Average Inflation Targeting (AIT): Impact on Asset Classes

At the Federal Reserve’s 2020 Jackson Hole symposium, Fed officials announced a new way of managing inflation, now called average inflation targeting, or AIT for short.

The market basically ignored the announcement, as it didn’t seem entirely consequential with any near-term effects. But arguably it’s a notable announcement.

Two main forces influence markets at the highest level, growth and inflation, and their changes relative to what’s already discounted in. Some assets do well in a particular environment, broadly bucketed into four different types:

- high growth / high inflation (e.g., commodities)

- high growth / low inflation (e.g., stocks, corporate credit)

- low growth / high inflation (e.g., inflation-linked government bonds)

- low growth / low inflation (e.g., nominal government bonds)

So, events that could have an influence on the future of inflation are worthy of attention.

The Fed has communicated previously that its 2 percent annual inflation target is symmetric.

In other words, if inflation is 1.5 percent over a certain period, then 2.5 percent should be tolerable for an equal amount of time.

However, in the past, the Fed has lost some level of credibility over the symmetry of its inflation mandate.

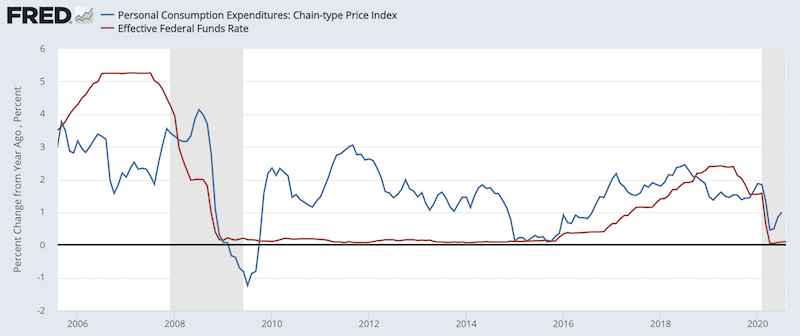

Since the 2008 financial crisis, when inflation (blue line below) ticked up toward 2 percent, the Fed would preemptively hike interest rates (red line) even before it got to that level.

(Sources: BEA, Board of Governors)

This has made some view the two percent as more of a ceiling.

For example, the year-over-year figure for 2015 averaged close to zero percent. Yet the Fed hasn’t shown any inclination to tolerate the mirror allotment over that two percent to compensate for the undershooting (high three percent).

Formally, the Fed has announced that it will target 2.25 to 2.5 percent inflation in the strong part of the business cycle. This would take into account past undershootings to help average around two percent.

It’s a little bit of an increase in the desired targeted inflation rate. This means any interest rate increases in the future are likely to come at a later point in the business cycle.

It also suggests that the Fed will want the unemployment rate to decline to levels below where they might estimate full employment, which should help more people find jobs.

But the question is still whether the symmetric target will be fully embraced.

The deflationary forces in the market are huge. For example:

- High debt relative to income (i.e., if debt has to be paid it diverts away from spending on goods and services)

- Aging demographics (higher dependency ratios, increasing obligations relative to revenue)

- Offshoring production of various forms to more cost-efficient countries, a drag on “labor inflation” (i.e., worker salaries) as it effectively expands the supply of labor

- Technological developments to increase economy-wide pricing transparency and reduce reliance on expensive labor

- Lower role for organized labor

Inflationary forces include very low short- and long-term interest rates, supplemental liquidity programs, and a contraction on the supply side of the economy.

The last one in particular makes the post-2020 period different from the post-2008 period.

As China rises to challenge the US (and Europe and the west more broadly) as the world’s main power, this brings additional conflict. Historically, this means greater trade conflict, disruption in capital flows, and becomes geopolitical in most other ways.

Supply restrictions with respect to goods, services, capital, commodities, and/or labor is more likely to lead to higher inflation.

At the least, we can say that the uncertainty in inflation is higher.

From 2008 to 2020, the risks to inflation were skewed to the downside (i.e., disinflationary). Central bank measures in the post-2008 period stopped the free fall in the economy and markets, but also caused the economy to start from a high debt base.

That meant raising interest rates would have no problem slowing the economy down with the outsized effect raising interest rates even slightly would have on debt servicing costs.

