Programming Packages & Libraries for Portfolio Optimization (Python, R, C++, Java, Scala)

Portfolio optimization is a key component of quantitative finance, involving the selection of the best portfolio (asset allocation/distribution), out of a set of all possible portfolios, that offers the highest expected return for a given level of risk.

It’s heavily used in trading, investment management, and financial analytics.

Portfolio optimization is a well-explored domain across various programming languages, and each has its own set of libraries or tools.

As we talked about in our article on algorithm development, there are many programming languages that are used.

However, there tend to be 4-5 languages that take up most of the market in financial programming:

- Python

- R

- C++

- Java

- Scala

C++ has classically been more popular, as it’s been widely used since the mid-1980s.

But as more hedge funds and financial institutions have moved to the cloud (e.g., AWS), Python has gained more popularity. (It’s also easier to learn with its readability and simplicity, and is hugely popular as a general-purpose language.)

Let’s explore some of the libraries available for Python, R, C++, Java, and Scala as it pertains to portfolio optimization.

Python

Several programming packages and libraries have been developed to aid in portfolio optimization.

Many them are available for Python due to its popularity in the data science and financial engineering communities.

Here is a list of some notable packages and libraries:

PyPortfolioOpt

This is one of the most popular Python libraries for portfolio optimization.

It implements classical mean-variance optimization techniques and is built on top of the cvxpy library.

PyPortfolioOpt can handle various portfolio optimization tasks such as asset allocation, risk management, and deriving the efficient frontier.

Features include the ability to incorporate expected returns, the covariance matrix of returns, and individual asset constraints or transaction costs.

cvxpy

While not solely dedicated to portfolio optimization, cvxpy is a Python-embedded modeling language for convex optimization problems.

(Convex optimization problems typically involve minimizing risk for a given return in portfolio construction under certain constraints like budget or market exposure.)

It’s used as a building block for other libraries (like PyPortfolioOpt) to solve complex optimization problems that can arise in portfolio optimization.

Users can define their optimization problems in a readable format and solve them with various algorithms.

QuantLib

QuantLib is more than only a portfolio optimization library. It’s a popular software framework in quantitative finance.

Written in C++ and connected to other languages via SWIG, it can be used in Python for various tasks including portfolio optimization.

QuantLib allows for sophisticated models and numerical methods. For example, it could be used to optimize portfolios that include derivatives and other complex securities.

zipline

Primarily known as a backtesting package, zipline can also be used for portfolio optimization.

It allows for strategy development and testing ideas on historical data.

And with the right setup, one can incorporate portfolio optimization algorithms within the trading strategies.

riskparity.py

This library is specifically designed for risk parity portfolio optimization, where the risk is evenly distributed across the various assets in the portfolio.

The library provides tools to calculate and backtest risk parity weights using historical return data.

SciPy

The SciPy library has general-purpose optimization functions that can be used for portfolio optimization.

It is particularly useful for problems where the objective function or constraints are not necessarily linear.

It requires more work from the user to set up the optimization problem, but offers great flexibility.

cvxopt

This is a free software package for convex optimization based on the Python programming language.

It’s another library that can be used to solve portfolio optimization problems and is similar to cvxpy.

It’s particularly good for large-scale linear and quadratic programming but is less user-friendly than cvxpy.

Pandas and NumPy

While these are not optimization libraries, any work in portfolio optimization in Python is likely to involve pandas for data manipulation and NumPy for numerical calculations.

These are foundational libraries upon which many optimization tasks depend – especially for handling return series and calculating covariances and correlations.

arch

The “arch” package is meant for econometricians and includes tools for estimating volatility models.

It can be an important part of portfolio optimization – particularly when dealing with the risk aspect of the optimization process.

While not specifically for portfolio optimization, it can be combined with other optimization libraries to account for changing risk dynamics in portfolio construction.

Summary of Python Libraries for Portfolio Optimization

When choosing a library, it’s important to consider:

- your specific needs, such as the types of assets you’re dealing with

- the complexity of the optimization problem

- the need for speed and efficiency, and

- your own comfort with mathematical programming and optimization algorithms

Each library has its own strengths and is suited to different types of portfolio optimization problems.

R

R is widely used in statistical computing and finance for data analysis and quantitative modeling.

Here are some R packages for portfolio optimization:

PortfolioAnalytics

This package is designed for modeling and solving portfolio optimization problems.

