Is Day Trading a Game?

As the number of day traders grows, so does the debate: Is day trading a good investment or business strategy, or is it more akin to a game?

We’ll look at the various aspects of day trading – both the elements that can make it seem game-like to some and the factors that set it apart as a serious financial pursuit.

We’ll go into the psychology behind day trading, the skills required, the risks involved, and the regulatory landscape surrounding this practice.

Key Takeaways – Is Day Trading a Game?

- Controversy of Gamification Elements

- Instant feedback, competition, and the way some gamified platforms can make day trading feel like a game to some.

- Knowledge and Skills Are Critical

- Important to differentiate games of skill vs. games of chance.

- Unlike games of chance, day trading requires analysis, risk management, and psychological discipline to succeed.

- Whether day trading is a “game” (or analogous to one) is a matter of semantics.

- Financial Risk is Real

- Traders put real money on the line with every trade, making day trading far riskier than typical recreational activities.

- Regulations Add Seriousness

- Rules like the Pattern Day Trader requirement highlight that day trading is a regulated financial activity, not just a pastime.

- Skill vs. Luck Debate

- While some view day trading as luck-driven, consistent success requires a skillful, strategic approach where skill will win out over time.

The Game-like Elements of Day Trading

Instant Gratification and Adrenaline Rush

One of the most game-like aspects of day trading is the instant gratification it provides.

Much like video games or gambling, day trading offers quick feedback on decisions, with profits or losses reflected almost immediately.

This rapid cycle of action and reward can create an adrenaline rush that many traders find addictive.

Longer-term styles of trading (e.g., swing trading, position trading) or investing don’t necessarily provide the same level of pace and activity that risk-seeking market participants might want.

Competition and Leaderboards

Some trading platforms or competitions incorporate game-like features such as leaderboards, performance rankings, and social sharing options.

These elements provide a sense of competition among traders, encouraging them to outperform their peers and climb the ranks.

Gamification of Trading Platforms

Trading platforms often use gamification techniques to engage users and make the trading experience more enjoyable.

These can include progress bars, achievement badges, and other visual cues that mimic elements found in games.

There is nonetheless regulatory pushback against these practices.

Getting people excited to save, learn about markets, and secure a better financial future is great, but incentivizing frequent trading or speculation will receive regulatory scrutiny.

The Illusion of Control

Frequent trading can give some traders a false sense of control over market outcomes, similar to how casino games can make players feel they have a strategy to beat the house.

This illusion can lead traders to overestimate their ability to predict short-term market movements.

The Serious Side of Day Trading

Required Knowledge and Skills

Day trading may have game-like elements, but it also requires a substantial body of knowledge and a diverse skill set that sets it apart from mere games of chance.

We talk more about the cognitive skills here, as well as a skills checklist.

Technical Analysis

Successful day traders often rely heavily on technical analysis, using various indicators to identify potential trading opportunities.

This requires an understanding of chart patterns, trend analysis, and technical indicators.

Fundamental Analysis

Fundamental analysis tends to be less common because it takes longer for fundamental factors to show up in prices.

So even though day trading focuses on short-term price movements, a solid grasp of fundamental analysis is important because many traders in the market are using economic factors in their analysis.

Traders need to understand how economic data, company earnings, and global events can impact asset prices.

Risk Management

Effective risk management is perhaps the most critical skill for day traders.

This involves setting appropriate stop-loss orders, managing position sizes, and understanding the risk-reward ratio of each trade.

Psychological Discipline

Day trading demands a level of psychological discipline that far exceeds what’s required in most games.

Traders must:

- Control emotions and avoid impulsive decisions

- Maintain focus for extended periods

- Handle the stress of financial risk

- Overcome biases and learn from mistakes

These psychological challenges are real and can have significant consequences, unlike the low-stakes environment of most games.

Also, many games aren’t necessarily that competitive since a lot of the time you’re simply playing a fairly weak AI.

For example, many card game apps give players an edge at a fairly rudimentary skill level to encourage them to come back and experience the excitement of winning and making progress.

But beating the dealer in blackjack or beating skilled poker players is not generally an easy thing to do in real life.

Markets are difficult because there’s so much competition and so many resources put into profiting from them (in excess of simply indexing to representative benchmarks).

Capital Requirements and Financial Risk

Unlike games, day trading involves real financial risk.

Traders put their own capital on the line with each trade, and the potential for losses is always there.

This level of financial risk distinguishes day trading from recreational activities and aligns it more closely with other forms of investment and business ventures.

The Regulatory Landscape

Legal Framework

Day trading is subject to a complex regulatory framework that varies by country and financial instrument.

In the United States, for example, the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) oversee day trading activities in stocks.

Pattern Day Trader Rules

In the US, the Pattern Day Trader (PDT) rule requires traders who execute four or more day trades within five business days to maintain a minimum account balance of $25,000.

This regulation tries to protect inexperienced traders from excessive risk and highlights the serious nature of day trading.

Tax Implications

Day trading has significant tax implications that further differentiate it from games.

Profits from day trading are subject to capital gains tax, and traders must keep detailed records of their transactions for tax reporting purposes.

The Debate: Skill vs. Luck

The Role of Skill in Day Trading

Proponents of day trading argue that success in this field is primarily a result of skill.

