11+ Options Strategies for Synthetic Leverage (Cost-Effective)

Options strategies are often used for synthetic leverage.

They help us get exposure to the underlying asset without having to transact in the underlying market.

Traders use options to, for example:

- have a customized and/or defined-risk trade structure

- help them leverage their positions – i.e., get exposure to a higher amount of notional than would otherwise be possible trading the underlying

- avoid certain fees (e.g., shorting costs, margin interest)

Below we have several creative options strategies to gain exposure to a stock, security, or asset as a form of synthetic leverage.

Note: We assume in all of our examples that the underlying is a security with an underlying price of 100 (unless otherwise specified).

For all of our payoff diagrams, the orange line shows payoffs at expiration. The blue line is just an estimated short-term payoff curve, showing the inherently non-linear nature to it.

Key Takeaways – Options Strategies for Synthetic Leverage

- Different options strategies for synthetic leverage are provided below.

- Choose trade structures that align with your expectations of the underlying’s price movement and volatility.

- Be mindful of how structures and variations alter your maximum loss potentials and breakeven points.

Strategy #1: Capturing the Fat Part of the Distribution

Some traders don’t want just a linear exposure to the market because it isn’t customized to the specific part of the distribution of outcomes that they want.

So they can tailor it with this example setup:

- Buy OTM Puts

- Sell ATM Calls

- Sell ITM Puts

Rationale for this Trade Structure

This provides the trader with a net credit at the outset from selling more moneyed premium (ATM calls and ITM puts) and buying OTM premium for prudent hedging purposes.

If the trade goes against us, we have the OTM puts and ATM calls working for us (and ITM puts working against us). If it goes in our favor we’ve got the ITM puts working for us – up to a certain level (and OTM puts and ATM calls going against us).

Below we have examples done on a real-life SPY market.

This structure is designed to capture the typical tailwind associated with stocks (called “drift” in mathematical terms) or the positive expected risk premia associated with them, while also protecting against their occasional plunges.

Trade-Offs

But everything has a trade-off…

We do leave open the possibility of a strong bullish move (25%+ yearly move) causing us losses.

For example, a +30% year would cause the same losses as a -30% year.

But we may not want this because we’d prefer the trade-off of having capped losses in our left tail and gains when the underlying has mild losses or mild/decent gains (0-20%).

It’s all trade-offs and we’re simply customizing to our preferences.

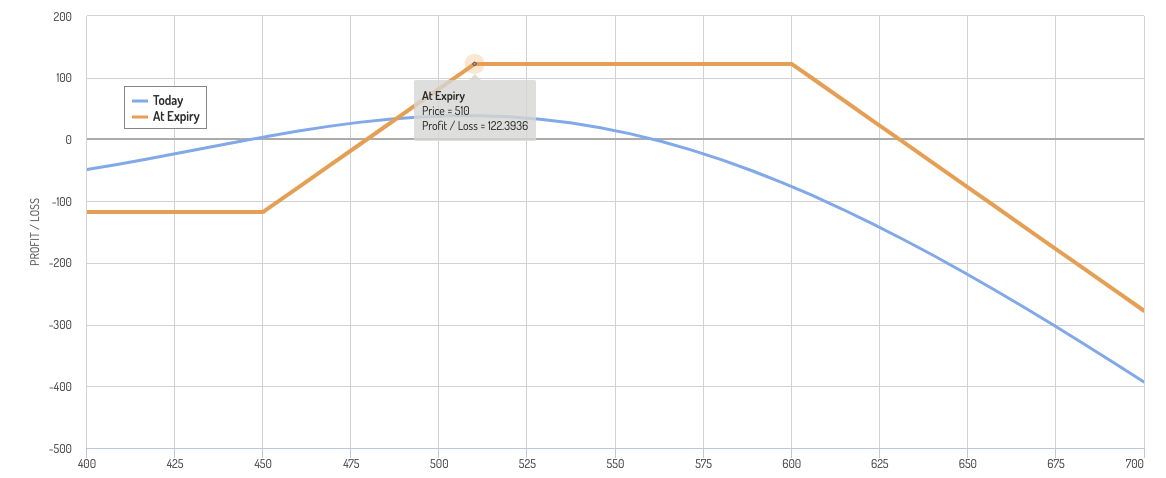

Let’s look at our examples. These are real-world SPY examples where 510 is our underlying price. (Starting with our next strategy, 100 will be the assumed underlying price.)

Example #1

- Buy 4 OTM Puts

- Sell 4 ATM Calls

- Sell 4 ITM Puts

Modifications can be made to this to the extent of the trader’s bullishness.

For example, if we sell an extra ITM put, we can see how the structure starts tilting more bullish (to an extent).