It includes functions for various objectives and constraints, such as minimum and maximum weight constraints, box constraints, leverage constraints, and the ability to create custom constraints and objectives.

tseries

While not exclusively for portfolio optimization, the tseries package offers functionality for time series analysis.

This can be integral in calculating financial metrics needed for portfolio optimization.

PerformanceAnalytics

This package provides a wealth of functions for performance and risk analysis, including tools that can be used to help in the optimization process.

fPortfolio

The fPortfolio package is part of the Rmetrics suite, which offers extensive capabilities for portfolio selection and optimization, including expected return and risk modeling.

quadprog

The quadprog package solves quadratic programming problems and is often used in portfolio optimization for mean-variance analysis.

Other Packages

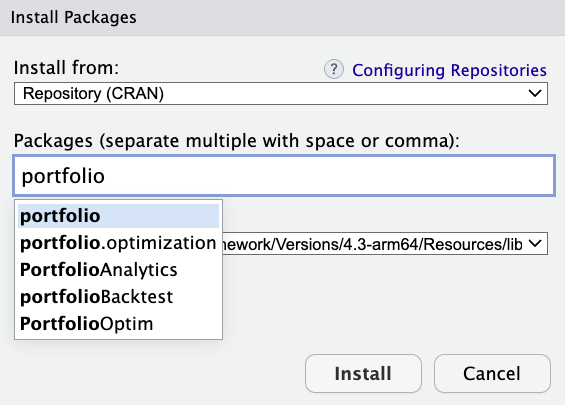

There are also other packages you can try for optimization and backtesting in addition to those mentioned above like portfolio.optimization, PortfolioOptim, and portfolioBacktest, though we personally haven’t used them.

Overall, R has a strong community of finance professionals contributing to a growing library of tools tailored for financial analysis.

Related

- Black-Scholes Model in R

- Monte Carlo Simulations of Options Prices in R

- Basic Monte Carlo Simulation in R

C++

C++ is known for its high performance and is commonly used in scenarios where execution speed is essential.

We discussed in a previous article how C++ is the most common programming language in the HFT space.

Here are some C++ libraries:

QuantLib

As mentioned, QuantLib is a comprehensive library for quantitative finance, written in C++.

It has components that can be used for portfolio optimization, particularly through its solvers for different financial problems.

OptimLib

OptimLib is a C++ library for nonlinear optimization, which can also be employed for solving certain types of portfolio optimization problems.

AlgLib

This is a numerical analysis and data processing library available in several programming languages, including C++.

It offers optimization algorithms that could be used in portfolio optimization.

Java

Java is not as common for data science tasks as Python or R, but it does have libraries that can handle portfolio optimization.

It’s also commonly used for trading algorithms (Two Sigma is an example institution that writes its code in Java).

SuanShu

SuanShu is a Java library for numerical and statistical computing, including optimization algorithms suitable for portfolio optimization.

JOptimizer

JOptimizer is an open-source Java library for convex optimization problems.

It can be used for various optimization tasks, including portfolio optimization.

Apache Commons Math

The Apache Commons Math library contains a collection of mathematical and statistical tools.

Among them are optimization algorithms that could be used for portfolio optimization.

Finmath.net

Although more focused on financial mathematics, finmath.net provides tools for valuation and risk management and can be adapted for portfolio optimization.

Scala

Scala, being a JVM (Java Virtual Machine) language, can make use of Java libraries for portfolio optimization, as it has interoperability with Java.

However, dedicated Scala libraries for this purpose might not be as prevalent as those for languages more traditionally associated with data science, like Python or R.

Here are a few avenues Scala users can explore for portfolio optimization:

Breeze

Breeze is a numerical processing library for Scala that is like NumPy in Python.

While it’s not specifically for portfolio optimization, it provides the necessary mathematical and statistical foundation upon which one could build optimization algorithms.

This includes linear algebra, Fourier transforms, and other numerical computing features.

Saddle

Saddle is another scientific computing library for Scala.

But it’s less comprehensive than Breeze.

It might be used in the same way as Breeze to provide the underlying calculations for an optimization process.

Scala Quant

Scala Quant is a financial mathematics and algorithmic trading library for Scala that could, in principle, be extended to include portfolio optimization tasks.

Java Libraries

Since Scala is interoperable with Java, one can directly use Java libraries within Scala applications.

Libraries that we covered above for Java such as JOptimizer, Apache Commons Math, and finmath.net can be integrated into Scala programs and used for portfolio optimization tasks.

