Trading EUR/USD

The EUR/USD represents the world’s two largest economies and is the most traded currency pair. But while rich volatility and volume attract traders worldwide, generating substantial profits is no straightforward feat. This guide will break down the history of the EUR/USD, plus how to trade it in 2025, including online charts, signals, strategies, news and more. We also list the best brokers for trading EUR/USD.

EUR/USD Trading Brokers

Why Trade EUR/USD?

As the most popular of the major forex pairs, the EUR/USD is often highlighted on trading platforms and exchanges. But why do so many traders opt to pursue profits from this pair?

- Liquidity – The EUR/USD promises consistent liquidity, plus low bid-ask spreads.

- Volatility – The huge numbers of active traders and market speculation ensure relatively high levels of volatility. All of which can lead to greater profit potential.

- Prevalence – They are the two most popular reserve currencies. Their size leads to an abundance of financial data on the pairing being released. This also makes them relatively straightforward to follow.

- Availability of resources – In some ways, short and long-term forecasts are now easier to make. You have access to historical graphs, candlestick and monthly charts, plus customizable indicators. Conducting Elliott wave analysis is more straightforward, for example. In addition, you have online active trading communities. These are often full of weekly forecasts and predictions for today.

So, with historical data downloads just a few clicks away and spreads plastered across the internet, intraday traders have plenty of access to the necessary information.

Chart

Drawbacks & Risks

Despite several benefits to trading the EUR/USD pair, there are also certain drawbacks:

- Leverage – Margin trading may increase your potential profit. However, it can amplify losses (regulators such as ESMA warn that leveraged forex and CFD products carry a high risk of rapid losses). So, if you do utilise leverage, it’s vital to have a clear risk-management plan and to understand that even short-term forecasts are highly uncertain.

- Volatility – The high levels of volatility within the EUR/USD can result in winning positions swiftly turning into losing ones. Often, no amount of historical data and 20-year charts can prepare you for the speed at which prices can swing.

- Automated competition – Unfortunately, even with attractive forward and live quotes, competition is now fierce. You are investing against an increasing number of trading algorithms. With your interactive chart, you need to manually analyse and react to a bullish market. However, bots will automatically enter and exit positions once certain criteria have been met.

Influences on EUR/USD Movement

Political Events

A crucial factor is the political landscape. As seen in the Brexit referendum, instability can influence the direction of currencies. Yet it isn’t just major elections that play a part. Changes such as Switzerland’s decoupling from the euro peg hit exchange rates. Global events like the Russia-Ukraine conflict also influenced the EUR/USD because of the extensive impact on the economy.

The challenge comes in keeping an eye on the numerous countries within the eurozone. So, keep track of the latest political and economic news. If you combine recent events with EUR/USD historical data on a simple Excel or interactive chart, it will allow you to make more accurate forecasts for 2025 and beyond.

Economic Growth

Your EUR/USD live analysis makes far more sense if you have a thorough understanding of what influences price trends. Central bank research also highlights the role of interest-rate differentials in driving EUR/USD movements.

