Gamma Squeeze

A gamma squeeze is a sudden, sharp rise in a stock’s price, often triggered by a rush of options trading activity.

It’s driven by the actions of market makers and their hedging activity in response to the activities of options traders.

Key Takeaways – Gamma Squeeze

- Leverage Driven Volatility

- A gamma squeeze occurs when rapid call option purchases drive the stock’s underlying price upwards.

- This magnifies volatility due to the leverage effect of options.

- Market Maker Hedging Activity

- To hedge risk from selling call options, market makers purchase the underlying stock, further fueling the price surge, creating a feedback loop that can dramatically push prices higher.

- Potential for Rapid Gains and Losses

- Gamma squeezes can result in quick profits but also large losses, especially if the stock price abruptly falls after the buying frenzy subsides.

What Is Gamma?

Gamma measures the rate of change in an option’s delta relative to a one-point movement in the underlying asset’s price.

It indicates how the option’s sensitivity to price changes accelerates as the expiration date approaches.

It’s non-linear.

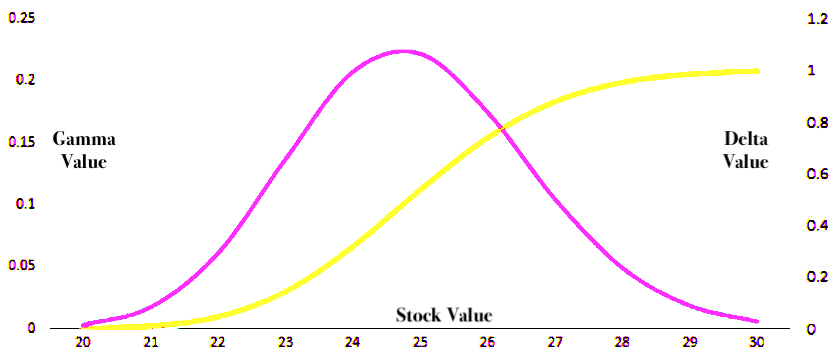

Here you can see gamma (purple) as it relates to delta (yellow) as it relates to the stock price:

Gamma (Purple) vs. Delta (Yellow) vs. Stock Price

Related: Greeks in Options Pricing

Overview of How a Gamma Squeeze Works

Options Explosion

Traders start buying lots of call options (bets that the stock price will go up).

Put options can also be involved, but it’s less common.

Market Maker Scramble

The market makers who sold those options need to manage risk.

To protect themselves from big losses if the stock price keeps rising, they buy the underlying stock.

Fuel to the Fire

This buying frenzy pushes the stock price even higher.

Feedback Loop

As the price climbs, more traders jump in to buy calls, forcing market makers to buy even more stock.

This cycle repeats, pushing the price to higher levels.

Why It Matters

Gamma squeezes can create wild price swings, leading to huge profits for some traders and painful losses for others.

They’re not everyday events, but when they happen, they can shake up individual tickers.

The Role of Options in Gamma Squeeze

Call options are contracts that give you the right, but not the obligation, to buy a stock at a specific price (the strike price) by a certain date (the expiration date).

They’re the key ingredient in most gamma squeezes.

Here’s why:

Leverage

Options provide leverage.

You can control a large number of shares with a relatively small investment (the premium paid).

This attracts traders looking for big gains.

Gamma

To reiterate, this is the Greek letter that measures how fast an option’s delta (its sensitivity to the underlying stock price) changes.

High gamma means a small stock price move can lead to a big change in option value.

Market Maker Hedging

When a market maker sells a call option, they’re essentially betting the stock price won’t go above the strike price.

To protect themselves, they’ll often buy some of the underlying stock as a hedge.

The Squeeze Begins

When a large number of call options are purchased, it creates a lot of open interest.

This forces market makers to buy more and more shares to hedge their positions.

This buying pressure fuels the stock price upward.

The Feedback Loop

As the stock price rises, the option price increases nonlinearly.

This means even small price moves can cause significant changes in option value, forcing market makers to buy even more shares to maintain their hedges.

This creates a self-reinforcing cycle: higher prices, more buying, even higher prices.

Mechanics of Gamma Squeeze

Let’s break down the gears and levers behind a gamma squeeze:

It All Starts with Delta

Delta measures how much an option’s price changes when the underlying stock price moves by $1.

Think of it like a car’s speed – a higher delta means the option’s price is moving faster in response to the stock’s movement.

