What Are Eurodollars? [Eurodollar Futures, Options, Bonds]

Eurodollars are deposits of US dollars in foreign banks, or in the foreign branches of American banks. The eurodollar market is the global market for these deposits.

There is no one eurodollar market. Instead, eurodollars are traded in a number of different markets, including London, Frankfurt, and Zurich.

In addition, eurodollars can be traded in the interbank market or through Eurodollar futures contracts on major exchanges such as the Chicago Mercantile Exchange (CME).

The eurodollar market began in the 1950s when European banks began to accept deposits from US companies and individuals.

These deposits were outside of the regulatory control of the US government, which made them attractive to both depositors and banks.

The eurodollar market has grown significantly since then, and today it is the largest market for US dollar-denominated deposits.

Understanding the Eurodollar

Eurodollars are important because they provide a way for companies and countries to borrow US dollars without having to go through the American banking system.

This can be advantageous for borrowers who may not have access to the American banking system or who want to become more tax-efficient when it comes to their interest income.

In addition, eurodollars can be used to hedge against currency risk.

Investors can also participate in the eurodollar market by buying eurodollar-denominated bonds or investing in eurodollar mutual funds.

These investments can provide a way to diversify one’s portfolio and to earn interest income in a foreign currency.

What Is a Eurodollar Deposit?

A eurodollar deposit is a bank deposit of US dollars in a foreign bank or in the foreign branches of an American bank.

The eurodollar market is the global market for these deposits, which can be traded in several global banking hubs.

History of the Eurodollar Market?

The eurodollar market began in the 1950s when European banks began to accept deposits from US companies and individuals.

These deposits were outside of the regulatory control of the US government, which made them attractive to both depositors and banks.

The eurodollar market has grown significantly since then, and today it is the largest market for US dollar-denominated deposits.

What Are the Benefits of a Eurodollar Deposit?

There are several benefits of eurodollar deposits:

- They provide a way for companies and countries to borrow US dollars without needing to go through the US banking system.

- They can help those who don’t have access to the American banking system.

- They can be used to hedge against currency risk.

What Are the Risks of a Eurodollar Deposit?

There are several risks associated with eurodollar deposits:

- The eurodollar market is subject to international political and economic conditions.

- Changes in interest rates can affect the value of eurodollar deposits.

- The eurodollar market is also subject to credit risk, which is the risk that banks won’t be able to repay their deposits.

Eurodollar bonds

Eurodollar bonds serve as funding sources for non-US entities.

They are issued in dollars but are issued and held overseas. As a result, eurodollar bonds are not subject to US taxation.

Interest income from eurodollar bonds is also exempt from withholding tax in most jurisdictions.

Eurodollar bonds are normally issued in denominations of $1,000 or more and have maturities of one year or more.

Eurodollar bonds can be issued by companies, financial institutions, and sovereign governments.

What Is the Difference Between a Eurobond and a Eurodollar Bond?

A eurobond is a bond that is denominated in a currency other than the issuer’s domestic currency.

A eurodollar bond is a type of eurobond that is denominated in US dollars and issued outside of the United States.

What Are the Advantages of Eurodollar Bonds?

There are several advantages of eurodollar bonds:

- They provide a way for companies and countries to raise capital in a foreign currency.

- They can be advantageous for non-US borrowers.

- They can be used to hedge FX risk.

What Are the Risks of Eurodollar Bonds?

There are several risks associated with eurodollar bonds:

- The eurodollar bond market can see adverse changes dependent on global market conditions.

- Changes in interest rates can affect the value of eurodollar bonds.

- The eurodollar market is also subject to credit risk.

- Eurodollar bonds may be less liquid than other types of bonds.

Eurodollar Futures

Eurodollar futures refers to an interest rate product that tracks the fed funds rate.

The eurodollar contract is the world’s most actively traded interest rate product and accordingly are often more favored than fed fund futures.

It is a cash-settled contract that is based on a eurodollar deposit with a maturity of three months.

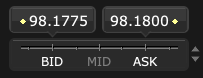

The eurodollar contract is traded on the Chicago Mercantile Exchange (CME).

What Are the Advantages of Eurodollar Futures?

There are several advantages of eurodollar futures:

- They provide a way to hedge against changes in interest rates.

- They can be used to speculate on the direction of interest rates.

- They are highly liquid and have low transaction costs (i.e., narrow bid-ask spreads).