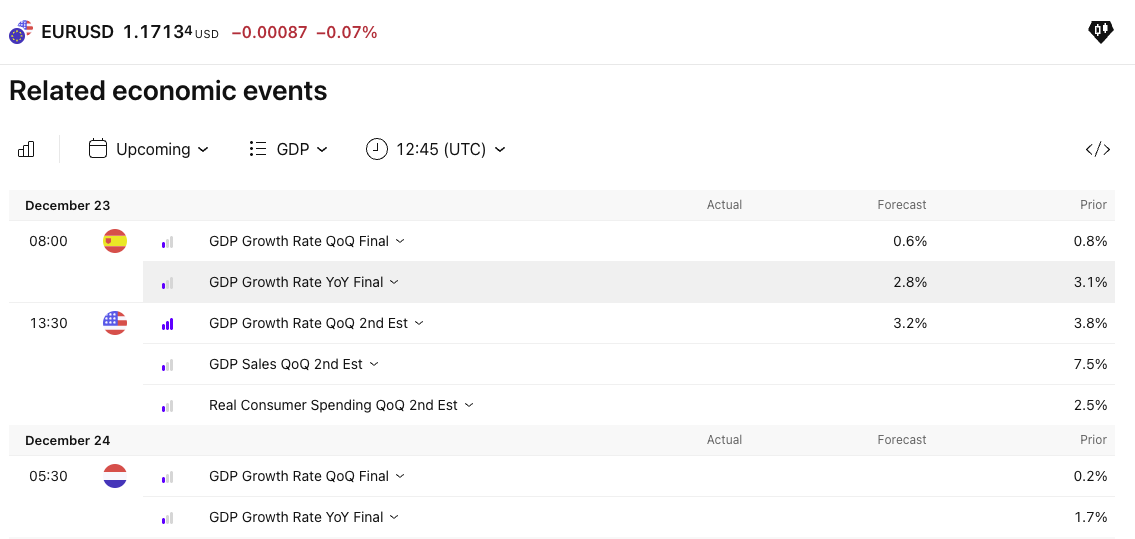

The biggest factor is the strength and outlook of the two economies. You can track this using official macro data such as GDP growth, unemployment and inflation from institutions like the World Bank and IMF. If the European economy grows faster than the US economy, the euro tends to strengthen against the dollar over time, and vice versa, although other factors can dominate in the short run.

Interest-rate differentials also matter. When US interest rates rise relative to those in the euro area, that often coincides with a stronger dollar against the euro, although the relationship is not one-to-one.

Monetary Policy

There is also a correlation between the monetary policy implemented by the respective central bank and the EUR/USD relationship.

Today, many that are investing focus on projections and expectations of central bank policy, using sources like the ECB and the Federal Reserve, to help them form strategies around the EUR/USD.

Currency Correlations

While you focus your trading efforts on the EUR/USD, there are specific correlations with other currencies to be aware of. You will notice that some feature in numerous forex pairings. This is because all currencies are interlinked—none of them trade entirely independently of each other.

Their relationships are known as positive and negative correlations:

- Positive correlation – This is when currency pairs react in line with each other. The three most popular pairs, GBP/USD, AUD/USD, and EUR/USD, are all positively correlated due to the USD being the counter currency. So, any change in the US dollar will impact all the pairs.

- Negative correlation – Occurs when they react in the opposite direction. Popular pairs include USD/CHF, USD/JPY, and USD/CAD. Here, the US dollar is the base currency. This means they move in the opposite direction of the previously mentioned majors, where the US dollar plays the counter.

Application

A EUR/USD trader can use this knowledge to better understand the implications of movement in certain pairs. Let’s take the British Pound vs the US dollar, for example. When trading this pair, to an extent, you are also trading the Euro vs the British pound.

Of course, it isn’t quite that straightforward. Economic factors and market speculation can result in shifts in currency correlations. A negative correlation may turn positive and vice versa. Still, it remains a useful indicator that can inform trading decisions.

EUR/USD Trading Strategy

An effective EUR/USD strategy is more than understanding how you can use pip values and calculators to your advantage, or even getting a feel for premarket sentiment. It is about using your investing chart in real-time to consider tick data and weigh up your options.

Timing

Once you have a solid grasp of how EUR/USD market forces interact, you will need to turn your attention to a strategy. 5-minute, 30-minute, weekly, and all-time charts may prove useful, but knowing when to trade is just as important.

Part of the attraction of forex day trading is that you can buy and sell 24 hours a day. But while this is true, it doesn’t mean you should. Instead, you want to trade when the EUR/USD pair is active, with plenty of volume and volatility.

