification?

It’s okay, but not ideal in terms of balancing.

The 3-fund portfolio doesn’t shed insight on allocation, but most concentrate their money in stocks and have the bulk of their risk in stocks.

We’ve written on the idea of balancing portfolios better in other articles.

- The Math Behind Portfolio Diversification

- How to Balance Risk to Achieve More Return Per Each Unit of Risk

- Building a Balanced Portfolio with Options

- Building a Balanced Portfolio with VRP Overlay

What are some Boglehead 3-fund portfolio alternatives?

Some Boglehead 3-fund portfolio alternatives include the 4-fund portfolio and the 5-fund portfolio.

These portfolios add additional diversification by including small cap value and real estate investments, such as REITs.

Some versions also might include commodities or gold to help provide exposure to more so-called hard assets.

Alternative portfolios might also provide exposure to inflation-indexed bonds, such as TIPS.

As with anything related to trading or investing, there are lots of different portfolio approaches you can try.

The Boglehead 3-fund portfolio is just one option that you might want to consider, especially for those who want to keep things simple.

What is the Boglehead 3-fund portfolio withdrawal rate?

The Boglehead 3-fund portfolio withdrawal rate is the percentage of your portfolio that you can safely withdraw each year without running out of money.

A common rule of thumb is the 4 percent rule, which says you can withdraw 4 percent of your portfolio value each year without having to worry about depleting your savings.

So, for example, if you have a $100,000 Boglehead 3-fund portfolio, you could withdraw $4,000 per year or a little over $300 per month without running out of money.

Of course, this is just a general guideline and your actual withdrawal rate may be higher or lower depending on your specific circumstances.

What is the Boglehead 3-fund portfolio rebalancing?

Rebalancing is the process of resetting your asset allocation back to your original target percentage.

For example, say you originally allocated 60 percent of your Boglehead 3-fund portfolio to domestic and international stocks, 30 percent to bonds, and 10 percent to cash.

Over time, as the stock market goes up and down, your asset allocation will naturally drift away from your original targets.

Rebalancing simply means selling some of your winners (assets that have gone up in value) and buying more of your losers (assets that have gone down in value) to get back to your original targets.

Rebalancing can be done on a regular basis, such as once a year, or when your asset allocation gets out of whack by a certain percentage.

For example, you might rebalance when your stocks go up to 70 percent of your portfolio (sell some to buy bonds) or down to 50 percent (sell bonds to buy stocks).

What is the Boglehead 3-fund portfolio return?

The Boglehead 3-fund portfolio return is the percentage of your investment that you earn each year from interest and dividends.

It does not include capital gains or losses from selling assets.

The Boglehead 3-fund portfolio return will depend on the specific investments you hold and the current market conditions.

In general, stocks have outperformed other asset classes over the long run.

However, there have been periods where bonds or even cash have done better than stocks.

Returns are also affected by things like inflation and fees.

What is the Boglehead 3-fund portfolio expense ratio?

The Boglehead 3-fund portfolio expense ratio is the percentage of your investment that is charged in annual fees by the fund managers.

For example, if you have a Boglehead 3-fund portfolio with an expense ratio of 0.5 percent, that means you will pay $50 in annual fees for every $10,000 you invest.

Expense ratios can vary widely, from as low as 0.1 percent to more than 2 percent for actively managed funds.

Generally, index funds have lower expense ratios than actively managed funds.

Should I allocate less money to bonds than stocks in the 3-fund portfolio as I get closer to retirement?

Your asset allocation will depend on your investment goals, risk tolerance, and time horizon.

In general, stocks are considered to be more volatile than bonds, so a higher percentage allocation to stocks will result in a higher potential return, but also a higher risk of loss.

Bonds are considered to be less volatile than stocks, so a lower percentage allocation to bonds will result in a lower potential return, but also a lower risk of loss.

What is the Boglehead 3-fund portfolio stock allocation?

The Boglehead 3-fund portfolio stock allocation is the percentage of your investment that is allocated to stocks.

For example, if you have a Boglehead 3-fund portfolio with an asset allocation of 30 percent domestic stocks, 30 percent international stocks, and 40 percent bonds, that means 60 percent of your overall investment will be in stocks.

As mentioned, your allocation to equities will depend on your investment goals, risk tolerance, and time horizon.

What is the 3-fund portfolio bond allocation?

The Boglehead 3-fund portfolio bond allocation is the percentage of your investment that is allocated to bonds.

