Jade Lizard Option Strategy [Setup, Pros & Cons]

The Jade Lizard is a mildly bullish options strategy that involves the following:

- Buying a Call (typically ITM or around ATM)

- Selling a Call (ITM)

- Selling a Put (OTM)

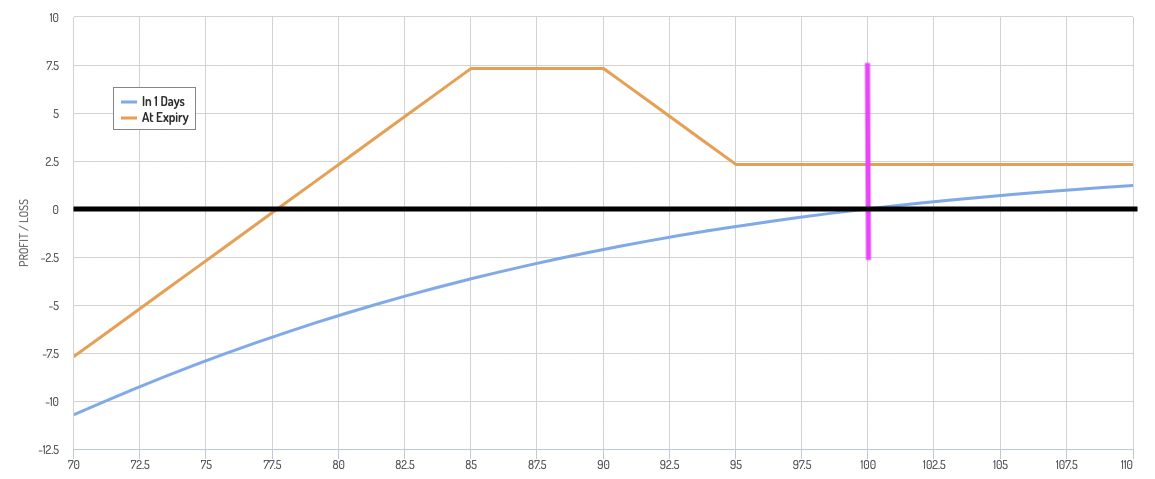

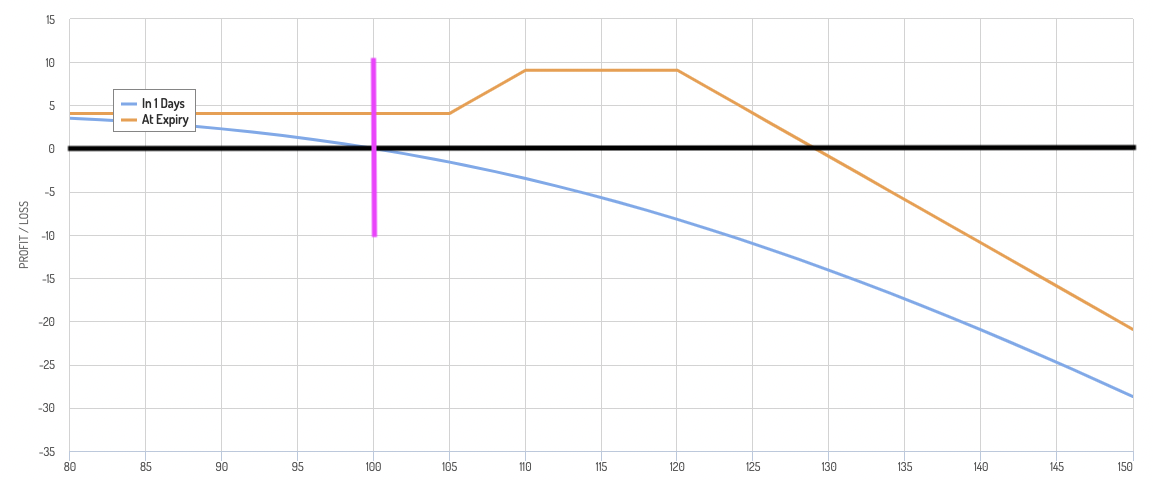

The resulting payoff diagram is as follows:

(This example involves a current price of $100 for the underlying, buying a 95 call, selling a 90 call, and selling an 80 put.)

The pink vertical line denotes where price is currently.

The space under the orange line and above the black line denotes the profitability zone.

The space above the orange line and below the black line denotes where losses are.

The blue line is a proxy for short-term profit or loss.

Benefits of the Jade Lizard option strategy

The Jade Lizard has a high probability of profit.

The stock or underlying asset has to fall a lot for it to be unprofitable.

And even if the stock or asset does fall, you can still make money if it stays within the profitability range.

It is considered a bullish to neutral strategy.

It is best used in an environment where there are high implied volatilities.

This allows for more premium to be collected and no upside risk if the underlying asset trades higher.