For example, when London and Europe are open for business, pairs that feature the British Pound and the euro are more actively traded. If you are day trading with EUR/USD, volume charts show the most active period is when both London and New York are open. London is typically active from about 08:00 to 16:00 UK time, and New York from about 13:30 to 20:00 UK time, so the most liquid overlap for EUR/USD is roughly early afternoon UK time.

The danger is, if you invest at the wrong times, the cost of spreads and commissions can cancel out your profits. So, many suggest only trading within a three to four-hour window.

Ideal Window

So, when is the best time to day trade EUR/USD binary options, futures and other instruments?

In practice, many intraday EUR/USD traders focus on roughly 12:00–16:00 UK time, when both London and New York desks are busiest, and spreads are usually tightest. This three-hour window is when London and New York are both open. Volume from both markets means spreads are normally tightest during this window.

This is also when forex forums come alive, and you will see the biggest daily moves. All of the above factors can result in the greatest profit potential. So, while it may be tempting to respond to every buy-sell signals you see today, resistance may prove sensible.

Try not to let graph and market noise pressure you into trading on 12-hour intraday forecasts. Focus on what you know and ensure volume validates any potential moves.

Buying & Selling the Breakout/Breakdown

EUR/USD live charts and technical analysis will be needed to succeed with this strategy. You will find the pair swing back and forward within boundaries for considerable periods. This creates clear trading ranges, which should lead to new trends, higher or lower.

Bide your time during the consolidation phases. The reward could be low-risk trade entries when you spot that resistance and support levels ultimately break, leading to a rally or sell-off.

This technique relies on timing. Enter your position too early, and you may find the range holds and a reversal is triggered. Go in too late, and your risk increases as the position may execute above new support or below new resistance.

Narrow Range Patterns

You will frequently see the pair climb or drop into a substantial barrier and then fall dormant, creating narrow price range bars, leading to minimal volatility. This also results in powerful entry signals for breakouts and breakdowns.

So, enter your position within the narrow range pattern, placing a tight stop to prevent losses from a major reversal.

The benefits of this method are that the straightforward pattern often predicts that price bars will increase in significant breakouts and breakdowns. In addition, it’s low risk as you can place stop losses close to the entry price.

When it comes to day trading EUR/USD, different strategies work for different people. Some prefer using pivot points, swap points, and forward curves; others will focus on trading around forex news announcements. Whether you opt for chart investing or not, though, be patient; perfecting a strategy takes time.

Role of the US Dollar

The EUR/USD-related index you look at today will have been shaped to some extent by the unique role the US Dollar has played over the years. These are just a few of the reasons it has grown to become the world’s most important currency:

- The quoted live price of gold and other commodities is often set in US dollars.

- The Organization of Petroleum Exporting Countries (OPEC) also conducts transactions in US dollars.

- Considered the world’s reserve currency, it is widely used to settle international trade and financial transactions.

- Many small countries will peg their currencies’ value to that of the US Dollar, whilst global banks will hold a large portion of currency reserves in US Dollars.

- It is the most featured currency in popular pairs, so as an aspiring forex trader, you need a solid understanding of what drives the US economy to predict where the US Dollar will go.

Role of the Euro

The European Union is the second biggest economic region, only overtaken by the USA. Its nominal GDP is around $16.5 trillion for the euro area and roughly $19.4 trillion for the wider European Union, making Europe the world’s second-largest economic region after the United States.

But what some don’t realize when they look at their EUR/USD live chart is that services and manufacturing predominantly drive the Euro’s growth. As such, when economic activity slows in the EU, the Euro usually weakens.

The euro is used by 20 of the EU’s 27 member states, covering about 350 million people as of 2025. As its popularity has grown, so have the implications of economic and political events in the EU. So, whilst many traders focus on the catalysts behind the US Dollar, to be a successful FX trader, the Euro also warrants your attention.

History

Wind back the clock twenty years, before the mini futures and binary options of today, and the forex markets were a different place. It was the German Deutschmark vs US dollar, plus the French Franc vs US dollar, that dominated the scene.

