15+ Betting Strategies in Trading

Betting systems in trading are strategies that determine how much capital to allocate to each trade.

These systems borrow many concepts from gambling and apply them to trading.

These betting systems represent various ideas when it comes to managing risk, maximizing profits, or recovering from losses.

Key Takeaways – Betting Systems & Strategies in Trading

- Betting systems and strategies should be used in conjunction with analysis.

- Traders should always prioritize risk management and discipline in their trading decisions.

- No betting system can guarantee profits, and traders should be aware of the risks involved.

- Betting systems can be adapted to suit individual trading styles and goals.

1. Fixed Fractional Betting

In fixed fractional betting, a trader risks a predetermined percentage of their total bankroll on each trade, typically ranging from 1% to 5%.

For example, with a $10,000 bankroll and a 2% risk per trade, the trader would risk $200 on each trade.

Advantages

- Limits exposure to any single trade, reducing the risk of catastrophic losses.

- Helps maintain a consistent position size as the bankroll grows or shrinks.

- Easily scalable as the account balance changes.

Disadvantages

- Gains might be slower compared to more aggressive systems.

- Requires continuous recalculations of position sizes as the bankroll changes.

Related: 1% Rule in Day Trading Risk Management

2. Fixed Ratio Betting

This system involves risking a fixed dollar amount on each trade, regardless of changes in the bankroll size.

For example, a trader may decide to risk $100 on each trade, irrespective of wins or losses.

Advantages

- Easy to implement and manage since the trade size remains constant.

- Makes it easy to forecast potential gains or losses.

Disadvantages

- Doesn’t adjust to changes in the bankroll.

- Can lead to over-risking when the account size decreases or under-risking when it increases.

- Can be riskier if not adjusted during prolonged losing streaks.

3. Martingale Betting

The Martingale system involves doubling the bet size after each loss with the goal of recovering all previous losses plus securing a profit on the next win.

For example, starting with a $100 trade, if the first trade loses, the next trade would be $200, then $400, and so on.

Advantages

- Theoretically ensures recovery of losses with one winning trade.

- Appeals to traders wanting to recover from losses quickly.

Disadvantages

- A few consecutive losses can lead to exponentially increasing bet sizes.

- Risks a significant portion of the bankroll or leading to a margin call.

- Due to its high-risk nature, this system is generally not advised for trading.

- Very high eventual risk of ruin.

4. Anti-Martingale Betting (Paroli System)

The Anti-Martingale system is the opposite of the Martingale.

In this system, traders increase the bet size after a win, trying to capitalize on winning streaks while reducing risk during losing streaks.

The Paroli system is a close variation involving limiting multiplicative betting to three consecutive trades.

Advantages

- Allows traders to maximize profits during winning streaks.

- Reduces exposure after a loss.

- Preserves capital.

Disadvantages

- Doubling after a win streak can lead you back to square one once a losing trade occurs.

