Ed Seykota Trading Strategy & Philosophy

Ed Seykota is a trader most known for his work with automated, systematic trading and the futures market.

Famous for his feature in Market Wizards where author Jack Schwager wrote that his “achievements must certainly rank him as one of the best traders of our time,” Seykota began trading in the 1970s, at a time when computerized trading was still in its infancy, and developed one of the first commercially successful trading systems.

His strategies, which emphasize trend following, risk management, and psychological discipline (from adhering to predefined rules), have become commonplace among systematic market practitioners today.

Key Takeaways – Ed Seykota Trading Strategy & Philosophy

- Who Is Ed Seykota? – Ed Seykota is a commodities trader known for pioneering computerized trading systems and trend following strategies.

- Embrace Trend Following – Seykota’s philosophy centers on riding trends with a systematic approach. He allows winners to grow while strictly limiting losses.

- Prioritize Risk Management – He emphasizes quantifiable risk management, advocating for small position sizes and swift exits on losing trades to preserve capital.

- Stick to Your System – Consistent rule adherence is key. Seykota stresses that traders should find or develop a compatible trading system and follow it without deviation.

- Use Automated Systems – Seykota is often considered the guy who got the entire quant trading trend started. He pioneered computerized trading systems to reduce emotional biases, which marked an important shift toward algorithmic trading and systematic decision-making.

- Balance Psychology with Technique – Success in trading requires both technical skills and emotional control, and Seykota encourages self-awareness to handle market fluctuations.

Early Career and Initial Struggles

The Start in Futures Trading

Ed Seykota entered the futures market in the early 1970s with an electrical engineering background and an interest in financial markets.

At first, like all traders, he encountered setbacks – Seykota’s predictions didn’t always align with the market, which taught him the value of systematically studying market trends rather than relying solely on intuition.

It was during this period that he discovered Richard Donchian’s work* (most known today for Donchian channels) on mechanical trend-following systems, an approach he initially doubted but soon began testing.

* Donchian’s work involves 5- and 20-day moving averages to spot trends.

Creation of a Systematic Approach

Inspired by Donchian’s insights, Seykota created one of the first computerized trading systems by leveraging computational frameworks to test and refine trend-following strategies.

His initial position as an analyst with a brokerage firm limited his access to the company’s technology, leading him to quit after just a month.

However, Seykota’s interests led him to a new role that allowed him access to the computer resources he needed.

Over time, he developed a unique, systematic approach that would become his claim to fame, focusing on a disciplined execution of rules rather than reliance on discretionary market timing or hunches.

All of this was much different than the security analysis approach – buying stocks and bonds based on their fundamental strength – that was common in the 1970s.

The Trading System That Changed Futures Trading

The Power of Trend Following

Seykota’s trading system centered around trend following, an approach where traders align themselves with ongoing market trends.

He demonstrated that by adhering to a set of strict technical criteria, traders could potentially profit over the long term, regardless of short-term fluctuations.

He was known for taking charts, taping them to a wall, then going on the opposite side of the room to see the trend. That then became the basis of his market bias.

He focused on moving averages and other indicators to capture these trends and embraced the “ride your winners” mindset using trailing stops, a principle that emphasizes maximizing gains by allowing profitable positions to grow.

In addition to moving averages, he also uses momentum oscillators and volume indicators.

Impact of Computerized Trading

Using IBM’s advanced technology at the time, Seykota developed a computerized system that allowed him to automate trading decisions, removing emotional biases.

His systems used exponential moving averages and other indicators to determine optimal entry and exit points.

This approach enabled Seykota to take calculated risks while cutting losses quickly – essentially setting a standard in both trend-following strategies and risk management.

Key Principles of Seykota’s Trading Philosophy

Principle #1: Cutting Losses

Central to Seykota’s strategy is the principle of cutting losses swiftly.

In his philosophy, protecting trading capital is paramount, and exiting losing trades is the first rule in achieving long-term success.

For example, if a market falls 2%, a value investor might then prefer to buy more of the asset if their thesis remains intact.

Seykota, on the other hand, might believe that invalidates his analysis and prefer to be out of the position.

Seykota emphasized that every trader will face losses, but by maintaining a strict stop-loss discipline, these losses could be minimized and absorbed within an overall profitable strategy.

Principle #2: Riding Winners

Seykota’s approach encourages traders to let winning trades run to capture full profit potential.

