Harry Browne Permanent Portfolio

The Harry Browne Permanent Portfolio is an investment strategy designed to offer a balanced approach, safeguarding assets during economic downturns while still achieving long-term growth.

This approach, named after the late American economist and investment analyst Harry Browne, aims to mitigate risk and provide a stable investment foundation.

In this article, we’ll look at the key aspects of the Harry Browne Permanent Portfolio, compare it to the All Weather Portfolio, 60/40, and an all-stocks allocation approach, and explore its advantages and disadvantages.

Key Takeaways – Harry Browne Permanent Portfolio

- The Harry Browne Permanent Portfolio is a balanced investment strategy that aims to preserve during economic downturns while achieving long-term growth.

- It divides assets equally among stocks, long-term bonds, cash, and gold.

- The portfolio offers simplicity, diversification, and stability, making it suitable for conservative investors, retirees, or those with a lower risk tolerance.

- Per a test we ran (please see below), it has historically demonstrated improved risk-adjusted metrics and lower drawdowns compared to other portfolios.

- However, the equal allocation may result in underperformance during strong market conditions, and the heavy allocation to gold and cash could limit potential returns.

- Investors can customize the portfolio to better align with their risk tolerance and investment goals.

Harry Browne Permanent Portfolio Allocation

The core idea behind the Harry Browne Permanent Portfolio is to divide investments equally across four distinct asset classes: stocks, long-term bonds, cash, and gold.

Each allocation is weighted at 25%, which is intended to provide protection and growth across various economic conditions.

The general thinking is as follows:

- Stocks offer growth potential during times of prosperity

- Long-term bonds provide income and stability during recessions

- Cash ensures liquidity and provides a hedge when money and credit are tight (causing other assets to decline), and

- Gold serves as a hedge against inflation and currency depreciation over the long-run (not necessarily the short-run)

Harry Browne Permanent Portfolio vs. All Weather Portfolio

The All Weather Portfolio is another well-known investment strategy with a similar objective of providing balance and risk mitigation.

However, the allocation of assets in the All Weather Portfolio differs from the Harry Browne Permanent Portfolio.

There is no single All Weather mix.

However, one popular version is that the All Weather Portfolio allocates:

- 30% to stocks

- 40% to long-term bonds

- 15% to intermediate-term bonds

- 7.5% to gold, and

- 7.5% to commodities

The higher allocation to bonds in the All Weather Portfolio is intended to reduce volatility and offset the higher volatility of stocks while still providing returns during various economic climates.

Investors can also consider diversifying some of the mix of bonds to inflation-protected varieties (e.g., TIPS) rather than just nominal rate bonds.

Harry Browne Permanent Portfolio Advantages

The Harry Browne Permanent Portfolio offers several advantages for investors.

Its simplicity and equal allocation across four asset classes make it easy to understand and implement.

Additionally, the diversification helps to reduce risk and protect against significant losses during turbulent economic conditions.

This strategy is also designed to perform well across various economic cycles, providing investors with a sense of security and stability.

Harry Browne Permanent Portfolio Disadvantages

Despite its advantages, the Harry Browne Permanent Portfolio has its share of drawbacks.

One potential downside is that the equal allocation of assets may lead to underperformance during strong market conditions, as a higher allocation to stocks might yield better returns.

At the same time, stocks are more volatile than bonds, so even though both are allocated at 25%, the stocks will tend to dominate. This is also the case with portfolio approaches like 60/40.

Moreover, the heavy allocation to gold can be a point of contention for some, as gold may not always provide the desired returns or protection against inflation, especially in the short run where its performance against inflation is not reliable.

The allocation to cash is also high.

Who Is the Harry Browne Permanent Portfolio Best For?

The Harry Browne Permanent Portfolio is best suited for investors seeking a simple, balanced, and low-maintenance investment strategy.

This approach is particularly beneficial for those who desire a hands-off investment strategy with the aim of preserving capital and reducing risk.

While it may not outperform more aggressive portfolios during strong market conditions, it offers a level of stability that appeals to conservative investors, retirees, or those with a lower risk tolerance.

How Has the Harry Browne Permanent Portfolio Done Historically?

We ran the backtest to find out.

