How Difficult is Day Trading?

Day trading is often perceived as an exciting and potentially lucrative pursuit.

The reality of day trading is nonetheless far more complex and challenging than many realize.

We look into the difficulties associated with day trading and the various aspects that contribute to its complexity and high failure rate.

Key Takeaways – How Difficult is Day Trading?

- High Difficulty and Attrition Rate

- Around 90% of day traders lose their initial investment within six months.

- Over 80% of day traders quit within two years due to financial losses and mental exhaustion.

- Cognitive Demands

- Day trading requires advanced analytical thinking, adaptability, and decision-making under pressure, skills that aren’t easily mastered.

- Psychological Strain

- Managing emotions like fear and greed is essential, as emotional control often dictates success or failure in trades.

- Technical Knowledge is Critical

- Proficiency in market analysis, trading platforms, and risk management strategies is necessary for survival.

- Opting to Not Pursue Day Trading Isn’t Necessarily Failure

- Trying day trading and doing something else isn’t a failure but an opportunity to learn and evolve.

- The skills gained – e.g., decision-making, emotional control, analysis, risk management – are transferable to other trading/investing styles or life pursuits.

- It’s about finding what suits your strengths and long-term goals best.

- Even successful active traders often commit most of their savings to longer-term investment approaches.

Success Rates and Profitability

The statistics (more linked here) paint a sobering picture of day trading success:

- Only about 1-20% of day traders actually profit from their endeavors in some way, depending on the timeframe considered.

- Approximately 4% of day traders manage to make a living from day trading.

- Around 5% to 20% of day traders consistently make money, with up to 95% losing money.

- It’s reported that 90% of day traders lose their initial investment within six months.

- Approximately 97% of day traders lose money, with most losing their capital within 90 days.

These numbers highlight the difficulty of succeeding in day trading.

The vast majority of traders not only don’t make a profit but often lose their initial investment, sometimes within a very short period.

Attrition Rates

The high difficulty of day trading is further evidenced by the significant attrition rates:

- Around 40% of day traders exit the scene within a month.

- Only about 13% remain after three years (87% exit).

- Around 80% of all day traders quit within the first two years.

These statistics show the challenge of day trading and the likelihood of punting or being forced out due to losses.

Assessing Trader Skill Can Take Time

“Bad” traders are easily identifiable because they tend to lose their initial investment relatively quickly.

However, for traders who exhibit some type of at least marginal skill, it can take much longer.

For traders who have some skill to very good skill (e.g., they can perform at a Sharpe ratio of 0.00-1.00+), it’s not easy to tell in a short period of time who may be more or less talented due to variance.

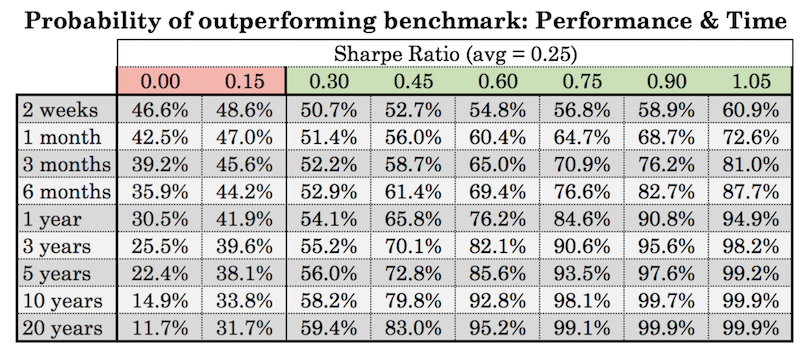

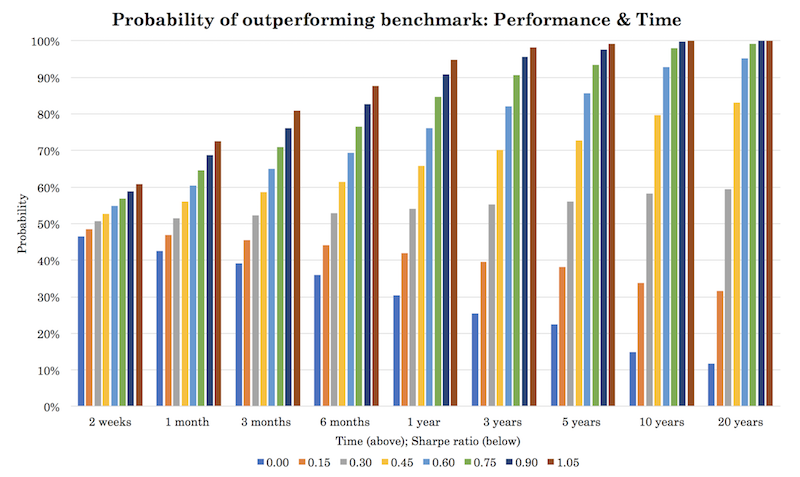

(Financial asset classes can expect to have a Sharpe ratio of somewhere around 0.25 over the long run as noted on the graph.)

