Weighted Average Cost of Capital (WACC) in Making Investment Decisions

WACC stands for the weighted average cost of capital. WACC (commonly pronounced “whack”) is the average of the costs of all capital, including equity and debt, that a company has raised to finance its operations.

WACC is used to discount a company’s future cash flows back to present value, in order to determine whether or not an investment is worth making.

How to Find WACC

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets.

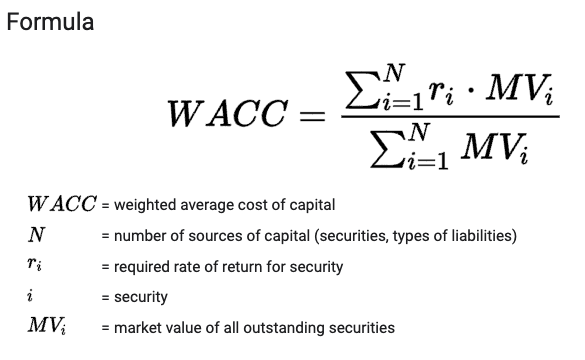

WACC can be expressed as:

WACC = Wd*(1-Tc)*rd + We*Re

Where:

- Wd is the percentage of financing that is debt

- Tc is the corporate tax rate

- rd is the before-tax cost of debt

- We is the percentage of financing that is equity, and

- Re is the cost of equity

WACC is also commonly seen as:

WACC = E/V x Re + D/E x Rd(1-Tc)

Where:

E/V = market value of equity / market value of total capitalization

Re = cost of equity

D/E = market value of debt / market value of total capitalization

Rd = cost of debt

Tc = corporate tax rate

The WACC formula can be modified for use in different situations, such as when a company has more than one class of stock or when preferred stock is outstanding.

WACC is commonly used when making investment decisions.

“Good investments” are those that provide returns in excess of the costs to fund them, such as generating 10 percent returns for a 6 percent cost, or 5 percent returns off a 2 percent cost.

WACC is also used in capital budgeting to decide which projects are worth pursuing and which are not.

A company with a lower WACC is generally considered to be better off than a company with a higher WACC, because it can finance its operations at a lower cost.

There are several factors that can affect a company’s WACC, including the mix of debt and equity that it has raised, the interest rates on its debt, and the tax rate. (Debt is often considered a “tax shield” because its interest is commonly tax-deductible, but it depends on the jurisdiction.)

A company’s WACC is not static; it can change over time as a company’s capital structure changes.

Why Using WACC Is Important

Weighted average cost of capital (WACC) is the average of the costs of all capital, including equity and debt, that a company has raised to finance its operations.

WACC is lowest when a company has an optimal mix of equity and debt financing.

Debt vs. Equity WACC Optimization

Debt is cheaper than equity, so that’s the main benefit. The trade-off is that if you have too much debt, it increases the risk of default.

So debt up to a certain level is a good thing. But debt past a certain level is bad, so it’s an optimization problem to see the optimal level of debt and equity (i.e., the total capitalization for a firm).

Investment analysts and investment bankers advising on this process can generate a graph and take the first derivative of the curve to find the optimal mix of debt and equity.