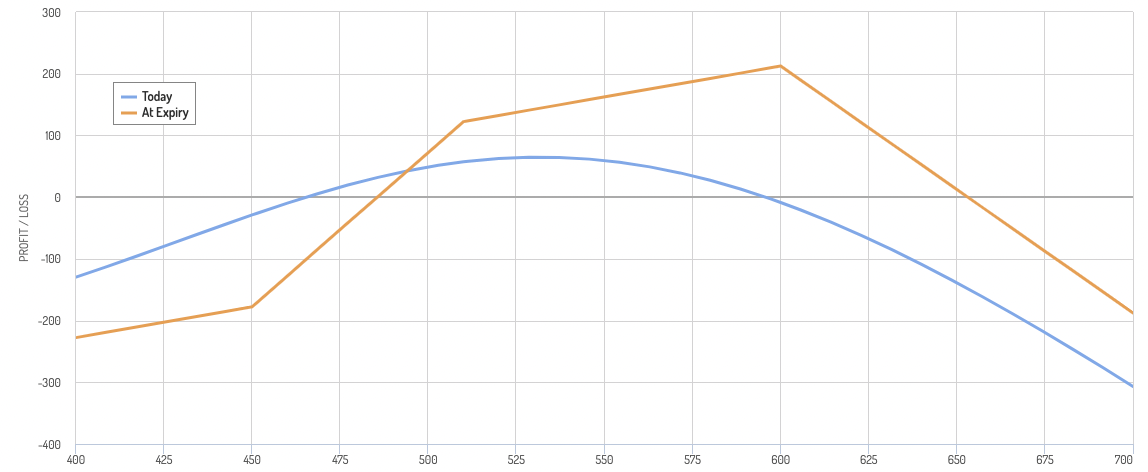

Example #2

- Buy 4 OTM Puts

- Sell 4 ATM Calls

- Sell 5 ITM Puts

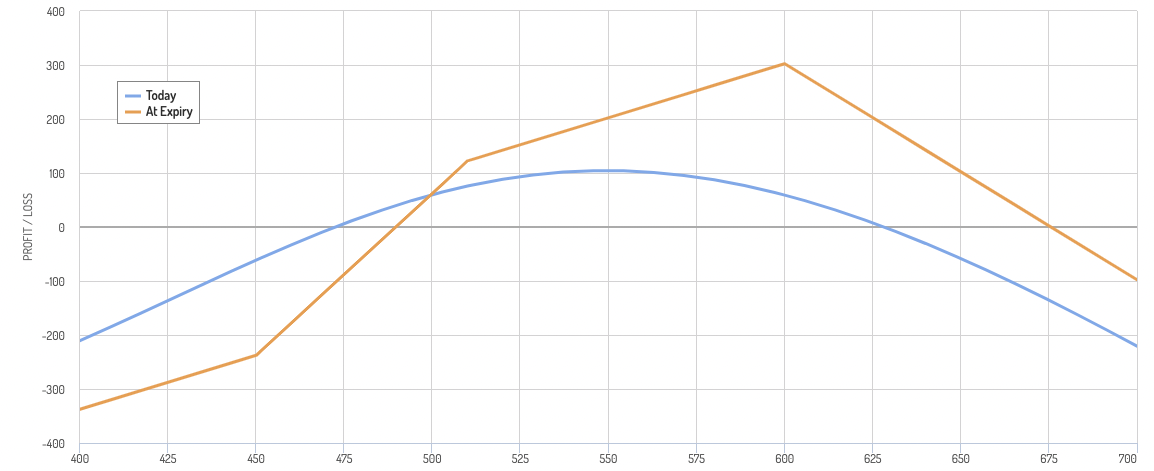

Example #3

- Buy 4 OTM Puts

- Sell 4 ATM Calls

- Sell 6 ITM Puts

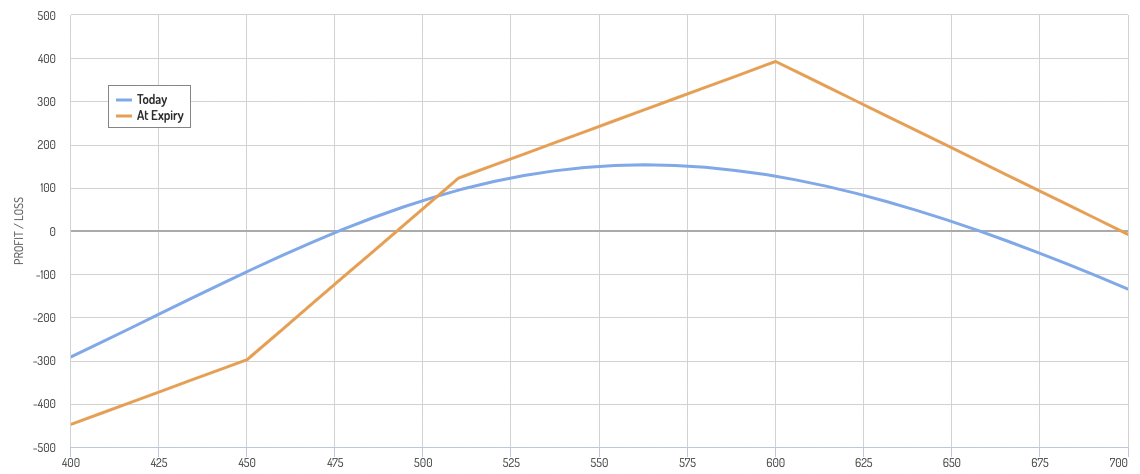

Example #4

- Buy 4 OTM Puts

- Sell 4 ATM Calls

- Sell 7 ITM Puts

Gold (GLD) Example

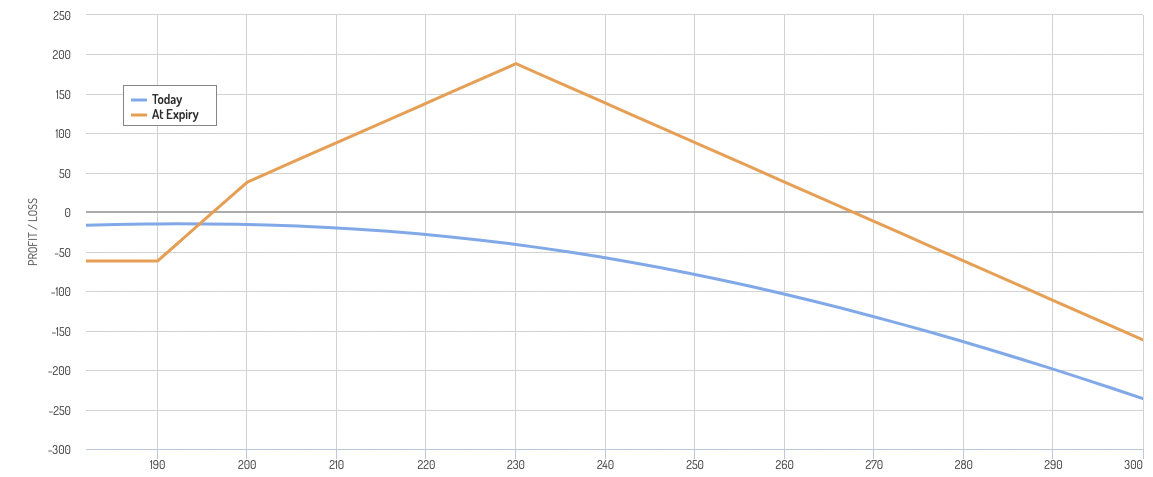

Same concept as applied to gold (200 is the current price in this example):

- Buy 2 OTM Puts

- Sell 1 ATM Calls

- Sell 2 ITM Puts

So, we have a limited downside structure that allows for up to a 35% bullish move. Our trade-off with this is that a too-bullish move would be bad for us.

One possibility is to hedge our right tail with short-term deep OTM options, which are cheap and also lower our margin/collateral requirements.

Just beware of the cumulative cost of doing this over time.