They point to consistent performers who have demonstrated the ability to generate profits over extended periods as evidence that day trading is not merely a game of chance.

In the short run, there’s going to be variance, but over time skill will increasingly win out.

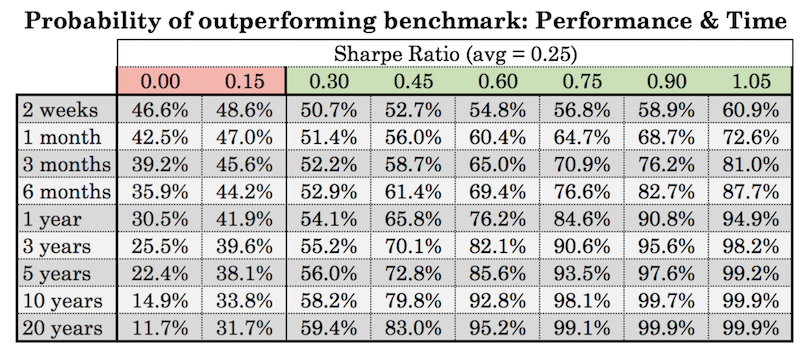

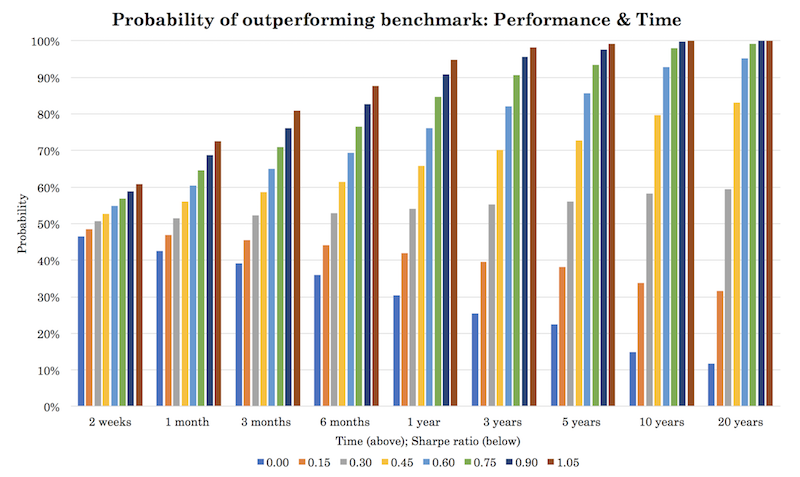

These charts give an idea of how the role of luck can be quite high in the short run over various performance levels, but thins out over time.

Table

Graph

Developing an Edge

Successful day traders often speak of developing an “edge” in the market – a combination of strategies, tactics, frameworks, analysis, and insights that give them a statistical advantage over time.

This concept of an edge aligns more closely with professional poker players than with participants in games of pure chance.

Poker is also a game, but it’s a skill-based game to those who pursue it professionally.

Learning and Adaptation

The markets are changing not just in price but change over time in how they’re analyzed, who the market participants are, how influential they are, and their motivations.

This requires day traders to continuously learn and adapt their strategies.

This need for ongoing education and improvement is characteristic of professional disciplines rather than games.

The Influence of Luck

Critics argue that short-term price movements are essentially random and that any success in day trading is primarily due to luck rather than skill.

Market Unpredictability

The variance in financial markets, especially in the short term, introduces an element of chance (variance) into day trading outcomes.

Even the most skilled traders can’t avoid drawdowns.

The Impact of Technology

Algorithmic Trading

Algorithmic trading and high-frequency trading (HFT) have significantly impacted trading at small timescales.

These computer-driven trading systems can execute trades at speeds and frequencies impossible for human traders.

In turn, some have raised questions about the fairness and viability of manual day trading.

What’s the reality about this?

Day traders and high-frequency traders operate in the same market, but their roles differ significantly, as HFT focuses on ultra-short-term, high-speed trades, while day traders typically rely on manual strategies and hold positions for longer periods within a day.

Democratization of Information

Analysis tools and real-time market data, once available only to institutional investors, are now accessible to retail traders.

This has leveled the playing field in some respects but has also increased competition.

Other Considerations

Societal Impact

Critics argue that day trading can have negative societal impacts, such as:

- Encouraging a short-term, speculative approach to finance

- Potentially destabilizing markets through increased volatility

- Diverting capital and talent from more productive economic activities

Addiction and Mental Health

For some, the game-like elements of day trading, combined with the potential for financial gain, can lead to addictive behavior.

But while day trading carries risks, it can also be a highly disciplined and strategic activity for individuals who approach it with proper risk management and emotional control – i.e., treating it more like a profession than a game.

Conclusion

So, is day trading a game?

Day trading incorporates elements that make it feel game-like, such as instant feedback, competition, and the potential for an adrenaline rush.

But it also requires knowledge, training, skills, and discipline that set it apart from mere games of chance.

Unlike most games, day trading involves real financial risk and is subject to various regulations.

The debate over whether success in day trading is primarily due to skill or luck largely depends on who is engaging it and what their approach is.

Ultimately, while day trading may have game-like aspects, it’s a serious financial activity with real-world consequences.

Those considering day trading should approach it with caution, understanding both its potential rewards and significant risks.