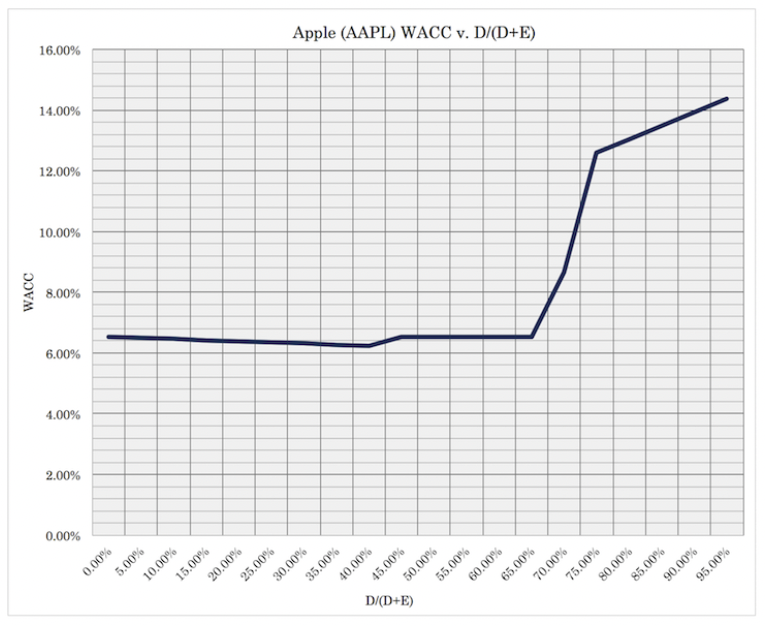

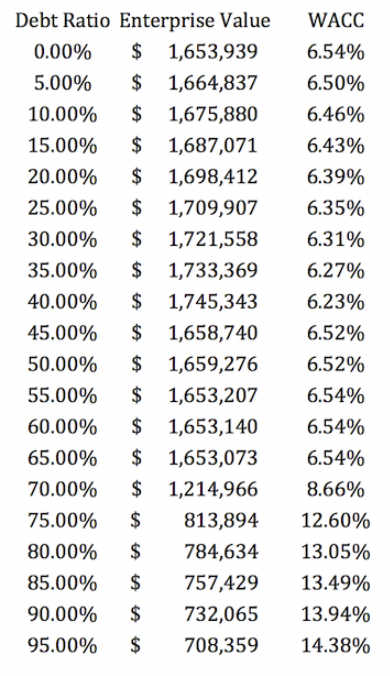

This is how it might look for Apple (AAPL), for example:

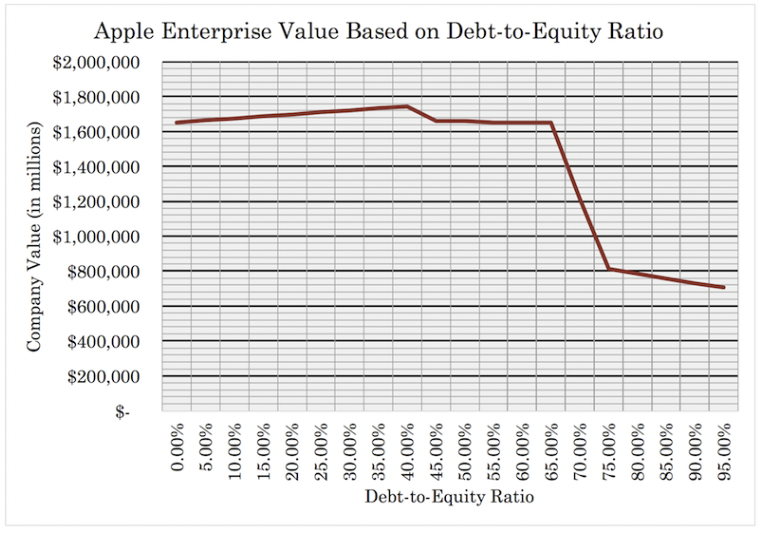

And how it would feed through into enterprise value:

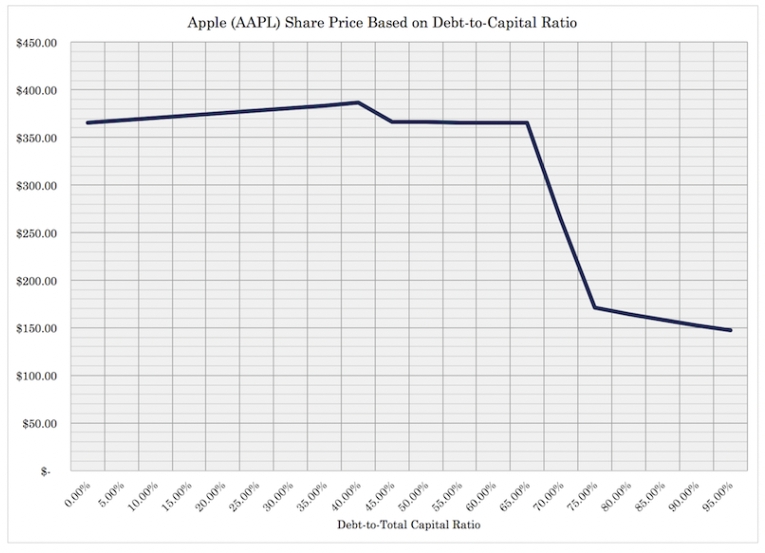

Then we can also translate this into the share price:

As can be seen, the enterprise value of the company increases to a point with more debt capitalization because it’s less expensive relative to equity.

