Drawdowns – Why They’re the Worst Thing in Trading

The entire purpose of trading and investing is to earn more money back over time than is lost. At worst, it should preserve your purchasing power over time. Drawdowns are the one thing that should be avoided at all costs.

Warren Buffett is known for his quotes on investing, one of which pertains to his “rules”:

“Rule number 1: Never lose money.

Rule number 2: Don’t forget rule number 1.”

Of course, it is widely known that Buffett himself has lost billions of dollars in a very public way many times over his career, including a $23 billion loss, or about 40 percent of his net worth, during the financial crisis of 2008.

The math on drawdowns

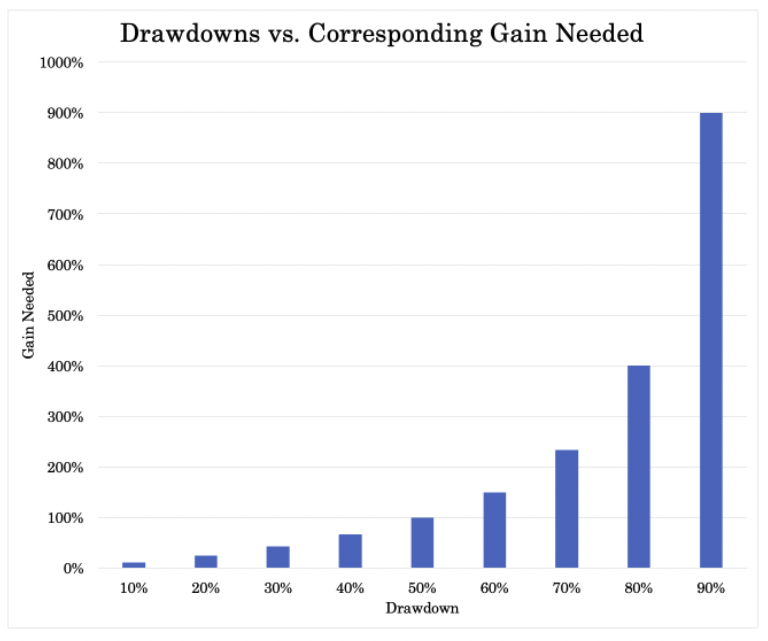

If you lose 10 percent, you need an 11 percent gain to get back to where you were.

However, if you lose 20 percent, you now need a 25 percent gain to get back to breakeven.

If you lose 50 percent, you now need a full 100 percent (doubling of your portfolio).

The idea is that losses are not made up for by corresponding gains, so it’s important to avoid drawdowns.

The effect is non-linear.

The bigger the hole, the bigger it is to get out of.

How much of a drawdown should be tolerated?

It’s largely a function of your risk tolerance, time horizon, and financial goals.

This could mean needing to ensure the portfolio is always holding its value in real (inflation-adjusted) terms to accepting larger nominal drawdowns to keep larger upside.

We cover that subject in this article.

Equal-percentage losses and gains don’t offset each other

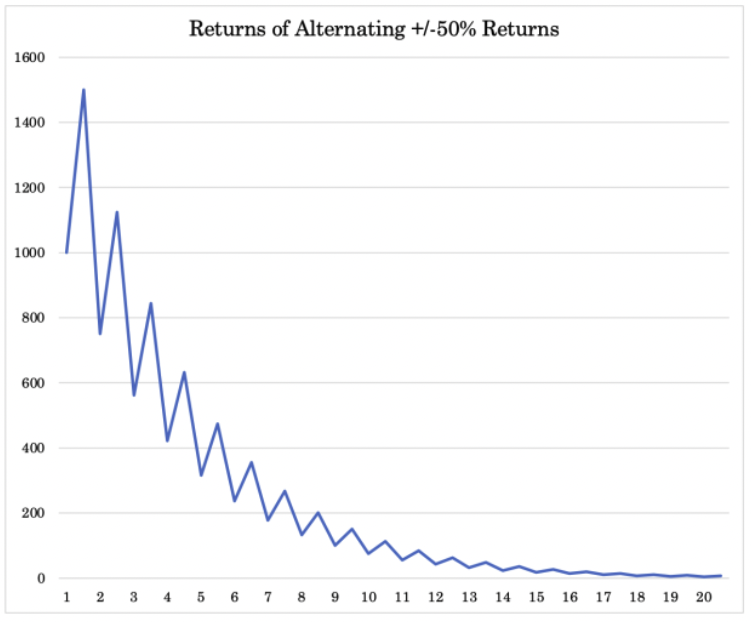

One implication is that if you play a game where you alternate gains and losses of the same size you’ll eventually run out of money.