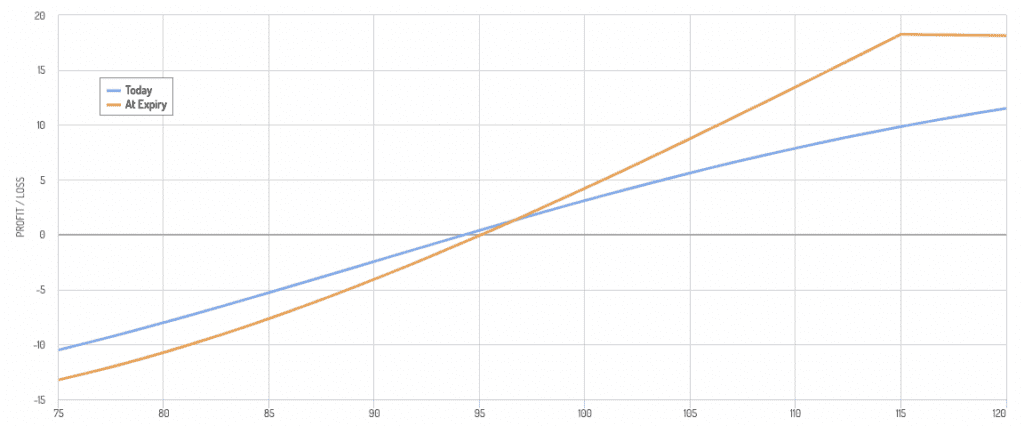

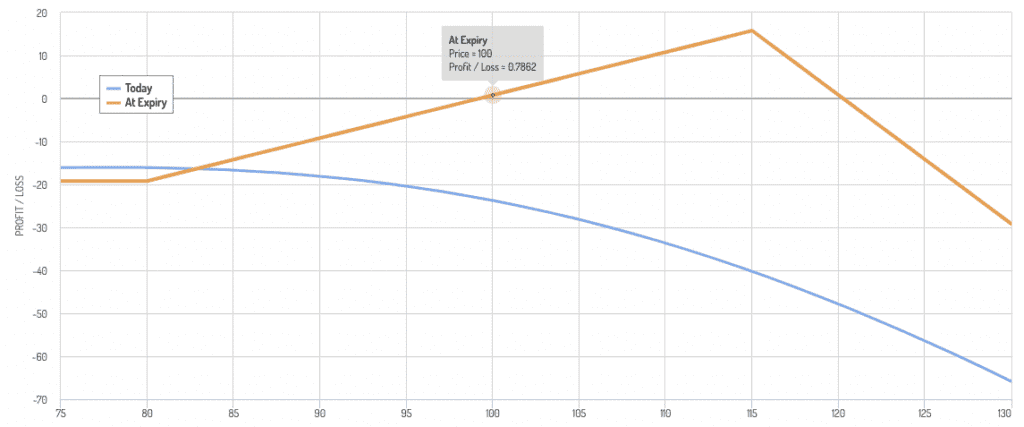

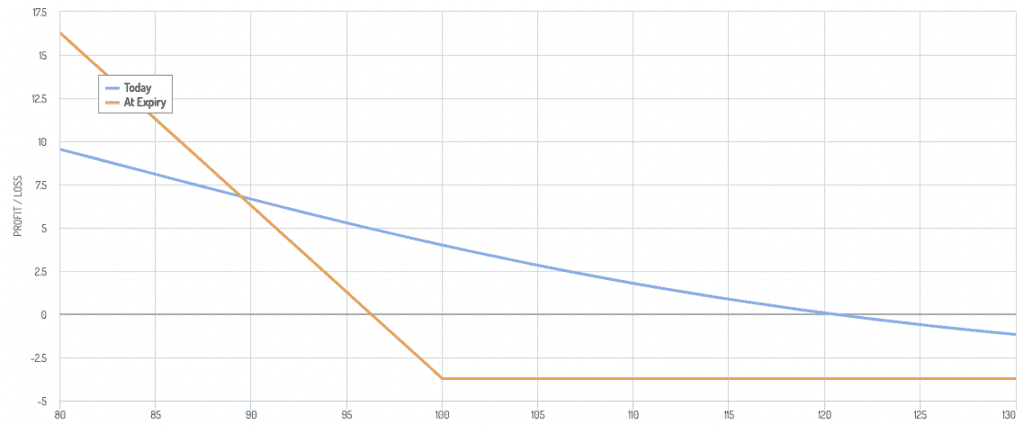

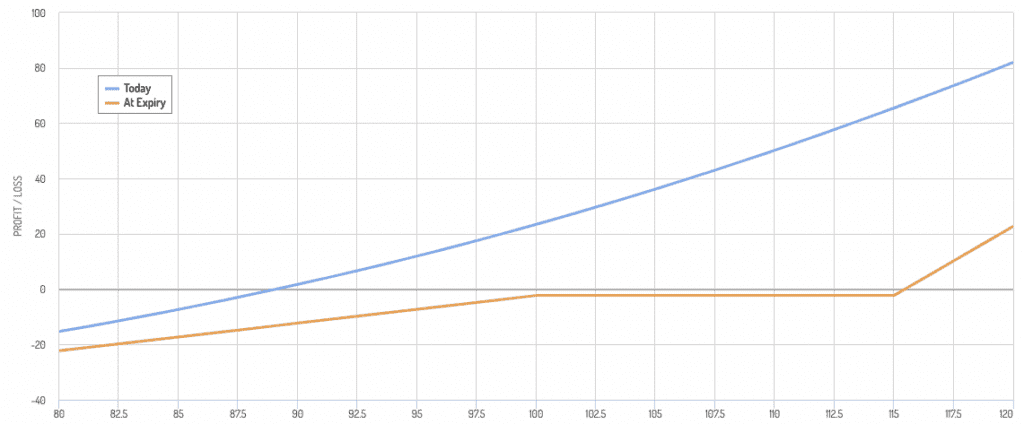

Strategy 2: Bullish Diagonal Spread

- Buy a longer-term, deep in-the-money (ITM) call option with a low strike price.

- Sell a shorter-term, out-of-the-money (OTM) call option with a higher strike price.

Rationale:

- The long ITM call gives you exposure to the security’s upside. Its high delta (sensitivity to underlying price change) minimizes the impact of time decay.

- Selling the OTM call generates premium, reducing your net debit (cost) of the trade.

- Potential losses are capped, unlike a naked call sale.

Example:

- Buy a 80 call one-year-forward

- Sell a 115 call 6-months-forward

Options with different expirations have different theta (time decay properties), which is something to keep in mind.

For beginner or intermediate traders, it’s generally recommended to keep expirations the same for multi-leg options strategies to avoid the complexities of different time decays.