Still the question remains – does a year of zero percent inflation allow for one equal year of four percent inflation?

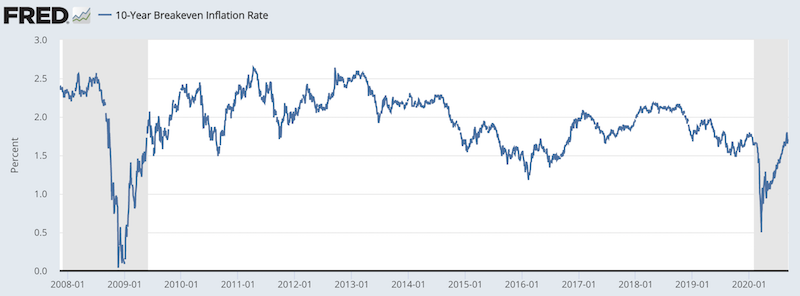

The market doesn’t expect much.

The 10-year breakeven inflation rate in the US is 1.69 percent. That’s about average of the general expectations over the 2008-2020 economic cycle.

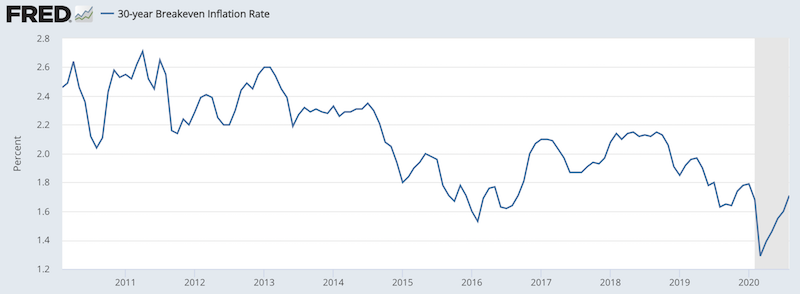

The 30-year breakeven inflation rate is about the same at 1.71 percent.

(Source: Federal Reserve Bank of St. Louis)

So, even with the Fed signaling they want and will allow higher inflation, the market is skeptical they’ll get it.

Another implication is that the standard global benchmark for interest rates and fixed income – the 10-year US Treasury – yield about minus-1 percent in real terms (i.e., inflation-adjusted terms).

In other words, traders expect to lose about one percent in real spending power per year just to keep their money safe. Plus, 10-year Treasury bonds have price risk because of their longer duration.

When there’s an expected loss in real wealth from tying up money in a safe asset, that has implications for other asset classes.

It practically makes everything overvalued. Many people don’t move their assets into riskier assets because they’re good investments in terms of reward relative to their risk, but because everything else is so bad in relative terms.

From the perspective of the central banks, there’s a lot of debt relative to income both within countries at various levels (central governments, local governments, corporate sector, households) and globally.

That means it’s fairly straightforward that policymakers are going to have to help the debtors relative to the creditors.

At the same time, the diminishing effect of very low nominal interest rates means policy easing will have limited ability to accomplish this.

Letting inflation flare up more will assist debtors with fixed-rate debt.

If nominal incomes increase faster than the rate nominal debt servicing is coming due, this helps “burn” the debt off. Or essentially “inflating it away” to a degree.

Debt monetizations (essentially a pillar of MMT) and currency depreciations are likely to pick up. This will reduce the real value of money and the real returns for creditors.

That nominal rate bonds are not likely to be the best investment.

It will test how far lenders and fixed income holders will allow central banks to go in providing negative real returns before shifting into other asset classes.

Phillips curve implications

The Phillips curve is a generally accepted economic concept explaining the trade-off between inflation and economic output.

Namely, if you want higher economic output (i.e., lower unemployment), this will carry with it higher inflation.

In general, when there is a demand of something in excess of supply (e.g., labor), prices will rise.

Central bankers’ attitudes toward inflation have necessarily evolved.

No longer is it only just a cyclical phenomenon where inflation picks up as labor slack decreases, but a function of secular forces, such as the various deflationary elements mentioned above.

This practical evolution in understanding inflation means the inflation-unemployment trade-off is less robust than it used to be and less likely to be used in policymaking decisions.

