When to Quit Day Trading

Day trading can be an alluring prospect for many, offering the potential for quick profits and financial independence.

However, it’s a challenging endeavor that doesn’t suit everyone.

Knowing when to step away from day trading is important for your financial and mental well-being.

This article explores various scenarios and indicators that suggest it might be time to quit day trading.

Key Takeaways – When to Quit Day Trading

- Consistent Losses Erode Capital

- If your trading account steadily declines over months despite strategy adjustments, it’s time to step back.

- Protect your remaining capital before it’s depleted.

- Emotional or Physical Health Reasons

- Chronic stress, anxiety, or trading addiction severely impact mental health and decision-making.

- Prioritize well-being over potential profits.

- Life Changes Demand Reassessment

- Major life events or evolving personal goals may conflict with day trading’s demands.

- Align your career with your current lifestyle and long-term objectives.

- Other Forms of Trading Available

- There are other forms of trading and longer timeframes.

- Swing trading, position trading, and investing are also valid and bring better success for many.

- There’s never any shame in switching gears and doing something better suited for your personal circumstances.

- Even successful day traders move on to longer-term trading styles or other ventures.

Consistent Financial Losses

Depleting Capital

If you find your trading account balance consistently decreasing over time, it’s a clear sign that your strategy isn’t working.

While occasional losses are normal, a persistent downward trend in your capital should prompt serious reconsideration of your day trading career.

Inability to Cover Trading Costs

Day trading involves various costs, including commissions, platform fees, and data subscriptions.

If your profits can’t cover these expenses, you’re effectively losing money.

This situation is unsustainable and indicates it might be time to quit.

Psychological and Emotional Strain

Chronic Stress and Anxiety

Day trading can be incredibly stressful, with rapid market movements causing emotional highs and lows.

If you’re experiencing chronic stress, anxiety, or mood swings that affect your daily life and relationships, it’s time to reevaluate your involvement in day trading.

Trading Addiction

Some traders develop addictive behaviors, constantly checking markets and unable to step away.

If day trading is consuming your thoughts and actions to an unhealthy degree, it’s important to recognize this and consider stopping.

Impact on Personal Life

Neglecting Relationships

Day trading can be all-consuming, leading some to neglect personal relationships.

If your trading is causing significant strain on your family life or friendships, it might be time to prioritize these relationships over trading.

Health Issues

Day trading can involve looking at a screen for extended periods doing a stressful activity.

The sedentary nature of day trading, combined with high stress levels, is not for everyone.

If you’re experiencing mental or physical health issues related to your trading lifestyle, it’s essential to reassess your priorities.

Lack of Progress and Growth

Inability to Improve

If you’ve been day trading for a considerable time without seeing improvement in your skills or results, you may need to re-evaluate what’s holding you back.

Continuous learning and adaptation are important in day trading.

Also note that there can be significant variance in day trading.

It’s not easy to tell who’s lucky or good over short timeframes (unless they are really bad).

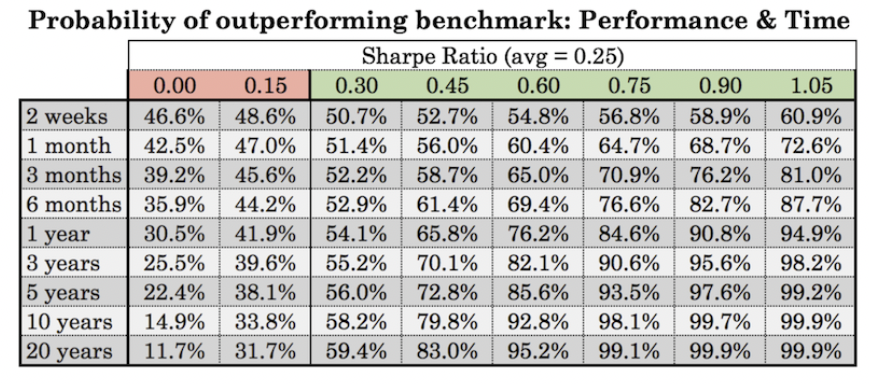

This chart gives a general idea.

For example, a trader with a Sharpe Ratio of 0.45 is pretty good – it’s better than the reward-to-risk expected in most asset classes over time (generally around 0.25-0.30).

However, even after one year there’s only about a 66% chance they’ll outperform. And even over 20 years, it’s just 83%.

You can also notice the spread over two weeks and one month, where the differences between a trader who simply earns the rate of cash (0.00 Sharpe) and a very talented trader (1.05 Sharpe) might not be perceptible.

Failing to Develop a Consistent Strategy

Successful day traders have a well-defined, consistent strategy.

If you’re unable to develop or stick to a strategy after multiple attempts, it could be a sign that day trading isn’t suited to your skills or temperament.

Financial Instability

Risking Essential Funds

If you find yourself risking money that you can’t afford to lose, such as funds for rent, bills, or other essential expenses, it’s a clear sign that you should quit day trading immediately.

Accumulating Debt

Taking on debt to fund your trading activities or to cover losses is a dangerous path.

If day trading is leading you into debt, it’s time to stop and reassess your financial situation.