For example, let’s say you have alternating gains and losses of 50 percent each.

Say you start the game with $1,000.

You gain 50 percent in the “gain” part of the first round – i.e., you’re now at $1,500 – and lose 50 percent to end the round, so you’re down to $750.

In other words, you had a 50 percent gain and 50 percent loss and you’re already down 25 percent.

Then in round two, you gain 50 percent (back above breakeven up to $1,125), but losing 50 percent you’re down to $562.50, and so on.

Each round of this game that you go through, you’re going to end up with less money than you had before.

As we mentioned above, to pay off that 50 percent loss, you need a 100 percent gain, not just the corresponding percentage loss.

Even though it’s the same magnitude, your 50 percent gain simply isn’t anywhere near enough.

At the start of the fourth round of this game, after you’ve had three wins and three losses, you’ll already be down more than 50 percent of your original investment at just above $400.

After only ten rounds of this game – even despite the fact that you’re having equal wins and losses of the same percent – you’ll have already lost about 90 percent of your original investment.

After 15 rounds, you’ll be down more than 97 percent.

And after 20 rounds, you’ll be down more than 99 percent of your initial sum – to just $6 left of your original $1,000.

Graphically this is how it looks:

This exercise shows the importance of careful risk management and how careful you need to be when managing money.

It’s the most important aspect of trading and, in general, of most business activities.

Average Drawdowns in US Stock Markets

In any given year, it’s entirely normal for US equity markets to experience a drawdown of around 10%.

This fluctuation is a standard feature of equity investing.

Over the past four decades, the average year has included a temporary dip of about 10%, even during strong bull markets or periods of stable economic growth.

This recurring pattern reflects the market’s tendency to price in a wide range of macroeconomic, geopolitical, and policy-related risks.

Such mid-cycle drawdowns often occur due to shifting expectations about growth, inflation, risk premiums (one asset/asset class’ return relative to another), interest rates, or global events.

For instance, signs of a slowdown in GDP growth or rising trade-policy uncertainty can trigger a pullback. History nonetheless shows that these types of corrections are typically temporary.

While valuations may adjust downward in response to slower economic growth, the longer-term market trajectory often remains intact, especially outside of recessions or 2008 dynamics.

Drawdowns of this magnitude might be unsettling in the moment, but aren’t necessarily a sign of systemic weakness.

A 10% decline has historically presented a buying opportunity rather than a reason to exit the market. Market timing is hard and most will get it wrong.

When the broader economy and corporate earnings continue to expand, markets tend to recover and resume their upward path.

Over the last 40 years, an investor who bought the S&P 500 after a 10% drop from its peak would have seen positive six-month returns about three-quarters of the time.

This historical pattern reinforces the idea that market volatility is simply part of the process. It’s neither rare nor inherently alarming for markets to experience these temporary setbacks.

Stocks are a long-duration asset class that are continuously marked to market. That’s just their nature.

Instead, they are a natural reaction to changing data, shifting sentiment, and uncertainty – often short-lived.

For long-term investors, understanding this context is key to staying focused on broader trends rather than reacting emotionally to routine declines.

To Put This into Context

In the short run, stock prices are heavily influenced by macroeconomic forces – shifts in expected growth, inflation, interest rates, and risk premiums.

These variables affect how future cash flows are discounted, sometimes causing large price swings even when a company’s actual performance remains stable.

For example, rising discount rates or a sudden change in perceived economic outlook can compress valuations quickly, particularly for high-duration stocks with earnings expected far into the future.

However, over the long run, these fluctuations tend to even out, and it’s earnings that drive returns.

Example

A stock with a P/E of 15 ($1 in expected earnings for every $15 in market value) means ~1.7% of market value accrues quarterly (1/60th) – small but steady.

Over time, this compounding effect matters far more than near-term market noise.

A company’s ability to generate consistent, growing profits becomes the dominant force behind its stock price and not the day-to-day.

This is where fundamentals take over – revenue growth, margins, return on capital, and operational efficiency become the real determinants of value.

Quality Companies Can Help Control Drawdowns

Quality companies stand out in both contexts.

In the short term, their lower risk profiles, strong balance sheets, and reliable cash flows help cushion the impact of external shocks.

They’re less sensitive to rising discount rates or uncertainty because investors can count on steady earnings today, not just promises of growth tomorrow (which may or may not pan out).