Akka

While not a numerical computing or optimization library, Akka is a toolkit for building concurrent, distributed, and resilient message-driven applications on the JVM.

In a more complex system, you might use Akka to manage the distribution of large-scale optimization problems across a computing cluster.

Apache Spark

Apache Spark is a multi-language engine for executing data engineering, data science, and machine learning on single-node machines or clusters.

Spark’s MLlib could be used to perform certain types of portfolio optimization, especially those involving large datasets, given its scalable nature.

Custom Solutions

Scala developers might find themselves creating bespoke solutions by combining the computational capabilities of libraries like Breeze with optimization algorithms implemented either from scratch or adapted from Java libraries.

And since Scala runs on the JVM, it can use any Java portfolio optimization library directly.

This can expand the options available to a Scala developer.

Connecting Algorithms to Market Data & Your Broker

Connecting algorithms to market data and executing trades through a broker typically involves the following steps:

Market Data Subscription

Subscribe to a market data provider to receive real-time or delayed data feeds.

Examples include Bloomberg, Thomson Reuters, Interactive Brokers, or free alternatives with more limitations like Yahoo Finance APIs or Alphavantage.

Broker Account

Open an account with a brokerage firm that provides an API for automated trading.

Brokers such as Interactive Brokers offer APIs that allow you to programmatically execute trades.

API Keys

Obtain API keys from both your market data provider and your broker.

These keys are used for authentication and will be used in your algorithm to establish secure connections.

Development Environment

Set up a development environment with the necessary software libraries that are compatible with the APIs you intend to use.

For Python, libraries like ‘requests’ or ‘websocket-client’ can be used for RESTful or WebSocket APIs, respectively.

Data Connection

Write code to establish a connection to your market data feed using the provider’s API.

You’ll need to handle the data in a way that your algorithm can use it.

This typically involves parsing the data into a structured format.

Algorithm Integration

Integrate the market data into your trading algorithm.

Your algorithm will process this data to make trading decisions based on predefined criteria.

Broker Connection

Establish a connection to your broker’s API in your algorithm.

Write functions to send trade orders (buys/sells), and handle responses from the broker such as confirmations, rejections, or error messages.

Compliance and Risk Management

Implement compliance checks and risk management features to ensure your algorithm adheres to regulatory requirements and your specified risk parameters.

Testing

Test your algorithm using historical data (backtesting) and with the broker’s paper trading API (forward testing) to validate its performance and execution without risking real capital.

Deployment

Deploy your algorithm in a live environment.

Ensure you have a stable and reliable system to run your algorithm.

This may involve setting up a dedicated server or cloud instance with failover and recovery mechanisms.

Monitoring

Continuously monitor the system’s performance, trades, and connectivity.

You should also have alerting systems in place for any potential issues with the algorithm or the infrastructure.

Summary

Connecting to live market data and executing trades automatically requires a thorough understanding of the involved systems, compliance with any legal and regulatory standards, and rigorous testing to minimize risks.

It’s also critical to ensure that your system has robust error handling and failure recovery processes in place to handle issues like API disconnects or unexpected market events.

Using Algorithms as a Personal Assistant Only (Non-Automated, Manual Trading)

If you want your algorithms to function as a personal assistant rather than execute trades automatically, you can adjust the workflow to focus on analysis, alerts, and recommendations, without the automated order execution.

Here’s how you might set this up:

Market Data Connection

Connect to your chosen market data source using their API to stream or fetch data as required.

Algorithm Development

Develop your algorithm to analyze this data.

Alert System

Implement an alert system within your algorithm.

Instead of placing trades, the algorithm can notify you of certain market conditions or opportunities via email, SMS, push notifications, or a dedicated app interface.

User Interface (UI)

Develop a UI where you can view the output of the algorithm.

This could be a dashboard displaying key metrics, charts, text, and/or signals that the algorithm generates.

Interaction Capability

Build in features that allow you to interact with the algorithm’s output, such as drilling down into signals, adjusting parameters, or manually confirming trades you’d like to make.

Manual Trade Execution

When the algorithm identifies a trading opportunity, you would manually execute the trade through your brokerage’s trading platform or website.

Compliance and Record Keeping

Ensure that your system complies with any relevant regulations regarding data usage and privacy.

Maintain logs and records of the algorithm’s outputs and actions for your reference and auditing.