What Are the Risks of Eurodollar Futures?

There are several risks associated with eurodollar futures:

- Changes in interest rates can affect the value of eurodollar futures.

- The eurodollar market is subject to global market conditions.

- The eurodollar market is also subject to credit risk.

- Eurodollar futures may be less liquid than other types of futures contracts.

How Are Eurodollar Futures Used?

Eurodollar futures are used by a variety of market participants, including banks, hedge funds, and retail investors.

They are commonly used to hedge against changes in interest rates and to speculate on the direction of interest rates.

Eurodollar futures are also used as a basis for trading other interest rate products, such as eurodollar options and eurodollar bonds.

Eurodollars to hedge stock portfolios

Traders often use eurodollar futures to hedge their stock portfolios.

Stock prices are broadly a function of two things:

- Earnings, and

- Interest rates

A stock price is a series of future cash flows, with the present value being a function of how they are discounted by future interest rates.

So when interest rates rise, holding all else equal, the present values (prices) of stocks fall.

Accordingly, a trader might want to hedge against price falls in stocks by shorting an appropriate amount of eurodollars to hedge against the possibility of interest rate-driven falls in stocks.

However, a trader will need to be careful because long stocks / short eurodollars is not a perfect hedge.

Stocks may fall because discounted earnings fall. This can also happen as discounted interest rates also fall.

While falling interest rates are a good thing in isolation for stock prices, if earnings fall to a greater extent than the discounted fall in interest rates, stocks will decline at the same time eurodollar futures decline as well.

Moreover, a trader would need to size the position correctly to have appropriate balance.

On top of that, the appropriate maturity or maturities of eurodollars must be used.

A contract less than a few months out may not be a good hedge for interest rate risk because the Fed may already be committed to a certain path for interest rates over that timeframe.

What Is the Difference Between Eurodollar Futures and Eurodollar Options?

Eurodollar futures are a type of derivative contract that tracks the federal funds rate (fed funds rate).

Eurodollar options are a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell eurodollar futures at a specified price on or before a certain date.

What Is the Difference Between Eurodollar Futures and Eurodollar Bonds?

Eurodollar futures are a type of interest rate product that tracks the federal funds rate. Eurodollar bonds are debt instruments that are issued in US dollars and held outside of the United States.

Eurodollar bonds may be issued by companies, governments, or supranational organizations.

What Is the Difference Between Eurodollar Futures and Treasury Bills?

Eurodollar futures are a type of interest rate product that tracks the federal funds rate (fed funds rate). Treasury bills are short-term debt instruments that are issued by the US government.

Treasury bills have a maturity of one year or less.

Eurodollars FAQ

Are Eurodollars in M2?

M2 is the narrowest US monetary/credit aggregate measurement that includes some eurodollar deposits.

M2 includes overnight eurodollar deposits held by US residents other than depository institutions and money market funds at branches of American banks worldwide.

Why are Eurodollars called Eurodollars?

The eurodollar is a dollar-denominated deposit held in a foreign bank.

The eurodollar market began in the 1950s when European banks started accepting deposits from US companies and individuals.

What are Eurodollars used for?

Eurodollars are commonly used to hedge against changes in interest rates and to speculate on the direction of interest rates.

They are also used as a basis for trading other interest rate products, such as eurodollar options and eurodollar bonds.

What is the difference between a Eurodollar and a Euro?

A eurodollar is a dollar-denominated deposit held in a foreign bank. A euro is the currency of the European Union (EU).

Some mistakenly think that Eurodollar refers to the EUR/USD exchange rate.

What is the difference between a Eurodollar and a US dollar?

A eurodollar is a dollar-denominated deposit held in a foreign bank.

A US dollar is the currency of the United States.

What banks accept eurodollars?

Most major banks worldwide accept eurodollar deposits. Some notable examples include HSBC, Barclays, Deutsche Bank, and Citigroup.

What are eurodollar futures?

Eurodollar futures are a type of derivative contract that tracks the federal funds rate.

They are commonly used to hedge against changes in interest rates and to speculate on their direction.

What is the eurodollar futures contract?

The eurodollar futures contract is a type of derivative contract that tracks the federal funds rate.

The eurodollar futures contract is traded on the Chicago Mercantile Exchange (CME).

Who trades eurodollar futures?

Eurodollar futures are traded by a variety of market participants, including banks, hedge funds, retail traders, and individual investors.