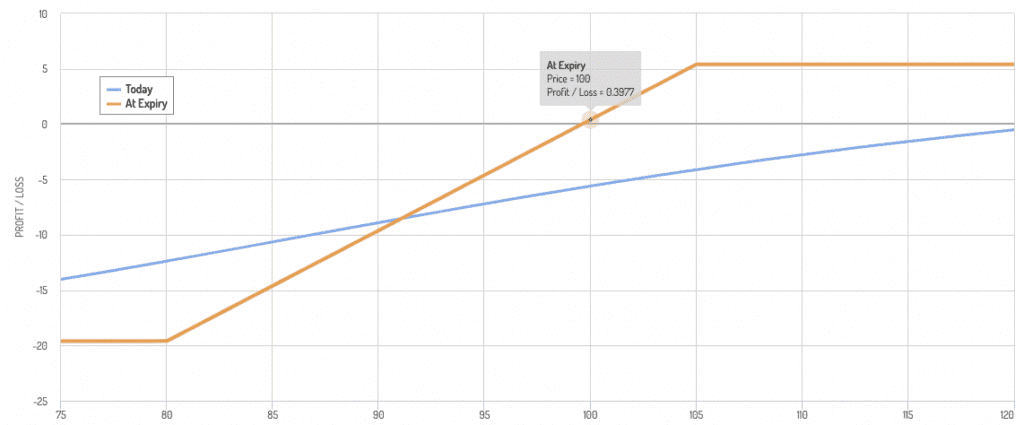

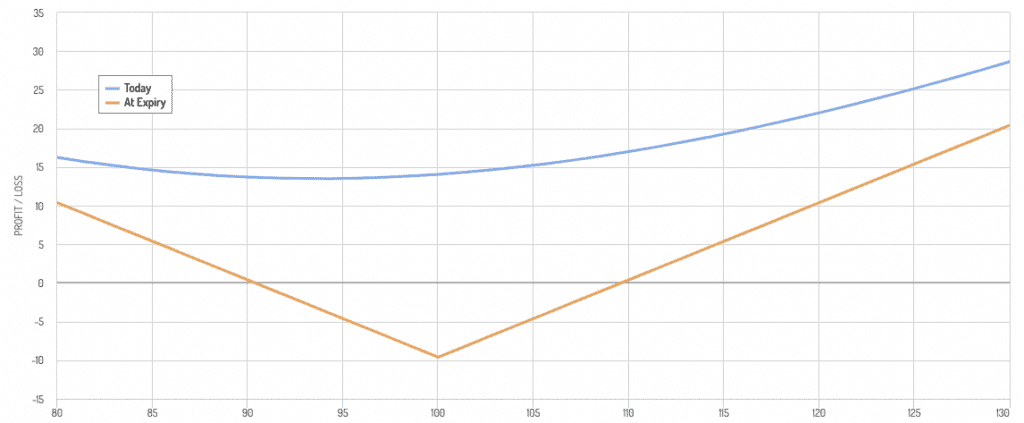

Strategy 3: Poor Man’s Covered Call

- Buy a deep ITM call option as a substitute for owning the stock itself.

- Sell an ATM or OTM call option against it, mirroring a traditional covered call.

Rationale:

- Replicates the covered call payoff profile but with a much lower capital requirement.

- Less downside risk than owning the shares outright. If buying ATM, you’re essentially just harvesting the volatility risk premium.

Example:

- Buy a 80 call one-year-forward

- Sell a 100 call one-year-forward

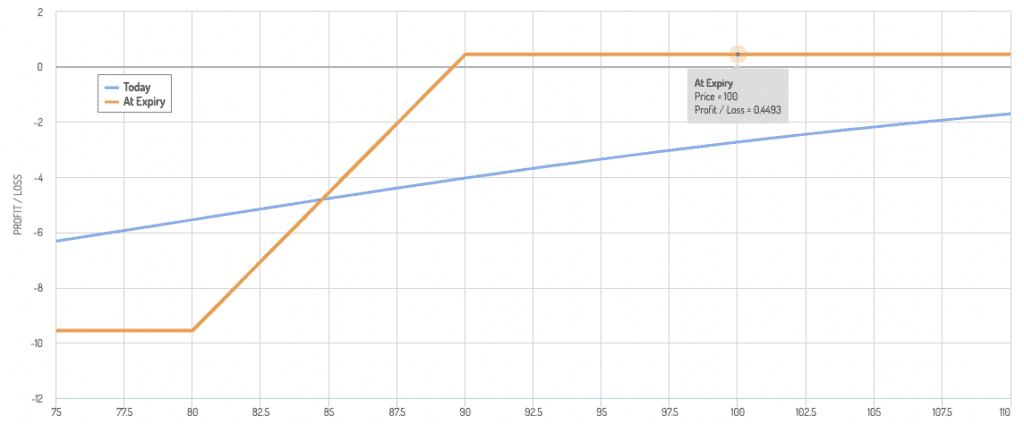

Strategy 4: Calendar Put Spread

- Sell a higher strike put

- Buy a lower strike put

Rationale:

- The premium received from the short put lowers the cost of the long put.

- Benefits if the underlying remains stable or moves slightly higher.

- This strategy profits from increased volatility and/or time decay.

Example:

- Sell a 90 put

- Buy a 80 put

Here we see a thin profitability range, but a high probability of turning a profit.

We have a lower chance of losing money, but when we do it can be many multiples of our profitability amount.

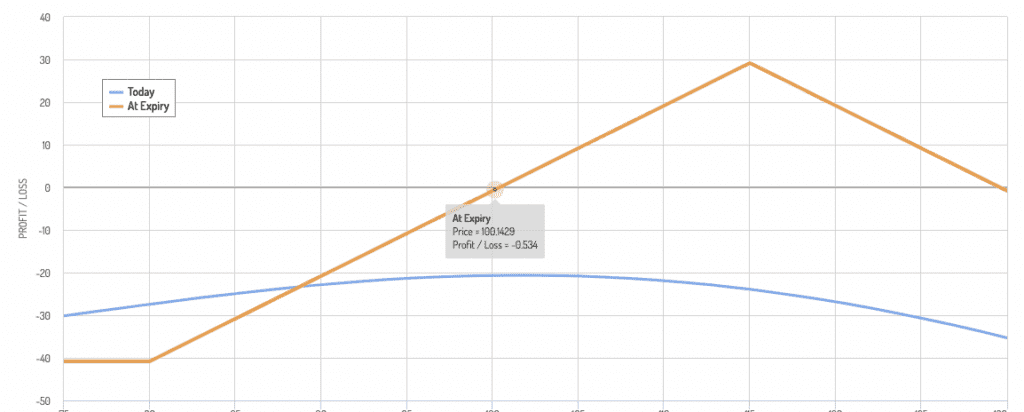

Strategy 5: The “Ratio Spread”

This strategy involves buying and selling different numbers of options contracts to create a desired risk/reward profile and reduce upfront costs.

Consider these examples:

- Bullish Ratio Call Spread – Buy 2 long-term ITM calls, and sell 3 or more shorter-term OTM calls. The higher number of short calls generates more premium to offset the long call cost but increases risk.