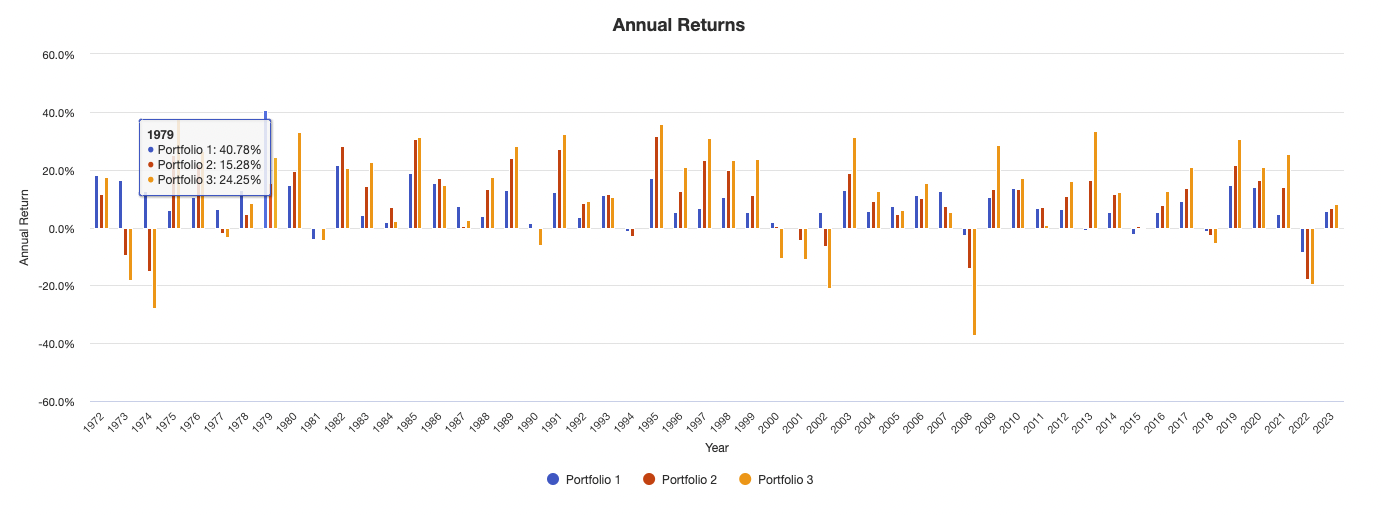

We also compared it against 60/40 and a portfolio of just stocks (i.e., S&P 500) from 1972 forward.

Here are the results:

Performance Summary

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Harry Browne | $10,000 | $556,751 | 8.14% | 7.12% | 40.78% | -8.44% | -13.19% | 0.52 | 0.82 | 0.58 |

| 60/40 | $10,000 | $951,199 | 9.28% | 10.13% | 31.69% | -17.84% | -28.54% | 0.49 | 0.73 | 0.94 |

| S&P 500 | $10,000 | $1,554,061 | 10.33% | 15.75% | 37.82% | -37.04% | -50.89% | 0.42 | 0.61 | 1.00 |

We can observe that the Harry Browne Permanent Portfolio has improved risk-adjusted metrics (e.g., Sharpe, Sortino) because of the way it diversifies.

It also has a much lower drawdown (it keeps a larger cash position), less volatility, and lower drawdowns.

Its best year was actually better than both the 60/40 and stocks portfolio due to the performance of gold in the 1970s.