Over the long term, these same fundamentals allow such companies to compound value and deliver sustainable returns.

So, while market sentiment and macro forces may dictate price action in the near term, it’s the underlying earnings power that ultimately anchors and lifts stock valuations.

Tiger Global and ARKK

In 2022, interest rates rose and practically all long-duration equities sold off heavily.

Technology managers like ARK (through its popular ETF ARKK) and Tiger Global suffered badly, losing more than 50 percent of their portfolios.

Tiger Global was surprising.

It was one of the world’s largest hedge funds, specializing in technology since its inception and managing around $35 billion in its public equity portfolios (and about another $65 billion in its private equity portfolios, though these funds are not marked to market).

Chase Coleman opened the fund in 2001 after working at Julian Robertson’s Tiger Management. It had a great track record of investing for more than 20 years through all kinds of markets.

In a May letter to investors, Tiger Global wrote:

Dear Investor,

April added to a very disappointing start to 2022 for our public funds. Markets have not been co-operative given the macroeconomic backdrop, but we do not believe in excuses and so will not offer any.

We are continuing to manage the portfolio in the ways we described in our Q1 letter. We are confident in our team, our process, and our portfolio and know we will look back on this as one point in time on a long journey and benefit from the process improvements we continue to make as a firm.

We are here to answer your questions, remain committed to earning back our losses, and intend to be as transparent and communicative as possible during this challenging period. We appreciate your commitment and trust.

Sincerely,

The Tiger Global Investment Team

From the Financial Times:

Robertson’s own hedge fund closed in 2000 when its returns significantly lagged behind those achieved by other investors during the dot-com bubble.

After its closing, this led to the formation of new hedge funds by many of his employees and proteges, known as Tiger Cubs.

Softbank is another popular technology fund that was hit.

According to Bloomberg, Masa Son firm was also estimated to have lost about $18.6 billion on its public portfolio alone during the first quarter of 2022. The Vision Fund unit lost about $10 billion.

Drawdowns in the context of the hedge fund industry

These kinds of steep losses are very difficult to recover from in the hedge fund industry.

Hedge funds charge performance fees on top of management fees. This is traditionally called “2 and 20” with the 2 standing for two percent management fees and 20 percent performance fees. (Today, it’s more like “1.5 and 17” in terms of industry average.)

Though the management fees are generally in excess of mutual funds (about double typically), the performance fees are where big revenue can be made.

In fact, some hedge funds are waving management fees for the reward of higher performance fees. This is risky because it means they have no base revenue to pay operating costs.

However, with competition and with LPs (i.e., their investors) wanting to better align incentives, it’s a somewhat popular way of structuring agreements.

For example, a pension fund typically needs 6 to 8 percent annual returns to fund its obligations.

So, the incentive of a pension would be to pay as little of a management fee as possible and pay as little of a fee on the type of returns its needs (because it would simply eat into the returns it gets).

Accordingly, on anything in excess of its needed returns (that 6 to 8 percent) it might be willing to offer a big performance fee because anything above that is “nice to have” but not necessarily “have to have”.

So you might see something like a zero or near-zero management fee and a 40+ percent performance fee on anything above its needed returns.

High water marks

Hedge funds have what are called high water marks.

This means they often collect performance fees only once a certain return is achieved.

For example, a hedge fund might give the first six percent gains to a client for free and then charge a performance fee on anything above. It all depends on the agreement.

This also means that if they lose money and have a bad year, they don’t get to just wipe the slate clean and start over again.

That high water mark tracks them continually until they make it up.

That means if they lose 20 percent and have an existing 6 percent high water mark, they need to gain that 20 percent back – i.e., a 25 percent corresponding gain – plus the 6 percent, plus anything additional (e.g., if another 6 percent kicks in).

Otherwise, there will be no performance fees.

And without performance fees, that means it’s hard to keep your best talent if they know they won’t be receiving a bonus for a long time, if ever again as long as they’re working at that firm.

If there’s a brain drain from a fund, then it’s possible the fund could be set back even further and eventually have to slog through years of not having performance fees.

It may also have to cease operations if it can’t get back.

Melvin Capital

Melvin Capital famously lost a lot during the GameStop “meme stock” saga in early 2021. Melvin’s CEO Gabe Plotkin sought to move investors out of its fund before allowing them to invest back in a new one.

This tactic was designed to try to reset things so they could start charging performance fees sooner.