Market makers use delta to hedge their positions.

If they’ve sold call options (betting the stock price won’t rise), they buy shares to offset their risk if the stock price does increase.

Gamma Enters the Picture

Gamma measures how fast delta changes.

It’s like the car’s acceleration – a high gamma means the option’s delta can change rapidly, even with small stock price movements.

As the stock price nears the call option’s strike price, gamma is at its highest level.

The Squeeze Begins

When lots of call options are bought, market makers need to buy more shares to adjust their delta hedges.

This buying pressure pushes the stock price up.

The Feedback Loop

As the stock price rises:

- The delta of the call options increases, requiring market makers to buy even more shares.

- The gamma of the call options also increases, making delta even more sensitive to price changes.

This creates a snowball effect.

This cycle can continue until the buying frenzy subsides.

Key Factors

- Open Interest – The number of outstanding options contracts. High open interest in call options increases the potential for a gamma squeeze.

- Short Interest – The number of shares sold short (betting the stock price will fall). A high short interest can exacerbate a squeeze, as short sellers are forced to buy shares to cover their positions.

Mechanics of Gamma Squeeze

Let’s look back at some famous gamma squeeze events:

GameStop (GME): The Mother of All Squeezes (2021)

A band of retail traders on Reddit’s r/wallstreetbets forum ignited a short squeeze – partially attributed to a gamma squeeze – on GameStop stock.

They piled into call options and the shares themselves, forcing market makers to buy shares to hedge their positions and shorts to unwind.

The result?

GME’s stock price soared from around $20 to nearly $500 in a matter of weeks.

This event highlighted the power of retail investors and the potential volatility of options trading.

AMC Entertainment (AMC): The Sequel (2021)

Shortly after the GameStop saga, AMC Entertainment experienced a similar gamma squeeze.

It had many of the same characteristics that made it ripe for one – low market cap, low share price (retail can buy more shares), low float (easier to move the price), high short interest.

Again, driven by enthusiastic retail traders, AMC’s stock skyrocketed, creating huge gains for some and significant losses for short sellers.

The AMC squeeze reinforced the impact social media and coordinated trading can have on stock prices.

Tesla

Tesla’s stock often experiences gamma squeezes due to high volumes of call option purchases, prompting market makers to buy up shares to hedge their positions, which drives the stock price higher.

Lessons Learned

These examples highlight several key takeaways:

- Retail Power – Social media and online forums can empower retail traders to influence market dynamics. This is nonetheless harder for large-cap securities or larger markets because retail money is a small fraction of the market. For example, after the GME and AMC saga, there was rumblings about doing the same in silver – a small market by commodity standards, but a large market relative to the smaller stock names being squeezed higher.

- Volatility – Gamma squeezes are inherently volatile events, capable of creating extreme price swings in a short period.

- Risk Management – Short sellers and market makers need to be aware of the potential for gamma squeezes and manage their risk accordingly.

Impact of Gamma Squeeze on Stock Prices

Stock Prices: To the Moon (and Sometimes Back)

The most obvious impact is on stock prices. Gamma squeezes can cause quick rises in a short time.

This attracts a frenzy of attention, often pulling in more buyers and further fueling the price surge.

However, the ascent isn’t generally based on fundamentals and isn’t typically sustainable.

Once the buying pressure eases or the options expire, the stock can come back down, leaving latecomers with heavy losses.

Market Volatility

Gamma squeezes inject a dose of volatility into the market.

The wild price swings can unsettle traders/investors.

This volatility isn’t just limited to the stock undergoing the squeeze – it can spill over into related sectors or the broader market, depending on the liquidity linkages.

Fear and Greed

Gamma squeezes tap into powerful emotions:

- Fear of Missing Out (FOMO) – As the stock price climbs, it triggers a fear of missing out on potential profits. This can lead to irrational buying decisions as traders jump on the bandwagon.

- Greed – The lure of quick riches can cloud judgment. Traders may take excessive risks, chasing the dream of striking it big.

- Panic – The inevitable price correction can trigger panic selling, as traders try to cut their losses and exit the market.

Other Effects

- Short Sellers – Gamma squeezes can be a nightmare for overconcentrated short sellers. They’re forced to buy shares at inflated prices to cover their positions, leading to losses. This is why diversification and position sizing are important considerations.

- Market Makers – While market makers are typically hedged against losses, they still face risks during extreme volatility. They may need to widen their bid-ask spreads and adjust their positions rapidly, incurring significant costs.