But then it falls after a point because debt is an obligation (or risk default) and thus there comes a point where the drawbacks to taking on more debt outweigh the benefits.

Equity and Debt Components of WACC Formula

WACC is calculated by multiplying the cost of each capital source (i.e., debt and equity) by its weight as a percentage of total capital.

The cost of equity is the return that shareholders require for investing in the company. This can be calculated using the Capital Asset Pricing Model (CAPM).

The cost of debt is the interest rate that the company must pay on its outstanding debt.

The tax rate is used to adjust the cost of debt, because interest payments on debt are tax-deductible.

Hence the corporate tax rate is part of the WACC formula as it pertain to the debt portion.

WACC = E/V x Re + D/E x Rd(1-Tc)

Example of How to Use WACC

Let’s say that a company has raised $1 billion in total capital, consisting of $500 million in equity and $500 million in debt.

The cost of equity is 10 percent, the cost of debt is 5 percent, and the corporate tax rate is 30 percent.

The WACC for this company would be based on this formula: WACC = E/V x Re + D/E x Rd(1-Tc)

WACC = 0.5 x 10 percent + 0.5 x 5 percent (1-0.3)

WACC = 6.75 percent

This means that the company’s future cash flows (FCFF model) must be discounted at a rate of 6.75 percent in order to determine their present value.

If the company’s WACC is higher than the return it is earning on its investments, then the company is destroying value.

Conversely, if the company’s WACC is lower than the return it is earning on its investments, then the company is creating value.

Limitations of WACC

Higher debt levels past a point mean the investor or company will require a higher WACC.

Balance sheets that are more complicated, such as varying types of debt (e.g., different types of bonds, loans, and other fixed-income securities with various interest rates) and hybrid securities (e.g., convertible bonds, preferred stock), make it more difficult to calculate WACC.

Together this mix of debt, equity, and any debt/equity hybrid instruments form what’s called the company’s capital structure.

Another limitation is that WACC focuses on the average cost of all financing sources, rather than the marginal cost.

This means that WACC might not always be the best discount rate to use when making investment decisions, especially those with high levels of debt.

Weighted average cost of capital (WACC) – FAQs

What Is a Good WACC?

A “good” WACC is considered a lower WACC. If a company can get lower-cost capital, it is more likely to make accretive investment decisions.

For example, it’s easier to make a return on a liability that costs 3 percent than one that costs 10 percent.

But WACC is not the only thing that should be considered when making investment decisions.

The company’s business model, competitive advantages, growth prospects, and other factors are also important.

WACC can be a good starting point for analyzing a company’s investment opportunities, but it should not be used in isolation.

Is WACC nominal or real?

WACC is in nominal terms. This means it’s not adjusted for inflation.

To convert WACC to real terms, you can subtract the expected rate of inflation.

For example, if WACC is 10 percent and expected inflation is 3 percent, then WACC in real terms would be 10 minus 3, or 7 percent.

What Is WACC Used For?

WACC is used to discount a company’s future cash flows in order to determine their present value.

This is also known as the weighted average cost of capital or the marginal cost of capital.

The higher the WACC, the higher the discount rate and the lower the present value of future cash flows.

WACC is also used to compare the cost of capital of different companies.

For example, if Company A has a WACC of 5 percent and Company B has a WACC of 15 percent, then Company A’s cost of capital is lower than Company B’s.

This means that, all else being equal, Company A is more efficient at using its capital than Company B.

It could also mean that Company A is a lot more stable while Company B could be less stable, such as being a startup or a company is in bad shape financially.

What Is WACC Formula?