However, everyone quickly figured out what it was about. Some investors were so miffed by the proposal to circumvent the high water mark they said they planned to take all their money out of the firm at the first opportunity.

This forced Plotkin to backtrack.

Melvin would eventually shut down in May 2022, 17 months after the peak of the meme stock frenzy.

Plotkin wrote that he had come to his decision after conferring with Melvin’s board of directors during a months-long process of reassessing the firm.

“The past 17 months has been an incredibly trying time for the firm and you, our investors,” he wrote.

“I have given everything I could, but more recently that has not been enough to deliver the returns you should expect. I now recognize that I need to step away from managing external capital.”

Drawdown Risk for Individual Traders

For individual traders and investors, drawdowns can also be incredibly difficult to recover from.

This is especially true for those who are close to retirement and don’t have much time to make up for the losses.

It can also be difficult psychologically. After all, it’s hard to watch your account balance go down during market sell-offs.

It’s easy to start doubting your strategy or question whether you should have been trading or investing in the first place.

This can lead to very costly mistakes if you dramatically change what you’re doing.

The key is to stay calm and keep a long-term perspective.

This is also especially important in up markets as well. When central banks are easing as much as possible, this is traditionally when the riskiest stocks do best.

You might see your neighbor tripling their money every few months in unprofitable and otherwise highly speculative investments. That doesn’t mean you need to change things up and follow along, as those strategies will eventually get burned.

Trading and investing is a marathon designed to benefit you over decades and you will eventually come out of the drawdown if you’re following reliable strategies and continuing to save and invest your money.

Drawdown Assessments

Before investing, it’s important to determine your tolerance for drawdowns.

How much can you stomach before you start getting anxious or making decisions you probably shouldn’t be making?

Once you know your risk tolerance, you can be more strategic about how you allocate your investments and what types of investments or trading strategies you choose.

For example, if you’re someone who can’t handle much volatility, you might want to focus on investing in blue-chip stocks or index funds rather than investing in individual stocks or actively managed funds that run higher volatility.

You may want to balance your portfolio among different asset classes and different countries.

Trading and investing is all about finding the right balance for you.

If you’re too conservative, you may miss out on potential gains.

But if you’re too aggressive, you could end up taking on more risk than you’re comfortable with and literally losing sleep at night.

If you’re having to check your portfolio balance constantly or you’re afraid to look you’re probably taking too much risk.

Time to Recover a Drawdown

It’s also important to keep in mind that it takes time to recover from a drawdown.

Generally speaking, the bigger the drawdown, the longer the underwater period. So the deeper you get, the more time it’ll take.

So if you lose 50 percent and need 100 percent to get back, that can take a long time. It’s not uncommon for markets to need 10 years to double, depending on what it is. You would need a bit more than seven percent compounded over those 10 years.

If you’re investing for the long term, you may be able to weather the storm and come out ahead eventually, especially as you save more money.

But if you’re investing for a short-term goal, such as retirement, a drawdown can throw a wrench in your plans.

You may need to adjust your timeline or have to work longer.

Drawdowns are a normal part of investing but they can be difficult to deal with, financially and otherwise.

It’s important to have a plan in place before investing so you know how you’ll handle a drawdown if one occurs. By doing so, you can help minimize the impact a drawdown has on your portfolio and your general peace of mind.

What Is a Maximum Drawdown (MDD)?

A maximum drawdown (MDD) is the largest peak-to-trough decline in an investment’s value.

It is typically expressed as a percentage and calculated by taking the difference between an asset’s highest peak and its lowest valley, divided by the asset’s highest peak.

For example, if an investment has a historical high of $100 and a historical low of $50, its MDD would be 50 percent.

Because MDD measures the size of a drawdown relative to the asset’s highest point, it makes it useful for comparing different investments.

It can also help investors assess how much risk they’re comfortable with.

Generally speaking, investments with higher MDDs are considered to be riskier.

Return Over Maximum Drawdown (RoMaD)

RoMaD is defined as a portfolio’s return divided by its maximum drawdown.

It is a risk-adjusted measure of performance that adjusts for the amount of drawdown an investment experiences.

The higher the RoMaD, the better the investment’s risk-adjusted return.

RoMaD can be useful for comparing different investments or assessing how much risk you’re comfortable with.

For example, if two investments have the same return but one has a higher RoMaD, it means that that investment had less drawdown relative to its return and is therefore considered to be more efficient.

Trading Drawdowns FAQ

What is a good drawdown to limit oneself to in trading?