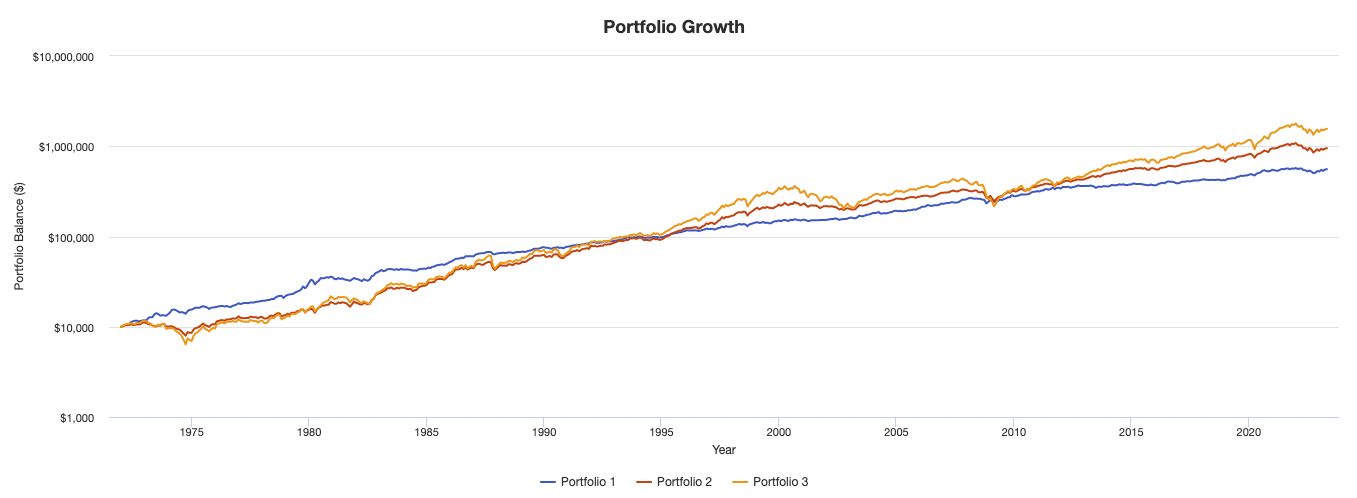

Portfolio Growth

Below we have an image of portfolio growth, with the Harry Browne Permanent Portfolio as the blue line, 60/40 as the red line, and stocks as the yellow line.

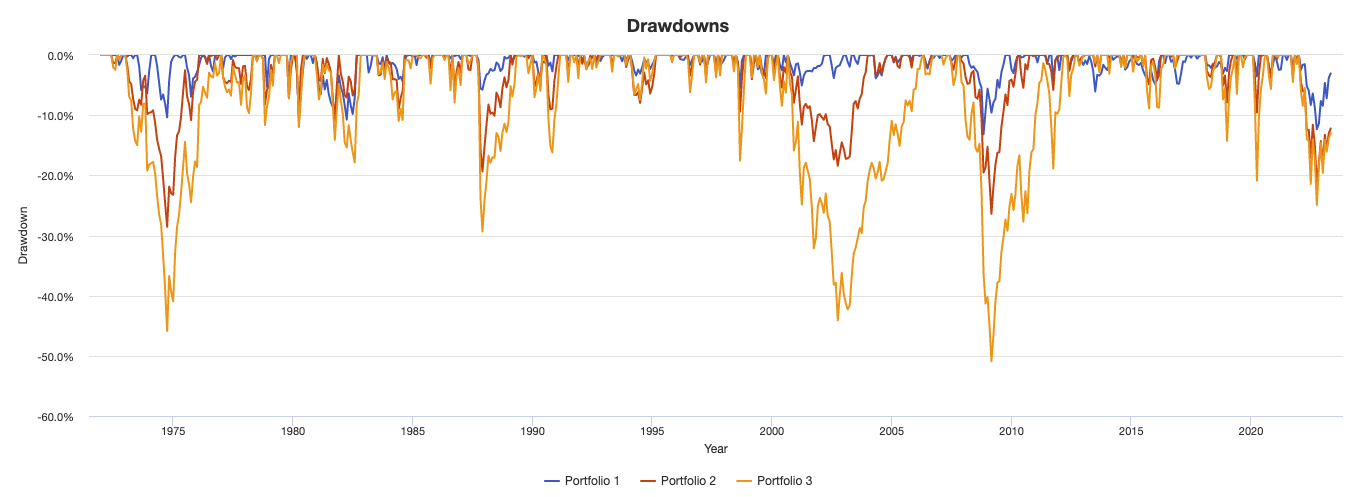

Drawdowns

We can also see how the diversification creates shallower drawdowns for the Harry Browne Permanent Portfolio:

Summary Statistics

And below we have summary statistics on each portfolio:

