Academic Skills Used in Trading – What Major Is Best?

Trading is an activity that combines elements of economics, finance, business, mathematics, statistics, probability, programming, psychology, politics and government, history, and other disciplines into one.

All of these are important, as the market gathers all sorts of different market participants with all sorts of different motivations and backgrounds.

If you’re an aspiring trader, it might even help you brainstorm which college major or area of study might be best.

Let’s go through each one by one.

Key Takeaways – Academic Skills Used in Trading

- Economics and Finance – Understand how economic cycles, interest rates, growth, and inflation impact markets to predict asset performance and diversify effectively.

- Mathematics and Probability – Use models to analyze data, optimize portfolios, and evaluate risks by understanding concepts like probability distributions and expected value.

- Programming – If/when possible, automate strategies, analyze large datasets, and leverage AI for pattern recognition and better decision-making.

- Psychology – Recognize emotional biases and crowd behaviors to avoid reactionary decisions and maintain disciplined strategies.

- History, Government, and Politics – Study past market trends, crises, and asset performances as another important framework for understanding how things work and anticipate potential future scenarios.

Economics

Understanding economics is important in trading because it helps you comprehend the underlying factors that drive market movements.

Markets aren’t random. They operate based on logical, cause-and-effect relationships.

Studying these relationships, you can better anticipate future events and make better trading decisions.

For instance, consider how changes in interest rates affect different asset classes. When interest rates rise, bond prices typically fall, and vice versa.

This is because the fixed interest payments of bonds become less attractive compared to other investments when interest rates increase.

Similarly, stock prices are influenced by economic indicators such as economic growth, inflation, interest rates, and their relative “yield” relative to that of other asset classes.

Understanding these economic principles, you can better predict how different assets will perform under various economic conditions.

And not just for tactical reasons.

It can also help strategically, such as learning how to diversify better and spread your portfolio among high and low growth assets (e.g., stocks vs. government bonds), and assets that do better or worse in different inflation environments (e.g., commodities vs. nominal rate bonds).

Additionally, recognizing economic cycles can help you identify long-term trends and potential turning points in the markets.

For example, during a recession, certain sectors like consumer discretionary may underperform, while others like consumer staples and utilities may remain stable or even grow.

Moreover, a deep understanding of economics allows you to develop a more systematic approach to trading.

When you make explicit your understanding of how the economic and market systems work, you can create rules for trading that can be tested and improved over time.

This approach can help you stay disciplined and avoid emotional decision-making.

Lastly, economics helps you understand the concept of risk and how to manage it effectively.

Recognizing that different assets have varying levels of risk, you can diversify your portfolio to balance potential returns with acceptable levels of risk.

This is essential for long-term trading success, as it helps protect your capital during market downturns and helps with more consistent performance over time.

Finance

Finance helps you understand the mix of various economic forces and how they affect the markets.

For instance, if you understand the relationship between interest rates and bond prices, and concepts like duration and present value, you can predict how a change in interest rates might impact bond prices and adjust your trading strategy accordingly.

And as mentioned, making explicit your understanding of how economic and market forces work, you can create clear rules for trading.

This approach allows you to test, share, and improve your understanding over time. For example, if you understand the financial concept of risk parity, you can allocate risk more effectively across different assets for a more balanced and resilient portfolio.

Finance also emphasizes the importance of diversification.

No matter how confident you are in your understanding, surprises are the norm in markets.

These surprises can cause large moves in any given market or asset class and can cause even your highest-conviction trades to go wrong.

As such, it’s critical to diversify across many good, unrelated sources of return.

Understanding financial concepts like correlation and risk-adjusted returns can help you achieve this diversification.

Finance also helps you differentiate between alpha and beta returns. Beta returns reflect the market risk, while alpha returns reflect the manager’s decisions.

Understanding this distinction can help you better assess opportunities and manage risk.

For example, if you understand that alpha returns are zero-sum, you’ll be more discerning in selecting managers and strategies, focusing on those with a proven track record of generating positive alpha.

You might assume that that isn’t what you’re going for and simply allocate to beta. We talk about how to do that here.

Business

Understanding business is important in trading decision-making because it allows you to comprehend the underlying factors that drive market dynamics.

When you grasp how businesses operate and what influences their performance, you can better anticipate changes in the market and make more informed trading decisions.

For instance, knowing that asset classes tend to outperform cash over the long term can guide your strategy.

This is rooted in the fundamental economic structure, where capital is expected to generate returns exceeding cash to sustain economic growth.

Historical evidence supports this, as a well-diversified portfolio of stocks and bonds has consistently provided higher returns than cash over prolonged periods.

Every investment carries risk, and investors demand compensation for this risk through the risk premium.