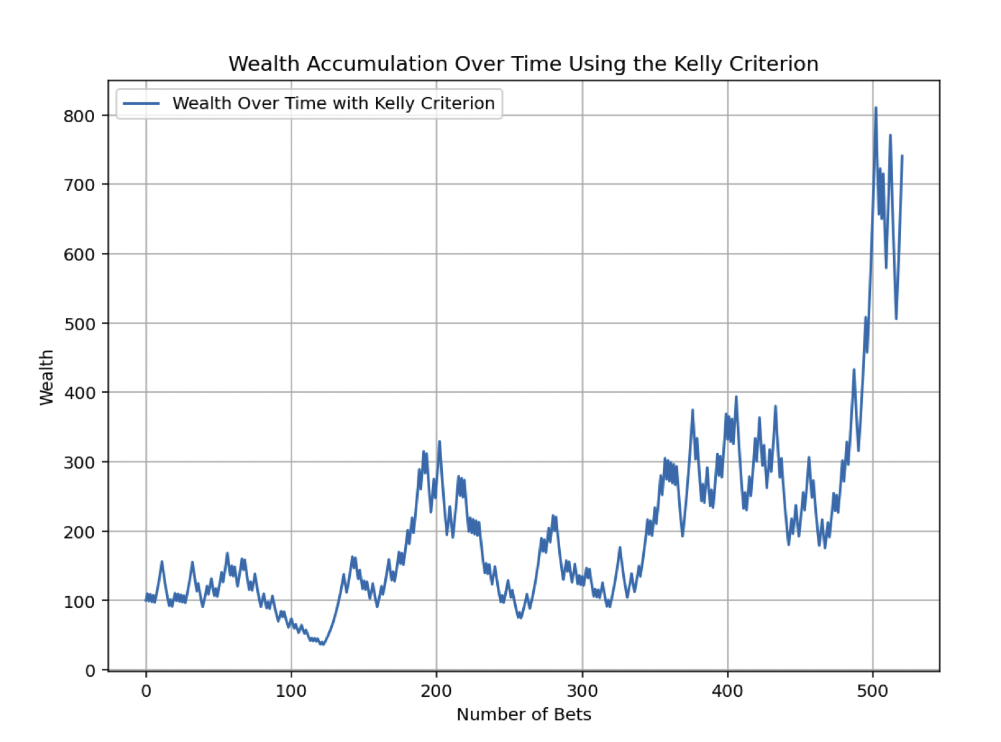

5. Kelly Criterion

The Kelly Criterion is a formula used to determine the optimal size of a series of bets (or trades) to maximize logarithmic growth of the bankroll.

The formula takes into account the probability of winning, the payout, and the current bankroll.

Advantages

- Maximizes long-term growth of the bankroll while minimizing the risk of ruin.

- Adjusts position sizes based on the perceived edge in the market.

Disadvantages

- Requires accurate estimates of win probability and payout ratios, which can be difficult in real-world trading.

- Can lead to larger bet sizes.

- Often overly large relative to what’s considered best practices in modern trading contexts.

- May increase short-term volatility in the account.

In a separate article, we ran simulations using the Kelly Criterion.

An example:

6. Proportional Betting

Proportional betting involves adjusting the bet size in proportion to the perceived edge or confidence in a trade.

For example, a trader may risk more on high-confidence trades and less on lower-confidence ones.

Advantages

- Allows traders to adapt their position sizes based on market conditions and confidence levels.

- Can lead to higher returns if the trader accurately assesses their edge.

Disadvantages

- Relies on the trader’s judgment, which can be influenced by emotions or biases.

- Inconsistent assessment of the edge can lead to variable returns and increased risk.

7. Value Betting

Value betting is a system where traders place bets (trades) when they believe the odds are in their favor based on their analysis.

This approach is common in sports betting and certain card games when a perceived edge can be exploited (e.g., poker)

Can also be applied to trading when a trader identifies mispriced assets.

Advantages

- Trades are based on analysis and perceived value, rather than random chance.

- By focusing on value, traders can potentially achieve higher returns over time.

Disadvantages

- Success relies on the trader’s ability to accurately assess value.

- Requires skill and experience to execute.

- Genuine value opportunities may be infrequent, leading to fewer trades.

8. Oscar’s Grind

This system aims to recover losses and make a small profit by increasing the bet size after a win, but only if the trader is in a net loss position.

The bet size remains constant after losses.

Advantages

- Conservative approach to recovery and limits exposure during losing streaks

Disadvantages

- Slow recovery process

- May require a long winning streak to be effective

9. D’Alembert System

Similar to the Martingale, but instead of doubling bets after losses, it increases them by a fixed amount.

After wins, it decreases by the same fixed amount.

Advantages

- Less aggressive than Martingale

- Potentially lower risk of ruin

Disadvantages

- Still carries significant risk during losing streaks

- May not recover losses as quickly as more aggressive systems

10. Fibonacci Betting

Based on the Fibonacci sequence, this system increases bet sizes according to the sequence after losses and moves back two steps in the sequence after wins.

Advantages

- More measured progression than Martingale

Disadvantages

- Can still lead to large bet sizes during extended losing streaks

- Complexity in tracking position in the sequence

11. Labouchere (Cancellation) System

The trader creates a sequence of numbers, bets the sum of the first and last numbers, and crosses them out if they win.