- Bearish Ratio Put Spread – The opposite of the above, buying long puts, and selling a higher number of short puts.

Above, we have a bullish ratio call spread, where we have 1 ITM long calls and 4 OTM short calls.

Our blue line represents our estimated near-term payoff curve; it notes that we can actually lose money if it goes in our intended directional bias (long) because of the gamma of the OTM short calls.

Here we have a bullish ratio call spread with 2 ITM long calls and 4 OTM short calls.

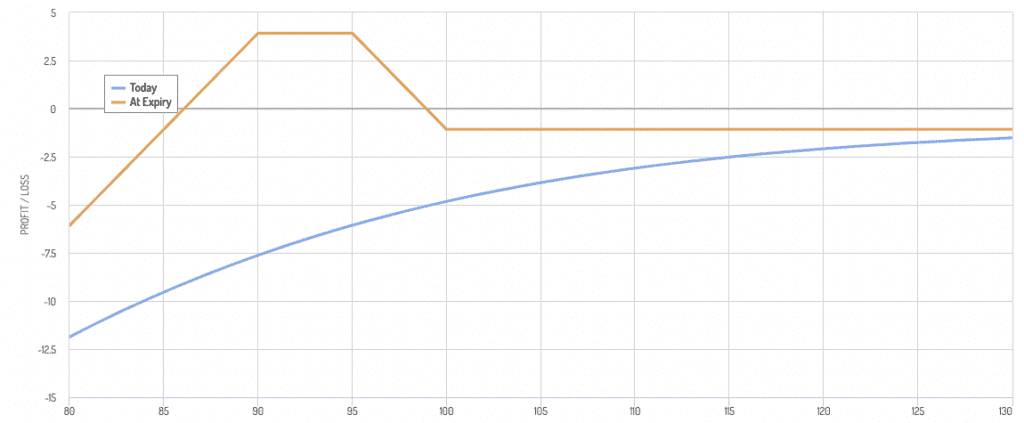

Strategy 6: The Jade Lizard

This strategy is designed to profit from a neutral to slightly bearish view on the underlying with limited upfront cost and a defined risk profile. It involves:

- Selling an OTM put

- Selling an OTM call

- Buying an ITM put with a lower strike than the short put

Above we have this example:

- Long 100 Call

- Sell 95 Call

- Sell 90 Put

Who would want to use the Jade Lizard option structure?

For example:

- A trader expecting modest losses to be likely, but large losses to be unlikely.

- A trader long a dividend stock who believes the dividend may be too high relative to its earnings, causing potential mild depreciation in the stock (“melting ice cube” type situation). But the yield on the dividend can compensate for the mild loss from the options structure if the stock stays the same price or appreciates.

Strategy 7: Synthetic Stock with LEAPS

- Buy a deep ITM LEAPS (long-term options) call option with an expiration a year or more out.

- Sell an ATM (at-the-money) against it.

Rationale:

- The ITM LEAPS option has a high delta (close to 1), mimicking stock ownership.

- Selling the ATM calls generates ongoing income to help offset the LEAPS cost.

Example:

- Buy 80 Call

- Sell 100 Call

Strategy 8: Bull Put Spread

- Buy a put option with a higher strike price

- Sell a put option with a lower strike price (both with the same expiration date)

Rationale:

- Max profit occurs if the stock drops below the lower strike by expiration.

- Max loss is limited to the net premium paid.

- Benefits from a moderate decline in the underlying but still has defined risk.

Example:

- Buy a 100 Put

- Sell a 80 Put

Variations on Bull Put Spread

- Shifting Strikes: Adjust the strike prices closer or further apart to alter your risk/reward profile. Closer strikes limit risk and potential gain, while wider strikes do the opposite.

- Credit Spread: Instead of buying puts, sell a higher strike put and buy a lower strike put for a net credit. This lowers upfront cost, but increases maximum loss if the underlying falls sharply.

Strategy 9: Long Straddle

- Buy a call option and a put option at the same strike price and expiration date.

Rationale

- Profits from large moves in either direction (up or down) before option expiration.

- Breakeven points are wider apart, making this a higher risk/higher potential reward play.

- Ideal for when you anticipate significant volatility in the underlying but are unsure of the direction.

Example

- Buy a 100 Call

- Buy a 100 Put

Variations on the Long Straddle

- Out-of-the-Money Straddle: Purchase OTM calls and puts to reduce upfront cost in exchange for higher volatility needs to profit.

- Strangle: Purchase an OTM call and an OTM put with different strikes, potentially reducing cost if you anticipate a very large move.