Market Changes

Inability to Adapt to Market Conditions

Markets are constantly evolving, with new regulations, technologies, and global events influencing trading conditions.

If you’re struggling to adapt to these changes, it might be time to consider other trading or investment strategies.

Decreasing Opportunities

Some market environments or regulatory changes can reduce profitable trading opportunities.

Sometimes things change and it can be time to switch gears.

Niche Opportunities

If you find that your niche or preferred market no longer offers viable trading prospects, it might be time to explore other options.

Some traders do genuinely find something profitable (e.g., selling highly overpriced volatility or noticing a market out of whack for liquidity reasons).

But such things are highly tactical in nature and tend to be fleeting.

They arise due to specific market conditions and disappear once the conditions normalize. And they may never happen again.

Once the market corrects and they go away, is there a sustainable strategy that can be repeatable over years or decades?

Time and Lifestyle Considerations

Conflicting Life Goals

As your life circumstances change, day trading might no longer align with your goals or lifestyle.

Whether it’s starting a family, pursuing a new career, or simply desiring more stability, it’s important to recognize when day trading no longer fits into your life plan.

Burnout

The intense focus required for day trading can lead to burnout.

If you’re feeling constantly exhausted, unmotivated, or disconnected from your work, it might be time to take a break or quit altogether.

Ethical Concerns

Misalignment with Personal Values

Some traders may find that certain aspects of day trading, such as trading in certain industries, conflict with their personal ethics or values.

In certain cultures, day trading might be frowned upon.

If you’re consistently uncomfortable with the nature of your trading activities, it might be time to reconsider your involvement.

Consider the Competition

Day traders face very difficult competition from sophisticated trading firms and institutions.

For instance, many trading firms employ teams of experts with years/decades of experience with advanced skills and abilities in mathematics, statistics, finance, economics, computer science, and business to optimize their algorithms for predicting micro-movements in stock prices.

These algorithms can execute thousands of trades per second, capitalizing on price discrepancies that last milliseconds.

Meanwhile, quantitative hedge funds may use machine learning models developed by mathematicians and computer scientists to analyze satellite imagery of retail parking lots, predicting consumer trends before they’re reflected in company earnings reports. Such insights give them a significant edge over individual traders relying on publicly available information.

Consider also the infrastructure advantages: Some firms have invested millions in microwave towers to transmit data between Chicago and New York microseconds faster than fiber optic cables, gaining a speed advantage in arbitrage opportunities that many day traders might look for.

Furthermore, proprietary trading firms often have access to exotic financial instruments and dark pools that are unavailable to retail traders. They might use complex derivatives or engage in strategies across multiple asset classes simultaneously.

Their research, risk management, liquidity management, portfolio structuring, and so on, will all be more sophisticated.

Given these realities, day traders are often competing against entities with vastly superior resources, technology, and information.

It’s akin to an amateur entering a Formula 1 race with a regular car. Certain steps need to be taken before they can level the playing field for themselves – their skills, tools, and infrastructure – so they’re on the level or better than their competition.

That said, this disparity isn’t as big of a deal for those who think longer-term about their trading or investing and are more strategic and passive rather than tactical and active.

Shorter-term trading styles can absolutely be effective; but they can be difficult.

Other Forms of Trading Available

Day trading can be appealing, but it’s not the only path to financial success in the markets.

Many traders find greater success and satisfaction by exploring alternative trading styles that better suit their personalities, lifestyles, and risk tolerances.

Swing Trading

Swing trading involves holding positions for several days to weeks, capitalizing on medium-term price movements.

This approach allows for a more balanced lifestyle, as it doesn’t require constant market monitoring.

Swing traders can maintain full-time jobs while still actively participating in the markets.

Position Trading

Position trading takes an even longer-term view, with trades lasting weeks to months.

This style aligns well with fundamental analysis and macroeconomic trends, appealing to those who enjoy deep research and have patience for their thesis to play out.

Investing

Investing, the longest-term approach, focuses on holding assets for months to years.

This strategy suits those seeking steady growth and often involves less active management, making it ideal for individuals with limited time or those preferring a hands-off approach.

Some also prefer it for tax reasons (i.e., long-term capital gains taxes are lower than short-term capital gains taxes in most jurisdictions).

Decide on the best approach

Each of these alternatives offers unique advantages.

They typically involve lower stress levels, reduced transaction costs, and the potential for more stable returns compared to day trading.

Moreover, these approaches often align better with work-life balance and personal commitments.

Quitting ≠ Failure

Recognizing that day trading isn’t suitable for everyone and exploring other trading styles isn’t a sign of failure.

Instead, it demonstrates adaptability and self-awareness.

Many successful market participants have transitioned between different trading styles throughout their careers, finding approaches that better match their evolving skills, circumstances, and goals.

Many find that day trading is more appealing to younger traders, while longer-term styles become more popular as one ages.

We found that approximately 65% of day traders are between 18 and 34.

Conclusion

While day trading can be rewarding for some, it’s not a suitable career or hobby for everyone.

Recognizing the signs that it’s time to quit is important for protecting your financial health, mental well-being, and overall quality of life.

If you identify with multiple points discussed in this article, it may be time to seriously consider stepping away from day trading and exploring other financial strategies or career paths.