If they lose, they add the lost amount to the end of the sequence.

Advantages

- Flexible

- Allows traders to set their own sequences

- Can be tailored to different risk appetites

Disadvantages

- Can become complex to manage

- Risk of significant losses if the sequence grows too long

- Not the most empirical approach

12. 1-3-2-6 System

A positive progression system where bets increase after wins in the sequence 1 unit, 3 units, 2 units, and 6 units.

After completing the sequence or on a loss, the trader returns to 1 unit.

Advantages

- Capitalizes on winning streaks

- Has a defined endpoint, which limits potential losses

Disadvantages

- Requires a specific win sequence to maximize profits

- Can lead to larger losses on later bets in the sequence

13. Percent Risk Model

Similar to fixed fractional betting, but instead of risking a percentage of the total bankroll, the trader risks a percentage of the account based on the distance to their stop loss.

Advantages

- Adapts position size to market volatility

- Can help maintain consistent risk across different market conditions

Disadvantages

- Requires accurate stop-loss placement

- May lead to very large or very small positions depending on how markets are acting

The following are examples of more traditional betting strategies in financial portfolio contexts:

14. Risk Parity as a Betting Strategy

Risk parity is a strategy that allocates capital to various assets or trades based on their risk contribution rather than their dollar value.

The goal is to equalize the risk across different assets or trades.

This ensures that no single asset or trade dominates the overall risk of the portfolio.

Advantages

- Risk parity ensures that each asset or trade contributes equally to the overall portfolio risk.

- Prevents one asset from disproportionately affecting the portfolio’s performance.

- Diversification – By focusing on risk rather than capital allocation, this strategy often leads to a more diversified portfolio, which can reduce volatility and better smooth out returns.

- Adaptive to Market Conditions – Risk parity adjusts allocations based on changes in asset volatility, making the portfolio more resilient to changing markets.

Disadvantages

- Complexity – Implementing a risk parity strategy requires sophisticated analysis and calculations, such as estimating the volatility and correlation of assets, which can be challenging for individual traders.

- Overemphasis on Low Volatility Assets – The strategy might lead to an over-allocation in low-volatility assets.

- Rebalancing Costs – Regular rebalancing is required to maintain risk parity, which can incur transaction costs.

15. Fixed Sizing as a Betting Strategy

Fixed sizing involves allocating a predetermined and constant amount of capital to each trade, regardless of the trade’s risk or the trader’s total bankroll.

For example, a trader may decide to risk $1,000 on every trade, irrespective of the trade’s potential volatility or the overall account size.

Advantages

- Fixed sizing is straightforward to implement.

- Requires minimal calculations and adjustments, making it easy for traders to manage their trades.

- Since the same amount is risked on every trade, it’s easy to predict potential losses.

- Can help traders manage their emotional responses to trading outcomes.

- Fixed sizing allows for a consistent approach, reducing the temptation to make emotional or impulsive decisions based on recent gains or losses.

Disadvantages

- This strategy doesn’t account for varying risk levels across different trades.

- High-risk trades are treated the same as low-risk trades, which can lead to suboptimal risk management.

- If a trader’s account balance decreases, the fixed size may become too large relative to the account (increases the risk of large losses).

- In cases where certain trades offer higher potential returns with lower risks, fixed sizing might under-allocate capital, missing out on potential gains.

16. Volatility-Based Betting Strategy

Volatility-based sizing is a strategy that adjusts the position size of each trade based on the volatility of the asset being traded.

The idea is to risk a consistent amount of capital across trades by varying the position size according to the asset’s volatility.

For example, a more volatile asset would have a smaller position size, while a less volatile asset would have a larger position size.

Advantages

- Traders can manage risk more effectively, so that more volatile assets don’t disproportionately impact the portfolio.

- This approach helps maintain a consistent level of risk across different trades, regardless of the varying volatility of the assets involved.

- Can lead to more stable overall performance.