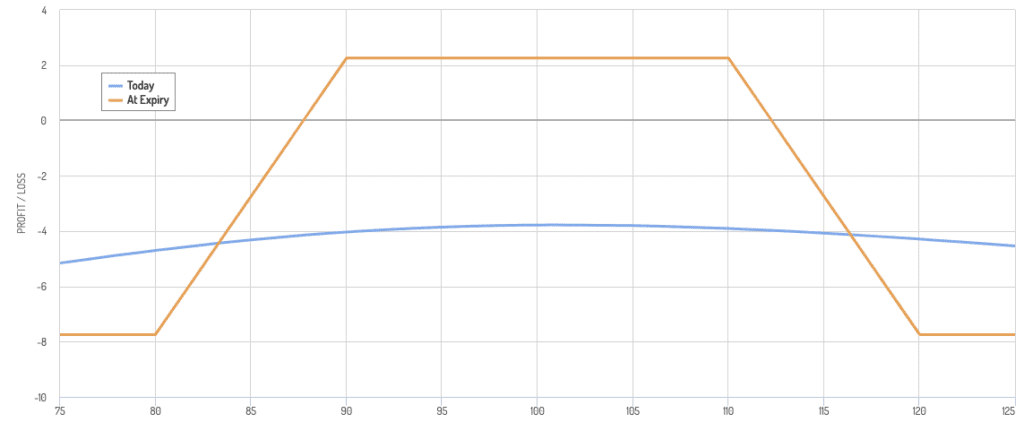

Strategy 10: Iron Condor

- Combines a bull put spread and bear call spread with different strike prices

Rationale

- Aims to profit from a range-bound market where the underlying stays within a defined channel.

- Has a complex risk profile with limited profit potential and potential losses on both sides if the market breaks out of the range.

Example:

- Sell 90 Put

- Buy 80 Put

- Sell 110 Call

- Buy 120 Call

Variations on Iron Condor (Strategy 9)

- Adjusting the Width: Change the strikes of the calls/puts to widen or tighten the profit range. Wider ranges offer more premium income with a lower probability of success.

- Iron Butterfly: Instead of selling a call spread and a put spread, buy one OTM call/put spread and sell an ATM call/put spread. This has more limited profit potential but defined risk on both sides.

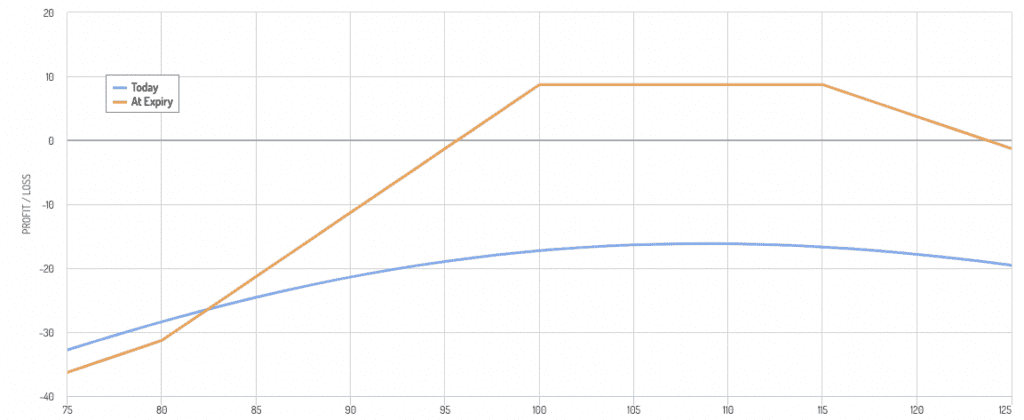

Strategy 11: Iron Condor-ish

This strategy extends the max profitability range from the current price of the underlying to 15% higher.

Example:

- Buy ITM 80 Call

- Sell 2 ATM 100 Calls

- Sell 1 ITM 115 Put

Strategy 12: Sell ITM or ATM Premium to Fund OTM Options

Options can be expensive, which is why many simply choose to trade the underlying.

However, some strategies you can fund what you’re buying by what you’re selling while expressing your particular view.

Example:

- Sell 1 ATM Put

- Buy 5 OTM Calls

This is a more hyper-bullish strategy that does best in a very bullish scenario.