Identifying Potential Gamma Squeeze Opportunities

It’s not an exact science, but here are some clues to look for:

1. High Open Interest in Call Options

This is the number of outstanding options contracts.

A large open interest in call options, especially those near the current stock price (“at the money” or slightly “out of the money”), suggests strong bullish sentiment and potential fuel for a squeeze.

2. Increasing Trading Volume in Call Options

A surge in call option buying can indicate a growing wave of bullish bets.

Look for unusual volume spikes, particularly in out-of-the-money options, as these can signal a gamma squeeze brewing.

3. High Short Interest

When a stock has a high percentage of its shares sold short, it creates a potential powder keg for a squeeze.

Short sellers are betting the stock price will fall, but if it rises instead, they could be forced to buy shares to cover their positions, adding fuel to the fire.

4. Social Media Buzz

Keep an eye on social media platforms, forums, and trading communities.

Sentiment and discussion can sometimes foreshadow a coordinated effort to push a stock higher.

GameStop was largely driven by retail traders on Reddit and spilling onto other platforms like Twitter and the traditional media.

5. Technical Indicators

Look for a stock breaking out of a trading range or consolidating above a key resistance level.

This could be a sign that buying pressure is building and a squeeze is possible.

6. Fundamental Catalysts

A positive news event or earnings announcement can spark a sudden surge in buying activity, potentially triggering a gamma squeeze.

Important Considerations:

- Timing – Gamma squeezes are short-lived events. You need to identify potential opportunities early and be prepared to act quickly.

- Risk Management – These situations are volatile. Have a clear exit strategy and use stop-loss orders or other options to protect yourself from unexpected downturns.

- Do Your Homework – Don’t just follow the crowd and only trade what you can afford to lose.

Risks and Rewards of Trading in a Gamma Squeeze Environment

The Rewards

- Explosive Gains – The most enticing aspect is the potential for astronomical profits. During a gamma squeeze, stock prices can skyrocket in days or even hours.

- Momentum Trading – Gamma squeezes often attract a flood of attention and trading activity. This can create a self-fulfilling prophecy, where more buyers jump in, further driving up the price and generating even more momentum.

The Risks

- Volatility Whiplash – Gamma squeezes are notoriously volatile. The stock price can reverse course just as quickly as it rose, leaving you with large losses if you’re not careful.

- Timing is Everything – Getting in early is important. If you enter the trade too late, you could get caught holding the bag when the music stops and the price collapses.

- Psychological Traps – FOMO (fear of missing out) and greed can lead to impulsive decisions and excessive risk-taking. It’s easy to get caught up in the hype and lose sight of your trading plan.

- Short Squeeze Risk – If you’re shorting the stock, a gamma squeeze can be a disaster. You could be forced to cover your position at a much higher price.

Navigating the Squeeze

- Risk Management – Use stop-loss orders to protect yourself from sharp reversals.

- Research – Analyze the company and its fundamentals before taking a position. A gamma squeeze doesn’t change the underlying value of the stock.

- Be Realistic – Don’t expect every gamma squeeze to be a GameStop. Most squeezes are less dramatic and involve lower movements.

- Exit Strategy – Have a clear plan for when to exit the trade, whether you’re taking profits or cutting losses.

Regulatory Perspective on Gamma Squeezes

Regulators face a balancing act.

They want to protect traders/investors from excessive risk and market manipulation, while also fostering innovation and healthy trading activity.

Gamma squeezes complicate this picture.

Concerns

- Market Manipulation – Regulators worry that gamma squeezes can be intentionally triggered by coordinated groups, leading to artificial price inflation and potential harm to unsuspecting traders.

- Volatility and Systemic Risk – The extreme volatility of gamma squeezes can disrupt orderly markets and even pose systemic risks if they spill over into other sectors.

- Investor Protection – Inexperienced traders can be drawn into gamma squeezes by the promise of quick riches, only to face devastating losses when the bubble bursts.

Actions and Implications

- Increased Scrutiny – Regulators monitor options trading activity, especially in stocks with high open interest in call options.

- Enforcement Actions – Regulators launched investigations into potential market manipulation in past gamma squeeze events.

- Balancing Act – Regulators need to weigh the potential benefits of options trading (price discovery, risk management) against the risks of manipulation and instability and also arbitrage effects (i.e., what traders do when the rules for one thing change).