Drawdowns are inevitable, but they can’t be significant.

Ten percent or lower is ideal.

Once you start getting over 20 percent, they become much more difficult to recover from, especially when that 20 percent is a significant percentage of how much money you can realistically save over a year.

For example, if you have a $100k portfolio and lose 20 percent ($20k), if you are able to save only $5,000 per year, that can be a significant drawdown.

In such a case, you will likely need to deeply understand what went wrong and develop a strategy where you’re not running a portfolio at such a high volatility.

This might include:

- buying some OTM options to get rid of your left-tail risk

- learning how to balance a portfolio better through diversification

- choosing securities with better earnings yields and better balance sheets, and so on

More: Successful Trading: 8 Principles to Enhance Returns & Reduce Risk

How do I prevent myself from going into a deep drawdown?

The best way to prevent a deep drawdown is to have a plan in place before trading and investing.

This plan should include an assessment of your risk tolerance and investing goals.

It’s also important to diversify your investments and not put all your eggs in one basket.

Finally, don’t forget to monitor your portfolio regularly and make adjustments as needed.

At the same time, don’t over-trade. More activity is not necessarily associated with more trading gains.

What are the biggest trading drawdowns?

Some of the biggest trading drawdowns include the stock market crash of 1929, which saw the Dow Jones Industrial Average fall by 89 percent.

Other notable crashes include the 1987 crash, when the Dow fell by over 22 percent, and the 2008 financial crisis, when the Dow fell by over 50 percent.

These events highlight the importance of having a plan in place to deal with a drawdown.

How do I recover from a trading drawdown?

The best way to recover from a trading drawdown is to first understand what led to the drawdown in the first place.

If you’re suffering big drawdowns, you’re likely very unbalanced in your portfolio – e.g., highly exposed to one asset or one asset class, using too much leverage or leverage-like instruments (such as being short options), and don’t have quality risk management practices in place.

The one thing about drawdowns is they force you to adapt and learn how to do things better.

What is the difference between investing and trading drawdowns?

Investing and trading are two different approaches to managing money.

Investing is about buying assets and holding them for the long term, while trading is about buying and selling assets in the short term.

While both investing and trading can lead to drawdowns, they tend to be different in nature.

Investing drawdowns are usually caused by macroeconomic factors such as recessions or market corrections and sometimes just poor selection of securities or instruments.

Trading drawdowns, on the other hand, are often caused by individual trades that go against the trader.

This is why risk management is so important for traders.

How do I know if my drawdown is too big?

There is no hard and fast rule for this, but a good general guideline is that a drawdown shouldn’t exceed 20 percent of your account value.

Once you start getting over 20 percent, it becomes much more difficult to recover.

Of course, this is just a guideline and you should always tailor your risk management to your own individual circumstances.

What is the difference between a drawdown and a loss?

A drawdown is a peak-to-trough decline in an investment’s value, while a loss is simply when the value of an investment falls below its original purchase price.

Drawdowns can be short-lived or last for extended periods of time, while losses are typically realized over a shorter timeframe.

How do I calculate my maximum drawdown?

There are several ways to calculate maximum drawdown, but the most common method is to simply take the difference between an investment’s or portfolio’s peak value and its trough value.

For example, if an investment peaks at $100 and then falls to a trough of $50, the maximum drawdown would be 50 percent.

The percentage drawdown formula takes into account both the peak and the trough values, which is the original value minus the drawdown value divided by the original value.

For our example above, the percentage drawdown would be (($100-$50)/$100)*100, or 50 percent.

Why are drawdowns so important?

Drawdowns are important because they provide a way to measure risk.

The larger the drawdown, the higher the risk. This is why it’s so important to limit your exposure to potential drawdowns.

What is a good strategy for dealing with investing drawdowns?

There is no one-size-fits-all answer to this question, as the best strategy for dealing with investing drawdowns will depend on your individual circumstances.

However, some general tips include maintaining a diversified portfolio, sticking to your investment plan, and staying disciplined with your investing.

Bottom line

Drawdowns are a natural part of investing and trading.

However, you can take steps to avoid them, such as:

- having better diversification

- owning options to protect you

- owning securities that have better earnings yields and balance sheets

- having exposure to different asset classes in different countries and in different currencies

- owning returns streams that are uncorrelated

When they do happen, it’s important to have a plan in place to deal with them.

By understanding what causes drawdowns, you can put yourself in a better position to weather the storms and come out ahead in the long run.