The WACC formula is:

WACC = E/V x Re + D/E x Rd(1-Tc)

Where:

- E/V = the ratio of equity to total value

- Re = the cost of equity

- D/E = the ratio of debt to total value

- Rd = the cost of debt

- Tc = the corporate tax rate

Why is Debt Considered a Tax Shield?

The WACC formula includes a term for the after-tax cost of debt, which is Rd(1-Tc).

This is because the interest payments on debt are tax-deductible.

The corporate tax rate (Tc) is used to adjust the cost of debt for this tax deduction.

As a result, debt is considered a “tax shield”.

What Are the Different Types of WACC?

There are four different types of WACC: levered WACC, unlevered WACC, pre-tax WACC, and post-tax WACC.

The levered WACC takes into account the company’s capital structure, while the unlevered WACC does not.

The pre-tax WACC includes the tax deduction for interest payments, while the post-tax WACC does not.

Is WACC Relevant to Public Companies?

WACC is relevant to both public and private companies.

However, it’s more commonly used to discount the cash flows of public companies because they have a more complex capital structure.

This is because public companies can issue different types of securities, such as equity, debt, and hybrid securities.

Private companies usually have a simpler capital structure, with just equity or debt.

What Is the Miller-Modigliani Theory?

The Miller-Modigliani theory states that the cost of capital is irrelevant to a company’s investment decisions.

This theory was developed in the 1960s and has been widely criticized.

The main criticism is that it assumes that all companies are financed with 100 percent equity, which is not realistic.

Despite its criticisms, the Miller-Modigliani theory is still taught in business schools and is relevant to WACC.

What Is WACC Calculator?

A WACC calculator is a tool that can be used to calculate the weighted average cost of capital.

There are many WACC calculators available online, and they usually allow you to input different values for the different variables in the WACC formula.

What Are WACC Assumptions?

The WACC formula makes a number of assumptions, including:

- The company’s capital structure is static. This means that the ratio of debt to equity is constant over time.

- The cost of debt and equity are constant over time.

- The company is in equilibrium. This means that it is not growing or shrinking, and that its WACC is equal to the cost of new capital.

- The cash flows being discounted are perpetual. This means that they go on forever into the future.

- The company’s tax rate is constant over time.

What Is WACC Marginal?

WACC marginal is the additional cost of capital associated with raising one more unit of financing.

This contrasts with WACC average, which is the weighted average cost of all the financing a company has raised.

WACC marginal is used when making investment decisions, as it reflects the true cost of additional capital.

What Is WACC Optimization?

WACC optimization is the process of finding the WACC that results in the highest possible value for a company.

This is usually done by solving for the WACC that results in the highest present value of future cash flows.

What Are WACC Ranges?

WACC ranges are the minimum and maximum WACC that a company can have without affecting its value.

For example, if a company’s WACC is 10 percent and its value is $100, then the company’s WACC range might be 9.5 percent to 10.5 percent.

This range is often used when making investment decisions, as it provides a good starting point for analyzing a company’s opportunities.

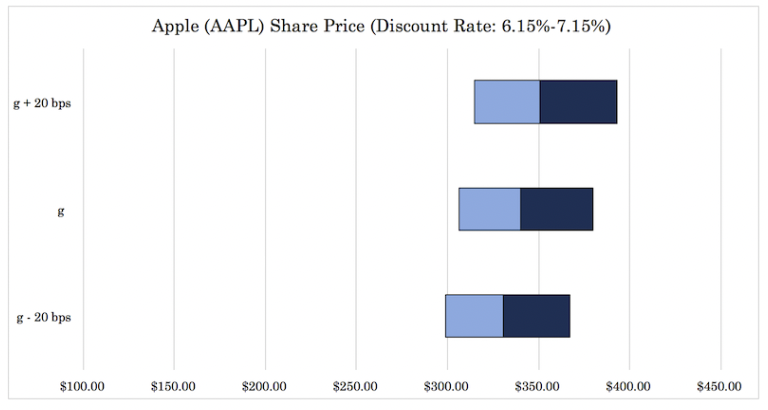

When investment bankers or investors deliver WACC ranges, they’ll show how this impacts the company’s value or share price through what’s commonly called a “football field” graph.

This is because of its resemblance to the yard markings on a field.