Disadvantages of the Jade Lizard option strategy

If the stock or underlying asset falls a lot you can lose a lot.

It’s also a short gamma position. That means the underlying just has to fall a little bit before you start losing money in the short-term.

This is because if the underlying falls in price, your long call will lose money and your OTM put will rise in value (hurting you as you’re selling it).

This is what the blue line represents in the option payoff diagram.

Keep expected value in mind

All trading follows the concept of expected value.

The Jade Lizard options strategy has a high probability of making money. But your potential losses are high if you do lose money.

If a stock is at $100 and your breakeven point is $77.50, and anything above that is profit, then you will probably feel pretty good about the trade.

However, crazy things happen, so it’s never a guarantee. And if you do lose, you can lose a lot.

Based on the example diagram we’ve shown in this article, if the stock is $100 and stays above $95, your max profit is about $2,300.

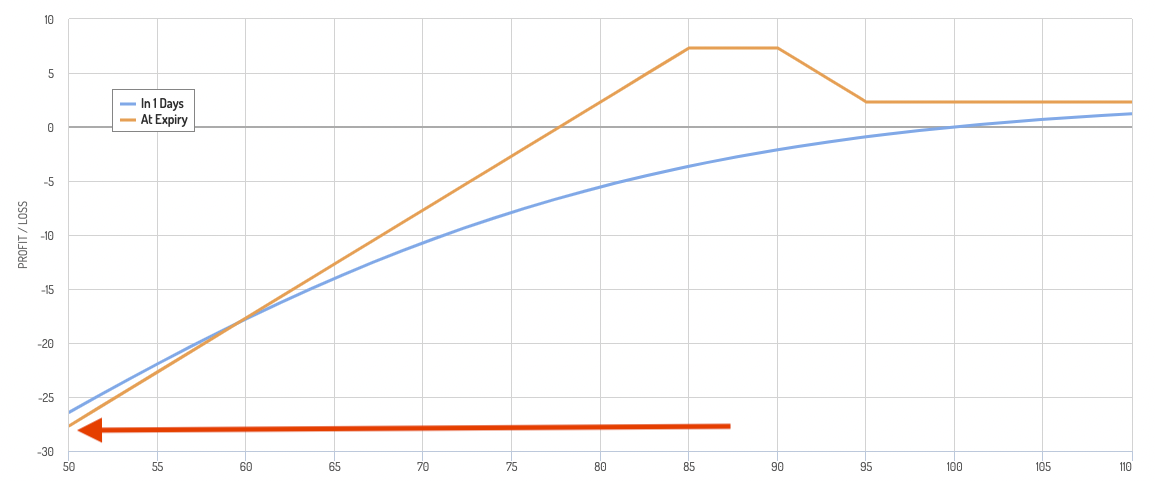

Let’s say the stock goes to $50.

Then you lose… $27,700.

That’s more than 10x your gain if the stock remains high.

Even if the stock temporarily falls, you can lose money, which can cause margin calls and require you to bust up the trade at a huge loss.

Being short gamma isn’t inherently bad, but it’s an easy way to lose a lot of money or blow up entirely.

If we set the range on this graph all the way down to $0 – the max loss on a stock – then the Jade Lizard can set you up for huge losses due to the short put.

Example

Let’s say you put on a Jade Lizard and you have an 80 percent chance of making a profit with an expected profit of $4,000.

And let’s say you have a 20 percent chance of suffering a loss with an expected loss of $15,000.

Is this a trade that’s worth making?

Expected value = 0.80 * $4,000 – 0.20 * $15,000 = $3,200 – $3,000 = +$200

You have a relatively small positive expected value.

At the same time, the most you can lose is potentially tens of thousands of dollars.

What can you do to make the Jade Lizard safer?

To minimize the risk of massive losses, it may be a good idea to buy an OTM put below your other OTM put to cap your downside.

This example we’ve used has a current price of $100 for the underlying, buying a 95 call, selling a 90 call, and selling an 80 put.

If you wanted to cap your potential losses you could buy a 65 put, for example. This will also help you neutralize the gamma.

Accordingly, if the stock fell, you wouldn’t lose as much in the short-term because that OTM put (the one you own) would start kicking in.

Why is it called the ‘Jade Lizard’?

The term “jade lizard” was first used by Liz Dierking and Jenny Andrews, former CBOE floor traders, on the Tastytrade Network.

Jade Lizard offshoots

Twisted Sister

A reverse Jade Lizard is often called a Twisted Sister.