Allowing profitable positions to grow, Seykota’s strategy tries to balance out smaller losses, so that a few high-performing trades can drive overall profitability.

This principle aligns closely with his trend-following philosophy, where traders are encouraged to follow market momentum rather than attempt to predict reversals.

Principle #3: Small Bets and Risk Control

Seykota advocates for keeping individual trade sizes modest, a practice that reduces emotional influence and limits exposure.

Controlling the size of each position, traders can maintain discipline and avoid emotion overruling their logic.

Traders should bet so small that each individual trade should not matter that much.

Seykota also suggests that traders should only risk amounts that will have a meaningful impact but not jeopardize their financial stability.

Principle #4: Adhering to Rules

The consistent application of rules forms the backbone of Seykota’s philosophy.

Trading is hard and there are many aspects of it that humans are generally not very good at – e.g., thinking probabilistically, dealing with the emotions of trading, following logic in a consistent way.

He emphasizes that traders should develop a compatible system and strictly follow its rules without deviation, as emotions can often lead to destructive decision-making.

So, even when facing temporary losses, as adherence to the system is key to long-term profitability.

Ed Seykota Quotes

Quotes can be a great way to learn somebody’s trading strategy and philosophy.

Rather than relying on a third party, you can hear from them directly.

We’ve compiled a list of Seykota’s quotes:

“Win or lose, everybody gets what they want out of the market. Some people seem to like to lose, so they win by losing money.”

This quote reflects Seykota’s belief that traders’ underlying desires – often unconscious – shape their outcomes in the market.

“Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.”

Seykota emphasizes the importance of aligning a trading system with one’s own style.

A compatible system is easier to follow and aids in consistent adherence.

There are many viable ways to do things.

“The trend is your friend except at the end where it bends.”

This highlights Seykota’s view that traders should follow market trends but stay alert for signs of trend reversal.

This is why Seykota uses trailing stops.

“The elements of good trading are cutting losses, cutting losses, and cutting losses.”

Seykota’s philosophy revolves around minimizing losses as the cornerstone of successful trading.

“The markets are the same now as they were five or ten years ago because they keep changing just like they did then.”

He reminds traders that while markets evolve, the nature of change itself remains consistent.

It also goes for Seykota’s own philosophy.

It’s useful to learn from the traders who came through in the 1970s and 80s (and before and after), but ultimately everyone’s style will evolve and will have to.

“To avoid whipsaw losses, stop trading.”

Seykota suggests that sometimes, stepping away from trading is the best way to avoid erratic market-induced losses.

If you aren’t getting viable signals, then simply don’t trade.

“Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. If there is no such amount, don’t play.”

He advises a balanced approach to risk, so that trades are significant enough to matter but not financially threatening.

A general rule is 1% of your trading balance committed to any given trade.

Also, watch correlations so you don’t have on many trades that are essentially the same.

“Pyramiding instructions appear on dollar bills. Add smaller and smaller amounts on the way up. Keep your eye open at the top.”

This emphasizes controlled scaling of trades in a trend, with caution as you begin to max out a position.

Don’t get overly exposed on a position.

For Seykota, this was about 5% of his account balance.

“Markets are fundamentally volatile. No way around it. Your problem is not in the math. There is no math to get you out of having to experience uncertainty.”

Seykota warns that no calculation can eliminate market uncertainty, and traders must accept inherent volatility.

These days quants use stochastic models and understand things in terms of probability distributions that account for randomness and variance in markets.

“It can be very expensive to try to convince the markets you are right.”

Seykota advises traders to adapt to the market rather than attempt to force a particular view on it.

“I don’t think traders can follow rules for very long unless they reflect their own trading style. Eventually, a breaking point is reached and the trader has to quit or change or find a new set of rules he can follow. This seems to be part of the process of evolution and growth of a trader.”

This quote reflects Seykota’s belief that traders need a system that resonates with their personal trading style to maintain discipline and longevity.

Also, your trading style and criteria will change over time.

This is the natural process of evolution.

“Our work is not so much to treat or to cure feelings, as to accept and celebrate them. This is a critical difference.”

Seykota underscores the importance of acknowledging and embracing emotions, rather than suppressing them.

He knows that fear/greed/anger might be part of the process – just not letting it affect your trading.

“When a feeling dissolves, it ceases to be your enemy and begins to be one of your allies.”

This emphasizes that emotional clarity, once achieved, can become a supportive aspect in a trader’s decision-making.