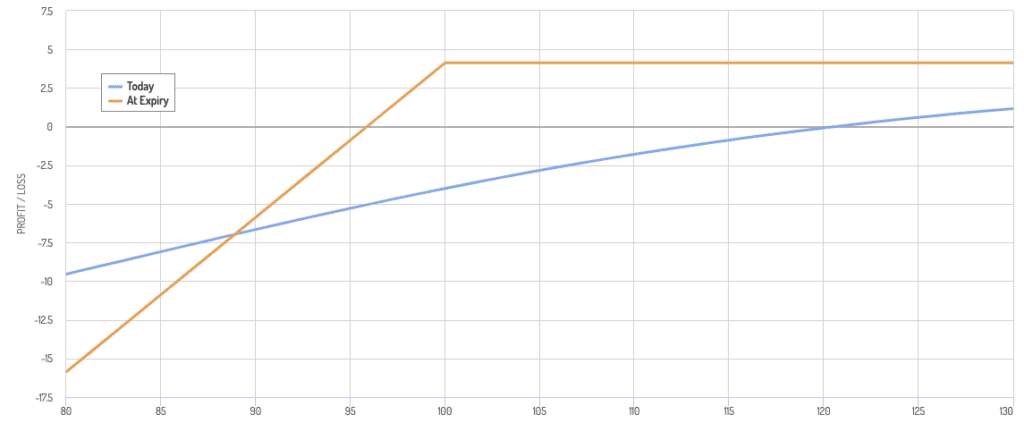

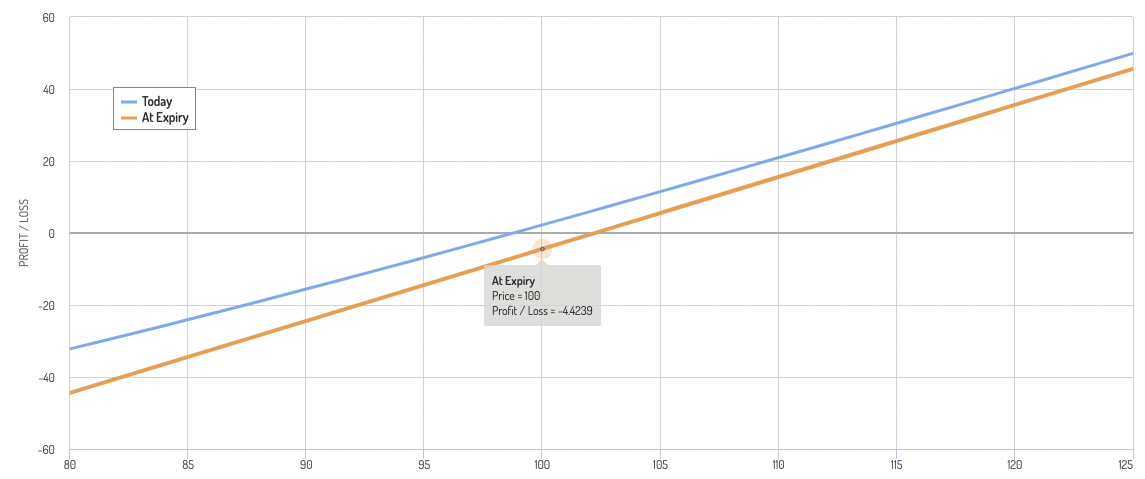

Strategy 13: True Synthetic Long

A true synthetic long is when you try to emulate being long the underlying as closely as possible.

Do this by being long a deep ITM call.

- Long 80 Call

You will start off the trade a bit in the hole since you’re still paying a little bit of premium (excluding the moneyness of the option).

But this may be a price you’re willing to pay to be leveraged long – while having some built-in risk management cushion (losses are limited to the premium) – without paying broker interest charges.

If this is being done on a dividend stock or interest-bearing instrument/security, you won’t receive it, so this is another consideration.

Summary of Basic Options Strategies & Ingredients for Synthetic Leverage

Options strategies provide a way to achieve synthetic leverage, allowing investors to control a larger position in an underlying asset with a relatively small investment.

This leverage amplifies both potential gains and losses without the need to borrow funds directly.

Here’s a summary of the basic key strategies/ingredients that use options for synthetic leverage:

1. Long Call Options

- Mechanism – Buying call options grants the buyer the right, but not the obligation, to purchase the underlying asset at a specified price (strike price) within a certain period.

- Leverage Effect – The cost (premium) of the call option is much lower than the cost of buying the underlying asset outright, providing leverage. If the asset’s price increases above the strike price, the investor can realize potentially high returns relative to the initial investment.

- Risk – The premium paid for the option is the maximum loss, limiting downside risk compared to owning the asset directly.

2. Long Put Options

- Mechanism – Buying put options gives the buyer the right to sell the underlying asset at a specified strike price within a certain timeframe.

- Leverage Effect – This strategy can be used to speculate on a decline in the asset’s price with limited capital, as the premium paid for the put option is significantly less than short selling the asset directly. Brokerage costs for shorting can also be very high (several percent higher than the risk-free rate).

- Risk – The trader’s risk is confined to the premium paid for the put option.

3. Bull Call Spread

- Mechanism Involves buying a call option at a lower strike price and selling another call option at a higher strike price, both with the same expiration date.

- Leverage Effect – This strategy reduces the net premium paid, lowering the break-even point and providing leverage on a bullish move up to the higher strike price.

- Risk – The maximum loss is limited to the net premium paid, while the maximum gain is capped at the difference between the two strike prices minus the net premium.

4. Bear Put Spread

- Mechanism – Entails buying a put option at a higher strike price and selling another put option at a lower strike price, both with the same expiration.

- Leverage Effect – This strategy benefits from a decline in the asset’s price within a specific range, reducing the cost of taking a bearish position.

- Risk – The risk is confined to the net premium paid, and the potential profit is limited to the difference between the strike prices minus the net premium.

5. Synthetic Long Stock

- Mechanism – Created by buying a call option and selling a put option at the same strike price and expiration date.

- Leverage Effect – This combination mimics owning the actual stock, as gains and losses mirror the asset’s price movements beyond the strike price, but requires less capital than buying the stock outright.

- Risk – While the upfront cost is lower, the trader is exposed to similar risks as holding the stock if the market moves unfavorably, especially due to the short put position. If there’s a dividend, the trader also won’t get that.

6. Synthetic Short Stock

- Mechanism – Involves buying a put option and selling a call option at the same strike price and expiration.

- Leverage Effect – This strategy simulates short selling the stock, allowing traders to profit from declines in the asset’s price without the need to borrow the stock.

- Risk – Risk can be significant if the asset’s price increases, especially due to the sold call option, but initial capital outlay is lower than short selling.

These strategies offer flexible, cost-effective ways to achieve leverage and specific trading outcomes.

Nevertheless, the complexity and risks associated with options trading require a thorough understanding of the mechanisms and potential market movements.

Related

- Options Strategies for Income

- VRP Strategies

- Directional Strategies

- 100+ Systematic & Discretionary Trading Strategies

- Balanced Beta Strategy

- All Weather Strategy

- Building a Balanced Portfolio with Options

- Structured Product Design