Mathematics

Understanding mathematics is important in trading because it provides a framework for analyzing and interpreting financial data, managing risk, and making informed predictions.

Mathematical models help traders identify patterns, optimize portfolios, and execute strategies with precision.

Additionally, mathematical concepts such as probability and statistics are important for understanding potential outcomes and making decisions based on quantifiable evidence.

Statistics and Probability

Probability Distributions

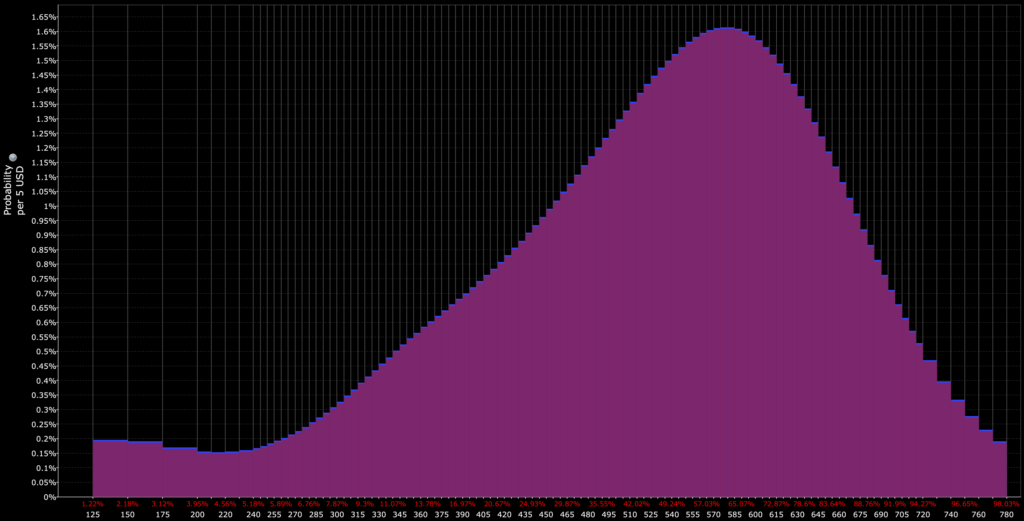

Probability distributions are key because they show us the range of possible outcomes and their likelihoods.

In finance, we deal with random variables like financial asset returns.

Knowing the probability distribution helps us understand the risks and potential rewards.

Expected Value

Expected value (EV) is another important concept.

Expected value is a concept in probability and statistics that refers to the average outcome you would expect to see if you repeated an event many times. It’s a way of quantifying the likelihood of different outcomes and then averaging them out.

Let’s say you’re considering an investment that has a 50% chance of making $100 and a 50% chance of losing $50.

The expected value of this investment would be calculated as follows: (0.5 * $100) + (0.5 * -$50) = $25.

This means that, on average, you would expect this investment to make $25.

Nonetheless, expected value is just an average. It doesn’t tell you what will happen in any single instance of the event.

In our example, you wouldn’t expect to make exactly $25 on a single investment. You would either make $100 or lose $50.

But if you made this same investment many times, your average return would likely be close to $25.

In trading, expected value can be a useful concept for decision-making. But it’s not the only factor to consider. You also need to think about risk, diversification, and your own personal financial goals.

Statistical Significance

Statistical significance is about determining whether an observed effect is likely due to chance or if it’s meaningful.

In finance, this helps you validate trading/investment strategies or models. If a strategy shows statistically significant results, it means there’s a good chance it’s not just a fluke.

Sample size matters because it affects the reliability of our conclusions.

A larger sample size generally gives us more confidence in our results. In finance, this means looking at enough data to ensure our analyses are robust.

Hypothesis Testing

Hypothesis testing is a method to test assumptions or claims. In finance, we might test if a new trading strategy outperforms the market.

By setting up a hypothesis and using statistical tests, you can see if the evidence supports the claim.

Let’s say you have an opinion on which you want to make a trading decision (i.e., a hypothesis).

You can write down the criteria, then stress test it to see how it would work.

Overall

So, statistics and probability provide the concepts and frameworks to analyze data, evaluate risks (in all their various forms), and make decisions that are grounded in reality rather than guesswork.

They give a clearer understanding of what might happen and why.

Programming

Understanding programming and computer science in trading is important because it allows you to automate and optimize trading strategies, analyze large datasets, and make informed decisions quickly.

AI and machine learning are especially useful as they can identify patterns and trends that humans might miss.

In turn, this can lead to more accurate predictions and potentially higher returns.

Going Beyond Our Personal Capacities

Programming enables us to translate our ideas into algorithms, extending our capabilities beyond the inherent limitations of the human mind.