Table

Graph

For example, if a trader adds no value over simply investing in cash (Sharpe ratio of 0.00), there’s still a 22% chance they perform at above a 0.25 Sharpe ratio over 5 years.

The trader who is at a 0.60 type of level has about an 85-86% chance of outperforming the 0.25 level over 5 years.

You can see the dispersion as time goes on, but there’s still no guarantee.

Factors Contributing to Day Trading Difficulty

We’ll look at the following factors that contribute to the difficulty of day trading:

- Cognitive demands

- Psychological challenges

- Technical knowledge requirements

- The zero-sum nature of day trading

Cognitive Demands

Day trading requires a unique set of cognitive skills that are not easily acquired or maintained:

Analytical Thinking

Traders must excel at various skills – pattern recognition, critical analysis, and quantitative reasoning.

They need to interpret data and separate signal from noise in real-time.

Emotional Intelligence

Self-awareness, emotional regulation, and understanding market sentiment and other traders motivations (e.g., who’s involved in this market, who is likely on the other side of the trade) are important.

Traders must make rational decisions under pressure and manage their emotions effectively.

Adaptability

Successful traders need to quickly learn and adapt to changing markets, remaining open to new ideas and strategies.

Risk Management

Thinking probabilistically and handling uncertainty well are key skills that many struggle to develop.

Decision-Making Under Uncertainty

Traders must make quick decisions with incomplete information, a skill that is undervalued in traditional education but critical in trading.

Psychological Challenges

The psychological aspects of day trading can be particularly difficult to master:

Emotional Control

Fear, greed, and other emotions can impact decision-making, leading to poor trades.

Stress Management

The high-pressure environment of day trading can be emotionally and mentally taxing.

Dealing with Losses

Frequent losses, which are inevitable in day trading, can be psychologically challenging to handle.

Overcoming Biases

Traders must constantly work to recognize and mitigate cognitive biases that can affect their decision-making.

Technical Knowledge Requirements

Day trading demands a deep understanding of various technical aspects:

Market Analysis

Traders need to be proficient in various forms of analysis – i.e., fundamental and technical analysis, risk management.

Trading Platforms

Understanding and effectively using trading software and platforms is essential.

Economic Indicators

Knowledge of how various economic factors impact markets is important.

Risk Management Techniques

Proper risk management strategies is important for long-term survival.

This involves diversifying, hedging, proper position sizing, setting stop-losses (if applicable), and understanding risk-reward ratios.

Managing exposure and limiting potential losses allows traders to protect their capital and improve the chances of sustained profitability.

The Zero-Sum Nature of Day Trading

Day trading in terms of alpha generation is often described as a zero-sum game (or negative-sum when accounting for transaction costs).

This means that for every winner, there must be a loser.

In practice, this translates to:

- Only a few traders prosper and make money consistently.

- The majority of participants end up losing money to these successful traders and to transaction costs.

This inherent structure makes day trading exceptionally difficult, as traders aren’t just competing against the market, but directly against other, often more experienced and better-resourced traders.

Impact of Short-Term vs. Long-Term Strategies

Interestingly, the difficulty of day trading is further highlighted when compared to longer-term strategies:

- Day traders who hold positions for less than a day have a success rate of about 47%.

- Those holding for more than a year see a success rate of 73%.

This stark difference suggests that the short-term nature of day trading significantly increases its difficulty compared to longer-term investment strategies.

One reason is simply transaction costs – i.e., they matter a lot more on shorter timescales.

They matter much less on longer-term timescales and noise is less relevant on longer time horizons.

Stocks, for example, tend to wiggle around a lot day-to-day but as companies (at least most companies) and the economy get more productive over time, stock prices reflect this long term.