For example, if you have a 3-fund portfolio with an allocation of 60 percent stocks and 40 percent bonds, then you’d have a fairly standard 40 percent allocation to fixed income.

In general, bonds are considered to be less volatile than stocks, so a lower percentage allocation to bonds will result in a lower potential return, but also lower drawdowns.

What is the Boglehead 3-fund portfolio equity premium?

The Boglehead 3-fund portfolio equity premium – also known as the equity risk premium – is the difference between the returns of stocks and bonds.

For example, if over the past 10 years stocks have returned an average of 7 percent per year and bonds have returned an average of 3 percent per year, then the equity premium would be 4 percent.

This equity premium is one reason why stocks are considered to be riskier than bonds.

What is the Boglehead 3-fund portfolio Sharpe ratio?

The Boglehead 3-fund portfolio Sharpe ratio is a measure of risk-adjusted return.

It is calculated by dividing the portfolio’s excess return (the difference between the portfolio’s return and the risk-free rate) by the portfolio’s standard deviation of returns.

A higher Sharpe ratio indicates a better risk-adjusted return.

For example, if a portfolio has a return of 10 percent and a standard deviation of 20 percent, then its Sharpe ratio would be 0.5.

If another portfolio has a return of 15 percent and a standard deviation of 15 percent, then its Sharpe ratio would be 1.0.

The first portfolio has a higher return, but the second portfolio has a better risk-adjusted return.

The average Sharpe ratio of asset classes is around 0.2 to 0.3 over time.

If excess returns are too high or low relative to excess risks then it will change capital allocation decisions until those ratios get back into a more appropriate equilibrium.

What is the 3-fund portfolio standard deviation?

The Boglehead 3-fund portfolio standard deviation is a measure of volatility.

It is calculated by taking the square root of the sum of the squares of the returns.

For example, if a portfolio has returns of 1, 2, and 3 percent over three years, then its standard deviation would be sqrt((1^2 + 2^2 + 3^2)/3) = 1.732 percent.

A higher standard deviation indicates a more volatile investment.

What is the 3-fund portfolio tracking error?

The Boglehead 3-fund portfolio tracking error is a measure of how closely a portfolio tracks its benchmark.

It is calculated as the standard deviation of the difference between the portfolio’s return and the benchmark’s return.

For example, if a portfolio has a return of 10 percent and its benchmark has a return of 12 percent, then the tracking error would be 2%.

A lower tracking error indicates an investment that more closely tracks its benchmark.

What is the 3-fund portfolio information ratio?

The Boglehead 3-fund portfolio information ratio is a measure of active risk.

It is calculated by dividing the portfolio’s excess return (the difference between the portfolio’s return and the risk-free rate) by the tracking error.

For example, if a portfolio has a return of 10 percent and a tracking error of 2 percent, then the information ratio would be 5.

A higher information ratio indicates a more actively managed investment.

What is the 3-fund portfolio R-squared?

The Boglehead 3-fund portfolio R-squared is a measure of how much of the portfolio’s return can be explained by the return of its benchmark.

It is calculated as the correlation between the portfolio and its benchmark squared.

For example, if a portfolio has a correlation of 0.6, then the R-squared would be 0.36 (the square of the correlation between the two returns).

A higher R-squared indicates a more closely tracked investment.

What is the 3-fund portfolio alpha?

The Boglehead 3-fund portfolio alpha is a measure of how much of the portfolio’s return is due to active management.

It is calculated as the difference between the portfolio’s return and the return of its benchmark, adjusted for risk.

For example, if a portfolio has a return of 10 percent and its benchmark has a return of 12 percent, then the alpha would be minus-2 percent.

A positive alpha indicates that the portfolio has outperformed its benchmark, while a negative alpha indicates that the benchmark has outperformed the portfolio.

What is the 3-fund portfolio beta?

The Boglehead 3-fund portfolio beta is a measure of the portfolio’s volatility relative to its benchmark.

It is calculated as the correlation between the portfolio and its benchmark.

The formula for calculating beta is the covariance of the return of an asset with the return of the benchmark, divided by the variance of the return of the benchmark over a certain period.

A higher beta indicates a more volatile investment.

Summary – Boglehead 3-fund portfolio

The Boglehead 3-fund portfolio is a simple, low-cost way to build a diversified investment portfolio.

It’s suitable for both beginner investors and experienced DIY investors alike. If you’re looking for an easy way to invest without having to choose individual stocks or excessively manage your own portfolio, this 3-fund portfolio be an option to consider.