Skill vs. Luck in Day Trading

Is success in day trading primarily a result of skill, or is it predominantly determined by luck or variance?

This article looks into the various aspects of this question, looking at the roles that both skill and luck play in day trading and trading more generally.

Key Takeaways – Skill vs. Luck in Day Trading

- Luck impacts short-term results

- Unpredictable events and market volatility significantly influence individual trades and short-term performance.

- Chance, uncertainty, risk, and probabilities are all influential.

- Diversification and strong risk management help reduce these random factors.

- Long-term performance matters most

- Short-term success can be misleading due to luck.

- Truly skilled traders consistently outperform over 3-5+ years, with higher Sharpe ratios (0.60+) or other return/risk measures indicating talent.

- Skill development

- Focus on honing analysis skills, market knowledge, risk management, emotional control, and adaptability to improve long-term trading outcomes.

The Role of Skill in Day Trading

Technical Analysis

Skilled day traders often rely heavily on technical analysis, using charts, indicators, and patterns to predict short-term price movements.

Market Knowledge

This knowledge involves economic indicators, company fundamentals, broader market trends, and a host of other things.

Day traders often have an intuitive sense of how a market might move.

Risk Management

Perhaps the most critical baseline skill in day trading is effective risk management.

This involves setting appropriate stop-loss orders, managing position sizes, and knowing when to exit trades to minimize losses or lock in profits.

Emotional Control

Successful day traders must develop the ability to control their emotions, make rational decisions under pressure, and avoid impulsive actions driven by fear or greed.

Adaptability

Markets are constantly evolving, and skilled day traders must be able to adapt their strategies to changing conditions.

This includes recognizing when a particular approach is no longer effective and adjusting accordingly.

The Influence of Luck in Day Trading

Short-Term Market Unpredictability

Despite the best analysis and preparation, short-term market movements can be highly unpredictable.

Random events, news releases, or large institutional trades can cause sudden price shifts that no amount of skill could have anticipated.

The risk can simply be managed effectively.

The Role of Chance in Individual Trades

Even with a sound strategy, the outcome of any single trade is subject to a degree of chance.

A trader may make all the right decisions based on their analysis, only to have some unexpected event move the market against their position.

Survivorship Bias

The perception of skill in day trading can be influenced by survivorship bias.

We often hear about successful =traders but rarely about the many who don’t make it through the development period, potentially overestimating the role of skill in trading outcomes.

Are certain traders there because of actual trading skill or because of other factors or soft skills.

Some hedge fund managers are much better at raising capital than trading, for example.

Market Conditions and Timing

A trader may happen to start trading during a period particularly suited to their strategy.

This can lead to initial success that may be difficult to replicate consistently.

Most tend to look good in a bull market.

Level of Experience

Beginning traders have no way of knowing what they don’t know.

When novice traders first start, they will tend to mistake positive results for skill.

But the more they do it, they more they’ll realize they need to significantly upskill if they hope to compete.

The Interplay of Skill and Luck

The Skill-Luck Continuum

Rather than viewing day trading as purely skill-based or entirely luck-driven, it’s more accurate to consider it as existing on a continuum.

Different aspects of trading fall at various points along this spectrum.

It’s similar to poker, a game trading is often compared to.

You can be card dead, suffer from bad beats, and be down a lot but still be a skilled player.

Many poker professionals know their odds of coming out ahead during any ~100-hand session against a quality amateur player may be no better than around 55%.

Short-Term vs. Long-Term Outcomes

While luck may have a more significant impact on short-term results, skill tends to play a larger role in long-term outcomes.

Consistently profitable day traders often attribute their success to disciplined application of skills over time.

Absolute Skill vs. Relative Skill

The skill of those in financial markets tends to increase over time, similar to how modern athletes tend to be more talented than those from the 1980s for various reasons.

Alpha is a zero-sum game, or involve taking from someone else.

So relative skill is an important factor.

Poker Analogy

A big part of being a professional poker player, for example, is identifying softer games where they have an edge over weaker players.

Let’s say someone has shown themselves to be somewhere around the 10th-best poker player in the world over years of results.

But if they’re at a table with the other 9 players considered ahead of them, they probably don’t have any edge at all and may even be at a skill deficit.

Variance would play a bigger role in how well they do if they’re at a skill disadvantage.

But at a table with average poker pros and amateurs, they would be exceptional.

They may not necessarily win over small sample sizes, but over the long run having an edge and applying it consistently will usually be a winning formula.

Skill vs. Luck in Trading in One Chart

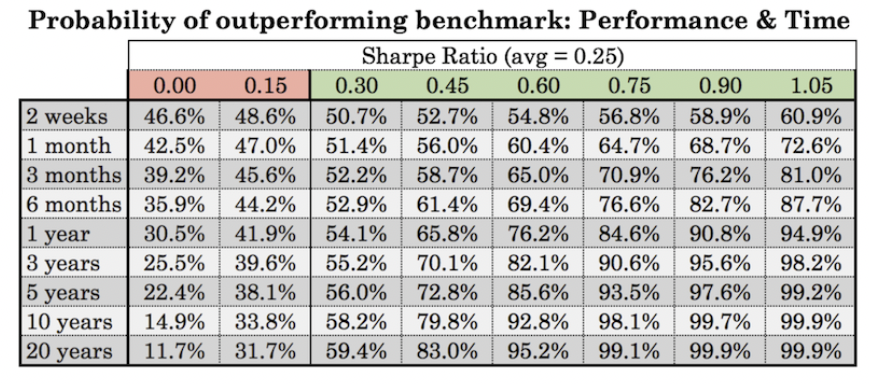

We constructed measures of how a trader would be likely to perform if we knew their underlying talent level (measured by the Sharpe ratio) and how long they trade.