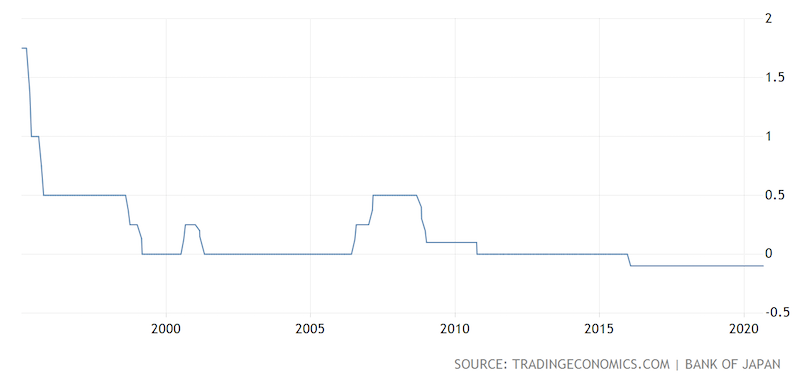

Average inflation targeting could mean a perpetual hold on zero, near-zero, or negative interest rates. Japan has been under this policy for decades and has had bigger problems with deflation than inflation.

The lack of ability to push nominal rates down much further likely means the end to the US Treasuries bull market that’s been in effect since 1981.

Even if Treasuries were to go from 0-1 percent down to minus-1 percent (world’s lowest yields), that only adds up to about seven percent annualized return over three years.

A normalization in real yields and a pick up in inflation to four percent – as a standard bear case – would mean losing about 20 percent annualized over three years, or about 3x more.

Though Treasuries are considered safe, having practically zero nominal return and negative inflation-adjusted return makes them unappealing to US-based investors. (This also goes for all other developed bond markets from a domestic investor’s perspective.)

For non-domestic traders and investors, the risks are worse because of the currency situation.

If bonds don’t yield anything and central banks are creating a lot of currency to deal with their debt problems, that’s bearish for the currency.

So, for example, from a Chinese investor’s perspective looking at US Treasury debt, not only does owning those bonds not yield anything, but there’s the currency risk as well. There’s also increasing conflict between China and the US, which brings risks in terms of capital flows and disruptions. The US can unilaterally decide to suspend its interest payments to China if it wanted to.

Stimulus and “The Four D’s”

Some refer to “the four D’s” when thinking about inflation in the context of the current world:

– Debts and deficits

– Depreciation (of currency; dollar debasement)

– De-globalization

– Demographics

Fiscal and monetary stimulus to help offset debts and deficits is inflationary. We saw this in 2008.

It’s been particularly inflationary for the financial economy (i.e., the supply and demand for money and credit), but not much has gotten into the real economy (i.e., the supply and demand for goods and services).

Currency depreciations are inflationary, holding all else equal. Exports become cheaper to the rest of the world, but imports cost more and can drive up the prices of domestic goods.

Commodities increase in price, again holding everything the same. Commodities are priced in a certain amount of money per unit.

With something like gold, when its price goes up (i.e., a certain dollar amount per ounce), it’s not because its utility is increasing but because the value of money is going down.

It’s the same dynamic with oil, but add in the major supply and demand factors that rule that market.

De-globalization and restrictions in the free flow of goods and services is inflationary due to the supply-side effects. Lower supply with the same or equal demand lifts inflation.

Aging demographics and higher dependency ratios are deflationary. The amount of IOUs expected by retirees related to healthcare and pensions relative to the amount of income being produced by current workers will be inadequate. Central governments will eventually have to monetize these obligations.

Rising inflation expectations is a direct knock on asset markets. Also, as interest rates are already low, this has lengthened the duration of financial assets.

The present value of future cash flows increases when rates are lowered in a non-linear way. This makes them more susceptible to outsized valuation reversals on a move back down.

That puts the central bank in a tough spot if inflation gets up to an unacceptable level (which may be around 3-4 percent, or sooner depending on the trajectory).

Do they have to raise rates to fight inflation and cause a significant re-rating in financial asset prices along the way?

Market impact

Nominal interest rates are a function of nominal growth rates.

Nominal growth is the sum of real growth and inflation. Real growth is limited to productivity (which doesn’t change much over time) and labor growth (which is also limited).

