How Large of a Drawdown Should Be Tolerated?

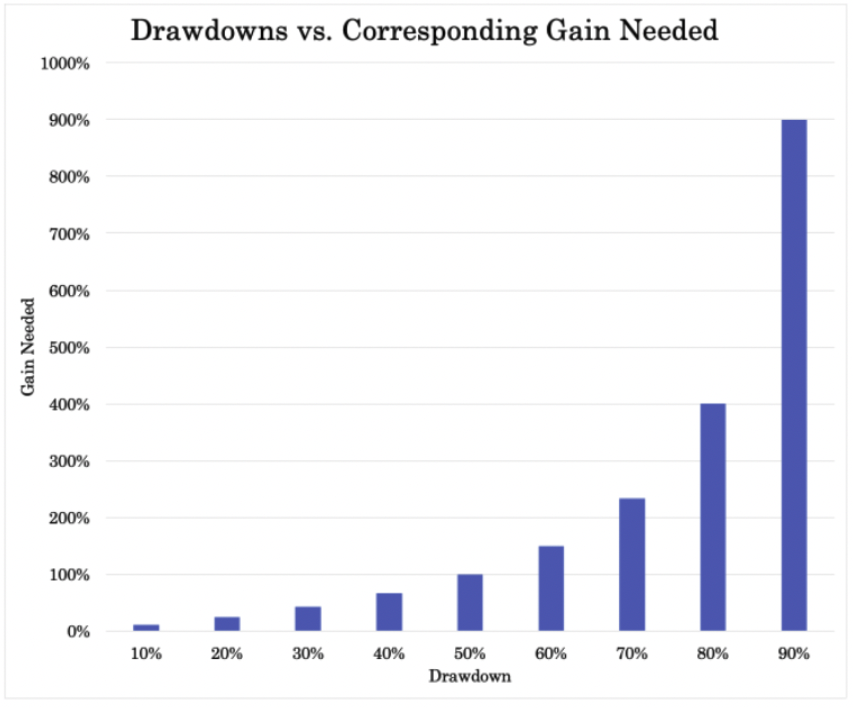

The non-linear relationship between losses and the gains required to recover those losses is an important concept in portfolio management.

For example:

- A 10% loss requires an 11% gain to recover.

- A 20% loss requires a 25% gain to recover.

- A 50% loss requires a 100% gain to recover.

Mathematically, if “L” is the loss percentage (expressed as a decimal), the gain “G” needed to recover to the original value is given by:

G = (1-L) / L

For example, if L = 0.50 (a 50% loss), then G = 0.50 / (1 – 0.50) = 1.00 or 100%.

Graphically, it appears as the following:

As a result of the non-linearity of this, we need to consider how much of a drawdown is acceptable.

Determining Acceptable Drawdown

Determining an acceptable drawdown is a complex decision and depends on various factors, including the investor’s risk tolerance, investment horizon, and financial goals.

Here are a few considerations:

1. Risk Tolerance

- Conservative Investors: Typically accept lower drawdowns because they have a lower risk tolerance. A drawdown of 5-10% might be acceptable.

- Aggressive Investors: Might be willing to tolerate higher drawdowns, perhaps up to 20-30%, in pursuit of higher returns.

2. Investment Horizon

- Short-Term: Investors with a shorter investment horizon might prefer to accept lower drawdowns to preserve capital.

- Long-Term: Investors might be able to tolerate higher drawdowns, given they have more time to recover losses.

3. Financial Goals

- If the portfolio is needed for imminent financial needs (like retirement within the next few years), a lower drawdown might be prudent.

- If the portfolio is not needed for immediate financial obligations, a higher drawdown might be acceptable to keep greater upside.

Hedging Using Options

To hedge against tail risk and limit drawdowns using options, you might consider strategies like buying put options or implementing a collar strategy:

Buying Put Options

Purchasing put options can provide downside protection.

If the portfolio falls in value, the put options will increase in value, offsetting some of the losses.

Theta Decay

Options lose value as time goes on (all else equal). So you will need to pick a timeframe where it provides the protection at an economical price.

Some traders/investors, to limit the theta decay (options losing value due to time), might choose a hedge one year out, then sell that hedge in six months’ time, while choosing another year-long hedge.

This way, they limit the impact of theta on their portfolio returns.

Liquidity Considerations

There are also liquidity considerations. Some options are more liquid than others (i.e., higher or lower bid-ask spread depending on their duration).

This affects their prices.

Taxes

Taxes are another factor – i.e., short-term capital gains vs. long-term capital gains.

Collar Strategy

This involves buying a put option to protect against downside risk while simultaneously selling a call option to help offset the cost of the put.

This strategy limits both downside and upside potential.

Diversification

Diversification reduces a portfolio’s drawdowns by spreading investments across various assets, sectors, or geographies.

This mitigates the impact of a poor-performing investment on the overall portfolio.

Different investments that are intrinsically different often don’t move in tandem. When some may be declining, others might be rising. This can offset losses and smooth overall returns.

This blend of assets that are not perfectly correlated provides a cushion against significant losses, as the negative performance of some investments is counterbalanced by the positive performance of others.

If you think of your prospective returns as a type of distribution of expected outcomes, diversifying helps to tighten the distribution, thinning out the tails of the distributions and tightening it by reducing the variance.

Accordingly, diversification can stabilize portfolio value, minimizing the magnitude and duration of drawdowns and enhancing risk-adjusted returns.

Moreover, thinner tails can also reduce hedging costs.

Conclusion

Your risk tolerance, time horizon, and financial goals are largely will determine what kind of drawdown you can accept.

Some general ideas on how to approach it:

- Hedging With Options: Buying options to limit portfolio drawdowns is the easiest way to remove tail risk.

- Diversification: Ensure the portfolio is well-diversified across different asset classes and sectors to mitigate risk.

- Regular Review: Continuously monitor and adjust the hedging strategy based on changing market conditions and investment goals.

- Professional Advice: Consider seeking advice from a financial advisor to ensure that the hedging strategy aligns with the overall investment objectives and risk tolerance.

And while hedging can limit losses, it also often involves costs and can limit upside potential.

Balancing protection against cost is key in constructing an effective hedging strategy.