Our brains have finite capacity for awareness, calculation, processing speed, and memory, but programming helps us overcome these constraints.

Psychology

Psychology is important in trading and financial decision-making because it’s deeply intertwined with market dynamics and economic outcomes.

When we look at markets, we see they’re not just driven by numbers and facts but also by human emotions and behaviors. This is what’s often called crowd psychology.

Consider a time when there’s a consensus in the market – everyone believes a particular stock or asset is going to rise. This belief gets priced into the market, and the asset’s value increases.

Nonetheless, if the future turns out differently than expected (i.e., what’s priced into markets), even by a small margin, it can lead to large reversals.

This phenomenon occurs because people have made decisions based on the belief that the asset will continue to rise, and any deviation from this expectation can catch them off guard.

For instance, during periods of prolonged low volatility, traders/investors might assume it’s safe to borrow more, leading them to increase their leverage.

When markets change, this over-leveraging can result in large losses.

Our brains are wired to focus more on short-term results, leading us to overreact to immediate changes rather than considering long-term trends.

This tendency causes prices to swing more than fundamentals would suggest, resulting in manias and depressions.

For example, US household investors tend to buy mutual funds more during bull markets than bear markets, which can be detrimental to their performance over time.

The famous Peter Lynch Magellan mutual fund case illustrates this well, where the average investor in it grossly underperformed largely due to buying high and selling low.

So, understanding psychology helps understand these human tendencies – not just in humans as a whole but also when and where it occurs within ourselves – and make better financial decisions.

It allows us to recognize when we’re getting caught up in crowd psychology and when we need to step back and reassess our strategies.

It also helps us understand why markets might behave in the way they are and how we can take advantage of these situations.

As such, psychology isn’t just about understanding others. It’s also about understanding ourselves and our reactions to market changes.

Government and Politics

Government and politics are key in trading because these elements are deeply intertwined with the economy, which in turn affects markets and trading.

In a simplified way, you can say that economics drives politics and politics drives economics.

This means that economic conditions can influence political decisions, and vice versa.

For example, consider the 2008 financial crisis.

The severe economic downturn led to high unemployment and financial instability, which pressured governments worldwide to implement extreme fiscal and monetary policies, such as massive bailouts and stimulus packages.

These political decisions had immediate effects on the markets, demonstrating how economic conditions shape political agendas and how those agendas, in turn, impact economic environments.

Conversely, political decisions can directly affect economic outcomes. Take the tax reform introduced in the United States in late 2017, which aimed to stimulate economic growth by reducing the corporate tax rate.

This policy decision had immediate effects on business investment and stock market performance, highlighting how political actions create economic ripple effects.

The stimulus in response to the Covid-19 pandemic led to impacts on asset markets, asset correlations, and global inflation patterns that were the reverse of most people’s experiences.

The cost of living and housing became a hot political issue.

Accordingly, understanding government and politics can help traders anticipate market trends and make informed investment decisions.

Recognizing how economic conditions shape political agendas and how political decisions influence economic environments, traders can better think through what’s happening, the political actions and outcomes that are likely, market responses, and so on through the meta-game of markets.

History

Having a good grasp of history is like having a map in a forest.

It doesn’t tell you exactly where you are or where you’re going, but it gives you a sense of the terrain, the patterns, and the potential pitfalls we face.

In markets and financial decision-making, history is a guide to understanding the economic and market cause-effect linkages that brought us to today.

Studying history, we can see the patterns and understand the relationships that drive the cause-and-effect behind markets.

For example, we can see how debt cycles work, how central banks respond to inflation, and how markets react to geopolitical events. This understanding helps us anticipate the future and make better trading or investment decisions.

But history isn’t just about learning from the past. It’s also about testing our ideas and strategies.

Looking at historical data, we can see if our understanding of economies and markets holds up.

We can see if our strategies would have worked in the past and under what conditions/environments.

This process of stress testing helps us refine strategies and make them better.

Moreover, history teaches us about the importance of diversification to limit the adverse impact of surprises.

These surprises can cause outsized moves in any given market or asset class and can cause any individual trading idea – even those in which we have the highest confidence – to go wrong.

Studying history, we can see how different asset classes perform under various economic environments (e.g., high/low growth, high/low inflation, wars, pandemics, nature events, etc.).

This understanding helps us build a diversified portfolio that can withstand different market scenarios.

So, understanding history is about using the past to understand the present within its various analogous contexts and prepare for the future.

It’s about developing a fundamental approach to understanding markets and economies, doing things more systematically, and diversifying in the appropriate ways.

Related

- History of Financial Wealth Wipeouts in the 20th Century

- History of Money

- History of Derivatives

- History of Chinese Empires from a Financial Perspective

- Financial History of the Past 500 Years