Asset prices, to justify their valuations in nominal terms, are likely going to need higher nominal growth. Or else they’ll eventually need to re-rate.

What does well in a stagflationary environment?

Nominal fixed-rate bonds are generally the worst thing one can have. They don’t yield anything and the currency is being actively depreciated.

They yield something in most emerging markets, which can provide returns if the deflationary forces globally win out (and provide currency diversification).

Inflation-linked bonds can take the place of some of the bond mix.

Rate-sensitive stocks, like some forms of leveraged real estate and utilities, would likely decline if inflation materially picked up.

This is because stocks are typically valued off their expected returns above a Treasury yield (or comparable safe asset).

If this occurs, both stocks and bonds could drop in price at the same time.

Traditional portfolio diversification strategies are not likely to work even though many extrapolate that they will because of how they’ve done in the recent past.

That means the traditional 60/40 stocks-bonds portfolio isn’t likely to do as well. Both are biased toward disinflationary environments as both asset classes benefit from interest rates dropping.

And even if deflation does win out, there isn’t additional room in the yield curve to eke out much more in gains. Traditional forms of diversification like long-duration Treasuries are unlikely to work as well.

Adding inflation protection to a portfolio through gold, commodities, and Treasury inflation protected securities (TIPS).

General risk considerations

Yields on investment assets are subject to economic conditions. Yield is just one factor when considering making an investment decision.

Stocks may fluctuate on news or analysis of companies, sectors, market conditions, and the economic environment.

Bonds and fixed income securities are subject to interest rate and duration risk.

When interest rates rise, bond prices fall, and vice versa. Generally the longer a bond’s maturity, the more sensitive it is to duration risk.

Some bonds are subject to call risk, which occurs when the issuer redeems the debt at its option before the scheduled maturity date, either fully or partially.

The market value of credit instruments may change. Moreover, the proceeds from sales prior to debt maturity may be more or less than the amount originally invested or the stated maturity value. This can be due to changes in market or economic conditions, or changes in the issuer’s credit quality.

Bonds are subject to the issuer’s credit risk. This is the risk associated with issuer not being able to make interest and/or principal payments at the agreed-upon dates.

Debt securities are also subject to re-investment risk. This is the risk that principal and/or interest payments an investor receives from a given security may need to be reinvested at a lower interest rate.

Asset allocation and strategic diversification do not guarantee a profit and may not protect against loss in declining financial markets, particularly when such approaches are based on an over-fitting of recent historical data.

Rebalancing one’s portfolio – e.g., selling stocks to invest in bonds when stocks have outperformed, skewing the predetermined allocation – does not protect against a loss in declining financial markets.

There may also be potential tax implications associated with a rebalancing strategy that buys and sells securities within a timeframe that makes them subject to different tax laws.

Sector-specific investments tend to have more volatility than investments that diversify more broadly across several sectors and companies.

Technology stocks, while prized as many of these companies help create new innovations, may be particularly volatile.

Overall sectors can be prone to bubbles and extreme bad patches for elongated periods of time that make them highly risky or cause them to greatly underperform the general market.

International investing entails different types of risks compared to investing in one’s domestic market, particularly if comparing one’s home market to a foreign emerging market.

These risks include currency fluctuations and political and economic uncertainties of foreign countries that have unique vulnerabilities. These types of risks can be greater in countries that are considered frontier or emerging markets. These countries may have less stable political situations and capital markets and economies that are less developed.

Investing in commodities entails a variety of risks.

Commodity prices may be impacted by a variety of influences at any time, including, but not necessarily limited to:

(i) changes in supply and demand characteristics of the commodity

(ii) governmental policies and programs (e.g., subsidizing a commodity, building a stockpile or strategic reserve)

(iii) geopolitics – national and international political and economic events, armed conflict, trade conflict, and terrorist events

(iv) changes in relative exchange rates, interest rates, the supply of money, and the value of money

(v) idiosyncratic trading activities in commodities and related contracts

(vi) technological changes, weather, and public health events

(vii) the idiosyncratic price volatility of a commodity

(viii) liquidity, government intervention, speculative activity, and other disruptions or temporary distortions