“Fundamentals that you read about are typically useless as the market has already discounted the price, and I call them ‘funny-mentals’. However, if you catch on early, before others believe, you might have valuable ‘surprise-a-mentals’.”

Seykota explains that widely known fundamentals often lose relevance, but early insights before others catch on can provide an edge.

“If you can’t measure it, you probably can’t manage it… Things you measure tend to improve.”

He stresses the importance of measurement for management and improvement in trading.

He believe that trading should not be based on hunches or intuition – especially intuition that isn’t well-developed and backed by a track record of success.

“The key to long-term survival and prosperity has a lot to do with the money management techniques incorporated into the technical system.”

This reflects Seykota’s belief that sound money management is essential for enduring success in trading.

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right.”

Seykota illustrates the futility of fighting market forces, likening the market to ocean waves that should be observed rather than controlled.

And especially for larger traders, their size can actively move the market against them.

“Before I enter a trade, I set stops at a point at which the chart sours.”

Seykota stresses the importance of pre-determined stop losses to manage risk before a trade is executed.

What price level would invalidate his trade?

That’s where his stop-loss is placed.

“Trading requires skill at reading the markets and at managing your own anxieties.”

Technical market knowledge and emotional control are both important.

“The positive intention of fear is risk control.”

Seykota views fear as a helpful emotion, guiding traders toward prudent risk management.

“Speculate with less than 10% of your liquid net worth. Risk less than 1% of your speculative account on a trade. This tends to keep the fluctuations in the trading account small, relative to net worth. This is essential as large fluctuations can engage {emotions} and lead to feeling-justifying drama.”

He advises conservative speculation to keep emotions in check and maintain account stability.

“Trying to trade during a losing streak is emotionally devastating. Trying to play ‘catch up’ is lethal.”

Seykota warns that trying to recover from losses by increasing risk can lead to compounding failures.

“The elements of good trading are 1, cutting losses. 2, cutting losses. And 3, cutting losses. If you can follow these three rules, you may have a chance.”

He reiterates the paramount importance of cutting losses for survival and success in trading.

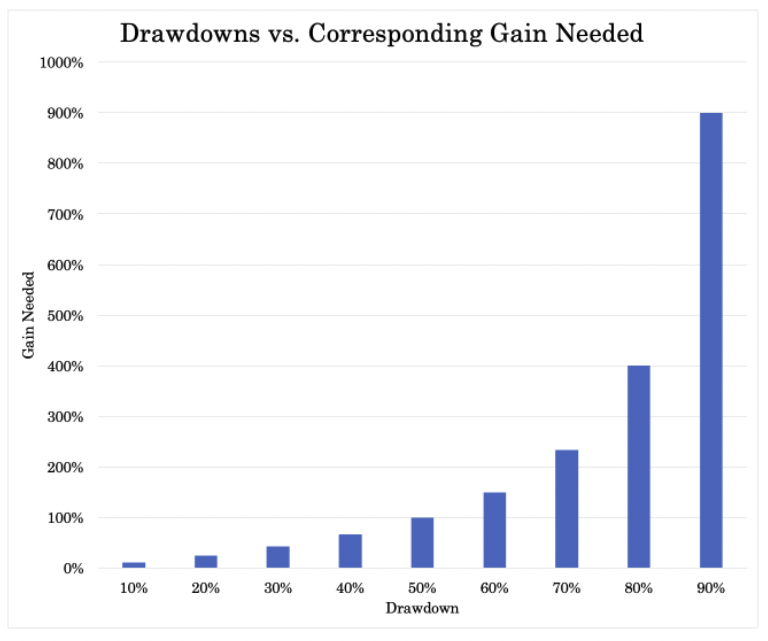

Everything boils down to not letting your drawdowns go too far.

For example, if you lose 10%, you need an 11% gain to get back to breakeven.

But if you lose 25%, you need 33%. If you lose 50%, you need 100%.

There’s a compounding effect, as shown in the chart below.

“Losing a position is aggravating, whereas losing your nerve is devastating.”

Seykota cautions that emotional resilience is more critical than any single trade loss.

“Luck plays an enormous role in trading success. Some people were lucky enough to be born smart, while others were even smarter and got born lucky.”

He acknowledges that both skill and luck have substantial roles in a trader’s success.

Control what you can control and take ownership over your results.