It is the opposite and involves the following:

- Buying a Put (typically ITM or around ATM)

- Selling a Put (ITM)

- Selling a Call (OTM)

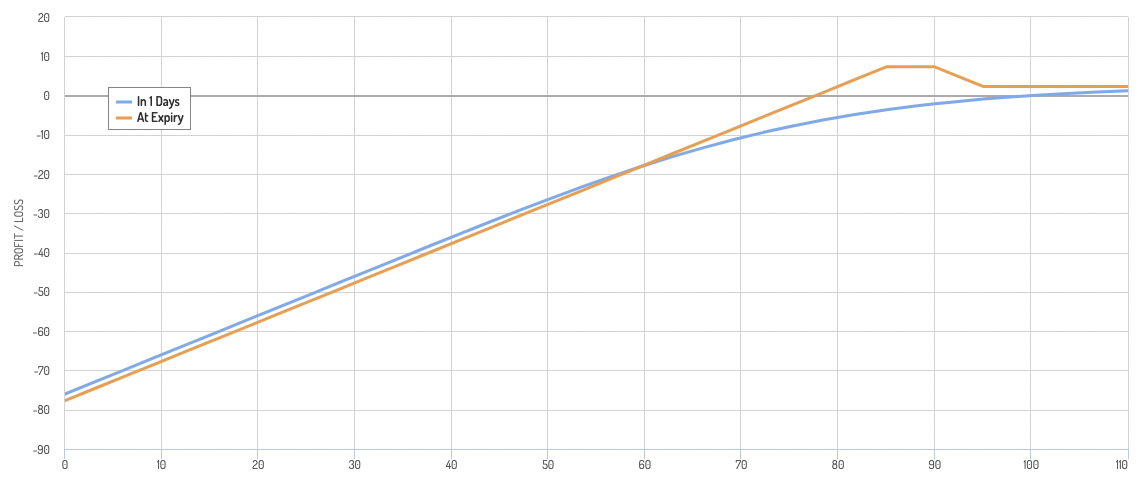

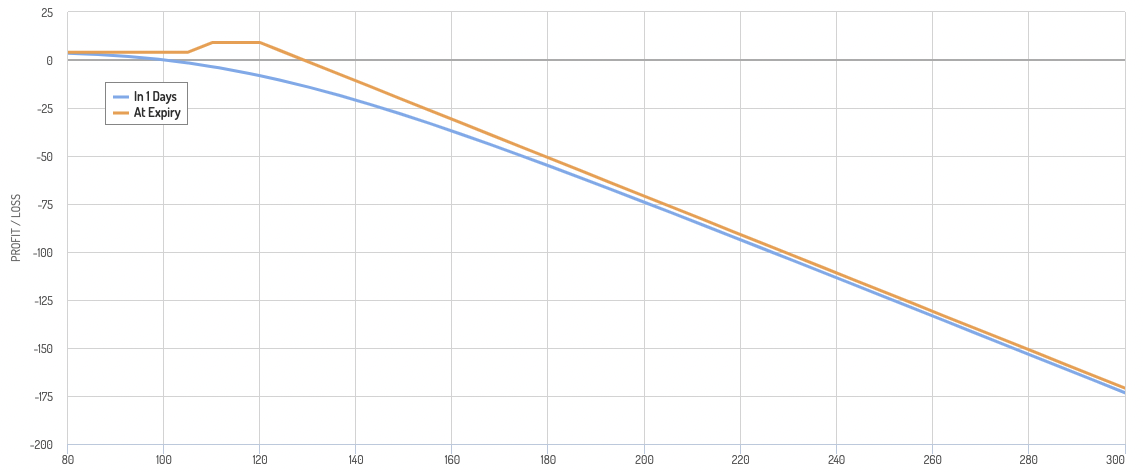

The options payoff diagram appears as:

The pink vertical line shows where price is currently.

The space under the orange line and above the black line denotes the profitability zone.

The space above the orange line and below the black line denotes where losses are.

The blue line is a proxy for short-term profit or loss.

Are the Jade Lizard and Twisted Sister mirror images of each other?

Yes, but with two main caveats.

1) For stocks, there is volatility skew that causes put options to be priced higher than call options.

(Because portfolios are skewed long stocks, there is more demand for downside protection, causing the prices of puts to exceed that of calls.)

So a Jade Lizard will typically harvest more premium than a Twisted Sister, holding all else equal.

2) With a Twisted Sister you have unlimited upside risk.

With a Jade Lizard, your downside is limited by how low the asset can fall. For example, a stock can only go down to $0 while there’s no theoretical limit as to how high a stock can go.

Some assets can go below $0 (e.g., commodities).

The lower implied volatility for call options and the unlimited upside risk make it a riskier trade.

For example, if a stock went from $100 to $300, this would massively dwarf any premium that was otherwise hoped to be gained from the trade.

This risk can of course be mitigated by owning an OTM call option to cap your potential losses.

Conclusion

The Jade Lizard is a complex options trade that can be used to make money if a stock rises or only loses a little bit by expiration.

It’s important to remember that it involves being short gamma, which can lead to large losses if the stock price moves against you.

You should only use this trade if you’re comfortable with the risks and have a solid understanding of how to set it up correctly and how it works.