We assessed the resultant probability of outperforming a benchmark index measured against their underlying skill over time.

The main takeaway from this chart is that it is challenging to assess the true talent level of a trader over short timeframes.

Here’s a more detailed interpretation:

Short Timeframes

- 2 Weeks to 1 Month – Even a trader with a moderate Sharpe ratio of 0.60 only outperforms the benchmark around 55-60% of the time over a month. This makes it difficult to distinguish between luck and skill. Less skilled traders and more skilled traders don’t show much of a delta in performance.

- Exception for Poor Performers – Traders with very low Sharpe ratios (e.g., -2.00) can be identified as poor performers with high confidence (~80%) over short periods like two weeks. Traders that are obviously bad are the only ones that are obvious. These would be cases of those who have quick deep drawdowns.

Moderate Timeframes

- 3 Months to 1 Year – A trader with a Sharpe ratio of 0.60 improves their probability of outperforming the benchmark to about 65-76% over 3 to 12 months. However, this is still not definitive enough to make a judgment on talent.

- Typical Traders – Most traders, who operate at Sharpe ratios of 0.45 or less, will not significantly outperform the market. Over a year, even a Sharpe ratio of 0.30 gives only about a 54% chance of outperforming.

Long Timeframes

- 3 Years to 5 Years – Over these periods, the probability of a trader with a Sharpe ratio of 0.60 outperforming the benchmark rises to 82-86%. This is more indicative of talent but still requires patience.

- 10 Years and Beyond – For long-term evaluations (10 to 20 years), high Sharpe ratio traders (0.75 and above) almost consistently outperform, with probabilities reaching 98-99%.

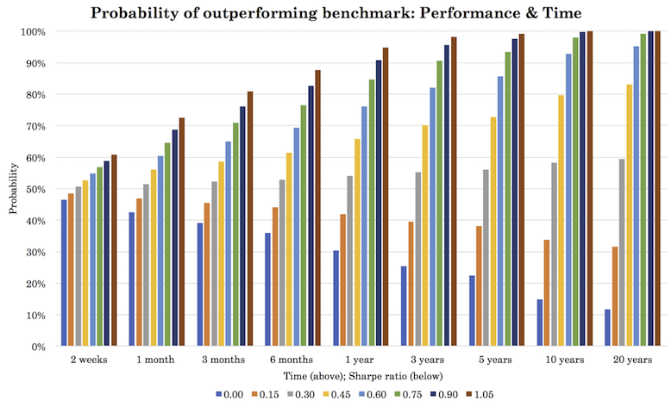

This bar chart below can show the probabilities more starkly in how skill wins out over luck long-term. Skill outcomes improve with time. Luck outcomes get worse with time.

It’s similar to how you don’t evaluate athletes based on just one game, but on their body of work over time to get the true picture.

Implications for Evaluating Trading Talent

- Patience is Key – It takes a substantial amount of time to accurately assess a trader’s talent. Short-term performance can be misleading due to the inherent randomness in market movements.

- Distinguishing Talent – While very poor performers can be identified quickly, recognizing truly talented traders requires observing their performance over several years. This is where other measures might come into play to assess somebody’s ability, such as cognitive tests or other measures that have high subsequent correlation with trading success.

- False Positives – Investing in a trader based on short-term success can often lead to “false positives,” where luck/variance is mistaken for skill. Longer-term data provides a more reliable assessment.

- Distribution of Talent – Trading talent falls along a distribution, with most traders achieving Sharpe ratios of 0.45 or less over the long run (since indexes themselves don’t normally maintain such high Sharpe ratios over time). Hence, the majority will not significantly outperform the market.

In short, evaluating a trader’s ability necessitates extended periods of performance data to distinguish between skill and luck reliably.

Strategies for Upskilling

Continuous Learning and Improvement

To maximize the impact of skill, day traders should commit to continuous learning and improvement in whatever ways they can.

This includes staying informed about market developments, refining trading strategies, and learning from both successes and failures.

Diversification and Risk Management

To reduce the impact of luck/variance, traders can use diversification strategies and strong risk management techniques.

This helps to protect against the potential negative outcomes of “unlucky” trades.

We have an article on the math behind asset allocation here.

Maintaining a Long-Term Perspective

Day trading focuses on short-term price movements, but maintaining a long-term perspective can help traders avoid overreacting to short-term luck-driven outcomes and focus on developing their skills over time.

Tracking and Analyzing Performance

Tracking and analysis of trading performance can help traders distinguish between skill-driven and luck-driven outcomes.

This analysis can inform strategy adjustments and highlight areas for skill improvement.

Conclusion

The reality is that both factors play significant roles in trading outcomes. While luck can have a substantial impact on short-term results and individual trades, skill remains important for any kind of long-term success in day trading.

Successful day traders recognize the influence of both skill and luck, focusing on developing their skills while acknowledging and managing the role of chance, uncertainty, risk, and probabilities in their trading outcomes.

By maintaining this balanced perspective, traders can work to maximize their potential for success.

Ultimately, those considering day trading should approach it with a realistic understanding of both skill and variance.

While skill can certainly improve one’s chances of success, variance will always have a role in trading outcomes.

As such, day trading should be approached with caution, thorough preparation, and a clear understanding of the risks involved.