“Having a quote machine is like having a slot machine at your desk – you end up feeding it all day long. I get my price data after the close each day.”

Seykota advocates for disciplined trading by limiting exposure to constant price updates.

He believe there’s too much noise in intraday data and prefers longer-term time horizons.

He was more of a swing trader and position trader.

“A losing trader can do little to transform himself into a winning trader. A losing trader is not going to want to transform himself. That’s the kind of thing winning traders do.”

He asserts that personal transformation and the will to improve differentiate winning traders from those who don’t.

Self-awareness is key.

“If you can’t take a small loss, sooner or later you will take the mother of all losses.”

Seykota stresses the importance of accepting small losses to avoid disastrous ones in the future.

This gets back to cutting losses.

“Risk no more than you can afford to lose, and also risk enough so that a win is meaningful.”

He emphasizes balanced risk-taking where potential losses are bearable, and potential gains are rewarding.

“Dramatic and emotional trading experiences tend to be negative. Pride is a great banana peel, as are hope, fear, and greed. My biggest slip-ups occurred shortly after I got emotionally involved with positions.”

Seykota warns of the dangers of emotional attachment to trades, which often leads to mistakes.

“Be sensitive to subtle differences between ‘intuition’ and ‘into wishing’.”

He advises traders to distinguish between genuine insight and hopeful thinking.

Get in the habit of writing down your criteria and measuring in an objective way, not going off opinions.

“The trading rules I live by are 1. Cut losses. 2. Ride winners. 3. Keep bets small. 4. Follow the rules without question. 5. Know when to break the rules.”

This gets at Seykota’s core trading guidelines, balancing discipline with adaptive flexibility.

#5 is part of the process of evolution, no matter what business or undertaking you do.

“Fundamentalists figure things out and anticipate change. Trend followers join the trend of the moment. Fundamentalists try to solve their feelings. Trend followers join their feelings and observe them evolve and dissolve.”

Seykota contrasts fundamental analysis with trend following, emphasizing that trend followers align with the market as it currently is rather than as they believe it should be.

“The feelings we accept and enjoy rarely interfere with trading.”

He highlights that embracing emotions rather than fighting them reduces their potential negative impact on trading decisions.

“It can be very expensive to try to convince the markets you are right.”

Seykota cautions traders against fighting market movements, as the cost of stubbornness can lead to large losses.

This goes back to the waves analogy where your hand has no influence on the waves in the ocean.

“There are old traders and there are bold traders, but there are very few old, bold traders.”

This timeless adage warns that reckless risk-taking can jeopardize a trader’s longevity in the market.

Risk management is key to lasting a long time.

“I would add that I consider myself and how I do things as a kind of system which, by definition, I always follow.”

Seykota regards himself as a system, continually adhering to his principles as a way to achieve trading success and consistency.

“Systems trading is ultimately discretionary. The manager still has to decide how much risk to accept, which markets to play, and how aggressively to increase and decrease the trading base as a function of equity change.”

He acknowledges that even systematic trading requires human judgment in risk management, market selection, and position scaling based on account performance.

“I usually ignore advice from other traders, especially the ones who believe they are on to a ‘sure thing’. The old-timers, who talk about ‘maybe there is a chance of so and so,’ are often right and early.”

He values cautious insights from experienced traders over confident but speculative advice.

This gets into the idea that experienced traders engage in probabilistic thinking.

“I set protective stops at the same time I enter a trade. I normally move these stops in to lock in a profit as the trend continues. Sometimes, I take profits when a market gets wild. This usually doesn’t get me out any better than waiting for my stops to close in, but it does cut down on the volatility of the portfolio, which helps calm my nerves. Losing a position is aggravating, whereas losing your nerve is devastating.”

Seykota shares his approach to protecting gains while managing emotional stability in turbulent markets.

“I intend to risk below 5 percent on a trade, allowing for poor executions.”

He practices strict risk limits, factoring in possible execution errors.

And he might start a trade with much less than that, but build up to a larger position over time.

“I don’t judge success, I celebrate it. I think success has to do with finding and following one’s calling regardless of financial gain.”

Seykota believes that true success is about aligning with one’s purpose, beyond financial rewards.

“Acting out this drama could be exciting. However, it also seems terribly expensive. One alternative is to keep bets small and then to systematically keep reducing risk during equity drawdowns. That way you have a gentle financial and emotional touchdown.”