- Volatility-based sizing dynamically adjusts to changing markets, reducing exposure when markets become more volatile and increasing it when markets are calm.

- Traders can potentially optimize returns by avoiding overexposure to high-risk assets while still capitalizing on lower-risk opportunities.

Disadvantages

- Calculating the appropriate position size requires accurate volatility measurements and frequent adjustments.

- Makes this strategy more complex to implement than fixed sizing.

- Frequent rebalancing based on volatility changes can lead to higher transaction costs, particularly in fast-moving/highly volatile markets.

- The effectiveness of this strategy depends on the accuracy of volatility forecasts.

- Incorrect estimations can lead to suboptimal position sizes, either overexposing or underexposing the portfolio to risk.

Applications of Betting Systems in Trading

Betting systems can be applied to various aspects of trading, including:

1. Position Sizing

Betting systems can help traders determine the optimal position size for each trade, based on their risk tolerance and bankroll size.

2. Risk Management

Betting systems can help traders manage risk by allocating a fixed amount of money to each trade, or by adjusting the position size based on market conditions.

3. Bankroll Management

Betting systems can help traders manage their bankroll by allocating a fixed percentage of the total bankroll to each trade.

4. Trade Management

Betting systems can help traders manage their trades by adjusting the position size, stop-loss, and take-profit levels based on market conditions.

Risk Management in Betting Strategies

Position Sizing

Proper position sizing is important for managing risk in trading bets.

Example Position Sizing Techniques

- Fixed fractional sizing – Risking a fixed percentage of account equity on each trade.

- Kelly Criterion – A mathematical formula that determines optimal bet size based on perceived edge.

- Volatility-based sizing – Adjusting position size based on the asset’s volatility.

- Risk parity – Adjusting position size based on risk rather than dollar amounts.

Stop-Loss Orders

Stop-loss orders are used by many types of traders for limiting potential losses on trading bets.

Types of stop-loss orders

- Fixed stop-loss – Placing a stop at a predetermined price level.

- Trailing stop – A dynamic stop that moves with the price, locking in profits.

- Time-based stop – Exiting a trade after a specific time period, regardless of price.

Diversification

Diversifying bets across different assets and strategies can help manage overall portfolio risk.

Diversification methods

- Asset class diversification – Spreading bets across stocks, bonds, commodities, and currencies.

- Strategy diversification – Using multiple betting strategies simultaneously.

- Geographic diversification – Placing bets on assets from different countries or regions.

Psychological Aspects

Like many things in trading, sticking to a tried and true betting system is easier said than done due to the psychological aspect.

Emotional Control

Maintaining emotional control is critical for successful using betting strategies in trading.

Techniques for emotional control

- Mindfulness practices – Using meditation or deep breathing to stay focused and calm.

- Journaling – Keeping a trading journal to track emotions and decision-making processes.

- Setting realistic expectations – Understanding that losses are part of trading and avoiding overreaction.

Discipline and Consistency

Adhering to a well-defined betting strategy requires discipline and consistency.

Maintaining discipline

- Creating a trading plan – Developing a detailed plan that outlines entry, exit, and risk management rules.

- Backtesting – Rigorously testing strategies on historical data before real-money implementation.

- Regular review – Periodically assessing and adjusting strategies based on performance.

Dealing with Losses

Learning to handle losses effectively is important for long-term success in trading.

Strategies for dealing with losses

- Acceptance – Acknowledging that losses are an inevitable part of trading.

- Analysis – Reviewing losing trades to identify areas for improvement.

- Risk of ruin – Understanding and managing the risk of catastrophic loss.

Conclusion

These betting systems illustrate different approaches to risk management and position sizing in trading.

Each system has its merits and potential drawbacks, and the choice of system often depends on the trader’s risk tolerance, strategy, and market conditions.

Traders can also mix and match and find the best approach for them on an individual level.

While these systems can be interesting to study and may offer some insights into risk management, they certainly don’t guarantee profits in trading.

Many professional traders and financial advisors recommend more robust risk management strategies based on thorough market analysis, diversification, and an understanding of one’s own risk tolerance.