Testing and Optimization

Regularly backtest and optimize the algorithm with historical data to improve its accuracy and reliability.

Deployment

Run your algorithm on a reliable system.

Even if you’re not executing trades automatically, you’ll still want your system to be stable and available when you need it.

Monitoring and Maintenance

Continuously monitor the algorithm’s performance and maintain the system, updating the code as necessary to adjust for changes in market conditions or in your trading strategy.

Summary

By setting up your algorithms this way, you retain full control over the final trade execution.

This reduces the risks associated with automated trading systems.

It also allows you to be more flexible and intuitive with your trades.

You can incorporate other factors that the algorithm may not consider.

FAQs – Programming Packages & Libraries for Portfolio Optimization

How does PyPortfolioOpt simplify the process of portfolio optimization?

PyPortfolioOpt provides a high-level API for constructing portfolios.

This offers pre-built functions for common optimization tasks such as mean-variance optimization.

Accordingly, it simplifies complex mathematical programming into simple function calls.

What are the key features to look for in a portfolio optimization library?

Key features include support for:

- different optimization objectives (e.g., maximizing Sharpe ratio, maximizing return within a certain volatility threshold)

- the ability to handle various constraints (e.g., long-only, leverage)

- efficient frontier computation, and

- robustness to different market conditions

Can portfolio optimization libraries handle constraints such as transaction costs and taxes?

Many portfolio optimization libraries allow for the inclusion of transaction costs.

Some advanced libraries can also accommodate taxes and other real-world constraints in the optimization process.

Is there a difference between libraries used for asset allocation versus those used for risk management?

Libraries for asset allocation focus on optimizing the weight of assets in a portfolio to maximize returns for a given risk.

Risk management libraries often deal with measuring and managing the risk of the portfolio, sometimes independently of allocation.

How do open-source portfolio optimization libraries compare to commercial software?

Open-source libraries are typically free and community-driven, offering transparency and customization.

But you have to basically do it yourself or grab code from someone else/another source.

Commercial software might provide more integrated solutions, professional support, and additional proprietary features.

What are some challenges one might face when using programming packages for portfolio optimization?

Challenges include:

- the complexity of setting up the problem correctly

- data quality issues

- handling non-linearities and constraints, and

- the need for computational efficiency in large-scale problems

How can machine learning be integrated with portfolio optimization packages?

Machine learning can be integrated to predict asset returns, estimate covariances, or learn complex relationships between assets.

This can feed into the optimization model to enhance the decision-making process.

Just be sure to have a deep understanding of what you’re doing.

Do portfolio optimization libraries also provide capabilities for backtesting?

Some libraries, particularly those geared toward a full trading pipeline, include backtesting modules to evaluate the performance of optimized portfolios over historical data.

Are there any packages that support real-time portfolio optimization?

Certain libraries are designed to be fast enough to support near real-time optimization.

But true real-time optimization is generally more dependent on the underlying data infrastructure and computational resources.

What types of optimization algorithms are commonly used in these programming libraries?

Common algorithms include quadratic programming for mean-variance optimization, conic solvers for problems involving transaction costs, and heuristic algorithms like genetic algorithms for more complex, non-convex problems.

Can these libraries handle multi-period portfolio optimization problems?

Some advanced libraries and frameworks support multi-period optimization.

But this often increases the complexity and computational demand.

How do these libraries account for different risk measures like VAR or CVaR in portfolio optimization?

Many libraries allow for risk measures like VaR (Value at Risk) or CVaR (Conditional Value at Risk) to be specified as constraints or objectives within the optimization problem.

What kind of data inputs are required to use a portfolio optimization library effectively?

Typically, historical return data, estimates of future returns, the covariance matrix of asset returns, and any relevant financial constraints are needed as inputs.

Are there any libraries that offer graphical visualization of the efficient frontier or other optimization outcomes?

Yes, some libraries offer visualization tools to plot the efficient frontier, asset allocations, and other results, which are important for analysis and reporting.

How does the choice of a programming package for portfolio optimization affect the computational efficiency and speed of solving the optimization problem?

The choice of package can significantly affect computational efficiency, as some are optimized for speed and large-scale problems.

Others might offer more features but at the expense of slower performance.

How does Scala compare to Java for financial programming?

Scala offers a more expressive and concise syntax compared to Java.

This can lead to increased developer productivity and ease in implementing complex financial models, while still providing the robustness and performance of the JVM.