How are eurodollar futures traded?

Eurodollar futures are traded electronically on the CME Globex platform. They are also traded on the CME floor via open outcry.

What is the tick size for eurodollar futures?

The eurodollar futures contract has a tick size of 0.0025 percent, or a quarter of a basis point.

What is the tick value for eurodollar futures?

The eurodollar futures contract has a tick value of $25.

Each full rise and fall in eurodollar futures per each one percentage point is equal to $2,500.

Being long eurodollar futures means betting on declines in the expected future fed funds rate.

Being short eurodollar futures mean betting on rises in the expected future fed funds rate.

What is the margin for eurodollar futures?

Initial margin for eurodollar futures is typically 5 to 10 percent of the contract value. Maintenance margin is typically 2 to 5 percent of the contract value.

It may, however, vary from broker to broker.

Do brokers offer trading on eurodollar futures?

Yes, many do. Interactive Brokers is one example.

What hours are eurodollar futures traded?

Eurodollar futures are traded 23 hours per day from Sunday evening through Friday afternoon, from 6 PM Sunday to 5 PM Friday EST.

They are closed for one hour Monday through Thursday from 5 PM to 6 PM EST.

How are eurodollar futures priced?

Eurodollar futures are priced in terms of 100 – the implied interest rate plus a spread.

For example, if the eurodollar future is trading at 99, then the fed funds rate plus the spread at that point in the future is expected to be 100 minus 99, or 1 percent.

If the eurodollar future is trading at 98, then the fed funds rate at that point in the future is expected to be 100 minus 98, or 2 percent. And so on.

Usually when the fed fund rate is priced at 0.00-0.25 percent – the Fed’s lower bound – eurodollars are priced at just over 99.25.

This reflects an extra premium because of credit risk.

Eurodollar futures (CME: GE) chart

(Source: Interactive Brokers)

What is the minimum price movement for eurodollar futures?

The eurodollar contract has a minimum price fluctuation of 0.0025 (0.25 basis points).

This means that eurodollar futures can only move in increments of one-quarter of a basis point.

What is the contract size for eurodollar futures?

The eurodollar contract size is $250,000, given that it’s priced at 100 when the implied interest rate is zero.

What is the delivery month for eurodollar futures?

Eurodollar futures were traded in quarterly increments (March, June, September, December).

Now they are traded in monthly increments out 10 years.

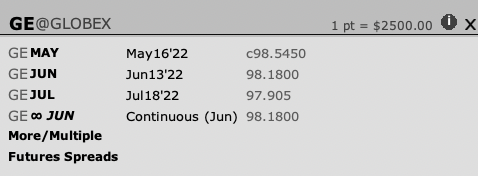

You can see the future pricing of eurodollars as implied by the futures curve.

Example of eurodollar futures curve (10 years)

A trader would interpret the above chart as implying a near-term Fed tightening, followed by a slight easing, and a neutral fed funds rate a little bit above three percent. (A trader must also account for the fact that a credit risk spread is baked into the interest rate.)

Near-term eurodollar futures have more liquidity than those dated further out.

What is the last trading day (expiration date) for eurodollar futures?

The last trading day for eurodollar futures is typically two business days prior to the third Wednesday of the delivery month.

However, this may vary depending on the exchange rules and the underlying fed funds rate.

If eurodollar futures expire on a holiday, they will expire on the business day prior to the holiday.

What is the settlement price for eurodollar futures?

The settlement price for eurodollar futures is the average fed funds rate for the delivery month.

The settlement price is determined by taking a weighted average of the rates quoted by major banks during a 30-minute window on the last trading day.

What happens if I hold eurodollar futures until expiration?

If you are holding eurodollar futures when they expire, your broker will close out your position and settle your account accordingly.

You will either be charged or credited the difference between the settlement price and your original purchase price.

Conclusion

Eurodollar bonds, eurodollar futures, and eurodollar options are all financial instruments that are used to trade or hedge against changes in interest rates.

Eurodollar bonds are debt instruments that are issued in US dollars and held outside of the United States.

Eurodollar futures are a type of derivative contract that tracks the federal funds rate.

Eurodollar options are a type of derivative contract that gives the holder the right, but not the obligation, to buy or sell eurodollar futures at a specified price on or before a certain date.

Each of these instruments has its own advantages and risks that should be considered before trading.