Longer-term trading styles like swing trading, position trading, or investing aren’t necessarily better than day trading or trading over very short time horizons, but they tend to be less time-intensive.

Capital Requirements and Risk

The amount of capital available to a day trader can greatly impact their chances of success:

- Day traders who are short on capital and use leverage have a high probability of losing all their capital.

- As mentioned, only about 4% of day traders with adequate capital and who invest multiple hours daily manage to make a living from day trading.

This indicates that not only is skill a factor, but having sufficient capital to withstand losses and avoid over-leveraging is key for survival in day trading (or any form of trading).

Demographic Insights & Global Distribution of Day Traders

Demographics

The demographics of day trading provide additional context:

- The field is predominantly male, with approximately 9.5% of day traders being women and 90.5% being men.

- There’s a tilt towards younger traders, with 65% of online traders in the UK falling in the 18-to-34-year age bracket.

- The presence of traders above 45 years old has seen a decline.

These demographics suggest that day trading may be particularly appealing to younger, male traders who might be more prone to risk-taking behavior.

As people grow older or have less risk tolerance more generally, they tend to switch to longer-term styles of trading and investing that are more strategic and less tactical.

Global Distribution

The global distribution of day traders offers insights into where the practice is most prevalent:

- Asia has the highest concentration at 33%

- The US and Europe each account for 16%

- Africa hosts 14%

- The Middle East has a 10% share

- South America comprises 6%

- Central America and Oceania have smaller shares at 3% and 2% respectively

The Difference Between Trading and Gambling

While day trading isn’t inherently gambling because of the analysis and skill element, there are some parallels:

- Both activities involve quick decisions for potential profit or loss.

- Both involve risk, uncertainty, and the potential for addiction.

- Some traders may exhibit addictive behaviors similar to gambling, becoming hooked on the excitement and “action” derived from trading.

These similarities contribute to the difficulty of day trading.

Traders need to constantly guard against falling into gambling-like behaviors and maintain a disciplined and analytical approach.

Quitting Day Trading: Not a Sign of Failure

Deciding to stop day trading doesn’t necessarily mean you’ve failed as if there’s something to be ashamed about not day trading in perpetuity.

It can be a valuable part of your journey in understanding both yourself and the markets.

Day trading can be an intense and demanding activity, and for many, it’s a stepping stone to discovering better-suited trading, investing, or business strategies.

A Learning Process

Day trading provides real-world experience with decision-making, market behavior, and risk management.

Even if you move away from day trading, the skills and knowledge you’ve gained are transferable to many other careers, pursuits, and life in general.

You’ve likely developed a deeper understanding of financial markets, which can be applied to other forms of trading or investing, such as swing/position trading, long-term investing, or passive portfolio management.

Evolving into Different Styles

Everyone has different risk tolerances, time commitments, and mental strengths.

Day trading may not fit your personality or lifestyle, but that doesn’t mean the markets aren’t for you.

You might prefer a different approach, like longer-term investing, value investing, or options trading.

Each style requires unique skills, and sometimes stepping back from day trading helps you discover your natural fit.

Applying Lessons to Life and Business

The discipline, emotional control, and problem-solving skills honed in day trading are valuable beyond the markets.

Whether you pursue other business ventures, entrepreneurship, a different job, or personal goals, the lessons learned from trading can help you make better decisions, understand your strengths and weaknesses, handle uncertainty, and manage risk effectively.

Ultimately, whether day trading is in your long-term plans or not, it’s about growing, experimenting, and finding what works best for you.

Conclusion

The evidence overwhelmingly suggests that day trading is extremely difficult, with a high likelihood of failure for most participants.

The combination of cognitive demands, psychological challenges, time intensity, technical knowledge requirements, and the zero-sum nature of alpha generation creates a barrier to success.

For the vast majority of individuals, a more passive and long-term investment strategy is likely to yield better results.

This approach aligns with the principle of risk management and supports the goal of achieving financial security and growth without exposing oneself to the high level of competition and volatility that day traders and active traders go through.

Even successful active traders often maintain separate portfolios with lower-risk, longer-term investments.

Many sophisticated analysts and traders within hedge funds often invest their savings through index funds, not by actively trading and trying to time the market.

This diversification strategy not only helps manage risk but also acknowledges the inherent difficulties and uncertainties of day trading.

Ultimately, while day trading can be profitable for some with the right skills, resources, and temperament, it remains a very challenging activity with a high probability of financial loss for most participants.