However, January 1st 1999 set the wheels in motion for foreign exchange history. But the road to the Euro had been paved decades before that.

There existed two earlier versions of the Euro, both were internal accounting units for European Community (EC) members. They were:

- European unit of account

- European currency unit (ECU)

Neither were ‘real’ pairs. They were groups of specific EC currencies, engineered to help stabilize European exchange rates. Together, they helped form the EUR/USD we all know today.

The ECU section of currencies had a somewhat alternative makeup to those that were to form the Euro. But the ECU still played a key part in the historical exchange rate of the Euro. The value of one Euro was set as the value of one ECU, when it was first created on January 1st, 1999. So, the initial EUR/USD exchange rate was 1.1686.

Despite this, the Euro wasn’t to become a physical currency until 2002. However, the 1999 launch brought all the eurozone currencies together, including:

- Italian Lira

- French Franc

- Spanish Peseta

- German Deutschmark

It was at this point that they stopped having separate, floating historical foreign exchange rates. They were bundled together until they were engulfed in the currency of today.

EUR/USD history data and opinion of the time showed many had expectations the Euro would steal the Dollar’s unofficial title as the global reserve currency. However, this is a mountain it has yet to climb.

Key Dates

Taking into account the biggest previous events that triggered substantial volatility and monitoring the EUR/USD today, you may be able to better forecast price movements. Here are some of the most important periods for the pair in recent history:

- Dot-com bubble – 1997-2001 saw speculation that rocked the EUR/USD relationship. It took years for the dust to settle and stability to arrive.

- Real estate bubble – The bubble was thought to be a key driver of the 2007-2009 recession that was hugely damaging to the US economy.

- European debt crisis – The impact of the European Debt crisis is still remembered today; it had a significant impact on the relationship between the two currencies.

- Trump’s election – On the 20th of January 2017, Trump was inaugurated as the US president, which boosted the value of the dollar.

- Russia-Ukraine war – Following Russia’s invasion of Ukraine in 2022, the euro slid below parity with the US dollar and fell to its weakest levels in roughly two decades, before later recovering, as investors sought the relative safety of the dollar.

EUR/USD exchange rate history and data demonstrate the effect of central bank action on prices. So, perhaps those that analyze the Federal Reserve System will be more able to accurately predict fluctuations in the world’s most popular currency pairing.

On top of the factors highlighted in the timeline above, conflicts, elections and output levels have all influenced the EUR/USD in the past.

Final Word on Trading EUR/USD

When day trading the EUR/USD, you should take into consideration fundamental and technical analysis. Economic data releases, central bank statements, and the latest news are just a few considerations your strategy could take into account.

If you want to join the likes of Andrew Krieger and Bill Lipschutz in the forex hall of fame, you will also need to trade at the right time. You may be able to trade 24 hours a day, but the quality of trades often trumps quantity.

For more day trading guidance, see our forex page.

FAQs

Where Can I Find EUR/USD Signals Today?

Websites like TradingView provide an excellent look at today’s price, alongside market signals. See our guide to forex trading signals for our top picks.

What Does EUR/USD OTC Trading Mean?

Unlike trades that are executed on a formal exchange, OTC positions are agreed and settled directly between participants in a decentralised broker-dealer network.

When Did The EUR/USD Originate?

The EUR/USD pair came into being on 1 January 1999, when the euro was introduced as a book currency for 11 founding euro-area countries, replacing their national currencies in wholesale and financial markets.

What Affects The EUR/USD?

Political events, wars, governmental policies, and production are some of the most influential factors. One notable example is the Russian-Ukrainian conflict, which coincided with the euro falling below parity and hitting its lowest levels against the dollar since the early 2000s.

Why Is The EUR/USD So Important?

The USA and Europe are the top economic areas in the world. As a result, many countries peg their currency to that of the Euro or Dollar, causing an interlinking between FX pairs. This also makes it popular with retail forex investors.