For example, let’s say we use Apple (AAPL) as an example like earlier.

This football field graph will show the lower, middle or median, and upper valuations of the range across various criteria.

In this case, Apple stock is valued across the discount rate range – 6.65 percent +/- 50bps, and across the perpetual growth rate range of 1.80 percent +/- 20bps.

What Are WACC Costs?

WACC costs are the costs associated with raising capital, including the cost of equity, the cost of debt, and the corporate tax rate.

These costs can be static or variable, and they can change over time.

What Is WACC Beta?

WACC beta is a measure of a company’s sensitivity to changes in the weighted average cost of capital.

A high WACC beta means that a company’s WACC will increase when the market WACC increases, and vice versa.

A low WACC beta means that a company’s WACC is less sensitive to changes in the market WACC.

What Is WACC Equity?

WACC equity is the portion of a company’s WACC that is attributable to equity financing.

This includes the cost of common stock, preferred stock, and other equity instruments.

What Is WACC Debt?

WACC debt is the portion of a company’s WACC that is attributable to debt financing.

This includes the interest paid on loans, bonds, and other debt instruments.

What Are WACC Flows?

WACC flows are the cash flows associated with a company’s WACC.

These flows can be positive or negative, and they can change over time.

What Are WACC Risks?

There are several risks associated with WACC:

- WACC can be biased if the inputs are estimated incorrectly.

- WACC does not account for all types of risk. For example, it does not account for market risk or liquidity risk.

- WACC is a long-term measure, so it may not be relevant for short-term investment decisions.

- WACC is a static measure, so it does not account for changes in a company’s capital structure over time.

Despite these risks, WACC is still a useful tool for analyzing a company’s investment opportunities.

When used correctly, it can give you valuable insights into a company’s cost of capital and its investment efficiency.

What Is WACC Simultaneous equations?

WACC simultaneous equations is a method of estimating a company’s WACC using multiple regression analysis.

This method is used when there is no single dominant source of financing, and it allows for WACC to be estimated with greater precision.

What Is WACE Methodology?

The weighted average cost of equity (WACE) methodology is a performance measurement technique that calculates the weighted average cost of all the equity financing raised by a company.

WACE is often used as a metric to compare different companies or to compare a company’s WACE to its WACC.

WACE can also be used to assess a company’s financial performance, as it takes into account both the cost and the amount of equity financing raised.

The WACE methodology has a number of advantages, including its ability to account for different types of equity financing and its flexibility in terms of weighting. However, WACE also has some disadvantages, such as its reliance on historical data and its lack of precision.

What Is WACC Model?

A WACC model is a model used to estimate a company’s WACC.

There are many different WACC models, but they all use the same basic inputs: the cost of equity, the cost of debt, and the tax rate.

The most common WACC model is the Capital Asset Pricing Model (CAPM).

What Are WACC Ratios?

WACC ratios are ratios that compare a company’s WACC to its peers.

These ratios can be useful in identifying companies with high or low WACC, and they can be used to make investment decisions.

What Is WACC Discount Rate?

WACC discount rate is the interest rate used to discount a company’s future cash flows when estimating its value.

This rate is equal to the WACC, and it is used because it reflects the true cost of capital.

What Is WACC weighted average?

WACC weighted average is a method of calculating a company’s WACC using the weights of each source of financing.

This method is used when there is a dominant source of financing, and it allows for WACC to be calculated with less precision.

Summary – Weighted average cost of capital (WACC)

Weighted average cost of capital (WACC) is a financial metric that reflects the overall cost of capital for a company.

The WACC includes the costs of both equity and debt financing, and it is typically expressed as a percentage.

The WACC can be used to make investment decisions, and it is often used in conjunction with other financial metrics, such as the discount rate.

There are many different WACC formulas, but they all use the same basic inputs: the cost of equity, the cost of debt, and the tax rate.

WACC ratios are ratios that compare a company’s WACC to its peers.

These ratios can be useful in identifying companies with high or low WACC, and they can be used as another piece of information as it pertains to making investment decisions.

The discount rate is the interest rate used to discount a company’s future cash flows when estimating its value.

This rate is equal to the WACC, and it is used because it reflects the true cost of capital.