| Metric | Harry Browne | 60/40 | Stocks |

|---|---|---|---|

| Arithmetic Mean (monthly) | 0.68% | 0.78% | 0.93% |

| Arithmetic Mean (annualized) | 8.41% | 9.84% | 11.71% |

| Geometric Mean (monthly) | 0.65% | 0.74% | 0.82% |

| Geometric Mean (annualized) | 8.14% | 9.28% | 10.33% |

| Standard Deviation (monthly) | 2.05% | 2.92% | 4.55% |

| Standard Deviation (annualized) | 7.12% | 10.13% | 15.75% |

| Downside Deviation (monthly) | 1.07% | 1.77% | 2.96% |

| Maximum Drawdown | -13.19% | -28.54% | -50.89% |

| Stock Market Correlation | 0.58 | 0.94 | 1.00 |

| Beta(*) | 0.26 | 0.61 | 1.00 |

| Alpha (annualized) | 5.20% | 2.67% | 0.00% |

| R2 | 33.43% | 89.13% | 100.00% |

| Sharpe Ratio | 0.52 | 0.49 | 0.42 |

| Sortino Ratio | 0.82 | 0.73 | 0.61 |

| Treynor Ratio (%) | 14.05 | 8.21 | 6.69 |

| Calmar Ratio | 0.32 | 0.28 | 0.55 |

| Active Return | -2.18% | -1.05% | 0.00% |

| Tracking Error | 13.01% | 7.04% | 0.00% |

| Information Ratio | -0.17 | -0.15 | N/A |

| Skewness | 0.24 | -0.35 | -0.52 |

| Excess Kurtosis | 2.56 | 1.41 | 1.92 |

| Historical Value-at-Risk (5%) | -2.31% | -4.19% | -7.14% |

| Analytical Value-at-Risk (5%) | -2.70% | -4.02% | -6.55% |

| Conditional Value-at-Risk (5%) | -3.55% | -6.05% | -10.11% |

| Upside Capture Ratio (%) | 35.67 | 64.86 | 100.00 |

| Downside Capture Ratio (%) | 15.37 | 56.40 | 100.00 |

| Safe Withdrawal Rate | 5.23% | 4.15% | 4.31% |

| Perpetual Withdrawal Rate | 3.89% | 4.90% | 5.81% |

| Positive Periods | 399 out of 616 (64.77%) | 401 out of 616 (65.10%) | 384 out of 616 (62.34%) |

| Gain/Loss Ratio | 1.33 | 1.08 | 1.02 |

| * US stock market is used as the benchmark for calculations. Value-at-risk metrics are based on monthly values. | |||

Has the Harry Browne Permanent Portfolio Outperformed the All Weather Portfolio?

Over a more limited testing sample (data on some assets doesn’t go back as far), based on the All Weather allocation mentioned above, it has outperformed:

| Portfolio | Initial Balance | Final Balance | CAGR | Stdev | Best Year | Worst Year | Max. Drawdown | Sharpe Ratio | Sortino Ratio | Market Correlation |

|---|---|---|---|---|---|---|---|---|---|---|

| Harry Browne | $10,000 | $25,374 | 5.87% | 7.20% | 16.19% | -12.03% | -15.58% | 0.70 | 1.14 | 0.52 |

| All Weather | $10,000 | $25,294 | 5.85% | 7.68% | 18.30% | -17.53% | -19.84% | 0.66 | 0.96 | 0.62 |

FAQs – Harry Browne Permanent Portfolio

How often should I rebalance my Harry Browne Permanent Portfolio?

Rebalancing the portfolio typically involves bringing the asset allocations back to their original 25% weightings.

As we wrote in a separate article, it is generally recommended to rebalance the portfolio at least once a year.

However, some investors may choose to rebalance more frequently, such as quarterly or semi-annually or as needed, depending on their personal preferences and market conditions.

Is the Harry Browne Permanent Portfolio suitable for investors with a long investment horizon?

Yes, the Harry Browne Permanent Portfolio is suitable for long-term investors due to its focus on capital preservation and risk reduction.

However, investors with a higher risk tolerance or a desire for potentially greater returns may wish to explore alternative strategies that allocate a larger proportion to equities or other growth-oriented assets.

How does the Harry Browne Permanent Portfolio handle inflation?

The inclusion of gold in the portfolio serves as a hedge against low real yields, currency devaluation, and inflation (in the long-run).

Gold has historically maintained its value during periods of inflation and currency depreciation.

However, it is essential to recognize that gold’s performance may vary and is not guaranteed to provide protection against inflation, especially in the short-run.

Can I implement the Harry Browne Permanent Portfolio using Exchange Traded Funds (ETFs)?

Yes, you can implement the Harry Browne Permanent Portfolio using ETFs.

For each asset class, you can select an ETF that tracks the performance of the respective asset.

Examples include a broad-market stock ETF, a long-term bond ETF, a short-term Treasury ETF (for cash), and a gold ETF.

This approach simplifies the investment process and provides easy access to diversification.

How does the Harry Browne Permanent Portfolio perform during a bear market or economic recession?

The diversified nature of the Harry Browne Permanent Portfolio helps protect against significant losses during bear markets or economic recessions.

The allocations to long-term bonds and cash provide stability and income during such periods, helping to offset potential losses in the stock and gold components.

However, it is important to remember that no investment strategy is immune to losses, and individual results may vary.

Can I customize the Harry Browne Permanent Portfolio to better suit my risk tolerance or investment goals?

While the original concept of the Harry Browne Permanent Portfolio focuses on an equal allocation across the four asset classes, you can customize the allocations to better suit your risk tolerance or investment goals.

For example, you may increase the allocation to stocks for potentially higher growth or decrease the allocation to gold if you prefer a more conservative approach.

It’s important to consider your individual circumstances and consult with a financial advisor before making any significant changes to your financial strategy.