He advises gradually reducing risk during down periods to manage both financial losses and emotional stress.

“In order of importance to me are: 1) the long-term trend, 2) the current chart pattern, and 3) picking a good spot to buy or sell.”

Seykota ranks trend following and chart analysis as his primary methods for trading.

“If I am bullish, I neither buy on a reaction nor wait for strength; I am already in. I turn bullish at the instant my buy stop is hit and stay bullish until my sell stop is hit. Being bullish and not being long is illogical.”

He emphasizes that his trading aligns with his convictions, maintaining positions through them.

The Psychological Aspect of Seykota’s Philosophy

Understanding Trading Psychology

Seykota’s philosophy is as much about psychology as it is about numbers.

He understood early on that a trader’s mindset impacts performance (unfortunately, usually in a bad way).

His teachings encourage traders to be aware of their emotions, avoiding impulsive decisions that can undermine strategic goals.

Seykota’s focus on self-awareness, risk tolerance, and stress management has influenced countless traders, emphasizing that mastering one’s mind is as important as mastering market mechanics.

Emotional Discipline

Maintaining emotional discipline allows traders to respond to market volatility without panicking or deviating from their plan.

This is where a more systematic approach comes in to keep the harmful emotions out of the process.

Self-Awareness and Stress Management

Seykota believes that understanding one’s own emotional responses to market movements can help prevent irrational decisions.

With self-awareness, traders can recognize psychological triggers and manage stress effectively, leading to more disciplined and ultimately successful trading practices.

Ed Seykota’s Influence on Risk Management

Revolutionizing Risk Management Techniques

Seykota set a new standard for risk management in trading, advocating for quantifiable risk parameters over subjective judgment.

By meticulously setting stop losses and enforcing strict position-sizing rules, Seykota demonstrated the power of objective risk control in preserving trading capital.

His insistence on controlling risk is a foundational principle in modern trading.

Modern Approaches to Capital Preservation

Seykota’s strategies prioritize capital preservation through conservative position sizes and systematic loss-cutting.

Before this, investing was more about buying stocks and bonds and holding them, basically letting the portfolio do whatever it does.

Cutting losses was seen as illogical as it meant the securities were cheaper (just as a farmer might buy more farmland if the price went down or you might be inclined to buy a house if it’s less expensive).

Trading was considered akin to speculation and still not taken that seriously.

Seykota encourages traders to risk only a small percentage of their capital on each trade, a method that allows traders to endure losses without facing catastrophic financial setbacks.

Not every trade will work, but the winners should more than pay for the losers.

Automated Trading Systems and Algorithmic Innovations

Development of Algorithmic Systems

Ed Seykota’s belief in algorithmic trading have left a lasting impact on the financial markets.

By creating a system that could process vast amounts of data, Seykota brought more objectivity to trade execution, reducing human bias.

His computerized systems enabled traders to enter and exit trades with unprecedented speed and precision.

This helped set the stage for modern algorithmic trading.

Key Elements of Seykota’s System

- Computerized Moving Averages – Seykota’s systems used exponential moving averages to smooth out price fluctuations, identifying trends with greater accuracy.

- Rules-Based Trading – His algorithms eliminated emotional biases, relying on pre-set rules to execute trades.

- Backtesting – Seykota’s system rigorously tested trading strategies against historical data, refining entry and exit points.

- Streamlined Trade Execution – Seykota achieved more consistent and reliable trade execution by automating it.

The Legacy of Seykota’s Algorithmic Approach

His systems laid the groundwork for quantitative trading, emphasizing the importance of data over intuition.

Seykota’s influence is visible today in the use of algorithmic trading strategies across global markets, where consistency, speed, and data-driven decisions are how many firms operate.

Mentorship and Influence on Future Traders

Through his Trading Tribe, Seykota created a platform for traders to explore the psychological challenges of trading.

He mentored traders not only on technical analysis but also on building psychological resilience.

His philosophy has inspired many modern trading mentors, who now integrate psychological training into their coaching programs.

Conclusion

Ed Seykota’s contributions to trading are both technical and philosophical.

His systematic approach to trend following, combined with a deep understanding of risk management and trading psychology, is the foundation that a lot of modern trading is based on.

Seykota’s insistence on maintaining emotional discipline and adhering to set rules has influenced trading philosophy since the 1970s.

His legacy endures in the trading systems, risk management techniques, and psychological insights that have reshaped modern finance.