Scala’s functional programming features can also simplify the handling of immutability and concurrency (important aspects in financial programming for ensuring correctness and performance).

When did each of the following programming languages start?

Below are official first appearances of each language:

- Python (1991)

- R (1993; CRAN in 1997)

- C++ (1985)

- Java (1995)

- Scala (2004)

Initial work on each generally started in previous years.

Initial development of each:

- Python (1989)

- R (1993)

- C++ (1979)

- Java (1991)

- Scala (2001)

What are some other programming languages for financial algorithms not covered in this article?

If you’re looking for other programming languages to consider, here are some examples:

- MATLAB: Used for prototyping and complex mathematical computations in finance. We’ve covered its use for finance in other articles.

- C#: Commonly used within the .NET framework, particularly in front-office applications.

- Julia: Dynamic language designed for technical computing. Strengths in numerical and computational science.

- JavaScript/TypeScript: For financial applications on the web or server-side with Node.js.

- Go (Golang): Known for its performance and efficiency in concurrent processing (i.e., ability to do more than one task at the same time).

- Ruby: Used in finance for scripting and web applications, especially with the Ruby on Rails framework.

- VBA (Visual Basic for Applications): Embedded in Microsoft Office applications. It’s used for automating tasks in Excel, including financial modeling. Common in investment banking and any spreadsheet-heavy jobs in finance.

- F#: A functional-first language on the .NET platform. Not overly popular beyond data science applications. But can be used for quantitative finance due to its concise syntax and strong mathematical libraries.

- Swift: Employed for developing finance apps for Apple’s ecosystem. (Most iOS apps are written in Swift. Objective-C is used for many older iOS apps.)

- Perl: Once more popular (first appeared in 1987), it is still used for legacy systems and data processing tasks in finance.

- Clojure: A modern, functional Lisp (first appeared in 2007) that runs on the JVM and is known for its concurrency support.

- Kotlin: Another JVM language gaining popularity for its concise syntax and interoperability with Java. Accordingly, it’s suitable for financial services software.

- Erlang: Used for its fault-tolerant, non-stop, real-time properties in trading systems. Not the most popular, given it’s not the most accessible for beginners. Also competes with Elixir and Elm.

- Rust: A system programming language focused on safety and performance. Useful in high-frequency trading for its no-garbage-collection advantage. (We’ll define garbage collection below.)

- Smalltalk: An object-oriented, dynamically typed, reflective programming language. Older language (development began in 1969; first appeared in 1972). Has influenced many modern languages and is known for its simplicity and design patterns.

- Fortran: An older language (1957) that’s still used in high-performance computing tasks in finance. Used in areas that involve complex numerical computation.

- Haskell: A standardized, general-purpose purely functional programming language, with non-strict semantics and strong static typing, sometimes used in research or for developing high-assurance systems.

- Q/KDB+: A database and language (Q) used in high-frequency trading applications for its time-series analysis capabilities.

- Objective-C: Previously used for Apple platforms before the advent of Swift, it’s sometimes still used in maintaining older financial applications for macOS or iOS.

- COBOL: An older language that’s still running a significant amount of legacy banking systems. Known for its simplicity and business-oriented design.

- PL/SQL and T-SQL: Extensions of SQL for Oracle and Microsoft SQL Server, respectively. Used for database programming and complex querying within financial applications.

- Shell scripting languages (Bash, PowerShell): Often used for automating tasks in financial data processing pipelines and system administration.

- Assembly language: In extremely performance-critical portions of financial software, assembly might be used for optimizations. But not common due to its complexity and maintenance challenges.

What is garbage collection in programming?

Garbage collection (GC) in programming is an automatic memory management feature that reclaims memory occupied by objects no longer in use by the program.

It prevents memory leaks and reduces manual memory handling errors.

Pros:

- Simplifies development, as programmers don’t need to manually release memory

- Enhances safety and efficiency in memory-intensive applications

Cons:

- Can cause unpredictable pauses in program execution (latency)

- Increased memory usage

- Might not immediately free resources (a concern in real-time systems)

Conclusion

When working with any of these libraries, it’s important to have a strong understanding of the mathematical principles underlying portfolio optimization, as well as experience in the respective programming language.

Portfolio optimization problems can range from simple mean-variance optimization to complex, nonlinear problems with multiple constraints, and choosing the right tool will depend on the specific needs and complexity of your task.